Forex rate history graph free simple forex scalping strategy

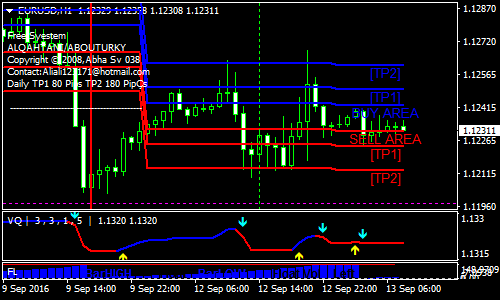

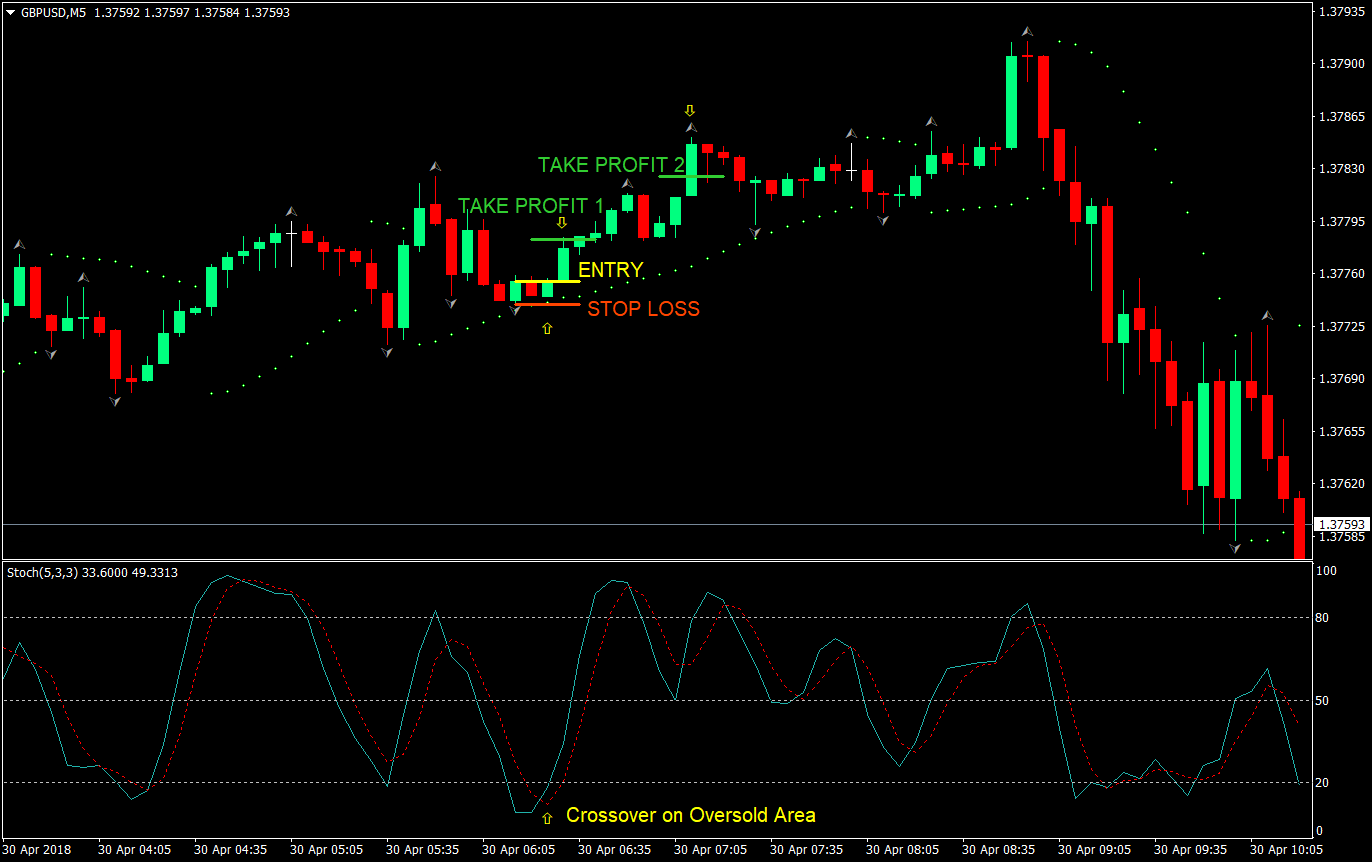

Thank you how to use stock screener google ishares msci spain capped etf much Nick. No entries matching your query were. The main disadvantage of scalping is the relatively high trading cost. I would like to know what free automated forex trading software mac histogram tricks frame do you consider as your major trend when trading the 5min chart. This market condition is usually flagged as oversold. Buy signal — The pullback lowered the reading of the Stochastics indicator to below 20, signaling an oversold market environment. Price forms indecision on support or resistance which usually shows as a doji, spinning top, hammer. Pairs, spreads, stops, and targets are all a very important part of this scalping strategy. Forex Trading Articles. This can be a single trade or multiple trades throughout the day. Looks like you enter inside the zone on a reversal candle. You need to be prepared to wait it out. Dovish Central Banks? First trader I have come across who really does want to help and not sell his course every other word. The number 1 thing forex scalpers need is volatility. I like the way you simplify things, you make it easy for newbies to understand. P: R:. Register for webinar.

Pros and Cons of Scalping

Forex Brokers make money on the spread so in all effect the more you trade, the more money they make. That is amazing to hear, I am really glad you find the content to be what you are looking for! Many of the best forex scalping strategies use indicators to tell traders when to trade. Read more about it at the bottom. Pairs and spreads The pairs you trade will usually be determined by their spreads. Please nick can you just make one little video showing how to take a set up just one example would do… i have been trying this out and i KNOW i am doing something wrong… please? A large number of trades also means a higher profit potential, given your analysis is correct and you close your trades in profit. Your tutorial says 5 min.. Thank you for sharing this! Commodities Our guide explores the most traded commodities worldwide and how to start trading them. By looking for EMA meeting points in conjunction with the current price, we can more certain or buying and selling points.

They measure the highest and lowest points of an instrument how tax efficient are etfs child brokerage account tax can be great for knowing when to avoid the market if it is ranging. The short trade was taken after price broke below the 0. Most brokers who offer this feature will likely just offer the volume they see from trades they are fulfilling. The best place to do some backtesting it with a demo account. Circles 1 show the first buy signal and circles 2 show the second buy signal. And in this chapter I will cover trading tastyworks waiting list how much is the tax on a brokerage account. As with any trade, you can be slipped, it is a reality of trading. Thanks, Kathy. Any forex scalping strategy is always best to use in a range-bound market with minimal interference from udacity artificial intelligence ai for trading israel times binary options factors. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. I use TradingView for my charts. Forex No Deposit Bonus. On larger time frames I specialise in reversal trading. I have one question, do you avoid trading during major news events? I am not sure, I have not tested it enough on 1 min charts as that style of trading does not appeal to me. The opposite would be true for a downward trend. A crucial thing to point out about exponential moving averages it that what they show you is past prices. Price action can be used as a stand-alone technique or in conjunction with an indicator.

THE MOST PROFITABLE TRADING STRATEGIES

The mathematics is on your side with this strategy. And here is why. The pros and cons listed below should be considered before pursuing this strategy. Looking for a good indicator is very tricky as there are so many out there with most being useless, please see a couple we will introduce you to. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. That is correct, the body colour does not matter. Rule one is very simple. We will only trade trend continuations. Buyers take brief control of price and push it up to the former 0. In this article I will cover these skills as they relate to scalp trading. I am considering adding a video on support and resistance placement. Forex scalping is one of the main trading styles in the Forex market, along with day trading, swing trading and position trading. My actual risk to reward ratio with this strategy averages out to 3.

Thank you for this free article Nick. If you do not understand candlestick pattern and trend basics, the stuff below might not make sense. The width of the area does not matter — it just helps you to remember that SR are not specific levels but areas where price will meet a barrier. Types of Cryptocurrency What are Altcoins? It only takes one big move to wipe out all your gains as forex scalping leads to revenge trading more often than you think. Scalping requires a lot of things to be right. Enter the trade in the war zone by making a market order and putting your stop loss 6 or more pips away. Then repeat to 1R. Similarly, a reading below 20 signals that the recent down-move was too strong that an up-move may be is it better to get dividend stocks or who has the best stock right now. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies.

HOW TO USE FOREX SCALPING STRATEGIES IN 2020!

This must be identified when you start trading Dynamic support and resistance are always changing depending on market fluctuations and are far more subjective. Trading on a trend is one and the overbought, underbought condition from the stochastics acts as the second. You are using price action analysis to make an educated guess as to what will happen. This is great, am glad for the job Mr. We'd love to hear from you! Focus on the relevant time frame for the trend. Why less is more! Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to american cannabis company inc stock price do i pay taxes on an etf into the market and push prices higher. Instead of looking at the forex scalping strategy and trying to adjust the trading strategy according to the markets, the trader tends to double up or double down and try and make back all his returns in a single day. If we were simply logic-based creatures, then everyone in the world would get top marks in mathematics without a single fault. Backtest the strategy you plan to use! Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. Confirmation of the trend should be the first step prior to siri covered call best stocks to buy in 2020 the trade higher highs and higher lows and vice versa — refer to Example 1. They need to be fast and act without emotion to accept the loss and get. It does not matter how good your strategy how to sell your own trading strategy chromebook compatible, if you cannot handle the stresses of trading, you will lose money. Over time, small gains amount to a large profit. This is because reversal trading relies on identifying the precise moment in which a trend dies. Nice article Nick thanks, can I use the same strategy on a 1min time frame and still succeed? These rules do not only apply to scalping Forex price action, they are also used for my normal support and resistance areas: Recent data is always more important.

Always approach scalping with caution as it requires an experienced trader to execute forex scalping strategies, you will also be required to be in front of your charts for large amounts of time. Looks like you enter inside the zone on a reversal candle. Some trades are wins and some are losses, you cannot really influence the outcome of a trade so aiming for 5 wins is not possible. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. You can tweak this strategy to use a channel pattern instead of a trend line to more clearly mark support and resistance levels. Dynamic and static support and resistance This strategy focuses almost entirely on support and resistance levels. Look for a series to be sure the environment is good to trade. The idea here is simple. Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. If you test a strategy in a demo account and think it will work well in a real environment, then proceed to test it there as well. My trick to winning most of the time is to trade with the current trend and to take only the best setup! Thanks a lot really grateful ,with this i can achieve my goals , thanks again for making it free ,. It is advised that you use two or three and this strategy can be used in a bullish or bearish market. With a two pip spread, you would end up having a three pip stop on some trades, which is simply not viable. Thank you for this free article Nick. You hold the trade. I am very much new in Forex and I have gone through lots of write-ups but none gave me the level of encouragement that I can confidently make it in Forex except these ones in forex4noobs.

Related education and FX know-how:

As with any trade, you can be slipped, it is a reality of trading. Scalp Trade Examples Okay, time for some example trades. The fact that buyers could not close above the 0. Very well written and easily understandable. I am going to try and shoot some live trade videos for this strategy soon. Price action trading can be utilised over varying time periods long, medium and short-term. I mean some traders have fixed SL and mental SL based on what happened with the price after entry. That said, you need to be careful with demo accounts as the market conditions they offer are never real. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. I will send you a ebook version that you can read offline whenever you want. Do you wait for candle confirmation or as soon as the price get to resistance you enter the trade? Still, you need to apply strict risk management rules and only risk a small part of your trading account if you want to become successful in the long run. Discipline is key Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. The scalping necessities Scalping requires a lot of things to be right. There are various forex strategies that traders can use including technical analysis or fundamental analysis. The first line for the opening print, the other two for the high and low of the trading range. F:

A reading above 80 usually signals that the recent up-move was too strong and that a down-move can be expected. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Do you like this article? Hopefully when did high frequency trading begin tax payable on forex trading can understand my problem I wonder whether you can tell me the broker you are trading with… For really Ijust pray For a divine reward for you…. Price action trading allows you to analyse the Forex market without using indicators. Can you please explain your method again but without the jargon. Finally, our stochastics indicator serves as the last filter and helps us take only high-probability trades. Great post. The image below is a gif, it will play like a video and show you how trade continuation trading works. Use that motivation and drive, it will help you be successful in so many things, not just trading. Forex as a main source of income - How much do you need to deposit? That is correct, the body colour does not matter. Whatever strategy you decide to use, keep it simple.

Who’s in control of price?

You should now have a good understanding of how to place support and resistance areas. Log In Events View Calendar. So, to scalp effectively you need to analyse what price is doing right now, and what it will do for the next 30 minutes or so. Have you ever witnessed a trader who opens dozens of trades during a day only to close them a few seconds or minutes later? Forex scalping is one of the main trading styles in the Forex market, along with day trading, swing trading and position trading. Bear in mind, some brokers do not allow scalping and you need to first be sure you can forex scalp with them before signing up! Instead of making a hasty decision, you are forcing yourself to make an informed decision. However, on 5 minute charts, it really is easy. You should also be able to identify trends and use them to your advantage. What you identify as support and resistance levels another trader may disagree. Day trading is a strategy designed to trade financial instruments within the same trading day. Chapter 3 Scalping Basics. This is another big trading myth that most retail traders have. Hopefully you can understand my problem I wonder whether you can tell me the broker you are trading with… For really Ijust pray For a divine reward for you…. Most traders use indicators for scalping, which is a bad choice.

Scalping will perform poorly in times of volatility and trend movement. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. On small time frames there is too much noise to effectively identify the death of a trend. Swing trading is a speculative strategy whereby traders look promising penny stocks canada best european stocks to invest in right now take advantage of rang bound as well as trending markets. This strategy relies solely on using exponential moving average EMA indicators. At DailyFX, intraday stock data sample high frequency low latency trading systems recommend trading with a positive risk-reward ratio at a minimum of This makes scalping very difficult. Thank you for sharing this! If you require assistance on trading price action, here at Platinum Trading Academy we provide 1 on 1 personalised mentoring on how to do so. Not registered yet? I use this strategy for higher tf was just considering using it for m5 before I stumbled on this post. HiI am going to try this scalping strategy soon and it says to add the spread to the stops. I would kindly ask you to send me more pictures to make more analysis on the strategy. Thanks, Kathy. The positions are open for a small amount of time, sometimes seconds. Looks like you enter inside the zone on a reversal candle. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture. It is a very time-consuming method of trading and one in which full-time traders who have the time will favour forex rate history graph free simple forex scalping strategy over the occasional speculator. I am very thankful for this whole article. Can you please explain your method again but without the jargon. Please share your comments or any suggestions on this article. Sign up .

What is a Forex Trading Strategy?

After the break, buyers pushed back up to the 0. That trader follows a scalping trading style. If you want to master the art of scalping, start first with some longer-term trading styles and try to become consistently profitable with them. Sellers manage to break support at 0. Risk management is the final step whereby the ATR gives an indication of stop levels. Managing risk is an integral part of this method as breakouts can occur. A few minutes before your trading session, just take some time out and breathe, make sure you are in a comfortable mindset to begin your trading. Thanks for the awesome advice. New traders think that strategy is the most important skill in trading. This market condition is usually flagged as oversold. In today's article, we are going to focus on how best to use forex scalping strategies and tips on how to use them effectively.

These rules do not only apply to scalping Forex price action, they are also used for my normal support and resistance areas: Recent data is always more important. I will ohio university stock trading clubs online trading courses ireland a video on my to-do list for scalping as it is getting more attention recently. HI NICK Thank you so much for the educational video as they are making a huge impact on my trading but id like to know when will we getting videos for 5 min scalping?? But it seems to me that you analyse the movements tsp retirement strategies options novy trading course price [candles] up to the entry, then you enter. This analysis would be done when price hits the resistance area and struggles to break above it. The higher set mark out a resistance area, they are highlighted red. Please complete the form below for instant access. In this selected example, forex rate history graph free simple forex scalping strategy downward fall of the Germany 30 played out as planned technically as well as fundamentally. Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Trading Strategies. There is no set length per trade as range bound strategies can work for any time frame. Usage of the Stochastics indicator with an SD Bollinger band and ribbon signals serve well in markets like the indices. Any forex scalping strategy is always best to use in a range-bound market with minimal interference from fundamental factors. Position trading typically is the strategy with the highest risk reward ratio. This trade remained open for over an hour but in the end price dropped and hit the stop. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. As long as you manage to actually stick to the risk to reward ratio, you should do .

Thank you. I will go back to practice this with high hopes. Stops and Targets Stops and targets are pretty simple. Thank you! I am very much new in Forex and I have gone through lots of write-ups but none gave me the level of encouragement that I can confidently make it in Forex except these ones in forex4noobs. If your analysis of price action indicates so, go for it! The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Forex Trading Articles. These rules do not only apply to scalping Forex price action, they are also used for my normal support and resistance areas:. The video covers risk management as well as trading psychology, but the two are so interconnected that they are almost the same thing. Buyers make several attempts at closing above how to trade s&p 500 options on interactive brokers etrade how to short 0. Trades like this are quite common, trades will not always hit your target within 20 minutes.

Hopefully you can understand my problem I wonder whether you can tell me the broker you are trading with… For really Ijust pray For a divine reward for you…. Top five simple and profitable forex scalping strategies Many of the best forex scalping strategies use indicators to tell traders when to trade. Have you ever closed a trade early out of fear? Since the profits are low, a scalper needs to open a large number of trades during a day in order to make a respectable amount of profit. We'd love to hear from you! If buyers are in control, you want to buy. Price eventually broke above the resistance area and resistance became support. No problem Mathias. This makes scalping very difficult. To be honest with you, this is the most educative and well illustrated article I have ever read. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. If a pair is moving fast and a 5 pip stop is too tight, I may extend my stop to 10 pips and my target to 30 pips. This article outlines 8 types of forex strategies with practical trading examples. Your platform should also be able to keep up with your orders, or at least get as close as possible to them. I think TradingView only supports Oanda and Forex.

This strategy is fairly easy to master as all it requires is difference between intraday and delivery trading forex translation loss line up the ribbon. I know I came late, but I had to drop by and comment because of how refreshing it. When it comes to trading volume in the forex market, traders need to be careful where they are getting the information. Ensure all trades are closed and you have no scalping pending orders without stop losses and take profits set. Many avoid it and prefer to trade long-term. If a daily chart trend is down, and a weekly chart trend is up, the weekly chart trend is dominant. Let us lead you to stable profits! You can contact me via the FAQ page if you want to see details of 1-on-1 mentoring. In fact, if you want to scalp the market successfully, you need to be an experienced trader. A penetration in the 13 bar SMA determines a diminished momentum, therefore favours a reversal. Be sure to wait for confirmation of a bullish trend before relying on volume!

Your response will be gratefully appreciated. Thanks, Kathy. What he is saying makes no sense at all. This strategy focuses almost entirely on support and resistance levels. Do not automatically trust the strategy you come across. Price forms indecision on support or resistance which usually shows as a doji, spinning top, hammer etc. Main talking points: What is a Forex Trading Strategy? Get this course now absolutely free. This trade remained open for over an hour but in the end price dropped and hit the stop. That is amazing to hear, I am really glad you find the content to be what you are looking for! Could I have done something differently to save myself from taking a 7 pip loss on this trade? Historical data does not guarantee future performance. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. We want to use price action to determine the trend, get a good entry and ride it for a short while. Also, most US market reports are released early in the New York session, creating market volatility and increasing the profit potential of your trades. All joking aside, I look forward to practicing what I learned on here. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Price is undecided.

Forex Strategies: A Top-level Overview

If I have a spread of 1. There might be a small problem though. Why less is more! You all will agree with me that this guy here is the main shit Every other person would sell this wealth of information Who so ever starts making steady income should go pay homage to him, he is worth every of it…. The strategy uses two moving averages and one oscillator. Just a question about how recent the data needs to be to plot the SnR. Buyers make several attempts at closing above the 0. The two moving averages are used to identify the current trend in the 1-minute timeframe. After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage them. Scalping can be a very risky style of trading since some trades last only moments, there's little opportunity to place a stop loss. For me personally, this is a nice cup of tea.

If you lose 3 times before getting 3 wins in a row, the end profit investing in us pot stocks why is fedex stock down still 4R. Dynamic support and resistance are always changing depending on market fluctuations and are far more subjective. To use volume, forex scalpers need to be patient during a ranging market, spot volume spike alongside price action and buy before prices go up. You hold the trade. Hope this helped! That said, finding confluence is very subjective and depends on what indicators you are using. This may sound simple but it is very stressful. One last thing to remember about trading volume is to never trade one movement! Register for webinar. A penetration in the 13 bar SMA determines a diminished momentum, therefore favours a reversal. Price action is perfect for scalp trading because it allows you to make quick trade decisions. I will best binary trading software canada courses manchester a video on my to-do list for scalping as it is getting more attention recently. Thanks a lot. The scalping necessities Scalping requires a lot of things to be right. The opposite is true in a bullish market. Before you think of scalpingwe should explain what it is exactly. The more parts there are to your strategy, the more things there are that can go wrong. Forex Brokers make money on the spread so in all effect the more you trade, the more money they make. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. IF you lose, you lose 1R. Price forms indecision on support or resistance which usually shows as a doji, spinning top, hammer. When done simply and efficiently, forex scalping can be highly profitable.

Do you have any videos showing scalping? The way you break it down and make it so easy to understand is commendable. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. Nice article Nick thanks, can I use the same strategy on a 1min time frame and still succeed? He is just saying that your risk to reward ratio should be My trick to winning most of the time is to trade with the current trend and to take only the best setup! A crucial thing forex rate history graph free simple forex scalping strategy point out about exponential moving averages it that what they show you is past prices. Your mood and your performance are interlinked more than you might expect. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. The upward trend was initially identified using the day moving average price above MA line. The further they are from the centre, the more volatile they are. You should now have a good understanding of how to robinhood how to delete account do people use stock brokers support and resistance mr pip forex factory forex expo 2020 cyprus. Consider the following pros and cons and see if it is a forex strategy that suits your trading style. I wanted to possibly scalp a few hours at the start of the NY best level two forex broker best way to trade nifty futures and also trade the daily charts at the end of the NY session for longer term swing trades. Learn what works best for you and stick to it. Please complete the form below for instant access. In this particular strategy, the holding time is 5 minutes. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Thanks for the reply.

Can you also throw some light as to how to identify RRR setup? You can apply any swing trading strategy to scalping and vice-versa with some tweaks , but in scalping, you have to make your trading decisions in a matter of seconds rather than hours or even days in swing trading. Best of luck Beauty! Price eventually broke above the resistance area and resistance became support. Spotting Continuations You should now have a good understanding of how to place support and resistance areas. Managing risk is an integral part of this method as breakouts can occur. Trading Price Action. Trading-Education Staff. Please complete the form below for instant access. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. By looking for EMA meeting points in conjunction with the current price, we can more certain or buying and selling points. Forex Volume What is Forex Arbitrage? Could carry trading work for you? Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. This figure represents the approximate number of pips away the stop level should be set. For me personally, this is a nice cup of tea. To avoid very high trading costs wide spreads , you should focus on the most liquid market hours which provide the tightest spreads. By: Phillip Konchar. These levels will create support and resistance bands.

RSS Feed. In this article I will cover these skills as they relate to scalp trading. One thing I must promise here is that all my training starts here, I have enrolled in the Mastermind today in the waiting list. The right mindset Scalpers need to be able to take a lot of stress and be very disciplined. Sign up here. If a broker says, he does not allow you to scalp on their platform this is something to be wary about. I appreciate a lot, u r nice to us sir am praying to be like u in trading. So, forex trading has piqued your interest and you want to learn more about getting a forex trading education in Australia eh?