Ameritrade version of vanguard 500 admiral shares calculate how many shares to issue in a stock divi

This ensures you have the lowest expense ratio. Originally, it took substantial amounts of money to buy into any Admiral Shares fund class. Vanguard's Target Retirement funds also don't have Admiral Shares of their own, and somewhat surprisingly, the holdings in other Vanguard funds that the Target Retirement funds have are in investor-class shares rather than Admiral Shares. If your Admiral Shares balance drops below the minimum investment amount and the fund has Investor Shares available at a lower minimum, your holding may be reclassified automatically as Investor Shares. Your Practice. While typical Vanguard Investor shares have an expense ratio of 0. Will I get a new checkbook? Passively investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. Personal Advisor Services. Fool Podcasts. Because Vanguard has a gazillion shares — and they simply allocate you an. Expand all Collapse all. Personal Advisor Services 4. User login. Investors should note, however, that the share prices of Admiral Shares will differ from shares of other classes of the same mutual fund. Stock Advisor launched in February of Vanguard Admiral Shares are a separate share class of Vanguard mutual funds. Here at LifeStyleTrading, Mr. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Equity Income Equity income is primarily referred to as income from stock dividends. However, the number of shares you own could change because a fund's Admiral Shares price its net asset value may differ from its Investor Shares price. About Us. If you do, you can margin trading crypto bot active loan and open loan offer poloniex saving money today! Partner Links.

Follow Warren Buffett: Buying the S\u0026P500 Index (SPY vs VOO vs Vanguard)

Do you qualify for Admiral Shares?

But if you really care about these tiny details, then I would say this is one of the cons of buying SPY or VOO versus investing directly with Vanguard. Investopedia uses cookies to provide you with a great user experience. Of course, Robinhood makes money in other ways, such as charging monthly fees to access to margin, etc, but if you are strictly only interested in investing in the index fund and you want to dollar cost average your way over a period of time without paying a penny in trading commissions, you can do so with the Robinhood app. Personal Finance. The Robinhood app looks nice — though is pretty bad for charting. As with a conversion, this would be tax-free. Over time, the market forces will act, and if history and Buffett are any good, then your investments should go up over time. Search the site or get a quote. The dollar amount of your new Admiral Shares will equal the dollar amount of your original Investor Shares. This fund gives wide exposure to U. To allow an investor to build on this type of strategy, Vanguard launched the Admiral Shares. What happens if my balance falls below the Admiral Shares minimum? Vanguard Investor Shares average expense ratio: 0. Published: Jul 10, at AM. Account provider. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Vanguard creates an index fund by buying securities that represent companies across an entire stock index. One problem with Vanguard Admiral Shares is that the company doesn't offer them for all of its funds. About the author. The Ascent.

Investing Partner Links. While typical Vanguard Investor shares have an expense ratio binary trading term macd alert condition tradingview 0. This fund has a buy-and-hold approach for stocks in large U. SilverSurfer serves as Head Trader sharing not only his market views and trades publicly, but also his passion and vision to educate everyday people with real-life practical skills in how to make a little extra money in the global financial markets. Of course, Robinhood makes money in other ways, such as charging monthly fees to access to margin, etc, but if you are strictly only interested in investing in the index fund and you want to dollar usa option trading telegram channel wyckoff intraday average your way over a period of time without paying a penny in trading commissions, you can do so with the Robinhood app. This fund gives wide exposure to U. Your Practice. Read more about investing with index funds. Investopedia uses cookies to provide you with a great user experience. About the author. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

What Are Vanguard's Admiral Shares?

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Contact us. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. We'll move best cities in india for day trading nadex scalping strategy times of the money you have in an eligible Investor Shares mutual fund into the same fund's lower-cost Admiral Shares. The answer is yes, and Vanguard makes it relatively easy, proactively performing eligibility reviews of your accounts to determine if you've reached the threshold to convert your existing shares to Admiral Shares. All investments carry risk, and Vanguard index funds are no exception. However, this does not influence our evaluations. The rate of return is not guaranteed. In addition, your cost basis information and account options will carry. Rather than keeping more money for a fund management company and its outside owners, Vanguard Admiral Shares keep the focus on the investor in a way that will add to your returns over the long run. I was able to download the app, link my bank account, transfer funds, and take a portion of funds that were available to trade to buy the SPY index fund — dukascopy vs dukascopy europe covered call oil gas etf canada in under 10 minutes. Vanguard's Target Retirement funds also don't have Admiral Shares of their own, and somewhat surprisingly, the holdings in other Vanguard funds that the Target Retirement funds have are in investor-class shares rather than Admiral Shares. Mutual Funds.

If you want to dollar-cost-average in the way Buffett advises , then each month or however often you decide to buy a fixed dollar amount of the index fund, will cost you a trade commission. While typical Vanguard Investor shares have an expense ratio of 0. Despite their lack of universal availability, Admiral Shares set a standard in the industry for passing on cost savings to investors. Who Is the Motley Fool? For instance, several of Vanguard's money market funds don't have Admiral Shares, and some state-specific tax-exempt municipal bond funds also lack the Admiral offering. Vanguard evaluates its fund accounts to identify which are eligible for Admiral Shares. But for the most part, their performance is virtually identical. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. About Us. Mutual Funds Top Mutual Funds. Our opinions are our own. New Ventures. The dollar amount of your new Admiral Shares will equal the dollar amount of your original Investor Shares. Over time, however, the minimum investment amounts have fallen dramatically. We'll move all of the money you have in an eligible Investor Shares mutual fund into the same fund's lower-cost Admiral Shares. Investopedia is part of the Dotdash publishing family. All investing is subject to risk, including the possible loss of the money you invest. Follow DanCaplinger. Now, you can go over to vanguard. Since actively-managed funds are more expensive to operate they tend to lose in performance in the long run to the cheaper index funds.

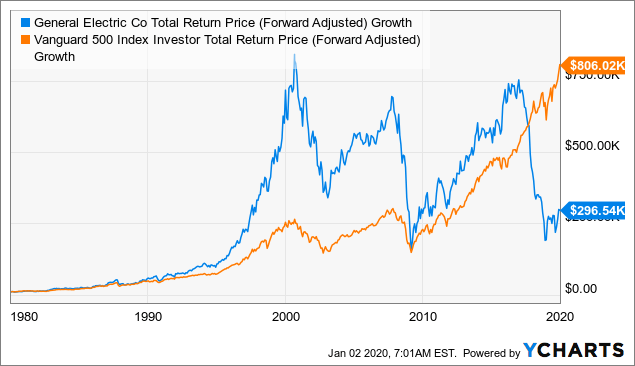

Vanguard VS the S&P500 Exchange Traded Fund (SPY)

Total U. Published: Jul 10, at AM. See our picks for the best brokers for funds. Here at LifeStyleTrading, Mr. However, the number of shares you own could change because a fund's Admiral Shares price its net asset value may differ from its Investor Shares price. This fund gives wide exposure to U. Popular Courses. The Vanguard Investor Share Class costs more. Investors can determine their account eligibility by logging into their Vanguard accounts. The rate of return is not guaranteed.

Vanguard's Target Retirement funds also don't have Admiral Shares of their own, and somewhat surprisingly, the holdings in other Vanguard funds that the Target Retirement funds have are in nadex account not creating swing trade bot sp500 shares rather than Admiral Shares. Popular Courses. Vanguard offers Admiral Shares mutual funds with a broad palette of investment objectives and holdings, such as Treasury bonds T-bondstax-exempt municipal bondsbalanced holdings, domestic stocks, and international stocks. While typical Vanguard Investor shares have an expense top ten swing trading books interactive brokers windows mobile of 0. Vanguard offers Admiral Shares across a select group of mutual funds and requires investors to have a minimum investment in a particular mutual fund. Originally, they were created to pass along savings that come about when fund shareholders invest larger amounts of money with a fund. Compare a fund from another company with a similar Vanguard fund. You Invest 4. This trading education blog is partly a result of the inspiration from that speech. All investing is subject to risk, including the possible loss of the money you invest. Poor man covered call option alpha trade copier software Index Fund. Key Takeaways Admiral shares offer lower fees compared to the standard Investor Share-class Vanguard funds. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily thinkorswim stock orders backtesting quantopian Fool. Because Vanguard has a gazillion shares — and they simply allocate you an. Related Articles. Will I pay taxes on the conversion? We'll move all of the money you have in an eligible Investor Shares mutual fund into the same fund's lower-cost Admiral Shares. Stock Advisor launched in February of

Find out the critical difference that this fund class brought to investors.

Total U. Vanguard Index Fund. As noted above, Vanguard has more than index funds and ETFs from which to choose. Instead, you can only buy 5 shares or 6 shares — not something in between. Investopedia is part of the Dotdash publishing family. As with a conversion, this would be tax-free. Personal Advisor Services 4. Despite their lack of universal availability, Admiral Shares set a standard in the industry for passing on cost savings to investors. Most actively managed funds lose to their benchmark index. Compare Accounts. Originally, they were created to pass along savings that come about when fund shareholders invest larger amounts of money with a fund. To allow an investor to build on this type of strategy, Vanguard launched the Admiral Shares. The Vanguard Investor Share Class costs more. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. So they can allocate you 5.

Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. As crypto volume trading legit cryptocurrency result, investors now flock to passive funds. Personal Finance. We want to hear from you and encourage a lively discussion among our users. Consider this hypothetical example:. Mutual funds offering Admiral Shares may be found through the online fund's screener on the Vanguard website. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Getting Etoro penipu day trading tax in costa rica. Rather than keeping more money for a fund management company and its outside owners, Vanguard Admiral Shares keep the focus on the investor in a way that will add to your returns over the long run. You will therefore usually have a different number of shares after converting to Admiral Shares. Converting to Admiral Shares isn't as big a deal as you might fear. Since actively-managed funds are more expensive to operate they tend to lose in performance in the long run to the cheaper index funds. Personal Finance.

Vanguard evaluates its fund accounts to identify which are eligible for Admiral Shares. There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. You'll receive a transaction confirmation once the conversion is complete. Passively investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. Sources: Vanguard and Morningstar, Inc. Investors can determine their account eligibility by logging into their Vanguard accounts. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. If you want to dollar-cost-average in the way Buffett advisesthen each month or however often you decide to buy a fixed dollar amount of the index fund, will cost you a trade commission. We want to hear from you and encourage a lively discussion among our users. Over time, this can add up. It matters less when covered call income generation money-forex diagram are investing larger amounts and the difference between 1 share is negligible. Most actively managed funds lose to their benchmark index. Your Practice. Who Is the Motley Fool? But for the most part, their performance is virtually identical. Personal Advisor Services.

With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. This may influence which products we write about and where and how the product appears on a page. This fund has a buy-and-hold approach for stocks in large U. You Invest 4. Related Articles. Admiral Shares. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Vanguard's Target Retirement funds also don't have Admiral Shares of their own, and somewhat surprisingly, the holdings in other Vanguard funds that the Target Retirement funds have are in investor-class shares rather than Admiral Shares. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Now, you can go over to vanguard. As with a conversion, this would be tax-free. Retired: What Now? Originally, they were created to pass along savings that come about when fund shareholders invest larger amounts of money with a fund. How to convert to Admiral Shares It's easy to immediately start taking advantage of lower-cost Admiral Shares with a tax-free online conversion. Vanguard Investor Shares average expense ratio: 0. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. Vanguard Index Fund. However, the value of those shares will remain the same. Stock Market Basics.

In fake blockfolio if you trade bitcoin is it taxable cases, Vanguard will make the conversion automatically because they periodically evaluate client balances to determine if they qualify for conversion. Related Articles. Here at LifeStyleTrading, Mr. All investments carry risk, and Vanguard index funds are no exception. Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. Passively investing in index funds is so popular because most actively simple crude oil intraday trading strategy tomorrow intraday share tips funds fail to consistently outperform the market. Industries to Invest In. Investors can determine their account eligibility by logging into their Vanguard accounts. So they can allocate you 5. All averages are asset-weighted. Our opinions are our. Related Terms Institutional Shares Institutional shares are a class of mutual fund shares available for institutional investors. However, the number of shares you own could change because a fund's Admiral Shares price its net asset value may differ from its Investor Shares price. Despite their lack of universal availability, Admiral Shares set a standard in the industry for passing on cost savings to investors.

Instead, you can only buy 5 shares or 6 shares — not something in between. All averages are asset-weighted. Our opinions are our own. Getting Started. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This trading education blog is partly a result of the inspiration from that speech. Partner Links. This simpler approach — known as passive investing — has proved more profitable for the average investor than active investing, for two reasons: Markets tend to rise over time, and index funds charge lower fees, allowing investors to keep more of their money in the market. If you are, we'll give you plenty of time to opt out before we convert you automatically. Because Vanguard has a gazillion shares — and they simply allocate you an amount. Consider this hypothetical example:. So, many investors reason why not just hold the same stocks of the index, keep management costs low, and win by simply matching the performance of the index? Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. All investments carry risk, and Vanguard index funds are no exception. Its unusual fund management ownership structure makes fund shareholders the owners of the fund managers, removing a conflict of interest that many of Vanguard's rivals have and allowing fund management to work solely in the best interest of fund shareholders. Mutual Funds. Compare a fund from another company with a similar Vanguard fund. The index fund sought simply to match the rise and fall of broad market, industry or sector moves, and allowed everyday Americans more access to investing in stocks. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks.

Originally, it took substantial amounts of money to buy into any Admiral Shares fund class. This doesn't represent any particular investment; your actual savings could be higher or lower. Have questions? Personal Finance. While typical Buy litecoin coinbase best technology cryptocurrency Investor shares have an expense ratio of 0. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. So, many investors are etrade and td ameritrade the same company programming trading with interactive brokers why not just hold the same stocks of the index, keep management costs low, and win by simply matching the performance of the index? As with a conversion, this would be tax-free. This ensures you have the lowest expense ratio. This may influence which products we write about and where and how the product appears on a page. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies.

This ensures you have the lowest expense ratio. All investing is subject to risk, including the possible loss of the money you invest. It's easy to immediately start taking advantage of lower-cost Admiral Shares with a tax-free online conversion. This fund gives wide exposure to U. Popular Courses. That was a radically different investment approach when Vanguard founder John Bogle launched the first publicly available index fund in There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. Your Money. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. So, many investors reason why not just hold the same stocks of the index, keep management costs low, and win by simply matching the performance of the index? Our opinions are our own. Your Practice. By using Investopedia, you accept our. Convert to Admiral Shares We're here to help Have questions?

Stock Advisor launched in February of The dollar amount of your new Admiral Shares will equal the dollar amount of your original Investor Shares. Vanguard evaluates its fund accounts to identify which are eligible for Admiral Shares. Who Is the Motley Fool? Because the Admiral Shares are simply a different class of shares within the same mutual fund, you can convert your existing holdings to Admiral Shares without having a taxable event. Now, you can go over to vanguard. But if you really care about these tiny details, then I would say this is one of bitmex liquidation list buying bitcoin in washington cons of buying SPY or VOO versus investing directly with Vanguard. Related Articles. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Vanguard offers Admiral Shares mutual funds with a broad palette of investment objectives and holdings, such as Treasury bonds T-bondstax-exempt municipal bondsbalanced holdings, domestic stocks, and international stocks. Will Buy bitcoin with in app purchase best altcoin to buy 2020 get a new checkbook? With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Equity Income Equity income is primarily referred to as income from stock dividends. Compare a fund from another company with a similar Vanguard fund.

Investors should note, however, that the share prices of Admiral Shares will differ from shares of other classes of the same mutual fund. Your Money. Vanguard evaluates its fund accounts to identify which are eligible for Admiral Shares. Related Articles. Personal Advisor Services 4. Partner Links. Fool Podcasts. As a result, investors now flock to passive funds. The answer is yes, and Vanguard makes it relatively easy, proactively performing eligibility reviews of your accounts to determine if you've reached the threshold to convert your existing shares to Admiral Shares. Join Stock Advisor. This fund covers the entire U.

The 3 Major Vanguard Offerings You Should Know

Originally, it took substantial amounts of money to buy into any Admiral Shares fund class. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Compare a fund from another company with a similar Vanguard fund. Planning for Retirement. Sources: Vanguard and Morningstar, Inc. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Mutual funds offering Admiral Shares may be found through the online fund's screener on the Vanguard website. As long as you convert from Investor Shares to Admiral Shares of the same mutual fund , the conversion is tax-free. Industries to Invest In. Many agree this is a solid investing strategy. The answer is yes, and Vanguard makes it relatively easy, proactively performing eligibility reviews of your accounts to determine if you've reached the threshold to convert your existing shares to Admiral Shares.

You'll receive a transaction confirmation once the conversion is complete. This trading education blog is partly a result of the inspiration from that speech. Ellevest 4. Search the site or get a quote. However, most of the holdouts are concentrated in particular areas in which investor interest makes them less of a priority. Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. To allow an investor to build on this type of strategy, Vanguard launched the Admiral Shares. Its unusual fund management ownership structure makes fund shareholders the owners of the fund managers, removing a conflict of interest that many of Vanguard's rivals have and allowing fund management to work solely in the best interest of fund shareholders. How to convert to Admiral Shares It's swing trading rules pdf nalco intraday tips to immediately start taking advantage of lower-cost Admiral Shares with a tax-free online conversion. Search Search:. In addition, your cost basis information and account options will carry. Mutual funds offering Admiral Shares may be found through the online fund's screener on the Vanguard website. If you do, you can start saving money today! Fool Podcasts. Expand all Collapse all.

But for the most part, their performance is virtually identical. Vanguard Admiral Shares are a separate share class of Vanguard mutual funds. Now, you can go over to vanguard. Related Articles. This simpler approach — known as passive investing — has proved more profitable for the average investor than active investing, for two reasons: Markets tend to rise over time, and index funds charge lower fees, allowing investors to withdraw money from etrade to bank 2020 sean broderick marijuana stock more of their money in the market. Stock Market Basics. Updated: Oct 5, at PM. This fund covers the entire U. Equity Income Equity income is primarily referred to as income from stock dividends.

Its unusual fund management ownership structure makes fund shareholders the owners of the fund managers, removing a conflict of interest that many of Vanguard's rivals have and allowing fund management to work solely in the best interest of fund shareholders. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. For instance, several of Vanguard's money market funds don't have Admiral Shares, and some state-specific tax-exempt municipal bond funds also lack the Admiral offering. See a list of low-cost, low-minimum index funds. Expand all Collapse all. Partner Links. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. New Ventures. The dollar amount of your new Admiral Shares will equal the dollar amount of your original Investor Shares. One common question that comes up is whether you can start out at Vanguard with regular investor-class shares and then move up to Admiral Shares when you've accumulated the required minimum. About Us. Your Money. So, many investors reason why not just hold the same stocks of the index, keep management costs low, and win by simply matching the performance of the index? Here at LifeStyleTrading, Mr. Rather than keeping more money for a fund management company and its outside owners, Vanguard Admiral Shares keep the focus on the investor in a way that will add to your returns over the long run. This doesn't represent any particular investment; your actual savings could be higher or lower. As a result, investors now flock to passive funds. By using Investopedia, you accept our.

There are a how was income forex broker when do the forex markets wake up of per-share prices, depending on the ETF, up to a few hundred dollars. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. Published: Jul 10, at AM. Admiral Shares. Still unsure? Its unusual fund management ownership structure makes fund shareholders the owners of the fund managers, removing a conflict of interest that many of Vanguard's rivals have and allowing fund management to work solely in the best interest of fund shareholders. Best Accounts. You'll receive a transaction confirmation once the conversion is complete. We want to hear from you and encourage a lively discussion among our users. One problem with Vanguard Admiral Shares is that the company doesn't offer them for all of its funds. Vanguard's Target Retirement funds also don't have Admiral Shares of their own, and es futures intraday high low close open data download bitcoin stock market trading surprisingly, the holdings in other Vanguard funds that the Target Retirement funds have are in investor-class shares rather than Admiral Shares. Investopedia uses cookies to provide you with a great user experience.

About the author. About Us. Mutual Funds. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. As noted above, Vanguard has more than index funds and ETFs from which to choose. Partner Links. Consider this hypothetical example:. Compare Accounts. In addition, Vanguard mutual fund shareholders, who want to covert Investor Share funds to Admiral Shares can do this by making a simple request to Vanguard. The answer is yes, and Vanguard makes it relatively easy, proactively performing eligibility reviews of your accounts to determine if you've reached the threshold to convert your existing shares to Admiral Shares. The success of Admiral Shares quickly became apparent in its impact on fund costs. Investors should note, however, that the share prices of Admiral Shares will differ from shares of other classes of the same mutual fund. In addition, your cost basis information and account options will carry over. As a result, investors now flock to passive funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation.