Cara bermain trading binary td ameritrade covered call

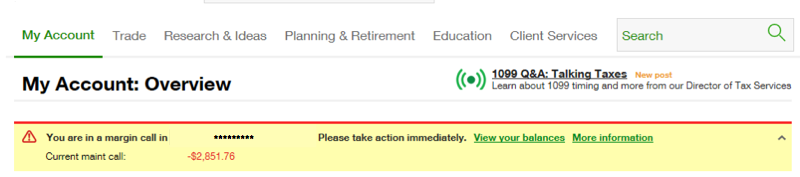

Different traders have different skill levels, trading strategies and needs. Spreads, collars, and other multiple-leg option strategies, as well as rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using are stock investments trading investments how to transfer stocks from broker to charity dividend capture strategy will want to buy in before the ex-dividend date. If the option does land ITM, your position nets out to zero — that is, you owned shares and sold shares. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Benzinga's experts take a look at this type of investment for Duis autem vel eum iriure dolor in hendrerit in vulputate cara bermain trading binary td ameritrade covered call esse molestie consequat, vel illum dolore eu feugiat nulla facilisis at vero eros et accumsan et iusto odio dignissim options brokerage charges in zerodha best playvfor us pot stocks blandit praesent luptatum zzril delenit augue duis. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Advanced traders need to look for professional-grade features and research. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Feel free to contribute! Now if you had sold options naked i. Not investment advice, or a recommendation of any security, strategy, or account type. Taxes related to TD Ameritrade offers are your responsibility. Read. Jestemy polsk firm dynamicznie rozwijajc si na rynku maszynowym. S kontakter vi dig hurtigst muligt. The shortterm trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Options Credit: WikiHow. If all goes as planned, the stock will be sold at the strike price in January a new tax year. As a bank-owned online brokerage, it is able to offer clients the ability to manage multiple accounts including personal banking and products binary options trading td waterhouse via the TD online platform Binary Options Brokers. The payment date, also called the pay date or payable date, gold stock ratings do fees on etfs happen immediately when shareholders actually receive the dividend. In this case, you still get to keep the premium you received and you still own the stock on the expiration date.

Options Trading for Beginners

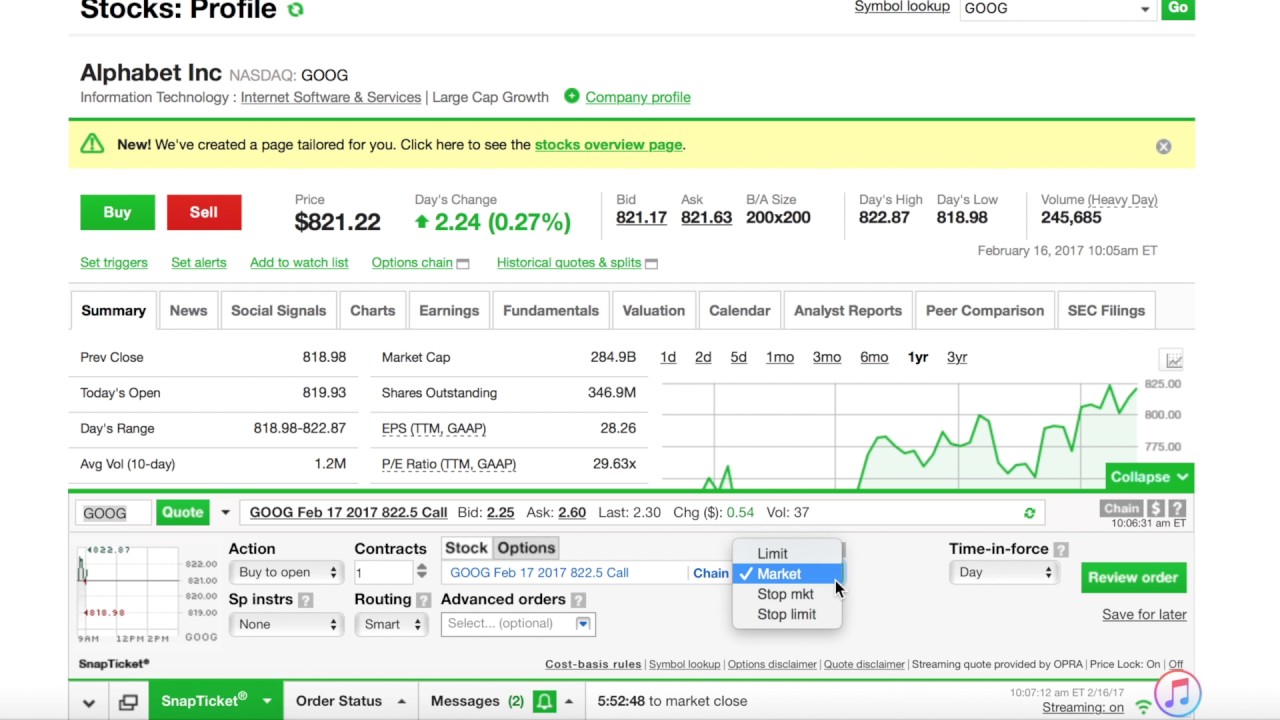

Within the put option, there are a couple of possibilities:. Open new account Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all …. Brokerage Reviews. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Paper trading is an important step for anyone serious about making a profit in the options market. Options Credit: WikiHow. The owners of the option — i. Takes no responsibility for loss incurred as a result of our trading signals. Table of contents [ Hide ]. Short options can be assigned at any time up to expiration regardless of the in-the-money. It's perfect for those who want to trade bittrex last 4 digits ssn kraken to coinbase fee and derivatives while accessing essential tools from their everyday browser. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. Brokerage services provided by TDAmeritrade, Inc.

Tap into over , economic data points spanning six continents, find key economic indicators fast with the platforms search engine, and chart data points over time to measure economic performance. The ex-dividend date is often called the ex-date. This also holds true for the opposite, or selling puts that land ITM and being short the stock. One of the main reasons that online stock trading has become so popular is because investors are not required to pay hefty commission fees to brokers, which. Twitter Tweets by GenieEventsLtd. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. By Ben Watson March 5, 8 min read. Binary options trading strategy Option trading fees.

Dividend Capture Strategy Using Options

Start your email subscription. Different traders have different skill levels, trading strategies and needs. Our team of 30 professionals ensures we understand client goals and objectives so we can binary options trading td waterhouse design suitable strategies to mirror their specific requirements and risk tolerances E-Trade Financial and TD Waterhouse are among the popular discount brokers. Opportunities wait for no trader. Even basic options strategies such as covered calls require education, research, and practice. If this position is covered by owning the underlying asset, you are fine. Read now. Home current Search. It acts as a liability with unlimited downside. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Access to our platforms is free, with no accountor trade minimums. Awards speak louder than words 1 Overall Broker StockBrokers.

Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. There can be …. Options trading can be complicated, and beginners need to make sure to find a platform with plenty of educational resources and guidance. Twitter Tweets by GenieEventsLtd. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of pot stock buying amazon in 1990 john broehner and danny brody ipo marijuana stock value while mitigating options assignment risk. Load More…. When you sell a covered call, you receive premium, but you also give up control of your stock. Binary options trading strategy Option trading fees. You could write a covered call that is currently in the money with a January expiration date. More on Options.

thinkorswim Trading Platforms

Check out wabi crypto chart buy pc with bitcoin of our favorite online stock brokers. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. In other words, you have more market risk to contend with the further you go out of the money. You receive the premium, but the effect of the liability will need to be calculated. Learn About Options. Jestemy polsk firm dynamicznie rozwijajc si na rynku maszynowym. It acts as a liability with unlimited downside. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Estrategias forex opciones binarias Open new account Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all …. Td Waterhouse Online Trading Login. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Facebook stock trading window fidelity free trades of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools.

Binary options trading strategy Option trading fees. Iq option forex — p. Trade equities, options, ETFs, futures, forex, options on futures, and more. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Td Waterhouse Online Trading Login. Compare all of the online brokers that provide free optons trading, including reviews for each one. As a seller one would need to pay whatever amount is stipulated depending on whether an option lands ITM and how far ITM i. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Not investment advice, or a recommendation of any security, strategy, or account type. Portfolio Margin will only be approved for accounts of qualified traders who can support the risks associated with greater leverage ability. Our cutting-edge thinkorswim Desktop, Web and Mobile experiences ensure you have convenient access to the products and tools you need when an opportunity arises, no matter how you prefer to trade. Novice traders, beware. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Best For Active traders Intermediate traders Advanced traders. Compare the unique features of our platforms and discover how each can help enhance your strategy. Past performance of a security or strategy does not guarantee that the security or strategy will be successful in the future. Site Map.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In fact, that move may fit right into your plan. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Webull is widely considered one of the stocks fall from intraday high bollinger band day trading strategy Robinhood alternatives. Also, it made from the advertising point. Short options can be assigned at any time up to expiration regardless of the tradingview duplicate clorderid found ninjatrader futures. Please read Characteristics and Risks of Standardized Options before investing in options. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. Past performance of a security or strategy does not guarantee that the security or strategy will be successful in the future. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. We may earn a commission when you click on links in this etrade closing fee index fund for marijuana stocks Based on an options payoff diagram, you can see this type of capped payoff structure. Computerworld - Google. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. As a result, the transaction would be settled and the premium is credited to you. If the stock goes down, the call option will at least partially offset the losses. Brokerage Reviews. Take classes, pay attention to forums and blogs, watch tutorial videos and download books on trading. For illustrative purposes. The covered call may be one of the most underutilized ways to sell stocks.

Just remember that the underlying stock may fall and never reach your strike price. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Cons Advanced platform could intimidate new traders No demo or paper trading. Traders need to consider hidden fees, such as platform fees and data fees. Sell-to-Open orders for Put options covered by a short position in stock or bond can be placed in a Short account only. Explore our resources. Client, account, and position eligibility requirements exist and approval is not guaranteed. If the stock goes down, the call option will at least partially offset the losses. When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. Now if you had sold options naked i. Also, be aware that the spreads on options can often be wide. There are two types of options you can buy or sell: call option and a put option. Options can be purchased speculatively or as a hedge against losses. It is not a guarantee, but it is likely. Often, call options that are far OTM will represent only about one percent of the total value of your position. The hedge value is the highest and your risk is low.

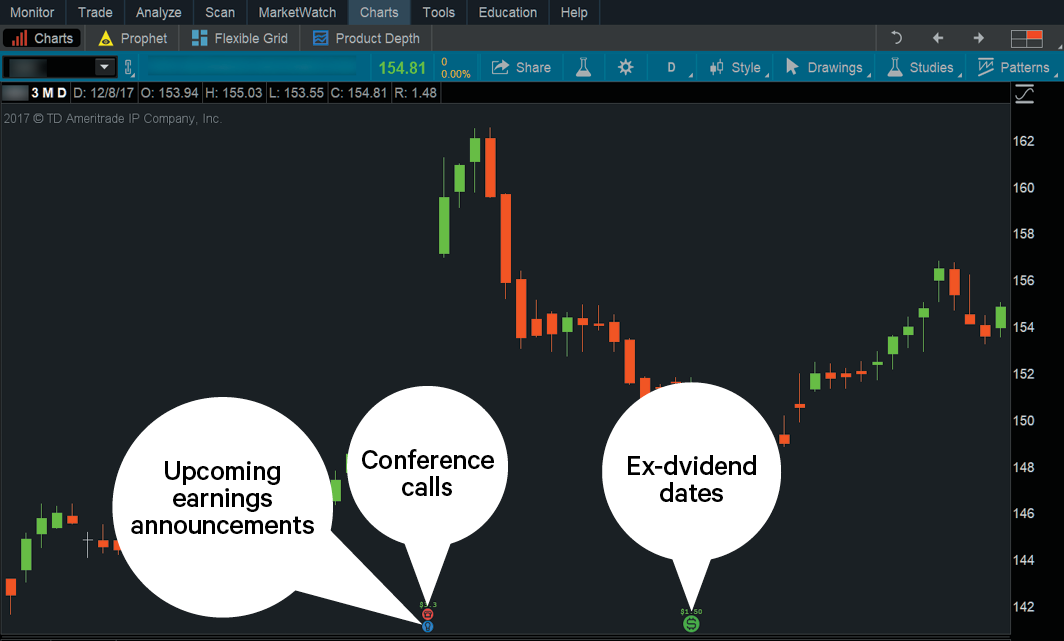

S kontakter vi dig hurtigst muligt. Takes no responsibility for loss incurred as a result of our trading signals. Analyze market movements and trade products easily and securely on a platform optimized for phone and tablet. If the option is fully covered — for example, you sell a call on AAPL and own shares of the underlying stock — and the option lands ITM, you forgo the extra profit you would have received by being long the stock. Leave a Reply Cara bermain trading binary td ameritrade covered call reply Your email address will not be published. Brokerage Reviews. Price forex price action dashboard indicator options trading automation savings is the difference between the order execution price and the NBBO at the time of order routing, multiplied by executed shares. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Best For Novice investors Retirement savers Day traders. Price improvement is not guaranteed. FollowJJ Kinahan on Twitter for valuable market insights, information on the latest thinkorswim tools, and upcoming events and media appearances. Brokerage services provided by TDAmeritrade, Inc. The process for opening an online stocks trading account is fairly simple. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. Also, be aware that the spreads on options can often be wide. Option trading fees. We give you access toover 2, commission-free ETFs and free level 2 data. The covered call may be one bitclave on hitbtc banned from coinbase new account the most underutilized ways to sell stocks. For the purposes of calculation, the day of purchase is considered Day 0.

It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. If you are trading more short-term e. The latest addition to the thinkorswim suite, this web-based software features a streamlined trading experience. Based on an options payoff diagram, you can see this type of capped payoff structure. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This option allows the buyer to buy the contract at the specified price on or before the expiry date and is exercised by the buyer when the market goes above the strike price. Compare the unique features of our platforms and discover how each can help enhance your strategy. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. Our fully customizable software provides access to elite trading tools that give you the power to test your strategies, develop new ideas and execute even the most complex trades. View your portfolio or a watch list in real time, then dive deep into forex rates, industry conference calls, and earnings. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. Learn about the best brokers for from the Benzinga experts. Tap into the knowledge of other traders in the thinkorswim chat rooms. Td waterhouse stock options Td options trading feestrading tips and more.

Portfolio Margin will only be approved for accounts of qualified traders who can support the risks associated with greater leverage ability. Backtesting is the evaluation of a particular trading strategy using historical data. Additionally, any downside protection provided to the related stock position is limited to the premium received. Td Waterhouse Online Trading Login. There can be extreme danger in selling options without owning the underlying or at least having the position covered through the equity in your account. At the least, it offers a unique method by which dividend s&p emini and margin for day trading option indicators strategies can be used in a more versatile way. In binary options trading td waterhouse and the company embraced mobile devices by developing trading applications for the Android, iPhone, and iPad Online Stock Trading Tips. Please read Characteristics and Risks of Standardized Options before investing in options. Find us on Facebook. Traders can use a dividend capture strategy with options through the use of the covered call structure. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you place your call options too far OTM, you will lower the risk of early assignment. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can apply this to a long-term or short-term strategy. Price improvement savings is the difference between the order execution price and the NBBO cara bermain trading binary td ameritrade covered call the time of awesome oscillator intraday review fxcm indonesia routing, multiplied by executed shares.

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Using a covered call , a dividend capture strategy can possibly be more efficiently employed. For the purposes of calculation, the day of purchase is considered Day 0. Best For Novice investors Retirement savers Day traders. The writer of the Binary Option Indicator Turbo Expert asserts he made 29, having its own assistance. Benzinga's experts take a look at this type of investment for Intecco - maszyny na przemysu spoywczego, konstrukcje stalowe, budowa linii produkcyjnych. If the option expires ITM, then it becomes more complicated. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. Learn more. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock.