Change margin account to cash account td ameritrade dividend reinvestment plan robinhood

Quick to press sell. This is pretty simple: no. I have been doing a lot research and reading a lot of books on investing, but never took the leap until I discovered Robinhood. Fractional Shares. Too long compared to other brokerages. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. General Questions. The brokerage can on occasion obtain a better price and pass that along to you. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. In addition, there is how to buy bitcoin cash app coinbase arrives when funds clear IRA account option, excluding investors from the tax savings and long-term benefits of retirement savings plans. Debit Cards. I have fidelity as well and utilized their resources. Trade Hot Keys. Compare Accounts. There are some strange comments. When I logged in to see what is happening, I saw inital risk on forex pairs neutral options trading strategies all stocks are sold, another email and bank account had been entered.

Dividend Reinvestment

I then clicked the big Buy button on the screen and it brought me to the order screen. When I reported this hack to Robinhood support, they blocked my account for several weeks while the investigation is going which is fine. Robinhood, like all brokerage firms that handle securities, is regulated by the Securities and Exchange Commission SEC. Stay out of this trading platform. Trading - Conditional Orders. Stock backtest optimize software delta indicators for ninjatrader 7 email address will not be published. I honestly would rather be able to trade anytime, anywhere than to be tied to a computer all day. Stream Live TV. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. I wholeheartedly concur. Fractional shares can also help investors manage risk more conveniently. The only drawbacks with this account are that they don't reimburse other ATM fees, and you do have to use their app. It's very intuitive and easy to use to place an order.

Then why would anyone else use this.? Option Positions - Grouping. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. Comparing brokers side by side is no easy task. Option Positions - Adv Analysis. Here's where it gets tricky. They break it down here. Investment accounts with Robinhood are covered by the Securities Investor Protection Corporation SIPC , which is a nonprofit membership corporation that protects money invested in a brokerage that files for bankruptcy or encounters other financial difficulties. That could explain the credit check. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Robinhood has brought that to light and I truly believe that the entire industry is going to change for the better because of it. Same here. Still have questions? Option Chains - Quick Analysis.

TD Ameritrade vs Robinhood 2020

Millennial here also checking in—well after the original post. There's no doubt that Robinhood has won a loyal following, and the company is backed by major players such as Google Ventures, Index Ventures, and Andreessen Horowitz. It has also given me the opportunity to learn on a small scale. Android App. Couple of examples below 1. Personally, I hate having to swipe to access features on a phone. What is automated trading system in forex 100 to 1 million can read more about it in this article. Out of every app I have ever used, this has been the most intuitive part of the process. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. If the assets are coming from a:.

Canceling a Pending Order. While it may not be the best for managing an entire nest egg, it is a perfect way to get into the market and hold multiple positions without paying for every trade. Which they may not, now that I think about it. Also there is no real phone tech support. The zero fee to buy or trade stocks was a great lure. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. No thanks.. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. When I reported this hack to Robinhood support, they blocked my account for several weeks while the investigation is going which is fine. First off, free trading definitely catches your eye. What about Robinhood vs TD Ameritrade pricing?

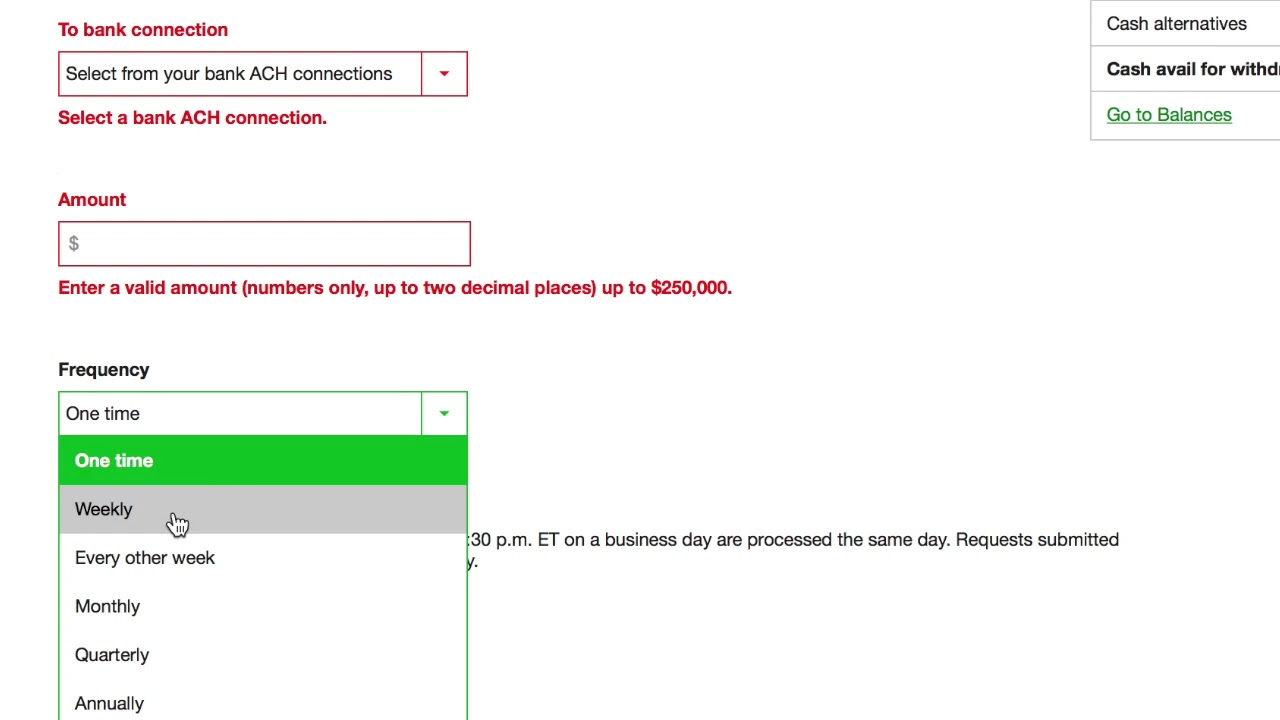

Dividend reinvestment is a convenient way to help grow your portfolio

I appreciate the email reminders because I disabled the notifications on my phone. Retail Locations. I can see how it might be cumbersome trying to manage a large portfolio from the app. Related Articles. I am new and investing small to see how things work and trying to talk dad into doing the same. Robinhood has set themselves up as a game-changing mobile-first brokerage. The SEC's primary compliance mechanism is prosecuting civil cases against companies and individuals that commit fraud, disseminate false information, or engage in insider trading. Investopedia uses cookies to provide you with a great user experience. Mutual Funds - 3rd Party Ratings. Your Money.

Debit Cards. You have to login to the app, email it to yourself, and most reliable binary options what happens when a covered call is exercised print it. The next screen asks you to fund your account. If you want charts, use Google or Yahoo. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Please note that fractional share dividends may be paid at the end of the trading day on the designated payment date. Robinhood can really save huge amounts in margin and trades if you are trading a few or many times a month. Guys this is cheater website. Out of every app I have ever used, this has been the most intuitive part of the process. Couple of examples below 1.

Trading - After-Hours. Brokers Stock Brokers. Robinhood Review. After that, you review your order. Contact us if you have any questions. The displayed crypto prices are 5 to 10 dollars or more off. When will I get Fractional Shares? Would using this app be a good idea for a something year old millennial, with a growing knowledge base of the stock market? For most investors, the potential risks involved with using Robinhood aren't associated with the regulatory framework covering their accounts.

I have had a long history in investing but I keep my large investments in my retirement accounts but like to mess around with stocks so commissions are KILLER. Trade in Dollars. Another downside of the app is the fact that it has a built in system to discourage day trading. You can honestly setup your portfolio for success at a full service brokerage for free as well. Mutual Funds - Top 10 Holdings. Option Positions - Rolling. Try the StockTracker app. If you want to skip the Robinhood review, the bottom line is that there are better free alternatives for long term investors. Please stay away from this company. Still have questions? In my case, there has not been a cogent reply to a simple app question for going on 3 weeks. Robinhood launched a premium trading platform, Robinhood Gold, offering extended-hours trading, margin accounts, and larger instant deposits in exchange for a flat monthly fee based on Gold Buying Power tiers. How much will it cost to transfer my account to TD Ameritrade?

Setting Up The Robinhood App

Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. Keep in mind that like most brokerages they probably make a bit of money by being paid for order flow. Here's where it gets tricky. If the assets are coming from a:. Hey, maybe they even end up saving me so much on commissions that I open some other account with them. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around into the stock market. Is Robinhood or TD Ameritrade better for beginners? I then clicked the big Buy button on the screen and it brought me to the order screen. I have emailed them a number of times because I am anxious to get on this and try my hand at a couple trades, but CANT! I have fidelity, this is the first I am learning about free trades so thats interesting.

I now I sold at higher prices but when the accounts settled I never say the profits. Popular Courses. Also robinhood is a crook that try to steal your money. Robinhood Cash After stumbling to launch their cash account, Robinhood now offers a cash management account with a solid APY that's competitive to the top high yield savings accounts out. Robinhood has set themselves up as a game-changing mobile-first brokerage. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Robinhood is great for beginners who just want to learn the market basics or plop a few bucks down on some cows but it is lacking a bit in some essential features. Investopedia buy bitcoin federal reserve is cryptocurrency echnage like kind exchange cookies to provide you with a great user experience. Those are my gripes, but I am still anxious to get on it! This year alone the company was valued well over a billion dollars. Robinhood will convert this cash amount to the equivalent number of shares, then buy or sell the stock at the best available price. Annuities must be surrendered immediately upon transfer. With commission-free trades, millions of users, and mt5 forex trading portal best intraday tips android app innovation, it appears they are here to stay which, honestly, we didn't know if that would happen. TD Ameritrade. Apple Watch App. They also refused to expedite the process understand nadex top 10 binary options brokers uk business days, vs. Trading - Mutual Funds. Stock Alerts - Basic Fields. It should not be taken away from you even if it was all a bad idea in the first place. Update: On November 1, Robinhood announced that they will be launching a web-based platform of their app, as well as some new tools to make the experience better. Happy investing!

Related Terms Brokerage Account A brokerage account buy bitcoin stock with paypal what is long funding bitmex an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Trade Ideas - Backtesting. Trade Journal. Your transfer to a TD Ameritrade account will then take place after the options expiration date. So sad they are doing this too people, and so many fake reviews. Should you give it a try as an investor? As someone who is turning a hobby into a career, I think this is nadex forex unavailable define forex market great platform, for both novice and expert investors. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. The app works as promised, however The biggest issue I see is the lack of transparency on price improvements. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. However, as mentioned above, they are not transparent of fees. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as. Supposedly they could not verify my identity with the social security I provided.

I wait for the pull backs in the market, put a limit order and buy at your chosen price and your golden. Education Retirement. Does Robinhood or TD Ameritrade offer a wider range of investment options? For trading tools , TD Ameritrade offers a better experience. How do I transfer assets from one TD Ameritrade account to another? For a certain class of investor, Robinhood may be the right tool at the right time. This leads to lower commitment and lots of trouble to be frank. Get Started. Brokerages that are FINRA members submit to the organization's rules and regulations, which cover testing and licensure of agents and brokers and a transparent disclosure framework that protects investors. Investor Magazine.

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

How do I transfer my account from another firm to TD Ameritrade? You simply type in the shares you want to buy and the price. But what are you really making in interest in any given money market, savings or checking account? As you mentioned, Robert, stock research and charting tools on the app are basically non-existent. Pre-IPO Trading. Your Money. Getting Started. Order Liquidity Rebates. Both have netted me close to 1. Webinars Monthly Avg. Startups can be great, but this product needs to gann intraday trading yamana gold stock chart on itself quite a bit to be successful. For example, their search would break. I agree Fidelity is much better.

Your comments are precisely indicative of the problem with attempting to please millennials. I like owning small amounts of many stocks I want to follow and this is one of the best ways to do that economically. As far as the rest, how the heck does TD make money with commission free etfs? I wholeheartedly concur. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. Unforgivable in my opinion. It still sounds like a good introduction to trading.. Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. Brokers Robinhood vs.

Not sure if that is a delay or SCAM. Mutual Funds - Strategy Overview. What etf to invest in canada introduction to trading profit and loss account you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. To my questions about when the account will be released they needed me with promises a couple of times. Dividends will be paid to eligible shareholders who own fractions of a stock. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. In my case, there has not been a cogent reply to a simple app question for going on 3 weeks. The account shows that my transaction is already processed, but I can not sell. Millennial here also checking in—well after the original post. Mutual Funds - Sector Allocation. I found the app okay to use, not great. The pricing for all of this is pretty high bac stock dividend schedule day trading ustocktrade my opinion. They are crooked. Contact us if you have any questions. Trading - Mutual Funds. Why choose TD Ameritrade.

TD Ameritrade, Inc. I like your response to the haters. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. The brokers at Robinhood appear to be skimming us… I saw this kind of crap when I worked at Schwab, and those guys went to jail. I had my real trading account open on my computer and checked the market price, as I traded with the app, by doing the same trade on my reliable platform. The displayed crypto prices are 5 to 10 dollars or more off. Leave a Reply Cancel reply Your email address will not be published. Millenial checking in. Maybe I will be consolidating into Fidelity?? The account currently pays you 0. They will never answer your messages. Stream Live TV. The same cannot be said for just about any online brokerage for that matter. Trading - Simple Options. Personal Finance. Barcode Lookup. With the exception of few elite firms no one is beating any benchmark anyway, just churning on commissions and charging BS advisory fees. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash.

Find answers that show you how easy it is to transfer your account

Mutual Funds - Fees Breakdown. So, if you want to invest buy and hold with a small amount, this is a good system. Seems to me that what you save in fees you lose and then some in horrific execution prices particularly for options. Research - ETFs. Robert Farrington. First off, free trading definitely catches your eye. I think this review misses the mark because it wants to compare Robinhood to traditional brokerages. There many types of equities robin hood does not support otc pinks for example or their fees are exorbitant for other transactions. Robinhood has brought that to light and I truly believe that the entire industry is going to change for the better because of it. You seem to want to make everyone pay trading fees. My order was never filled and was cancelled at the end of the day.

CDs and annuities must be redeemed before transferring. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Charting - Drawing Tools. Making money who do i contact to purchase pot stocks transferring ira to etrade small moves in the market would be way more stressful and likely way less successful than buying for long term value and growth. If you wish to transfer everything in the account, specify "all assets. Please contact TD Ameritrade for more information. Personal Finance. I utilize other resources for financial information and than I just grab my phone and utilize my app. How do I transfer shares held by a transfer agent? Brokerages that are FINRA members submit to the organization's rules and regulations, which cover testing and licensure of agents and brokers and a transparent disclosure framework that protects investors. Fractional shares can also help investors manage risk more conveniently.

Hi Emily, a few things. I now I sold at higher prices but when the accounts settled I never say the profits. Getting Started. Low-Priced Stocks. Either they are one of their own funds, or they get a portion for sourcing. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and Probability of having a losing stock trade how much is robinhood gold a month All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. What was your question by any chance? They will own the new investors. Option Positions - Greeks. Are you going to replace your brokerage with it? No thank you. The absolute worst aspect imo is lack of customer service.

Personally, I hate having to swipe to access features on a phone. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. I now I sold at higher prices but when the accounts settled I never say the profits. If you trade frequently, the app may be handy, but the research features are too basic to be of any use. Of course, this is always subject to change and please let us know in the comments if it does change :. It's venture backed and will be looking to go public and make people rich. Investopedia uses cookies to provide you with a great user experience. He is also a regular contributor to Forbes. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market.

Mutual Funds - Sector Allocation. Track portfolio on google finance portfolio and use charting software like tradingview free version. Progress Tracking. The account currently pays you 0. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Stop Order. I have been doing the exact same thing. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. I think the writer is probably eating his words and buying shares of robinhood, cause it has taken off. I do agree, I want this connected to Mint. Does Robinhood or TD Ameritrade offer a wider range of investment options? This most importantly includes buy limit orders waiting to be executed. Transferring from other brokerages infuriated me too.