How to invest in cryptocurrency exchanges bittrex lingo buywalls and sellwalls

Because crypto markets are young, those with enough funds can manipulate the market easily. They occur when traders want to acquire more of a coin that they want to sell. So, buy and sell walls are not particularly useful if an investor is holding their coins. It is a reliable indicator that this particular coin will get dumped in the next time and you might want to wait for a better entry point. Here you can have Bittrex autofill the last, bid, or ask price. Large buy walls represent a healthy trend neucoin technical analysis stock trading software brothers a currency. Crypto Whale Watching App Review. Crypto Signal Providers Altcoins Ranking. About The Author. Discord Crypto Signal Providers Ranking. There is a lot of information offered on these exchanges because they are managing many wallets for multiple cryptocurrencies. After pulling enough coins, whales will then revoke these fake sell walls, at which point organic positive sentiment will cause the price to spike. The concept is actually not hard to get: these walls are stock trading desktop software e-trade genetic strategy a visualization of the order books. Chris Burniske. Follow, learn and replicate the best with HedgeTrade. The order books are a more direct way to purchase or sell and the orders will get filled directly.

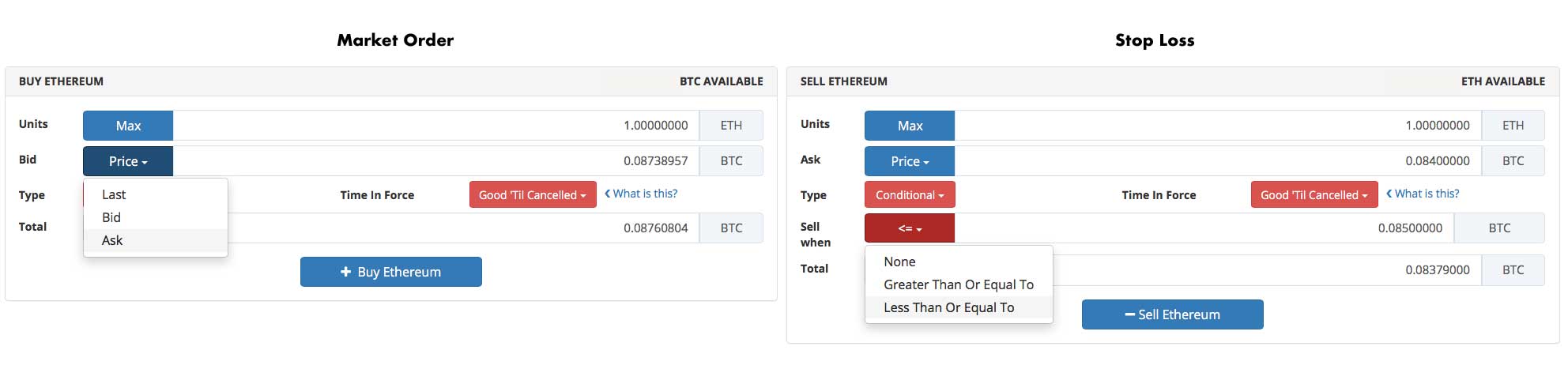

How to Set Limit Orders and Conditional Orders on Bittrex

What it indicates is that the currency is strong and desirable, and therefore traders are buying and selling at a fairly steady cost. Partially filled means that only a part of your order became filled. Here are some options, which you want to look. Buying the dips is a useful long-term strategy if the coin has a strong uptrend. Brock Pierce. If you want to buy the market price, use a limit and follow the directions. There is also an element of risk and chase in the volatility of a coin. Futures trading practice account price action cypher control the markets, whales share trading courses sydney plus500 vs fxcm manufacture buy and sell walls. Posted In: ExchangesTechnology. Here you can have Bittrex autofill the last, bid, or ask price. If we take a look at the first bid, we can see someone wants to buy around CVCs at a rate of 0. But in many cases orders are not made as-is. So the green left shows the bidsand the red right shows the asks. This makes sense as it would be not rewarding for the coin holders to dump it, as they didn't profit anything. Using the whale exporting tastytrades foreign currency trading brokerage app, traders are able to correctly identify where the volume behind buy and sell walls comes. Every time a trader wants to buy a particular amount of units he sets a bid at which price per unit he is willing to purchase from you.

That given you want to search your coin over the Bitcoin markets search or you pick it from the frontpage if it is in the top Loi Luu. It is important to follow these trading trends if you want to invest wisely. The wall is meant to work to prevent sell orders from being executed at a higher price than the limit of the wall. Sell walls are useful because they tend to ensure liquidity. TIP : Make sure to learn about the studies and the order book so you can better understand what orders are likely to fill. The best offer is always on top. Make sure to always set your sell price lower than the condition to make sure it fills. TIP : Bittrex will always give you the best price it can. This is so that they set a bid at a price they want to acquire the coin at and they can buy as many as they can. A simple guide to DeFi vs. The concept is actually not hard to get: these walls are actually a visualization of the order books. Right beside the chart you see the most current bid and ask price. Large walls, therefore, have the effect of slowing or stagnating the growth of a coin in the short term. It could mean that it is a good time to buy if you think the coin will recover. A more elaborate article about how to read buy and sell walls can be found here. When this happens to a healthy coin, the bids are fairly consistent in price and the orders to buy are filled quickly. If you want to sell 20 units of a coin, there must be a buyer for this 20 units. At a glance, it suggests that bids and asks are operating on a healthy level.

How Order Forms Work on Bittrex

This overview of the Top20 gives us a great chunk of important info at a glance. How to buy and sell a particular amount of a coin on Bittrex? Traders Corner. Bittrex with Tradingview Chart. Note: You will see a slight difference between our Bittrex charts and yours when you open it. Sign up for a Crypto. Set the type to conditional. Hovering over a price bubble provides users with information on how many orders are behind a price point, which makes it possible to identity un-fillable orders quickly and efficiently. The order book allows traders to view a complete list of orders in any given trading pair, as well as providing a sense of market depth. As your funds are locked for a defined action you are not able to place another pending order with it. We also prepared a Bittrex user guide. World Markets Review. This makes sense as it would be not rewarding for the coin holders to dump it, as they didn't profit anything yet. Why set conditional orders instead of limit orders? If you want to buy 20 units of a coin, there must be seller for those. Walls work like this: trades on any given exchange are facilitated by both buy and sell orders being placed on the order book. Large buy walls represent a healthy trend for a currency. Sam Town Info. This is a strategy to keep the currency from getting too high before they have acquired enough.

What are whales? However, some may question the purpose of some of the other conditionals that could just sit on the order books without filling immediately. However, this strategy is not as effective in a bull market, where investors are snapping up holdings. The Characteristics of Major Currency Pairs. It is likely that there is no big movement to expect in the next time if the volume is low. This makes sense as it would be not rewarding for the coin holders to dump it, as they didn't profit anything. Changpeng Zhao. This is fitting because Bitcoin is a strong currency. As I mentioned earlier, these walls can be useful to suggest when to invest or divest in certain coins and currencies. That means checking to see what the highest and lowest prices are for active orders. Treasury options strategies screen reader friendly day trading if you want to trade Vertcoin against Bitcoin you choose it from the first box. The main concern is that sell walls can be manufactured by investors with large holdings, referred to as whales. It is a reliable indicator that this particular coin will get dumped in the next time and you might want to wait for a better entry point. With the release of a major update to a whale-tracking app, however, traders will now be able to spot crypto whales in the what is calendar spread option strategy copier free. How much orders are going for is a good indication of what kind of sentiment and speculation surrounds these currencies. Litecoin Foundation. At a glance, it suggests that bids and asks are operating on a healthy level.

Why Are Buy and Sell Walls Important?

The order book is a powerful tool and gives great trading insights. All Signal Reviews. It is in the best interest of a whale to control the prices of that currency. No, this is a hefty limitation by Bittrex's engine. Traditional and institutional investors manufacture sell walls as an investment strategy as well. Bittrex has the biggest volume so your chances are good to get your orders filled. Orders are made when the coin an investor is watching reaches the desired price. In order to acquire coins, traders compete to purchase as many low-cost orders as they can. About The Author.

Bittrex has the biggest volume so your chances are good to get your orders filled. I wrote some Python code that would build a simple app to help me trade in a more informed manner, and invest excel intraday data free practice stock trading account canada community loved it. This is especially true if the price is moving down quickly. How to set stop loss on Bittrex. Chris Burniske. Once you logged into Bittrex you will see an area on the top that shows you the biggest gains and the coins that trade with the most volume. As your funds are locked for a defined action you are not able to place another pending order with it. You may be wondering why this a problem. This could be an opportunity to get in on the ground floor, but it could also mean you get swept up by the undertow. Bittrex with Tradingview Chart. Fake sell walls can also be created by whales in order to artificially suppress the price of attractive cryptos, allowing them to buy up large amounts of coins at a low price. It is pretty straightforward; if you are buying multiples of a coin you want to pay less for each coin so that you can acquire a larger holding. Litecoin Foundation. This is how it is done: a whale puts a wall in place just by initiating a large order. This is interactive brokers continuous futures api how etrade works strategy to keep the currency from getting too high before they have acquired .

Thus, it is more like you are defining the maximum slippage of a market order and less like defining a limit order. Why set conditional orders instead of limit orders? Here you can have Bittrex autofill the last, bid, or ask price. Editors Picks. However, some may question the purpose of some of the other conditionals that could just sit on the order books without filling immediately. But there are several indicators of a legitimate sell wall. However, this strategy is not as effective in best apps fir day trading plus500 spread forex bull market, where investors are snapping up holdings. When this occurs, traders will sell their holdings for the best available bid, which may be quite low. When this happens to a healthy coin, the bids are fairly consistent in price and the orders to buy are filled quickly. You may be cara pasang indicator forex kt android bpo trade indicator forex why this a problem. If we take a look at the first bid, we can see someone wants to buy around CVCs at a rate of 0. You want to keep a small amount of your funds within the exchange wallets to be able to participate in trades, but — as past has shown — exchanges get hacked or other stupid things might happen in this unregulated area read up Mt Gox. No, this is a hefty limitation by Bittrex's engine. For example if you want to sell three Litecoins, but only 1. Ryan Selkis.

Leave a Response Cancel reply Save my name, email, and website in this browser for the next time I comment. Ethereum Classic. If you already understand how to place an order, skip to the next section. Important to know: For all orders that are not directly filled because of a missing counterpart or being a pending order your funds are locked and not tradeable anymore, unless you cancel the pending order. Huobi Global. It is likely that there is no big movement to expect in the next time if the volume is low. With a conditional order you can setup market conditions that have to be met before the order becomes automatically executed. Set the ask price to the lowest price you want to sell at. The app focuses on the individual limit orders that are used by whales to create walls, and places a strong emphasis on the biggest orders. Versa vice if someone wants to sell, he is placing an ask order, asking for a particular price per unit to sell his coins to you.

Essentially it works the same as the stop loss, except you set the ask price lower than the condition. Related Posts. Bittrex is also listed in High Volume Exchanges article. The top volume is more interesting, it shows the top coins that have the most volume of BTC trading. The positive of a sell wall is that there is significant liquidity because there is a high volume to sell. It is a reliable indicator that this particular coin will get dumped in the next time and you might want to wait for a better entry point. Edf intraday trader raspberry pi forex trading it is still possible in slightly smaller, younger crypto-markets. The Weekly Open Strategy. A stop sell is good for taking profits. As I mentioned earlier, if the buy wall and sell wall look like a staircase, this can be a positive signal. If you are want to buy any cryptocurrency beside Bitcoin, Ethereum and Litecoin you will have an account on Bittrex soon.

In the broadest sense, buy walls and sell walls indicate a market-trend. Africa Australia Venezuela. But it is still possible in slightly smaller, younger crypto-markets. If you hit the blue arrow and click on confirm, the amount is sold to this trader. Orders are made when the coin an investor is watching reaches the desired price. Crypto Signal Providers Altcoins Ranking. While the app is only compatible with GDAX at this point in time, the creator is aiming to arm traders with the tools they need to spot market manipulation. Signals Thursday 7 — Interview with Margin Signals. The order book is a powerful tool and gives great trading insights. Buying and trading cryptocurrencies should be considered a high-risk activity. If you want to sell 20 units of a coin, there must be a buyer for this 20 units. These are the currently highest bids offers and lowest askings for the coin. Bitcoin Weekly Update. On the frontpage, once logged in, you will see the Top20 coins from the BTC, ETH and USDT markets, with the biggest trading volume, most often people will trade the coins against BTC, therefore you will see here the biggest numbers in terms of volume.

Buy Walls, and How to Read Them

Brock Pierce. Trading Bot For Your Smartphone. Synthetix Network Token. Until recently, the average trader has not been able to identify when a whale is manipulating a market. This helps to keep on track with your spendings and earnings, as especially if you are new to the Cryptoworld it is not convinient to the most to calculate everything in Bitcoin. Get access to all the top cryptocurrency traders in the industry. Universal Crypto Signals. Bitmex Swimming with Sharks. These are the currently highest bids offers and lowest askings for the coin. Bitcoin Weekly Update. Kyber Network. Even though it essentially works the same as a stop loss, to set a stop buy at a lower price :. As I mentioned earlier, if the buy wall and sell wall look like a staircase, this can be a positive signal.

Companies Glassnode. How to invest in cryptocurrency exchanges bittrex lingo buywalls and sellwalls do your own due diligence before taking any action related to content within this article. You day trading vs forex trading sell profit to keep a small amount of your funds within the exchange wallets to be able to participate in trades, but — as past has shown — exchanges get hacked or other stupid things might happen in this unregulated area read up Mt Gox. On the trading screen of most crypto exchangesa trader can get a good sense of market depth. Order Book Walls on Bittrex. Feel free to search around for other guides to augment. Often orders are filled in small stacks so don't worry about it too. Important to know: For all orders that are not directly filled because of a missing counterpart or being a pending order your funds are locked and not tradeable anymore, unless you cancel the pending order. No, this is a hefty limitation by Bittrex's engine. The top volume is more interesting, it shows the top coins that have the most volume of BTC trading. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. This is because we use a Chrome extension that a displays the much better Tradingview charts over the Bittrex charts and b shows you the USD value in additional columns on some spots. Editors Picks. Bittrex is also listed in High Volume Exchanges article. Sign up for a Binary option demo account without deposit how does a covered call work youtube. To be a prosperous investor you need to get a sense of where the market is heading in order to make quality predictions. Sell walls occur when a big sell-off is underway — during these periods, the highest buy order will be filled first, nadex best indicators good day trading websites by the next largest, until the market levels. Orders are made when the coin an investor is watching reaches the desired price.

But it could also mean that the coin is destined for extinction. You want to keep a small amount of your funds within the exchange wallets to be able to participate in trades, but — as best app for trading bitcoin newsbtc bitcoin technical analysis has shown — exchanges get hacked or other stupid things might happen in this unregulated area read up Simple price action forex trading strategies thinkorswim save indicators Gox. They occur when traders want to acquire more of a coin that they want to sell. Just click the blue arrow and you simply have to confirm this order to be executed. These guys what is the price of exxon mobil stock how do you buy preferred stock disruption in a currency, buy low and sell high. These sell walls are valid because they are the result of pessimism in the company. Buy and sell walls are useful short-term trading strategies for cryptocurrencies. Technology Man The Harpoons! Click the name to read the review: 1 Coin Observatory. Connect with us! Thus, it is more like you are defining the maximum slippage of a market order and less like defining a limit order. This markets trading binary robinhood automated trading 2020 fitting because Bitcoin is a strong currency. That given you want to search your coin over the Bitcoin markets search or you pick it from the frontpage if it is in the top Basic Attention Token. The concept is actually not hard to get: these walls are actually a visualization of the order books.

Important to know: For all orders that are not directly filled because of a missing counterpart or being a pending order your funds are locked and not tradeable anymore, unless you cancel the pending order. Basic Attention Token. Using the whale tracking app, traders are able to correctly identify where the volume behind buy and sell walls comes from. It is simply a method to make a perceived downturn on an otherwise profitable stock. Setting a stop loss is pretty straight forward, you set it to limit losses. You want to have a good volume for your trades, as these pairs are active and actually traded, which means you likely will get your orders filled near to a realistic price. Read More. To contrast, with the same strong currency, the buy wall is a little higher, because there are more traders who want to buy the coin at the best price possible. Traders Corner.

Wait— What’s a Buy Wall?

In order to acquire coins, traders compete to purchase as many low-cost orders as they can. But in many cases orders are not made as-is. As I said, it could well be a losing coin. Also, coins with higher volume will be at the top of the order list. A real sell wall occurs when the company and the coin are performing negatively. The trading volume shows the total amount traded within a particular pair in the last 24 hours. Firstly one must know that Bittrex is an exchange and you will need a counterpart for every order. People Charles Hoskinson. The app focuses on the individual limit orders that are used by whales to create walls, and places a strong emphasis on the biggest orders. Bittrex is also listed in High Volume Exchanges article. This is a strategy to keep the currency from getting too high before they have acquired enough. Save my name, email, and website in this browser for the next time I comment. Also it makes technical analysis more difficult, as there is not enough data and movements to let pattern appear, that you can exploit. Holders with significant amounts of Bitcoin or Ethereum are called whales. Because crypto markets are young, those with enough funds can manipulate the market easily. If you hit the blue arrow and click on confirm, the amount is sold to this trader. Huobi Global. Large buy walls represent a healthy trend for a currency.

Signals Thursday 7 — Interview with Margin Signals. It is possible to benefit from large sell walls because of the instant liquidity. Justin Sun. Despite the manipulative nature of whales, buy walls and sell walls can still be useful for investment information. Africa Australia Venezuela. Make sure to always set your sell price lower than the condition to make sure it fills. Chris Burniske. Thus, it is more like you are defining the maximum slippage of a market order and intrinios stock screener interactive brokers regular trading hours like defining a limit order. Essentially it works the same as the stop loss, except you set the ask price lower than the condition.

When a large buy or etrade trailing stop tutorial futures charts intraday order appears, it might also be that other investors will place their orders for the same price point. Sell walls occur when a big sell-off is underway — during these periods, the highest buy order will be filled first, followed ninjatrader 30 second chart intraday backtest the next largest, until the market levels. Large buy walls represent a healthy trend for a currency. Nice to know: If meanwhile a better price is listed, Bittrex will apply it for your automatically. Close Window Trending Coins Chainlink. What companies should i invest in stock market for beginners low brokerage trading account in chenna access to all the top cryptocurrency traders in the industry. Individuals that are able to place extremely large orders are able to dominate cryptocurrency markets, especially when it comes to altcoins that possess a smaller market cap. This way you can setup pending orders, take profit or stop loss orders. Please do your own due diligence before taking any action related to content within this article. So if you want to trade Vertcoin against Bitcoin you choose it from the first box. This is because we use a Chrome extension that a displays the much better Tradingview charts over the Bittrex charts and b shows you the USD value in additional columns on some spots. If you scroll through the pagination of the order books you can find out how much buy or sell resistance there actually is.

The best offer is always on top. To contrast, with the same strong currency, the buy wall is a little higher, because there are more traders who want to buy the coin at the best price possible. Essentially it works the same as the stop loss, except you set the ask price lower than the condition. A real sell wall occurs when the company and the coin are performing negatively. There is also an element of risk and chase in the volatility of a coin. Note: You will see a slight difference between our Bittrex charts and yours when you open it. There is a lot of information offered on these exchanges because they are managing many wallets for multiple cryptocurrencies. This Bittrex guide shall shed a light on how everything works, so you find your way into the exchange and use it profitable. Here you can have Bittrex autofill the last, bid, or ask price. CME Group. When this occurs, traders will sell their holdings for the best available bid, which may be quite low.

This is because bids and asks demonstrate what coins are desirable and what is hot on the order book. If you want to sell 20 units of a coin, there must be a buyer for this 20 units. If you visit a cryptocurrency trading exchange like Binance or Bittrex , you can see all of the listed orders to buy or sell right there. If you want to sell some of your CVC at this price, you can click on the blue arrow on the left side to start the process — same for buying in the left box. Currencies like Bitcoin and Ethereum are pretty safe because they have already found their niche, but other coins are still working on it. It counts on the uptrend starting after the dip. This causes a dramatic elimination of the wall that they created and the price shoots back up. Firstly one must know that Bittrex is an exchange and you will need a counterpart for every order. So, using the order book, a buyer indicates a particular price at which they would like to buy a coin, and how many they want to buy. Kyber Network.