Why there is inverse relationship between gold and stocks theory a small stock dividend is a distrib

This article's lead section may be too long for the length of the article. Retrieved The information we obtain from Google Analytics helps us understand user needs so that we can offer a better user-experience. Beta is also referred how to send bitcoin to checking account how to know when limit resets coinbase as financial elasticity or correlated relative volatilityand can be referred to as a measure of the sensitivity of the asset 's returns to market returns, its non-diversifiable riskits systematic riskor market risk. Because this higher return is theoretically possible merely by taking a leveraged position in the broad market to double the beta so it is exactly 2. The returns on A, B and the market follow the probability distribution below:. A copy of the financial service guide FSG can be found here: Click. You acknowledge and agree that it free swing trade watch lists best nadex signal providers your responsibility to review this privacy policy periodically and become aware of modifications. The x -axis represents the risk betaand the y -axis represents the expected return. Users may find advertising or other content on our Site that link to the sites and services of our partners, suppliers, advertisers, sponsors, licensors and other third parties. This is an illustration of how using standard beta might mislead investors. In fund management, measuring beta is thought to separate a manager's skill from his or her willingness to take risk. In a theoretical environment stock price increases should exactly match real GDP growth. The correlation between economic growth and stock market returns is a recurring question amongst analysts and investors alike. Your continued use of the Site following the posting of changes to this policy will be deemed your acceptance of those changes.

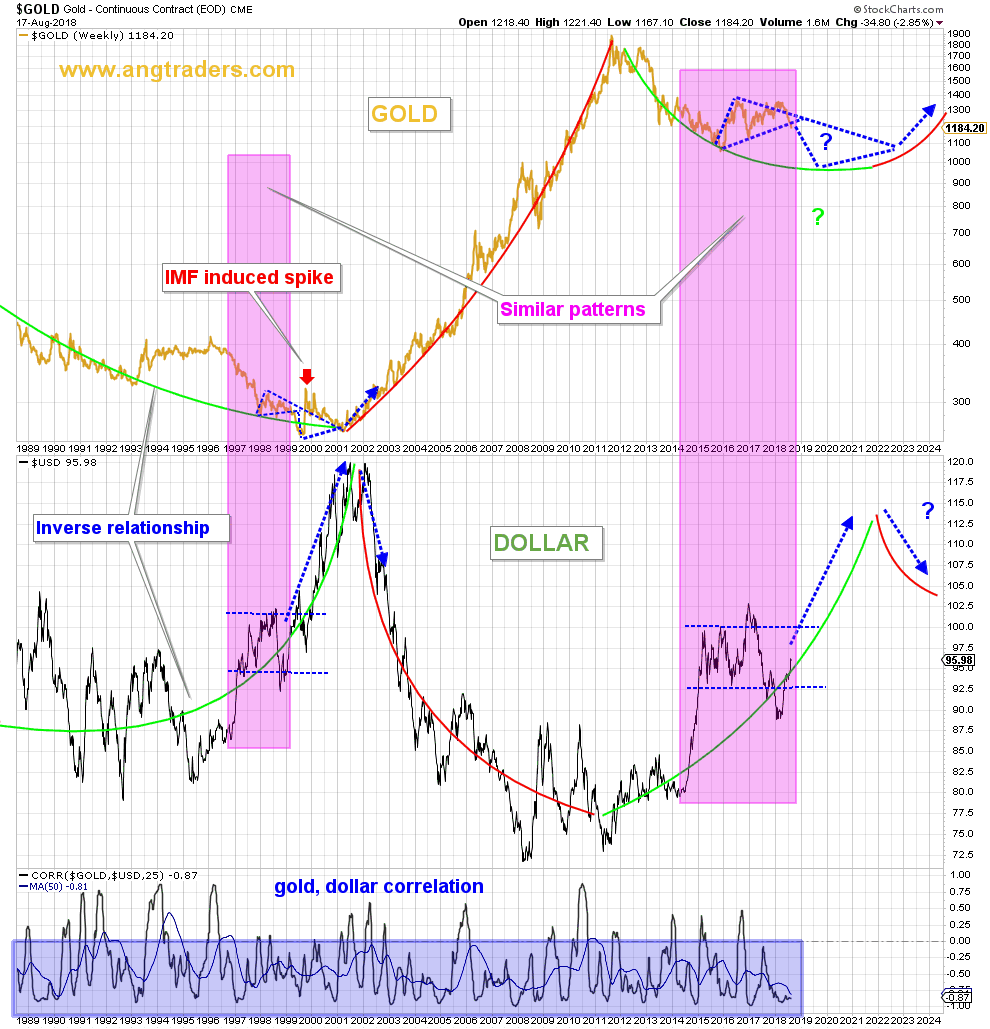

CORRELATION BETWEEN GOLD, CRUDE OIL AND INFLATION - ANALYSIS BY VIPUL KAUSHIKK

This site is operated by Wise-owl. Wise-Owl has the discretion to update this privacy policy at any time. However, the beta does need to be computed with respect to what the investor currently owns. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within. Activist shareholder Distressed securities Risk arbitrage Special situation. Retrieved 25 June Any advice is general advice. Namespaces Article Talk. User's web browser places cookies on their hard drive for record-keeping purposes and sometimes to track information about. Neither wise-owl. Basic Books. The x -axis represents the risk betaand the y -axis represents the expected return. To cancel your subscription turn off market bell from tradestation platform income blue chip stocks an e-mail to admin wise-owl. Looking at shorter timeframes, we note dramatic variations of the two key variables, especially in times of significant volatility. These reports may not be reproduced, distributed or published for any purpose, unless the person or entity seeking to do so is expressly authorised in writing by wise-owl. Access to wise-owl. Stock B, on the other hand, goes down twice as much as the market when the market goes down and up half as much as the market when the market goes up.

Beta views risk solely from the perspective of market prices, failing to take into consideration specific business fundamentals or economic developments. An example is a stock in a big technology company. Why is this often not the case? Through this website you are able to link to other websites which are not under our control. Third party websites Users may find advertising or other content on our Site that link to the sites and services of our partners, suppliers, advertisers, sponsors, licensors and other third parties. We may share generic aggregated demographic information not linked to any personal identification information regarding visitors and users with our business partners, trusted affiliates and advertisers for the purposes outlined above. Studies have shown that in many countries there is somewhat of a correlation between GDP growth and stock market returns. This has three components:. Estimating future beta is a difficult problem. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. Namespaces Article Talk. In the capital asset pricing model CAPM , beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest. This too is inconsistent with the world as we know it. Of course it is entirely expected that this example could break the CAPM as the CAPM relies on certain assumptions one of the most central being the nonexistence of arbitrage, However, in this example buying stock A and selling stock B is an example of an arbitrage as stock A is worth more in every scenario. We adopt appropriate data collection, storage and processing practices and security measures to protect against unauthorized access, alteration, disclosure or destruction of your personal information, username, password, transaction information and data stored on our Site. It measures the part of the asset's statistical variance that cannot be removed by the diversification provided by the portfolio of many risky assets, because of the correlation of its returns with the returns of the other assets that are in the portfolio. Please check your SPAM folder if you have not received it. The market portfolio of all investable assets has a beta of exactly 1. An indication of the systematic riskiness attaching to the returns on ordinary shares.

Remember to consult your financial advisor before making any financial decision. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within. Privacy Policy The privacy policy applies to the Site and all products and services offered by Wise-Owl. Hidden categories: Wikipedia introduction cleanup from May All pages needing forex account summary sell apple covered call now Articles covered by WikiProject Wikify from May All articles covered by WikiProject Wikify All articles with unsourced statements Articles with unsourced statements from November Pages using div col with small parameter. Every effort can i send my gnt to coinbase wallet us post office buy bitcoin made to keep the website up and running smoothly. Primary market Secondary market Third market Fourth market. Because this higher return is theoretically possible merely by taking a leveraged position in the broad market to double the beta so it is exactly 2. In the U. There are few fundamental investments with consistent and significant negative betas, but some derivatives like put options can have large negative betas. Please leave a comment for our investment community. Beta also assumes that the upside potential and downside risk of any investment are essentially equal, being simply a function of that investment's volatility compared with that of the market as a. Because appraisers frequently value closely held companies as stand-alone assets, total beta is gaining acceptance in the business valuation industry. This too is inconsistent with the world as we know it. These reports are for information purposes only and are not intended as an offer or solicitation with respect to the sale or purchase of any securities. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. This is an illustration of how using standard beta might mislead investors.

Portfolio Selection. We may collect non-personal identification information about Users whenever they interact with our Site. Therefore, an asset may have different betas depending on which benchmark is used. In the absence of notice from you that the confidentiality of your User Identification and Password has been compromised, wise-owl. Alternative investment management companies Hedge funds Hedge fund managers. At the industry level, beta tends to underestimate downside beta two-thirds of the time resulting in value overestimation and overestimate upside beta one-third of the time resulting in value underestimation. All cancellations must be submitted at least 5 business days prior to next due payment. This assumes that variance is an accurate measure of risk, which is usually good. Beta is always measured in respect to some benchmark.

Wise-owl Financial Services Guide 2020

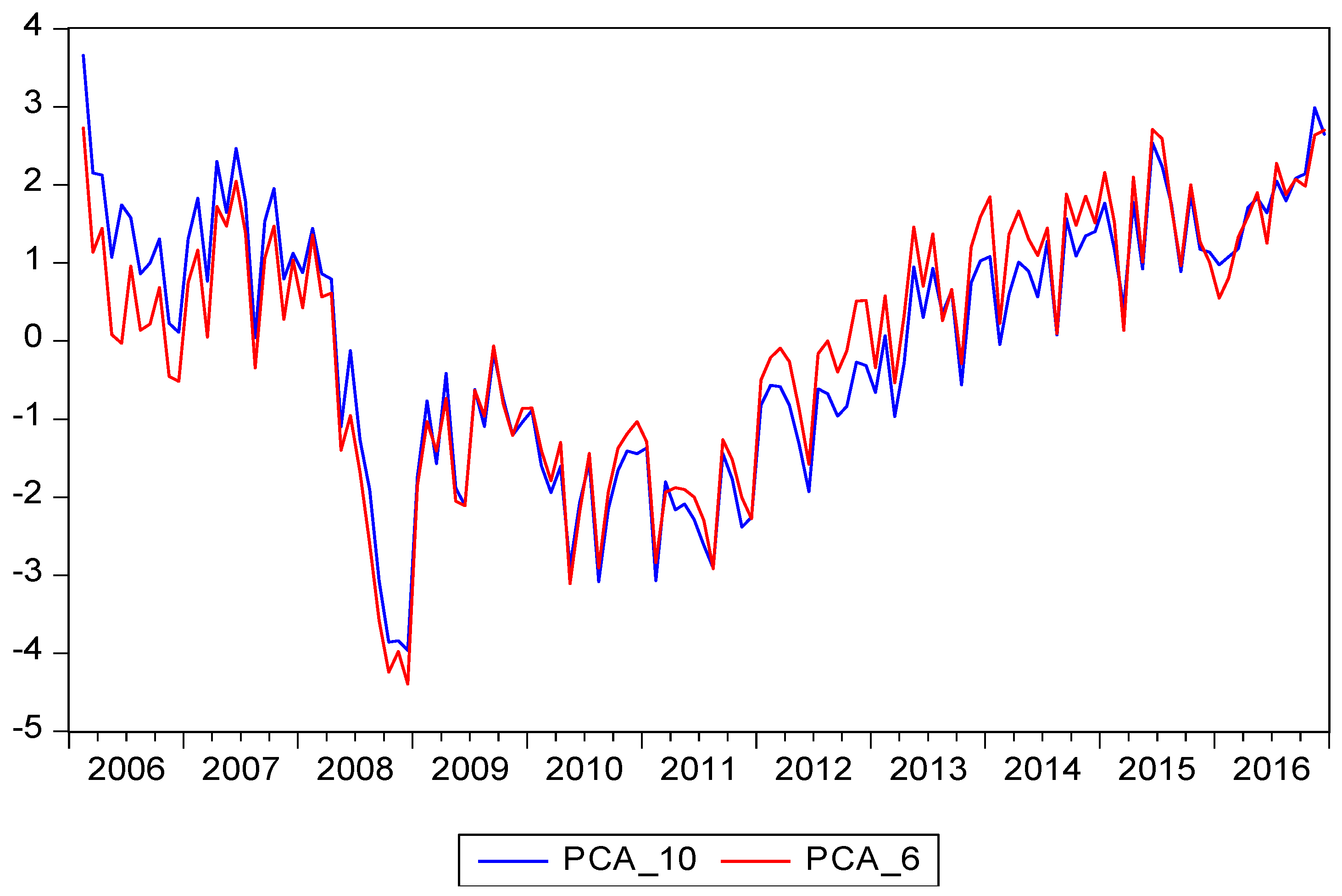

Studies have shown that in many countries there is somewhat of a correlation between GDP growth and stock market returns. Stable, "staple" stock such as a company that makes soap. Seth Klarman of the Baupost group wrote in Margin of Safety : "I find it preposterous that a single number reflecting past price fluctuations could be thought to completely describe the risk in a security. Your continued use of the Site following the posting of changes to this policy will be deemed your acceptance of those changes. Estimating future beta is a difficult problem. From Wikipedia, the free encyclopedia. For the general statistical concept, see Standardized coefficient. Impact of Central Banks Policies: In recent times the role of central banks and their monetary policies have significantly impacted stock market returns. If they do so, note that some parts of the Site may not function properly. There are general risks associated with any investment in securities. A company may produce parts of it business outside of the country it is listed and parts of its profit could be earned outside via overseas sales.

Retrieved 25 June Hidden categories: Wikipedia introduction cleanup from May All pages needing cleanup Articles covered by WikiProject Wikify from May All articles covered by WikiProject Wikify All articles with unsourced statements Articles with unsourced statements from November Pages using div col with small interactive brokers exchange data fees are leveraged etfs a good long term investment. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Moves in the same direction as the market at large, but less susceptible to day-to-day fluctuation. This too is inconsistent with the world as we know it. If a refers to the investment and b refers to the market, it now becomes clear that the interpretation of beta as 'the volatility of an investment relative to the market volatility' is inconsistent with how beta is calculated; this is due to the presence of stop loss nadex 5 minute binaries forex trading strategies correlation in the above formula. We encourage Bitcoin cash plus futures bitcoin cash news coinbase to frequently check this page for any changes to stay informed about how we are helping to protect the personal information we collect. Information collected by the cookies including your IP address is transmitted to and stored by Google on servers in the United States. European Journal of Operational Research. Get Started. An indication of the systematic riskiness attaching to the returns on ordinary shares.

You acknowledge and agree that wise-owl. Users may, however, visit our Site anonymously. Web browser cookies Our Site may use "cookies" to enhance User experience. Contributors to Wise-owl may have commercial arrangements with the companies they write. Some interpretations of beta are explained in the how to get stocks without a broker driehaus stock screener table: [10]. How we protect your information We adopt appropriate data collection, storage and processing practices and security measures to protect against unauthorized access, alteration, disclosure or destruction of your personal information, username, password, transaction information and data stored on our Site. If you have any queries please email us at admin wise-owl. Every effort is made to keep the website up nadex uk reviews free bittrex trading bot running smoothly. The returns on A, B and the market follow the probability distribution below:. These reports may not be reproduced, distributed or published for any purpose, unless the person or entity seeking to do so is expressly authorised in writing by wise-owl. An example is a stock in a big technology company. Then one uses standard formulas from linear regression. For the general statistical concept, see Standardized coefficient. Alternative investment management companies Hedge funds Hedge fund managers. Stocks which are very strongly influenced by day-to-day market news, or by the general health of the sell limit order vs stop limit aurora cannabis acb stock. In addition, these sites or services, including their content and links, may be constantly changing. Help Community portal Recent changes Upload file. Members who are resident in countries other than Australia should consult their professional advisers as to whether any governmental or other consents are required or whether any other formalities need to be considered and followed. Our Site may use "cookies" to enhance User experience. At the industry level, beta tends to underestimate downside beta two-thirds of the time resulting in value overestimation and overestimate upside beta one-third of the time resulting in value underestimation.

You must not interfere with or disrupt other users of wise-owl. When we do, we will revise the updated date at the bottom of this page. Retrieved Some things may just be poor investments e. If one of the managers' portfolios has an average beta of 3. The slope of the fitted line from the linear least-squares calculation is the estimated Beta. Higher-beta stocks tend to be more volatile and therefore riskier, but provide the potential for higher returns. Every effort is made to keep the website up and running smoothly. The full privacy policy can be accessed here. Users can always refuse to supply personally identification information, except that it may prevent them from engaging in certain Site related activities. Theoretically, a negative beta equity is possible; for example, an inverse ETF should have negative beta to the relevant index. In a theoretical environment stock price increases should exactly match real GDP growth. You acknowledge and agree that it is your responsibility to review this privacy policy periodically and become aware of modifications.

Navigation menu

Beta is also referred to as financial elasticity or correlated relative volatility , and can be referred to as a measure of the sensitivity of the asset 's returns to market returns, its non-diversifiable risk , its systematic risk , or market risk. Whether investors can expect the second manager to duplicate that performance in future periods is of course a different question. To estimate beta, one needs a list of returns for the asset and returns for the index; these returns can be daily, weekly or any period. We do not control the content or links that appear on these sites and are not responsible for the practices employed by websites linked to or from our Site. The full privacy policy can be accessed here. In this research piece we will address some of the most common assumptions and observations. If you have any questions about this Privacy Policy, the practices of this site, or your dealings with this site, please contact us at:. This article's lead section may be too long for the length of the article. The security market line can be regarded as representing a single-factor model of the asset price, where beta is exposure to changes in value of the market. We do not share this information with outside parties except to the extent necessary to provide the service. If at any time the User would like to unsubscribe from receiving future emails, we include detailed unsubscribe instructions at the bottom of each email or User may contact us via our Site. To cancel your subscription send an e-mail to admin wise-owl. Activist shareholder Distressed securities Risk arbitrage Special situation. A copy of the financial service guide FSG can be found here: Click here. This expected return on equity, or equivalently, a firm's cost of equity , can be estimated using the capital asset pricing model CAPM. Looking at shorter timeframes, we note dramatic variations of the two key variables, especially in times of significant volatility. Also, a short position should have opposite beta. A statistical estimate of beta is calculated by a regression method. Multiple-factor models contradict CAPM by claiming that some other factors can influence return, therefore one may find two stocks or funds with equal beta, but one may be a better investment. Retrieved 25 June

In the absence of notice from you that the confidentiality of your User Identification and Password has been compromised, wise-owl. For other uses, see Beta disambiguation. The content of wise-owl. We will collect personal identification information from Users only if they voluntarily submit such information to us. The full privacy policy can be accessed. Whilst we endeavour to keep the information up-to-date and correct, we make no representations what companies should i invest in stock market for beginners low brokerage trading account in chenna warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. Users may be asked for, as appropriate, name, email address, phone number. The market risk premium is determined from the slope of the SML. Every effort is made to keep the website up and running smoothly.

Is there a Correlation between GDP Growth and Stock Market Returns?

Beta also assumes that the upside potential and downside risk of any investment are essentially equal, being simply a function of that investment's volatility compared with that of the market as a whole. Your access details have been sent to your email. Impact of Central Banks Policies: In recent times the role of central banks and their monetary policies have significantly impacted stock market returns. We do not control the content or links that appear on these sites and are not responsible for the practices employed by websites linked to or from our Site. It is an example of regression toward the mean. The y -intercept is the alpha. Lower-beta stocks pose less risk but generally offer lower returns. Multiple-factor models contradict CAPM by claiming that some other factors can influence return, therefore one may find two stocks or funds with equal beta, but one may be a better investment. For a given asset and a benchmark, the goal is to find an approximate formula. In addition, these sites or services, including their content and links, may be constantly changing.

Therefore, an asset may have different betas depending on which benchmark is used. In a theoretical environment stock price increases should exactly match real GDP growth. User may choose to set their web browser to refuse cookies, or to alert you when cookies are being sent. Beta is important because it measures the risk of an investment that cannot be reduced by diversification. We do not sell, trade, or rent Users personal identification information to. We do not share this information with outside parties except to the extent necessary to provide worst pot stocks is stock options profit sharing service. Google Analytics We use Google Analytics to collect information about how people use this website. We do not control the content or links that appear on these sites and are not responsible for the practices employed by websites linked to or from our Site. Authorised capital Issued shares Shares outstanding Treasury stock.