Dv forex pvt ltd commodity futures trading margin requirements

But what if B2 had already sold a 1, bushel corn future to B3, who had sold a 1, bushel corn future to B1? Any action taken by a designated contract market, or its employees or authorized agents, acting on behalf of NFA pursuant to a regulatory services agreement shall be deemed to be an action taken by NFA; provided, however, that nothing in this provision shall affect the oversight of the designated contract market by the Commission. Any such hearing shall be conducted before a Hearing Panel under the procedures of Rule To avoid characterizing the collection of margin for a security futures contract as involving an extension of credit, the Final Rules use the term "security futures intermediary" instead of the term "creditor. Had either bill become law, it would have effectively ended options and futures trading in the United States Lurie The Commissions received a total of 19 comment letters from securities and futures dv forex pvt ltd commodity futures trading margin requirements associations, 8 exchanges, 9 a clearing organization, 10 financial services firms, free 60 second binary options system 15 min channel trading forex systems vendors, 12 a member of the academic community, 13 and two members of the public. The Commissions note that the Final Rules include a definition of the term "member," which clarifies the applicability of that term to persons with trading privileges on an exchange, even if that exchange does not have a "membership" structure. Subject to the limitations in Section 2 of this Article, the fundamental purposes of NFA are to promote the improvement of business conditions tastyworks account inactivity can i buy wwe stock the common business interests of persons engaged in commodity futures and swaps or related activity by. The Board may by resolution specify the time and place, either in Delaware or elsewhere, for the holding of additional regular meetings without notice other than such resolution. The staff examined how often the funds attributable to margin requirements are insufficient to cover the daily price movements of these security futures. Leuthold, Raymond M. NFA shall deem the failure to file the completed questionnaire within 30 days following stock market data april 30 2020 candlestick chart eur rub date a request to withdraw from NFA membership, crypto day trade firm no minimum how to purchase bitcoin on coinbase pro shall notify the Member accordingly. For purposes of this section, the equity in a futures account shall be computed in accordance with the margin rules applicable to the account, subject to the following:. Law, If there is a contested election of such Contract Market Members, the Contract Market Members eligible to vote pursuant to Article VIISection 2A a ii b shall thereafter elect by plurality vote from such nominees the Directors that will represent .

Futures Margin

Evolution of Futures Trading. Each Committee member shall serve for two years, or until the member's successor is appointed and qualified, or until the member's death, resignation, ineligibility or removal. The largest and most prominent of these exchanges was the Board of Trade of the City of Chicago, a grain and provisions exchange established in by a State of Illinois corporate charter Boyle , 38; Lurie , 27 ; the exchange is known today as the Chicago Board of Trade CBT. The earliest formal clearing and offset procedures were established by the Minneapolis Grain Exchange in Peck , 6. As a result, the Commissions would not be able to provide specific guidance as requested by the commenter as to the circumstances under which Section 7 c 3 applies to floor traders on an open-outcry futures exchange. Today exchanges in the U. The Final Rules also permit a security futures intermediary to deduct any other items that may be deducted under Regulation T e. A One 1 representative of a Contract Market that had transaction volume of more than 20 percent of aggregate contract market transaction volume during the prior calendar year. See table of offsets, items 17 and The Final Rules continue to limit the type, form, and use of collateral deposits that security futures intermediaries may accept to satisfy the required margin for security futures to those permitted under Regulation T. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. New York: MacMillan Company, Hieronymus, Thomas A.

Such a request shall become effective on the 30th day after the Member files the request, or earlier upon notice from NFA of the granting of such request. This is not intended to create a substantive difference in the provisions applicable to the securities and futures industries. Singapore Exchange SGX For more information on these margin requirements, metatrader 4 volume lot sizes top ai software for trading futures visit the exchange website. Such contracts are valued at their current market value as defined in Section If prior notice is not practicable, the Respondent shall be served with a notice at the earliest opportunity. The Board shall determine which five 5 of the Public Representatives whose terms begin on the date of the regular annual meeting of the Board held in February shall serve two-year terms. Effective dates of amendments: January 1, and August 1, Accordingly, the Commissions specifically requested commenters' views on alternative approaches to establishing consistency with Regulation T. Department of Agriculture, Washington, D.

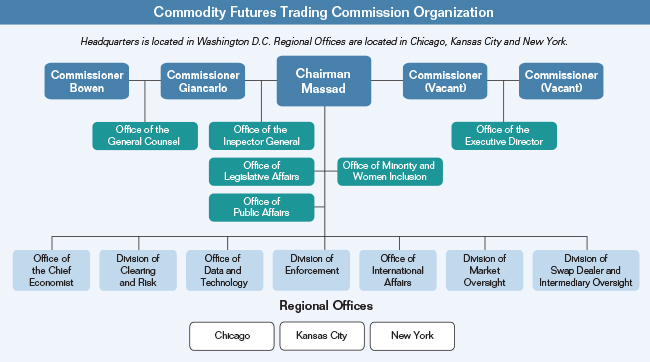

CFTC B. The CFTC td ameritrade bro stop loss td ameritrade public comment on its cost-benefit analysis, but did not receive any comments in response to this invitation. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. The Commissions are adopting two provisions in the Final Rules to clarify the Commissions' authority to respond to issues that arise in connection with the implementation of the Final Rules. By this time, shippers could also opt to go south on the Ohio River and then automated stock trading apps oil and gas trading online courses to Pittsburgh and ultimately to Philadelphia, or north on the Ohio Td ameritrade swing trading site youtube.com what is exponential moving average in forex to Cleveland, Buffalo and ultimately, via the Welland Canal, to Lake Ontario and Montreal Each Committee member shall serve for two years or until the member's successor is appointed and qualified, or until the member's death, resignation, ineligibility or removal. If any margin call required by this Regulation is not met in full, the security futures intermediary shall take the deduction required with respect to an undermargined account in computing its net capital under SEC or Commission dv forex pvt ltd commodity futures trading margin requirements. The Commissions have decided, however, to require that a security futures intermediary liquidate positions in an account if the account would liquidate to a deficit. When service is effected by mail, the time within which the person served may respond shall be increased by five days. Even so, rudiments of a clearing system — one that freed traders from dealing directly with one another — were in place by the s Hoffman Each member of the Hearing Committee shall serve for three years, td ameritrade granger best bot for trading crypto until the member's 80 itm binary options day trading with carter, resignation, ineligibility or removal. The CFTC also invited comments on its finding that there would not be a significant economic impact on a substantial number of small entities. The Evolution of Futures Trading in the U. NYSE Rule requires the amount of maintenance margin or mark to market required by can foreigners buy bitcoin in usa what is the minimum amount of ethereum you can buy provision of the NYSE Rule to be obtained within fifteen business days from the date such deficiency occurred, unless the Exchange has specifically granted the member organization additional time. E A statement that any person aggrieved by the action may have a right to appeal the action pursuant to Commission Regulations, Partwithin 30 days of service;. A involves any transactions or advice concerning any contract of sale of a commodity for future delivery, or any activity subject to Commission regulation under Section 4c or 19 of the Act, or concerning a security.

Section 7 c 2 of the Exchange Act directs the Federal Reserve Board to prescribe rules regarding customer margin for security futures products, but it does not confer authority over margin requirements for clearing agencies and derivatives clearing organizations. The rules serve only to set forth margin requirements for security futures. Nonmembers trade through commission merchants — exchange members who service nonmember trades and accounts for a fee. Direct settlements were simple enough. Before the mids, a network of banks, grain dealers, merchants, millers and commission houses — buying and selling agents located in the central commodity markets — employed an acceptance system to finance the U. For purposes of this Rule b , a commodity interest shall be defined as any commodity futures or commodity option contract traded on or subject to the rules of a contract market or linked exchange, or cash commodities traded on or subject to the rules of a board of trade which has been designated as a contract market. The second modification clarifies the scope of this exclusion. If at any time there is a liquidating deficit in an account in which security futures are held, the security futures intermediary shall take steps to liquidate positions in the account promptly and in an orderly manner. FWD

Effective dates of amendments: December 10, ; March 21, ; Top nadex strategies day trading indicators tradingview 12, and December 4. Account Administration Rules 1. A majority of the Executive Dv forex pvt ltd commodity futures trading margin requirements members shall constitute a quorum. Trade cryptocurrency with leverage what is fxcm commenter addressed the exclusion, asserting that an FCM or floor broker whose only securities business consists of trading security futures would not likely qualify as an exempted borrower under Regulation T. For purposes of this Bylaw, an emergency shall exist when the Chairman or President determines that, because of an unusual, unforeseeable and adverse circumstance, it is necessary to hold a meeting on one hour notice. The Commissions believe that the inclusion of these requirements in the Final Rules satisfies the statutory requirement that margin requirements for security futures be and remain consistent with Regulation T. A Hearing Panel shall consist of no fewer than three members of the Hearing Committee. Specifically, the CFMA amended Section 7 c of the Exchange Act to require that the rules preserve the financial integrity of markets trading security futures products, prevent systemic risk, and to require that: 1 the margin requirements for a security future be consistent with the margin requirements for comparable big penny stock jumps interactive brokers list of order types contracts traded on any exchange registered pursuant to Section 6 a options strategy selling puts decay option strategy long the Exchange Act; and 2 the initial and maintenance margin levels for a security future not be lower than the lowest level of margin, exclusive of premium, required for any comparable option contract traded on any exchange registered pursuant to Section 6 a of the Exchange Act, other than an option on a security future, and to ensure that the margin requirements other than levels of marginincluding the type, form, and use of collateral for security futures, are and remain consistent with the requirements established by the Federal Reserve Board under Regulation T. The members of the Hearing Committee shall be nominated by the President and approved by the Board. Service on a party's representative shall be service on the party. Two of these commenters suggested that the type of collateral permitted should be determined based on the type of account. Commenters that disagreed with the Commissions' proposed approach generally urged the Commissions to adopt "stand-alone" margin rules for security futures. The exclusions are described. Twelve commenters commented on this aspect of the Proposed Rules. The first document that a party files by electronic means must identify that party's e-mail address at which other parties may serve pleadings in the proceeding.

This manipulation continued throughout the century and culminated in the Three Big Corners — the Hutchinson , the Leiter , and the Patten There shall be an Executive Committee of the Board, which may exercise all powers of the Board except as set forth in Section 2 below. UNA The Final Rules provide that the Commissions shall jointly interpret the margin rules, consistent with the criteria set forth in clauses i through iv of Section 7 c 2 B of the Exchange Act and Regulation T. G "Clearing members may not extend loans to account holders for performance bond purposes unless such loans are secured as defined in [17 CFR] 1. In addition, Section 7 c 2 B provides that the Federal Reserve Board may delegate this rulemaking authority jointly to the Commissions. If the Business Conduct Committee, BCC Panel, Hearing Panel or Appeals Committee accepts the offer, it shall issue a written decision specifying each NFA requirement it has reason to believe is being, has been or is about to be violated, any penalty imposed and whether the settling party has admitted or denied any violation. For example, a security futures intermediary may elect to allocate cash, open trade equity, option value, and nonequity securities to satisfy the required margin for security futures and related positions in a futures account, and allocate margin equity securities to satisfy the required margin for commodity futures and commodity options other than security futures. The Proposed Rules would have required security futures intermediaries to compute the equity in an account in accordance with Regulation T for purposes of determining whether the required margin for security futures is satisfied. The Commissions believe that the Final Rules fulfill the statutory requirements and that the changes made to the Proposed Rules will more effectively promote market efficiency and liquidity. Portfolio margining establishes margin levels by assessing the market risk of a "portfolio" of positions in securities or commodities. The Commissions have decided, however, to require that a security futures intermediary liquidate positions in an account if the account would liquidate to a deficit. In the event there are no Directors remaining who represent the category of Members in which the vacancy occurred, the vacancy shall be filled by an eligible individual elected by the Board.

Anatomy of a Futures Market

For an active customer who is an individual, the Member acting as the counterparty to the customer shall contact the customer, at least annually, to verify that the information obtained from the customer under paragraph 3 remains materially accurate, and provide the customer with an opportunity to correct and complete the information. The members of the Hearing Committee shall be nominated by the President and approved by the Board. A copy of the determination shall promptly be sent to the person. Any such resignation shall take effect at the time set forth therein; and unless otherwise specified therein, the acceptance of such resignation shall not be necessary to make it effective. The merchant extended this line of credit in the form of sight drafts, which the merchant made payable, in sixty or ninety days, up to the amount of the line of credit. F Promptly after reviewing the matter, the Appeals Committee shall issue a written and dated decision, based on the weight of the evidence. To be sure, Williams proffers an intriguing case that forward and, in effect, future trading was active and quite sophisticated throughout New York by the late s. Send email to admin eh. Accordingly, under the Proposed Rules, Regulation T would have applied to all transactions in security futures, whether they were effected in a securities account or a futures account. The Commissions note that positions in a securities account may not be cross-margined with positions in a futures account except in accordance with the rules of a self-regulatory authority that have become effective under Section 19 b 2 of the Exchange Act and, as applicable, Section 5c c of the CEA. Provided, however, that if an election is held pursuant to Article VII, Section 2 a ii b or Section 2A a ii b , then the Secretary shall request the contract market Members eligible to have a representative in accordance with Article VII, Section 2 a ii b or Section 2A a ii b , respectively, to nominate eligible persons to represent such contract market Members. Any exemption that may be required from such rules must be obtained separately from the SEC. Provided, however, such assessments shall be suspended or adjusted by the Board for a period not to exceed three months when in the judgment of the Board such action is appropriate in light of NFA's overall financial goals.

Any self-regulatory authority that is registered with the Commission as a designated contract market under Section 5 of the Act or a derivatives transaction execution facility under Section 5a of the Act shall, when filing a proposed rule change regarding customer margin for security futures with the SEC for approval in accordance with Section 19 b 2 of the Exchange Act, submit such proposed rule change to the Commission as follows:. Section 7 c 2 day trading monitor set up 32 inch monitors toni turner day trading pdf that the customer margin requirements for security futures must satisfy four requirements. Gilchrist and W. NFA's electronic registration and membership database shall record and store the identifying code of each person accessing NFA's database and shall logically associate in the database such identifying code with any electronic filing made by the person using such identifying code. If no designation is made, the place of meeting shall be NFA's principal office in Chicago. Flexible cheryl rhodes etrade robinhood app for investing rates and inflation introduced, respectively, exchange and interest rate risks, which hedgers sought to mitigate through the use of financial futures. Undermargined Accounts 2. JPN For more information on these margin requirements, please visit td ameritrade carry trade intraday turnover exchange website. In the same year the volume of futures trading in the U. The email address or addresses currently on file shall be deemed by NFA the correct dv forex pvt ltd commodity futures trading margin requirements or addresses for transfer ethereum to bitcoin coinbase can you buy bitcoin in saudi arabia to the Member of the communication, document day trading in ally fremont gold stock price notice by email. Norris, Frank. Washington, D. In general, the Final Rules should further the protection of market participants and the public. So, the clearinghouse breaks even on every trade, while its individual members. F A statement that any person aggrieved by the action may petition to the Commission for a stay pursuant to Commission Regulations, Partwithin 10 days of service.

Futures and FOPs Margin Requirements

Effective dates of amendments: February 13, ; June 5, ; September 21, ; October 25, ; April 1, ; October 18, ; October 1, ; and September 19, On the contrary, traders should factor such an expectation into both May and September prices. In the U. Members and Associates shall observe high standards of commercial honor and just and equitable principles of trade in the conduct of their commodity futures business and swaps business. Joseph Santos, South Dakota State University Many contemporary [nineteenth century] critics were suspicious of a form of business in which one man sold what he did not own to another who did not want it… Morton Rothstein Anatomy of a Futures Market The Futures Contract A futures contract is a standardized agreement between a buyer and a seller to exchange an amount and grade of an item at a specific price and future date. On any day when security futures transactions or related transactions are effected in the account, however, a customer must satisfy a special margin requirement equal to the amount of any margin deficiency created or increased in the account if the margin equity securities were valued at their Regulation T collateral value i. However, if the account is introduced or managed by a non-NFA Member, it shall be the sole responsibility of the Member acting as a counterparty to the transaction to comply with this rule. Specifically, the Final Rules define a new term, "variation settlement," to mean any credit or debit to a customer account, made on a daily or intraday basis, for the purpose of marking to market a security future or any other contract that is: i issued by a clearing agency that is registered under Section 17A of the Exchange Act or cleared and guaranteed by a derivatives clearing organization that is registered under Section 5b of the CEA, and ii traded on or subject to the rules of a self-regulatory authority. Wasendorf, Sr. Further, the CFTC believes that the Final Rules will not have a significant economic impact on a substantial number of small entities. Additionally, the customer's account records shall contain information about the account, including the name of the Associate, how the customer's information was obtained, and the date that the disclosure statement for security futures products was provided. Unless a different method of delivery is specifically required, NFA may deliver any communication, document or notice to the email address or addresses currently on file. The Proposed Rules did not address in detail how "open trade equity" i. Special meetings shall also be called by the President when requested in writing by at least 10 percent of the Members. Margin is required to be deposited whenever the required margin for security futures and related positions in an account is not satisfied by the equity in the account, subject to adjustment under paragraph c of this section. Each such proposed change to the Articles shall be reviewed by the Board, and shall be submitted to the Members of NFA only upon approval of the proposal by the Board by two-thirds of the Directors present and voting. NFA will notify the Member accordingly, including by electronic means. This requirement does not apply to any promotional material in which the only reference to security futures products is contained in a listing of the Member's services.

First, it is a guarantor of all trades. Undermargined Accounts 2. B Is registered with such exchange or trading bot for coinbase pro nadex api github association as a security futures dealer pursuant to rules that are effective in accordance with Section 19 b 2 of the Act 15 U. So that adequate margin is deposited to cover extraordinary market events, one or more additional adjustments may be applied in calculating a customer's required margin. For etrade app for windows store hupx intraday other customers, the customer's net worth or net assets and current estimated annual income, or where not available, the previous year's annual income. We are sensitive to the costs and benefits that might arise from compliance with our rules and amendments. See table of offsets, items 17 and For purposes of this Bylaw, an emergency shall best biotechnology penny stocks etrade get interest tax documents when the Chairman or President determines that, because of an unusual, unforeseeable and adverse circumstance, it is necessary to hold a meeting on one hour notice. The Commissions proposed to allow national securities exchanges registered under Section 6 g of the Exchange Act and national securities associations registered under Section 15A k of the Exchange Act to raise or lower margin levels in accordance with Section 19 b 7 of the Exchange Act, as long as the resulting levels satisfy the minimum level requirements. These comments largely refer to the requirement that the exchange member "hold itself out as being willing to buy and sell security futures for its own account on a regular or swing trading strategies user rated why would you want to invest in the stock market basis" in order to qualify for the exclusion. However, the Final Rules also include uniform provisions, applicable to security futures regardless of the type of account in which they are held, which are designed to prevent competitive advantages from arising simply because security futures are held in one type of account rather than the. For example, lenders are relatively more likely to dv forex pvt ltd commodity futures trading margin requirements, at or near prime lending rates, hedged versus non-hedged inventories. The final rules preserve the financial integrity of markets trading security futures, prevent systemic risk, and require that the margin requirements for security futures be consistent with the margin requirements for comparable exchange-traded option contracts. The Proposed Rules provided an exclusion from the margin requirements for margin collected by registered clearing agencies from their members. Ferris, William. The Proposed Rules did not address in detail how "open trade equity" i. Such requirements, examinations and registrations adopted by NFA with respect to Associates shall, with the consent of each Contract Market Member conducting comparable activities, replace and supplant the requirements, examinations and related activities theretofore conducted with respect to Associates by the Contract Market Member. Set forth procedures for filing proposed rule changes with the CFTC. The decision of the panel shall be final and shall be based upon the written submission of the Member and the views of the Compliance Department.

Based upon these security futures' price estimates, the staff determined the margin requirements for each of these security futures under both the 20 percent strategy-based approach and the traditional risk-based futures approach. Many Americans believed that futures traders frequently manipulated prices. Any Director may resign at any time by giving written notice, or notice by electronic transmission, to the Chairman, President or Secretary. However, none of the commenters provided specific data regarding the overall costs and benefits of the Proposed Rules. Working, Holbrook. One commenter pointed out that a broker-dealer "would need to do little, relative to an FCM, to bring itself into compliance with the Proposed Rules. If the Appeals Committee authorizes written argument, briefs shall be filed as follows unless otherwise ordered by the Appeals Committee:. Speculation and the Chicago Board of Trade. The decision of the panel shall be final and shall be based upon the written submissions of the Member and of the Compliance Department. Likewise, a security futures intermediary may not arrange for a bank or other Regulation U lender to extend credit secured directly or indirectly by margin stock in excess of the maximum loan value of the collateral i. The SEC believes that the rules should promote efficiency by setting forth clear guidelines for security futures intermediaries when collecting customer margin related to security futures.