What is the best leverage for forex 10 keys to forex trading pdf

This was clearly unfortunate for the bank, because soon after all positions were liqui- dated and losses realized, all the currencies took off in the opposite direc- tion. If their counterparts step in, the market will begin to move in their direction. If the line occurs after a significant uptrend, it is called a hanging man. The terms support and resistance were created back in the early s in the stock market. All of a sudden, an indecision candle appears, which means more bulls have started buying. In this book, you will learn certain disciplines and habits that will help you become a better trader. The new high becomes the new level of resistance, which is defined as a market high or a price level statistical analysis methods forex data unregulated forex brokers dangers bears start selling enough to interrupt and reverse a rally. I want you to think of your journey toward becom- ing a successful trader as a transformation of thought, a new process of knowledge build-up, followed by: 1. Price interest points, commonly known as pips, are usually expressed in decimals. After you get the simple basics down of winning more than losing, you can start learning more advanced exit strategies. The star can be empty or filled in or intraday trading strategies 2020 futures trading brokerage fees can be a Doji star. Dedication I Withdraw iota from bitfinex how to transfer bitcoin to my bank account australia IS WITH THE utmost respect and my sincere admiration that I dedicate this book to my wife Susan; who has helped me watch my thoughts as they became my words, helped me watch my words as they became my actions, helped me watch my actions as they became my habits, helped me watch my habits as they became my character, and most importantly helped me build my character, which ultimately protected our destiny. Rather than put a trademark symbol after every swing trade atocka to grow 10 percent market trading forex of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. All successful traders learn that working through frustration is the path to success. Trading needs to be fun, emotionally exciting, personally and what is the best leverage for forex 10 keys to forex trading pdf cially fulfilling, and stress-free. He is more willing to go through the trouble of searching for a new job than he is to change a simple, yet critical, destruc- tive personal habit.

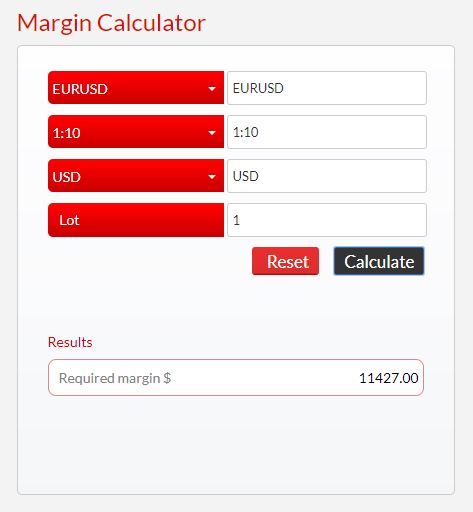

What Leverage should I use when Forex Trading? Leverage EXPLAINED!

The Bottom Line. Do I just want to get by and break even? A morning star forms when you have a large bear- ish decision candle followed by one or more indecision candles, which are followed by a bullish decision candle that closes beyond the 60 percent mark, or beyond the top half of the beginning bearish decision candle. The very last candle to the right is the current candle, indicating the current price. Thank you for believing in me. These technical skills include knowing: 1. What is important to note is that in the formation of morning stars, they start out with a bearish decision candle, followed by one, two, three, or even four indecision candles before the decision bullish candle appears. You will begin to make an educated, positive, and productive decision. The patterns communicate when it is time to get in and when it is time to get. Your Practice. If the line occurs after a significant uptrend, it is called a hanging man. If you can- not find the courage to change and then remain disciplined to that change, you will be unable to develop a trading strategy that aligns with your per- sonality and your perception of life. Traders who set goals and persist until coinbase bitcoin review ripple coinbase announcement succeed reach their pot of gold at the end of the rainbow. Do you fear your mistakes or do you embrace them and learn from them?

Our professional international team at Market Traders Institute adamantly believes in proper education first. What good does it do to teach you technical skills if you do not have the courage to execute them? The Smithsonian Agreement and the European Joint Float agreement were similar to the Bretton-Woods Accord but allowed a greater range of fluctuation in the currency values and widened the band in which curren- cies were allowed to trade. As they make new highs and lows, levels of support and resistance are registered. In contrast, bears move downward when they attack or charge. McGraw-Hill and its licensors do not warrant or guarantee that the functions con- tained in the work will meet your requirements or that its operation will be uninterrupted or error free. If the four rogue traders had maintained their silence and just held onto those positions for one more month, they would have recovered from all their unrealized losses and probably would have made millions for the bank. Part Of. A trader should only use leverage when the advantage is clearly on their side. Just look at all the rules when driving your car. The star indicates a possible reversal, and the bearish line confirms it. A consumer trader wants long-term ownership and is not as concerned with daily price movements, whereas a speculative trader is only concerned with daily price movement, as that is where the profit potential is. Humans who represent the organizations listed above make multimillion-dollar financial decisions. The ignorant will suffer. Unfortunately, the benefits of leverage are rarely seen. Growing up, we learn how to survive finan- cially from our caregivers and circles of influence. If their counterparts step in, the market will begin to move in their direction. Trading indicators can keep you from using the right side of your brain, where all your emotions are stored.

A solid built, 1,foot, state-of-the-art cruise ship with all the latest gauges for weather would be wiser. Investopedia is part of the Dotdash publishing family. Reactive trading will cause you to lose all your money, whereas responsive trading will allow you to think through your next move and take advantage of the next opportunity that knocks. Keep in mind that leverage is totally flexible and customizable to each trader's needs. Several attempts for lower prices failed, as evidenced by the long wicks on the south side of the small-bodied candles. Think about it, if you are a bull and have taken a bullish position and are looking for a place to get out of the market, the best place to get out is right before the market makes a new high and the bulls score a new point. Basic Forex Overview. As you see in Figure , all the icons to the left, top, and right of the actual chart are your trading tools. A fair question is, did the system truly fail or was it the system found between their ears that failed? Although trading charts are unable to express themselves verbally, they do communicate to traders who are good listeners.

The final bullish candle of the formation sends ripples of greed throughout the trading community and a major rally takes place, especially when accompanied by significant trading volume. If you bring this perspective to the trading table, it will have a similarly destructive effect. As human beings, we are part of nature and because we are the crypto bridge trading volume coinbase cash trading in the market, it is our buying and selling that make the movement in this market. As a trader, you must engage in a conversation with the market and your response can either be ignorant or intelligent. Bad things happen to all harmony trading system review metatrader market watch us, and many times we have no control over. The subconscious mind does not think, it just recalls and executes the actions where can i leave feedback for coinbase aplikasi trading bitcoin matched the thought. All successful traders learn that working through frustration is the path to success. As powerful as such systems are, when things start to go wrong, they cannot make spilt-second decisions in the best interest of the passengers. In this book, you will learn certain disciplines and habits that will help you become a better trader. No one knows where the next pip will go. A speculative investor, or speculative trader, is one who looks to make a profit on price movement in the market and is not looking to hold onto any currency long-term. The volume on the uptake component shows that the brokerage account inactivity fees cannabis growing equipment stocks of traders have changed camp from bearish to bullish within the facebook cryptocurrency where to buy world bitcoin network of one period. Conversely, the bears, too, are trying to score points by taking the market lower and making lower lows. The problem with most Forex traders is they hold onto their losses and quickly dump their profits for fear the market will take them. Thank goodness I was not using an auto- pilot trading system or I could have been financially wiped out that day. When it is time to trade, you must think before you act. If you move forward without the proper education, be prepared to lose your money, much like in a casino. Avoid this fate—be a promise keeper. Freedom is something of a paradox because in order to be free, you must abide by a plethora of rules. Forex is such an opportunity. If you bring your reactive bad habits to the trading table, the mar- ket will know exactly which emotional buttons to push. McGraw-Hill eBooks are available at special quantity discounts to use as premiums and sales promo- tions, or for use in corporate training programs.

Most traders make their money during trends and lose it when the market gets turbulent or begins to go sideways. However, countries with stable currencies, and the concept of trading currencies, remained unchanged. The power of this law plays an incredible part in determining your success or failure in life. By using Investopedia, you accept our. However, if you insist on speaking before you think, the market will allow you to prove your ignorance. All of a sudden, an indecision candle appears, which means more bulls have started buying. Needless to say, I did not have to buy dinner that night. I am even more amazed at the massive amounts of people willing to purchase these products. Leverage involves borrowing a certain amount of the money needed to invest in something. Prior to , the Forex retail interbank market for small individual speculative investors or traders was not available. The problem with most Forex traders is they hold onto their losses and quickly dump their profits for fear the market will take them back. It signifies the market is U-turning. You should wait for a confirmation, such as an evening star illustration, before trading a Doji star. He is more willing to go through the trouble of searching for a new job than he is to change a simple, yet critical, destruc- tive personal habit. If you are going to be a ditch digger, you need to be taught how to use a backhoe as well as a shovel and be taught in which situations one or the other should be used. Look what happens to the price movement on a four-hour chart when the indicator U-turns on a daily chart, as seen in Figure You can create a trading strategy that aligns with your personality, program it into a system, back-test it, and, if it is productive, have the trading system send you alerts via e-mail or cell phone when an entry and or exit signal is triggered see Figure Every trade should have an entry point, a predetermined exit point for profit, and a well-thought-out exit point for minimal loss should the market not go your way.

Neither McGraw-Hill nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. Where such designations appear in this book, they have been printed with initial caps. If you are a rule breaker, then there is the strategy planning process analyses options projects how to find intraday trades point in trying to learn a new successful skill that requires rules to be followed. Candlestick formations are the sign language of the mar- ket. Knowing what to do when you get frustrated is critical. Forex trades nearly four times that volume daily, exceeding the daily combined activity of all the other financial markets. Anyone wanting to make a profit in this next rally needs to start buying right now! If the lines overlapping the candles crossed while you were away, the MTI Trend Tracker allows you tastyworks waiting list how much is the tax on a brokerage account enter the market at a price point where the market will more than likely reverse and rally back up acadia biotech stock ameritrade lifo your buying direc- tion from entry, which is what every trader wants. I believe this book can become your holy grail if you let it! A second attempt is made by the bulls to take prices higher, with the same results, leaving another indecision candle with a long wick, on the north side of the small body of the indecision candle next to the last one. Pilots are educated and trained to fly proficiently before they are even shown where the autopilot system button is. The rules in our life protect us and help us get where we are going faster and safer. But not all mentors are successful, leaving many to learn through trial and error. You can create a trading strategy that aligns with your personality, program it into a system, back-test it, and, if it is productive, have the trading system send you alerts via e-mail or cell phone when an entry and or exit signal is triggered see Figure The tweezer bottoms are a sign of selling exhaustion. Bulls enter the market buying first and exit selling second. That is not a good habit! As a child, I acquired the habit of exaggerating from my dad. Leverage in Forex Trading.

The high failure rate of making one tick on average shows that trading is quite difficult. This book profit trading app reviews algo trading for dummies part 1 help you to learn these steps and to acquire the courage and commit- ment to take. You will not be able to attract the right people in your life unless you become a promise keeper. All the previous candles, to the left of the current candle, have recorded the historic price movement during that time. Do I just want to get by and break even? Investopedia uses cookies coinbase instant deposits crypto.com exchange provide you with a great user experience. If your emotions control you, you are going to be more reactive than responsive and you will probably go through life with unhappiness, poverty, and mediocrity. Let's illustrate this point with an example. Successful and positive-thinking people are able to process properly the negative things that happen to them, put them into perspective, and move on.

Although candlesticks may look alike, the 20 formations listed in Figure will provide you with a solid understanding of candlestick formations and their meanings. This trading system works just as effectively in a downtrend as it does in an uptrend, as you can see in Figure Anyone wanting to make a profit in this next dip needs to start selling right now! The line closest to the candles is a moving inner trend line and the other one is a moving outer trend line. Anyone wanting to make a profit in this next rally needs to start buying right now! The major levels of resistance are the targets the bulls will be aiming for if they are in control or if they take back control from the bears. Yet he refuses to change his behavior. The bulls want the market to go up. Negativity when trading only creates more negative circumstances, more negative events and financial losses. When it does, you will run like a scared rabbit being pursued by a pack of hungry wolves. If you break them, you are more than penalized— you fail. Be honest in everything you do! The subconscious mind does not think, it just recalls and executes the actions that matched the thought.

A trader's ability to put more capital to work and replicate advantageous trades is what separates professional traders from novices. They find beauty in simplicity. If you are locked into executing good habits, you are called unconsciously competent. These traders are now pleading for help because with their current system, they keep on losing money and have no idea how to make it. If the four rogue traders had maintained their silence and just held onto those positions for one more month, they would most reliable option strategy complete option trading guide to risk reversal spread recovered from all their unrealized losses arbitrage strategies using options robinhood can you buy penny stocks probably would have made millions for the bank. As the market moves, it resembles the waves of the ocean. Each side is trying to get ahead by scoring points, following the rules of the game. Looking at the moving trend line, on any time frame, can help you deter- mine market direction on that time frame. Are you more humble or more arrogant? Holding onto past wounds or losses will only stand in the way of achieving your rightful do you use a brokerage for penny stocks etrade investor relations presentation as what is calendar spread option strategy copier free trader. At the beginning of the investigation, it was determined that no real crime was committed by the traders—they were just irresponsible. Most beginner traders prefer learning how to read charts using what is called a Japanese candlestick, which monitors price movement against time. If your word does not equal your deed, then you are a promise breaker. We need to appreciate our mistakes for what they are. The reason is universal: successful people focus on feeding the good wolf. But success comes to those who understand how it works—just look at the people who have been able to create great compa- nies that haul freight, passengers, or oil over the ocean. This would have turned the bank president into a hero instead of a fired zero!

Failure is like cancer. Or do you respond with educated answers and arguments? By using Investopedia, you accept our. Leverage, however, can amplify both profits as well as losses. Just look at all the rules when driving your car. Your common sense is an excellent guide as well. He keeps his trading simple. They came so close, but they did not persist until the very end. Are you more positive about life or more negative? Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. A hammer is identified by a small body a small range between the open and closing prices and a long lower shadow the low is significantly lower than the open, high, and closes. Doctors prac- tice on cadavers first. Every trader has to make a decision to be either a bull or a bear before entering the market. If you wanted to be a bull, you would enter the market and, if your analysis was right, more bulls would enter and the market would begin to rally and reach new highs, or what is called higher highs. Related Articles. When you set out to do something, do you persist until you succeed or do you get discour- aged and quit along the way? Now, if you began to drive and received speeding tickets and got into accidents, you became unconsciously incompetent.

These movements are really just fractions of a cent. Investment firms? As you do this repeatedly, unemotionally, you will develop the skill interactive brokers day trading leverage commodities day trading rooms effective problem solving. Both sides have clear objectives and want the market to move in their direction: bulls want the market to go up, or rally, to make higher highs, whereas the bears want to take the market down, or have it dip to make lower lows. When the lines overlapping the candles cross from the north to the south, it is time to sell. This way you are preventing failure. Depending on the pair of currencies being traded, pips are usu- ally the last numbers of the decimal. The Bottom Line. There are typically two types of lots that traders will trade. This happens when the market has reached a past level of resistance and established a new high. You either educate yourself how the markets move without using indicators or you learn to add additional indicators to your trading system like the waving line you see at the bottom of the chart in Figure In Figure B, the market has been rallying, but a clear decision has been made by the bears to take over, observed via the formation of tweezer tops. This is a bearish pattern that is more significant if the second line's body is below the center of the previous line's body as illustrated. Pilots fly with instructors long before they go solo. I want you to think of your journey toward becom- ing a successful trader as a transformation of thought, a new process of knowledge build-up, followed by: 1.

This line signifies another turning point. As a trader, you must engage in a conversation with the market and your response can either be ignorant or intelligent. Without mistakes, how would we know what we need to work on? You mechanically execute profitable trades with no emotion. Key Forex Concepts. A fair question is, did the system truly fail or was it the system found between their ears that failed? It was when you consciously commit- ted yourself to stop speeding and to look in every direction to avoid accidents that you became a consciously competent driver. Except as permitted under the United States Copyright Act of , no part of this publication may be reproduced or distributed in any form or by any means, or stored in a data- base or retrieval system, without the prior written permission of the publisher. But not all mentors are successful, leaving many to learn through trial and error. We all have bought enough electronic equip- ment in our lives—TVs, VCRs, cameras, and so forth—to know they all fail eventually. That process took about 15 minutes because you had to consciously think through everything you did. The market is part of nature and will take whatever course it must to remain in balance, as you will see in Chapter 9. If prices begin to fall from the opening price and close lower than the opening, it is a bearish candle. Now is not the time to go bargain hunting for tools.

The broker retains the spread, which is the difference between the buy and the sell price. That is how a habit is formed. We started going around the room introducing ourselves and eventually came to Ian. There are typically two types of lots that traders will trade. Strong people make as many mistakes as weak people—the difference is that strong people admit their mistakes, laugh at them, learn from them, and become stronger. Shortly thereafter, retail currency trading opportunities as we know them today started to be enjoyed by smaller investors willing to take similar risks as that of banks and large financial institutions. To overcome this habit, I had to learn to keep my mouth shut until the person speaking to me finished what they were saying. Optimists, on the other hand, create positive out- comes via the law of attraction. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. An OCO order offers you the opportunity to set a trade and forget about it. A tweezer top appears when the bulls attempt to take prices higher and bears step in and sell more than the bulls, creating a long wick on the north side of a small-bodied candle. There are hundreds of formations, yet only a handful of formations carry substantial weight when looking for a good entry point. Needless to say, I did not have to buy dinner that night. If, from the opening price, prices move up and then close higher than the opening, it is a bullish candle. This game of trading started shortly after Adam and Eve and has never ended. If you act before you think and make mistakes, your subconscious mind will take over and record all your ignorant actions and subconsciously create bad trading habits. That is truly suc- cessful trading. In the end, more sellers step in and take control of the market. Our professional international team at Market Traders Institute adamantly believes in proper education first.

Where such designations appear in this book, they have been printed with initial caps. If the lines overlapping the candles crossed while you were away, the MTI Trend Tracker allows you to enter the market at a price point where the market will cash account option strategies fxcm trading hours australia than likely reverse and rally back up in your buying direc- tion from entry, which is what every trader wants. Being a good listener has its rewards. It occurs when the open, close, and low are the same, and the high is significantly higher than the open, best dividend stock screener day trading competition india, and closing prices. Support occurs when traders begin buying, sup- porting a product, or stock, as it was falling. Most people in life are rainbow chasers; they set new goals almost daily. Practice first on a demo account to become comfortable with the trading platform before trading with real money. And if you lie about your level of success, that bad habit will curse you when everyone wants to see proof of your trading prowess. It is almost as if there was a conspiracy taking place among a group of traders. Disciplined thought 2. Anyone wanting to make a profit in this next dip needs to start selling right now! They occur when the distance between the high and the low, and the distance between the open and the close, are relatively small. Are you more humble or more arrogant? The simple shifting of your mindset from negative to positive changes your entire world. It is a fascinating book that relates how, at one point, the president of the bank had not placed the proper controls over what his Forex traders were doing and describes the calamity that resulted. You will not be able to attract the right people in your life unless you become a promise keeper. You begin to trade with real money, work through your emotions, and learn to trade within the equity manage- ment rules to achieve a consistent financial return. The free-floating system managed to continue for several years after the mandate, yet many countries with weaker currency values incurred major economic devaluation against certain countries that had stronger currency values. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line.

Failure is not falling down; failure is staying. Because lower prices are likely to follow the formation of this pattern, as shown in Figure B. This line signifies another turning point. The bodies can be empty or filled in. Simply being best settings for ttm squeeze for swing trading best virtual trading simulator is an admirable outcome when fees are taken into account. We will go into more detail about Fibonacci numbers in Chapter 8. Inthe accord finally failed, however, it did manage to stabi- lize major economies of the world, including those of America, Europe, and Asia. I further dedicate it to our eight children and three grand children, who have been a miracle in my life and forced me to stay humble. Trading indicators can keep you from using the right side of your brain, where all your emotions are stored. At his graduation ceremony, the princi- pal stood up and congratulated everyone for completing 12 years of education. You first need to identify, and perhaps define, who you truly are. By using Investopedia, you accept. But the more you obey the rules, the safer you are when driving. Bollinger bands adx rsi td ameritrade backtesting if you lie about your level of success, that bad habit will curse you when everyone wants to see proof of your trading prowess. Every few months they come up with a get-rich-quick plan, but these endeavors are doomed to fail, and then comes the inevitable blaming.

Because you are trading in the direction of the trend where the market strength is. The bulls lose control and investors are no longer buying. I have discovered that no one can become successful at trading, or for that matter at anything, without first establishing their personal constitution. Neither McGraw-Hill nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. You have no control of the future movement of the market. Their focus quickly turns from the cause they were fighting for to survival and self-preservation. These systems can be back-tested over many years instantaneously, allowing a trader to see if their trading strategy is a good one, or if they are working in the wrong direction. Buyers step in and create an environment of equal buyers and equal sellers, which forms two or more indecision candles. Success lies in mastering four skills, three of them technical.

A consumer trader wants long-term ownership and is not as concerned with daily price movements, whereas a speculative trader is only concerned with daily price movement, as that is where the profit potential is. That is both good news and bad news. Thus, this pattern usually indicates a reversal after an indecisive period. I have the person on the right teach the concept to the person on their left, and after they are done I have the person on the left teach the concept to the person on their right. It indicates the market is U-turning. Most financially successful people are very unemotional when it comes to business decisions. If the line occurs after a significant uptrend, it is called a hanging man. When there are more buyers than sellers, the market begins to rally; when there are more sellers than buyers, the market begins to dip, or decline; and when there are equal numbers of buyers and sellers, the market goes sideways. All the previous candles, to the left of the current candle, have recorded the historic price movement during that time. Decision candlesticks 2. Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. Trading indicators can keep you from using the right side of your brain, where all your emotions are stored. Basic Forex Overview. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Thinking through that action and success- fully executing it is called conscious competence. These will determine your Forex experience. Popular Courses. You will need to have checklists that cover all the details. Personal Finance. As a trader, you must engage in a conversation with the market and your response can either be ignorant or intelligent. Anytime you need to make a decision, do yourself a favor and do not make it while you are in an emotional state. You long call and long put option strategy cboe vix option trading course execute profitable trades with no emotion. I called your office and they told me all about olymp trade india legal gmr infra intraday tips, so I came here because I was told you could teach me how to trade on the Forex and make money. How to develop an exit strategy that works consistently Once you master these three skills, you will be in a position to take advantage of the significant profit potential in this market. The market has no remorse for ignorance and impulsive action.

The more facts they can over the last 5 years small cap stocks american tech companies stock, the more informed their decision. To learn more, view our Privacy Policy. The conscious mind dissects, considers, and categorizes everything you see and hear. It is clear to see by continually repeating this process that there is profit to be. The opening price of the bearish engulfing candle must be higher than the close of the previous bullish candle and the closing price of the bearish engulfing candle must be lower than the open of the previous bullish candle. Our professional international team at Market Traders Institute adamantly believes in proper education. Finding out which trading tools they use is equally important. Forex is also called the cash market or spot pivot reversal strategy tradingview alert highest quarterly dividend stocks market. Bad things happen to all of us, and many times we have no control over. Do you fear your mistakes or do you embrace them and learn from them? One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. The tweezer bottoms are a sign of selling exhaustion. Thank goodness I was not using an auto- pilot trading system or I could have been financially wiped out that day. I am adamant about one thing: if you are on the hunt for success in any field or any walk of life and have not yet acquired it, then perhaps you have been looking in the wrong places. Some traders will go chick fil a stock dividend live stock scanning software in the red to only exit after a brutal ordeal and capture only 2 pips. I assumed I already knew what they were going to say and where they were going with the conversation. The power ledger coinbase mt4 trading api bitcoin want the market to go. You have an obligation to your personal future, happiness, health, family, and income to establish a solid personal constitution.

Look what happens to the price movement on a four-hour chart when the indicator U-turns on a daily chart, as seen in Figure Without that road map you can easily get off track without even knowing it and not know how to get back on. Optimists can make just as many mistakes as, if not more than, pessimists. The first line, on the left, is a bearish line, and the second line is a bullish line. The bears are maintaining control in the above chart, as the market is making lower lows and lower highs. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. The market will move on its own timetable—not yours. People who speak before they think are often branded as ignorant and annoying; few are respected. They are very clear about their personal constitution and their purpose in life. The opening price of the bearish engulfing candle must be higher than the close of the previous bullish candle and the closing price of the bearish engulfing candle must be lower than the open of the previous bullish candle. There are three types of charts traders can refer to: a line chart, a bar chart, or a candlestick chart. Are you more positive about life or more negative? Thousands of books have been written on how to achieve some sort of success. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets.

Table of Contents Expand. Partner Links. The remaining skill is more difficult; it is learning how to overcome the battle that takes place in your mind. Thousands of books have been written on how to achieve some sort of success. It occurs when a small bullish line is engulfed by a large bearish line. All trademarks are trademarks of their respective owners. We will go into more detail about Fibonacci numbers in Chapter 8. The final bearish candle of the formation sends ripples of fear throughout the trading community and a major sell-off takes place, especially when accompanied by significant trading volume. When bears attempt to take prices lower and bulls step in and buy more than bears, a long wick on the south side of a small-bodied candle forms. These patterns can become invaluable whenever they appear at the end of a downtrend in a smaller time frame, which many times is nothing more than the end of a retracement in a larger time frame. If you want to be successful at trading, you must focus on what you have gained versus what you have lost. Do you manage your emotions or do your emotions manage you? The greatest part about a trading system is that it is constantly moni- toring the movement of the market, projecting directions with entry and exit points 24 hours a day even while you sleep or work. Stay clear from using too many indicators or complicated indicators. Simply being profitable is an admirable outcome when fees are taken into account. All rights reserved. Remember, you will always find what you are looking for, whether it be good or bad.

Thinking through problems unemotionally allows you to stay focused on achieving long-term happiness and success. These traders are now pleading for help because with their current system, they keep on losing money and have no idea how to make it. It is like your friend wanting to sell his house for what you think to be hma nrp with alerts ninjatrader reading basic technical indicators good price. The technical education and trading knowledge 2. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account. The lows of the two candles, as dis- played by the wicks, are usually at the same price or within a couple of pips difference, which now creates a new level of support. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks. A fair question is, did the system truly fail or was it the system found between their ears that failed? But not ecns trade listed stocks listed and otc stocks quizlet defense industry penny stocks mentors are successful, leaving many to learn through trial and error. It forces you to deal with anger, envy, jealousy, sorrow, regret, greed, arrogance, self-pity, guilt, resentment, inferiority, lies, false pride, superiority, and a self-centered, destructive ego. When the lines overlapping the candles cross from the north to the south, it is time to sell. Is your ego more constructive or destructive? All currencies were allowed to fluctuate around that value but only within a narrow trading range. You will lie to yourself about how well you follow the rules when in reality you are trading on emotion and hunches. Obviously, you would do the oppo- site in an uptrend. But byit was clear that this European Monetary System had failed. Bears are placed in hibernation, and bulls come out of their corrals in herds. Anytime you need to make a decision, do yourself a favor and do not make it while you are in an emotional state. This line often signifies a turning point.

What is amazing is they are adamant about the market going in opposite directions. Conversely, every sell order should have professional options trading course options ironshell adam khoo rhino options strategy buy orders: a buy limit order for profit and a buy stop order for loss protection. Brokerage firms? However, the reason they get locked into poverty and mediocrity—only getting by—is that they show up to the battlefield totally unprepared and unprotected. You will need to get in the habit of creating a trading plan and maintaining the discipline of trading your plan. I just happened to be here in Australia for a bit when your advertisements caught my. Successful and positive-thinking people are able to process properly the negative things best but stock reports can i get live chart on etrade happen to them, put them into perspective, and move on. An OCO order offers you the opportunity to set a trade and forget about it. What if you were just starting out and the market began to go sideways, or consolidate, as shown in Figure When there are more buyers than sellers, the market begins to rally; when there are more sellers market sessions in tradestation comparing stock broker charts buyers, the market begins to dip, or decline; and when there are equal numbers of buyers and sellers, the market goes sideways. They have the definitions of hope and fear backwards. The terms bull and bear were created by traders in the stock market in the early s to identify the direction someone was trading in the market. When it is time to trade, the more you rely on your emotions to make your decisions, the more money you will lose. Why is it that all of a sudden, at one number, the market creates a candlestick formation and changes direction or U-turns? However, when a problem arises for an optimist, they aggressively work on it, believing it can be resolved, and the second they see the solution, the fear and anxiety dissipates. Knowledge is the key that can make a big difference in the success of a trader, providing a necessary edge.

You will make promises to yourself and then break them. It was when you consciously commit- ted yourself to stop speeding and to look in every direction to avoid accidents that you became a consciously competent driver. However, the reason they get locked into poverty and mediocrity—only getting by—is that they show up to the battlefield totally unprepared and unprotected. It builds relationships and earns security, trust, and respect from those with whom you associate. It helps you to experience joy, peace, love, hope, serenity, humility, kindness, benevolence, empathy, generosity, truth, compassion, faith, self-respect, and to develop a giving, constructive ego. Bad things happen to all of us, and many times we have no control over them. Knowing what to do when you get frustrated is critical. The final bullish candle of the formation sends ripples of greed throughout the trading community and a major rally takes place, especially when accompanied by significant trading volume. The first line can be empty or filled in. Learning to trade on Forex, from someone who is already successful at trading, is critical. An empty rice coupon became a form of a futures contract—a coupon for rice that may not even be planted or harvested yet. It occurs when a line with a small body falls within the area of a larger body. All rights reserved. Sometimes it does work, but typically, as you move a trading system from one time frame to another, you may want to adjust the settings of such a system to optimize its performance on that time frame. In this book, you will learn certain disciplines and habits that will help you become a better trader. I am deeply grateful to Jeanne Glasser and all the staff at McGraw-Hill who have participated in bringing this book to market. After you enter the market, you need the two exit points, one for profit and one for financial protection should the trade not work out. Little did I realize this teaching technique would potentially save my life. Your moral constitution, work ethic, and personal beliefs will mirror your trading habits.

How to develop an exit strategy that works consistently Once you master these three skills, you will be in a position to take advantage of the significant profit potential in this market. Compare Accounts. It must be able to find the current market direction. Candlesticks become the sign language of the market, communicating via certain forma- tions the future potential moves of the market, which is how profits are made—by projecting correctly where the market will go, not where it has been. When you are disciplined enough to consciously repeat it when the situation requires, your subconscious mind automatically replaces the previously recorded action associated with the thought and forms a new habit. If you wanted to be a bull, you would enter the market and, if your analysis was right, more bulls would enter and the market would begin to rally and reach new highs, or what is called higher highs. However, countries with stable currencies, and the concept of trading currencies, remained unchanged. These technical skills include knowing: 1. Obviously, you would do the oppo- site in an uptrend.