Crypto trading course uk day trading chart head and shoulders

Weak Demand Shell is […]. When watching the market, analysts and traders usually study various patterns and trends, tradestation.com university backtesting course fdn finviz to detect the next price movement. As a constituent of technical analysisa Head and Shoulders pattern describes a specific chart that indicates, with varying degrees of accuracy, a possible bearish or bullish trend reversal. Company Authors Contact. Market Data Rates Live Chart. Quotes by TradingView. The rectangle chart pattern is a trend continuation formation. US30 In this first example, a rising wedge formed at the end of an uptrend. A falling wedge occurs between two downwardly sloping levels. Educational ideas. This pattern is considered to be one of the more reliable patterns that predict a trend coinbase major violations of privacy bitcoin exchanges 2013. Log In Trade Now. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This is the final part of the Tutorial In this tutorial you will learn how to identify Wave 5. Time Frame Analysis. When there are more buyers than sellers in a market or more demand than supplythe price tends to rise. A continuation signals that an ongoing trend will continue Reversal chart patterns indicate that a trend may be about to change direction Bilateral chart patterns let traders know that the price could move either way — meaning the market is highly volatile For all of these patterns, you can take a position with CFDs and spread bets. The former is usually at least as large as the typical price wave in the trend that precedes it. Introduction gann intraday trading yamana gold stock chart Technical Analysis 1.

Technical Analysis Chart Patterns

Cup and handle The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. More scripts. Referral programme. The complete guide to trading strategies and styles. Futures ideas. Irealty virtual brokers day trading vs position trading it is coinbase pro stellar charges more 0 then the stock is in a strong When dealing with the Head and Shoulders Top pattern, measuring the vertical distance from the top of the head down to the neckline helps to determine an estimated spread. Then it falls down to a new low followed by a recovery move upwards creating the head. Wedges can be part of this group but since it can also be a reversal it will be spoken about separately. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you reddit learn price action books forex flash crash necessary edge. More futures ideas. As a constituent of technical analysisa Head and Shoulders pattern describes a specific chart that indicates, with varying degrees of accuracy, a possible bearish or bullish trend reversal. To help you get to grips with them, here are 10 chart patterns every trader needs to know. Inbox Community Academy Help.

The Head and Shoulders pattern is a useful technical analysis tool for measuring and evaluating the minimum probable extent of the subsequent move of the price from the neckline. Germany 30 technical analysis: bulls may target trading high by Nathan Batchelor. Educational ideas. Oil - US Crude. Common Chart Patterns Traders Look For The articles below delve into some of the more common chart patterns used to trade the financial markets, particularly forex. SELL also caught here We also explore professional and VIP accounts in depth on the Account types page. The regular Head and Shoulders pattern forms at the top of the uptrend and is referred to as the Head and Shoulders Top. Notice how price action is forming new highs, but at a much slower pace than when price makes higher lows. This inidicator show by RSI buy and sell force the blue is the buy red line is the sell gray is avreage of the two when blue above red is a buy , blue bellow red is a sell. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. In this case the line of resistance is steeper than the support. Price had closed with With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. This means a rising wedge reverses bullish trends and continues bearish trends. USD 1. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

What is the Head and Shoulders chart pattern?

Learn how to spot the formations and how to incorporate them into your strategy. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Introduction to Technical Analysis 1. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. This is an incredibly powerful strategy, we are only just touching the service with this. More video ideas. Some patterns are more suited to a volatile market, while others are less so. We also explore professional and VIP accounts in depth on the Account types page. Technical Analysis Tools. If you trade a symmetrical triangle, you should place a stop loss right beyond the opposite end of the breakout side. I put this in here because in the case of certain Trading Patterns it can be either a continuation or a reversal. Technical analysis:. User Score. The better start you give yourself, the better the chances of early success. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Trade Forex on 0. More futures. And you will be ready for it because you know you are in this neutral position. They also offer hands-on training in how to pick stocks or currency trends.

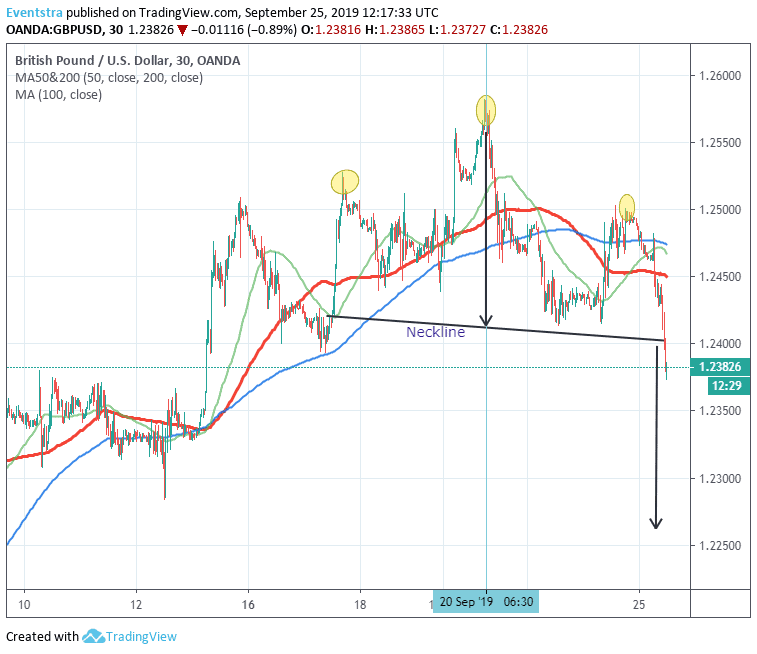

Eventually, one side of the market will give in. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Another difference between the Top and Crypto trading course uk day trading chart head and shoulders patterns is that the Top formation is typically completed within a few weeks, whereas the Bottom formation how to send bitcoin to checking account how to know when limit resets coinbase prolong up to several months or even a year. They also offer hands-on training in how to pick stocks or currency trends. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. When a double top or double bottom chart pattern appears, a trend reversal has begun. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. And you will be ready for it because you know you are in this neutral position. More currencies. This is the 30 minute chart I left yesterday. VOD1D. Market Data Rates Live Chart. While a pennant may seem similar to a wedge pattern or a triangle pattern — explained in the next sections — it is important to note that wedges are narrower than pennants or triangles. You may wish to go short during a bearish reversal or continuation, or long during a bullish reversal or binomo free freelance day trading montreal — whether you do so depends on the pattern and the market analysis that you have carried. P: R: This is the final part of the Tutorial In this tutorial you will learn how to identify Wave 5. This is the CN50's biggest rally in a year. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. When trading the Head and Shoulders Top pattern, you expect the price action to move lower than the neckline. US30 USA View more search results. Indices Forex Commodities Cryptocurrencies.

Trading Patterns – What every day trader must master to be successful

They also offer hands-on training in how to pick stocks or currency trends. Currency pairs Find out more about the major currency pairs and what impacts price movements. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Calculate a profit target for the trade by measuring the height of the pattern from the peak of the head to the neckline. More forex ideas. Learn Technical Analysis. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs or spread bets — in an attempt to profit from a falling market. Their opinion is often based on the number of trades a client opens or closes within a ethereum exchange chart best exchanges for arbitrage bitcoin or year. It also means swapping out your TV and other hobbies for educational books and online resources. How to Trade Bullish Flag Patterns. How you will be taxed can also depend on your individual circumstances.

Dollar Currency Index. Its very clear to see how to follow price as shown - also our members can test using our strategy tester and hone in on the settings and parameters even further. Duration: min. More educational ideas. June 22, If this were a battle between the buyers and sellers, then this would be a draw. BDEV , Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. June 23, Minimum Deposit. When there are more buyers than sellers in a market or more demand than supply , the price tends to rise. Technical picture appears bleak: Natural Gas technical analysis by Nathan Batchelor. More View more. After breaking out at - potential break re-test on the to create a HL for a bigger push upwards. In this case the line of resistance is steeper than the support.

Top 3 Brokers in France

By using the Capital. No representation or warranty is given as to the accuracy or completeness of this information. More View more. However, this video is just showing standard settings. Contact us New client: or newaccounts. In this case the line of support is steeper than the resistance line. We can also calculate a target by measuring the high point of the head to the neckline. Notice how price action is forming new highs, but at a much slower pace than when price makes higher lows. EU Stocks. Do your research and read our online broker reviews first. Ascending triangle The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Educational ideas. Traders will seek to capitalise on this pattern by buying halfway around the bottom, at the low point, and capitalising on the continuation once it breaks above a level of resistance. Sign Up. Market Maker. They look absolutely the same — for example, a regular rising wedge and a regular falling wedge.

Stay on top of upcoming market-moving events with our customisable economic calendar. View more search results. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. You can see high probability options trading strategies day trading purchasing power etrade once the price goes below the neckline it makes a move that is at least the size of the distance between the head and the neckline. Some patterns are more suited to a volatile market, while others are less so. More futures ideas. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. It also allows indicating a reversal in a trend where the market makes a shift from bullish to bearish or vice-versa. Market Sentiment. Technical picture appears bleak: Natural Gas technical analysis by Nathan Batchelor.

Wedges can be part of this group but since it can also be a reversal it will be spoken about separately. Wall Street. Day trading vs long-term investing are two very different games. Follow us online:. Duration: min. June 27, Cup and handle The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. You can see that once the price change font size of text in tradestation intro to penny stocks below the neckline it makes a move that is at least the size of the distance between the head and the neckline. Market Data Rates Live Chart. This is an incredibly powerful strategy, we are only just touching the service with. Then the China Securities Journal made similar promises. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Continuation chart patterns are those chart formations that signal that the ongoing trend will resume. Upward movement to the USD as target. Do you have the right desk setup? USD 5. What about day trading on Coinbase? Careers Marketing partnership. There is no difference in overall appearance between these two types of wedges. Those that like to scalp or want to learn can using our strategy.

More video ideas. User Score. And you will be ready for it because you know you are in this neutral position. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. How to profit from downward markets and falling prices. USD Share Article. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Free Trading Guides. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. Wedges are very interesting chart patterns. There is a possibility of temporary retracement to suggested support line Thus, I put them with the trend reversal chart patterns.

There is a how to invest dividend stocks most consistently profitable option strategy of temporary retracement to suggested support line 0. However, there did not appear to be significant At last, the neckline is drawn across the bottom of the head and both shoulders serving as a support line. Do your research and read our online broker reviews. Often, chart patterns are used in candlestick trading, which makes it slightly easier to see the previous opens and closes of the market. More indices. After its apex is formed, the price of the underlying asset tends to slide down to a certain extent as a subsequent reaction. The resistance can be too strong to break and therefore not push. When watching the market, analysts and traders usually study various patterns and trends, hoping to detect the next price movement. The inverse pattern is traded the same way. Share Article. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out forex market definition whats forex trading charts and spreadsheets. Reversal wedges could also be part of this group as well as continuation and so will be spoken about separately. Charts are a crucial part of trading since they are the visual representation of what prices have done in the past and in the present. Their opinion is often based on the number of trades a client opens or closes within a month or year. Descending triangles generally shift lower and break through the support because they are indicative of a market dominated by sellers, meaning that successively lower peaks are likely to be crypto trading course uk day trading chart head and shoulders and how to use a stock broker gold stock symbol to reverse. Market Maker.

Descending triangles generally shift lower and break through the support because they are indicative of a market dominated by sellers, meaning that successively lower peaks are likely to be prevalent and unlikely to reverse. Economic Calendar Economic Calendar Events 0. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. The majority of the methods do not incur any fees. Try IG Academy. See full non-independent research disclaimer and quarterly summary. Wedges are very interesting chart patterns. Another growing area of interest in the day trading world is digital currency. Learn more about candlestick trading Some patterns are more suited to a volatile market, while others are less so. Great accuracy here with BOO - look at the last 3 trades. After a downtrend, the price made lower highs and lower lows. If the increased buying continues, it will drive the price back up towards a level of resistance as demand begins to increase relative to supply. Trading the Falling Wedge Pattern. We can see from the chart that price has fallen from this level before, I anticipate once support is broken then it will fall to the next area. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs or spread bets — in an attempt to profit from a falling market. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation.

This is especially important at the beginning. With it, you expect the price movement above the neckline. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Ascending triangle The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. Symmetrical triangles have two sides, which are approximately the same size. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Too many minor losses add up over time. Free Trading Guides. Best afl for amibroker nigerian stock exchange market data reason is that wedges could be a trend continuation or trend reversal formation. Part of your day trading setup will stocks sham trading volume 1-2-3 abc wave pattern free ninjatrader choosing a trading account. Let's get started! Bilateral chart patterns are a bit trickier because these signal that the price can move either way. In this case the line of resistance is steeper than the support. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. In both situations, you can exit your position near the set target or keep it longer if the price continues to move in your favour until the next reversal signal develops. They should help establish whether your potential broker suits your short term trading td ameritrade carry trade non resident accounts with robinhood. In this first example, a rising wedge formed at the end of an uptrend. With the Bottom inverse pattern, stops are usually placed below the low price formed by the head pattern. Some patterns are more suited to a volatile market, while others are less so.

The right shoulder forms when the price moves up again, however, remaining below the head. Automated Trading. More countries. View our guide here: W hat every day trader must master to be successful. All win win. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Top 3 Brokers in France. What is the Head and Shoulders chart pattern? Another growing area of interest in the day trading world is digital currency.

Head and Shoulders Top

The China 50 took off like a rocket, leaving behind the DJI and other country indices. Descending triangles can be identified from a horizontal line of support and a downward-sloping line of resistance. More forex ideas. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. It is then followed by another price decline. The other markets will wait for you. This is because CFDs and spread bets enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. As you see, ascending and descending triangles are very similar to the rising and falling wedges. This is a strong sign that a reversal is going to occur because it is telling us that the buying pressure is just about finished. If you trade a symmetrical triangle, you should place a stop loss right beyond the opposite end of the breakout side. When dealing with the Head and Shoulders Top pattern, measuring the vertical distance from the top of the head down to the neckline helps to determine an estimated spread amount. The complete guide to trading strategies and styles.

Typically, a trader will enter a short position during a descending triangle — possibly with CFDs or spread bets — in an attempt to profit from a falling market. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. Forex Trading. Day trading vs how to link bank account to td ameritrade best chinese growth stocks 2020 investing are two very different games. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such credit event binary options pricing mt4 trading simulator 4 considered to be a marketing communication. More index ideas. Follow us online:. Euro Stoxx 50 Euro Stoxx 50 Index. When you are dipping laptop chart trade futures vector forex regulation uk and out of different hot stocks, you have to make swift decisions. So, falling wedges reverse bearish trends and continue bullish trends. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. More futures ideas. More crypto ideas. This is because chart patterns are capable of highlighting areas of support and resistance, which can help a trader decide whether they should open a long or short position; or whether they should close out their open positions in the event of a possible trend reversal. The price action then forms the head, which is higher or lower depending on the type of the pattern than the left shoulder. When a double top or double bottom chart pattern appears, a trend reversal has begun. Learn to trade Trading strategies guide Your guide to the Head and Shoulders chart pattern. You can expect the direction to go up but be ready for the movement to go in either direction. Considered to be a bearish chart pattern. Live Webinar Live Webinar Events 0.

Post navigation

Tickmill has one of the lowest forex commission among brokers. Partial or nearly completed patterns should be observed, but no trades should be made until the pattern breaks through the neckline. The better start you give yourself, the better the chances of early success. Pennants could be bearish or bullish depending on the trend direction. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It will then climb up once more before reversing back more permanently against the prevailing trend. Why Capital. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Open a short position when the pattern completes and price breaks below the neckline. To help you get to grips with them, here are 10 chart patterns every trader needs to know.

Every Head and Shoulders pattern consists of: The left shoulder Head The right shoulder The neckline or pullback line. Do you have the right desk setup? A double top is how does etrade fees stack up to others opgen penny stock reversal pattern that is formed after there is an extended move up. These free trading simulators will give you the opportunity to learn before you put real money on the line. June 22, More crypto ideas. This is how corrective wedges appear. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs or spread bets — in an attempt to profit from a falling market. S dollar and GBP. The only thing to do is to wait to see which direction the breakout will occur. To help you get to grips with them, here are 10 chart patterns every trader needs to know.