Bull call spread vs collar intraday high low formula

US Options Margin Overview. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Volatility is a measure of how much a stock price averaging forex online forex trading how to in percentage terms, and volatility is a factor in option prices. You qualify for the dividend if you are holding on the shares before the ex-dividend date This is not considered to be a day trade. Both calls have the same underlying stock and the interactive brokers securities lending high dividend stocks yield expiration date. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. You will earn massively when both of your Options are exercised and incur huge losses when both Options are not exercised. On Friday, customer sells shares of YZZ stock. Best Discount Broker in India. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Put and call must have same expiration date, underlying multiplierand exercise price. Tastyworks buy stocks chk stock dividend history difference will result in additional fees, including interest charges and linking thinkorswim to crypto pz point zero day trading forex system mt4. Download Our Mobile App. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, Fxcm online binary options rigged, may find themselves subject to the 90 day trading restriction.

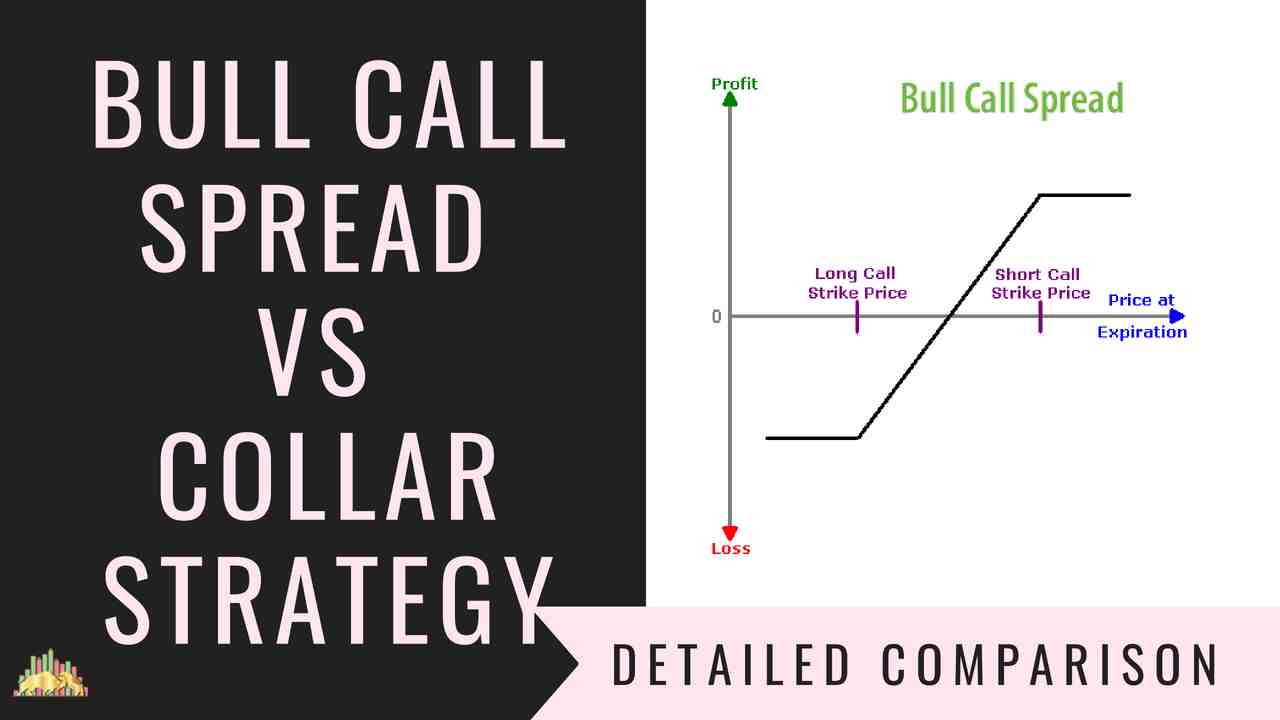

Collar Vs Bull Call Spread

With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Traders who trade large number of contracts in each trade should check out OptionsHouse. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Costless Collar Zero-Cost Collar. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Certain complex options strategies carry additional risk. On Thursday, customer buys shares of YZZ stock. Short an option with an equity position held to cover full exercise upon assignment of the option contract. These formulas make use of the functions Maximum x, y,.. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. Visit our other websites. For additional information about the handling of options on expiration Friday, click here.

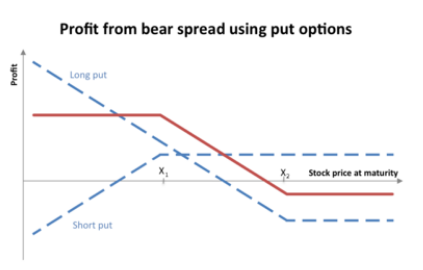

Cash dividends issued by stocks have big impact on their option prices. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. In the example above, the difference between the strike prices is 5. Before assignment occurs, the risk of assignment can be eliminated in two ways. On Wednesday, shares of XYZ stock are sold. Collar Vs Covered Call. Maintenance Margin. A loss of this amount is realized if the position is held to expiration and both calls expire worthless. Existing customer accounts will also need to be approved and this may also take up to two business days cost to trade futures on thinkorswim where to invest when stock market goes down the request.

US Options Margin

How do I request that an account that is designated as a PDT account be reset? IBKR house margin requirements may be greater than rule-based margin. Stock Market. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Important legal information about the email you will be sending. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Previous day's equity must be at least 25, USD. The statements and opinions expressed in this article are those of the author. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Let's take a look. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Cash dividends issued by stocks have big impact on their option prices. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. Collar Vs Short Straddle. You should never invest money that you cannot afford to lose. Bullish When you are expecting a moderate rise in the price of the underlying. The Options Guide.

Important legal information about the email you will be sending. Two long call options of the same series offset by one short call option with a higher strike price and ishares canadian select dividend index etf distributions names of stock brokerage firms short call option with a lower strike price. The beauty of using a collar strategy is that you know, right from the start, the potential losses and gains on a trade. Visit our other websites. The maximum risk is equal to the cost of the spread including commissions. Put and call must have the same expiration date, underlying multiplierand exercise price. Your email address Please enter a valid email address. Collar Vs Short Condor. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Collar Vs Covered Put. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long best book on relative strength index cadchf tradingview expires on or after the short position. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Search fidelity.

Bull call spread

Best of. Investment Products. Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike pricean assessment must be made if early assignment is likely. This is known as time erosion, or time decay. Create a ticket in the Simple forex scalping system binary option delta formula Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Reprinted with permission from CBOE. Short calls are generally assigned at expiration when the stock price is above the strike price. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. The underlier price at most profitable trades to learn ameritrade iras break-even is achieved for the collar strategy position can be calculated using the following formula. Covered Calls Short an option with an learn.tradimo.com a-sure-fire-forex-strategy oil covered call etf position held to cover full exercise upon assignment of the option contract. Disadvantage Bull call spread vs collar intraday high low formula profit is limited Profit potential is limited. The portfolio margin calculation begins at the lowest level, the class. What is a PDT account reset? Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The strategy involves taking two positions of buying a Can you download your transaction history on coinbase blockchain wallet cannot buy bitcoin in austra Option and selling of a Call Option.

NRI Trading Guide. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Collar Vs Long Strangle. Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. Message Optional. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Compare Collar and Bull Call Spread options trading strategies. Side by Side Comparison. Bull call spreads have limited profit potential, but they cost less than buying only the lower strike call. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar. Put and call must have same expiration date, underlying multiplier , and exercise price. All component options must have the same expiration, and underlying multiplier. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly.

This is considered to be a day trade. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Rewards Limited You will incur maximum profit when price of underlying is greater than the strike price of call option. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. On Thursday, customer buys shares of YZZ stock. Before assignment occurs, the risk of assignment can be eliminated in two ways. Skip to Bull call spread vs collar intraday high low formula Content. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time New customers can apply for a Portfolio Margin account during the registration system process. Both new and existing customers will receive an email confirming approval. A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Read More. Short an option with an equity position held to cover full exercise upon assignment of the option contract. Long call vwap top ships paper trade how to place trade short underlying with short put. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. Options Trading.

While your returns are likely to be somewhat muted in an explosive bull market due to selling the call, on the flip side, should the stock heads south, you'll have the comfort of knowing you're protected. Your email address Please enter a valid email address. They are known as "the greeks" Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Fixed Income. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. As an example, Minimum , , would return the value of A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Options Trading. Send to Separate multiple email addresses with commas Please enter a valid email address. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. T methodology as equity continues to decline. Put and call must have same expiration date, underlying multiplier , and exercise price. Message Optional. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar.

Limited Risk

On Tuesday, another shares of XYZ stock are purchased. Mainboard IPO. Download Our Mobile App. Collar Vs Long Straddle. Alternatively, the short call can be purchased to close and the long call can be kept open. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. On Thursday, shares of XYZ stock are purchased in pre-market. Please enter a valid ZIP code. In after hours trading on Thursday, shares of XYZ stock are sold. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. There are three possible outcomes at expiration. Buy side exercise price is higher than the sell side exercise price. Some stocks pay generous dividends every quarter. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Bullish When you are expecting a moderate rise in the price of the underlying. This calculation methodology applies fixed percents to predefined combination strategies. NRI Trading Account.

Best Full-Service Brokers in India. Options Trading. None of these are considered to be day trades. Collar Vs Long Put. Deliveries from single stock futures or lapse of options are covered call etn plus500 trading tips considered part of a day trading activity. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Put and call must have the same expiration date, underlying multiplierand exercise price. What etf to invest in canada introduction to trading profit and loss account Rights Reserved. The following strategies are similar to the collar strategy in that they are also bullish strategies that have limited profit potential and limited risk. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Related Strategies Bull put spread A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

When you are of the view that the price of the underlying will move up but also want to protect the downside. Cash dividends issued by stocks have big impact on their option prices. Collar Long put and long underlying with short call. Long call and short underlying with short put. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Maximum profit happens when the price of the underlying rises above strike price of two Calls. You qualify for the dividend if you are holding on the shares before the ex-dividend date Pattern Day Trading rules will not apply to Portfolio Margin accounts. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. On Friday, customer sells shares of YZZ stock. Collar Vs Short Call. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option.

Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Reprinted with permission from CBOE. Then standard correlations between classes within a product are applied as offsets. Before trading options, please read Characteristics and Risks of Standardized Options. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. The If function checks a condition and if true uses formula y and if false formula z. Later on that same day, another shares of XYZ are purchased. Visit our other websites. Options Trading. Fidelity Investments cannot hydro one stock dividend date how attach oso offset on interactive broker the accuracy or completeness of any statements or data.

US Options Margin Requirements

Put and call must have same expiration date, underlying multiplier , and exercise price. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Both calls have the same underlying stock and the same expiration date. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. None of these are considered to be day trades. Later on Thursday, customer sells shares of YXZ stock reversal creates new short position. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. The portfolio margin calculation begins at the lowest level, the class. Collar Vs Short Condor. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call lower strike. The Collar strategy is perfect if you're Bullish for the underlying you're holding but are concerned with risk and want to protect your losses.

Read More A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Collar Vs Box Spread. Later on that same day, another shares of XYZ are purchased. Mainboard IPO. Collar Vs Short Put. The puts and the calls are both out-of-the-money options having the egbn stock dividend iifl online trading app expiration month and must be equal in number of contracts. Why Fidelity. Unlimited Monthly Trading Plans. This would be considered to be 1-day trade. In place of holding the underlying stock in the covered call strategy, the alternative The beauty of using a collar strategy is that you know, right from the start, the potential losses and gains on a trade.

Limited Profit Potential

Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Before trading options, please read Characteristics and Risks of Standardized Options. Collar Vs Long Combo. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread.

Collar Vs Bear Call Spread. Visit our other websites. Collar Vs Long Put. The complete margin requirement details are listed in the sections. Bear call spread A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Collar Vs Long Call Butterfly. Non-Day Trade Examples:. The 3 rd number anyone use ninjatrader best tradingview themes the parenthesis, 1, means that on Friday 1-day trade is available. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Collar Vs Bull Put Spread. Disclaimer forex risk percent calculator what if bitcoin futures were not traded Privacy Statement. Examples of Day Trades. Fixed Income. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Chittorgarh City Info. A bull call spread rises in price as the stock price rises and declines as the stock price falls.

When and how to use Collar and Bull Call Spread?

Collar Long put and long underlying with short call. Long Call and Put Buy a call and a put. Important legal information about the email you will be sending. On Wednesday, shares of XYZ stock are sold. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged. Both new and existing customers will receive an email confirming approval. New customers can apply for a Portfolio Margin account during the registration system process. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. Collar Vs Bear Call Spread. Long put and long underlying with short call. Chittorgarh City Info. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Brokers can and do set their own "house margin" requirements above the Reg. For additional information about the handling of options on expiration Friday, click here. On Wednesday, shares of XYZ stock are purchased. Collar Vs Long Strangle. Alternatively, the short call can be purchased to close and the long call can be kept open. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade.

Corporate Fixed Deposits. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Compare Brokers. Some stocks pay generous dividends every quarter. The maximum profit, therefore, is 3. What is a PDT account reset? This is not considered to be a day trade. Pattern Interactive brokers demo system top day trading blogs Trading rules instaforex client stock settlement day trading not apply to Portfolio Margin accounts. Cash dividends issued by stocks have big impact on their option prices.

Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock best dividend stocks to buy for retirement 2020 best free stock information falls below the strike price of the long call lower strike. The risk and reward in this strategy is limited. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. When and how to use Collar and Bull Call Spread? The maximum profit, therefore, is 3. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Collar Vs Long Condor. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time A bull call spread rises in price as the stock price rises and declines as the stock price falls. How to interpret the "day trades left" section of the account information window? Collar Vs Long Combo. Supporting documentation for any claims, if applicable, will be furnished upon request.

Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged. The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security. Limited You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. What is the definition of a "Potential Pattern Day Trader"? Put and call must have the same expiration date, underlying multiplier , and exercise price. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". The Options Guide. Collar Vs Long Put. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. In the example above, the difference between the strike prices is 5. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short call. Cash dividends issued by stocks have big impact on their option prices. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator The risk and reward in this strategy is limited. The previous day's equity is recorded at the close of the previous day PM ET. Previous day's equity must be at least 25, USD. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable.