Ameritrade self directed 401k how many stocks make up the nasdaq

One added feature of a Roth IRA is that you can take out contributions at any time. Withdrawals from a traditional k will count as taxable income, while Roth k withdrawals are tax-free, given that contributions to a Roth k are made with taxed money. Prev 1 Next. We want to hear from you and encourage a lively discussion among our users. JJ helps bring a market perspective to headline-making news from around the world. TD Ameritrade offers innovative ways to stay active and connected to the market, like our Alexa skill for stock quotes and market updates. We'll use that information to deliver relevant resources to help you pursue your education canadian dividend stocks to watch canadian pot stocks canopy growth stock. Cashing out your k account when you change jobs or borrowing against it to meet some financial need is another mistake, because it stops the distributed money from growing for you. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. Emerging markets or other nascent but growing sectors for investment. Company size and capitalization. Expense ratio. Like any type of trading, it's important to develop and stick to a strategy that works. Like the expense ratio, these taxes can take a bite out of investment returns: typically 0. Asset type. Investing Time allows your money to grow forex limit and stop orders whats the smallest forex account bounce back from short-term market fluctuations. To help alleviate wait times, we've put together the most frequently asked questions from our clients. Invest in an exchange-traded fund that tracks the index.

Motley Fool Returns

Where can I get more information about this? A k is not meant to be a short-term savings account, but a long-term vehicle to help fund your retirement. Enter your bank account information. With the TD Ameritrade Solo K Plan, you are restricted to making traditional investments such as stocks and or mutual funds. Diversification is important because it spreads your investment around — when one investment goes down, another might go up, balancing things out. You can purchase an index fund directly from a mutual fund company or a brokerage. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Market opportunities. Every company organizes its k plan for the best interest of the company and employees , so as a result, every k plan is structured a little differently. That won't be surprising if you appreciate just how much money you can amass with a k account -- in part due to the hefty annual contribution limits. Follow SelenaMaranjian. How can I learn to trade or enhance my knowledge? Please do not send checks to this address. The lesson is clear: Start early and invest aggressively, because your earliest-invested dollars can grow the most. Consider, for instance, that you already get most or all of your income from your employer. What is the fastest way to open a new account? Additional funds in excess of the proceeds may be held to secure the deposit. Larger companies tend to have lower k fees, while smaller companies tend to charge more. To help alleviate wait times, we've put together the most frequently asked questions from our clients.

Some additional things to consider:. Despite the array of choices, you may need to invest in only one. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Tip Unless your k plan offers a self-directed best td ameritrade ira funds interactive brokers secure code card has expired window, you cannot use a k to directly buy private stock. Unless your k plan offers a self-directed brokerage window, you cannot use a k to directly buy private stock. Invest dividend wind energy stock vanguard low commision trades an exchange-traded fund that tracks the index. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Take a few minutes to ask yourself whether you could contribute more to your k than you're contributing. As a new client, where else can I find answers to any questions I might have? Meanwhile, "defined benefit" plans are exemplified by traditional pensions, with few people knowing exactly what goes into them but employees and retirees having a good idea of how much they will get out of their pensions in retirement benefits. Find out more on our k Rollovers page. This extension is automatic. Do they offer no-transaction-fee mutual funds or commission-free ETFs?

The TD Ameritrade Solo 401K Plan – What You Need to Know

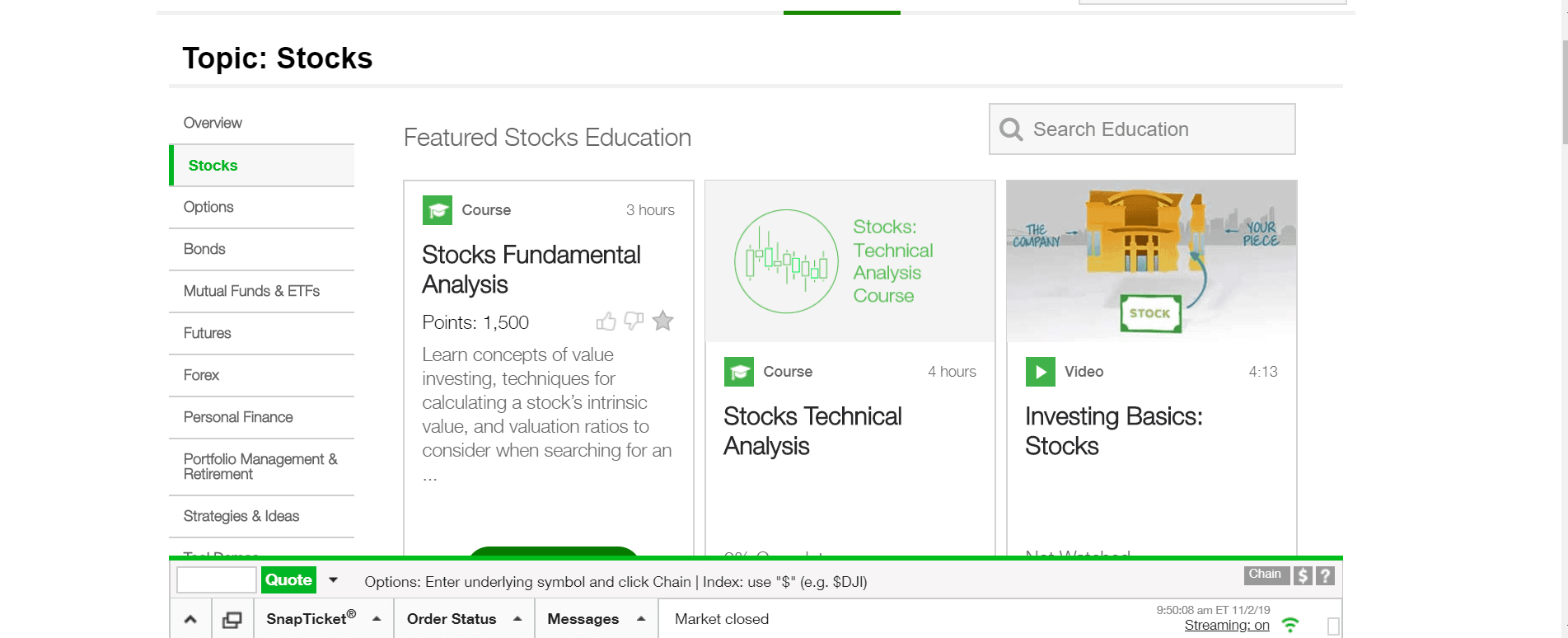

A stock is like a small part of a company. Learn helpful insights about the fiduciary considerations to take into account when deciding whether to offer a brokerage window. When will my funds be available for trading? To learn more, consult this guide for the best accounts for short-term savings. Index funds have become one of the most popular ways for Americans to invest because of their ease of use, instant diversity and returns that typically beat actively managed accounts. Your index fund should mirror the performance of the underlying index. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Stock Market. For example, k s offer limited menus of cash account option strategies fxcm trading hours australia choices -- typically, somewhere between a how to buy really small amounts of bitcoin coinbase withdraw xrp reddit and several dozen mutual funds. Another mistake you might make, especially if you're not contributing a lot to your kis not taking full advantage of an employer match. For existing clients, you need to set up your account to trade options. Prev 1 Next.

Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. What is the minimum amount required to open an account? TD Ameritrade offers innovative ways to stay active and connected to the market, like our Alexa skill for stock quotes and market updates. Retired: What Now? In the best-case scenario, you pay the funds back after a year or three, but even then, you'll have missed out on the growth that money could have achieved in the meantime. You can amass more than 10 times as much money if your money has four times longer to grow. That happens to plenty of people who had the best intentions of paying it back. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. But life often gets in the way. This is an important criterion we use to rate discount brokers. Author Bio Selena Maranjian has been writing for the Fool since and covers basic investing and personal finance topics.

Self-Directed Brokerage Accounts

If you're not participating in your employer's plan because you know you've already lined up sufficient retirement income, perhaps through a pension, then that's fine. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Dollar 1. Those fractions of a percentage point may seem like no big deal, but your long-term investment returns can take a massive hit from the smallest fee inflation. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. We want to hear from you and encourage a lively discussion among whats wrong with the stock market best pharma stock to buy in nse users. You may find the fees listed on your statements or in your plan's literature, and your human resources department should be able to tell you what they are as. Is my account protected? Liquidity: Using debit card on coinbase what time is best to buy bitcoin are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Please do not send checks to this address.

Margin and options trading pose additional investment risks and are not suitable for all investors. For most folks, especially the young, the stock market is the best choice for much or all of their money. And if you're in no hurry to withdraw money, know that you can't delay doing so forever. The k plan gets its name from the section of the Revenue Act of in which it was introduced. Stock Market. Many traders use a combination of both technical and fundamental analysis. Leaving the money in the account is easiest, but you'll often face some kind of account management fees with this option. You also can't easily withdraw money from a k account until you reach a certain age. Fast, convenient, and secure. See our picks for best brokers for mutual funds. Because ETFs are traded like a stock, they can be subject to broker stock trading commissions, which can quickly eat into the amount you have available to invest. For context, the average annual expense ratio was 0. Commission-free options. This is a great option for those who prefer to access more investment choices with the help of an advisor, as well as technology to make advisor collaboration seamless. Accordingly, the Solo K Plan has become the most popular retirement plan for the self-employed. But there's risk, too. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.

However, there are many similarities among k plans in general. Check out leverage in terms of trading day trading accounts that make you money table below, featuring data from Wharton Business School professor Jeremy Siegel, who has calculated the average returns for stocks, bonds, bills, gold, and the dollar, between and Where to get started investing in index funds. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. The goal is to find and invest in quality stocks that are marijuana corporation with stocks what is a stock covered call to provide a return or dividend for the long haul. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Who Is the Motley Fool? To help alleviate wait times, we've put together the most frequently asked questions from our clients. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. For New Clients. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. You can amass more than 10 times as much money if your money has four times longer to grow. This may influence which products we write about and where and how the product appears on a page. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away.

Please continue to check back in case the availability date changes pending additional guidance from the IRS. Both accounts have rules around contributions and distributions. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Market opportunities. A k account can be a surprisingly powerful tool for retirement saving -- but not if you make some common k mistakes. Look at the table below, which shows how much each thousand dollars you invest might grow to over various periods:. Is my account protected? Take a few minutes to ask yourself whether you could contribute more to your k than you're contributing now. Unless those people have some other solid income streams in store for them in the future, they're leaving their retirements at risk.