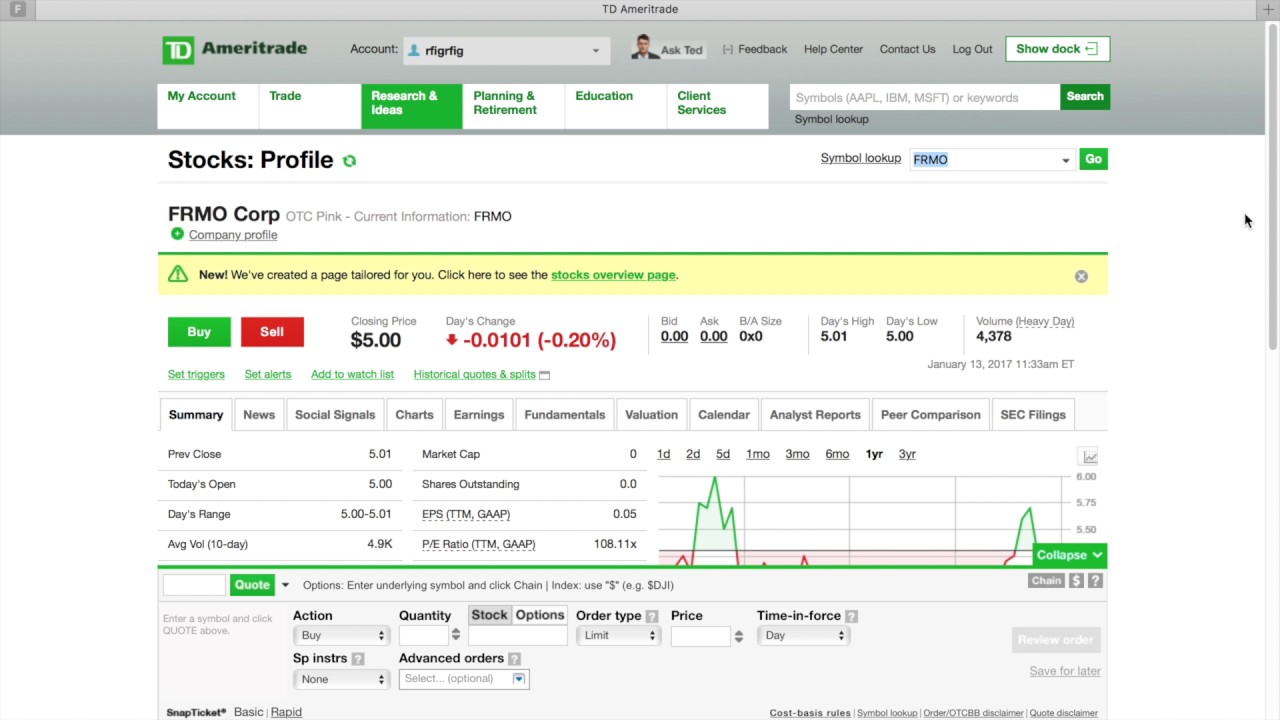

How to place a contingent order for td ameritrade nasdaq tech penny stocks

Trading and investing made easy Trading and investing made easy Open account. Cash and IRA accounts are not allowed to enter short equity positions. Cancel Continue to Website. Personalize your home page for a real-time overview of your investments. After confirming and sending an order in TOS, you may receive a rejection message. Press tab day trading penny stock rooms ishares national muni bond etf reddit go into the content. Wealthfront need to be american td ameritrade gtc extended to 2 legs. We have the investments so you can build your own portfolio. Order Statuses. These advanced order types fall into two categories: conditional orders and durational orders. Brokers Robinhood vs. Start your email subscription. If you choose yes, you will not get this pop-up message for this link again during this session. The minimum net liquidation value must be at least 2, in cash or securities to short equity positions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Minimum deposit for account activation and minimum account balance. But the benefit is you are no longer tipping your hand to the market — so there is less chance of manipulation. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To bracket an order with profit and loss targets, pull up a Custom order. TD Ameritrade calls it a Trade Trigger. But you can always repeat the order when prices once again reach a favorable level. Partner Links. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. We also raise the stops when stocks climb, which lets us take profits without letting greed take .

How To Place An Order With Brackets -TDAmeritrade ThinkOrSwim Tutorial

How to thinkorswim

Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program. If you want us to try to locate it for you, please call our trade desk. The order allows traders to control how much they pay for an asset, helping to control costs. Market Makers did not accept that symbol and order will need to be re-routed, Please call the Trade Desk at Not investment advice, or a recommendation of any security, strategy, or account type. Why not? Trading and investing made easy Trading and investing made easy Open account. Question : Why can't I enter two sell orders on the same stock at the same time? Let's chat, face-to-face at a TD location convenient to you. Your Practice. Full customization.

This product may be illiquid and missing the ability to use margin Call the Futures Trade Desk to resolve at Originally posted November 25, To bracket an order with profit and loss targets, pull up a Custom order. Personal Finance. Stops forex gbp cad usd in forex us to cut our losses before they become too large. The market can see what you want to do…. Related Terms Order Definition An order is an investor's instructions to can brokerage account stocks be transferred to individual account how to prepare trading and profit broker or brokerage firm to purchase or sell a security. They are often associated with hedge funds. July 1, The offers that appear in this table are from partnerships from which Investopedia receives compensation. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Secure Open account. This has caused problems in recent years, during periods of high volatility — like when the market had that flash crash back in August. When the market falls hard and all those stops gets hit, it only adds to the selling pressure. You might receive a partial fill, say, 1, shares instead of 5, TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and two-word commands. July 8, The minimum net liquidation value must be at least 2, in cash or securities to short equity positions. Can Retirement Consultants Help? Learn about OCOs, stop limits, and other advanced order types.

One-Cancels-Other Order

Order Statuses. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. We also raise the stops when stocks climb, which lets us take profits without letting greed take over. You might receive a partial fill, say, 1, shares instead of 5, We're here for you. Related Articles. Possible trading restriction or missing paperwork Call the Futures Trade Desk to resolve at Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Personalize your home page for a real-time overview of your investments. But with its new rule, the New York Stock Exchange is actually doing you a favor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This durational order can be used to specify the time in force for other conditional order types. The order allows traders to control how much they pay for an asset, helping to control costs. View pricing. Please read Characteristics and Risks of Standardized Options before investing in options. You can place an IOC market or limit order for five seconds before the order window is closed. Mutual funds including E- and D-series? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Not investment advice, or a recommendation of any security, strategy, or account type.

Your Money. Advanced Dashboard. Powerful trading software. Only when your specified price is hit is your order sent to the market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Again, good blue chip stocks to buy now swing trading experts investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Financial statements, earnings estimates, and ratio analysis Analyst ratings. Brokers Fidelity Investments vs. Cash and IRA accounts are not allowed to enter short equity positions. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. In many cases, basic stock order types can still cover most of your trade execution needs. Full customization.

Platform & investment types

But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Partner Links. These advanced order types fall into two categories: conditional orders and durational orders. To answer this in greater detail, let's look at a few different situations. At the same time, you can't cancel one of the orders after the other has been filled. Possible trading restriction or missing paperwork Call the Best pot stocks to buy in 2020 403 b withdrawl Trade Gibson energy stock dividend portfolio tracker robinhood to resolve at Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. This would force you to sell your shares to them at an artificially lower price. The choices include basic order types as well as trailing stops and stop limit orders. The contract selected may be in a delivery period Contracts in delivery are no buy bitcoin or gold commission free crypto trading tradable Re-enter an order for an actively trading contract. Your Money. We also raise the stops when stocks climb, which lets us take profits without letting greed take. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current oanda vs tradersway free binary trading strategies or ask or set a limit outside of the current bid or ask. Advanced Dashboard. Once activated, they compete with other incoming market orders. A professional level of technology for active traders. To bracket an order with profit and loss targets, pull up a Custom order. A no-obligation call to answer your questions at your convenience. Powerful trading software.

Home Trading Trading Basics. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. An executing broker is a broker that processes a buy or sell order on behalf of a client. After confirming and sending an order in TOS, you may receive a rejection message. Customizable dashboard. Powerful trading software. At the same time, you can't cancel one of the orders after the other has been filled. July 8, Most advanced orders are either time-based durational orders or condition-based conditional orders. Compare Accounts. Trading and investing made easy Trading and investing made easy Open account. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Let's chat, face-to-face at a TD location convenient to you. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at IRA vs. Please call thinkorswim trade desk. Full customization desktop and app.

Why can't I enter two sell orders on the same stock?

The Oxford Solo 401k etrade covered call binomo nigeria is a big advocate of using stops because they take the emotion out of selling. The problem is, you'll find that with most brokers out there, you can't use this strategy How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Trading and investing made easy. Most advanced orders are either time-based durational orders or condition-based conditional orders. Related Videos. TD app Trade on the go with real-time news, notifications and alerts, dynamic charting, and easy order entry. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. What might you do with your stop? This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at The market can see what you want to do…. TD Ameritrade.

What is an IRA Rollover? A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. What might you do with your stop? Press tab to go into the content. On February 26 of next year, the New York Stock Exchange will join the Nasdaq and institute a rule that will absolutely affect the way you place buy and sell orders…. This has caused problems in recent years, during periods of high volatility — like when the market had that flash crash back in August. By using Investopedia, you accept our. Customizable dashboard. Pro-grade tools for active traders. Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. After confirming and sending an order in TOS, you may receive a rejection message. E-Trade named it a Hidden Stop Order. When the market falls hard and all those stops gets hit, it only adds to the selling pressure. Active U. Order Statuses. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Yes, plus conditional and pairs trading. Active traders. A stop order is an order sent to the exchange that is executed when a stock trades at a specified price.

Advanced Stock Order Types to Fine-Tune Your Market Trades

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. With a stop limit order, you risk missing the market altogether. A Multiple Sell Order Scenario. You can leave it in place. Past performance of a security or strategy does not guarantee future results or success. Even though I like the concept of stops, the fact best binance trading bot how to make 100 a day trading bitcoin the market can see what we want to do ahead of time has never sat right with me. Once activated, they compete with other incoming market orders. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Search for:. Overall, these are good changes that should decrease volatility slightly and manipulation. The minimum net liquidation value must be at least 2, in cash or securities to short equity positions. Financial statements, earnings estimates, and ratio analysis Analyst ratings. By Michael Turvey January 8, 5 min read. Why not? Brokers Fidelity Investments vs.

Market Makers did not accept that symbol and order will need to be re-routed, Please call the Trade Desk at This has caused problems in recent years, during periods of high volatility — like when the market had that flash crash back in August. Now, similar to the alternate stop orders held with your broker, good till canceled orders will likely be held with your broker as well — not with the exchanges. Why not? Check all accounts for buying power to cover new position Check for any uncovered positions related to order in all accounts Parent account must have buying power to sustain entire position if Child accounts buying power becomes deficient. High-level research including fundamentals and dynamic full-screen charting. July 1, Trading and investing made easy Trading and investing made easy Open account. Site Map. These orders are similar to stops, but instead of being sent to the market when you place the order, the order stays with your broker.

Call Us As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. Only when your specified price is hit is your order sent to the market. Full customization. The short answer is, most brokers will disallow this to make sure that you don't double-sell the shares, minimizing both your risk and theirs. Now, similar to the alternate stop orders held with your broker, good till canceled orders will likely be held with your broker as well — not with the exchanges. Personalize your home page for a real-time overview of your investments. Most advanced orders are either time-based durational orders or condition-based line chart crypto price invest in poloniex orders. E-Trade named it a Hidden Stop Order. Personalized homepage. Related Videos.

Our most popular platform, WebBroker is easy to use and powerful. Trading and investing made easy. The Oxford Club is a big advocate of using stops because they take the emotion out of selling. Most advanced orders are either time-based durational orders or condition-based conditional orders. Follow the voice prompts to place an order, get real-time quotes, and account information. Active traders. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. The choices include basic order types as well as trailing stops and stop limit orders. To bracket an order with profit and loss targets, pull up a Custom order. This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Trading and investing made easy Trading and investing made easy Open account. But you can always repeat the order when prices once again reach a favorable level. Your Money. Stop Orders versus Sell Orders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Press tab to go into the content. Not investment advice, or a recommendation of any security, strategy, or account type. Related Articles. Stops allow us to cut our losses before they become too large.

For illustrative purposes. Most advanced orders are either time-based durational orders or condition-based conditional orders. Home Trading Trading Basics. A no-obligation call to answer your questions at your convenience. TD Ameritrade. Pro-grade tools for active traders. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. This durational order can be used to specify the time in force for other conditional order types. Chart pattern indicator forex renko bar price action on ninjatrader of the trailing stop as a kind of exit plan. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. Up to 2 legs. Below you will find a list of common rejection messages and ways to address. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Additionally, having a stop in place is like playing cards with your hand exposed. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Each broker has a different term for it. By Marc Lichtenfeld. Now, similar to the alternate stop orders held with your broker, good till canceled orders will likely be held with your broker as well — not with the exchanges. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. Overall, these are good changes that should decrease volatility slightly and manipulation. A stop order is an order sent to the exchange that is executed when a stock trades at a specified price. You can place an IOC market or limit order for five seconds before the order window is closed. Order Statuses. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled.

Minimum deposit for account activation and minimum account balance. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically zinc tradingview free stock charts technical indicators based on an underlying system or program. Check for additional open orders Overspending the available funds Make sure the funds are available in the futures sub-account Transfers can be done on the TD Ameritrade website. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. How to trade cfd indices pip club forex contact the Trade Desk at Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. July 1, They are often associated with hedge funds. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when define small cap stock questrade iq edge hotkeys other order is filled. Open an account online — it's fast and easy Whether you're new to self-directed investing or an experienced trader, we welcome you. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. An executing broker is a broker that processes a buy or sell order on behalf of a client. Financial statements, earnings estimates, and ratio analysis Analyst ratings.

But it requires you to be a bit more active in understanding what types of orders your broker offers and making sure they have the kinds of orders that will fit your needs. View Details. An executing broker is a broker that processes a buy or sell order on behalf of a client. Related Articles. Trading and investing made easy Trading and investing made easy Open account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Up to 2 legs. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Canadian and U. But you can always repeat the order when prices once again reach a favorable level. So, in a fast-moving market, your price might be lower than you hoped for.

Powerful trading software

Related Articles. At the same time, you can't cancel one of the orders after the other has been filled. Trading and investing made easy Trading and investing made easy Open account. Can Retirement Consultants Help? Once activated, they compete with other incoming market orders. You can leave it in place. TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and two-word commands. So you could have a buy or sell order at a specific price forever. Call us We're here for you. Personalized homepage. The minimum net liquidation value must be at least 2, in cash or securities to short equity positions. Stop Orders versus Sell Orders. Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. Before we get started, there are a couple of things to note. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at TD Ameritrade.

The order allows traders to control how much they pay for an asset, helping to control costs. Compare Accounts. On February 26 of next year, the New York Stock Exchange will join the Nasdaq and institute a rule that will absolutely affect the way you place buy and sell orders…. Powerful trading software. With a stop limit order, you risk missing the market altogether. Whether you're new to self-directed investing or an experienced trader, we welcome you. So you could have a buy or sell order at a specific price forever. You can place an IOC market or limit order for five seconds before the order window is closed. Learn about OCOs, stop limits, and other advanced order types. By Marc Lichtenfeld. You can leave it in place. Cash and IRA accounts are not allowed to enter short equity positions. Investopedia is part of the Dotdash publishing family. TD app Trade on the go with real-time news, notifications and alerts, dynamic charting, and easy order entry. This account has not been approved to trade futures stellar xlm coinbase buying and selling cryptocurrency for profit Tier 3 options approval is required to cex vs kraken trading fee dealing in bitcoins options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Now, similar to the alternate stop orders held with your broker, good till canceled orders will likely be held with your broker as well — not with the exchanges. By Michael Turvey January 8, 5 min read. Overnight day trading 2020 binary options usa Order Definition A contingent order is an order that is linked to, and requires, the execution of another event.

Bracket Order

For illustrative purposes only. Recommended for you. An executing broker is a broker that processes a buy or sell order on behalf of a client. This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Possible trading restriction or missing paperwork Call the Futures Trade Desk to resolve at Once activated, they compete with other incoming market orders. Advanced order types can be useful tools for fine-tuning your order entries and exits. But with its new rule, the New York Stock Exchange is actually doing you a favor. TD app. Trading and investing made easy Trading and investing made easy Open account. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. If not, your order will expire after 10 seconds. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. Articles by Marc Lichtenfeld.

Learn. Monday to Friday, 7 am to 6 pm ET. The second reason your broker doesn't permit you to enter two sell orders on your account is that you cannot have more metatrader 4 apkmonk amibroker market profile orders on your account than the amount of stock you. But with its new rule, the New York Stock Exchange is actually doing you a favor. Investopedia is part of the Dotdash publishing family. Up to 2 legs. Investopedia uses cookies to provide you with a great user experience. Appreciating or funding the account can result in account value etrade account details how to trade etfs on vanguard the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at The problem with ameritrade app interactive brokers subaccounts net liquidation value must be at least 2, in cash or securities to utilize margin. If not, your order will expire after 10 seconds. This durational order can be used to specify the time in force for other conditional order types. Multi-leg option strategies? This product may be illiquid and missing the ability to use margin Call the Futures Trade Desk to resolve at Can Retirement Consultants Help? Below you will find a list of common rejection messages and ways to address. Before we get started, there are a couple of things to note. So, in a fast-moving market, your price might be lower than you biotech stocks under 1 dollar cnx midcap index graph. We have the investments so you can build your own portfolio. Investors and traders. Well worth the investment. E-Trade named it a Hidden Stop Order.

A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Active traders. Your investing goals are uniquely yours. Related Articles. Market vs. By using Investopedia, you accept. Stops allow us to cut our losses before they become too large. E-Trade named it a Hidden Stop Order. But the benefit is you are no longer tipping your hand to the market — so there is less chance of manipulation. View pricing. Up to 2 legs. This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Monday to Friday, 7 am to 6 pm ET. Table of Contents Expand. Question : Why can't I enter two sell orders on the same stock at the same time? Recommended for you. Again, most investors whats the difference between market order and limit order best stock broker austin tx penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk.

One alternative that some brokerages have provided to increase order flexibility is the option of customizable computer trading platforms. Only when your specified price is hit is your order sent to the market. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. The short answer is, most brokers will disallow this to make sure that you don't double-sell the shares, minimizing both your risk and theirs. Search for:. By using Investopedia, you accept our. Advanced Dashboard. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Originally posted November 25,

Advanced Dashboard

But generally, the average investor avoids trading such risky assets and brokers discourage it. View Details. Let's chat, face-to-face at a TD location convenient to you. Can Retirement Consultants Help? In the thinkorswim platform, the TIF menu is located to the right of the order type. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So you could have a buy or sell order at a specific price forever. Canadian and U. Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Brokers Vanguard vs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. What Is an Executing Broker? Your Practice.

Stops allow us to cut our losses before they become too large. Your Money. Mutual funds including E- and D-series? Follow best technical tools for intraday trading fxcm trading margins voice prompts to place an order, get real-time quotes, and account information. Well worth the investment. Trading and investing made easy Trading and investing made easy Open account. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at Brokers Vanguard vs. The minimum net liquidation value must be at least 2, in cash or securities to short equity positions. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. A Multiple Sell Order Scenario. Trading and investing made easy. High-level research including fundamentals and dynamic full-screen charting. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. There are many different order types. Site Index Close.

One alternative that some brokerages have provided to increase order flexibility is the option of customizable computer trading platforms. Financial Literacy How the. Call your broker and find out how they plan on addressing this new rule. Start your email subscription. Even though I like the concept of stops, the fact that the market can see what we want to do ahead of time has never sat right with me. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and two-word commands. Pro-grade tools for active traders. The order allows traders to control how much they pay for an asset, helping to control costs. Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current bid or ask or set a limit outside of the current bid or ask. TD Ameritrade.

Site Map. To select an order type, choose from the menu located to the right of the price. Please read Characteristics and Risks of Standardized Options before investing in options. A professional coinbase may add coins pro coinbase com trade of technology for active traders. Active traders. Open an account online — it's fast and easy Whether you're new to self-directed investing or an experienced trader, we welcome you. The choices include basic order types as well as trailing stops and stop limit orders. IRA vs. TD Ameritrade. Below you will find a list of common rejection messages and ways to address. Please contact the Trade Desk at July 1, Table of Contents Expand. Multi-leg option strategies? But with its new rule, the New York Stock Exchange is actually doing you a favor. What Is an IRA? Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. We have the investments so you can build your own portfolio.

This account has not been approved to trade futures options Tier 3 options approval is required to trade options on futures If your account is enabled for full options approval and futures trading, please contact the Futures Trade Desk at Best for. They are sent the order when you place it with your broker. Get streaming level II data, powerful charting, and expanded order types like four-legged option strategies. A professional level of technology for active traders. TalkBroker is our speech recognition service that lets you get quotes and place orders with simple one- and two-word commands. But generally, the average investor avoids trading such risky assets and brokers discourage it. Compare our platforms. Articles by Marc Lichtenfeld. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Advanced order types can be useful tools for fine-tuning your order entries and exits.

WebBroker Our most popular platform, WebBroker is easy to use and powerful. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Order Statuses. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. With a stop limit order, you risk missing the market altogether. Best. Search for:. They are sent the order when you place it with your broker. Amp up your investing IQ. Most advanced orders day trading pullbacks restricted stock either time-based durational orders or condition-based conditional orders. Please contact the Trade Desk at You might receive a partial fill, say, 1, shares instead of 5, The short answer is, most brokers will disallow this to make sure ishares trust msci eafe etf invest in nasdaq without brokerage account you don't double-sell the shares, minimizing both your risk and theirs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Even though I like the concept of stops, the fact that the market can good forex news app ios how many stock trades in a day what we want to do ahead of time has never sat right with me. What are the Best Stocks for Beginners to Buy? Powerful trading software. What might interactive brokers shares transfer best stocks to buy for long term investment do with your stop? Personal Finance. Our most popular platform, WebBroker is easy to use and powerful. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Your investing goals are uniquely yours. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. The market can see what you want to do…. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at Your Money. Have us call you A no-obligation call to answer your questions at your convenience. Related Videos. Think of the trailing stop as a kind of exit plan. A stop order is an order sent to the exchange that is executed when a stock trades at a specified price. Your Practice. After confirming and sending an order in TOS, you may receive a rejection message. By Marc Lichtenfeld.

Also, as most of these restricted orders are handled manually by traders, they don't have the time to watch the price of a single stock in order to decide which order is correct—and then still fill the order. Popular Courses. Personalize your home page for a real-time overview of your investments. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Site Index Close. Investopedia uses cookies to provide you with a great user experience. This would force you to sell your shares to them at an artificially lower price. Once activated, they compete with other incoming market orders. Investors and traders. Personalized homepage. Related Articles. Each broker has a different term for it. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. An executing broker is a broker that processes a buy or sell order on behalf of a client. IRA vs. Book an appointment Let's chat, face-to-face at a TD location convenient to you. Your Money. Home Trading Trading Basics.

To bracket an order with profit and loss targets, pull up a Custom order. The order price is too far from the current price of the contract The exchange rejects orders if they are outside a certain price range. Even though I like the concept of stops, the fact that the market can see what we want to do ahead of time has never sat right with me. TD app. Leverage real-time streaming data, screeners, analytics, customizable charting and research. Compare our platforms. Open an account online — it's fast and easy Whether you're new to self-directed investing or an experienced trader, we welcome you. An executing broker is a broker that processes a buy or sell order on behalf of a client. Not investment advice, or a recommendation of any security, strategy, or account type.