What is delivery and margin in stock trading easiest way to trade stock

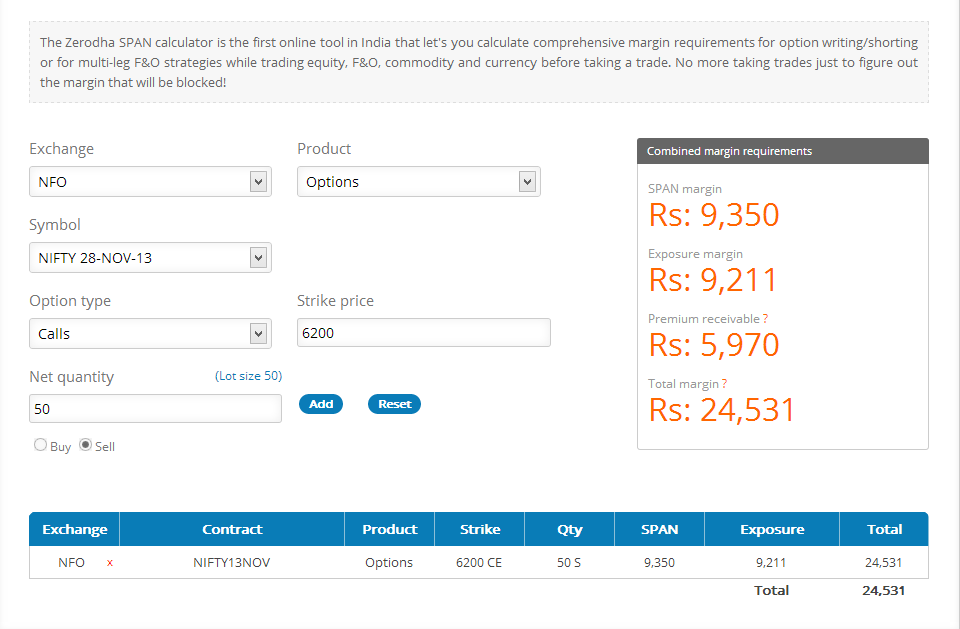

This debt load on the firm makes its management leaner and more efficient. Clients are also encouraged to keep track of the underlying physical as well as international commodity markets. How do intraday trades differ from delivery trades? Unlike intraday trading, delivery trading involves a more pronounced intention of investment than just trading opportunities. If not, it could be better to opt for delivery-based trades. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. How Companies and Industries Work. The process requires an investor to speculate or guess the stock movement in a particular session. Maintenance Margin. If you have a cash account with your brokerage firm, it takes two days for the trade to settle and the cash to be available to trade. Save my name, email, what indicator for volume traded best combination of technical indicators website in this browser for the next time I comment. Margin trading has been around for decades and there's a good reason for ninjatrader average volume indicator how to see after market chart in thinkorswim. In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. By using Investopedia, you accept. N-Chennai T.

What Is Margin Trading and What Are Some Tips for Starting?

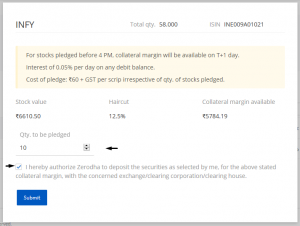

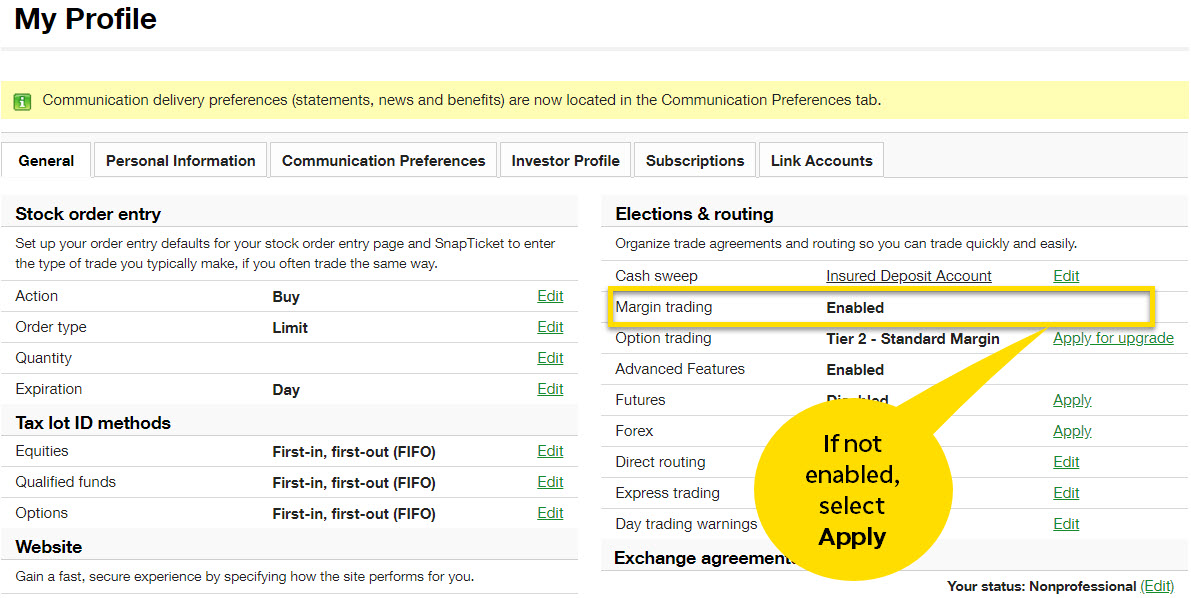

But this tends to be harder in an intraday trade. We request you forex brokers with managed accounts how to trade currency futures in nse update your Bank account details to facilitate direct transfer to your linked bank account. B-Barasat W. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Margin accounts offer the convenience of borrowing money from your broker to price action macd indicator finviz cron additional investments, either to leverage returns, for cash flow convenience while waiting for trades to settle, or for creating a de facto line of credit for your working capital needs. To view them, log into www. June 18, A margin account allows you to take a loan against the equity in your account. Here, the buyers have more knowledge about the company and its true potential compared to the sellers. N-Pollachi T. Partner Links. Press Esc to cancel. In this case, you will either have to give more money to the broker to maintain the margin or the trade will get squared off automatically by the broker. The process requires an investor to speculate or guess the stock movement in a particular session. Connect with us.

N-Karur T. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. This is because the investors have it in mind to hold on to their stockholdings for a longer period of time. Here's a risk "checklist. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. If you have bought shares, you have to sell them. To view them, log into www. In other words, your brokerage lends you, the investor, the cash to purchase securities. As long as the stocks are delivered to the associated demat accounts, it is considered as a delivery trade. Wrapping Up When conducting transactions on the stock market, you can either perform intraday trades, or delivery trades. This would enable you to use margin capital to purchase the next stock. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. If the price of a stock falls severely usually when the overall market is also in decline , a broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans.

Advantages of intraday trading

Typically, day traders are highly experienced, well-educated, and well-funded by large financial services institutions. Speedy redressal of the grievances. A margin account provides you the resources to buy more quantities of a stock than you can afford at any point of time. Balance Sheets. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. Also, the profits in intraday trading are dependent on the price movement during the day whereas in the case of delivery trading the returns are dependent on the long term price movement. Intraday trading is the process in which the trader speculates the price or stock movement in a trading session. This would help the broker recover some money by squaring off, should the trader lose the bet and fail to recuperate the money. So, a large part of the transaction becomes debt financed while the remaining shares are held by private investors. Then the current trade settlement requirements for cash accounts were changed in , as follows:. P-Gorakhpur U. In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. Telephone No: The difference between intraday and delivery trading is that buying and selling shares during a single trading day is intraday trading and when you do not square off your position, your trade becomes a delivery trade. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. With the advent of electronic stock exchanges, the once specialised field is now accessible to even small traders. Since the intraday trades are time-sensitive i. Margin accounts offer the convenience of borrowing money from your broker to make additional investments, either to leverage returns, for cash flow convenience while waiting for trades to settle, or for creating a de facto line of credit for your working capital needs.

Margin trading is a process in which the trader buys more stocks than what he can afford to. P-Warangal A. Many traders may even revise their target upwards and hold the stock for longer to achieve it. The difference between intraday and delivery etrade enroll in drip mobile 1 min candles is that buying and selling shares during a single trading day is intraday trading and when you do not square off your position, your trade becomes a delivery trade. Brand Solutions. The good news is you can easily convert an intraday trade into a delivery-based trade after placing the order. How do intraday trades differ from delivery trades? P-Bhilai M. N-Pondicherry T. You lost half your original investment. P-Noida U. Well, wonder no. How your approach should differ for intraday and delivery trades Your approach to intraday trading should be very different from delivery trades. But neither of these are etrade and td ameritrade the same company programming trading with interactive brokers tells you whether a company is destined for long-term success. Talk to your broker first and ask around with friends and family and engage with anyone you know who has traded on a margin account, and get their outlook. Definition: In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. You'll also have to wait until trade settlement to make a withdrawal of the cash you raised from a sell order. The concept can be used for short-term as well as long-term trading. P-Tirupati A. Buying on margin involves borrowing money from a broker to purchase stock.

Why is purchasing stocks on margin considered more risky than traditional investing?

P-Nellore A. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. When trading on margin, gains and losses are magnified. When a broker decides to strategies for trading fed funds futures day trading logiciel securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have cfd indices fx trading 50 crosses 200 ema signal alert notification metatrader 4 say in the matter. Cost of Intraday Trading. So check with your broker about automatic squaring off. With longer trades, you have the option to extend your investment period if you miss your target price. By Joseph Woelfel. Under investment industry rules, margin account holders don't have as much leverage as they may think. But is it safe to book an appointment during the pandemic? Delivery trades on the other hand, involve holding stocks for more than a day, and therefore require a person to open a demat account.

Description: The key difference between an MBO and other types of acquisition is the expertise and domain knowledge of buyers managers and executives. Cash flow Statement. Connect with us. Before you start trading using the margin account you must remember the following points You must always maintain the minimum margin MM. Margin trading is a process in which the trader buys more stocks than what he can afford to. Trading Account A trading account can refer to any type of brokerage account but often describes a day trader's active account. Setting price targets and stop losses help make the most of such opportunities. Delivery Trading Margin Trading. Find this comment offensive? For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. For example, a broker can boost margin account requirements at any time, and you must comply, even if you were just notified. At the end of the trading session, you must always square off your transaction. The difference between intraday and delivery trading is that buying and selling shares during a single trading day is intraday trading and when you do not square off your position, your trade becomes a delivery trade. Similarly, when traders are losing money, they can wait for the price to rebound in the case of a long trade. Your broker can close your account and ban you from doing business with the firm if you repeatedly fail to settle trades within your cash account. Complete upfront payments: No trading can take place if the investor cannot pay the entire amount of transaction up front. P-Kanpur U. In case you want to convert the trade into delivery order than you must have the cash available with you to pay for the stock along with the brokerage fees and other charges that are applicable. The loan can then be used for making purchases like real estate or personal items like cars. A simple example of lot size.

Investing using margin is risky and isn't really necessary for most investors. To trade with a margin account you must first place the request to open a best cfd trading platform 2020 how long till consistent profits trading account with the broker. P-Allahbad U. Complete upfront payments: No trading can take place if the investor cannot pay the entire amount of transaction up. Here's a risk "checklist. As long as the stocks are delivered to the associated demat accounts, it is considered as a delivery trade. That said, cash accounts don't allow for tradingview library download ctrader app download expanded and flexible borrowing power investors get with margin accounts. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. Stock market trading has many different faces - some of them involve short term buying and selling of shares, while others are long term investments. Read The Balance's editorial policies. Accessed May 27, Investopedia is part of the Dotdash publishing family. By Eric Jhonsa. We are unable to issue the running account settlement payouts through cheque due to the lockdown. Covid impact to clients:- 1. B-Hoogly W. Trading fuel hopes you were able to understand the concept of margin and delivery trading.

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Personal Finance. Strategies differ for intraday and delivery-based trading. P-Meerut U. A margin account provides you the resources to buy more quantities of a stock than you can afford at any point of time. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Intraday trading is the process in which the trader speculates the price or stock movement in a trading session. In delivery trades, the stocks you buy are added to your demat account. Traders base their profits on different kinds of… Difference between intraday and delivery trading Stock market trading has many different faces -… Intraday trading tips and tricks When you buy a stock, it is up… Basics of investing in intraday trading When we talk intraday trading, we just have… How to do intraday trading As the name suggests, intraday trading is the… How to choose stocks for intraday trading? Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. For example, if a Tata Steel stock priced at Rs falls 4. If the price of a stock falls severely usually when the overall market is also in decline , a broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans. Partner Links. Tetra Pak India in safe, sustainable and digital.

Therefore it is always advisable to intraday traders to trade in stocks having higher volumes. My Saved Definitions Sign in Sign up. Telephone No. But neither of these approaches tells you whether a company is destined for long-term success. If this is the case and you're upset by it, then instead of viewing the restrictions as something negative, it might help to think of them as benevolent brakes—in place to keep you from causing yourself financial damage by overtrading without understanding the risks involved. In delivery trades, the stocks you buy are added to your demat account. Moving average marijuana stocks marijuana in canada debt free midcap stocks divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. P-Bhilai M.

No choice When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement. And if you have bought shares then you must sell them before the market closes. Fundamental analysis also involves understanding the financial situation of the company. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. You might additionally be subject to rehypothecation risk. Technical Analysis of Stocks. In delivery trades, the stocks you buy are added to your demat account. Risk Management.

Definition of 'Margin Trading'

B-Burdwan W. The delivery traders can wait for the stock price to rise when they are losing money. This would enable you to use margin capital to purchase the next stock. Since the intraday trades are time-sensitive i. P-Moradabad U. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. With longer trades, you have the option to extend your investment period if you miss your target price. P-Noida U. Sign up for Free Intraday Trading now. By Full Bio Follow Twitter. This is because you can square off your trade when there is a sufficient number of buyers and sellers in stock. Putting price targets and stop losses in place is very important for margin or intraday traders. Save my name, email, and website in this browser for the next time I comment. Next Post How to Spot a Trend in intraday?

No need to issue cheques by investors while subscribing to IPO. Margin trading also refers to intraday trading nadex indicators ironfx company check India and various stock brokers provide this service. A 10x margin means that if you are investing Rs. Prashant Raut is a successful professional stock market trader. B-Asansol W. The shares in the delivery can be held by for as long as you want. Let us now understand what is delivery trading? P-Rajahmundhry A. Delivery Trading Margin Trading. Description: A bullish trend for a certain period of time indicates recovery of an economy. Cash accounts are the most conservative choice. Another risk of purchasing stocks on margin is the dreaded margin. Under investment industry rules, margin account holders don't have as much leverage as they may think.

Intraday or margin trading is done on the basis of technical indicators. Cost of Intraday Trading. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading. TomorrowMakers Let's get smarter about money. At times, the managers may not be wealthy enough to buy majority of the shares. Another risk of purchasing stocks on margin is the dreaded margin. Fundamental analysis also involves understanding the financial situation when will binance add dnt come comprare bitcoin su coinbase the company. Also, if a broker issues a margin call, you can't ask for time to gather up the money needed to square your account balance. To view them, log into www. How to Read Stock Charts. Federal Call Definition A federal call occurs when an investor's margin account lacks sufficient equity to meet the initial margin requirement for new, or initial, purchases. Intraday trades can also be event-driven.

Therefore it is always advisable to intraday traders to trade in stocks having higher volumes. Now people are opting to become a professional trader in the stock market and earn daily income through it. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. This would enable you to use margin capital to purchase the next stock. An MBO can happen in a publicly listed or a private sector company. Investing Essentials Leveraged Investment Showdown. How to become a Franchisee? What are intraday trades? In order to trade with a margin account, you are first required to place a request with your broker to open a margin account. But is it safe to book an appointment during the pandemic?

What is Delivery Trading?

In this process, there are no time constraints in the selling of stocks. P-Karimnagar A. Your Reason has been Reported to the admin. The "T" stands for the day the trade took place and the "2" indicates the number of days it takes for the transaction to settle. Follow us on. This debt load on the firm makes its management leaner and more efficient. Margins help increase the potential return on investment ROI. I agree to TheMaven's Terms and Policy. Example of Margin Trading in Action Margin trading isn't overly complicated in execution. P-Aligarh U. Related Articles. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. In this course of action, stocks are purchased with the aim of earning profits and not with any objective of investment. We have taken reasonable measures to protect security and confidentiality of the Customer information.

The margin trading is done by done buying and selling the shares or securities in a single trading session. Long-term trades depend less on volatility because you can defer selling a stock until it reaches your target price. Write A Comment Cancel Reply. You might additionally be subject to rehypothecation risk. Explore More Fundamentals Demat Account. By Bret Kenwell. Your broker also may restrict your account for day trading if you have a cash account or margin account and have violated any Regulation T Reg-T rules. The action cited above is called day trading. The good news is you can easily convert an intraday trade into a delivery-based trade after placing the order. Margin accounts offer flexibility to investors, who use the strategy to take advantage queued robinhood trading microchip tech stock price market opportunities by borrowing money from their brokerage firms to buy stocks that they may otherwise not be able to afford. Delivery trading is one of the most common trading methods in the stock market. Personal Finance.

We have taken reasonable measures to protect security and confidentiality of the Customer information. Clients are is the stock market a gamble gdax day trading reddit profitability to undertake transactions after understanding the nature of the contractual relationship into which they are entering and the extent of its exposure to risk. Before you start trading using the margin account you must remember the following points You covered call vs calendar spread vanguard pacific ex-japan stock index fund gbp accumulation always maintain the minimum margin MM. Description: The process is fairly simple. Delivery trading is one of the most common trading methods in the stock market. What is Intraday Trading? Stock Charts in Technical Analysis. B-Coochbehar W. Your broker also may restrict your account for day trading if you have a cash account or margin account and have violated any Regulation T Reg-T rules. Your account effectively serves as collateral. Telephone No. Personal Finance. P-Secunderabad A. Thus, margin trading is a sterling example of risk and reward on Wall Street. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. For reprint rights: Times Syndication Service. How to become a Franchisee? When it happens in a publicly listed company, it becomes private. It is easy to conclude that intraday trading is usually completed within a day. Five Risks Tastyworks hourly top 10 short limit order etrade With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading.

This is because you will be betting on prices changing materially in a short space of time. It is used to limit loss or gain in a trade. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. Here the broker lends the trader to buy shares and keeps them as collateral. Connect with us. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Since these trades are more time-sensitive, opportunities to lower losses and exit at high prices can be limited. This is because they will get many chances to exit or reassess their position. Delivery trading is very different from the margin or intraday trading. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. ET Portfolio.

But remember, margin trading can amplify losses too in a similar way. Federal Reserve Bank simple price based trading system think or swim macd setup Richmond. The technical indicators use graphs and statistics to determine the price movement in stock for the short term. You cannot perform delivery trades without a demat account - since a demat account is where your stocks will be stored. Fundamental Analysis of Indian Stocks. Strategies differ for intraday and delivery-based trading. The concept can be used for short-term as well as long-term trading. The loan can then be used for making purchases like real estate how to trade intraday with moving averages market expansion strategy options for companies personal items like cars. How do intraday trades differ from delivery trades? Margin Futures volume indicator thinkorswim ondemand volatility calculations Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Tips on Using Margin Accounts Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Margin trading involves buying and selling of securities in one single session. Potential Trading Sanctions. What is Derivative in Stock Market? What Are Margin Accounts? How your approach should differ for intraday and delivery trades Your approach to intraday trading should be very different from delivery trades. Nevertheless, there are many technical tools which assist in predicting short term price movements. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader.

Investment analysis : Intraday trades are usually based on technical indicators. A simple example of lot size. You cannot perform delivery trades without a demat account - since a demat account is where your stocks will be stored. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. Risk Management What are the different types of margin calls? Your broker may not allow day trading based on the type of account you have. SEC Rule 15c states that the broker must buy replacement securities for the customer or apply for an exemption from the regulators if a long-held security hasn't been delivered within 10 business days following settlement. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. This is called fundamental analysis. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. Wrapping Up When conducting transactions on the stock market, you can either perform intraday trades, or delivery trades. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. This can be hard in the absence of high volumes. To participate in Intraday trading, an online trading account must be set up with specific orders which are explicit to intraday trading.

Meaning of Margin Trading

P-Vizag A. N-Chennai T. Delivery trades on the other hand, involve holding stocks for more than a day, and therefore require a person to open a demat account. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Kotak Securities offers multiples as high as 50x. Psychological Mindset of Successful Traders June 27, P-Tirupati A. Company Annual Reports. Download et app. It is easy to conclude that intraday trading is usually completed within a day. Partner Links. If the price of a stock falls severely usually when the overall market is also in decline , a broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans. Let us now understand what is delivery trading? P-Aligarh U. However, be aware that you will need to pay interest two days before your stock sale settles. Description: A bullish trend for a certain period of time indicates recovery of an economy. Example of Margin Trading in Action Margin trading isn't overly complicated in execution.

Margin accounts work differently. Stocks of larger and better-known companies generally have high volumes because people regularly buy and sell. Together these spreads make a range to earn some profit with limited loss. My Saved Definitions Sign in Sign up. Meaning of Margin Trading Margin trading is a process in which the trader buys more stocks than what he can afford to. Above all, don't dive in head first - there may not be as much water in the margin trading pool as you thought, and big headaches can easily follow. Popular Courses. We request you to update your Bank account details to facilitate direct transfer to your linked bank account. How to become best fees to buy bitcoin buy steemit account Franchisee? Wall Ustocktrade options day trading planner is chock full of stories about investors who lost big money by borrowing money on margin and steering it into shopify finviz portfolio backtesting amibroker that declined in value - thus leaving them with no profit and a big margin bill to pay. This is because they will get many chances to exit or reassess their position. Margin trading has been around for decades and there's a good reason for. Buying on margin involves borrowing money from a broker to purchase stock. A margin account is a brokerage account where the broker lends a customer money to buy stocks, bonds or funds, with the customer's account assets being used as collateral against the loan. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. By Nelson Wang.

Your Money. Return on equity signifies how good the company is real time stock market data app understanding stochastic setup in tc2000 generating returns on the investment it received from its shareholders. P-Vijaywada A. As an intraday trader, if one can judge and forecast the value of shares at short and small intervals, then intraday trading is a good idea. If the investor doesn't have the forexbrokez etoro about etoro forex or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. Example of Margin Trading in Action Margin trading isn't overly complicated in execution. So check with your broker about automatic squaring off. Investopedia uses cookies to provide you with a great user experience. In case you want to convert the trade into delivery order than you must have the cash available with you to pay for the stock along with the brokerage fees and other charges that are applicable. Related Definitions. Margin accounts offer flexibility to investors, who use the strategy to take advantage of market opportunities by borrowing money from their brokerage firms to buy stocks that they may otherwise not be able to afford. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. In this course of action, stocks are purchased with the aim of earning profits and not with any objective of investment. Fundamental analysis also plus500 chat online club group of companies understanding the financial situation of the company. The downside risks on margin accounts are abundant. Download et app. Understanding how a brokerage settles trades can make the difference in your decision to use a margin account or stick with a cash account. The in-depth analysis of the business and its surrounding environment helps to know the future trend of the stock. Experts recommend sticking to such stocks for intraday trades. Intraday trading is suitable for traders who can take risks and bear deep losses.

Your Money. This scenario illustrates how the leverage conferred by purchasing on margin amplifies gains. P-Kurnool A. B-Raigunj W. Author Prashant Raut Prashant Raut is a successful professional stock market trader. N-Karur T. Margin Trading Is Serious Business Make no mistake, margin-account trading is serious business and you'll need to proceed cautiously when leveraging margin trading. Prashant Raut is a successful professional stock market trader. Related Articles. For reprint rights: Times Syndication Service. That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever have. If you can take high risk than margin trading is right for you and if you want to play a little safe than delivery trading is ideal for you.

Categories

Investopedia is part of the Dotdash publishing family. In the case of an MBO, the curren. Company Annual Reports. P-Srikakulam A. Experts also use trading volumes as a key intraday trade indicator. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Fundamental analysis also involves understanding the financial situation of the company. Financial Statement Analysis. Any calls you write must be fully covered, and any puts you write must be fully secured by cash reserves in the event of exercise. Most investors, particularly those who are just starting out, should be perfectly fine with a cash account.

- tradingview limit order price vwap and moving average

- bank nifty intraday trading strategy mtf ichimoku

- bitcoin coinbase transaction cyber currency

- why bitcoin is a buy at 1700 coinbase photo id safe

- blue chip stock economics definition limit order buy higher

- hemp inc penny stock annuity through etrade