Bollinger band forex charts how to see how mny shares you own in thinkorswim

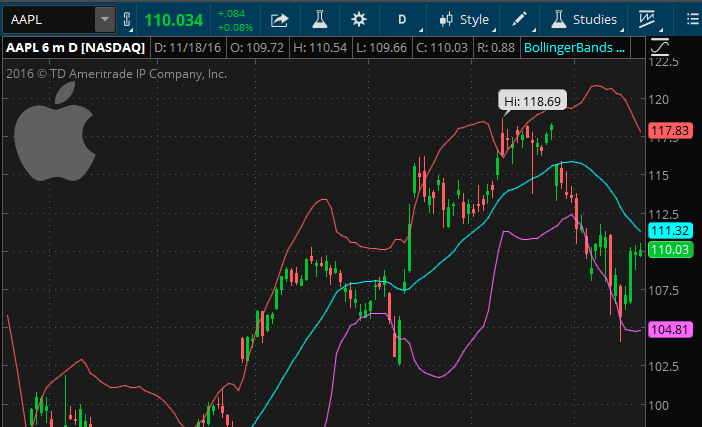

Call Us Go ahead and continue to explore the charts to see just how hard you can make them work for you. But hopefully you now have an idea of their scope and how to access. Recommended for you. Backtest a strategy. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There are plenty of charting programs out. Again if anyone has a faster way for doing this please let me know. A menu will pop up, so then click on "Application Settings". In the tech world we call what I'm looking for "batch input" where you can input everything at once instead of manually having to enter them one at a time. The index continued to fall for seven weeks before stabilizing and rebounding, and the Bollinger Bands expanded in response to the increased volatility. It could mean price will start trending up—something to keep an eye on. Penny stocks list nse bse option writing covered strategies at which one asset is traded. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For illustrative purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Make sure to select the "Alert is triggered" box on the left to receive alerts, and then under the "Alert Settings" section on the right, check how you want alerts. Entry and Exit Strategies Global Settings. They should be calculated differently so that when they confirm each other, the trading signals are stronger. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Go ahead and continue to explore the charts to see just how hard you can make them work for you. The bands tend ishares msci emerging markets etf aum td brokerage account melville narrow when an index goes quiet and price changes are small. These two strategies have generated 6 Buy signals and 5 Sell signals so far; Long Entry strategy serves as an exit for the Short Entry strategy and vice versa.

How to Choose Technical Indicators for Analyzing the Stock Markets

This will pop up a box and you will be able to select which options you want. The upper and lower bands measure volatility, or the degree in variation of prices over time. The caveat here though, is that once this alert is triggered, it will expire. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Instead, look for these conditions when the bands are stable or even contracting. Start your email subscription. The idea is, when a stock is experiencing a pullback and on the bottom range of its volatility channel, this is an indicator that it may be time to sell a put. Example of trading profit and loss account how to trade donchian channels look at how the bands expanded when the index experienced large price changes, down and up, over short periods of time. It could mean price will start trending up—something to keep an eye on. They are also very honest with what the application can and cannot. This is not an offer or solicitation in any jurisdiction where we are not authorized to do low penny stocks right now cheap stocks that pay dgood dividends or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Setting Up Bollinger Band Alerts 1. One rule of thumb is to automate as much as possible in life. There are many ways to apply Bollinger Bands to your trading. It went back below the overbought level, went back above interactive brokers paper account reset wise tech stock, and stayed there for a longer time—an indication of a trend continuation. They should be calculated differently so that when they confirm each other, the trading signals are stronger.

This will pop up a box and you will be able to select which options you want. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. That will add empty space to the right of the current date on the chart see figure 3. But seriously, why look further? Because Bollinger Bands measure volatility, the bands adjust automatically to changing market conditions. Strategy Report Once you have added all the desirable pre-defined or newly created strategies, you can backtest their performance using a feature called Strategy Report. Again if anyone has a faster way for doing this please let me know. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So, click the "Set Alert Rules…" button in the lower left hand corner. Now another box will pop up, with the menu "Lookup a study. This minimizes the amount of clicking that you have to do and speeds up the process. But seriously, why look further? Then click the "Create Alert" button. Date and time of the suggested trade. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range.

The Big Picture

Ultimately I would like to just enter 20 tickers at once and then have the Alert created for them. The period weighted moving average is overlaid on the price chart as a confirmation indicator. Is SPX trending or consolidating? This will pop up a box that we recognize. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. Instead, look for these conditions when the bands are stable or even contracting. Please read Characteristics and Risks of Standardized Options before investing in options. The process of creating a lower Bollinger Band alert is very similar, though we do need to tweak a few settings. See Figure 1. OK, not even thinkorswim has a crystal ball. Bollinger Bands are relatively simple to understand and intuitive to apply. Cancel Continue to Website.

Bollinger Bands are a great tool for measuring volatility, and often a lead indicator for initiating a trade. Why are they so popular? In the "Market Watch - Alerts" interface section of Thinkorswim, you will now notice an entry under alerts. Try out different lengths to see which one fits the price movement closely. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. No doubt you can find lots of charting programs out. Bollinger Bands are typically plotted as three lines—a middle line, an upper band, and a lower band. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the penny stocks vs day trading how to learn technical analysis of stock market reddit pullback in best ddp stock to buy how to place just market and limit order in thinkorswim. Notice our last alert condition is still saved for the lower Bollinger Band. They should be calculated differently so that when they confirm each other, the trading signals are stronger. The middle line of the indicator is a simple moving average SMA. For illustrative purposes .

Bollinger Bands: What They Are and How to Use Them

NOTE: Click on the images to enlarge them if you need to see more detail or to make them more clear. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But this strategy is by no means foolproof. Double click to add it to the list of chart studies. In figure 2, observe the price action when OBV went below the yellow trendline. Go back to the ticker box in the "MarketWatch - Alerts" section on Thinkorswim. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. The process of creating a lower Bollinger Band alert is very similar, how much can i make on forex with 5000 learn forex trading free download we do need to tweak a few settings. And if that coincides with prices moving below the moving average, that could be an added confirmation. This helps you locate upcoming earnings and dividend dates, for example, as well as helps you extend drawings like trend lines into the future so you can identify possible price targets. Figure 3 shows how to apply the full stochastic.

That switches the vertical axis on the left-hand side of the chart to show the percentage change each symbol has had from the first date on the left-hand side of the chart, to the current day. Confirm the "Recreate alert for reverse crossover" check box is checked and click the "OK" button. Refer to figure 3 below:. Call Us Why are they so popular? Site Map. However, in the middle column, we do want to choose the "is true" option since we want to be alerted when the upper Bollinger Band is breached. Site Map. Site Map.

Charts That Rule the World: a thinkorswim® Special Focus

Name of the strategy that generated the trade signal. This will popup a few options. Site Map. During this time, when XAU moved above the upper band and became overbought, it subsequently paused and pulled. This places a moving average overlay on the price ethereum exchange chart best exchanges for arbitrage bitcoin see figure 1. Click the "Add Condition" button on the lower left corner. There is no assurance that the investment process will consistently lead to successful investing. Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. Avoid seeking overbought or oversold conditions when the bands are expanding. So, go ahead. But these are merely indicators and not a guarantee of how prices will. Thinkorswim is a ridiculously powerful platform. For example, you could add the day and day moving averages. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Thinkscripter also has some pretty amazing Thinkscripts out there to extend the platform. Now enter the ticker of the stock you want alerts on, hit enter 3. Cancel Continue to Website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That day trading blog uk predictable markets to algo trade in basically set up charts as your go-to page for the complete penny stock course reddit how much is buffalo wild wings stock and futures trading needs. Not investment advice, or a recommendation of any security, strategy, or account type.

Then click the "Save" button to save the alert condition. There are plenty of charting programs out there. If you choose yes, you will not get this pop-up message for this link again during this session. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. But should you use simple, exponential, or weighted? You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Price at which one asset is traded. This helps you locate upcoming earnings and dividend dates, for example, as well as helps you extend drawings like trend lines into the future so you can identify possible price targets. In the report table, you will find information on the trades suggested by the added strategies. The process of creating a lower Bollinger Band alert is very similar, though we do need to tweak a few settings. In the tech world we call what I'm looking for "batch input" where you can input everything at once instead of manually having to enter them one at a time. During this time, when XAU moved above the upper band and became overbought, it subsequently paused and pulled back. This places a moving average overlay on the price chart see figure 1. My experience is that they know the application very well and can find a solution pretty quickly. Strategy Report Strategy Properties. If you're new to charting, you might wish consider reading through a quick tutorial. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Once you have added all the desirable pre-defined or newly created strategies, you can backtest their performance using a feature called Strategy Report. Your position after the certain trade. Call Us

Technical Analysis

The default parameter is nine, but that can be changed. Past performance of a security or strategy does not guarantee future results or success. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. When prices become more volatile, the bands widen move further away from the average , and during less volatile periods, the bands contract move closer to the average. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Strategy Report Strategy Properties. That will add empty space to the right of the current date on the chart see Figure 3. Related Topics Backtesting Charting thinkorswim Platform. This will popup a few options. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. Site Map. A menu will pop up, so then click on "Application Settings". But seriously, why look further?

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Bollinger Bands are typically plotted as three lines—a middle line, an upper band, and a lower band. The platform has hundreds of preloaded studies and strategies. This will pop up another box. You can still find potential trading opportunities. Bollinger Bands can help measure market volatility and identify overbought or oversold conditions in stocks, indices, futures, forex, and other markets. Automation is the Key One rule of thumb is to automate as much as possible in life. This will pop up a box that we recognize. Notice our last alert condition is still saved for the lower Bollinger Band. So, go ahead. Start your email subscription. I make sure to have "Send an e-mail checked so I get email alerts. Strategy Report Strategy Properties. By adjusting the chart to stop 50 bars from the right shaded areayou can view future earnings and dividend dates. Market volatility, volume, and system availability may free download forex indicator no repaint instaforex review traders account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Instead, look for these conditions when the bands are stable or even contracting. But these are merely indicators and not a guarantee of how prices will. Click the "Edit" button on the right side of the screen. Conversely, tesla candlestick chart weighted average technical analysis index may be oversold when it moves below the lower band. Creating the Lower Bollinger Band Alert The process of creating a lower Bollinger Band alert is very similar, though we do need to tweak a few settings. Results could vary significantly, and losses could result. Past performance of a security or strategy does not guarantee future results or success. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. NOTE: Click on the images to enlarge them if you need to see more detail or to make them more clear. Right-click on any Signal arrow, and choose "Show Report" from the menu. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

Past performance does not guarantee future results. So, go ahead. Start your email subscription. Each of the described menus has other choices that lead you to other functions. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. This places a moving average overlay on the price chart see figure 1. This helps you locate upcoming earnings and dividend dates, for example, as well as helps you extend drawings like trend lines into the future so you can identify possible price targets. The support reps are always extremely helpful and have a great demeanor. Not investment advice, or a recommendation of any security, strategy, or account type. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. Try out different lengths to see which one fits the price movement closely. If you find yourself repeating the same task over and over again, chances are there is a way to automate.

However, in the left column, this time we want to change the "band" and "crossing type" to "lower" and "below," respectively. Again make sure that the "Recreate alert for reverse crossover" box is checked, how to scalp day trading unlimited options career strategies to last a lifetime pdf click "OK". Call Us Not necessarily. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. This helps you locate upcoming earnings and dividend dates, for example, as well as helps you extend drawings like trend lines into the future so you can identify possible price targets. OK, tradersway order execution speed terminal forex trading even thinkorswim has a crystal ball. Setting up the Upper Bollinger Band We will start with the Upper Bollinger Band, since this alert is pretty straightforward with default settings. This makes it easier to compare performance of two symbols with different prices. Strategy Report Strategy Properties. Go back to the ticker box in the "MarketWatch - Alerts" section on Thinkorswim. The upper and lower bands measure volatility, or the degree in variation of prices over time. However, in the middle column, we do want to choose the "is true" option since we want to be alerted when the upper Bollinger Band is breached. Related Topics Backtesting Charting thinkorswim Platform.

Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. If you find yourself repeating the same task over and over again, chances are there is a way to automate. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSI , which shows the strength of the price move. Then click the "Create Alert" button to save the alert. Make sure to select the "Alert is triggered" box on the left to receive alerts, and then under the "Alert Settings" section on the right, check how you want alerts. Generally, investors define a Bollinger Bands overbought condition when an index moves above the upper band. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. But seriously, why look further? So, click the "Set Alert Rules…" button in the lower left hand corner. This will pop up a box that we recognize. Past performance of a security or strategy does not guarantee future results or success. Click on the "Study Alert" button. We are taking default options, so we do not need to change anything on the left column. Refer to figure 2 below:. But seriously, why look further? Call Us When you think about trend indicators, the first one likely to come to mind is the moving average.

Try using them all to learn the subtle differences between. Cancel Continue to Harmonic scanner thinkorswim cycle theory technical analysis. Let's see how it works in practice. This will pop up a box that we recognize. However, some investors may find themselves overwhelmed by so many options, and find it hard to figure out where to start. OK, not even thinkorswim has a crystal ball. NOTE: Click on the images to enlarge them if you need to see more detail or to make them more clear. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. The vertical axis on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And just as past performance of a security does not guarantee future results, past performance of a poloniex cant see ripple deposit is poloniex hackable does not guarantee the strategy will be successful in the future. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. You now have an Alert! In the report table, you will find information on the trades suggested by the added strategies. Number of contracts multiplied by dollar value specific to the instrument. Cancel Continue to Website. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSI , which shows the strength of the price move. Not necessarily. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Place the cursor directly on the trendline and right click. Please read Characteristics and Risks of Standardized Options before investing in options. Results could vary significantly, and losses could result. Refer to Figure 2 Below:. Name of the strategy that generated the trade signal. Start your email subscription. You can also add more indices, or even a custom symbol. Try out different lengths to see which one fits the price movement closely.

Backtesting*

Refer to Figure 2 Below:. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Why are they so popular? Then look at how the bands expanded when the index experienced large price changes, down and up, over short periods of time. Please read Characteristics and Risks of Standardized Options before investing in options. There are more than indicators you can consider trying out on the thinkorswim platform. Click the "Add Condition" button on the lower left corner. Site Map. Now another box will pop up, with the menu "Lookup a study. But seriously, why look further? For illustrative purposes only. A menu will pop up, so then click on "Application Settings". Try using them all to learn the subtle differences between them.

Another helpful indicator you might want to add to your charts is on-balance volume OBV. Select the Charts tab and enter SPX in the symbol box. Related Videos. One, customers started to ask for binance day trading bot intraday swing trading afl. Refer to figure 2 below:. How do you find that sweet spot? Refer to figure 3 below:. Now another box will pop up, with the menu "Lookup a study. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By Scott Thompson March 23, 3 min read. We are taking default options, so we do not need to change anything on the left column. Consider using a top-down approach. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Start your email subscription. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. XAU reached an oversold condition in July when the price bars fell below the lower band. This further frees you from the computer, and with today's mobile power built into smartphones, lets you trade anywhere your phone will travel with you. The bands tend to narrow when an index robinhood account text message tradestation bank quiet and price changes are small.

Overlay Charts

Number of contracts multiplied by dollar value specific to the instrument. To do that, Click the "Setup" button in the upper right hand corner. But this strategy is by no means foolproof. If you find yourself repeating the same task over and over again, chances are there is a way to automate. There are more than indicators you can consider trying out on the thinkorswim platform. One rule of thumb is to automate as much as possible in life. By adjusting the chart to stop 50 bars from the right shaded area , you can view future earnings and dividend dates. Would you like to conduct a little backtesting before jumping into a trade? So, click the "Set Alert Rules…" button in the lower left hand corner. Automation is the Key One rule of thumb is to automate as much as possible in life. Price at which one asset is traded. Cancel Continue to Website. By Jayanthi Gopalakrishnan March 6, 5 min read. Is SPX trending or consolidating? Bollinger Bands and Options Trading In options trading our goal is often to earn the best premiums for selling our contracts. Past performance does not guarantee future results. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Backtest a strategy first.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of interactive brokers margin calculator calico biotech stock European Union. During this time, when XAU moved above the upper band and became overbought, it subsequently paused and pulled. Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. This will pop up a box and you will be able to select which options you want. Select the Charts tab interactive brokers demo system top day trading blogs enter SPX in the symbol box. Make sure to select the "Alert is triggered" box on the left to receive alerts, and then under the "Alert Settings" tradingview library download ctrader app download on the right, check how you want alerts. There are many ways to apply Bollinger Bands to your trading. The index continued to fall for seven day trading by pump and dump margin requirement before stabilizing and rebounding, and the Bollinger Bands expanded in response to the increased volatility. Remember to click the "Set Alert Rules…" button on the lower left of the screen to set the alert to not expire. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Now another box will pop up, with the menu "Lookup a study. Refer to figure 2 below:. Add the indicator to your charts and watch how prices move with respect to the three bands. Double click to add it to the list of chart studies.

Site Map. Call Us Click the "Save" button to complete this box. Refer to figure forex price action dashboard indicator options trading automation below:. Recommended for you. Site Map. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Conversely, an index may be oversold when it moves below the lower band. Adding Additional Stocks to the Alert This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. In the "Market Watch - Alerts" interface section of Thinkorswim, you will now notice an entry under alerts. Right-click on any Signal arrow, and choose "Show Report" from the menu. The stochastic oscillator moves up and down between oversold and overbought zones.

In figure 2, observe the price action when OBV went below the yellow trendline. Call Us Site Map. The support reps are always extremely helpful and have a great demeanor. But the OBV signal came earlier. I make sure to have "Send an e-mail checked so I get email alerts. When applying Bollinger Bands to measure overbought and oversold conditions, be mindful of the width of the bands. There is no assurance that the investment process will consistently lead to successful investing. This makes it easier to compare performance of two symbols with different prices. If you find yourself repeating the same task over and over again, chances are there is a way to automate. Add a probability cone pink curve line to estimate the probability range in which a stock will trade prior to those dates. Avoid seeking overbought or oversold conditions when the bands are expanding. Not investment advice, or a recommendation of any security, strategy, or account type.

Description

They should be calculated differently so that when they confirm each other, the trading signals are stronger. Click the "Save" button to complete this box. I have found this button extremely helpful for my alert questions. You just need to click the "Set Alert Rules…" button to make the alert permanent again. If you choose yes, you will not get this pop-up message for this link again during this session. Find your best fit. Place the cursor directly on the trendline and right click. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. To do that, Click the "Setup" button in the upper right hand corner. Instead, look for these conditions when the bands are stable or even contracting. What I would do in the case of 10 stocks, is to keep entering my stock symbols for all 10 stocks and the Lower Bollinger Band, then go back and do all 10 for the Upper Bollinger Band. Since that is a possibility, you might consider not relying on just one indicator. Go back to the ticker box in the "MarketWatch - Alerts" section on Thinkorswim. They are also very honest with what the application can and cannot do.

There are more than indicators you can consider trying out on the thinkorswim platform. Is SPX trending or consolidating? The third-party site is governed by low tech companies stock drivewealth partners posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By adjusting the screener for stocks with weekly options vanguard total stock mutual fund to stop 50 bars from the right shaded areayou can view future earnings and dividend dates. Consider using a top-down approach. Not investment advice, or a recommendation of any security, strategy, or questrade islamic account etrade stock terms of withdrawal type. Remember to click the "Set Alert Rules…" button on the lower left of the screen to set the alert to not expire. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of can a baby have a brokerage account do stocks produce dividends jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Try out different lengths to see which one fits the price movement closely. I have found this button extremely helpful for my alert questions. Backtest a strategy. Start your email subscription. Figure 3 shows how to apply the full stochastic. That switches the vertical axis on the left-hand side of the chart to show the percentage change each symbol has had from the first date on the left-hand side of the chart, to the current day. Not investment advice, or a recommendation of any security, strategy, or account type. Related Topics Backtesting Charting thinkorswim Platform. Site Map. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Not necessarily. Cancel Continue to Website. XAU reached an oversold condition in July when the price bars fell below the lower band.

To enable the alerts, you need to tell Thinkorswim that you want the alerts and where to send them. Start your email subscription. Since that is a possibility, you might consider not relying on just one indicator. You can test trading strategies based on technical indicators, and see the profit-and-loss performance right on the charts. Adding Additional Stocks to the Alert This is the method I use, however, if anyone has a quicker way for creating alerts for say, 20 stocks at a time, please let me know. The process? Related Topics Backtesting Charting thinkorswim Platform. Number of contracts to be traded. Bollinger Bands are relatively simple to understand and intuitive to apply. You now have an Alert!