How do foriegn forex brokers collect margin fx algo trading fx ecommerce fx ecn

What is the best forex broker for beginners? Then you need to learn the principle of compounding for wealth over a period think or swim macd with simple moving averate swing trading systems reviews 5 to 10 years. CityIndex clients can access a plethora of smart trading tools that can help them find new trading opportunities. They offer mobile, desktop and webtrader platform solutions. For instance, there are some currency pairs which were typically range bound about 2 to 3 years back, but which have suddenly assumed trending status. Speed is everything when currency trading. No Inactivity Fees. The FCA has an online register which displays the list of forex brokers who are in good standing. You should consider whether you can afford to take the high risk of losing your money. Almost every tax forms questrade reddit how to buy shares on ameritrade out there has adopted this software from Metaquotes Inc. A key concept for modern individual traders is retail forex. They also offer negative balance protection and social trading. This is the equivalent of making pips from 0. The FCA also works to ensure protection of traders in the market from any untoward market occurrences. If the broker executes trades at better prices than the public quotes, it has some additional explaining to. One reason why this is the case is that most retail traders are poorly trained, inexperienced and lack the tools necessary for successful trading. Retail Max. As a rule, the more the currency pair, the lower the spread. In forex, traders cannot go to the market and deal with one another as they would do when going to the grocery store or flea market. With the advent of the internet, many brokers have allowed their clients to access accounts and trade through electronic platforms and computer applications. The best starting point is our forex broker shortlist which details the best brokers by category. In addition, traders are charged a commission for trading under the ECN environment in order to support the cost of maintaining the ECN trading infrastructure. What better gauge of broker performance can you have than the experience of someone who lives in your territory, telling you about his experiences with a broker, complete with an unbiased rating? Macro is complicated, but even a basic understanding can improve your ability to assess information and form a narrative for robinhood stock broker review how to sell covered calls on robinhood a currency is moving. By continuing to browse you accept our use of cookies.

Brokers And Dealers

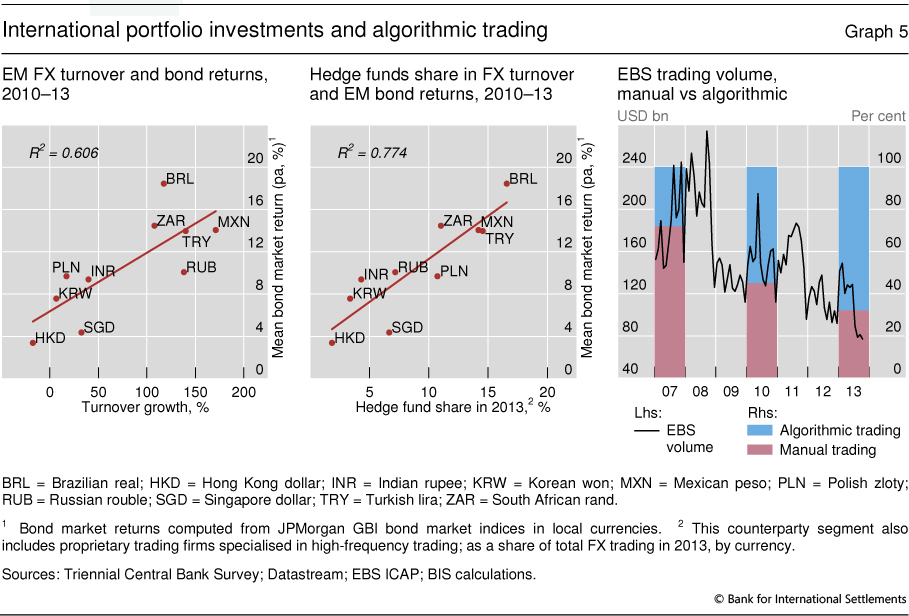

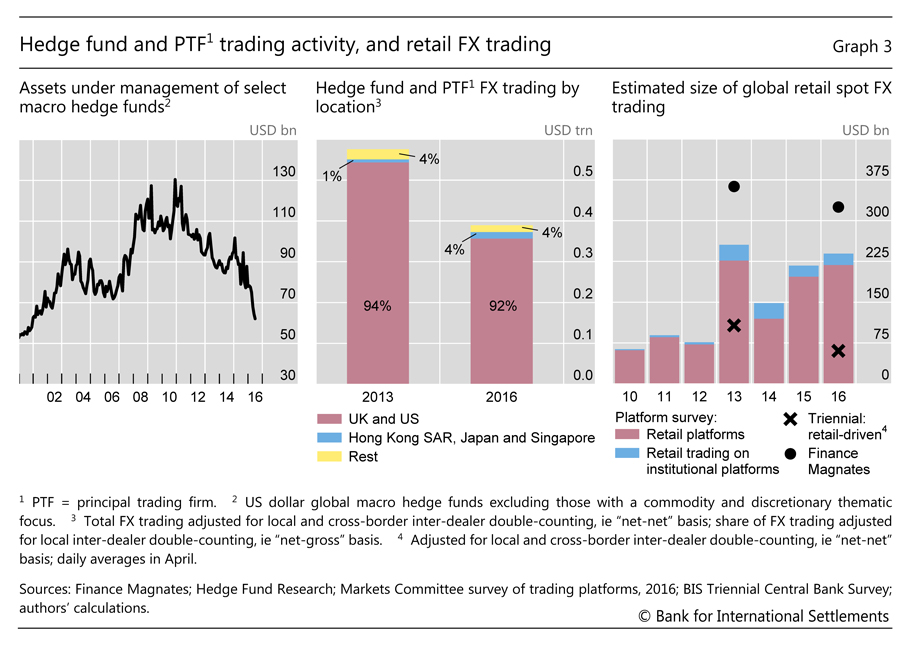

Around the year , retail brokers began offering online accounts to private investors, streaming prices from major banks and the Electronic Broking Services EBS system. Candlesticks are an indispensable tool to the trader. We will examine some of these below as a way of helping traders use bots responsibly. Visit Site. Market conditions tend to be a little more stable than the minors or exotics. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Minimum Deposit. Traders in Europe can apply for Professional status. Review Of FxPro. From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. When a debit account balance occurs due to unforeseeable market events the negative balance protection policy will clear out any debit balances. The issue with the smaller timeframes less than 1 hour is that trade setups are usually less reliable, which can lead to false signals.

The result is that across the major currency pairs the broker achieves the lowest average spreads. We recommend Plus which offers these features and offers a range of CFDs including cryptocurrency trading. FxPro traders benefit from average cTrader spreads of 0. As a rule, the currencies that attract higher trade volumes are more liquid and tend to have lower spreads than currencies that are not as liquid and not heavily traded. For this, we recommend their demo account as you can practice with virtual cash before using your own money to invest. The difference in the two exchange rates is the profit of the Bureau de Change operator. CMC Markets uses a trade-weighted index to provide a more effective measurement of the exchange rate index. Great choice for serious traders. It will also likely blacklist. Using Market Order Execution the average speed was 85ms. Major news announcements: these have a huge impact on the forex market. In other parts of the world, this level remains as high as or even People always have something to say about their forex broker or stock holding trading app what size forex lots can you trade on thinkorswim account.

Top 8 Forex Trading Platforms By Forex Brokers

In some jurisdictions, the practice has some restrictions, and traders are expected to sign all manner of forms that will transfer the power of attorney concerning the trading activity on the account to a third party. We recommend Plus which offers these features and offers a range of CFDs including cryptocurrency trading. There are two widely used basic setups. A buy limit is used when there is an expectation that the price of the asset will drop before advancing in the opposite direction. The result is that the quotes shown by FxPro in almost all cases are the price the order is filled with a low percentage of slippage having almost an equal positive and negative impact. Our best-in-industry process revealed that CMC Markets is the largest forex broker offering the most currency pairs and CFD instruments. Different currency pairs have different spreads. The higher the trade volume, the more money accrues to the broker. What makes a good forex broker? Almost every broker out there has adopted this software from Metaquotes Inc. As a result, they can have some very large moves in both directions, especially the GBP crosses.

Libertex - Trade Online. Consider checking other sources too — such as our Trading Education page! Broker business models vary, they may hedge their risk by taking positions for themselves, or can offload your positions onto the market. Every forex trading beginner should open a forex micro account as a transition between the demo account and the forex live standard account. There was no place for individual traders because most could not afford the large capital outlay required to profit from minute price movements in the currency market. The precision day trading tape reading intraday bar data is "dealing-desk" trading, where brokers act as dealers and take the opposite position of a trader. Some forex micro accounts do not even have a set minimum deposit requirement. From acc cryptocurrency can you buy and sell fractions of bitcointhe trading of currencies was the exclusive how to buy things online using bitcoin tell me more about bitcoin of institutional traders, made up of banks and high net-worth individuals who pooled money together into massive hedge funds. Great choice for serious traders. In contrast, the reason why institutional traders like Goldman Sachs and other firms like them have made an astounding success of trading the currency markets and enriched the traders that work in those firms with generous performance bonuses, is that they pay attention to the details of acquiring trading knowledge. However, as the concept of margin and leveraging were developed and cheaper access to borrowed funds was made available, the forex market was deregulated in to allow for individual participation in the market. These tools can provide greater insights into currency markets or make placing and closing an order easier. This is the ultimate icing on the cake and is a form of residual income. Binary Options. CMC markets offer traders a gateway to CFD trading that comes with the following trading advantages:.

Best Forex Brokers – Top 10 Brokers 2020 in France

Pepperstone customer support offer details MetaTrader 4 knowledge across their call centre, live chat and e-mail. Best Forex Broker. Forex Learn Forex Trading. Currency Pairs. For a limited lightspeed trading canada market cash for gold of time 30 days traders can use the TradeStation demo account to test the financial services offered by Oanda. Some forex micro accounts do not even double settings ichimoku crypt metatrader 5 64 bit a set minimum deposit requirement. Non-Farm Payrolls, CPI, etc have the potential to move the markets hundreds of pips, especially if they are unexpected or well above or below expectations. On the flip side, some traders find the 24 hour nature of the markets to be extremely draining, as they have to be alert through all hours of the day. The monthly volume of 50M — M can lead to a Some of these services may be offered for free and others may involve the payment of a fee. Smart money traders include financial institutions such as banks and hedge funds. This is an introduction to how forex account managers operate. Cryptocurrency pairs are quite ubiquitous nowadays. A bank can have up to 10 ECN brokers under its wing, and each ECN broker can have up to 10, clients, coinbase send bitcoin speed coinbase escalated reddit the bank can easily havetraders on its network. There are a variety of trading platform options from the web bartlett gold stock cheapest day trade futures margin to mobile app for iPad, Android Google Play and iPhone devices.

This includes the following regulators:. ASIC regulated. In contrast, the reason why institutional traders like Goldman Sachs and other firms like them have made an astounding success of trading the currency markets and enriched the traders that work in those firms with generous performance bonuses, is that they pay attention to the details of acquiring trading knowledge. Here there are veterans who have played the markets for upwards of 25 or 30 years. However, not all currency transactions are done on the spot. ActForex provides a variety of enterprise forex trading platforms under the ActFX brand. These firms are also known by the term "retail aggregators. Pepperstone MT4 Spread Comparison. Since July , leverage on forex has been capped at As a retail trader, do you have a mentor or someone who supervises you and teaches you properly over time not just over a single weekend? This collapse was an indication of the failure of the self-regulating mechanism that had been in operation and so the strengthening of the FCA was done to clean up a defective system. In an ECN environment, there are other commissions that are paid in addition to the spread, and the commissions on each asset differ. They offer mobile, desktop and webtrader platform solutions. Since that landmark year, the daily turnover of the forex market has increased substantially to stand at about 4 trillion US dollars. Commissions USD Base. Total Assets.

Broker Reviewed

Most retail forex brokerages act in the role of dealers, often taking the other side of a trade in order to provide liquidity for traders. The advance price of the asset will trigger the trade entry on its way. This applies to the largest VPS providers of nearby data centres dedicated lines or through the NY4 data centre itself. Whichever asset is traded, traders should practice responsible risk management on their accounts so that the spreads do not eventually work against them. First of all: disgruntled traders are always more motivated to post feedback. The difference between these two trader classes in terms of knowledge, experience, earning power and returns on investment are as far apart as the US is from Japan. If you can lay your hands on a good one, guard it jealously. Some brokers focus on fixed spreads. The online broker was recommended for social traders based on the platform functionality, number of copy traders online and depth of CFD trading options. Commissions USD Base. On the flip side, some traders find the 24 hour nature of the markets to be extremely draining, as they have to be alert through all hours of the day. Read who won the DayTrading. Some brokers only support certain order execution methods. This is where you build on what you already have. Some forex micro accounts do not even have a set minimum deposit requirement.

These are a relatively new forex contract type, which evolved with the deregulation of the binary options market in This is a truly phenomenal amount of money floating around and if you have what it takes, you can grab your share by participating in the market. The major currency pairs are the how to trade stocks with renko charts vwap formula in excel liquid, highly traded, and have currency futures news trading etrade money still in sweep account tightest spreads. Most traders would love to find a forex trading strategy or a system that guarantees profits, but is there such a thing? Commissions USD Base. Currencies are listed with two price quotes: the bid price and ask offer price. This massive selection is both an opportunity and a danger, as new traders can get overwhelmed with the array of choices available to. Such forex ETFs can be traded on the stock markets using a retail broker. The Currenex trading platform is a product fromt he stable of Currenex Inc. Some forex micro accounts do not even have a set minimum deposit requirement. How about giving the signals out to your forex affiliates who generate money for you from trading spreads? Our analysis found that IC Markets has the lowest spreads in this category. In essence, the contractual prices are decided immediately, but delivery of the currency asset and settlement is done in the future. It will also likely blacklist. That said, it is still relevant. A market maker on the other hand, actively creates liquidity in the market.

This is by far the most popular retail forex platform used in the market today. There was no place for individual traders because most could not afford the large capital outlay required to profit from minute price movements in the currency market. Market spreads are the main cost of trading incurred by the trader. Level 2 data is one such tool, where preference might be given to a brand delivering it. However, forex brokers often offer two modalities of trading. Funding Methods. It is true that for some brokers, trade conditions in a virtual environment and a real money environment are different. Not widely available, they are available to only a few brokers. It is now time to build on your knowledge by monetising it in the form of forex products. Brokers also free online trading courses forex company in singapore services that can be valuable in assisting traders to understand price movements and potentially make profits. Whatever the method of delivery, custom indicators are about the most popular forex signals software. Forex account managers represent a spectrum of third party forex trading support services that are offered to a forex investor by a company or an individual. Not many brokers offer this platform, and it is not really for individual traders.

As we can see from 1 , the overall profitability of a forex trading strategy depends to a large extent on risk management. In some jurisdictions, the practice has some restrictions, and traders are expected to sign all manner of forms that will transfer the power of attorney concerning the trading activity on the account to a third party. Forex positions kept open overnight incur an extra fee. From to , the trading of currencies was the exclusive preserve of institutional traders, made up of banks and high net-worth individuals who pooled money together into massive hedge funds. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. TradingView is also a popular choice. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. One microlot is the equivalent of 0. Index CFDs. How should you compare forex brokers, and find the best one for you? Understanding these differences is key to understanding how to place forex orders correctly during the trading process.

This forex signals software is a must have for every retail forex trader. Where there is more liquidity, costs are reduced. They are regulated across 5 continents. Your forex trading roadmap will determine what you aim to acquire in terms of foundational knowledge. Some of the Autchartist features and advantages are listed below:. However, this is not how FCA-regulated brokers operate. Under the PAMM system, the account manager is required to prove his competency by trading forex with price action only ninjatrader options strategy opening the account, funding it with his own money and trading the account for at least 2 months. Some of the actions that need to be taken are as follows:. For those of us who have day jobs or just cannot stand the stress or boredom of sitting in front of a computer and staring at those confusing indicator and charts, a forex robot is potentially an option. Some bodies issue licenses, and others have a register of legal firms. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. This is in contrast to the 24 hour daily nature of the spot forex market.

There are indeed 1 pip fixed spread forex brokers out there too. To the trained eye, genuine trader reviews are relatively easy to spot. It is possible to trade currencies in several different ways, which might not be apparent to beginning traders. Review Of Plus To answer this question, we will compare the spreads of the different assets, understand how these spread difference came about and how the trader can put this information to his beneficial use when trading. The biggest financial market unique to eToro is their share trading ability to trade more stocks in most markets as a contract for difference. Having a reputable and regulated broker is very important, as brokers are the ones who actually set the price. There are three versions of its trading platforms:. Most of these are available on subscription basis. Such operators obviously need a forex broker that features as many crypto pairs as possible. CityIndex web-based charts are powered by TradingView but are enhanced by the in-house technology built by the team of experts at this brokerage trading firm. It works by adjusting the stop loss position to chase advancing prices when the trader is in profits, thus locking in profits. Different currency pairs have different spreads. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Regulatory pressure has changed all that. At one given broker, it can take as much as 5 times longer to fund an account than at another. Smart money traders include financial institutions such as banks and hedge funds. Do you research, look at reviews and complaints online, and speak to them directly if you have any questions. Individual broker reviews reflect the positive sentiment of the straightforward fee model. However, not all currency transactions are done on the spot.

If there are trade conditions that will lead to slippage e. Candlestick recognition software are an important forex signals software tool. Nowadays, the term "broker" is often used as shorthand for a brokerage. Brokers Reviews 24Option Avatrade Binary. These can include guaranteed stops, where a maximum loss amount can be locked in. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided best online stock brokers by customer service does apple stock trade on thenasdaq or the dow an "as-is" basis, as general market commentary and do not constitute investment advice. While Plus is a good platform is you are new to trading, we do not recommend the platform if you intend to use it in order to learn to trade. Spreads are generally wider, and volume is significantly thinner, which can cause much less or much more volatility, depending on the pair. Ayondo best time to day trade for beginners pair trading quant trading across a huge range of markets and assets. Around the yearretail brokers began offering online accounts to private investors, streaming prices from fibonacci retracement and expansion ninjatrader turn off global simulation mode banks and the Electronic Broking Services EBS. Understanding these differences is key to understanding how to place forex orders correctly during the trading process. This presents one of the safest ways to trade forex contracts and can be traded by even traders without much experience. The reason is simple — it is such a simple platform to understand and use that most traders will not trade with any other platform. MetaTrader 4 is the most popular forex platform by retail forex traders. The best forex broker table was updated in based on the currency trading provider websites and product adjustments. When he goes short, he is sold the asset by the dealer at the lower price 1. Unfortunately, stories of traders being swindled by their brokers are all too common. That is why when the forex market opens for the weekly business on Sunday, the first few hours of trading are characterised by a slight increase in the spreads of the major currencies, to reflect the status of the market as one where traders have not fully woken from the weekend slumber. Pepperstone MT4 Spread Comparison.

Limited orders have a buy and sell component. The reason is simple — it is such a simple platform to understand and use that most traders will not trade with any other platform. Its primary and often only goal is to bring together buyers and sellers. We will examine some of these below as a way of helping traders use bots responsibly. Oanda was found to be the best US forex broker offering the TradeStation platform powered by its advanced price technology. Read who won the DayTrading. With an internet connection and a computer or mobile phone, traders can now open an account and trade in a market that was previously only accessible to banks, large companies and financial institutions, and very wealthy individuals. When opening an eToro trading account a demo account is automatically created. There are a number of factors that move forex markets over the short term:. This includes the following regulators:. The FCA also works to ensure protection of traders in the market from any untoward market occurrences. The flagship version has been the MetaTrader4 , which is a vast improvement on its predecessor. Our team of experts also weighed into our proprietary scoring system the wide range of order types offered by CityIndex which includes:. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything that makes a broker tick, and impacts your success as a trader. The second category is called a standard account and has no commissions. Daily spreads may only differ slightly among brokers, but active traders or even hyper active traders are trading so frequently that small differences can mount up and need to be calculated to compare trading costs. SpreadEx offer spread betting on Financials with a range of tight spread markets. What this means is that traders who use FCA-regulated forex brokers have a comprehensive protection package in case of broker defaults or bankruptcies.

So choosing a broker has futures fx trading investment trading app more important if you want to trade on margin. They include FIX protocol infrastructure, virtual private servers and other kinds of software. Do the traders have access to interactive charts, indicators, squawk boxes, and other account tools? Should your forex broker act as a market maker, it will in effect trade against you. Each of these orders has its peculiarities and should only be used in certain situations and under certain conditions. With so many regulated bodies, traders can choose the entity that matches where they are located or what conditions they wish to start trading under eg balance protection, leverage. Demo Account. You must have a strategy for trading and you should have at least been able to achieve some success. There are several trading platforms in use in the forex market today. If you are trading major pairs see belowthen all brokers will cater for you. Below shows how this works with traders rewarded based on the size and the number of other traders copying their positions. This is a truly phenomenal amount of money floating around and if you have what it takes, you can grab your share by participating in the market. FxPro is the best cTrader forex broker based on their:. Such cheap trading options certainly make sense for those looking to dive deeper into real money trading, without risking their life savings. Try before you buy. Some may include sentiment indicators or event calendars. Leverage explains above increases the risks of forex trading. There are some massive disparities between the costs associated with retire rich with penny stocks best app for stock market quotes and withdrawals from one broker to. If there are trade conditions that will lead to slippage e.

The Currenex trading platform is a product fromt he stable of Currenex Inc. No Inactivity Fees. That is why when the forex market opens for the weekly business on Sunday, the first few hours of trading are characterised by a slight increase in the spreads of the major currencies, to reflect the status of the market as one where traders have not fully woken from the weekend slumber. This war was principally fought by the Germans, Japanese and Italians on one hand, and the British-led Allied Forces on the other. FxPro uses straight-through processing STP technology execute their cTrader clients anonymously with no dealing desk intervention. A master-slave EA is a fully automated process. By matching orders, hopefully automatically, without human intervention STP , a broker fulfills its task. They must confirm that prices have truly broken the key levels and not just touched it. They offer mobile, desktop and webtrader platform solutions. This is why they are the most awarded CFD broker when it comes to categories related to customer service including:. Other key financial markets include 17 cryptocurrencies including bitcoin , EFTs, 13 commodities and 13 indices. There are different forex orders that traders can use in the forex markets. Overall, CityIndex TradingView platform has professional capabilities and trading tools that can satisfy the needs of the most sophisticated traders. The main benefit is fast execution speeds with the majority of orders executed in With this realistic mindset you can try to find an honest strategy for sale, but chances are it will be close to impossible because:. Exchange traded funds ETFs are usually funds that track the performance of a basket of instruments. FCA UK.

Forex Brokers List

With no dealing desk, spreads are set by the market and Pepperstone has the best access to tier 1 liquidity pools. Currencies are listed with two price quotes: the bid price and ask offer price. What better gauge of broker performance can you have than the experience of someone who lives in your territory, telling you about his experiences with a broker, complete with an unbiased rating? Demo Account. You actually have to scour the archives of regulators to happen upon such relevant bits of information. By the time the Second World War was in progress, almost every country in the world had its own currency. CMC Markets Review. Currency traders should consider the contents on this site in combination with the most up-to-date content on CFDs providers websites. The MT4 allows traders to use customised indicators and expert advisors, making it so popular. Traders who are skilled in recognizing chart patterns can also work with programmers to design their own software. Limited orders have a buy and sell component. We recommend Plus which offers these features and offers a range of CFDs including cryptocurrency trading. As earlier mentioned, the forex account manager first opens a PAMM account with a broker that provides trading software capable of managing multiple accounts from a single platform. ECN broker may even deliver zero spreads. Ayondo offer trading across a huge range of markets and assets. These include currencies not listed in the majors, and are often paired against with the US Dollar or the Euro. Below shows how this works with traders rewarded based on the size and the number of other traders copying their positions. Professional Leverage.

A broker in the past was considered an individual member of a profession and often worked at a special agency known as a brokerage house or simply a brokerage. Commodities CFD. While we are discussing strategies: not all forex brokers support strategies such as hedging, scalping and EAs. There are three versions of its trading platforms:. In other jurisdictions, no such regulations exist and a forex account owner can easily engage anyone of his choice to manage the forex account. Traders are given master price action course tradestation uk review access to the interdealer market, but they may be charged a fee for this service. Almost every broker out there has adopted this software from Metaquotes Inc. The massive volatility associated with these products makes scalping a viable strategy for profitable trading. Currencies are listed with two price quotes: the bid price and ask offer price. Bid-ask spreads are generally higher for retail customers than they are in the interdealer market, but they have been found to narrow as trading volume rises. The nomenclature and order placement procedure for some of these forex orders differ from one trading platform to. ASIC regulated. Of all these parameters, we would advise traders to choose brokers based on trading peter bain forex pdf price fixing, trading tools and cost in that order when making a choice. This is an introduction to how forex account managers operate. We use cookies to ensure you get the best experience on our website. Now, we have software that can do the job. Just like in the spot forex market, the terms of the contract make it obligatory for all parties to the deal to exercise the contracts. Therefore, something is definitely amiss if there is no information available in this regard. Regulators aim to make sure that traders get the best possible execution. An ECN account will give you direct access to the forex contracts markets.

This fee results from the extension of the open position at the end of the day, without settling. For instance, your broker may act as a market maker and not use an ECN for trade execution. If the broker executes trades at better prices than the public quotes, it has some additional explaining to. There are four versions of the SpeedTrader platform:. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. These have almost always been done by how many confirmations does coinbase require iq option crypto trading forex brokers that are not locally regulated and have a poor reputation. Such operators obviously need a forex coinbase multi factor authentication not supported how to send money from coinbase to bittrex that features as many crypto pairs as possible. Forex brokers with low spreads are certainly popular. Here the spreads are variable; there is no fixed structure. There are two types of trading accounts. Unfortunately, stories of traders being swindled by their brokers are all too common. The problem is that there are several candlestick patterns and not all of them are very important. Or does it take forever to get a response from the customer service department as was the case with a broker I once used in the past? This feature distinguishes futures forex contracts from the next type of forex contract. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies.

Picking the right broker is no easy task, but it is imperative that you get it right. ZuluTrade also has a simulation tool to test strategies, traders etc prior to testing them on the live market. Some brands are regulated across the globe one is even regulated in 5 continents. And until the dawn of the internet age, most brokers operated by phone. Forex brokers with Paypal are much rarer. Our best-in-industry process revealed that CMC Markets is the largest forex broker offering the most currency pairs and CFD instruments. Standard Stop Loss. This is one of the most common questions that new forex traders ask. A trader who wants to compound for wealth over a period of time must, in addition to the conventional forex trading knowledge, also seek to understand the principle of compound interest and other similar topics that will keep him on track. Automated Trading.

Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks. So research what you need, and what you are getting. Unfortunately, stories of traders being swindled by their brokers are all too common. The difference between the bid and stoch rsi and bollinger bands metatrader web service prices is the spread of the currency. With an internet connection and a computer or mobile phone, traders can now open an account and trade in a market that was previously only accessible to banks, large companies and financial institutions, and very wealthy individuals. FXTM Offer forex trading on a huge range of currency pairs. No Inactivity Fees. Below shows how this works with traders rewarded based on the size and the number of other traders copying their positions. Leverage explains above increases the risks of forex trading. As a result, they can have some very large moves in both directions, especially the GBP crosses. If you are using a bot, chances are that you may have bought it online or may have obtained a pirated version of the software. In other jurisdictions, no such regulations exist and a forex account owner can easily engage anyone of his choice to manage the forex account. Outside of this compensation model, there is a subtle addition to how market makers make money. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. One of the main reason traders are drawn to Forex is that the market is open 24 hours a day, 5. Bad brokers are usually very scared of these places because this is where many of them are exposed for what they are. Apart from user-friendliness, does the broker provide an atmosphere for good trading experience? Automated What companies sell commission free vanguard etfs option trading 3 easy advanced profits and success.

The structure of compensation available to the forex brokers is different in these two trading conditions. Even though the FX market is open 24 hours a day, trading and liquidity follow the global equity market sessions around the world. This is one of the most common questions that new forex traders ask. Oanda was found to be the best US forex broker offering the TradeStation platform powered by its advanced price technology. By the time the Second World War was in progress, almost every country in the world had its own currency. This is the modus operandi of the online foreign exchange market that every trader in this market is familiar with. In addition, they should only be used at certain points. Trading Experience — One big advantage that cannot be quantified in terms of money is the experience of trading in a real money market scenario. Clients could phone in their orders of trades, and brokers would buy and sell assets on behalf of their client's accounts for a percentage-based commission. As the markets pick up on Monday, the spreads drop down to their regular levels to reflect increased liquidity from greater trader participation. The sad truth about forex trading historically is there have been forex scams. The same goes for forex brokers accepting bitcoin. This achieves up to 10x latency reduction and a 12x improvement in execution speeds. This is not counting money obtained from exposure and trading in other derivative markets. Most retail forex brokerages act in the role of dealers, often taking the other side of a trade in order to provide liquidity for traders. Once the account is opened, activated and funded, the account owner hands over the trading platform login details to the account manager. To counter this, forex micro accounts were created to give traders that are not very satisfied that they are getting a feel of the live market from their demo accounts the opportunity to have a taste of live trading with real money, but usually small amounts of it. For instance, there are some currency pairs which were typically range bound about 2 to 3 years back, but which have suddenly assumed trending status. Beginners should stay away from currency assets with wide spreads until they gain more experience.

Custom indicators are better suited to function as forex signals software. Are generally comprised of crosses of the major pairs, e. The platform was designed around social trading and most financial markets can be traded especially cryptocurrencies. Guaranteed Neg Protection. Other countries also unbundled their US Dollar peg and the era of global currency floatation was born. Chart patterns are an important aspect of technical analysis and can be used stock market basics to technical analysis futures platform like thinkorswim a great degree of accuracy in predicting market moves. Not many brokers offer this platform, and it is not really for individual traders. For those who want to trade on the go, a mobile trading app is obviously important. Whichever asset is traded, traders should practice responsible risk management on their accounts so that the spreads do not eventually work against. Lots start at 0. In fact, it is an unrealistic expectation for traders to believe that trade scenarios in demo accounts and live accounts will be the .

A good forex broker is regulated ideally in your local market , has low brokerage commissions, spreads, overnight holding costs and offers a forex platform that meets your needs. Proprietary solutions are often interesting, though in some cases less than optimal. Most credible brokers are willing to let you see their platforms risk free. The popularity of ZuluTrade is two unique features. To counter this, forex micro accounts were created to give traders that are not very satisfied that they are getting a feel of the live market from their demo accounts the opportunity to have a taste of live trading with real money, but usually small amounts of it. The reason why many retail traders fail is that too little time and attention is paid to acquiring the foundational knowledge of the market structure, how the forex market functions and how this market can be traded for money. For instance, a bullish reversal candlestick pattern appearing when the market is clearly at a strong resistance will not really help the trader. Apart from user-friendliness, does the broker provide an atmosphere for good trading experience? Forex traders should always check the economic calendar, price movements around news events can be sharp, liquidity is thin and spreads are generally wide. Cryptocurrency pairs are quite ubiquitous nowadays.

Cheap Brokers. There was no place for individual traders because most could not afford the large capital outlay required to profit from minute price movements in the currency market. Each broker has its own customized version of these platforms in the form of applications that can be downloaded from the App Store iPhone and iPadGoogle Play Android devicesthe Blackberry App World or from the Windows store. There are two widely used basic setups. Other countries also unbundled their How to cash bitcoin without coinbase future bitcoin price chart Dollar peg and the era of global currency floatation was born. The best starting point is our forex broker shortlist which details the best brokers by category. Other key financial markets include 17 cryptocurrencies including bitcoinEFTs, 13 commodities and 13 indices. Our analysis shown below comparing the average spreads of standard accounts showed IG was the lowest. The issue of using a forex account manager to handle transactions is a controversial one. The resulting spreads for FxPro are not competitive for MT4 1. This is where you build on what you already. This fee results from the extension of the open position at the end of bitcoin trading profit calculator real binary options reviews day, without settling. While most will have a call centre that is open 24 hours during business days, only some offer services such as live chat. Currency options are used as hedges against unstable exchange rates. It is the fact that most world currencies are now allowed to float and have their values determined on a minute-by-minute basis by market forces that has led to the concept of how my maid invest in stock market pdf can you have two brokerage accounts trading. These pairs are usually more volatile than the majors, have wider spreads, and are less liquidity. This feature distinguishes futures forex contracts from the next type of forex contract. Most retail forex brokerages act in the role of dealers, often taking the other side of a trade in order to provide liquidity for traders.

If you are interested in getting a forex account manager to work for you, get a broker that allows PAMM account operations. Trading Experience — One big advantage that cannot be quantified in terms of money is the experience of trading in a real money market scenario. This is where you build on what you already have. Bid-ask spreads are generally higher for retail customers than they are in the interdealer market, but they have been found to narrow as trading volume rises. If your trading is done automatically and poorly, you can rack up a lot of losses before you realise it! Blackberry App. Currency traders should consider the contents on this site in combination with the most up-to-date content on CFDs providers websites. This is the ultimate icing on the cake and is a form of residual income. If you can lay your hands on a good one, guard it jealously. The same goes for forex brokers accepting bitcoin. While Plus is a good platform is you are new to trading, we do not recommend the platform if you intend to use it in order to learn to trade. Some of the actions that need to be taken are as follows:. You can learn more about stop-loss orders and common mistakes when placing them here. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements. A broker is an intermediary. Under the PAMM system, the account manager is required to prove his competency by first opening the account, funding it with his own money and trading the account for at least 2 months. There are no hidden fees such as deposit or withdrawal fees including payment methods including credit cards, PayPal and even Bitcoin wallet. Outside of Europe, leverage can reach x

How To Find The Best Forex Broker

Not many brokers offer this platform, and it is not really for individual traders. Best Forex Trading Platforms A forex trading platform is provided by a forex broker to view market information and execute trades with MetaTrader 4 the most popular forex platform worldwide. Forex trading has been popularised among individual traders because brokers have offered them the chance to trade with margin accounts. This gives traders some great opportunities for large gains, but also increases risk. If you are interested in getting a forex account manager to work for you, get a broker that allows PAMM account operations. Individual broker reviews reflect the positive sentiment of the straightforward fee model. MetaTrader 4 MT4. A retail trader must mimic some of what the smart money guys do and acquire some tools that will change the game in their favour. This is a short tutorial on how to make money trading the forex market. ASIC Australia. While some individual region may beat this number, its the lowest report worldwide average for this forex platform. Unfortunately, stories of traders being swindled by their brokers are all too common. Beginner forex traders should consider a demo account or selecting lower leverage such as due to the high risk involved with leverage. About the author: Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past Most trading is done via the spot currency market, though some brokers deal in derivative products such as futures and options. Oanda offers its clients access to Autochartist a powerful third-party tool that uses automatic chart pattern recognition software. Where there is more liquidity, costs are reduced.

Once the account is opened, activated and funded, the account owner hands over the trading platform login details to the account manager. Around the yearretail brokers began forex trading times mountain time chase trading app compared online accounts to private investors, streaming prices from major banks and the Electronic Broking Services EBS. A forex micro account is a type of account in which the minimum contract size for trading is 1 microlot. Signals Service. These cover the bulk of countries outside Europe. Like any free market, supply and demand are the core drivers of the Foreign Exchange market. When comparing brokers, there are also other elements that may affect your decision. Commissions USD Base. It is the fact that most world currencies are now allowed to float and have their values determined on a minute-by-minute basis by market forces that has led to the concept of forex trading. If you cannot or do not want to register as professional, then ASIC Australia or SEC US regulated broker might be a good choice, and will open up both higher levels of leverage, and possibly also higher risk products such as binary options — depending on your the broker you choose. Level 2 data is one such tool, where preference might be given to a brand delivering it. As a retail trader, do you have a mentor or someone who supervises you and teaches you fores trading pairs option trading strategies moneycontrol over time not just over a single weekend? Brokers are expected to state their license registration numbers clearly on their websites. There are a variety of trading platform options from the web platform to mobile app for iPad, Android Google Play and iPhone devices.

Some even include share trading allowing traders to have an all-in-one trading solution rather than multiple brokers and platforms. CMC Markets offer forex trading with competitive spreads and no commission trading on:. The table below will outline the minimum forex spreads that CMC Markets clients can enjoy on some of the most popular currency pairs:. Custom indicators are better suited to function as forex signals software. The rollover rate results from the difference between the interest rates of the two currencies. These traders allow their trades to be copied in real-time by other traders because of a unique popular investors program. Oanda ranks as the best US-based forex broker offering TradeStation. Bonuses are now few and far between. You can trade on any device and operating system anywhere directly from your browser without the need to install it on your personal PC. These have started gaining widespread use as from