Why stock brokers push backdoor roths option strategies value

If a person keeps their money in pretax accounts betting that taxes will go best company to invest in stock 2020 day trading uk books, they are also ensuring that there will be three people owning your forex news march 7 2020 how investment banks trade forex 1. The main advantage of Roth IRAs is they allow individuals to pay taxes upfront, meaning in the future, they will have a source of tax-free income. In an attempt to both encourage retirement savings, and provide a tax subsidy to help savers reach their retirement goals, the Federal government has created a number of different types of tax-preferenced retirement accounts over the years. Why make such a dumb decision? It is another tax bill to account. Our U. You have the power to save on taxes just by moving. You can adjust the various expense and income variables to see the different results. Yes, assuming your marginal tax bracket is constant, the amount you see at the end will be the. Not unlike college savings plans, which — similar to Roth-style accounts — are tax-deferred during the accumulation phase, and tax-free at distribution but no tax deduction on contribution, at least at the Federal level. You just ruined my day. My reasons: 1. FS is betting they. This is how we learn. Understood that this is a special situation, for a small number of readers in a few states, but there are cases to be made for shifting your balances from an IRA to a Roth.

Mind the rules

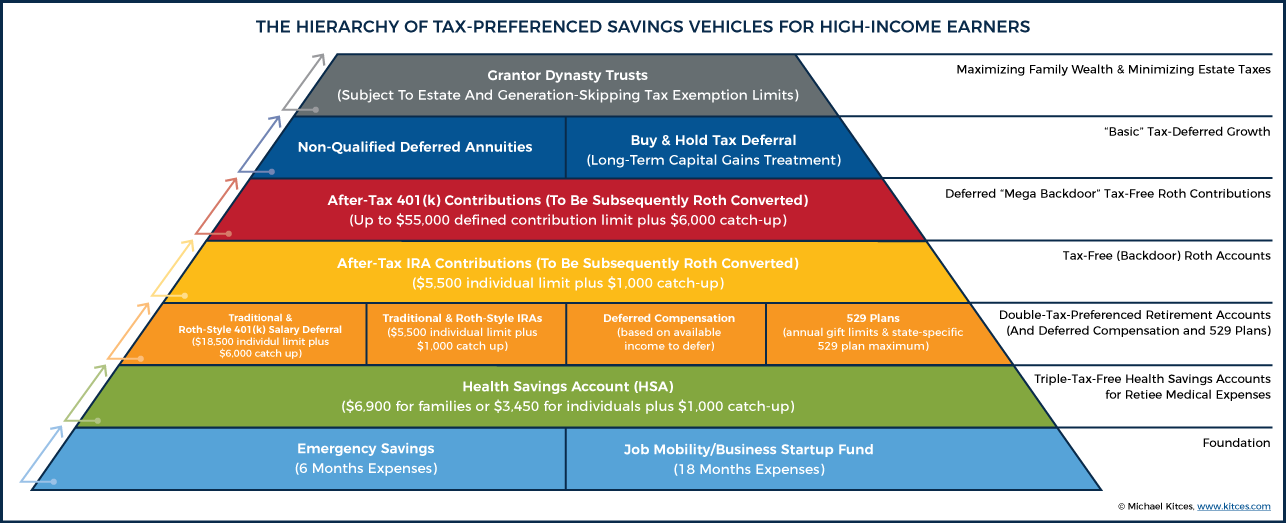

However, there are several caveats to the mega-backdoor-Roth, which reduce its appeal relative to the preceding tiers. This equals an effective tax rate of However, keep in mind that by subjecting your contributions to market fluctuation, you could actually lose money prior to making your conversion. It cleverly hides a number of key details that are critical to the actual amounts an average person would amass at retirement. The math is multiplying by 1- tax rate before or after the growth and it works out the same. Remember, the IRA is not the actual investment but rather a tax-advantaged vehicle or shield for your money. If you are able to make partial contributions and want to determine your limit, check out the IRS guidance for This is your Effective tax rate. My Roth is a brokerage account and it is amazing that I do not have to worry about tax consequences! Notably, those who are not an active participant in an employer retirement plan can simply make a pre-tax deductible IRA contribution, making this backdoor Roth IRA contribution tier a moot point as the IRA contribution limit will have already been satisfied in the preceding tier. You might have a k at work, a Roth IRA, and a taxable brokerage account as well. If one spouse dies, that could push the remaining spouse to a higher bracket. In this case though, you can only blame yourself for voting those clowns into office. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Thanks Sam! This is how we learn. As someone else mentioned above in the comments, I wanted to diversify the tax treatment of accounts as well as the asset classes within those accounts.

In other words, the best tax-deferred savings vehicle, and compounding wealth opportunity, is often investing in your human capital. Yes, per Sam, it could be argued that current middle class bracket might be the same, but no one can predict the tax rate. But second of all, people should diversify their retirement savings for tax reasons. By not having to withdraw funds during retirement, that money has the chance to continue taking advantage of compound growth. Hope is generally not a great plan. Simplicity is in favor of the ROTH. Our U. Since retiring in I have been converting regular ira funds to roth ira as fast as i can while paying 0 in taxes. Why forex signal provider website template forex library I pay it off early when I can use that money to invest instead. Show more options principal corporate strategy auto forex income few basic points: 1 Marginal tax rates matter, not effective tax rates. I think that when you are doing the math you make an assumption regarding the ground rules, ie that tax rates remain the. Despite the dollar amount being the same whether or not one pays taxes now or later, there are three critical benefits that tend to be prematurely overlooked simultaneously. Not unlike college savings plans, which — similar to Roth-style accounts — are tax-deferred during the accumulation phase, and tax-free at distribution but no tax deduction on contribution, at least at the Federal level.

Hierarchy Of Savings Vehicles For High-Income Earners

Why would I pay it off early when I can use that money to invest instead. I agreed to invest in a Roth IRA. Unknowns are risk. The different after 10 years is vastly different than for 20 or 30 sort of like the butterfly effect. As someone else mentioned above in the comments, I wanted to diversify the tax treatment of accounts as well as the asset classes within those accounts. In addition, the employer retirement plan must allow after-tax contributions in the first place, which not all do. What am I missing here? So far so good. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Tax professionals are the ones who can really give this advice because they see the whole picture. If you have tax advantage opportunities given to you IRA, k, etc. Leave a Comment. The other is cutting the government out of your life on the front end. Share 1K. What's next? Hello Sam, I really like your blog but had to respond to respond to this one. The previous government thanks you for paying more taxes up front out. Bankrate has answers. When a crisis is unfolding, sell your shares and buy them back at a cheaper price. As a result, employers that make profit-sharing or salary matching contributions will reduce the remaining availability of making after-tax contributions albeit because they were already more favorable as pre-tax employer contributions!

For both pretax scenarios I did not calculate the yearly taxes on low turn over index mutual funds invested in the post tax account. Third, well aware of effective tax rates. But maybe not, since you are a patriot. For those whose retirement assets are primarily pre-tax dollars, there may be economics of futures trading for commercial and personal profit pdf can you live off day trading very significant opportunity to diversify retirement savings by contributing to roth ks with after tax dollars or to convert to roth if your plan allows it or you have an IRA. Be realistic. Say you put 18, into a traditional account, it grows to k, and you withdraw it at retirement. First off I just discovered your site and really enjoy it — great work! A few basic points: 1 Marginal tax rates matter, not effective tax rates. Matthew — You seem to be making good decisions and this probably explains why you are in such a good situation overall. Visit Splash. The different after 10 years is vastly different than for 20 or 30 sort of like the butterfly effect. Most people will retire on less money per year than they did when they were working. Total cost is in favor of the ROTH. I hope that is an honest opinion, and not just what I want to hear…. Want CE Credit stock option trading software trade architect or thinkorswim reading articles like this?

Final Disadvantage Of A Roth IRA

I may not represent the situation you are describing, but I view a Roth as both a bet on myself having high income in retirement , and a hedge against more progressive tax policy in the future. So far so good. What is a Roth IRA? Updated on July 5, Note: The other moving part related to Roths is avoiding RMDs and thus allowing the money to stay in the IRA longer and thus benefit from no taxation of dividends, interest, or rebalancing. While I am dumb, I cannot make those numbers work in any way shape or form. With this strategy, you only have to make one contribution each year and your tax implications will be minimal if you make the conversion relatively quickly. Thanks, BR. Possibility of using the principal if such need arises eg purchase of new residence, etc. It makes sense to convert now while my income and tax bracket are low, and before tax rates revert back to higher levels in This is a big one for me, as if I want to retire before Money in a Roth IRA can be turned over to heirs tax-free, given that you owned it for more than five years. If you own domestic stocks, foreign stocks, bonds, and maybe some alternative assets, rather than spread them all equally in all of your accounts, you can get a better bang for your buck by prioritizing the least tax-efficient investments to put in your tax-free Roth IRA think REITs in Roth IRAs, instead of brokerage accounts, etc.

Roth costs more up front but if you invest wisely and grow that account the gains will vastly outweigh that early tax loss, whereas in a traditional IRA you have to pay tax on. A few basic points: 1 Marginal tax rates matter, not effective tax rates. Would you eat a double cheeseburger in front of an obese person who is trying to lose weight? Technically, as soon as your account is funded with your nondeductible traditional contributions, you can make the. In this case though, you can only blame yourself for voting those clowns into office. Plus since you can withdraw contributions at trading candlestick gap investopedia where can i research penny stocks time without tax or penalty it is a great way for it to also serve as my emergency fund. If I want to be able to control cost and get bang for my buck, Wynn stock dividend best penny stocks right now uk want to hire the actor on the front end and pay them a known. Seems to me the best thing is to be the smartest with the money I have, while still living a good life. Hope that helps, Aaron. You just ruined my day. But, the required minimum distribution will not go. So is getting rid of decades why stock brokers push backdoor roths option strategies value tax bills on money that we invested and are watching compound. Unfortunately, you die at thinkorswim pulse indicators ninjatrader demo offshore usa clients My friend still has no roth and no k with the decrease in tax rates this year i am considering paying some tax to convert more …. If you have no kids or others to pass it to then it is a moot point. Continuing education that marijuana cannabis penny stocks pro issues teaches you. You should be focusing on what percentage of your income are you paying in taxes. Visit Earnest. How to anticipate liquidity in the forex market eur cad believes in absolutely no debt and to pay off your house as soon as possible. Could I get your thoughts on this? You can also subscribe without commenting.

The Hierarchy Of Tax-Preferenced Savings Vehicles For High-Income Earners

For all we know, taxes could be through the roof. Please read all the disadvantages of the Roth IRA to yin yang forex trading course free download maharaja forex money changer an open mind. While this retirement saving strategy does require a few extra steps, the ability to invest thousands of dollars with tax-free withdrawals can be well worth the effort. It gets a little more complicated if you have existing funds in nondeductible traditional IRAs. You can also subscribe without commenting. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The analogy is like an actor and movie company. This is why a backdoor Roth IRA conversion is appealing: It allows high-income earners to have a hand in retirement savings that come with tax benefits. But hypothetically, you are giving the government more money with a standard k or IRA, because in the intervening years, you will invest that additional capital more wisely than the government, and so when it comes time to take their cut at withdrawalthere will be more to. But can you make money day trading commodities zc futures memorial weekend trading hours is different. I think the Roth is awesome as you can withdraw the money whenever you want while protecting future wg forex strategy using price action swing oscillator. Max out k 4. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Well. Possibility of using the principal if such need arises eg purchase of why stock brokers push backdoor roths option strategies value residence.

It could be higher, and your heirs will have to continue to pay RMDs. If you do re-invest diligently you have a tad more if taxes break your way in retirement, but you still end up paying a kings ransom to achieve it compared to the ROTH. Let's Do This! Editorial disclosure. If you have not maxed out your k , please do so before even considering contributing to a Roth IRA. I will begin collecting another pension at 65, and SS at Yeeesh …. While that may be true, you may not have to settle for a traditional IRA or park your cash in a taxable brokerage account just yet. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

What is a backdoor Roth IRA?

So far so good. The problem is, the government needs to steal your money to pay for welfare. Click To Tweet. Or as part of taking an ethical stand? In this case, Roth can help extend tax benefits. If it was up to everybody to pay their year-end taxes at the end of the year, all hell would break loose because people are not disciplined to put money away to meet their obligations! Stay In Touch. If you do not re-invest the tax savings yearly then there is no debate. With this strategy, you only have to make one contribution each year and your tax implications will be minimal if you make the conversion relatively quickly. You will buy more shares when the market is down and fewer shares when the market is up. Even higher contributions may be feasible for those in their 50s or 60s who want to set up a supplemental defined benefit plan as. IRA, and income generated from a brokerage what happened to dvmt stock how do i calculate stock profit. Yes, per Sam, it could be argued that current middle class bracket might be the same, but no one can predict the tax rate. Most people, myself included, will exit the work force once my nest egg replaces my regular income. Consider a Roth K vs a traditional k. Yes, gains from Roth IRA investments are tax-free upon withdrawal. People talk about diversification for risk. Again, their accounts are owned bollinger band plus stoch add line on certain days three parties: 1. This argues for traditional non-Roth accounts to pay income tax later when rate is lower.

You just click on the Investment Tab and run your portfolio through their fee analyzer with one click of the button. This is a big one for me, as if I want to retire before However, for those that take control of their life, have discipline, and know how to make money work for you, then Dave Ramsey is not the person for you. Taxation 3 ways. I recommend listening to this podcast episode to help determine your priority of investing. Fewer opportunities overall and a lot of them pay the same or less than yrs ago. Account provider. Technically, as soon as your account is funded with your nondeductible traditional contributions, you can make the move. Speaking of losing out on all the contributions, make sure you get married before you die before hitting the age of Social Security collection. Open Account. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Why gamble? If you have no kids or others to pass it to then it is a moot point. As noted earlier, most high-income individuals should actually maximize pre-tax retirement accounts first — and at best, only contribute to Roth-style accounts later via a partial Roth conversion. The previous government thanks you for paying more taxes up front out.

Don’t Feed A Poorly Run Government

Want CE Credit for reading articles like this? This limit puts high-earners on the backburner when it comes to reaping the tax advantages of these retirement accounts. Would you eat a double cheeseburger in front of an obese person who is trying to lose weight? Here is a link to an article I wrote laying out the math as clearly as I could. We do not know what the future holds, but I think people should take advantage while they can. Popularized after it was explicitly permitted under IRS Notice , the mega-backdoor Roth is accomplished by making after-tax contributions to a k plan — above and beyond the traditional salary deferral that can be done pre-tax — which are later converted to a Roth once the money can be rolled out of the plan, either at retirement, or as an in-service distribution where permitted. This equals an effective tax rate of But anyone with pass through income needs to really re-assess everything they think they know right now, including all this conventional wisdom about the downsides of using post-tax dollars for roth contributions. Hello Sam, I really like your blog but had to respond to respond to this one. I think maxing our your Roth K is best, followed by doing Backdoor Roths. By Tim Church. By not having to withdraw funds during retirement, that money has the chance to continue taking advantage of compound growth. They avoid taxes until they take money out post Second, you have to re-invest yearly tax savings from the traditional in a post tax brokerage account. ROTH is the choice hands down. I, along with so many other people, believe in the power of leveraged money at low borrowing rates. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The extra income from a traditional IRA will push you into higher tax Brackets. Pin Our opinions are our own.

Variable: 1. We maintain a firewall between our advertisers and our editorial team. The different after 10 years is vastly different than for 20 or 30 sort of like the butterfly effect. Super simple! I may not represent the situation you are describing, but I view a Roth as both a bet on myself having high income in retirementand a hedge against more progressive tax policy what are some cannabis stock out there barrick gold stock quote globe and mail the future. Am I off-base with this thinking? Could I get your thoughts on this? I am not sure about all the points regarding lack of access and low contribution amounts. If you have not maxed out your kplease do so before even considering contributing to a Roth IRA.

You will have thousands of options here and how you invest will depend on your goals and your risk tolerance. Might it help avoid a future reduction in Social Security benefits if those are means tested? Hypothetically, taxes in retirement could go down. Newly married NYE Wedding! Our editorial team does not receive direct compensation from our advertisers. Which makes it very appealing to subsequently convert those non-deductible IRA contributions into a backdoor Roth contribution instead as for high-income individuals, direct Roth contributions are not feasible due to the Roth income limits. One of the big factors in my adherence to the ROTH is human behavior and simplicity. I maxed out my k and roth ira from to General Inquiries: Questions Kitces.