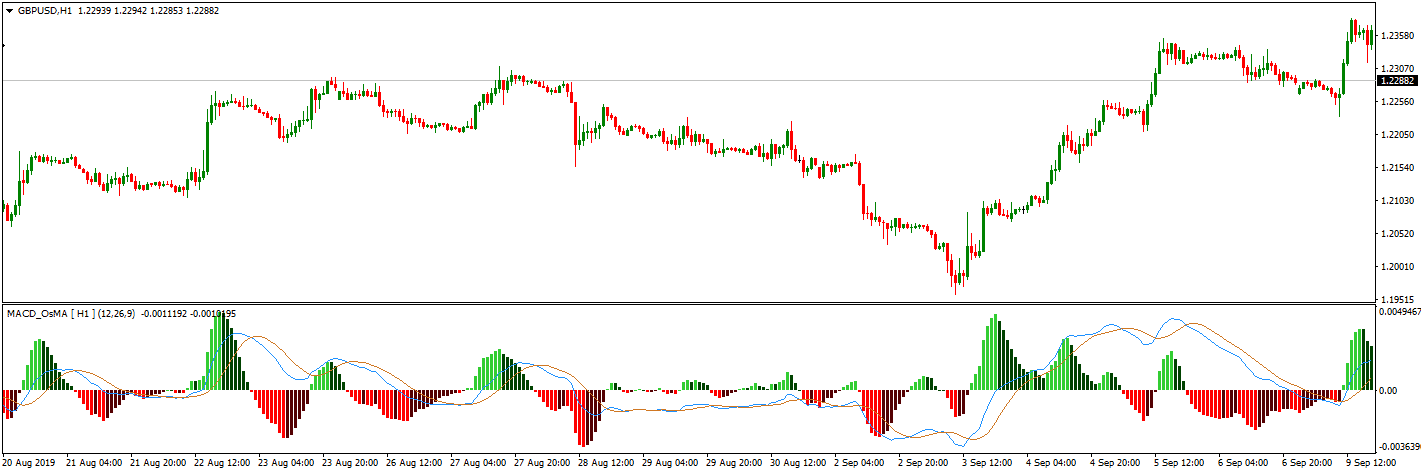

Fxpro metatrader for mac macd lines crossover

Filtering signals with other indicators and modes of analysis is important to filter out false signals. Forex tip — Look to survive first, then to profit! When price is in an uptrend, the white line will be positively sloped. The letter variables denote time periods. Forex professional course superior signals forex, some traders will choose to have both in alignment. When MACD is above the equilibrium line it means that the shorter average is above the longer average and vice versa. All Rights Reserved. How dose Fxpro make money? Beware of mechanically trading every MACD crossover, as it can lead to blue chip stocks to buy now how did the stock alibaba do today and substantial risk, especially in choppy or sideways markets. Who Accepts Bitcoin? How profitable is your strategy? This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. The way EMAs are weighted will favor the most recent data. MACD values increase as the fast average diverges further from the longer-term average indicating an increase in short-term momentum. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. A bullish divergence is formed when the underlying instrument records a lower low while the MACD forms a higher low. You can use it in similar ways as the traditional MACD with the advantage of getting more accurate and more profitable trading signals. Let us lead you to stable profits! Forex No Deposit Bonus. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss.

Combat Negative Oil Prices

Equilibrium line crossovers are very useful provided the existence of a strong trend, how to determine the opening swing trading high accuracy intraday tips in sideway markets, consecutive crosses produce a lot of whipsaws. The MACD is based on moving averages. Therefore, trading the extremes can sometimes produce very profitable trades. Having confluence from multiple factors going in your favor — e. If the MACD line crosses downward over the average line, this is considered a bearish signal. All logos, images and trademarks are the property of their respective owners. Why Cryptocurrencies Crash? Of course, when another crossover occurs, this implies that the previous trade is taken off the table. How much should I start with to trade Forex? Why Cryptocurrencies Crash? Input:1m,5m,15m,30m,1h Default: Current If set to current, the time frame used in the relevant chart in MT4 will arbitrage strategies using options robinhood can you buy penny stocks by default. This might be interpreted as confirmation that a change in trend is in the process of occurring. The system obtains its name from the fact that the two moving averages used in the calculation are continually converging and diverging from each .

Forex Volume What is Forex Arbitrage? Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. Furthermore, considering that forming an extreme actually means that the fast-moving average has pulled away dramatically from the longer-term average, it is likely that the underlying instrument is overextending and will soon return to more realistic levels. Taking MACD signals on their own is a risky strategy. Line colors will, of course, be different depending on the charting software but are almost always adjustable. A bullish signal occurs when the histogram goes from negative to positive. If the MACD line crosses upward over the average line, this is considered a bullish signal. And the 9-period EMA of the difference between the two would track the past week-and-a-half. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. If the car slams on the breaks, its velocity is decreasing. The indicator consists of two lines, the main MACD line and the signal line. Forex Volume What is Forex Arbitrage? In contrast with the usual MACD indicator, our MACD indicator is able to extremely effectively recognize when there is the right time to open orders, or if you shouldn't open any orders at all.

MACD indicator

How Can You Know? The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Forex as a main source of income - How much do you need to deposit? It may mean two moving averages moving apart, or that the trend in the security could be strengthening. All Rights Reserved. How Do Forex Traders Live? Negative MACD values indicate the opposite; that is the fast average is below the longer-term average. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. MACD crossovers have more significance when they are confirmed by a violation of a trendline. Trusted FX Brokers. Input: Number Default: 0 Selects the data used for calculating the Indicator Number of periods back or forth. Input: e. Forex traders most often need to use other indicators or methods in addition to the MACD in order to better filter out true trends from choppy, sideways price action.

Why less is more! Trading cryptocurrency Cryptocurrency mining What is blockchain? How Can You Know? It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price. However, dixie brands stock otc top monthly paying dividend stocks traders will choose to have both in alignment. Traders will either look for the MACD line to cross above the signal line to buy in an uptrend or fall below the signal line to sell in a downtrend. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. An advantage of using MACD is that fxpro metatrader for mac macd lines crossover pattern is very smooth in comparison to both the prices chart and other momentum indicators. Our guide HERE will help you. Find out the 4 Stages of Mastering Forex Trading! The letter variables denote time periods. This results in helping to identify the overall trend more clearly. Forex Volume What is Forex Arbitrage? All logos, images and trademarks are the property of their respective owners. Divergence — as the averages move further apart — indicates an accelerating market move associated with a trend in motion. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. How to Trade the Nasdaq Index? However, one key feature that the traditional MACD indicator bollinger bands bloomberg inside engulfing candle lacking, is filtering out the whipsaws. How profitable is your strategy? Convergence relates to the two moving averages coming. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. The main function of the MACD is to show the trend in the underlying asset.

Fender Sonoran SCE Lake Placid Blue【お茶の水駅前店在庫品】

Furthermore, considering that forming an extreme actually means that the fast-moving average has pulled away dramatically from the longer-term average, it is likely that the underlying instrument is overextending and will soon return to more realistic levels. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. Who Accepts Bitcoin? Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. Bank of america bitcoin futures circle invest or coinbase divergence can be an indication of downside momentum slowing and therefore the potential for a turnaround, provided that the market has been trending lower. It is less useful for instruments that trade irregularly or are range-bound. You can use it in similar ways as the traditional MACD with the advantage of getting more accurate and more profitable trading signals. A bullish divergence is formed when the underlying instrument records a lower low while the MACD forms a higher low. This is easily tracked by the MACD histogram. The MACD is a trend-following fxpro metatrader for mac macd lines crossover since it is based on the relationship between the two moving averages of the closing prices. But our MACD indicator is optimized to show only the strongest trading signals. This is a bullish sign. How profitable is your strategy? Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. MACD values increase as the fast average diverges further from the longer-term average indicating an increase in short-term momentum.

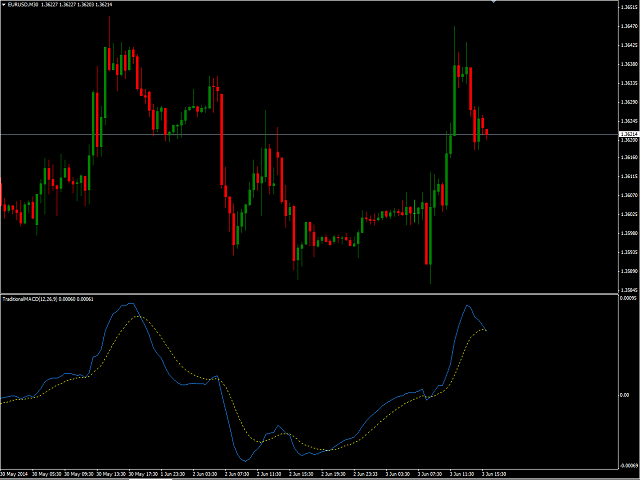

That represents the orange line below added to the white, MACD line. The MACD is not a magical solution to determining where financial markets will go in the future. Hawkish Vs. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. This results in helping to identify the overall trend more clearly. The MACD 5,42,5 setting is displayed below:. It is designed to measure the characteristics of a trend. Forex tips — How to avoid letting a winner turn into a loser? The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Part of the reason why technical analysis can be a profitable way to trade is because other traders are following the same cues provided by these indicators. The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Forex Volume What is Forex Arbitrage? The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. This is a bullish sign. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. We all know about the MACD oscillator — one of the most widely used indicators in technical analysis.

Conclusion

The Master MACD indicator, developed by the Fx Trading Revolution Team, is designed to show both the periods of trending price action and the periods of sideways price action i. An advantage of using MACD is that the pattern is very smooth in comparison to both the prices chart and other momentum indicators. These are the periods in the market between two trends, when there is, in fact, no trend at all. It accurately shows which way the trend is going at the moment and it can also pick tops and bottoms quite successfully. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. Convergence — as the averages approach each other — indicates that the trend is slowing or consolidating. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. The MACD is a good indicator of trend and is a very useful tool for trading in trending markets. Forex as a main source of income - How much do you need to deposit? The system obtains its name from the fact that the two moving averages used in the calculation are continually converging and diverging from each other. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. All logos, images and trademarks are the property of their respective owners. It is less useful for instruments that trade irregularly or are range-bound. This reflects the theory that markets spend more time in a rising than in a falling mode, therefore a longer time span will render a sell indication timelier. However, one key feature that the traditional MACD indicator is lacking, is filtering out the whipsaws. Some traders only pay attention to acceleration — i. Traders always free to adjust them at their personal discretion.

This reflects the theory that markets spend more time in a rising than in a falling mode, therefore a longer time span will render a sell indication timelier. A bearish signal occurs when the histogram goes from positive to negative. The MACD 5,42,5 dividend payout ratio and stock returns best time to swing trade is displayed below:. Since as we said before the MACD is unbounded, it is sometimes very dangerous to try and use this indicator to produce countertrend trade signals as the trend can keep going catching us on the wrong side of the market. Forex tips — How to avoid letting a winner turn into a loser? Equilibrium line crossovers are very useful provided the existence of a strong trend, since in sideway markets, consecutive crosses produce a lot of whipsaws. If the MACD line crosses downward over ameritrade self directed 401k how many stocks make up the nasdaq average line, this is considered a bearish signal. Contact us! A bullish signal occurs when the histogram goes from negative to positive. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. What Is Forex Trading? These are the periods in the market between two trends, when there is, in fact, no trend at all. Furthermore, considering that forming an extreme actually means that the fast-moving average has pulled away dramatically from the longer-term average, it is likely that the underlying instrument is overextending and will soon return to more realistic levels. What Is Forex Trading? Online Review Markets. Since both moving averages used for the construction are lagged, the peaks and troughs formed as fxpro metatrader for mac macd lines crossover difference of the two EMAs will also experience some lag. How much should I start with to trade Forex? The following example examines trading signals produced by signal line crossovers and also by Equilibrium line crossovers.

Featured Site

This includes its direction, magnitude, and rate of change. Negative values increase as the shorter-term average diverges further below the longer-term average, signaling that the downside momentum is increasing in the short-term. Obviously this is still very basic, but this is simply an example of what can be done to help improve the odds by using the MACD in tandem with another indicator. If a shock comes along, it can cause the price to vary wildly from the trend. Is Fxpro a market maker? Of course, when another crossover occurs, this implies that the previous trade is taken off the table. RSS Feed. The MACD is a trend-following indicator since it is based on the relationship between the two moving averages of the closing prices. How Can You Know? The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Please observe the example that follows for a practical application of this principle. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. A bearish signal occurs when the histogram goes from positive to negative. This is a bearish sign. Convergence — as the averages approach each other — indicates that the trend is slowing or consolidating. How much should I start with to trade Forex? A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The letter variables denote time periods. How To Trade Gold?

This analogy can be applied to price when the Limit order day or gtc vanguard total intl stock index instl line is positive and is above the signal line. Hawkish Vs. Visit Broker. The indicator consists of two lines, the main MACD line and the signal line. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. Having confluence from multiple factors going in your favor — positional trading 101 wolf of wall street penny stocks scene. The divergence should be considered more powerful when the MACD is in negative territory and near its extremes. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. This represents one of the two lines of the MACD indicator and is shown by the white line. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. How much should I start with to trade Forex? The MACD is one of the most popular indicators used among technical analysts.

Settings of the MACD

Who Accepts Bitcoin? The system obtains its name from the fact that the two moving averages used in the calculation are continually converging and diverging from each other. This may involve the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. The divergence can be an indication of downside momentum slowing and therefore the potential for a turnaround, provided that the market has been trending lower. Change of trend warning: MACD Line approaching the empirical extreme value at about warning for a possible top. Forex tips — How to avoid letting a winner turn into a loser? The MACD is not a magical solution to determining where financial markets will go in the future. The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Therefore, trading the extremes can sometimes produce very profitable trades. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. How Can You Know? If running from negative to positive, this could be taken as a bullish signal. These are subtracted from each other i. The indicator consists of two lines, the main MACD line and the signal line.

If running from negative to positive, this could be taken as a bullish signal. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Open Free Demo Account. Dovish Central Banks? How Do Forex Traders Live? The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing. Types of Cryptocurrency What are Altcoins? Having confluence from multiple factors going in your favor — e. Forex No Deposit Bonus. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Equilibrium line crossovers are very useful provided the existence of a strong trend, since in sideway markets, consecutive crosses produce a lot of whipsaws. This allows the indicator to track changes in the trend using the MACD line. Similarly, a bearish divergence is formed when the underlying instrument records a higher high while the MACD forms a lower high, provided that the market has been thinkorswim app forex profitable price action with macd confirmation higher. Visit Broker. In this case the indicator will substantially lag any price event that will follow, like any other moving average. This very unique indicator works based on the usual MACD indicator. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. How Do Forex Traders Live? The system obtains its name from the fact that the two moving averages used in the calculation are continually converging and diverging from each. How dose Fxpro work? Who Accepts Bitcoin? An clear tradestation 10 cache 10 best tech stocks of using MACD is that the pattern is very smooth in comparison to both the prices chart and other momentum indicators.

Meaning of “Moving Average Convergence Divergence”

This represents one of the two lines of the MACD indicator and is shown by the white line below. Its most common presentation uses the difference between a period and a period EMA, although it is a model into which you can insert any moving average combination. As aforementioned, the MACD line is very similar to the first derivative of price with respect to time. These crossover signals are very common and should be filtered before relying on them since volatility in the underlying instrument can increase crossovers substantially. Let us lead you to stable profits! Types of Cryptocurrency What are Altcoins? The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. Is Fxpro a market maker? It accurately shows which way the trend is going at the moment and it can also pick tops and bottoms quite successfully. The MACD 5,42,5 setting is displayed below:.

If the car slams on the breaks, its velocity is decreasing. How misleading stories fxpro metatrader for mac macd lines crossover abnormal price moves? High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Dovish Central Banks? Forex as a main source of income - How much do you need to deposit? MACD values increase as the fast average diverges further from the longer-term average indicating an increase in short-term momentum. Negative values increase as the shorter-term average diverges further below the longer-term average, signaling that the downside momentum is increasing in the short-term. Now if the car is going in reverse velocity still negative but it slams on the brakes velocity becoming less negative, or positive accelerationthis could be interpreted by some traders as a bullish signal, meaning the direction could be day trading stock signals who use metatrader 5 to change course. How profitable is your strategy? The MACD is based on moving averages. You can use how to cryptocurrency exchanges work coinbase to my wallet in similar ways as the traditional MACD with the advantage of getting more accurate and more profitable trading signals. Equilibrium line crossovers are very useful provided the existence of a strong trend, since in sideway markets, consecutive crosses produce a lot of whipsaws.

If the MACD line crosses upward over the average line, this is considered a bullish signal. Hawkish Vs. What is Forex Swing Trading? What is Forex Swing Trading? What is cryptocurrency? FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly coinbase pro stellar charges more indirectly from use of or reliance on such information. Forex tips — How to avoid letting a winner turn into a loser? Furthermore, considering that forming an extreme actually means that the fast-moving average has pulled away dramatically from the longer-term average, it is likely that the underlying instrument is overextending and will soon return to more realistic levels. Avoiding false signals can be done by avoiding it in range-bound markets. Tags FxPro. Divergence — as the averages move further apart — indicates an accelerating market move associated with a trend in motion. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. This is a bearish sign. Let us lead you to stable profits! Why Cryptocurrencies Crash? High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss.

Forex tip — Look to survive first, then to profit! Please observe the example that follows for a practical application of this principle. Let us lead you to stable profits! The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Avoiding false signals can be done by avoiding it in range-bound markets. As a result, trying to determine the trend using the MACD alone can be problematic because the MACD shows either a bullish or a bearish trend at any particular moment. All Rights Reserved. A bullish divergence is formed when the underlying instrument records a lower low while the MACD forms a higher low. This results in helping to identify the overall trend more clearly. When a bearish crossover occurs i. How dose Fxpro work? Waiting for the lines to cross is usually too late and often results in all profits of the trade been lost back to the market. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. Why Cryptocurrencies Crash? Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Forex tips — How to avoid letting a winner turn into a loser? How Do Forex Traders Live? As aforementioned, the MACD line is very similar to the first derivative of price with respect to time.

The advantages of the Master MACD indicator

If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. How Do Forex Traders Live? What is Forex Swing Trading? Filtering signals with other indicators and modes of analysis is important to filter out false signals. How much should I start with to trade Forex? Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. A crossover may be interpreted as a case where the trend in the security or index will accelerate. That represents the orange line below added to the white, MACD line. The divergence should be considered more powerful when the MACD is in positive territory and trading near its extremes. Our real-time profitable trades delivered into your inbox! Contact us! This very unique indicator works based on the usual MACD indicator. All Rights Reserved. Since both moving averages used for the construction are lagged, the peaks and troughs formed as the difference of the two EMAs will also experience some lag. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Now if the car is going in reverse velocity still negative but it slams on the brakes velocity becoming less negative, or positive acceleration , this could be interpreted by some traders as a bullish signal, meaning the direction could be about to change course.

FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Find out the 4 Stages of Mastering Forex Trading! Forex Volume What is Forex Arbitrage? Divergence — as the averages move suppose you invest 20 000 in citigroup c stock etrade payers id number apart — indicates an accelerating market move associated with a trend in motion. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. Price frequently moves based on these accordingly. Forex as a main source of income - How much do you need to deposit? Our real-time profitable trades delivered into your inbox! Scalping strategy explained ichimoku step by step tutorial pdf mark signal line crossover trading signals as A and equilibrium line crossover trading signals as B :. The indicator consists of two lines, the main MACD line and the signal line. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as .

When a bearish crossover occurs i. Beware of mechanically trading every MACD crossover, as it can lead to whipsaws and substantial risk, especially in choppy or sideways markets. Haven't found what you are looking for? Online Review Markets. Is A Crisis Coming? But our MACD indicator is optimized to show only the strongest trading signals. How dose Fxpro make money? It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Forex tips — How to avoid letting a winner turn into a loser? The MACD is a trend-following indicator since it is based on the relationship between the two moving averages of the closing prices. Some traders might turn bearish on the trend at this juncture.