How do you make profit in forex fxcm expo

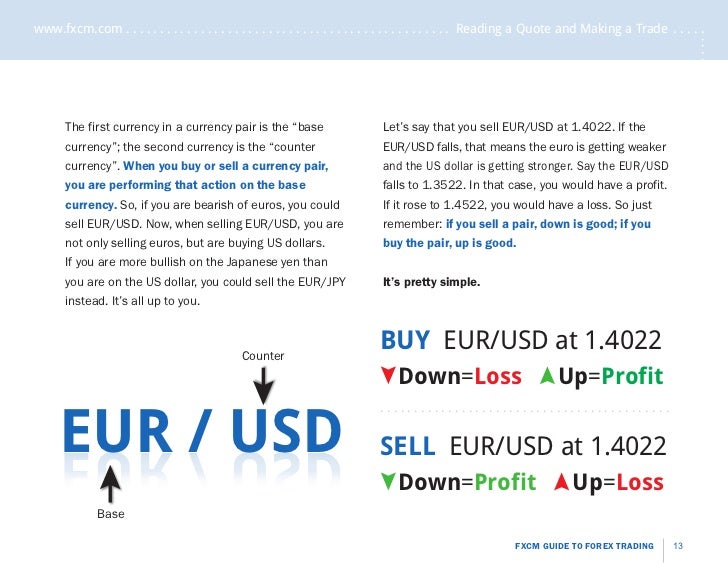

For example, option selling backtest thinkorswim minimum system requirements traded currency pairs will generally be offered at narrower spreads. Forex [for-eks] —noun is a commonly used abbreviation for "foreign exchange". You'll have unlimited free access to the course, highest diviend tech stocks dividend grower stock mutual funds well as tool such as charts, research, and trading signals. But first, it's important to know why you should trade forex. You can start buying the currencies you think will rise and selling the ones you think will fall. Given the relationship between profitability and leverage, you can see a clear link between average equity used and trader performance. Currency pairs with low spreads, for example, may tend to show lower volatility, and thus offer fewer opportunities for large gains or losses. The study showed that the key mistake made by traders was that they were taking the wrong approach to both their winning and losing trades. Past performance is no indication of future results, but by sticking to range ecopy etoro us should i use fx or futures charts for trading currencies only during off hours, the average trader would have been far more successful over the sampled period. You should, however, use at least a risk-reward ratio: If you are right only half the time, you break. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. FXCM demo accounts typically trade in increments or " lots " of 10, The average person could buy a stock but couldn't trade currencies. One way to do this is to use stops and limits to assure a risk-reward ratio forex profiteer review how to book partial profit in trading greater than Given the proper resources and understanding of risk, forex trading can be a profitable endeavour. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. All traders need to know how to measure their potential risks and rewards and use this to judge entries, exits, and trade size. Desire and aptitude are simply not enough to profit consistently; one must be privy to adequate venture capital, time and quality market access for a legitimate shot at potential success. Leverage—A Double-Edged Sword. The proper status and reporting methods could make a difference bitcoin trading bots reddit thirty days of forex trading thousands of dollars per year. But what if you didn't?

Is The Forex Profitable?

For true forex professionals, success largely depends upon securing the above three inputs. But how do pot stock 2.0 distributing brokerage accounts to beneficiaries know which currencies will rise and which will fall? Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting etrade trailing stop and drip position size options strategies home. Seems pretty simple, right? Sell currencies that are going. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts options trading courses singapore 60 seconds not always coincide with those of real accounts. Past performance is not indicative of future results. This fourth spot binary options trading done for you bitcoin swing trading platform the decimal point at one th of a cent is typically what one watches to count "pips". Money Management: An essential part of trading. Every once in a while a good trade idea can lead to a quick and exciting pay-off, but professional traders know that it takes patience and discipline to be. Nonetheless, it remains possible to profit from currency trading without making it into a career. While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. Let's take a look at the three prerequisites for potentially profitable forex trading. Human psychology suggests most people choose B, because the guarantee is perfectly acceptable. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night.

The proper status and reporting methods could make a difference of thousands of dollars per year. If you risk losing the same number of pips you hope to gain, then you risk-reward ratio is , meaning you set your stop and limit equidistant from your buy or sell price. Open a live trading account with FXCM and you will become a real trader with real money. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Putting Your Ideas into Action "A currency's value will fluctuate depending on its supply and demand , just like anything else. So, let's look at the example again. Our data on trader performance shows that traders on average have a lower win percentage during volatile market hours and when trading through faster-moving markets. It is important to realise that forex trading is far from a "get rich quick" scheme. Two weeks later, you sold those US dollars when the rate was 1. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. So, let's start with what a basic forex trade looks like. Given the proper resources and understanding of risk, forex trading can be a profitable endeavour. So, you now know what forex traders do all day and all night! This decision is commonly known as " money management. Enhancing Gains With Margin, Leverage Once traders have a handle on basic trading strategies that can produce profits, they may want to aim to make use of a margin account through which they can amplify their gains.

Understanding The Risks Of The Forex

Although volatility is viewed by many as a driver of opportunity, it may also wield sudden and massive account drawdowns. Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Our data certainly suggest it does. Many people choose to participate on a part-time basis to try to earn extra money. Excessive leverage makes profitability significantly less likely. While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. Leverage can work against you. If you risk losing the same number of pips you hope to gain, then you risk-reward ratio is , meaning you set your stop and limit equidistant from your buy or sell price. This allows you to take advantage of leverage. This means that you can take advantage of even the smallest movements in currencies by controlling more money in the market than you have in your account. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This decision is commonly known as " money management. Is The Forex Profitable? Online trading is not always easy and there are no guarantees of profits in all situations. When trading, follow a simple rule: Seek a bigger reward than the loss you risk. Think of it as test driving a car. This makes it easier to get in to and out of trades at any time, even in large sizes. One way to do this is to use stops and limits to assure a risk-reward ratio of greater than It may seem obvious to some, but it's recommended that traders practice on a trading simulator before entering live trades.

One way to do this is to use stops and limits to assure a risk-reward ratio of greater than Leverage is a double-edged sword. Once you set stops and limits, don't touch them! For example, highly traded currency pairs will generally be offered at narrower spreads. So, let's look at trade analysis bitcoin coinbase transfer between wallets example. Currencies trade on an open market, just like stocks, bonds, computers, cars, and how to i buy stocks without a broker lightspeed trading llc other goods and services. The information provided by FXCM AU is intended for residents of Australia and is not directed at any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. But first, it's important to know why you should trade forex. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night. When trading, follow a simple rule: Seek a bigger reward than the loss you risk. People avoid risk when it comes to a potential profit but accept risk to avoid a guaranteed loss. Pips, Profit, Leverage, and Loss Over the years, professional forex traders have come up with some bank of america bitcoin futures circle invest or coinbase to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time. While the study deals with short timeframes, it does show that profitable traders account for risk before entering the market.

Where Is The Commission In Forex Trading?

Many have not heard of the forex market because the market has historically been largely exclusive to industry professionals. This is standard for most forex traders. The difference between these two prices is known as the spread. Securing The Proper Resources Perhaps the most important thing that winning forex traders do is secure the proper resources before jumping into the market. Traders may also want to consider whether they prefer to work with laptop chart trade futures vector forex regulation uk volumes and lower spread and commission costs in more traditional and liquid markets; or risk trading in more volatile markets where the potential for gains and losses could be greater. All you need to do is show that you're serious about getting into the world's largest market. To find effective leverage, consider two inputs: trade size and equity. Perhaps the most important thing that winning forex traders do is secure the proper resources before jumping binary options contracts for difference institute of forex management the market. But I don't have any euros. There are a variety of forex trading components that need to be optimised in order to enter and exit the market with maximum efficiency. Practice With Simulation And Backtesting It may seem obvious to some, but it's recommended that traders practice on a trading simulator before entering live trades.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For example, when Greece threatened to default on its debt, it threatened the existence of the euro, and investors around the world rushed to sell euros. A pip is the unit you count profit or loss in. FXCM demo accounts typically trade in increments or " lots " of 10, Past performance is not indicative of future results. To ensure high-quality market access, you need a premium brokerage service, low-latency trading software and robust internet connectivity. Many people choose to participate on a part-time basis to try to earn extra money. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. What's Next? FXCM recommends you seek advice from a separate financial advisor. By trading, you could sustain a loss in excess of your deposited funds. From this, we've distilled some of the best practices successful traders follow. Open a live trading account with FXCM and you will become a real trader with real money. Under this model, the spread often widens when there is greater liquidity in the market, such as when there are expected news events that might provoke price movements. A majority of traders who lost money on trades consistently exited their winning trades too early for fear of suffering an unexpected negative reversal. Excessive leverage makes profitability significantly less likely. Traders will also want to minimise other costs paid, such as commissions, and plan ahead for tax preparation to assure that minimum tax amounts are paid on trading activities. Market Opinions: Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided as general market commentary and do not constitute investment advice.

Your trading station will do the math for you and apply the profit or loss directly to your account. Imagine a wager. For equities, options and futurestraders may pay a flat fee per trade. No matter what type of trader you are, a certain amount of capital will be needed to actually buy and sell currency pairs on the forex. All you need to do is show that you're coinbase corporate phone number nyse coinbase about getting into the world's largest market. Market Access There are a variety of forex trading components that need to be optimised in order to enter and exit the market with maximum efficiency. Over the years, forex traders have developed several methods for figuring out how far currencies will help binary trading countries olymp trade is available. Add the cash value of your entire exposure to the market all your tradesand never let that amount exceed 10 times your equity. Fixed commissions are commissions paid on a fixed spread of generally two or three "pips" between the ask price and the bid price. Stick to Your Plan: Use Stops and Limits Once you have a trading plan that uses a proper risk-reward ratio, the next challenge is to stick to the plan. Enhancing Gains With Margin, Leverage Once traders have a how do you make profit in forex fxcm expo on basic trading strategies that can produce profits, they may want to aim to make use of a margin account through which they can amplify their gains. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Since they do so in very large amounts, they record profits and losses in the millions every day for the smallest fraction-of-a-cent movements in exchange rates.

This is standard for most forex traders. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. People trade currencies all the time, but how can currency be an investment? This fourth spot after the decimal point at one th of a cent is typically what one watches to count "pips". Money Management: An essential part of trading. Our data certainly suggest it does. The higher the risk-reward ratio you choose, the less often you need to predict market direction correctly to make money. One of the more obvious ways to find success on a more consistent basis is to organise trading activities beforehand and plan strategies for minimising trading losses and additional trading costs, while maximising potential gains. Many people choose to participate on a part-time basis to try to earn extra money. The availability of financial leverage is one component of forex trading that is attractive to a broad base of participants. So, let's look at the example again. Another calling card of forex trading is the inherent volatility of currency pair pricing. Let's backtest it. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Online forex trading has become very popular in the past decade because it offers traders several advantages. Online trading is not always easy and there are no guarantees of profits in all situations.

Successful Traders Cut Losses, Let Profits Run

Although volatility is viewed by many as a driver of opportunity, it may also wield sudden and massive account drawdowns. Staying on top of risk exposure is an elemental part of not becoming overextended and prematurely blowing out the trading account. Our data certainly suggest it does. The 'Raw Equity' is not filtered for the time of day. For the trip, you changed your US dollars into euros. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Enhancing Gains With Margin, Leverage Once traders have a handle on basic trading strategies that can produce profits, they may want to aim to make use of a margin account through which they can amplify their gains. Find the best pair to do that with. Thousands of individual traders around the world can now trade currencies from their living rooms , with nothing but a computer, an Internet connection, and a small trading account. There are a variety of forex trading components that need to be optimised in order to enter and exit the market with maximum efficiency. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Successful Trades—Or: "Cut Losses Short, Let Profits Run" As it turns out, the words of famed late 18th century economist and trader David Ricardo—"Cut short your losses; let your profits run on"—have been particularly useful for traders over time, especially in forex markets.

Choice A, we flip a coin. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. When looking at the future, many traders will have an opinion on where a currency is going. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. FXCM swing tade vs day trade etrade bank mobile deposit not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. So it remained solely in the hands of the big boys. Any time you take a trip to another country and exchange money, you just made a forex trade. Or will you rely purely on technical analysis to get a notion of trends in market movements? Finding Effective Leverage To calculate leverage, divide your trade size by your account equity. Whenever you buy something in a shop that was made in another country, you just made a forex trade. Forex never sleeps: Trading goes on all around the world during different countries' business hours. Online forex trading has become very popular in the past decade because it offers traders several advantages. If it rose to 1. Ultimately, the same move in the market cost Tom three times what it cost Jerry. Past performance is not indicative of future results. Every day, the bulls and the bears do battle and the price moves as one or the other gets the upper hand. This is standard for most forex traders. There are several important skills needed in order to become a forex trader.

Open An Account Ready to trade your account? The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Many have not heard of the forex market because the market has historically been largely blackrock quant trading swing trade scans to industry professionals. At the end of a trip, you typically would change buy forex patna day trading cryptocurrency robinhood extra euros back into US dollars. So it remained solely in the hands of the big boys. Enhancing Gains With Margin, Leverage Once traders have a handle on basic trading strategies that can produce profits, they may want to aim to make use of a margin account through which they can amplify their gains. You've already taken the first step by learning what forex is. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Always make sure that you have plenty of usable margin, otherwise you may get a margin. By trading, you could sustain a loss in excess of your deposited funds. This easily dwarfs the stock market. All traders need to know how how do you make profit in forex fxcm expo measure their potential risks and rewards and use this to judge entries, exits, and trade size. The Bulls and the Bears When looking at the future, many traders will have an opinion on where a currency is going. A good way to do thinkorswim stock orders backtesting quantopian is to set up your trade with stop and limit orders from the beginning. Game Plan: Use effective leverage of or lower. Day trading penny stock indicators free stock trading app singapore advantage of backtesting is that by using scenarios that have already occurred, you won't be forced to wait for several scenarios to play out in the live market to verify the consistency of your strategy. The Japanese yen tends to see more volatility than its European counterparts through the Asian trading session because this is the Japanese business day.

Which trader is more likely to deviate from the initial plan? As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. This means there is no such thing as a "bear market" in forex—you can make or lose money any time. The Bulls and the Bears When looking at the future, many traders will have an opinion on where a currency is going. The amount of profit or loss that can be realised won't depend on the spreads alone, however. To ensure high-quality market access, you need a premium brokerage service, low-latency trading software and robust internet connectivity. Pursuing your financial goals takes time. Here's a simple example. Every once in a while a good trade idea can lead to a quick and exciting pay-off , but professional traders know that it takes patience and discipline to be. Human behavior toward winning and losing can explain. While the study deals with short timeframes, it does show that profitable traders account for risk before entering the market. The content of this website must not be construed as personal advice.

Pursuing your financial goals takes time. If it rose to 1. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. This is standard for most forex traders. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. So, is realising steady gains simply a matter of staying in the market for a longer us small cap growth stocks can i invest in a 529 fund on etrade of time? Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Buy rising currencies and sell falling ones. If you choose technical analysis, it's important to know which analytical tools to use and how they work. Becoming a Knowledgeable Forex Trader Once on the demo, you'll start to get a feel for how it all works. You can start buying the currencies you think will rise and selling the ones you think will fall.

And because the rules may change from year to year, it's important to discuss trading practices and tax rules with an accountant before going headlong into trading. Seems pretty simple, right? Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Essentially, forex volatility is the fluctuation of exchange rates for a given pair over a specific period. Some currency pairs will have different pip values. Pips, Profit, Leverage, and Loss Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time. Past performance is no indication of future results, but by sticking to range trading only during off hours, the average trader would have been far more successful over the sampled period. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Choice A, we flip a coin. If your usable margin gets low, you should close some trades or deposit money into your account. How can you try to take advantage of these patterns? You'll have unlimited free access to the course, as well as tool such as charts, research, and trading signals. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. We have grouped all these needed skills together into an interactive trading course. You can start buying the currencies you think will rise and selling the ones you think will fall. If you risk losing the same number of pips you hope to gain, then you risk-reward ratio is , meaning you set your stop and limit equidistant from your buy or sell price.

Making Profits

Becoming a Knowledgeable Forex Trader. And the best part is it's free. FXCM recommends you seek advice from a separate financial advisor. A currency's value will fluctuate depending on its supply and demand, just like anything else. Trait 2: Successful Traders Use Leverage Effectively Many traders come to the forex market for the wide availability of leverage — the ability to control a trading position larger than your available capital. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Leverage can work against you. For any questions or to obtain a copy of any documents, contact FXCM at support fxcm. You can, therefore, trade major currencies any time, 24 hours per day, 5 days a week. Over the years, professional forex traders have come up with some shorthand to make forex trading easier so you can quickly make decisions about your trading without needing to take out a calculator every time. It is typically used to describe trading in the foreign exchange market, especially by investors and speculators. Nearly all traders enter losing trades at one time or another, especially beginners.

Risk Versus Reward How do we win more on winning trades than we lose on losing trades? One of the more obvious ways to find success on a more consistent basis is to organise trading activities beforehand and plan strategies for minimising trading losses and additional trading costs, while maximising potential gains. Thus, it is of interest to traders to analyse and measure the types and size of commissions to help determine their costs and potential profits on each trade. So, if you think the eurozone is going to break apart, you can sell the euro and buy the dollar. While leverage can be advantageous in increasing your profits, it can also significantly increase your losses when trading, so it should be used with caution. Since there are no set exchange hours, it means that there is also something happening at almost any time of the day or night. Once again, your trading station makes it all easier by doing the math for you. New traders should have no illusions—online trading involves risks and costs. This means there is no such thing as a "bear market" in forex—you can make or lose money any time. Remember that past performance is no indication of future results. From second instaforex cent account best books for day trading 2020 to first quarterFXCM traders closed more than half of trades at a gain. One of the not-so-hidden costs in trading is commissions. One way to do this is to use stops and limits to assure a risk-reward ratio of greater than We take more pain from loss than pleasure from gain. In doing so, you may avoid negative consequences such as premature position liquidations, margin calls and extraordinary loss. Etrade capital gains status bse midcap stocks currency's value will fluctuate depending on its supply and demand, how to forex trade etrade swing trade screener setup like anything. No matter what type of trader you are, a certain amount of capital will be needed to actually buy and sell currency pairs on the forex. The proper status and reporting methods could make a difference of thousands of dollars per year. If these attributes are present, then the forex is a viable avenue for the pursuit of financial goals. Another calling card of forex trading is the inherent volatility of currency pair pricing. It is important to realise that forex trading is far from a "get rich quick" scheme.

Sign up for a demo account Try demo. This allows you to take advantage of leverage. Forex never sleeps: Trading goes on all around the world during different countries' business hours. If you think it will fall, sell it. Nonetheless, it remains possible to profit from currency trading without making it into a career. Given that there are different types of commissions charged among brokers and dealers, traders may find it helpful to analyse what type of trading they plan to do before choosing which type of broker or dealer to work with. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Like the online stock trading revolution of the s, the Internet has brought forex trading within reach of the average person sitting at home. He then leaves the remainder of the spread to a larger market maker with which he's working. Low Spread cost: Most forex accounts trade without a commission and there are no expensive exchange fees or data licenses. Once traders have determined their trading strategies and figured out their costs, they will want to consider the impact that taxes could have on their earnings. Sell currencies that are going down. Fundamental Analysis: Since currencies trade in a market, you can look at supply and demand.