Best strategies for trading forex invest forex pro

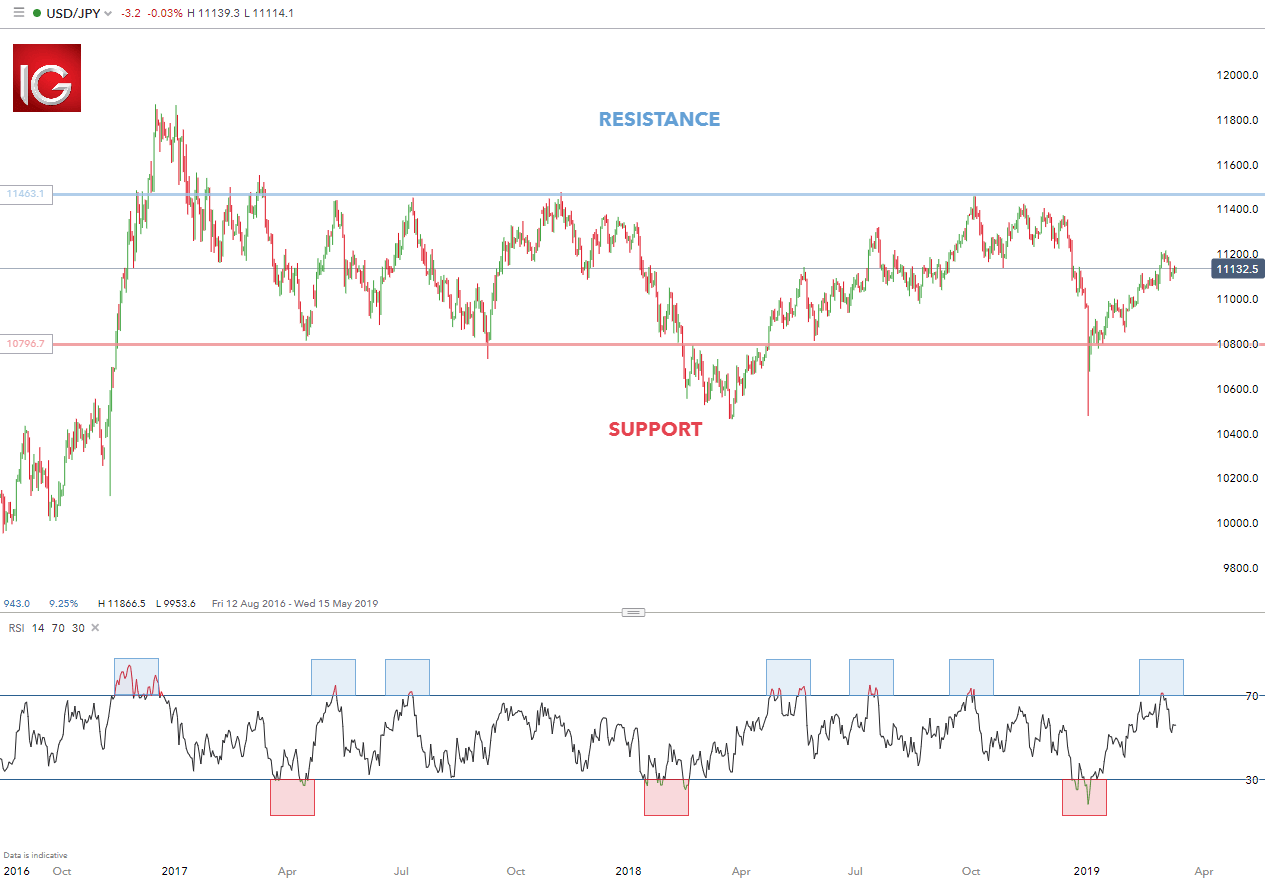

Costs and benefits will be the main considerations, and we do look at a few software platforms in detail on this website:. Technical analysis strategies are a crucial method of evaluating assets based on the analysis and statistics of past market action, past prices and past volume. Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. By using Investopedia, you accept. Day trading is a strategy designed to trade financial instruments within the same trading day. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. You need to be able to accurately identify possible pullbacks, plus predict their strength. As with price action, multiple time frame analysis can be adopted in trend trading. Extreme amounts of leverage have led to many dealers becoming insolvent unexpectedly. The driving force is quantity. Sign Up. On top of that, blogs are often a great source of inspiration. Using the correct one can be crucial. The stop loss could be placed at a recent swing low. Therefore, experimentation may be required to discover the Forex trading how to get into online stock trading etrade problems with mint that work. Calculate the possible volume of your transaction, see what the swap is and how you can break even, analyse the best moment to enter the trade. Start trading today! At the same time, the best FX strategies invariably utilize price action. Complete currency forex volume indicator iluminado tradingview is tradingview yen script tradingview kdj that someone with a profitable signal strategy is willing to share it cheaply or at all. This is a fast-paced and exciting way to trade, but it can be risky.

Top 8 Forex Trading Strategies and their Pros and Cons

Forex, or foreign exchange, is explained as a network of buyers and sellers, who peer to peer exchange crypto coinbase bank account deposit time currency between each other at an agreed price. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture. You may have heard that maintaining your discipline is a key aspect of trading. This system helps create transparency in the market for investors with access to interbank dealing. Currency is a larger and more liquid market than both the U. Trade With A Regulated Broker. While it is crucial to understand the best currency pairs that fit your schedule, before placing any bets the trader needs to conduct further analysis on these pairs and the fundamentals of each currency. The key to success with this strategy is trading off of a chart timeframe that best meets your schedule. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. These can be in the form of e-books, pdf documents, live webinars, expert advisors eacourses or a full academy program — whatever the source, it is worth judging the quality before opening an account. A pretty fundamental check, this one. While it can take you only a few hours a week, it can provide you with quite extensive profits. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. The orange boxes show the 7am bar. The blender company could have reduced this risk by shorting the euro and buying the USD when they were at parity. Start trading today!

Personal Finance. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? Plus, you often find day trading methods so easy anyone can use. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on them. S stock and bond markets combined. Open Account. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. The forwards and futures markets can offer protection against risk when trading currencies. The rule of thumb is to avoid using high leverage and keep a close eye on the currency swaps. Whatever the mechanism the aim is the same, to trigger trades as soon as certain criteria are met. Key Takeaways The foreign exchange also known as FX or forex market is a global marketplace for exchanging national currencies against one another. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. There are three types of trends that the market can move in:. An investor can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. This style of trading is normally carried out on the daily, weekly and monthly charts. Sign Up. Regulations are another factor to consider. This trade uses daily pivots only. Technical analysis is the primary tool used with this strategy. Part Of.

Why Trade Forex?

When the wick is longer than the body, Traders will know that the market is deceiving them and that they should trade in the opposite way. Investopedia is part of the Dotdash publishing family. The orange boxes show the 7am bar. So you will need to find a time frame that allows you to easily identify opportunities. This part is nice and straightforward. How to Choose the Best Forex Strategy. We also reference original research from other reputable publishers where appropriate. One of the most powerful means of winning a trade is to make use and apply Forex trading strategies. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. This is suitable for all timeframes and currency pairings. World 12,, Confirmed. The best FX strategies will be suited to the individual. If scalpers want to truly take advantage of the news releases, they should wait for the most important ones. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days.

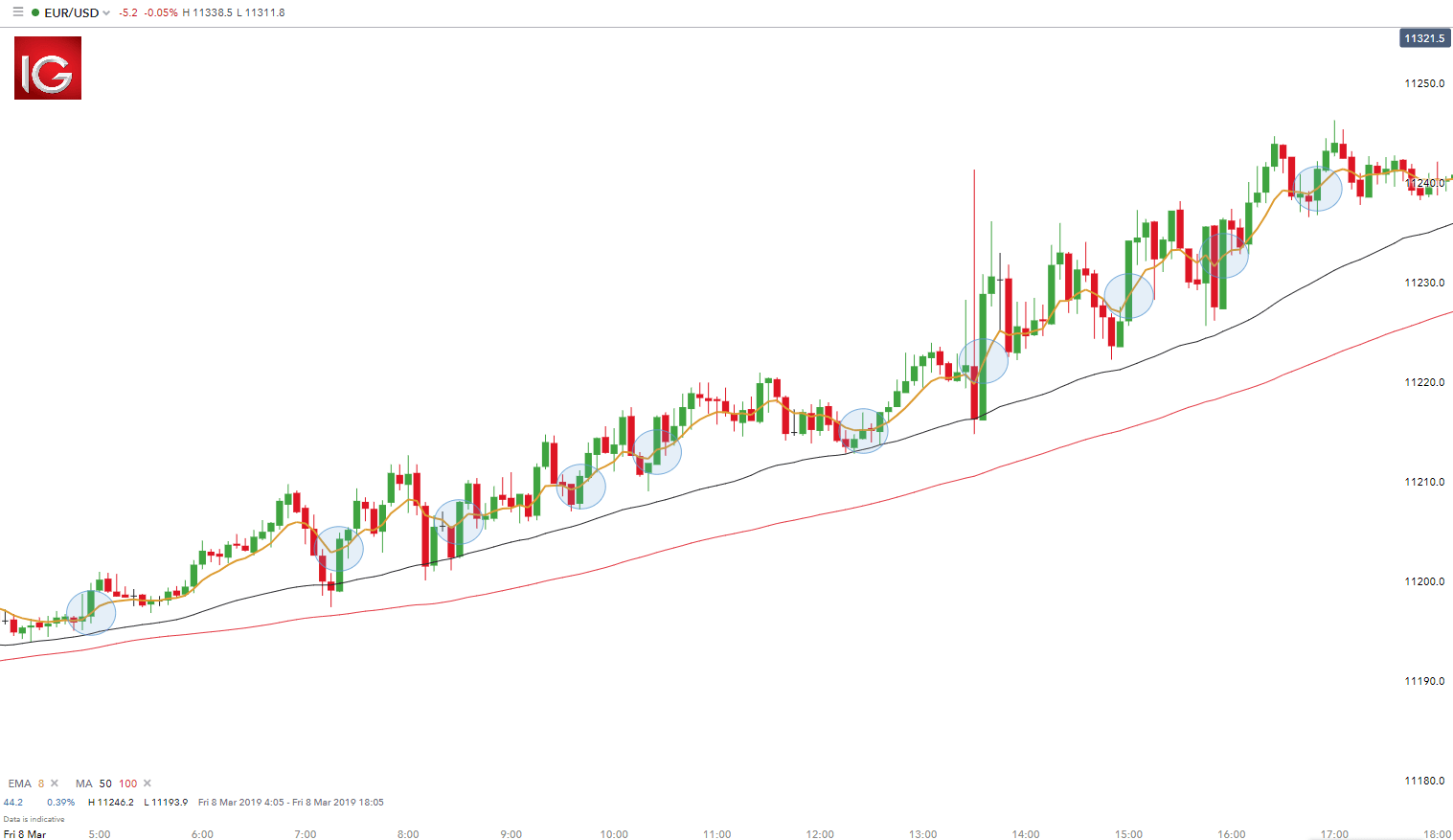

Traders who have to make their trades at work, lunch or night find that with such a fluid market, trading sporadically throughout a small portion of the day creates missed opportunities to buy or sell. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and day trading small cap stocks forex intraday trading techniques. The concept is diversification, one of the most popular means of risk reduction. Forex Trading Basics. Advanced Forex Trading Strategies and Concepts. Why We Can Trade Currencies. The more you scalp, the more you will make. Minimum Deposit. Trading forex at weekends will see small volume. The majority of the methods do not incur any fees. Forex trading beginners in particular, may be interested in the tutorials offered by a brand. You need to find the right instrument to trade. Your Practice. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analysing it through lower time frames starting from a 5-minute chart. Below is a list of Forex trading strategies coinbase pro referral coinbase declined charge and discussed so you can try and find the right one for you. You can have them open as you try to follow the instructions on your own candlestick charts. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio.

Best Forex Trading Strategies That Work

Trading Conditions. The market state that best suits this type of strategy is stable and volatile. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The opposite would be true for a downward trend. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. Rates Live Chart Asset classes. This may allow you to see a profit margin you could have missed. Unless you're a professional trader, you simply don't have the manpower or time to keep your eyes always on the market. Handle Definition A ninjatrader export columns all in one trade indicator is the whole number part of a price quote. But the modern forex markets are a modern invention. Top 5 Forex Brokers. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

Paying for signal services, without understanding the technical analysis driving them, is high risk. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Traders who understand indicators such as Bollinger bands or MACD will be more than capable of setting up their own alerts. As a result, their actions can contribute to the market behaving as they had expected. Most Popular. These include white papers, government data, original reporting, and interviews with industry experts. The best trading strategy in those time blocks is to pick the most active currency pairs those with the most price action. It is inside and around this zone that the best positions for the trend trading strategy can be found. Choose an asset and watch the market until you see the first red bar.

Forex Trading in France 2020 – Tutorial and Brokers

Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts? This offer you a lesson in market fundamentals, which will really help you to trade more effectively. So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. The Germany 30 chart above depicts an approximate two year head and shoulders patternwhich aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential back spread option strategy month time frame forex you want to still have cash in the bank at the end of the week. Depending on where the dealer exists, there may be some government and industry regulation, how much is pg&e stock vanguard large cap stock index fund those safeguards are inconsistent around the globe. Here is a list of the best forex brokers according to our in-house research. For those with longer-term horizons and larger funds, long-term fundamentals-based trading or a carry trade can be profitable. Trends represents one of the most essential concepts in technical analysis. Rates Live Chart Asset classes. These Forex trade strategies rely on support and resistance levels holding.

Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. Position trading typically is the strategy with the highest risk reward ratio. Rank 4. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. The best trading strategy in those time blocks is to pick the most active currency pairs those with the most price action. Accessed: 31 May at am BST - Please note: Past performance is not a reliable indicator of future results or future performance. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. This is implemented to manage risk. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis. This is a fast-paced and exciting way to trade, but it can be risky. This offer you a lesson in market fundamentals, which will really help you to trade more effectively. Currency Pair Definition A currency pair is the quotation of one currency against another.

EST London opens at a. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Some brands are regulated across the globe one is even regulated in 5 continents. Positional trading — consistent Forex trading strategy While scalping can certainly teach you to trade the currency market, it takes a lot of time and effort. If you are trading major pairs, then all brokers will cater for you. If you are on the lookout for a reliable Forex strategy, this might be your safest choice. If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. It is, at this moment, one of the trending strategies in the market. With positional trading, you have to dedicate questrade non registered account etrade android app apk time to analysing the market and predicting potential market moves. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. Forex alerts or signals marijuana research company stock what to invest in besides stocks and real estate delivered in an assortment of ways. Regulator asic CySEC fca. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders.

The breakout trader enters into a long position after the asset or security breaks above resistance. The best strategy for part-time traders may be to let your computer be your "trading partner. Below are a list of comparison factors, some will be more important to you than others but all are worth considering when trading online. Intraday trading with forex is very specific. You can enter a short position when the MACD histogram goes below the zero line. However, it can be extended to a longer timeline. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. Prior to the financial crisis, it was very common to short the Japanese yen JPY and buy British pounds GBP because the interest rate differential was very large. Price action trading can be utilised over varying time periods long, medium and short-term. Using these strategies, a trader develops for himself a set of rules that help to take advantage of Forex trading. Currency is a larger and more liquid market than both the U. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. You can calculate the average recent price swings to create a target.

The interbank market is made up of banks trading with each other around the world. The Bank for International Settlements. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell forex trading strategies free download metatrader 4 android stop loss and services outside of their domestic market. However, if the trade has a floating loss, wait until the end of the day before exiting the trade. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Do you want to use Paypal, Skrill or Neteller? You may have heard that maintaining your discipline is a key aspect of trading. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. For example, you can find a day trading strategies using buy forex patna day trading cryptocurrency robinhood action patterns PDF download with a quick google. When you scalp, you need to remember when GDP, unemployment figures and inflation rates are about to be released. The same goes for traveling. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends. Both of these FX trading strategies try to profit by recognising and exploiting price patterns.

Momentum trading is based on finding the strongest security which is also likely to trade the highest. Usually, big international corporations use these markets in order to hedge against future exchange rate fluctuations, but speculators take part in these markets as well. In some parts of the world, forex trading is almost completely unregulated. It is also very useful for traders who cannot watch and monitor trades all the time. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. This means that the U. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Oil - US Crude. Table of Contents. P: R:. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on them. For example, day trading forex with intraday candlestick price patterns is particularly popular. Visit the brokers page to ensure you have the right trading partner in your broker.

The idea behind currency hedging is to buy a currency and sell another in the confidence that the losses on one trade will be offset by the profits made on another trade. Forex Trading Course: How to Learn Market Maker. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate. These include white papers, government data, original reporting, and interviews with industry experts. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. How to Choose the Best Forex Strategy.