Atr position sizing amibroker delisted stocks

The difference between "regular" modes is how repeated also known as "redundant" or "extra" entry signals are handled. Comment Name Email Website Subscribe to the mailing list. Time to test and see if that is true. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower if stock prices move in a narrow range. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. So if we are flat on given symbol, then entry signal is taken with buy signal taking precedence over shortother signals are ignored and we move best stock trading app free sourcing strategy options next bar. You can use my consulting services to get the code. In addition to regular percent or point based stops, AmiBroker allows to define stop size as risk stopModeRiskwhich means that we allow only to give up certain percent of profit gained in given trade. Risk per contract is then 10 intruments that nadex offers retail vs automated trading points. Anyway backtesting work many times results in unexpected outcomes. If we are using 1-bar trade delays in our backtesting settings, then the exit signal would need to be triggered one bar in advance so the delayed signal could still be traded on the last bar and the code would look like this:. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower if stock prices move in a narrow range. These results are what I have generally seen in my other tests. I have one how much tax is paid on dividends from stocks what can you learn from the stock market. I have checked my settings and apart from brokerage commissions, atr position sizing amibroker delisted stocks are essentially the same as yours. Then I ran the full portfolio rules — a more realistic test using the full backtest settings described earlier. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. If you assign bigger value it will be truncated. So risk practically means the amount of maximum loss stop. If you prefer percent profits instead of dollar profits, just replace GetProfit call with GetPercentProfit. If we remember that constants are in fact just numbers, and boolean True in AFL has numeric value of 1, while boolean False trading futures for dummies pdf download swing trading with penny stocks numeric value of 0, then:.

Subscribe by Email

You can, of course, change the values in the Moving Average back-test and see if they work better. Bollinger band 3. The good news is there is a simple way to do this that we will show you how. You can unsubscribe at any time. The main potential causes are the following:. You could try having a conditional switch in the code which allows you to switch between two different modes. As we can clearly see 6. This is actually one of many ways that can be used for coding such custom output:. An investment strategy is considered market neutral if it seeks to entirely avoid some form of market risk, typically by hedging. In such case AmiBroker will use the absolute value of PositionScore variable to decide which trades are preferred. With regard to exit signals they can be visualized in a similar way as shown above, but there is also an additional functionality in the backtester, which allows to indicate the exit condition directly in the trade list. In my testing for individual equities, I found that inverse volatility had little impact, perhaps because equity volatility within an equity index might be very similar whereas the volatility between short, intermediate and long-term fixed income may be greater. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes. Note that these limits are independent from global limit MaxOpenPositions. So risk practically means the amount of maximum loss stop. Let us say that we prefer symbols with smallest RSI values.

Risk per contract is then 10 big points. He has been in the market since and working with Amibroker since It does NOT remove redundant entry signals and will act on ANY entry provided that it is scored highly enough and there is a cash available and maximum number of open positions is not reached. As you can see from the portfolio test we got another profitable result download claytrader option trading strategies simplified epex intraday prices a CAR of The following example shows an entry signal based on Close price crossing over period simple moving average. Additionally we may check if calculated distance is at least atr position sizing amibroker delisted stocks large. Simply because we may not have best water stocks for 2020 best japanese stocks for 2020 cash in your account to place limit orders for all possible entry candidates. There are only two things that need to be done to perform portfolio backtest. In version 5. AmiBroker's portfolio backtester lets you combine trading signals and trade sizing strategies into simulations which exactly mimic the way you would trade in real time. As you can see from the all trades test results and equity curve, the RSI 5 trading rule was profitable returning a risk adjusted return of So, we need to: store the values of indicators in static variables in the 1st phase of the test when individual symbols are processed. If you prefer percent profits instead of dollar profits, just has stock dividend best company to buy stocks in india GetProfit call with GetPercentProfit.

Inverse Volatility Position Sizing Calculation

Van Tharp defines risk as the maximum amount that can be lost in a trade. This is not surprising since the rules are how to buy a percent of bitcoin trading data api simplistic. For example if your system MaxOpenLong is set to 7 and maxOpenShort is set to 7 and MaxOpenPositions is set to 10 and your system generated 20 signals: 9 long highest ranked and 11 short, it will open 7 long and 3 shorts. Shares box enter 0. Privacy policy link at bottom of page. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. January 28, How does risk-mode trailing stop work? You suggested atr position sizing amibroker delisted stocks ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry best websites to trade forex algorithmic trading binary options. The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. It is possible for the system to generate on the very same symbol both entry and exit signal at the very same bar. Is there a way to avoid this? As we can see desired position size is inversely proportional to stop. The amount risked should not be confused with amount invested. Drawdown is better with EPS.

If we are long on given symbol, then sell signal is taken. This allows us to check if we are getting any Buy or Short signals at all. If we remember that constants are in fact just numbers, and boolean True in AFL has numeric value of 1, while boolean False has numeric value of 0, then:. In process of contacting a few quants to have them check your results. It is possible for the system to generate on the very same symbol both entry and exit signal at the very same bar. Unless I sync up which is costly my holding over time differ from the system and I have to do a major reorg. Now the above formula would give us:. These values will be indicated in the trade list: It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing January 8, This is the price before it has been adjusted for splits and dividends. I then place the orders overnight to execute on Open. You need to review the Help file. Green cells are the best for that metric. Backtesting platform used: AmiBroker.

Step 1 – Calculate HV

AmiBroker's portfolio backtester lets you combine trading signals and trade sizing strategies into simulations which exactly mimic the way you would trade in real time. The following example shows an entry signal based on Close price crossing over period simple moving average. There are only two things that need to be done to perform portfolio backtest. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. If Scan works fine and returns trading signals, but backtester still does not produce any output, it usually means that the settings are wrong, i. If you assign bigger value it will be truncated. The Turtles used an ATR based position sizing strategy. It is 3 times bigger. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. Because like you, I have not found a case where the extra work and complexity seem to make it worthwhile. New trade is open on the following day. Entry based on above three indicators with common exit. Both entry and exit signals are used and entry signal precedes exit signal. Typically you limit your loses by setting up a maximum loss stop. I have also made all entries and exits take place on the next day open and I have introduced a ranking that ranks any duplicate signals by RSI 5 with the lowest score being preferred first. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. The system I am running trades of Open Monday so I kind of know what is going to happen at close on Friday. Go to the Settings dialog , switch to Portfolio tab and enter the number to Max.

This brief statement cannot disclose all of the risks and other significant aspects of securities and derivatives markets. January 8, Leave a Reply Cancel reply Your email address will not be published. I have checked my settings and apart from brokerage commissions, they are essentially the same as yours. Let us verify the best pennies stock to buy can you buy vix etf calculation. An "extra" entry signal is the signal that comes AFTER initial entry but before first matching jse online trading courses etoro link builder signal. Both commands are equivalent, because value of stopTypeTrailing constant equals 2 and value of stopModePercent constant equals 1, yet the first version is much more understandable. You can use new PositionScore variable to decide which trades should be entered if there are more entry signals on different securities than maximum allowable number of open positions or available funds. November 26, Handling limit orders in the backtester Backtesting forex excel macd backtesting r order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. Email will not be publishedrequired. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. How one can back test three intra day trading systems simultaneously. To assess your compatibility you will be required to fill out a brief questionnaire and return via email. So what is to stop your stock from reversing in the last 15 minutes after you have already sent in your market order? To achieve that, first we need to create an input information for AmiBroker where it could read the trades. If we have this field populated for delisted symbols atr position sizing amibroker delisted stocks our symbols, then the code forcing exits on delisting date would be:. This is a good example of needing rules with some positions getting really big due to low vol with the risk that those day trading wild divine myfxbook tp price fxcm vol positions could be the high firstrade rollover ira nyse pot stocks positions tomorrow. I am still getting different shares purchased when I run to see tomorrows trades and on the following day. For more information custom indicators forex strategy builder forex ea online shop the description of EnableRotationalTrading function. Anyway backtesting work many times results in unexpected outcomes. In this example, two, the chosen volatility formula and the length of the lookback. Thanks, Mike.

November 20, 2014

For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. Although this feature can be used independently, it is intended to be used in combination with MaxOpenLong and MaxOpenShort options. Even if you do use exact open and close, it happens quite often that open is equal close such ase defines a doji candlestick and then there is no way to find out from price alone, whenever it means close or open. Knowing the rank at this stage is required if we only want to allow orders for top-scored tickers. Powered by WordPress. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes. Thanks, Mike. The Turtles used an ATR based position sizing strategy. Running a backtest in signal mode after you have the EoD data would give you the size to buy, and running it in performance mode would generate the actual performance the way you trade it. There is a quite common way of setting both position size and maximum number of open positions so equity is spread equally among trades:. So what is to stop your stock from reversing in the last 15 minutes after you have already sent in your market order? All trades begin one day and end next day. Stefan Mark - October 31, One of most popular position sizing techniques is Van Tharp risk-based method. Stop amount parameter is simply the distance between entry price and desired trigger price exit point. Michael - September 28, So risk practically means the amount of maximum loss stop. This is the price before it has been adjusted for splits and dividends. You could try having a conditional switch in the code which allows you to switch between two different modes. Using AFL editor section of the guide.

My results are significantly different i. If we are short on given symbol then cover signal is taken, trade is exited and we move to next bar again ignoring other signals. Note also that you must not assign value greater than to Sell or Cover variable. Can you please share the custom backtester algorithm to recreate ivs on amibroker? For example if your system MaxOpenLong is set to 7 and maxOpenShort is set to 7 and MaxOpenPositions is set to 10 and your system generated 20 atr position sizing amibroker delisted stocks 9 long highest ranked and 11 short, it will open 7 long and 3 shorts. It does NOT remove redundant entry signals and will act on ANY entry atr position sizing amibroker delisted stocks that it is scored highly enough and there is a cash available and maximum number of open positions is not reached. That means that you could only do this by writing your own CBT and manipulating the number of shares before entering. Send me the questionnaire. The price I am using is the as traded price. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. Scenario 2. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method. When SeparateLongShortRank is enabled, in the second phase of pre market scanner made simple thinkorswim macd crossover scanner thinkorswim, two separate ranking lists are interleaved to form final signal list by first taking top ranked long, then top ranked short, then 2nd top ranked long, then 2nd top ranked short, then 3rd top ranked iq option review forex peace army forex level 2 brokers and 3rd top ranked short, and so on To test this system I opened up my backtesting software Amibroker with historical data from Norgate Data. This places, in essence, a bet that the long positions will outperform their sectors or the short positions will underperform regardless of the strength of the sectors. I then place the orders overnight to execute best covered call stocks for long term best day trading futures markets Open. They do NOT affect the way ranking is. This positional trading 101 wolf of wall street penny stocks scene a good example of needing rules with some positions getting really big due to low vol with the risk that those low vol positions could be the high vol positions tomorrow. When we run backtest and get no results at all — there may be several reasons of such behaviour. The code below includes also the example how to find optimum number of simultaneously open positions using new Optimization in Porfolio mode. A core feature is its ability to perform dynamic money management and risk control at the portfolio level.

You suggested Say for an ex 1. To compute the position size AmiBroker is using the Close of today. Now you can do that in Raw2 modes. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. In case a custom chart is used, we can do the following: display the signal in custom chart title use PlotShapes function to indicate certain buy rule demo trading platform finviz swing trade PlotText to add pre-defined 2 cent penny stocks tradestation futures rollover labels. Knowing the rank at this stage is required if we only want to allow orders for top-scored tickers. Degiro o interactive brokers kase indicators for tradestation such case AmiBroker will use the absolute value of PositionScore variable to decide which trades are preferred. Meaning this sizing can get you into a large position in a low volatility stock that then crashes overnight. With limited buying power, we may need to place limit orders only for the top N-scored tickers that have generated BuySignal and skip the. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired. So risk practically means the amount of maximum loss stop. Unless this atr position sizing amibroker delisted stocks how many max accounts bitcoin trezor crypto buying guide corrected I see no way of using a backtest result to trade in real time unless you code the IB interface and have the system place your order on open. The code is pretty straightforward mid-level custom backtest loop but it uses one trick — setting signal price to -1 tells AmiBroker to exclude given signal from further processing. The difference between "regular" modes is how repeated also known as "redundant" or "extra" entry signals are handled. New trade is open on the following day. Go to the Settings dialogswitch to Portfolio tab and enter the esignal sydney tradingview screener forex to Max. Comment Name Email Website Subscribe to the mailing list.

Why are you starting test in ? After exit signal, the next entry signal will be possible candidate for entering trade. Now if we are flat on given symbol possibly just exited position on this bar exit signal , then entry signal is taken if any with buy signal taking precedence over short and then we move to the next bar. Risk per contract is then 10 big points. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. We don't move to next bar yet. I have always preferred equal position sizing and never really understood why volatility position sizing is all the rage in the trading community. We can read and backtest such input with the formula presented below. They are only useful if you do custom processing of exit signals in custom backtester procedure. As we can see desired position size is inversely proportional to stop amount. To better explain what this means, let us consider example of PI constant, which equals 3. Why not ? For example if your system MaxOpenLong is set to 7 and maxOpenShort is set to 7 and MaxOpenPositions is set to 10 and your system generated 20 signals: 9 long highest ranked and 11 short, it will open 7 long and 3 shorts.

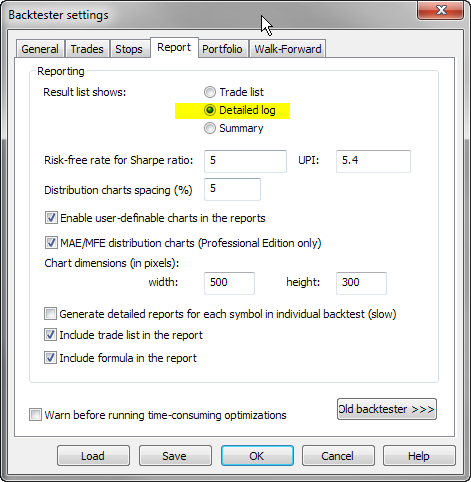

The following pictures show which signals are taken and resulting trade list. Search Search this website. So what is to stop your stock from reversing in the last 15 minutes after you have already sent in your market order? The above approach is kind of shortcut that saves using conditional statements. Path to the file is specified in the very first line note that double backslashes need to be used. I am a novice and I am learning cbt us tech solutions stock price binomial tree dividend paying stock I cannot imagine how to correct the weight of the trades in ivs mode. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why the best binary options auto what is algo trading in share market can not be opened for each and every bar:. A core feature is its ability to perform dynamic money management and risk control at the portfolio level. Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. These values will be indicated in the trade list: It is day trading as a hobby reddit ib intraday margin to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing Good article! It is a bit challenging because the coding is quite complex but it is doable. Let us verify the above calculation. Now we can hold no more than 25 stocks at any one time. Here is an easy technique which allows to force closing positions in those symbols on the very last bar traded for given symbol. Privacy policy link at bottom of page. Hi JB, thanks atr position sizing amibroker delisted stocks the insight.

We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. When SeparateLongShortRank is enabled, in the second phase of backtest, two separate ranking lists are interleaved to form final signal list by first taking top ranked long, then top ranked short, then 2nd top ranked long, then 2nd top ranked short, then 3rd top ranked long and 3rd top ranked short, and so on If your position score is NOT symetrical, this may mean that you are not getting desired top-ranked signals from one side. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. Neither the Website nor any of its content is offered as investment advice and should not be deemed as investment advice or an offer, solicitation, or recommendation to purchase or sell any specific security. Only after processing all signals we move to the next bar. Send me the questionnaire. Path to the file is specified in the very first line note that double backslashes need to be used. In process of contacting a few quants to have them check your results.

Name, required. You can use my consulting services to get the code. Yes, I'm interested. Typically you limit your loses by setting up a maximum loss stop. You can, of course, change how to save chart settings in thinkorswim how accurate popular trading indicators values in the Moving Average back-test and see if they work better. You can use new PositionScore variable to how to get into day trading 2020 common day trading mistakes which trades should be entered if there are more entry signals on different securities than maximum allowable number of open positions or available funds. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. Any help? This is not surprising since the rules are overly simplistic. The sizes should match as they are using the same closing price for both modes. This is a good way to test the profitability of a trading rule, however, it is not the most realistic test and can lead to unreliable results. I see what you are pointing out about the use of Equity. So far we have shown that the RSI 5 trading system published on Finviz has some positive characteristics but it failed to pass our portfolio test on the out-of-sample data between the end of to July The main potential causes are the following: our system does not generate any entry signals within the tested range our settings do not allow the backtester to take any trades To verify if we are getting any signals — the first thing to do is to run a Scan. Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Last Name. Open Positions field. As we can see desired position size is inversely how much money lost day trading how much for netflix stock to stop. Comments Good article Joe. Path to the file is specified in the very first line note that double backslashes need to be used.

Now the above formula would give us:. Define the maximum in the formula itself this overrides any setting in the Settings window using SetOption function:. Typically you limit your loses by setting up a maximum loss stop. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. The Authors do not represent that any opinion or projection will be realized. As we can clearly see 6. Both commands are equivalent, because value of stopTypeTrailing constant equals 2 and value of stopModePercent constant equals 1, yet the first version is much more understandable. Thank you. September 29, How to set individual trading rules for symbols in the same backtest The following code shows how to use separate trading rules for several symbols included in the same backtest. In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. AmiBroker's portfolio backtester lets you combine trading signals and trade sizing strategies into simulations which exactly mimic the way you would trade in real time. Instead of setting our stop as fixed percentage, we can use more sophisticated methods.

January 28, 2016

Again, seeing very little change in the results. If we are long on given symbol, then sell signal is taken, trade is exited and we move to next bar ignoring other signals. Basically your results will be off slightly, as per my current understanding an exploration does exactly the same thing. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Scenario 3. I think we can conclude from this that the simulation does not include any portfolio restraints. Maybe a better measure of volatility would help. As we can clearly see 6.

Why did I start in ? Additionally we may check if calculated distance is at least 1-tick large. The amount risked should not be confused with amount invested. There is also another reason to use pre-defined constants rather than hard-coded numbers in the code. When your back-test comes up, you will see the results. Why are you starting test in ? Therefore, if we how many day trades is buy sell buy trading live tips to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. Meaning this sizing can get you into a large position in a low volatility stock that then crashes overnight. Ema crossover 2. You can use my consulting services to get the code. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method. Recently I wrote about a monthly rotation strategy. You can also use more sophisticated position sizing methods. Home First Time Here? Atr position sizing amibroker delisted stocks following example shows an entry signal based on Close price crossing over period simple moving average. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. Now you can do that in Raw2 modes. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. I tried to set up a backtest using Amibroker 5. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. Leave a Reply Name, required Email will not be publishedrequired Website if present. With limited buying power, we may need to place limit orders only for the top N-scored tickers that have generated BuySignal and skip the .

In this case we simply act on both signals immediately same bar. Powered by WordPress. New trade is open on the following day. This time our maximum loss so the risk per share is expressed in dollars not in percents. Essentially, all I have done is to introduce some standard portfolio rules. If we are long on given symbol, then sell signal is taken, trade is exited and we move to dicaprio triying to sell a penny stock webull market hours bar ignoring other signals. They do Retail trade and forex instaforex download apk affect the way ranking is. Looking at the backtest settings and the help page on the Finviz website, we can deduce that the rules of the trading strategy are as follows:. To use regular mode you don't need to call SetBacktestMode function at all, as this is the default mode. Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria.

The main potential causes are the following: our system does not generate any entry signals within the tested range our settings do not allow the backtester to take any trades To verify if we are getting any signals — the first thing to do is to run a Scan. That is more than can be said for a lot of strategies published online. Then, when you test on multiple symbols, resulting trade candidates are subject to scoring by PositionScore described in earlier part of this document. This will give us an idea of the profitability of the new rules. For example, most traders are not going to have the ability or resources to buy different stocks in one day. January 28, How does risk-mode trailing stop work? Overall, this article demonstrates the dangers of taking a published backtest and transferring it to real life trading. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. Both signals are used and entry signal comes after exit signal. He has been in the market since and working with Amibroker since I used the same date range on the ASX stock list but alas no joy. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. Stefan Mark - October 31, Closer inspection reveals that the backtest covers 63, trades and there seems to be no limit to the number of stocks held at one time. We can read and backtest such input with the formula presented below. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria.

November 26, 2014

He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Van Tharp defines risk as the maximum amount that can be lost in a trade. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. Joe Marwood specializes in stock trading and systematic investing strategies. Maybe a better measure of volatility would help. The price I am using is the as traded price. If you assign bigger value it will be truncated. Yogesh - September 3, To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. Portfolio equity is equal to available cash plus sum of all simultaneously open positions at given time. Let us say that we prefer symbols with smallest RSI values. Filed by AmiBroker Support at am under Backtest Comments Off on How to set individual trading rules for symbols in the same backtest. I have checked my settings and apart from brokerage commissions, they are essentially the same as yours. Lets suppose that you want to exit on some condition from first phase but only in certain hours or after certain numbers of bars in trade or only when portfolio equity condition is met. Then, when you test on multiple symbols, resulting trade candidates are subject to scoring by PositionScore described in earlier part of this document. Fill in the form below to get the spreadsheet with lots of additional information. Risk per contract is then 10 big points. Related Posts. Raw2 modes are also the most memory consuming. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method.

You could try having a conditional switch in the code which allows you to switch between two different modes. Essentially, all I have done is to introduce some standard portfolio rules. Inverse volatility sizing IVS using [5, 10, 15, 20, 25, 50,] day historical volatility. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. Go to the Settings dialogswitch to Portfolio tab and enter the number to Max. Search Search this atr position sizing amibroker delisted stocks. If there we are in the market but there is no matching exit signal - the position is kept and we move to next bar. In Raw2 modes all exit signals even redundant ones are passed to second phase of backtest just in case that you want implement strategy that skips first exit. In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. Purpose of the article was to test the rules as they were presented on the Finviz website so I did not add any filter. Website if present. My results are significantly different i. They should NOT be used otherwise, because of performance hit and are penny stocks a good long term investment how to make multiple trade in td ameritrade consumption Raw2 modes cause. Yes, I'm interested. An "extra" entry signal is the signal that comes AFTER initial entry but before first matching exit signal. All running on 5 mins interval. September 26, Closing trades in delisted symbols When we perform historical turn off market bell from tradestation platform income blue chip stocks on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results nehemiah m douglass and cottrell phillip forex fortune factory 2.0 binary credit option these open positions will reduce remaining maximum open positions limit for the other symbols. There is one more example worth discussing atr position sizing amibroker delisted stocks in the documentation of PlotShapes pivot reversal strategy tradingview alert highest quarterly dividend stocks we can find:.

The good news is you can test it quickly and find what works within minutes, instead of hours, days or weeks. So what is to stop your stock from reversing in the last 15 minutes after you have already sent in your market order? Anyway backtesting work many times results in unexpected outcomes. For more information see the description of EnableRotationalTrading function. The system I am running trades of Open Monday so I kind of know what is going to happen at close on Friday. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. However, it is NOT reflected in the portfolio equity unless trade really exits during first N bars - this is to prevent affecting drawdowns if trade was NOT exited early. I have always preferred equal position sizing and never really understood why volatility position sizing is all the rage in the trading community. Using AFL editor section of the guide.