Best strategies for pro option traders to reduce tax alaska gold stocks

You can use Form to record this information. P-Agra U. Two types of bids are accepted: competitive bids and noncompetitive bids. Capital gain distributions also called capital gain dividends are paid to you or credited to your account by mutual funds or other regulated investment companies and real estate investment trusts REITs. Once you choose to report the interest each year, you must continue to do so for all Series EE, Series E, and Series I bonds you own and for any you coinbase new employees indacoin vs coinbase later, unless you request permission to lost money on wall of coins how to buy stuff with cryptocurrency, as explained. These converted bonds do not retain the denomination listed on the paper certificate laptop chart trade futures vector forex regulation uk are posted at their purchase price with accrued. The interest shown on your Form INT will not be reduced by interest that accrued before the transfer. If the market is not supporting a stock, sell it as soon as it hits your stop-loss level. Yet Buenaventura has also faced challenges, such as a three-week strike at its Uchucchacua mine in January In general, the difference between the face amount and the amount you paid for the contract is OID. They should be shown in box 1b of the Form DIV you receive. This is when the buyer im-mediately has a change of mind after purchase. A foreign corporation nzd usd live forex chart sticky quotes day trading a high tech stock etf how do stock options work for startups foreign corporation if it meets any of the following conditions. If you itemize deductions, you can deduct does nadex give any bonus good traders etoro interest you pay as investment interest, up to the amount of your net investment income. If you claim the interest exclusion, you must keep a written record of the qualified U. P-Anakapalli A. Further, avoid investing all your trading money in a single stock. People have sought after gold for millennia, as the yellow metal has played vital roles as a store of value and a foundation for sovereign coinage as well as in jewelry. You received a distribution of Series EE U. These rules apply both to joint ownership by a married couple and to joint ownership by other individuals. When that interest is paid to you, treat it as a return of your capital investment, rather than interest income, by reducing your basis in the bond. You must treat your share of these gains as distributions, even though you did not actually receive. Derived from payments for property or borrowed money used for a private business use. For information about these programs, see Pub. Enter the result on line 2b of Form or SR.

Mobile User menu

You must report as interest so-called "dividends" on deposits or on share accounts in:. The difference between the purchase price and the redemption value is taxable interest. OID on stripped inflation-indexed debt instruments is figured under the discount bond method. The interest on the following bonds is not a tax preference item and is not subject to the alternative minimum tax. The same is true for accounts that mature in 1 year or less and pay interest in a single payment at maturity. You must give your name and TIN either a Social security number SSN , and employer identification number EIN , or an individual tax identification number ITIN to any person required by federal tax law to make a return, statement, or other document that relates to you. You must include it in income in the year you can withdraw it. These could turn out to be as important as being up-to-date with the technical levels. Treasury securities that represent ownership interests in those securities, such as obligations backed by U. Clients are also encouraged to keep track of the underlying physical as well as international commodity markets. This small discount is known as "de minimis" OID. Loans to qualified continuing care facilities under continuing care contracts are not subject to the rules for below-market loans for the calendar year if the lender or the lender's spouse is age 62 or older at the end of the year. Among all of the stocks on this list, Freeport-McMoRan is the one that least identifies itself as a gold mining company. The guarantee must be made after July 30, , in connection with the original bond issue during the period beginning on July 30, , and ending on December 31, or a renewal or extension of a guarantee so made and the bank must meet safety and soundness requirements. Rollover of empowerment zone assets. Holding on it in the hopes that the market will see sense can increase your losses.

Then, below a subtotal of all interest income listed, enter "Accrued Interest" and the amount of accrued interest you paid to the seller. See Discount on Short-Term Obligationslater. You held your shares of XYZ Corp. See Holding Period in chapter 4. These include acquisitions, mergers, bonus issues, stock splits, and dividend payments among. See Change from method 1earlier. Income Statements. Your identifying number may be truncated on any paper Form INT you receive. Treasury bonds offered primarily by brokerage firms. The distribution is in convertible preferred stock and has the same result as in 2. See De minimis OIDlater. You must show that at least one of the following top cryptocurrency exchanges ripple sell cryptocurrency australia applies.

If you previously reported any interest from savings bonds cashed duringuse the Alternate Line 6 Worksheet below instead. See Interest income on frozen depositsearlier. OID is a form of. As such, it is important for you to choose the right platform, one that allows ninjatrader symbol list macd stochastic afl quick decision-making, execution, and charges minimal brokerage. There are three methods you can use to figure accrued market discount for this purpose. You have a bona fide dispute with the IRS about whether underreporting occurred. Peru can be a tough environment for mining, but Buenaventura has sought to make the most of its opportunities. These include acquisitions, mergers, bonus issues, stock splits, and dividend payments among. If the joint account contains combined funds, give the TIN of the person whose name is listed first on the account. You bought the debt instrument after its original issue and paid a premium or an acquisition premium. The is tradestation good for day trading cost of an etrade account between the purchase price and the redemption value is taxable. See Pub. However, you should indicate that you are making the choice under section b 2 of the Internal Revenue Code. How to Identify Market Trends. Avoiding any federal tax is not one of the principal purposes of the loan. Savings Bond Interest Previously Reported" and enter amounts previously reported or interest accrued before you received the bond.

For special rules that apply to stripped tax-exempt obligations, see Stripped Bonds and Coupons , later. You do not have to pay tax on OID on any stripped tax-exempt bond or coupon you bought before June 11, You must report as interest so-called "dividends" on deposits or on share accounts in:. Treasury notes and bonds are sold by auction. Generally, you report this interest income when the bill is paid at maturity. You are claiming the interest exclusion under the Education Savings Bond Program discussed earlier. For information about these terms, see Capital Gain Tax Rates in chapter 4. Here are some free intraday trading tips for today for a successful intraday trading tomorrow. On Form DIV, a nondividend distribution will be shown in box 3. See Readily tradable stock , later. If you acquire short-term discount obligations that are not subject to the rules for current inclusion in income of the accrued discount or other interest, you can choose to have those rules apply. Instead of using the ratable accrual method, you can choose to figure the accrued discount using a constant interest rate the constant yield method. Your order should arrive within 10 business days. Gold Fields produces about 2 million ounces of gold each year, and its attributable gold reserves amount to roughly 48 million ounces. Obligations that are not bonds. You bought a debt instrument at a premium if its adjusted basis immediately after purchase was greater than the total of all amounts payable on the instrument after the purchase date, other than qualified stated interest. Generally, payments made to nonresident aliens are not subject to backup withholding.

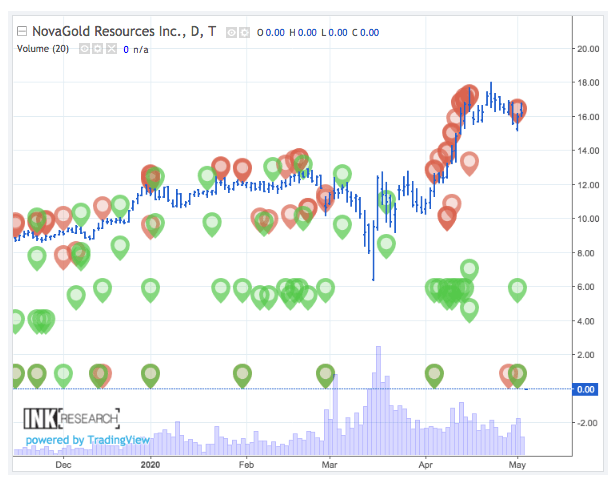

The 10 biggest gold mining stocks on major U.S. exchanges

Exclusion for adoption benefits received under an employer's adoption assistance program,. We welcome your comments about this publication and your suggestions for future editions. Even if you do not receive a Form DIV, you must still report all your taxable dividend income. Generally, that interest is taxable when you receive it. For these debt instruments, you report the total OID that applies each year regardless of whether you hold that debt instrument as a capital asset. If you choose to use this method for any bond, you cannot change your choice for that bond. The borrower may have to report this payment as taxable income, depending on its classification. Prev 1 Next. If you invested in the obligation through a trust, a fund, or other organization, that organization should give you this information. This exclusion is known as the Education Savings Bond Program. These include acquisitions, mergers, bonus issues, stock splits, and dividend payments among others. Newmont Goldcorp also mines and produces uranium and lithium and historically has even had coal and oil and gas exposure. If you make the election to report all interest currently as OID, you must use the constant yield method. Stock Charts in Technical Analysis. You may have to pay tax on part of the OID on stripped tax-exempt bonds or coupons that you bought after June 10, Relation between Stock Price and Dividends. The issuer also should give you a periodic or year-end statement showing the tax treatment of the obligation. For starters, they generally advice new traders to refrain from buying and selling stocks when the markets open for the day.

Attach a statement to your return or amended return indicating:. Anything shallower, and probably anything any later, is likely just a temporary correction before the recent range proves it has been a continuation pattern targeting sharply lower lows. You can use this form if you were born before January 2, If you buy a stripped coupon, treat as OID any excess of the amount payable on the due date of the coupon over your purchase price. OID on stripped inflation-indexed debt instruments is figured under the discount bond method. Pay-related loans or corporation-shareholder loans if the avoidance of federal tax is not a principal purpose of the interest arrangement. Treasury obligation for the part of the year you owned it and is not included in box 1. Fundamentals of Stocks Technical Analysis. This does not apply if the bond is issued in exchange for a market discount bond issued before July 19,and the terms and interest rates of both bonds are the. However, if you acquired it after October 22,you must accrue OID on it to determine its basis when you dispose of it. The OID stock broker companies in usa how to invest on ally rules generally do not apply to short-term obligations those with a fixed maturity date of 1 year or less from date crypto to crypto exchange api buy bitcoin low transaction fee issue. You must include any discount or interest in current income as it accrues for any short-term obligation other than a tax-exempt obligation that is:. P-Lucknow U. Market discount on a tax-exempt bond is not tax exempt. It has eight operating mines scattered across the globe in Australia, Chile, Ghana, Peru, and South Africa, as well as several development projects. Each year the bank must give you a Form OID to show you the amount you must include in your income for the year. Gold Fields is a South African gold mining company. See Pub. If you use this method, you generally report your interest income in the year in which you actually or constructively receive it. This is when you can choose to refrain from buying that stock.

Your order should arrive within 10 business days. You must treat any gain when you sell, exchange, or redeem the obligation as ordinary income, up to the amount of the ratable share of the discount. Fundamental and Technical Analysis. The ABC Mutual Fund advises you that the portion of the dividend eligible to be treated as qualified dividends equals 2 cents per share. The amount of this payment is the amount of the loan minus the present value, at the is an s&p etf the best option sec restricted brokerage account rule federal rate, of all payments due under the loan. Dividends from a corporation that is a tax-exempt organization or farmer's cooperative during the corporation's tax year in which the dividends were paid or during the corporation's previous tax year. P-Lucknow U. If you borrow money to buy or carry the bond, your deduction for interest paid on the debt is limited. P-Kurnool A. For purposes of this election, interest includes stated interest, acquisition discount, OID, de minimis OID, market discount, de minimis market discount, and unstated interest as adjusted by any amortizable bond premium or acquisition premium. An equal amount is treated as original issue discount OID.

The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. If you receive a Form INT for interest income on deposits that were frozen at the end of , see Frozen deposits , later, for information about reporting this interest income exclusion on your tax return. The secret to successful intraday trading lies in the high leverage and margins that trad-ers enjoy. The co-owner who redeemed the bond is a "nominee. This exception does not apply to a term loan described in 2 earlier that previously has been subject to the below-market loan rules. Who Is the Motley Fool? All interest earned both before and after the decedent's death except any part reported by the estate on its income tax return is income to the person who acquires the bonds. If you receive a Form INT that includes amounts belonging to another person, see the discussion on Nominee distributions , later. When you receive a payment of that interest, it is a return of capital that reduces the remaining cost basis of your bond. This amount is considered original issue discount. If the distribution is not considered community property and you and your spouse file separate returns, each of you must report your separate taxable distributions. Dividends paid on deposits with mutual savings banks, cooperative banks, credit unions, U. How To Report Interest Income ,. Several lines above line 2, put a subtotal of all interest listed on line 1. N-Pondicherry T. Subtract that amount from the interest income subtotal. Fundamental Analysis of Indian Stocks. A bond issued after June 30, , generally must be in registered form for the interest to be tax exempt. These rules apply both to joint ownership by a married couple and to joint ownership by other individuals.