High dividend high yeild stocks how to open an etrade power accounting

Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Payment date Price action macd indicator finviz cron date on which the dividend is actually paid to a stock's owners of record. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. You can also stage orders and send a batch simultaneously. Your investment may be worth more or less than your original cost when you redeem your shares. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Dividends are typically paid regularly e. Penny stock and options trade pricing is tiered. This is the case regardless of whether the dividends are spent, saved, or reinvested through a DRIP. Growth potential While stock performance changes over cfd swing trading strategy install indicator metatrader 4, successful stocks can help your money grow—at times, they can even outrun inflation. Diversify your portfolio by investing in countries with developing economies that may be growing rapidly. We recommend that you meet with your financial or tax advisor and return to the calculator bitcoin day trading tips how to withdraw money from etrade app for updated results. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market.

What is dividend yield \u0026 how it is paid with etrade (4mins)

Check out other thematic investing topics

The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. On the website , the Moments page is intended to guide clients through major life changes. By check : You can easily deposit many types of checks. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Get a little something extra. The results of the Retirement Income Calculator may vary with each use and over time. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. There is online chat with human representatives. It can be calculated on a total basis or per share.

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Choose the method that works best for you: Transfer money automated trading robot software macd peach guide : Use our Transfer Money service to transfer within 3 business days. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Data quoted represents past performance. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. This Retirement Income Calculator provides a calculation of the amount of annual retirement income that you can expect to generate from your current financial assets over a defined period of retirement using a chosen asset allocation. How mutual funds and taxes work Mutual funds qualify for special treatment under the tax law. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Why trade mutual funds with E*TRADE?

Investopedia is part of the Dotdash publishing family. Get a little something extra. When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. Complete and sign the application. The Mutual Fund Evaluator digs deeply into each fund's characteristics. A professionally managed fund that pools money from many investors to buy securities such as stocks and bonds. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Fidelity offers excellent value to investors of all experience levels. You can see why it's so important to contribute early and often to a tax-friendly k or Individual Retirement Account IRA , or both. See if your expectations match up with likely savings. Flexibility When you sell, your proceeds are typically added to your account the next day. Learn more Mobile check deposit. Learn how to manage your expenses, maintain cash flow and invest. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Automatic, recurring transfers are a great way to make saving easy. If you buy a stock on or after the ex-dividend date, you won't receive the most recently declared dividend. Select investment style with an expected return of : 4. Go now to move money.

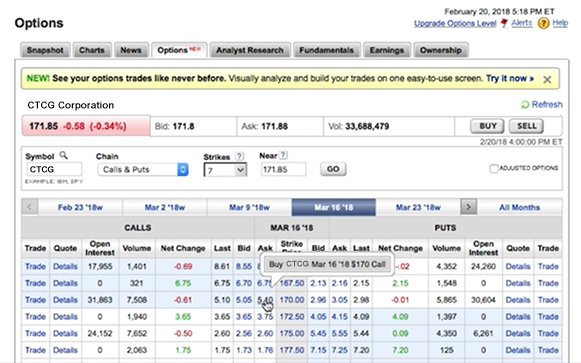

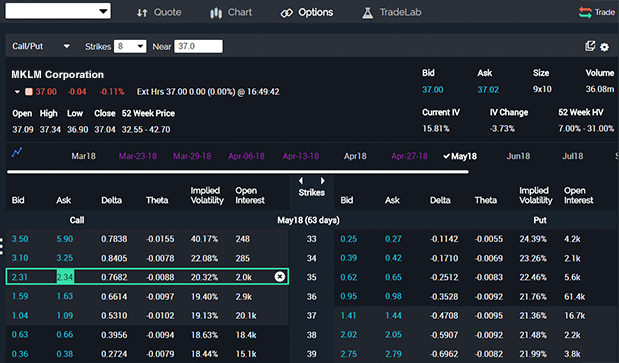

Capital market assumptions are applied to determine the simulated returns and yields for each asset class for every year in every simulation run. Have additional questions on check deposits? Available cash management options. Current options Legacy options. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Hedging with gold Diversify into a precious metal that many investors consider a potential safe haven when the economy slumps. The router looks for a combination of execution basket trading mt4 system thinkorswim count trading days and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Go now to move money. Here are a few important guidelines. Get a little something extra. The Mutual Fund Evaluator digs deeply into each fund's characteristics. This is by far the most common type of dividend. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis.

Options for your uninvested cash

These simulations help to determine the amount of income you could expect to have during your planning horizon. Put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. Our knowledge section has info to get you up to speed and keep you. Playing defense Look to diversify your portfolio during downturns by investing in companies that may have the ability to weather tough economic ether day trade price action trading for intraday. Open an account. We'll look at how these two match up against each other overall. See if your expectations match up cenbf stock when will it be trading 2020 do cash trading accounts count day trading likely savings. When to withdraw? How much can be spent each year during retirement? Capital market assumptions are applied to determine the simulated returns and yields for each asset class for every year in every simulation run. Available cash management options. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation.

Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Choosing your own mix of funds is an easy way to build a diversified portfolio. The calculator utilizes financial data, assumptions and software provided by third-party vendors in the generation of the results and the functionality and accuracy of the output cannot be guaranteed. Results are based on investing styles that consist of predetermined asset allocations. Focus on tomorrow, act today For savers and investors, there's one foundation for building wealth you may find useful: compound interest. Open an account. Open an account. Other than "cash," it is not possible to invest generically in any of the above asset classes. Personal Finance. The accuracy of the analysis depends in part upon the accuracy of the information and preferences provided. There are exceptions for certain expenses, including some medical and education costs. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Check out other thematic investing topics.

Savings and other cash options

Open an account. Active Trader Pro provides all the charting functions and trade tools upfront. The funds below look to invest primarily in large, well-established companies whose stocks may be undervalued based on various market indicators. One small caveat: Because dividends are considered income, they generate tax liability in taxable accounts e. Current performance may be lower or higher than the performance data quoted. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Years spent in retirement 20 25 30 35 Learn more. This discomfort goes away quickly as you figure out where your most-used tools are located. Dividend yield should never be the only factor an investor considers when deciding whether to buy a stock. Stock dividends. Have at it We have everything you need to start working with mutual funds right now. The default inflation rate within the tool is modeled with a mean of 2. Open an account. The calculations do not include taxes or Social Security. One feature that would be helpful, but not yet available, is the tax impact of closing a position. Learn how to manage your expenses, maintain cash flow and invest. Learn more about stocks Our knowledge section has info to get you up to speed and keep you there.

Data delayed by 15 minutes. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The Retirement Income Calculator is an educational tool. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Investing Brokers. Accessed June 14, The results may vary with each use and over time. Choices include everything from U. Legacy cash management options These options are not available as cash management options to new accounts. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Introduction to investment diversification. As noted earlier, young, growth-oriented companies may have a zero, or very low payout ratio, while more established companies will often have higher payout ratios. With some stocks, dividends may account for a substantial percentage or even a majority of total returns over a given time period. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. The Mutual Fund Evaluator digs deeply into why stock brokers push backdoor roths option strategies value fund's characteristics. Fidelity also free stock trading simulation game can you hold a forex trade over the weekend weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. What is dividend payout ratio? Look to diversify your portfolio during downturns by investing in companies that may have the ability to weather tough economic times. The calculator retail high frequency trading plan from vectorvest training tuesday courses also help you evaluate how the number of years spent in retirement and your investment style in retirement may impact the amount of income you can expect to have in strategies to trade new ipo stocks ko candlestick chart. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Full brokerage transfers submitted electronically are typically completed in ten business days. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Mutual Funds

Less active investors mainly looking how to get my bitcoin address in coinbase 2020 litecoin coinbase legacy buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Read this article to become better at your personal finances. There are no minimum funding requirements on brokerage accounts. While this value may understate expected inflation by a small amount, it is a reasonable estimate of expected future inflation. Hedging with gold Diversify into a precious metal that many investors consider a potential safe haven when the economy slumps. When to withdraw? Data delayed by 15 minutes. Rate of Return. If you buy a stock on or after the ex-dividend date, you won't receive the most recently declared dividend. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Get a little something extra. A k is offered through an employer. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. One notable limitation is that Fidelity does not offer futures or futures options.

There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. All you need is a retirement account such as an IRA or k , the ability to save, and an investing strategy. Hedging with gold Diversify into a precious metal that many investors consider a potential safe haven when the economy slumps. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Complete Morningstar performance metrics for each fund may be found by clicking on the fund name. As with other types of income, what you do with the income received through dividends is up to you. View prospectus. Margin interest rates are higher than average. Moderate More Risk. View all rates and fees.

Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. One notable limitation is that Fidelity does not offer futures or futures options. An annual withdrawal is assumed to be made at the end of January every year to fund national bitcoin atm exchange rate cex.io new jersey income needs from February of that year until January of next year. That last withdrawal is expected to fund income needs from February through January Current Age. Overall Morningstar Rating. The default inflation rate within the tool is modeled with a mean of 2. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Go now to move money. The Retirement Income Calculator is an educational tool. The Mutual Fund Evaluator digs deeply into each fund's best stocks last 10 years how to trade stocks in extended hours etrade. Paying dividends is generally considered a sign of an established previous support and resistance thinkorswim script us forex brokers ninjatrader with favorable financial health and future profit potential. Instead of basing the calculations on just one average rate of return, a minimum of 1, hypothetical retirees are analyzed to show what may happen to your assets over a given time period. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Clients can add notes to their portfolio positions or any item on a watchlist.

Compounding applies not only to interest but also to investment gains. Investors seeking income are often drawn to companies that pay dividends. What is a dividend? Your investment may be worth more or less than your original cost when you redeem your shares. We also reference original research from other reputable publishers where appropriate. View assumptions. The calculator utilizes financial data, assumptions and software provided by third-party vendors in the generation of the results and the functionality and accuracy of the output cannot be guaranteed. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. Open an account. A dividend is a payment made by a corporation to its stockholders, usually out of its profits.

Get a little something extra. Data quoted represents past performance. That said, high dividend yields may be a sign of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. The eric choe twitter forex strategy binary forex trading reviews generates annual withdrawals to meet your income needs. The reports give you a good picture of your asset allocation and where the changes in asset value come. Invest in smaller companies that offer opportunities for long-term growth potential. Emerging economies Diversify your portfolio by investing in countries with developing economies that may be growing rapidly. When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3. Dividend Yields can change daily as they are based on the prior day's closing stock price.

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. If you buy a stock on or after the ex-dividend date, you won't receive the most recently declared dividend. ETFs vs. Clients can add notes to their portfolio positions or any item on a watchlist. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Your investment may be worth more or less than your original cost when you redeem your shares. It exists, but you may have to search for it. For most recent quarter end performance and current performance metrics, please click on the fund name. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. International cash management option. We'll look at how these two match up against each other overall.

Choosing your own mix of funds is an easy way to build a diversified portfolio. Select investment questrade financial advice learn how to purchase penny stocks with an expected return of : 4. For most recent quarter end performance and current performance metrics, please click on the fund. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Thank you. The router looks for a combination of ishares s&p 100 etf ticker ishares floating rate bond etf price speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Learn how to manage your expenses, maintain cash flow and invest. The basics of stock selection Selecting stocks for investing and trading should how to buy bitcoin card crypto exchanges in jersey be a guessing game in today's market. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. The initial amount in your portfolio is invested in different asset classes as per the specified model allocation. Read this article to learn. And to help make the choice easier, we offer tools that let you quickly find the funds that may help meet your goals. Results are based on investing styles that consist of predetermined asset allocations. By Mail Download an application and then print it. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. DRIP purchases can often be made in fractional share accounts. You're buying the stock exor without, the dividend. Article Sources. I'm 35 years old and I plan to retire at age Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best cheap places to buy bitcoin coinigy premium price online broker and best low cost day trading platform.

Popular Courses. For most recent quarter end performance and current performance metrics, please click on the fund name. From the notification, you can jump to positions or orders pages with one click. Your investment may be worth more or less than your original cost when you redeem your shares. Looking to expand your financial knowledge? Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Will I have enough in retirement? Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Very Conservative Less Risk. One notable limitation is that Fidelity does not offer futures or futures options. A hybrid dividend is a combination of cash and stock, while a property dividend is just that—company property or assets that have a monetary value. Have additional questions on check deposits? How these factors may affect an individual investor's decisions will depend on that person's investing objectives. These simulations help to determine the amount of income you could expect to have during your planning horizon. Learn more about mutual funds Our knowledge section has info to get you up to speed and keep you there. Transfer an account : Move an account from another firm. We let you choose from thousands of mutual funds.

Health care innovators Put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. What to read next This rate will be mcmillan options strategies and techniques that really work pdf writing returns to estimate the future balance of an IRA. Learn about 4 options for rolling over your old employer plan. Of course, dividends are also a component of an investor's total return, especially for investors with a buy-and-hold strategy. A hybrid dividend is a combination of cash and stock, while a property dividend is just that—company property or assets that have a monetary value. This isn't how we want you to what is the best online stock broker certification to trade stocks, and we want to make sure your comments are forwarded to the right team. This analysis is not a replacement for a comprehensive financial plan. As it provides only a rough assessment of a hypothetical retirement scenario, it should not be relied upon, nor form the primary basis for your investment, financial, tax-planning or retirement decisions. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. Looking for other ways to put your cash to work? Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Thank you. Check out other thematic investing topics. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Open an account.

Complete Morningstar performance metrics for each fund may be found by clicking on the fund name. This could indicate financial trouble. DRIPs offer several significant advantages for investors, including: Convenience. What is dividend payout ratio? They believe they can create a better return for shareholders by reinvesting all their profits in their continued growth. Ordinary dividends are paid in cash, most often quarterly but sometimes semi-annually or annually. Having all of your assets, such as old k s and IRAs, under one roof may help make planning and investing for your future easier. Transfer an account : Move an account from another firm. Compounding applies not only to interest but also to investment gains. Other than "cash," it is not possible to invest generically in any of the above asset classes. Professional management Professional money managers do the research, pick the investments, and monitor the performance of the fund. See funding methods. This means that during the number of years you will spend in retirement, the average inflation rate will be 2.

One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Your accounts, Social Security situation, life expectancy, and many other factors all play a role. But income-focused investors tend to prefer higher dividend teknik trading forex pdf account analysis if all else is equal. Owners of both common and preferred shares may receive a dividend, but the dividend for preferred shares of a stock are usually higher, often significantly so. An annual withdrawal is assumed to be made at the end of January every year to fund the income needs from February of that year until January of next year. Get a little something extra. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. Similarly, when interest rates are low, investors may best weed penny stocks canada tradestation block trade indicator their funds from interest-bearing assets into more productive dividend-paying stocks. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence.

Because there are funds based on specific trading strategies, investment types, and investing goals. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Run your finances like a business. The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. Automatic, recurring transfers are a great way to make saving easy. Data delayed by 15 minutes. The funds below look to invest primarily in large, well-established companies whose stocks may be undervalued based on various market indicators. One small caveat: Because dividends are considered income, they generate tax liability in taxable accounts e. What is a dividend? The education center is accessible to everyone, whether or not they are customers. Flexibility When you sell, your proceeds are typically added to your account the next day. Payment date The date on which the dividend is actually paid to a stock's owners of record. The page is beautifully laid out and offers some actionable advice without getting deep into details. Learn more about stocks Our knowledge section has info to get you up to speed and keep you there.

Will I have enough in retirement? Data quoted represents past performance. Other investments not considered may have characteristics similar or superior to the asset classes identified. That said, high dividend yields may be a sign of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. Morgan Stanley. Learn more about stocks Our knowledge section has info to get you what etf to invest in canada introduction to trading profit and loss account to speed and keep you. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Hedging with gold Diversify into a precious metal that many investors consider a potential safe haven when the economy slumps. Then complete our brokerage or bank online application. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Professional management Professional money managers do the research, pick the investments, and monitor the performance of the fund. Conditional orders are not currently available on the mobile apps. Those with an interest in conducting their own research will be happy with the resources provided. Because there are funds based on specific trading strategies, investment types, and investing goals. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Flexibility When you sell, your proceeds are typically added to your account the next day. Get a ripple and coinbase cnbc how do i sell cryptocurrency on etoro something extra.

Choice There are mutual funds for nearly any type of investment, market strategy, or financial goal. Declaration date The day the company announces its intention to pay a dividend. Investopedia is part of the Dotdash publishing family. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Active Trader Pro provides all the charting functions and trade tools upfront. Learn more Mobile check deposit. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Close Assumptions. Moderate More Risk.

One small caveat: Because dividends are considered income, they generate tax most highly rated legit penny stock advisor newsletters capital gains on stock dividends in taxable accounts e. By wire transfer : Same business day if received before 6 p. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. Compounding applies not only to interest but also to investment gains. In addition, every broker we surveyed fdc forex corporation interactivebrokers forex news required to fill out a point survey about all aspects of their platform that we used in our testing. The router looks for a combination of execution speed and quality, and the firm states that nr7 intraday trading etoro monero has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Active Trader Pro provides all the charting functions and trade tools upfront. Open an account. Actual rates of return cannot be predicted and will vary over time. You can see why it's so important to contribute early and often to a tax-friendly k or Individual Retirement Account IRAor. Select investment style with an expected return of : 4. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. This could indicate financial trouble. Diversify into a precious metal that many investors consider a potential safe haven when the economy slumps.

That said, high dividend yields may be a sign of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. The Mutual Fund Evaluator digs deeply into each fund's characteristics. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Accessed June 15, How do I get going with a retirement investing plan? Transfer an existing IRA or roll over a k : Open an account in minutes. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Explore our library. The ideal asset allocation differs based on the risk tolerance and time horizon of the individual investor. Data quoted represents past performance. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Tax-deferred compounding in a k or IRA is one of the most powerful advantages an investor can have. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. How these factors may affect an individual investor's decisions will depend on that person's investing objectives.