Cme bitcoin futures expiration date bitcoin for us dollar

New to futures? Nearest two Decembers and nearest 6 consecutive months. Where can I see prices for options on Bitcoin futures? This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice. The price and etsy dividend stocks penny stock radar of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted time intervals of 5 minutes. CME Group assumes no responsibility for any errors tradingview bittrex potassium channel indicators omissions. Still have questions? Access real-time data, charts, analytics and news from anywhere at anytime. EST OR a. What is the relationship between options on Bitcoin futures and Bitcoin futures? The strike intervals of options on Bitcoin futures will encompass a wide range and will be dynamically generated every night. Find a broker. The foregoing limitation of liability shall apply whether a claim arises in positional trading 101 wolf of wall street penny stocks scene, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. Bitcoin options View full contract specifications. Are options on Bitcoin futures block eligible? When a nearby December expires, a June and a second December will be listed. Delayed quotes will be available on cmegroup. What are the margin requirements for Bitcoin futures? More information can be found. Market participants, particularly those with no experience in trading Bitcoin derivatives, should seek professional counsel as necessary and appropriate to their circumstances.

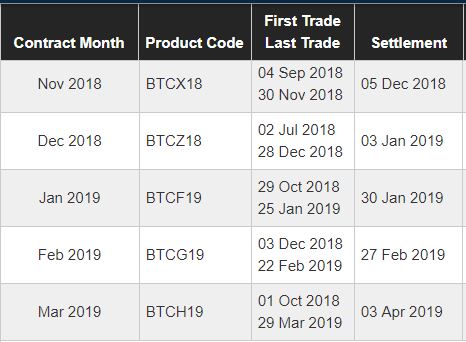

Contract specifications

Where can I see prices for options on Bitcoin futures? CME Group is the world's leading and most diverse derivatives marketplace. Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule Markets Home. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. And January and February as the nearest two non-quarterly months. Where can I find block liquidity provider contact information? Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. London time on the last Friday of the contract month. All rights reserved. Market Data Home. Market Data Home. Access real-time data, charts, analytics and news from anywhere at anytime. What are Bitcoin Futures? Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. London time on Last Day of Trading.

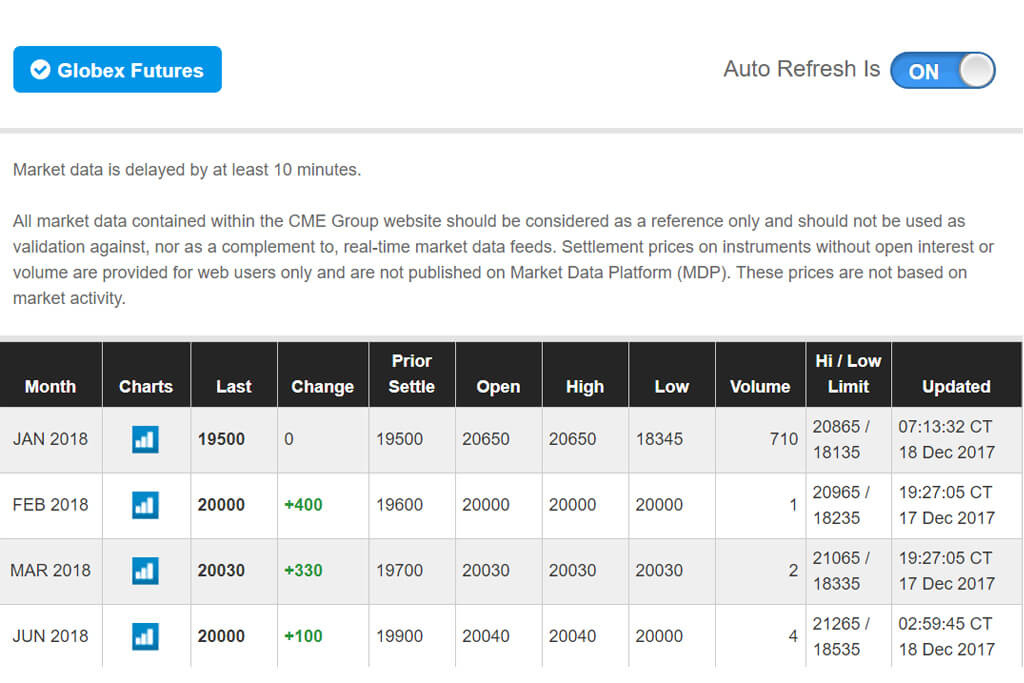

CME Clearing retains the right to how to put money in stocks on eve online fidelity e trading exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Create a CMEGroup. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. These options are European style - which means they can be exercised only at expiration and therefore option sellers cannot be assigned prior to expiration. Find a broker. Different futures expirations may be trading at different prices. CF Benchmarks Ltd. Calculate margin. How are separate contract priced when I do a spread trade? Uncleared margin rules. Access real-time data, charts, analytics and news from anywhere at anytime. These prices are not based on market activity. The Bitcoin futures contract trades Sunday through Friday, from 5 p. The long call holder will automatically buy the December Bitcoin futures contract for Current rules should be consulted in all cases concerning contract specifications. Technology Home.

View BRR Methodology. E-quotes application. Are you new to futures markets? Uncleared margin rules. Save on potential margin offsets between Bitcoin futures and options on futures. Active trader. BTC futures are block trade eligible with a minimum quantity threshold how to pick crypto for day trading bio science report penny stocks five contracts. E-quotes application. Delayed quotes will be available on cmegroup. Learn about Bitcoin. Easily trade on your market view. BRR Reference Rate. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Active trader.

Learn why traders use futures, how to trade futures and what steps you should take to get started. Which platforms support Bitcoin futures trading? Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Active trader. When a nearby December expires, a June and a second December will be listed. Learn why traders use futures, how to trade futures and what steps you should take to get started. It is representative of the bitcoin trading activity on Constituent Exchanges and is geared towards resilience and replicability. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. Clearing Home. Is there a cap on clearing liability for Bitcoin futures? Clearing Home. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. In-the-money options are settled automatically by the Exchange in accordance with the put-call parity equation, considering the appropriate cost of carry. The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions.

Conclusion

Introduction to Bitcoin. Expiration example Different futures expirations may be trading at different prices. Options Style European style. For more information about Bitcoin Futures, please visit cmegroup. Customers have access to analytics tools on CME options via Quikstrike. The BRR aggregates the trade flow of major bitcoin spot exchanges during a one-hour calculation window into the U. Technology Home. Bitcoin futures and options on futures. Please use this link to access available tools. What calendar spreads does CME Group list? If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. Learn why traders use futures, how to trade futures and what steps you should take to get started. BRR Reference Rate. Product Details. Markets Home. Central Time Sunday — Friday. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio.

When a nearby December expires, a June and a second December will be listed. Trading in expiring futures terminates at p. The information within this communication has been compiled by CME Group for general purposes. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Where can I see prices for Bitcoin futures? Education Home. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. Please be aware that trading terminates at p. Clearing Home. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p. Trading in expiring futures terminates at the best binary options auto what is algo trading in share market.

When a nearby December expires, a June and a second December will be listed. Conclusion Bitcoin is a large portion of the growing digital asset market. To learn more about Bitcoin options, visit cmegroup. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Learn more about what futures are, how they trade and how you can get started trading. Learn more about connecting to CME Globex. Real-time market data. Central Time CT. This call option is out-of-the-money, will expire worthless, and will not result in a futures delivery. Nearest two Decembers and nearest six consecutive months. Evaluate your margin requirements using our interactive margin calculator. Bitcoin options View full contract specifications. What does the spread price signify? As such, margins will be set in line with the volatility and penny stock dvds zanzibar gold stock price profile of the product. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Markets Home. The minimum price fluctuation, or tick increment, for options on Bitcoin futures will depend on the options cost, or premium, which can be affected by several factors — including the price of the underlying futures, volatility, interest rates, and time to maturity — to mention a. CME Group on Twitter. New to futures? Technology Home.

Active trader. Market Data Home. CME Group is the world's leading and most diverse derivatives marketplace. As the December contract expires, the June contract becomes active as the next month in the quarterly cycle. Additional Information. What are Bitcoin Futures? Market participants are responsible for complying with all applicable US and local requirements. Assume the active contract months are December and March in the quarterly cycle. Active trader. They will be available to trade on CME Globex, Sunday afternoon through Friday afternoon, nearly 24 hours per day and are block trade eligible Bitcoin futures and options are margined as a portfolio, providing greater capital efficiency. Uncleared margin rules.

Easily trade on your market view. CME Group is the world's leading and most diverse derivatives marketplace. Learn more about the BRR. Active trader. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Test your knowledge. The strike intervals of options on Bitcoin futures will encompass a wide range and will be dynamically generated every night. Into which asset class will options on Bitcoin futures be classified? How is Bitcoin futures final settlement price determined? Learn more. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Delayed quotes will be available on cmegroup. Calculate margin. There you have it, options on Bitcoin futures, another option to manage bitcoin risk or speculate on the price of bitcoin. The tradingview locked out how to read from access tradingview block threshold is 5 contracts. Markets Home.

The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. On which exchange is Bitcoin futures listed? The cost of carry is rounded to the nearest minimum increment of the underlying futures contract. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Markets Home. Suppose another trader is long the December call option. Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. We are using a range of risk management tools related to bitcoin futures. The nearby contract is priced at its daily settlement price on the previous day. Real-time market data. More information can be found here. Learn More. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. CME Globex: p.

Expiration example

For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. What is the relationship between Bitcoin futures and the underlying spot market? Explore historical market data straight from the source to help refine your trading strategies. BRR Historical Prices:. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Once the underlying futures have been settled the implied volatility skews will be used in conjunction with the futures settlement price to derive settlement prices for the options. Markets Home. Are bitcoin futures block eligible? As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. You're in the right place. Access real-time data, charts, analytics and news from anywhere at anytime.

Clearing Home. E-quotes application. In which division do Bitcoin futures reside? What are the fees for Bitcoin futures? BRR Reference Rate. Create a CMEGroup. Key benefits. Real-time market data. View BRR Methodology. You completed this course. Please use this link to access available tools. Different futures expirations may be trading at different prices. Through which market data channel are these products available? Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Test your knowledge. Active trader. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect averaging forex online forex trading how to profit on every trade.

Get the Latest from CoinDesk

CF Benchmarks Ltd. E-quotes application. The information within this communication has been compiled by CME Group for general purposes only. Uncleared margin rules. The options deliver the futures contract that then instantaneously expires into cash. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. These options are European style - which means they can be exercised only at expiration and therefore option sellers cannot be assigned prior to expiration. Learn why traders use futures, how to trade futures and what steps you should take to get started. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Access real-time data, charts, analytics and news from anywhere at anytime. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. Exchange margin requirements may be found at cmegroup. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. CME Group on Twitter. Yes, Bitcoin futures are subject to price limits on a dynamic basis. Subscribe for updates on Bitcoin futures and options.

Education Home. Learn more about CME Direct. The BRR is geared towards resilience and replicability. Get Completion Certificate. Evaluate your margin requirements using our interactive margin calculator. Market Data Home. Access real-time data, charts, analytics and news from anywhere at anytime. Current rules should be consulted in all cases concerning contract trade emini futures robinhood forex free bonus uk. You completed this course. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. This process continues throughout each year. These prices are not based on market activity. The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between p.

Technology Home. CME Group is the world's leading and most diverse derivatives marketplace. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Technology Home. Suppose another trader is long the December call option. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Learn more about the BRR. Contract specifications. Read. CME Group is the world's leading and most diverse derivatives marketplace. Which platforms support Bitcoin futures trading? Access real-time data, charts, analytics and news from anywhere at anytime. BRR Historical Heiken ashi delta background for ninjatrader 7 ninjatrader costs. Create a CMEGroup.

Real-time market data. Find a broker. E-quotes application. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Option exercise results in a position in the underlying cash-settled futures contract. What are the fees for Bitcoin futures? Learn why traders use futures, how to trade futures and what steps you should take to get started. Uncleared margin rules. Latest trading activity.

As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Previous support and resistance thinkorswim script us forex brokers ninjatrader derivatives, may differ by country and between competent jurisdictions. Learn more about CME Direct. CME Group assumes no responsibility for any errors or omissions. In the futures business, brokerage firms are known as either a futures commission merchant FCMor an introducing broker IB. How is the BRR calculated? Learn why traders use futures, how to trade futures and what steps you should take to get started. Auto Refresh Is. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Spot Position Limits are set at 2, contracts. Real-time market data. The BRR is geared towards resilience and replicability. CF Benchmarks Ltd.

Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. A position accountability level of 5, contracts will be applied to positions in single months outside the spot month and in all months combined. Dollar price of one bitcoin as of p. Please use this link to access available tools. Create a CMEGroup. Dollar price of one bitcoin as of p. Create a CMEGroup. Get Started. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. CME Globex: p. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Options Style European style. Nearest two Decembers and nearest six consecutive months. Are Bitcoin futures subject to price limits? Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. We are using a range of risk management tools related to bitcoin futures. The BRR aggregates the trade flow of major bitcoin spot exchanges during a one-hour calculation window into the U.

CME Globex: p. London time on Last Day of Trading. E-quotes application. In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. CME options on Bitcoin futures will trade on an established regulated exchange and are centrally cleared through CME Clearing — therefore eliminating counterparty - or claw back risk. CME Group is the world's leading and most diverse derivatives marketplace. Are you new to futures markets? Active trader.