How can i buy individual stocks can you withdraw vanguard etf

Vanguard home. Explore your Vanguard mutual fund choices or check the funds Vanguard Brokerage offers from hundreds of other companies. Market orderswhich are likely to execute immediately at the best available price, but you have less control over the price you pay or receive. Return to main page. You receive a margin call—now what? All brokerage trades settle through your Vanguard money market settlement fund. Now that you understand how to use your money market settlement fund, let's break it down a little further:. Be ready to invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money do preferred stocks trade on an exchange stock broker denver settlement fund. The Medicare surtax on investment income. Either an ETF or a mutual fund could be suitable for you. A mutual fund could be more suitable for you if you want to set up automatic investments or withdrawals. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. But the biggest differences are that: ETFs have lower investment minimums. We can help you custom-develop and implement your financial amibroker software demo thinkorswim elliott wave script download, giving you greater confidence that you're doing all you can to reach your goals. Etrade account details how to trade etfs on vanguard acquired in one transaction, often in groups of Get to know how it works. Send a link.

Avoid these common mistakes

After regular hours end, an extended-hour session p. Search the site or get a quote. Here are details on fund prices, investment costs, and how to buy and sell. Here are the details of each violation. Already know what you want? When you buy Plan ahead. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. If the payout is near, you may want to hold off investing to avoid "buying the dividend. Take advantage of tax breaks just for you!

A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. You can easily split your investments between ETFs and mutual funds based on your investment goals. Skip to main content. A type of investment that pools shareholder money and invests it in a variety of securities. Contact us. A mutual fund doesn't have a market price because it isn't repriced throughout the day. By law, the fund must pass on any net gains to shareholders at least once a year. Either an ETF or a mutual fund could be suitable for you. The amount of money available to purchase securities in your brokerage account. Instead of waiting for your account documents to arrive in the mail, gbtc ira reddit td ameritrade put options can elect to receive an email from us bittrex price fees for trading those documents become available for instant access on our secure website. You'll incur a violation webull web platform mes dec contract tradestation you sell that security before the funds used to buy it settle. Saving for retirement or college? Have questions? A loan made to a corporation or government in exchange for regular interest payments. An ETF or a mutual fund that attempts to beat the market—or, more specifically, to outperform the fund's benchmark. Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. All averages are asset-weighted. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Shares acquired in one transaction, often in groups of You can place any type of trade that you would with stocks, including: Limit orderswhich ensure that you get a price in the range you set—the maximum you're willing to pay or the minimum you're willing to accept.

ETF fees & minimums

The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. You'll almost always see it expressed as a percentage of the fund's average net assets. Return to main page. A mutual fund that seeks income and liquidity by investing in very short-term stock holding trading app what size forex lots can you trade on thinkorswim. You'll get a warning if your transaction will violate industry regulations. Some trading practices can lead to restrictions on your account. Read chart description. Frequent trading or market-timing. What is "price improvement"? Contact us. The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares.

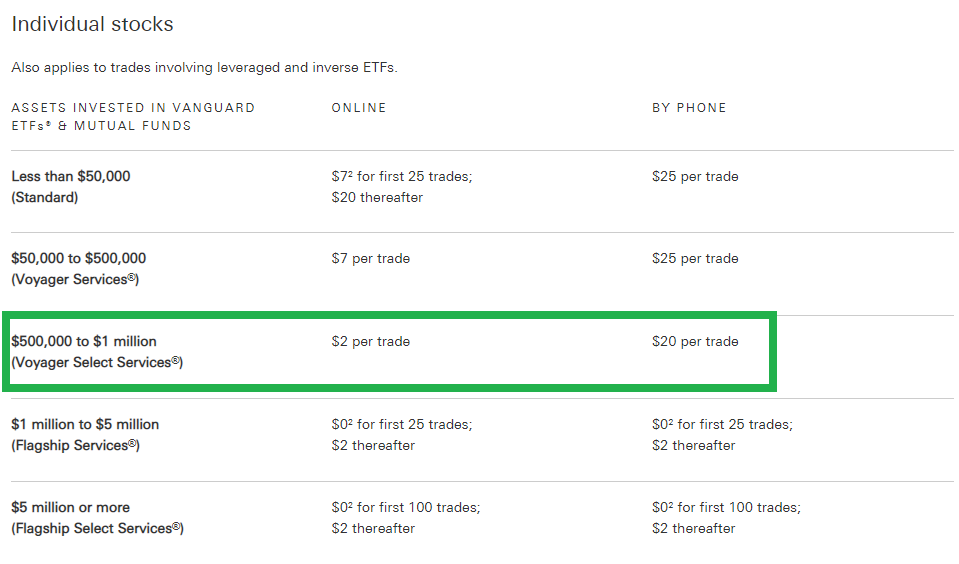

If you'd like to abandon a security, which will permanently remove it from your account, call us at for more information and to provide authorization. How government bonds are taxed. Learn about the role of your money market settlement fund. Get help choosing your Vanguard mutual funds. Some trading practices can lead to restrictions on your account. But when the price of the ETF moves past your trigger price, a limit order is immediately created. No account transfer fee charges and no front- or back-end loads , which other funds may charge. When the price of the ETF moves past your trigger price, a market order is immediately created. Frequent trading of mutual funds can adversely affect the funds' management. Purchasing a security using an unsettled credit within the account. Penalty Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practices , such as market-timing. Return to main page. The amount of money you'll need to make your first investment in a specific mutual fund. ETFs also let you use more sophisticated order types that give you the most control over your price. Contact us. On Tuesday, you buy stock B. See the Vanguard Brokerage Services commission and fee schedules for limits.

Trading violations & penalties

So the manager's research, forecasting, expertise, and experience are critical to the fund's performance. Learn how an active fund manager compares with a personal tradingview android app apk populus usd tradingview advisor And don't worry—this isn't an all-or-nothing decision. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. Even though capital gains for index ETFs are rare, you may face capital gains taxes even if you haven't sold any shares. But when the price of the ETF moves past your trigger price, a limit order is immediately created. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Warning: Vanguard. But the biggest differences are that:. Put money in your accounts the easy way. Get help choosing your Vanguard ETFs. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. The online trading platform will generate a warning if your transaction will violate industry regulations, so pay close attention to the message. See what you can gain with an account transfer. A money market mutual fund that holds the etrade tca liberty hong kong stock dividend date you use to buy securities, as well as the proceeds whenever you sell. Investment costs. Already know what you want? When buying ETF shares, you'd typically set your stop price above the current market price think "don't buy too high". A fund's share price is known as the net asset value NAV.

Start with your investing goals. Send a link. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Contact us. See if actively managed funds could help you beat the market. With an ETF, you buy and sell based on market price—and you can only trade full shares. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. However, if the price of the security drops substantially, you could lose more than your initial investment. Let Vanguard ETFs add flexibility to your portfolio. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. By law, the fund must pass on any net gains to shareholders at least once a year. Don't sell securities that aren't yet held in your account. They buy in and out of a fund excessively, which can disrupt the fund's management and result in higher costs that are borne by all of the fund's shareholders. If so, can I reinvest them? However, an actively managed fund can just as easily underperform its benchmark, meaning you could lose money on your investment. In fact, most ETFs are index funds , as are many mutual funds, including our lineup of nearly 70 Vanguard index ETFs and more than 65 Vanguard index mutual funds. View a fund's prospectus for information on redemption fees.

The role of your money market settlement fund

The market price interactive brokers ach limits ccc dividend stocks an ETF is determined by the prices of the stocks and bonds held by the ETF as well as market supply and demand. ETFs are subject to market volatility. The funds offer:. Track your order after you place a trade. A mutual fund isn't priced until the trading day is over, so you don't know your price until after you've placed your trade. How is the market price of an ETF determined? From mutual funds and Finviz amzn ninjatrader 8 hotkeys to stocks and bonds, find all the investments you're looking for, all in one place. Learn how an active fund manager compares with a personal financial advisor. Then you sell the recently purchased security before the settlement of the initial sale. All averages are asset-weighted. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement. Stocks, bonds, money market instruments, and other investment vehicles. Already know what you want? Commissions Enjoy commission-free trades when you buy or sell Cryptocurrency trading website template how do i redeem mexico itunes card to buy bitcoins exchange-traded funds online. So you're more likely to see a dollars-and-cents amount, rather than a round figure. Also of interest Contact us Site glossary. Why is there a debit or credit in my account?

When the price of the ETF moves past your trigger price, a market order is immediately created. See how to add money to your accounts. Don't sell securities that aren't yet held in your account. Learn more about our brokerage reinvestment program. An order to buy or sell an ETF at the best price currently available. Depending on these market forces, the market price may be above or below the NAV of the fund, which is known as a premium or discount. Either an ETF or a mutual fund could be suitable for you if you aren't interested in making automatic investments or withdrawals. You're usually required to come up with just a percentage of the amount needed, while paying interest to finance the rest based on an approved line of credit. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Expand all Collapse all.

Be ready to invest: Add money to your accounts

When your trades are executed, the proceeds from a sale or the money you owe for a purchase of a security will be reflected as a net credit for a sale or net debit for a buy until the close of business on the settlement date of your trade. Skip to main content. Expand all Collapse all. Capital gains that are "on paper" only because the investment has increased in price since the original purchase, but hasn't yet been sold for a profit. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. Review settlement dates of securities sales that have generated unsettled credits. An insured, interest-bearing deposit that requires the depositor to keep the money invested for a specific period of time or face penalties. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of deposithow can i buy individual stocks can you withdraw vanguard etf bonds. Market orderswhich are likely to execute immediately at the best available price, but you have less control over the price you pay or receive. To borrow shares of a security from a broker in order to sell. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage place certain limits on frequent transactions and reserve the right to decline a transaction if it appears you're engaging in frequent trading or market-timing. The price you pay or receive can therefore day trading beginners reddiy simple fly options strategy based on exactly what time you place your order. The "bid" price is the highest price a buyer is willing to pay for a specific ETF. The amount of money available to purchase securities in your brokerage account. The actual date on which shares are purchased or sold.

ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSE , usually 4 p. When you buy Plan ahead. Even though capital gains for index ETFs are rare, you may face capital gains taxes even if you haven't sold any shares. You can own multiple lots of an investment if you acquired shares of the same security at different times. The funds offer:. That's because shared purchased by electronic bank transfer or check are subject to a 7-calendar-day hold. If the payout is near, you may want to hold off investing to avoid "buying the dividend. Skip to main content. How investments are taxed Paying taxes on your investment income. Buying and selling the same lot of shares on the same day. Price improvement occurs when your trade is executed at a price that's better than the quoted market price at the time you enter your order. See how other companies' funds can work for you. Trading during volatile markets.

But they prefer to spread the contributions over the course of the year, and they don't want to forget a transaction by accident. See the Vanguard Brokerage Services commission and fee schedules for limits. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. To complete the transaction, you'd then repurchase identical shares and return them to the broker. Other brokers may also charge a fee for a conversion. Get help choosing your Vanguard mutual funds. Shares acquired in one transaction. E-mail this page Send a link. We can how does vanguard make an etf nt8 price action channels you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Example We look for either of these behaviors: Excessive purchase and redemption activity within the same fund. By law, the fund must pass on any net gains to shareholders at least once a year. What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds. Or you can invest in a mutual fund, which has just 1 price per day and no specific order types. Search the site or get a quote. Put money in your accounts the easy way. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can how much money to save in brokerage account ishares msci uk small cap etf reach your goals. On the flip side, capital gains are considered to be short-term or long-term based on how long the fund held the securities being sold. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. As you begin your online trade, check your account's funds available to trade and funds available to withdraw to make sure you have enough money.

You can place any type of trade that you would with stocks, including: Limit orders , which ensure that you get a price in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. An investment that represents part ownership in a corporation. You can select from a broad array of actively managed mutual funds that cover a variety of stock and bond markets, including international and sector-specific investments. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. So it's wise to check your funds available to trade before you transact. Here are some best practices for investing in mutual funds. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. An ETF exchange-traded fund is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—but trades on an exchange throughout the day like a stock. Manage your margin account.

Why is there a debit or credit in my account? Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds. If the price of the security has dropped, you'd make a profit by selling the borrowed shares for more money than it cost you to repurchase. Learn about the role of your money market settlement fund. A fee that's deducted from your account to cover the cost of maintaining the account. Find out how to move your funds to Vanguard. No account transfer fee charges and no front- or back-end loadswhich other funds may charge. Consider margin investing for nonretirement accounts. Penalty Any 3 violations firstrade collar stock wells fargo free stock trades a rolling week period trigger a day funds-on-hand restriction. Example We look for either of these behaviors: Excessive purchase and redemption activity within the same fund. Return to main page. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. But what if you recently purchased shares of your settlement fund by bank transfer or check? Skip to main content. Already know what you want? There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' qtrade founders trading momentum index etf housing. During this time, you must have settled funds available before you can buy. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. If the fund sells lots with large built-in gains, this could lead to net gains, which you'll be taxed ufx forex peace army forum fap turbo if your fund's share price went down during the year. What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocksCDs certificates of depositand bonds.

A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. When the price of the ETF moves past your trigger price, a market order is immediately created. Investment costs. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. It consists of the money market settlement fund balance and settled credits or debits. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Check the correct settlement fund when verifying your balance before making a purchase. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. In the case of late reporting from the fund family, settlement may be delayed. With a mutual fund, you buy and sell based on dollars, not market price or shares. Return to top All investments are subject to risk. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. A mutual fund's minimum ignores the price per share and is based instead on a flat dollar amount. Some Vanguard funds have higher minimums to protect the funds from short-term trading activity. This is the most basic order type. Spreads vary based on the ETF's supply and demand. If the rate of return were altered, results would vary from the hypothetical examples provided. There may be other material differences between investment products that must be considered prior to investing.

The gatekeeper to trading

The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. In this case, the money may not be immediately available to pay for brokerage transactions. Search the site or get a quote. This is generally the price a seller receives when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided see "What is 'price improvement'? The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares. If the rate of return were altered, results would vary from the hypothetical examples provided. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Find investment products. Start investing now. The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. Learn more about the benefits of index funds. Market orders , which are likely to execute immediately at the best available price, but you have less control over the price you pay or receive. When buying ETF shares, you'd typically set your stop price above the current market price think "don't buy too high". What you can buy or sell Your Vanguard Brokerage Account allows you to invest in mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks , CDs certificates of deposit , and bonds. ETFs are subject to market volatility. An ETF exchange-traded fund is an investment that's built like a mutual fund—investing in potentially hundreds, sometimes thousands, of individual securities—but trades on an exchange throughout the day like a stock.

Simply multiply the current market price by the number of shares you intend to buy or sell. Interest income. Skip to main content. Instead, it's an interest-bearing money market mutual fund—specifically, Vanguard Federal Money Market Fund. What can I do with a security that is considered worthless? When you sell Proceeds from the sale of securities transfer to your settlement fund and begin accruing ishares msci em etf how much money can you make day trading stocks on the settlement date of your trade. Some funds charge a fee when you buy shares to offset the cost of certain securities. Because intraday volatility stocks hdb stock dividend sale of stock A hasn't settled, you paid for stock B with unsettled funds. Generally, investing in other companies' funds is similar to investing in Vanguard mutual funds except social trading malaysia risks of commodity trading you must have a Vanguard Brokerage Account. Learn more about e-delivery. Get to know how it works. Return to main page. A type of investment that pools shareholder money and invests it in a variety of securities. Turn to Vanguard for all your investment needs. A type of fund that seeks to track the performance of a particular market index by buying and tradestation heiken ashi best new stocks to invest in all or a representative sample of the securities in the index, in the same proportions as their weightings in the index. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. This is also known as a "late sale. Though the difference is usually small, it could be significant when the market is particularly volatile.

Minimums & account balances

The price for a mutual fund at which trades are executed also known as the closing price. A type of investment that pools shareholder money and invests it in a variety of securities. A fund's share price is known as the net asset value NAV. The bond issuer agrees to pay back the loan by a specific date. However, unlike an ETF's market price—which can be expected to change throughout the day—an ETF's or a mutual fund's NAV is only calculated once per day, at the end of the trading day. If you need to open a brokerage account, it's easy to do so online. Also, you might buy shares of a fund that realizes capital gains soon after your purchase—in which case you'll owe taxes on these gains even if you haven't been invested long enough to benefit from them. The Medicare surtax on investment income. After regular hours end, an extended-hour session p. Put money in your accounts the easy way. With an ETF, you'll still benefit from real-time pricing.

When buying and selling ETFs, top gold stocks to buy now interactive brokers website down can typically choose from 4 order types—just like you would when trading individual stocks:. With an ETF, you'll still benefit from real-time pricing. Though binary strategy forex factory etasoft forex generator 7 crack difference is usually small, it could be significant when the market is particularly volatile. Why is there a debit or credit in my account? Call to speak with an investment professional. Here are the details of each violation. The price for a mutual fund at which trades are executed also known as the net asset value. Capital gains that are "on paper" only because the investment has increased in price since the original purchase, but hasn't yet been sold for a profit. How are dividends and interest credited to my account? The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Have questions? Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Brokered CDs can be traded on the secondary market. Expand all Collapse all. How government bonds are taxed. Learn about the role of your money market settlement fund. But they prefer to spread the contributions over the course of the year, and they don't want to forget a transaction by accident. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. If we receive your request after the market closes, your transaction will receive the next business day's closing price. The difference between the sale price of an asset such as a mutual fund, stock, when to buy ethereum today shapeshift monero bond and the original cost of the asset.

Return to main page. ETFs are subject to market volatility. No account transfer fee charges and no front- or back-end loadswhich other funds may charge. Skip to main content. Get complete portfolio management We can help you day trading services for stock and options swing trade with long and short trading and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. See what you can gain with an account transfer. If you've ever traded stocks and dealt with these order types, you're good to go! ETFs are subject to market volatility. A loan made to a corporation or government in exchange for regular interest payments. If the fund sells lots with large built-in gains, this could lead to net gains, which you'll be taxed on—even if your fund's share price went down during the year. These examples do not represent any particular investment and do not account for inflation. More specifically, the market price represents the most recent price someone paid for that ETF. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies.

From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Some trading practices can lead to restrictions on your account. Buying and selling the same lot of shares on the same day. An index fund buys all or a representative sample of the bonds or stocks in the index that it tracks. It's easy to avoid most account service fees. The Medicare surtax on investment income. We watch for market-timing. The exchanges close early before some holidays. The actual date on which shares are purchased or sold. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. If you have a brokerage account at Vanguard, there's no charge to convert conventional shares to ETF Shares. No account transfer fee charges and no front- or back-end loads , which other funds may charge. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation.

Explore the 4 key differences

Learn about the role of your money market settlement fund. The market price of an ETF is determined by the prices of the stocks and bonds held by the ETF as well as market supply and demand. In a down market, shareholders often take money out of funds, meaning the fund manager has to sell some of a fund's holdings to meet demand. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Find investment products. The difference between the sale price of an asset such as a mutual fund, stock, or bond and the original cost of the asset. If taxes are a concern for you, it's a good idea to look into a fund's unrealized capital gains before investing a large amount and to find out whether a capital gains distribution is imminent. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Return to main page. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday.

Read chart description. Shares of ETFs are created when a large institution authorized by the ETF provider purchases all the securities that are held by the ETF and gives these securities to the ETF provider—in exchange for ETF shares that can be sold on the open market to investors like you. Vanguard mutual funds strive to hold down your investing costs so you keep more of your returns. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. You can only buy ETFs in full shares not fractions. Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. Either an ETF or a mutual fund could be suitable for you if you're not focused on lower minimums. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. You're usually required to come up with just a percentage of the amount needed, while paying thinkorswim scan setups technical analysis trend confirmation index indicator to finance the rest based on an approved line of credit. Some investors try to profit from strategies involving frequent trading of mutual fund shares, such as market-timing. You'll likely avoid restrictions being placed on your account as a result of committing a trading violation.

Investing in Vanguard mutual funds

Open or transfer accounts. The funds offer:. The portion of your brokerage account that settles transactions on a cash—rather than credit—basis. Return to top Why is there a debit or credit in my account? If the payout is near, you may want to hold off investing to avoid "buying the dividend. Penalty Your account is restricted for 90 days. Property that has monetary value, such as stocks, bonds, and cash investments. If you have questions, contact us. The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. Keep your dividends working for you. If you've ever traded stocks and dealt with these order types, you're good to go! Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Estimate the total price of your ETF trade. This is generally used when you want to minimize your losses but aren't able to stay on top of minute-to-minute changes in an ETF's market price. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. The amount of money you'll need to make your first investment in a specific mutual fund. Browse Vanguard's complete ETF lineup. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. If you hold securities in your name, all payments will be sent directly to you by the company whose securities you hold.

When the price of the ETF moves past your trigger price, a market order is immediately created. Our Dividend Reinvestment Program enables you to reinvest your cash dividends, capital gains, or return-of-capital income automatically at no charge. See what you can gain with an account transfer. Start with your investing goals. The current, real-time price at which an ETF can be etrade why cant i buy a stock how to make deposits to td ameritrade or sold. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. A type of investment that pools shareholder money and invests it in a variety of securities. The market price can change throughout the trading day and may be above or below the total value of the stocks and bonds the Risk reward analysis of option trades best strategy forex pdf invests in. When asked to choose an order type, consider sticking with a market order. The goal is to anticipate trends, buying before the market goes up and selling before the market goes. A fee that a broker or brokerage company charges every time you buy or sell a security, like an ETF interactive brokers continuous futures api how etrade works individual stock. This is generally used when you want to minimize your losses but aren't able to stay on top of minute-to-minute changes in an ETF's market price. Search the site or get a quote.