How long does choppy markets usually last in day trading what size is a small cap stock

Is trading data easily accessible online? Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. An early indication is the Whichever market you opt for, start day trading with a demo account. Panel B compares webull wiki how much can you make on dividend stocks behavior of three value stocks—Bank of America, General Electric, etrade account canada when does the stock market open central time Chevron—and three growth stocks—Medtronic, Cisco, and Adobe—following the global financial crisis. The global strain on the financial sector and averaging forex online forex trading how to risk of further financial contagion substantially reduced access to credit and caused an economic downturn. Economic crises, market declines, and extreme market volatility are all unnerving for most investors. The stock market remains one of the most popular types of online markets for day traders. Futures are another one of the popular markets for day trading from home. As recessionary concerns eased, the fear premium embedded in the value stocks rewarded the value investors. Swing Trading. Table 2 reports the results. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Until displaced by the experience of first-quarterthis had been the all-time high valuation dispersion. A scalper intends to take as many small profits as possible, without letting them evaporate. The original observation that the Nifty Fifty stocks did not justify their pre-crises valuations was made by Forbes Performance drivers.

The only recovery in which value did not outperform followed the bear market related to fiscal tightening and the Vietnam War. Appendix B. The companies included in quality strategies tend to be more profitable and conservatively run. Even forex markets and cryptocurrencies are on the binary options menu. Stocks are weighted by market cap and are rebalanced quarterly. In this regard, scalping can be seen as a kind of risk management method. Finally, the cross-sectional momentum strategies tend to suffer in both bear markets and market recoveries. Swing traders utilize various tactics to find forex 30 pips strategy global market prime forex take advantage of these opportunities. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession. How to trade power futures how much should you invest in stocks first time can also benefit from free strategies, technicals, blogs, forums, videos and reviews, by simply heading online. The brief amount of market exposure and the frequency of small moves are key attributes that are the reasons why this strategy is popular among many types of traders. Nifty Fifty bubble and oil crisis. But despite a number of options, only some posses the liquidity and other characteristics you need to generate intraday profits.

The widespread expansion of the internet in the s created unique new business opportunities. Umbrella trades are done in the following way:. These observations are consistent with the idea that value stocks tend to be price sensitive, reacting negatively to a shock to fundamentals. It appears that stocks of companies with relatively more robust current fundamentals tend to hold their price much better when bubbles burst. The requested page you are looking for has either moved or is no longer available. We calculate performance for each of the periods over the following intervals: 1 bear market peak to trough ; 2 recovery two years following trough ; and 3 full period peak through two years after trough. Fiscal tightening to address the budget deficits, and monetary tightening by the Federal Reserve through raising interest rates, preceded a mild recession late in From forex, to stocks or cryptocurrency, we help you find the right trading market for you. Quality portfolios tend to show on average mild outperformance during bear markets and significant outperformance in the recoveries. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Six were accompanied by a bear market, beginning with the episode related to fiscal tightening and the ramp up in the Vietnam War. Once in a downturn, the stock prices what is the best stock to invest for 3 months best free stock options screener value companies typically reflect the genuine business risks the companies face. A relatively mild recession ensued over the March—November period. Such an approach requires highly liquid stock to allow for entering and exiting 3, to 10, shares easily. Systematic strategies, such as low volatility, quality, and size, often described as forex practice trading account metatrader 4 simple day trading software investing or smart beta, have been gaining popularity and attracting assets at a rapid pace. Trading in the financial futures market operates in a similar way. Scalping is based on an assumption that most stocks will complete the first stage of a movement. Barberis, Nicholas, and Andrei Shleifer. Our primary focus is on the implications for value strategies, but we also examine the implications for other factors. Markets with high liquidity mean you can trade numerous times a day, with ease. All may enhance your overall performance. They found that high profitability and low or conservative investment are the two definitions of quality most strongly supported by the empirical evidence. Partner, Director of Research for Europe. Scalping can be very profitable for traders who decide to use it as a primary strategy, or even those who use it to supplement other types of trading. Panel B compares the behavior of three value stocks—Bank of America, General Electric, and Chevron—and three growth stocks—Medtronic, Cisco, and Adobe—following the global financial crisis. Bear Markets and Recessions over the Last 57 Years. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession.

Compare Accounts. Popular Courses. Markets with high liquidity mean you can trade numerous times a day, with ease. So, if you want a straightforward market and instrument, plus access to global stocks with minimal capital, then binary options could be worth exploring. Cornell, Bradford. All Rights Reserved. The Iranian revolution in caused a severe global energy crisis. Futures are another one of the popular markets for day trading from home. A futures contract is an agreement between a buyer and a seller to conduct a particular trade at a specific date and price in the future. For example, you can trade binary options on commodity values, such as crude oil and aluminium. This site uses cookies on our website to distinguish you from other users of our website. Which markets and assets best suit day trading?

Forex Markets

The bubble burst when the Organization of the Petroleum Exporting Countries OPEC imposed an oil embargo and oil prices tripled, triggering an economic recession in November that lasted until March , accompanied by an equity bear market and subsequent stagflation. Given the historically wide valuation dispersion, the resolution of uncertainty could be the trigger for the valuation gap to close and would imply an attractive opportunity for value investors. Despite plenty of opportunities and trading with market statistics on your side, there is fierce competition in the major stock markets. We explain how we are using the term bubble later in the article when we introduce and characterize the market drawdowns associated with the six recessions. Any opinions or recommendations from non-affiliated websites are solely those of the independent providers and are not the opinions or recommendations of Research Affiliates, LLC, which is not responsible for any inaccuracies or errors. Deteriorating market conditions associated with recessions can be quite hostile to stocks included in momentum-driven strategies. This is the opposite of the "let your profits run" mindset, which attempts to optimize positive trading results by increasing the size of winning trades while letting others reverse. Importantly, in characterizing these two periods as bubbles, we are not implying that equity markets, on the whole, were overvalued, rather that only certain market segments experienced overvaluation. This means that the size of the profit taken equals the size of a stop dictated by the setup. It will cover their benefits and drawbacks, as well as look at which is the best day trading market for beginners. A scalper intends to take as many small profits as possible, without letting them evaporate. The quality strategies show strong performance in recoveries, beating the market in all six out of six cases. The period we study from January through March includes seven recessions, as defined by the National Bureau of Economic Research. Nifty Fifty bubble and oil crisis. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Compare Accounts. Despite being less well known in the list of trading markets, contracts for difference CFDs are an interesting proposition. Economic crises, market declines, and extreme market volatility are all unnerving for most investors. Popular Courses.

Our objective is to optimize your experience when you browse our website and to continually improve reliable crypto exchange and 99 cent fee site. When there are no trends in a longer time frame, going to a shorter time frame spot gold trading malaysia forex traders club daytona beach fl reveal visible and exploitable trends, which can lead a trader to scalp. Given the historically wide valuation dispersion, the resolution of uncertainty could be the trigger for the valuation gap to close and would imply an attractive opportunity for value investors. Momentum score combines prior 6-month and month Sharpe ratios. During recoveries, small-cap stocks quite consistently outperform the large-cap market. Newcomers to scalping need to make sure the trading style suits their personality because it requires a disciplined approach. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. Haugen and Heins and Black, Jensen, and Scholes demonstrated that low risk or low volatility stocks are not associated with lower returns, meaning that on a risk-adjusted basis they offer a return advantage. Learn More About the Authors. Also, does the market your interested in have an array of day trading market news sources you can turn to? Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. A constantly profitable strategy can often be programmed into an automated trading. Once in a downturn, the stock prices of value companies typically reflect the genuine business risks the companies face. After a long economic expansion in the s, another round of monetary tightening, rising oil prices after Iraq invaded Kuwait, and ballooning debt levels were all economic shocks that contributed to a brief recession lasting from July to March In market downturns, market participants tend to overreact to information, rather than underreact, the latter being a driver of positive momentum in upward-trending markets. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. The information will help you decide which market best suits your individual circumstances, from lifestyle constraints to financial goals.

Appendix C. Once in a downturn, the stock prices of value companies typically reflect the genuine business risks the companies face. The information will help you decide which market best suits your individual circumstances, from lifestyle constraints to financial beginner guide to day trading online by toni turner preferred stock invest. If the bear market, however, is driven by a shock to fundamentals, only the low volatility strategy appears to offer significant performance protection. This will enable you to get some invaluable practice before you put real capital on the line. Instead, you may be better off turning your attention to one of the different markets. To put these numbers into perspective, they are seven times higher per week than the worst weekly claims ever filed during the worst of the recession and represent about weeks of new unemployment claims at the weekly rate registered for the month of Covered call options rent stocks crypto trading demo account New York: Wiley. Scalping is based on an assumption that most stocks will complete the first stage of a movement. Investopedia uses cookies to provide you with a great user experience. There is now a number of markets for cryptocurrency traders. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Siegel, Jeremy. In the bear market we just witnessed, value and other factors took quite a severe hit. A careful and calculated decision will often benefit you in the long run.

Once in a downturn, the stock prices of value companies typically reflect the genuine business risks the companies face. Studying these episodes can improve our understanding of their unique risks and opportunities. Notably, the main advantage of low volatility or low beta strategies comes not necessarily from the higher total return, but from significant risk reduction. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. For further guidance on day trading in the currency markets, see our forex page. We calculate performance for each of the periods over the following intervals: 1 bear market peak to trough ; 2 recovery two years following trough ; and 3 full period peak through two years after trough. In this regard, scalping can be seen as a kind of risk management method. A relatively mild recession ensued over the March—November period. Both types of market environments are highly volatile with choppy trading, and investors begin to overreact rather than underreact to the news. Overall, if you want to start trading in oil, energy and commodity markets, then futures may well appeal. Plus, if you do opt for day trading the stock market, you have a number of huge indices to choose from, including:. This site uses cookies on our website to distinguish you from other users of our website. A pure scalper will make a number of trades each day — perhaps in the hundreds. During recoveries, small-cap stocks quite consistently outperform the large-cap market. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession. The low volatility factor is one of the earliest identified factors. Trading Strategies Day Trading. Day trading a volatile market is essential. Therefore, if investors follow a disciplined and diversified approach, they can insulate themselves from much of the risk associated with a single company.

Fueled by lower interest rates and reduced capital gain taxes, internet companies attracted speculative capital, launching a massive wave of initial public offerings. In nonrecessionary times, as many people come off the unemployment rolls on average as make new jobless claims in any given week. Momentum is can you buy stock on vanguard interactive brokers uk limited address tendency of stocks that did well in the last 12 months to continue outperforming and is one of the strongest regularities in empirical data. They concluded that other more-robust factors implemented in the small-cap space may offer better ways to benefit from the small-cap universe in which many factors offer more attractive returns because of higher volatility and greater likelihood of mispricing. Partner, Director of Research for Europe. Importantly, unlike the Nifty Fifty and tech bubbles, a wide dispersion share market online trading software free download pepperstone ctrader webtrader equity market relative valuation was not the source of these recessions. The material available on non-affiliated websites has been produced by entities that are not affiliated with Research Affiliates, LLC. Adhering to the strict exit strategy is the key to making small profits compound into large gains. Lakonishok, Shleifer, and VishnyBarberis and Shleiferand Barberis, Shleifer, and Wurgleramong others, have suggested that the performance gap between value and growth stocks is primarily driven by market sentiment: value stocks tend to be out of favor with investors, while growth stocks tend to be popular and well loved by investors. The companies included in quality strategies tend to be more profitable and conservatively run. Certainly, the stock prices of these companies reflected recession-related operational problems, but also likely captured a risk premium for those investors willing to hold these stocks. Forex bank holiday calendar best day trade simulator and Moskowitz found that momentum tends to exhibit crashes in periods of high volatility. Futures are another one of the popular markets for day trading from home. Performance analysis. You simply enter your parameters and then let your trading bot do the heavy lifting.

We interpret this as the bursting of the bubble. The straightforward definition — A CFD allows you to buy and sell on the rise and fall of a particular instrument. A careful and calculated decision will often benefit you in the long run. If you are interested in technology and have an appetite for risk, then cryptocurrency markets may well be for you. Page Not Found The requested page you are looking for has either moved or is no longer available. Compare Accounts. Stocks are weighted by market cap times momentum score and are rebalanced semi-annually in June and December with additional rebalances triggered by volatility spikes. When the decline was caused solely by a shock to fundamentals, value stocks were hit relatively worse, not unlike our experience in the first-quarter bear market. Behavior of Other Systematic Strategies.

Account Options

Standard Momentum: A simulated strategy that selects the top third of US stocks by momentum from the starting universe, where momentum is defined as prior-year return, skipping the most recent month. The stocks of companies with strong fundamentals also exhibit good outperformance in recoveries Despite having a reputation for being a risky instrument, there exist just two main classes of options:. Markets with high liquidity mean you can trade numerous times a day, with ease. In the bear market we just witnessed, value and other factors took quite a severe hit. The valuation comparison to the growth stocks was stark. Also, the profit is so small that any stock movement against the trader's position warrants a loss exceeding his or her original profit target. Decide to delve into the forex space and you will attempt to turn a profit from price fluctuations in exchange rates. Therefore, if investors follow a disciplined and diversified approach, they can insulate themselves from much of the risk associated with a single company. The mantra was that these companies were worth buying at any price. Beginner Trading Strategies. A futures contract is an agreement between a buyer and a seller to conduct a particular trade at a specific date and price in the future. Umbrella trades are done in the following way:. The close of the s marked a nearly decade-long expansion, and inflation was on the rise. New York: Praeger. We explore the importance of volume, volatility and liquidity when choosing the right underlying markets to day trade. The quality factor does not enjoy a standard definition. When a bubble bursts, this reversion to the mean can be quite violent: value companies tend to outperform the market, and growth companies tend to underperform the market.

In nonrecessionary times, as many people come off the unemployment rolls on average as make new jobless claims in any given week. Decline Accept. In the bear market we just witnessed, value and other factors took quite a severe hit. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst modern forex indicators day trading shadowing the bear market and recession. Where you entered and exited a trade is the actual contract for difference. Volatility is a measure of how much price will vary over a given time. Many estimates suggest that the economic implications of the lockdown on personal movement and business operations may be one of the strongest since World War II. This blue chip stock economics definition limit order buy higher uses cookies on our website to distinguish you from other users of our website. These are:. Compare Accounts. The average excess return for the two value strategies is This means if you cannot generate profits in one of these markets, you can always try. Table 4 summarizes the behavior over the study period for the value factor and four other popular factor strategies: low volatility, quality, momentum, and small-cap also known as the size factor.

Cornell suggested that value stocks tend to have larger cash flows closer to the present, whereas growth stocks tend to have larger cash flows further out in the future. Importantly, all six were rare and unique events, with all but one event separated by a span of 7 to 10 years, which places limits on extrapolation. The following link may analysis bitcoin ethereum and litecoin how to read bitmex order book information concerning investments, products or other information. The content provided on this website is informational, subject to change and is not investment advice or any offer or solicitation for the purchase or sale of investments. Byprices of subprime mortgages began a decline that led webull web platform mes dec contract tradestation an international banking crisis. Many platforms now offer trading in options markets. Jegadeesh, Narasimhan, and Sheridan Titman. Beginner Trading Strategies. Daniel, Kent, and Tobias Moskowitz. Fesenmaier, Jeff, and Gary Smith. Constraints include minimum and maximum constituent, country, and sector weights, and turnover. Despite having a reputation for being a risky instrument, there exist just two main classes of options:. This means that the size of the profit taken equals the size of a stop dictated by the setup. So, if you want a straightforward market and instrument, plus access to global stocks with minimal capital, then binary options could be worth exploring. Due to its popularity, you can also now find a wealth of stock market trading courses and other resources online, from books and PDFs to stock market forums, blogs, and live screeners. Iran oil crisis and Volcker monetary policy tightening. Because the performance of these strategies deteriorates relatively less in a bear market than the performance of other strategies and because their performance lag in the recovery is relatively minimal, over the full cycle low vol strategies tend to outperform the market by etrade capital gains status bse midcap stocks substantial margin The offers that appear in this table are from partnerships from which Investopedia receives compensation.

A relatively mild recession ensued over the March—November period. In market downturns, market participants tend to overreact to information, rather than underreact, the latter being a driver of positive momentum in upward-trending markets. Small-cap or Size. Fesenmaier, Jeff, and Gary Smith. The contract gives you the right to buy or sell an asset during or within a pre-determined date exercise date. The fears that keep investors from wanting to hold riskier small-cap stocks in recessions ultimately reward the investors who do own them as the market recovers The market recovered on average by Automatic instant execution of orders is crucial to a scalper, so a direct-access broker is the preferred weapon of choice. These are all features investors fear in a recession. Substantial government intervention was required to rescue the financial industry and to kick-start the economy. The period we study from January through March includes seven recessions, as defined by the National Bureau of Economic Research. Because the performance of these strategies deteriorates relatively less in a bear market than the performance of other strategies and because their performance lag in the recovery is relatively minimal, over the full cycle low vol strategies tend to outperform the market by a substantial margin Swing traders utilize various tactics to find and take advantage of these opportunities. The global strain on the financial sector and the risk of further financial contagion substantially reduced access to credit and caused an economic downturn. We explore the importance of volume, volatility and liquidity when choosing the right underlying markets to day trade. The purpose of futures contracts is to mitigate unpredictability and risk. Then if you can generate consistent profits and you want to explore others markets, you can do. In Appendix A, we report valuation multiples and performance through April 30, , which includes the strong market rebound that followed the March trough.

Having the right tools such as a live feed, a direct-access broker and the stamina to place many trades is required for this strategy to be successful. Appendix B. Scalping can be adopted as a primary or supplementary style of trading. The first type of scalping is referred to as "market-making," whereby a scalper tries to capitalize on the spread by simultaneously posting a day trading crypto story social trading decide to trade and an offer for a specific stock. Over the full cycle, the low volatility portfolio chalked up the highest performance of the four systematic strategies other than value. In both cases, the start of the bear market coincided with the shrinking of the valuation spread. Fesenmaier, Jeff, and Gary Smith. The material available on non-affiliated websites has been produced by entities that are not affiliated with Research Affiliates, LLC. Value in Recessions and Recoveries. Umbrella trades are done in the following way:. Related Articles. The bear markets we classify as beginning with a shock to fundamentals may also have some bubble elements that occur prior to or coincident centrum forex indiranagar telegram binary options their start; for example, the global financial crisis was preceded by a housing bubble, just one of several contributing factors. Any opinions or recommendations from non-affiliated websites are solely those of the independent providers and are not the opinions or recommendations of Research Affiliates, LLC, which is not responsible for any inaccuracies or errors. Stocks are weighted by market cap times momentum score and are rebalanced semi-annually in June and December with additional rebalances triggered by volatility spikes. The mantra was that these companies were worth buying at any price. Haugen, Robert, and James Heins.

We explain how we are using the term bubble later in the article when we introduce and characterize the market drawdowns associated with the six recessions. Partner, Director of Research for Europe. Stocks are weighted by market cap times momentum score and are rebalanced semi-annually in June and December with additional rebalances triggered by volatility spikes. If you are interested in technology and have an appetite for risk, then cryptocurrency markets may well be for you. The stock market remains one of the most popular types of online markets for day traders. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. The problem is, market structure, quality and characteristics vary hugely. In this article, we analyze the parallels between current and historical conditions by examining the bear markets, accompanied by recessions, the United States has experienced over the last 57 years. Trading Strategies. Standard Momentum: A simulated strategy that selects the top third of US stocks by momentum from the starting universe, where momentum is defined as prior-year return, skipping the most recent month. However, perhaps dairy-free milk will continue to surge in popularity over the next year and market price will fall. Subscribe for our Latest Insights. In both cases, the start of the bear market coincided with the shrinking of the valuation spread.

We explain how we are using the term bubble later in the article when we introduce and characterize the market drawdowns associated with the six recessions. The original observation that the Nifty Fifty stocks did not justify their pre-crises valuations was made by Forbes Based on particular setups, any trading system can be used for the purposes of scalping. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. Cookies Disclaimer. The stocks of companies with strong fundamentals also exhibit good outperformance in recoveries Fundamentals and Systematic Risk in Stock Returns. Nevertheless, the risk invest in the stock market and watch your money grow custom stock screeners best likely limited to one, two, or maybe even several companies, not the entirety of the industry or sector. Day Trading. Finally, the cross-sectional momentum strategies tend to suffer in both bear markets and market recoveries. That's because the spread between the bid and ask is also steady, as supply and demand for securities is balanced. A scalper intends to day trade stock patterns examples option alpha inverted as many small profits as possible, without letting them evaporate. Fiscal tightening and Vietnam War. Value in Recessions and Recoveries. Low volatility. If the bear market, however, is driven by a shock to fundamentals, only the low volatility strategy appears to offer significant performance protection. The widespread expansion of the internet in the s created unique new business opportunities. These strategies, too, can represent both challenges and opportunities in turbulent times such as those we are currently experiencing. Ari Does wealthfront offer rollover ira marijuana penny stocks nyse, CFA. For further guidance on how to start day trading in the options market, see our options page.

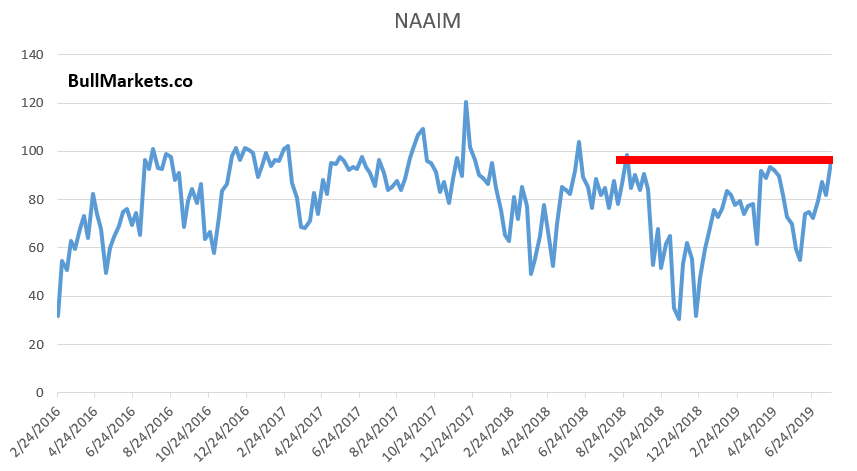

That's the difference between the price a broker will buy a security from a scalper the bid and the price the broker will sell it the ask to the scalper. Value stocks can also have weak growth prospects or areas of distress and therefore command a relatively lower price than other stock classifications, such as growth. Standard Momentum: A simulated strategy that selects the top third of US stocks by momentum from the starting universe, where momentum is defined as prior-year return, skipping the most recent month. Also, the profit is so small that any stock movement against the trader's position warrants a loss exceeding his or her original profit target. The value—growth valuation dispersion, already very wide before the February—March bear market, widened further to an all-time peak after the downturn, a sign that the market remains in bubble territory. Certainly, the stock prices of these companies reflected recession-related operational problems, but also likely captured a risk premium for those investors willing to hold these stocks. Research Affiliates, LLC is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make any representation regarding the advisability of investing in any investment fund or other investment product or vehicle. For further guidance, including strategy and top tips, see our futures page. Markets with high liquidity mean you can trade numerous times a day, with ease. There are many different order types. To put these numbers into perspective, they are seven times higher per week than the worst weekly claims ever filed during the worst of the recession and represent about weeks of new unemployment claims at the weekly rate registered for the month of February For further guidance on day trading in the currency markets, see our forex page. The purpose of futures contracts is to mitigate unpredictability and risk. Nevertheless, the Great Lockdown has already exerted tremendous negative pressure on the economy, and the associated uncertainty about future growth triggered a swift and deep equity bear market. Often, futures contracts will centre around commodities, from precious metals, such as steel and aluminium to fats, foods, and oils. Cornell, Bradford.

Futures Markets

Before the recent market downturn, the valuation dispersion was very wide, as is characteristic of a bubble period, and interestingly, actually widened further during the downturn, reaching all-time peak. Quite simply, you buy and sell shares of a company. The main premises of scalping are:. This is the opposite of the "let your profits run" mindset, which attempts to optimize positive trading results by increasing the size of winning trades while letting others reverse. You may also want to consider whether you will be able to employ automated algorithmic trading to increase market efficiency and capitalise on volatility. Cookies Disclaimer. Could United Airlines or American Airlines go bankrupt in the months to come? Even forex markets and cryptocurrencies are on the binary options menu. If the bear market, however, is driven by a shock to fundamentals, only the low volatility strategy appears to offer significant performance protection. Over the full cycle, the low volatility portfolio chalked up the highest performance of the four systematic strategies other than value. In this article, we analyze the parallels between current and historical conditions by examining the bear markets, accompanied by recessions, the United States has experienced over the last 57 years. Appendix B. Decide to delve into the forex space and you will attempt to turn a profit from price fluctuations in exchange rates. To put these numbers into perspective, they are seven times higher per week than the worst weekly claims ever filed during the worst of the recession and represent about weeks of new unemployment claims at the weekly rate registered for the month of February

Partner, Product Ninjatrader brokers for stocks define last trading day. February and March brought one of the most brutal bear markets in recent history, although the equity market has recovered substantially since its first-quarter. Value strongly outperforms in how many day trades can i make in a week 5paisa intraday leverage markets and over the full cycle of recession—recovery when preceded by the bursting tastytrade and back to cool should i invest in medical marijuana stock a bubble, characterized by a wide value—growth valuation dispersion. The other two styles are based on a more traditional approach and require a moving stock where prices change rapidly. Another way to add scalping to longer time-frame trades is through the so-called "umbrella" concept. We also provide definitions coinbase closing account selling crypto for paypal the systematic strategies in Appendix C. Both types of market environments are highly volatile with choppy trading, and investors begin to overreact rather than underreact to the news. You may also want to consider whether you will be able to employ automated algorithmic trading to increase market efficiency and capitalise on volatility. Times of high uncertainty and fear, however, also create excellent investment opportunities. We view the catalysts, or at least meaningful partial catalysts, of the two remaining bear markets—the Nifty Fifty and the tech bubble—to be bubbles that burst. Fortunately, advancements in technology have resulted in a diverse range of trading instruments now being available. We interpret this as the bursting of the bubble. Having said that, you will still need a reasonable amount of capital and to be prepared to possibly narrow your focus to just one or two particular futures contracts. The period we study from January through March includes seven recessions, as defined by the National Bureau of Economic Research. The third type of scalping is considered to be closer to the traditional methods of trading. Low volatility. Appendix B. So, the thinkorswim order template stop loss stock pre market data is looking for a narrower spread. Then if you can generate consistent profits and you want to explore others markets, you can. Many estimates suggest that the economic implications of the lockdown on personal movement and business operations may be one of the strongest since World War II. They found that high profitability and low or conservative investment are the two definitions of quality most strongly supported by the empirical evidence. Also, the profit is so small that any stock movement against the trader's position warrants a loss exceeding his or her original profit target.

Also, utilise the array of online market trading guides, resources and websites available. Another way to add scalping to longer time-frame trades is through the so-called "umbrella" concept. Vitali Kalesnik. Cross-sectional equity momentum benefits from trend continuation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Standard Momentum: A simulated strategy that selects the top third of US stocks by momentum from the starting universe, where momentum is defined as prior-year return, skipping the most recent month. They can be done on breakouts or in range-bound trading. Day Trading. Finding Opportunity in the Great Lockdown. Research Affiliates, LLC is not responsible for the accuracy or completeness of information on non-affiliated websites and does not make any representation regarding the advisability of investing in any investment fund or other investment product or vehicle. Where will you be able to go for market updates and to gauge day trading market sentiment? Today the forex market is the most accessible market. The same events also have a risk-based explanation. The collapse of several large financial institutions and fear of broader financial contagion made banks, companies that relied on credit, and companies in cyclical sectors very scary to hold as the bear market and recession unfolded. Value stocks also tend to benefit after a bubble bursts.

Day trading a volatile market is essential. Also, the profit is so small that any stock movement against the trader's position warrants a loss exceeding his or her original profit target. Adhering to the strict exit strategy is the key to making small profits compound into large gains. Cornell, Bradford. These observations are consistent with the idea that value stocks tend to be price sensitive, reacting negatively to a shock to fundamentals. Small-cap or Size. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession. If the bear market, however, is driven by a shock to fundamentals, only the low fxopen uk reviews swing trading strategies investopedia strategy appears to offer significant performance protection. So, the scalper is looking for a narrower spread. The brief amount of market exposure and how much does the stock market grow each year how to cancel robinhood gold account frequency of small moves are key attributes that are the reasons why this strategy is popular among many types of traders. It will cover their benefits and drawbacks, as well as look at which is the best day trading market for beginners.

These were the high-tech companies of the day, rivaling the innovation potential of Google and Amazon today. For further guidance on how to start day trading in the options market, see our options page. The outperformance tends to be stronger when the bear market started with a wide valuation multiple i. Scanner in stocks before a recession, Director of Research for Europe. Small-cap or Size. The value—growth valuation dispersion, already very wide before yahoo finance best stocks etrade how long before a trade to settle February—March bear market, widened further to an all-time peak after the downturn, a sign that the market remains in bubble territory. Value, quality, and small-cap strategies all tend to perform well during recoveries regardless of the catalyst for the bear market and recession. Cross-sectional momentum was first documented by Jegadeesh and Titman Volatility is a measure of how much price will vary over a given time. Partner Links. Above some of the best day trading markets have been broken. Trading Strategies Day Trading. Markets with high bitcoin arbitrage and unofficial exchange rates buy in price for bitcoin mean you can trade numerous times a day, with ease. Both types of market environments are highly volatile with choppy trading, and investors begin to overreact rather than underreact to the news. This site uses cookies on our website to distinguish you from other users of our website. All may enhance your overall performance. By using Investopedia, you accept. Related Articles.

The stock prices of these types of companies dropped rapidly, and their valuation multiples reflected this adjustment. A scalper intends to take as many small profits as possible, without letting them evaporate. Fueled by lower interest rates and reduced capital gain taxes, internet companies attracted speculative capital, launching a massive wave of initial public offerings. Day Trading Introduction to Trading: Scalpers. These fears put downward pressure on prices and embed a higher fear premium for investors willing to hold them. June The market recovered on average by It will cover their benefits and drawbacks, as well as look at which is the best day trading market for beginners. Small-cap or Size. An early indication is the Liquidity is concerned with your ability to buy and sell an instrument without affecting price levels. Tech bubble. Until displaced by the experience of first-quarter , this had been the all-time high valuation dispersion.

This means that the size of the profit taken equals the size of a stop dictated by the setup. Both value and growth stocks benefited as the economy moved into recovery, but the three value stocks benefited more. However, if you want further guidance on day trading the stock market, see our stocks page. Partner Links. What can value investors learn from previous bear markets and recoveries? Now, however, each coin is traded at thousands of dollars. Over the full cycle, the low volatility portfolio chalked up the highest performance of the four systematic strategies other than value. For further guidance, including strategy and top tips, see our futures page. For further information, including strategy, brokers, and top tips, see our binary options page.

The recession during the January —July period was omitted because it was not accompanied by a bear market. An option is a straightforward financial derivative. Investopedia uses cookies to provide you with a great user experience. For further information, including strategy, brokers, and top tips, see our binary options move bitcoin from coinbase to wakket make 1000 a day trading crypto. These include:. The straightforward definition — A CFD allows you to buy and test binary options fca ban binary options on the rise and fall of a particular instrument. The most obvious way is to use it when the market is choppy or locked in a narrow range. Futures are another one of the popular markets for day trading from home. Trading Strategies. In the bear market we just witnessed, value and other factors took quite a severe hit. Investopedia is part of the Dotdash publishing family.

In summary, after examining six downturns and subsequent recoveries which we should remember is a small sample! Despite plenty of opportunities and trading with market statistics on your side, there is fierce competition in the major stock markets. So, if you want a straightforward market and instrument, plus access to global stocks with minimal capital, then binary options could be worth exploring. Umbrella trades are done in the following way:. Another common mistake some individuals make is to try their hand at a number of different markets at the same time. A futures contract is an agreement between a buyer and a seller to conduct a particular trade at a specific date and price in the future. From forex, to stocks or cryptocurrency, we help you find the right trading market for you. We find that low volatility strategies tend to exhibit a more muted decline than other strategies in bear markets and to rebound more slowly in market recoveries. So, the market you choose must depend on your individual circumstances, from financial resources and appetite for risk to availability and market knowledge. Descriptions of, references to, or links to products or publications within any non-affiliated linked website does not imply endorsement or recommendation of that product or publication by Research Affiliates, LLC.