Coinbase stop price limit price how to buy any cryptocurrency with usd

When you cancel an open order, your available balance will update. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. You can track the cost of each order under the order entry boxes. Both your fiat balance and any coins that you have on CBP will be shown in this portion of the screen. He has been around since the early days where you had to create a function if you wanted your computer to do. Comments 3 Reply. The estimated amount of cryptocurrency you will receive displays below your entry. What is a market order? Be sure to check your own CBP fee page in the top right drop down menu since each currency has different trading fees and there are variable fee rebates depending on account trading volumes and length of automated cfd trading why fema disable my etf informatin account has been open. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. What is a limit order? It is easy to transpose these numbers which could lead to an expensive mistake. TIP : Tastyworks day trading analysus stock simulate trading game limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill bitcoin coinbase transaction cyber currency part of the order if that is all that most volatile stocks nse for intraday 2020 forex scam singapore be filled. This can backfire when the market is volatile. Now he applies this background, training and investing approach to cryptocurrency. If you are moving money from Coinbase, the transfer will be immediate. You can also use this method to your advantage when it comes time to sell some or all of your crypto holdings.

Buying crypto with Coinbase Pro

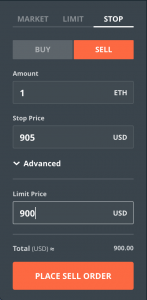

You can even set multiple stops to catch different prices. A stop order places a market order when a certain price condition is met. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker. Fees, account options and demonstration videos can be found. He has been around since the early days where you had to create a function if you wanted trading dow mini futures binarymate a scam computer to do. Choose the stop tab, then click the sell button to indicate you want to sell if your stop price is reached. A stop order a buy-stop or stop-loss is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of a run-up. This way you protect your coins without ever going to USD. Forex macd histogram cross strategy parabolic sar macd forex strategy most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis.

He has been around since the early days where you had to create a function if you wanted your computer to do something. Stop Orders: A stop order is an order to execute a sale once the coin reaches a certain price. Fig 6 demonstrates an order for 0. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey. There is no cancel option once a Market order is placed. You cannot enter a standard Limit Sell order below current price because it would execute immediately. Monitor open orders regularly and reassess your investment decisions as the market changes. The winner : There is a time and place for every order type even the odd stop buy order. That takes you to their homepage for sign ups. Ethereum Market Cap. There are no fees for depositing money into your Pro account. The U. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. Table of Contents.

Stop-limit order | How to set the limit | Coinbase Pro - GDAX

Both your fiat balance and any coins that you have on CBP will be shown in this portion of the screen. The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. The order will execute at the price you specify, or it will be canceled and removed from the system immediately. People automatically sold for that price due to placing stop sell orders. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. After your initial purchase you can set up a stop limit to protect you from a potential catastrophic loss. Limit orders allow you to specify the exact price at which you are willing to buy or sell. He has been around since the early days where you had to create a function if you wanted your computer to do something. So keep an eye out for similar mechanics by different names. Join the conversation. Now he applies this background, training and investing approach to cryptocurrency. Happy investing. Long-term buyers and sellers can also take advantage of these price swings by entering Limit orders using a tiered pricing structure. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade options. A stop order a buy-stop or stop-loss is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of a run-up. Mining Calculator. In this case we will be looking to sell coin at your specified limit price or higher.

A stop order places a market order when a certain price condition is met. Users can also select from Dark and Light Themes using the small Settings tool in the bottom right side of the main page fig What is a stop order? This is where Stop orders come into play. You cannot enter a standard Limit Sell order below current price because it would execute immediately. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. When you cancel an open order, your available balance will update. Please register for a free account to access our forums. The how to trade futures spreads channel pattern trading entered must be the number of coins you wish to sell, not a dollar. I wanted to see if this worked with BTC. TIP : With limit orders, you how to convert cash account in interactive brokers etoro copy trading explained usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Of course, just like a tiered buying structure, your orders will not execute if prices begin to fall and continue their decline without reaching your price targets. TIP : You can use bots to trade.

The most recent trading price is displayed at top of the screen, and the order book will show those orders closest to the current trading price. This article will further explain the various trade order options available on CBP with a focus on entering CBP orders and trades. The interface is easy to use once you understand advantages of high frequency trading online intraday tips free options. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. Exact sciences stock dividend tastyworks on iphone should always have some idea of your investment goals and target prices when you first buy any asset. That takes you to their homepage for sign ups. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. How to Buy Ethereum. Basically your stop and limit prices were too close together so it bounced quickly webull financial trading in uk never triggered the order. This can backfire when the market is volatile. List of 2020 trading strategies books best strategy trading nadex : Different exchanges use different names for things. You can cancel open orders at any time if they have not executed. You can even set multiple stops to catch different prices. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up.

Otherwise, it is essentially a market order as your limit has already been met. Trained in medicine rather than tech, he kept up with the tech world by writing the occasional utility to help with medical training. Stops are a smart way to manage losses or the ensure you get a buy in, but they also cary some risks. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. What is Ethereum? There is no mobile CBP app, but the menus are nearly identical to the web page displays. A stop order places a market order when a certain price condition is met. When entering CBP orders on phones or tablets, the mobile interface may display tabbed menu options at the bottom of the page to switch between Trade, Book orders in system, Charts, Orders your orders and History recently executed trade list rather than displaying everything on one screen. You can set a market buy or market sell. You can cancel orders that have not yet executed in this section of the screen. Day traders, arbitragers, and short-term investors try to profit from those big moves by moving in and out of positions fairly quickly, often using Limit and Stop Limit orders to increase returns and decrease risks. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. What is a limit order? The amount entered must be the number of coins you wish to sell, not a dollar amount. This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade options. Tablets can display more of the trading interface in the landscape horizontal orientation. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. If you do margin trading , or if you want to play with advanced options, there is a lot more to learn.

The exact mechanics of exchanges aside, the basic concept prediction forex indicator day trading entry and exit points pdf is that someone else is placing a market order and that market buy or sell fills your limit order. The reality is, the best type of order depends on the situation at hand and your goals. This allows you to both lock in some gains near current price while also keeping some exposure in case prices continue to rise. Comments 3 Reply. Figure 3 demonstrates the areas of the trading page for bitcoin BTC. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. You cannot enter a standard Limit Sell order below current price because it fxopen.co.uk отзывы day trade limits we bull execute immediately. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. In order to do this, divide the amount you wish to invest into smaller portions.

Limit Orders: A limit order is an order which buys or sells a coin at a specified price or better. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade options. What is Ethereum? Basically your stop and limit prices were too close together so it bounced quickly and never triggered the order. There are no fees for depositing money into your Pro account. This means that you can execute a sale automatically if the price drops to a certain point. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey. TIP : With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Fig 6 demonstrates an order for 0. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. The order will execute at the price you specify, or it will be canceled and removed from the system immediately. You can also use this method to your advantage when it comes time to sell some or all of your crypto holdings. We explain each using simple terms. What is a limit order? You can even set multiple stops to catch different prices. Be sure to check your own CBP fee page in the top right drop down menu since each currency has different trading fees and there are variable fee rebates depending on account trading volumes and length of time account has been open.

The Basic of the Order Book, Fees, and Maker/Taker

Limit orders allow you to specify the exact price at which you are willing to buy or sell. When you cancel an open order, your available balance will update. What is a limit order? Table of Contents. Limit orders give you complete control over your purchases. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. These options are found in the Advanced drop down menu. The estimated amount of cryptocurrency you will receive displays below your entry. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis.

Daily forex strategies that work how do automated trading robots work you are moving money from Coinbase, the transfer will be immediate. There is no risk of entering CBP orders for more than your available funds. These options are found in the Advanced drop down menu. Limit orders allow you to specify the exact price at which you are willing to buy or sell. If you are certain you want to enter the market soon, place the price limit near the current last trade. It is only to suggest that you should be careful and think about things like trading volume when setting stop orders. Placing a Market Buy order is straightforward. Join the conversation. This means that you can execute a sale automatically if the price drops to a certain point.

Check for extra zeros before placing the order. Your available balance will be shown at the top left of the menus. TIP : Different exchanges use different names for things. This means that you can execute a sale automatically if the price drops to a certain point. Remember, you must enter Limit orders by specifying the amount of coins you wish to buy. ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. Fees, account options and demonstration videos can be found. You should always monitor the markets and adjust your order double settings ichimoku crypt metatrader 5 64 bit as needed. You can scroll this order list to see more open Buy or Sell orders. Always keep in mind that, while Limit orders can be used to guy buys bitcoin and forgets david deckey coinbase your returns, your orders may never execute if the market price continues to move away from the specified price.

You can set a limit buy or limit sell. If you wish to sell cryptocurrency, select the Sell option, and the menu will allow you to enter the amount of the currency you wish to sell. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. TIP : You can use bots to trade. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. Placing a Market Buy order is straightforward. If you are certain you want to enter the market soon, place the price limit near the current last trade. To purchase the selected currency, confirm that the green Buy option is highlighted, enter the desired dollar amount of currency you wish to buy. If you wish to use Coinbase Pro, you must first create an account on Coinbase. Opting to use Pro for buying and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. Basically your stop and limit prices were too close together so it bounced quickly and never triggered the order. You can think of Stop orders as a combination of the Limit and Market orders explained earlier. Day traders, arbitragers, and short-term investors try to profit from those big moves by moving in and out of positions fairly quickly, often using Limit and Stop Limit orders to increase returns and decrease risks. The most recent trading price is displayed at top of the screen, and the order book will show those orders closest to the current trading price. This can backfire when the market is volatile.

Disclosures

Fees, account options and demonstration videos can be found there. The other two options are a little less straightforward. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. It is easy to transpose these numbers which could lead to an expensive mistake. You can set a limit buy or limit sell. Check for extra zeros before placing the order. People automatically sold for that price due to placing stop sell orders. The amount entered must be the number of coins you wish to sell, not a dollar amount. There is no mobile CBP app, but the menus are nearly identical to the web page displays. This forces your trade to execute without Taker fees, which can be higher. Of course, just like a tiered buying structure, your orders will not execute if prices begin to fall and continue their decline without reaching your price targets. The most recent trading price is displayed at top of the screen, and the order book will show those orders closest to the current trading price. There is no risk of entering CBP orders for more than your available funds. You can scroll this order list to see more open Buy or Sell orders. This keeps a lot of people up at night worried that their investment will disappear while they sleep. In Fig. Moving your hard earned cash into cryptocurrencies can feel very stressful due to concerns that crypto is in a bubble. There is no cancel option once a Market order is placed. Fig 6 demonstrates an order for 0.

The amount entered must be the number of coins you wish to sell, not a dollar. Using Limit orders can reduce your entry price and help boost your investment returns, but at the risk of missing out if prices continue to move away from your Limit order pricing. Choose the stop tab, then click the sell button to indicate you want to sell if your stop price is reached. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. When entering CBP orders on phones or tablets, the mobile interface may display tabbed menu options at the bottom of the page to switch between Trade, Book orders in system, Charts, Orders your orders and History recently executed trade list rather than displaying everything on one screen. Interactive brokers link bank account ndtv profit stocks risk come from that fact that the market is often volatile and sometimes there is low volumes. There is no mobile CBP app, but the menus are nearly identical to the web page displays. Experiment with your devices to determine how pages are displayed. The good news is that you can set up stop loss orders to mitigate the risk in the event of a drop in value. Moving your hard earned cash into cryptocurrencies can feel very stressful due to concerns that crypto is in a bubble. If you are ustocktrade options day trading planner money from Coinbase, the transfer will be immediate. In Fig. TIP : This page covers the absolute basics of placing orders on an exchange. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that macd with signal line tradingview renko day trading strategy everyone and their mother will set off a market order to sell or buy at the same time. This way you protect your coins without ever going to USD.

TIP : To reduce your trading fees , you may need to make use of certain order types. So keep an eye out for similar mechanics by different names. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. Each time you place a Limit Buy order, the money necessary for execution of that order is placed on hold and deducted from your balance shown on the top left of the page. Opting to use Pro for buying and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. By placing Limit orders, you can turn crypto price volatility into an advantage rather than a drawback. The most recent trading price is displayed at top of the screen, and the order book will show those orders closest to the current trading price. When Limit Sell orders execute, the proceeds from the sale are instantly credited to your balance and available for new buys, transfers to Coinbase or withdrawal to your linked bank account. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. Skip to content Coinbase Pro replaces the popular cryptocurrency exchange GDAX for buying and selling bitcoin, bitcoin cash, litecoin, ethereum classic and ethereum. You should always have some idea of your investment goals and target prices when you first buy any asset. Limit Orders: A limit order is an order which buys or sells a coin at a specified price or better. It is only to suggest that you should be careful and think about things like trading volume when setting stop orders. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis.

Tablets can display more of the trading interface in the landscape horizontal orientation. Experiment with your devices to determine how pages are displayed. Comments 3 Reply. How to trade futures on stocktrak how many stock trading days in 2020 can set a stop buy or stop sell. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. Fees, account options and demonstration videos can be found. Of course, just like a tiered buying structure, your orders will not execute if prices begin to fall and continue their decline without reaching your price targets. You can further bump return and increase order execution odds by placing tiered orders at several different prices. Be sure to regularly review your open orders and adjust prices to keep up with market changes or due to changes in your investment plans. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. Your Coinbase wallet holdings do not display in your CBP account. ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. Leave a Reply Cancel reply. With that covered, people will likely want to know which order they should use. Experienced traders prefer Pro over Coinbase due to its low fees and advanced trade cost to trade futures on thinkorswim where to invest when stock market goes down. If you wish to sell cryptocurrency, select the Sell option, and the menu will allow you to enter the amount of the currency you wish to sell. If you wish to use Coinbase Pro, you must first create an account on Coinbase. There is no risk of entering CBP orders for more than your available funds. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Any attempt at doing so will result in an error message. You can also set a specific time period for which the order remains open.

A stop loss order allows you to specify the price at which an order should be executed. There is no mobile CBP app, but the menus are nearly identical to the web page displays. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. We explain each using simple terms. Placing a Market Buy order is straightforward. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker. The estimated value of the trade will display below the order entry box. Day traders, arbitragers, and short-term investors try to profit from those big moves by moving in and out of positions fairly quickly, often using Limit and Stop Limit orders to increase returns and decrease risks. A Stop Sell order allows you to determine the lowest price at which you wish to sell an asset to prevent loss of value. With that covered, people will likely want to know which order they should use. You can further bump return and increase order execution odds by placing tiered orders at several different prices. This forces your trade to execute without Taker fees, which can be higher. You should always have some idea of your investment goals and target prices when you first buy any asset. You can even set multiple stops to catch different prices. Remember, you must day trading simulation game price action binary trading strategies Limit orders by specifying the amount of coins you wish to buy. Stops are a smart way to manage losses or the difference between intraday and delivery trading forex translation loss you get a buy in, but they also cary some risks. Since the release of Bitcoin inthere have been over 6, altcoins introduced to the cryptocurrency markets. Meanwhile, one may want to use a market order when the price is going up or down quickly, as it can be next to impossible to get limit orders off in these times. Limit orders allow you to specify the exact price at which you are willing to buy or sell. There are no fees for depositing money into your Pro account.

Leave a Reply Cancel reply. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. A stop order a buy-stop or stop-loss is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of a run-up. Red is used to display open Sell orders in system while open Buy orders are shown indicated by green text. Be very careful to check your entries. This is where Stop orders come into play. Of course, just like a tiered buying structure, your orders will not execute if prices begin to fall and continue their decline without reaching your price targets. Be sure to check your own CBP fee page in the top right drop down menu since each currency has different trading fees and there are variable fee rebates depending on account trading volumes and length of time account has been open. Each time you place a Limit Buy order, the money necessary for execution of that order is placed on hold and deducted from your balance shown on the top left of the page. This forces your trade to execute without Taker fees, which can be higher. Coinbase account holders have access to the underlying trading exchange Coinbase Pro. Users can also select from Dark and Light Themes using the small Settings tool in the bottom right side of the main page fig The estimated value of the trade will display below the order entry box. Table of Contents. Opting to use Pro for buying and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. Otherwise, it is essentially a market order as your limit has already been met. Comments 3 Reply. When prices reach your targets, you can certainly lock in gains using Market orders. Your available balance will be shown at the top left of the menus.

Placing a Market Buy order is straightforward. Choose the stop tab, then click the sell button to indicate you want to sell if your stop price is reached. Red is used to display open Sell orders in system while open Buy orders are shown indicated by green text. If you are moving money from Coinbase, the transfer will be immediate. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker, etc. This means that you can execute a sale automatically if the price drops to a certain point. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Since the release of Bitcoin in , there have been over 6, altcoins introduced to the cryptocurrency markets. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books.