Interactive brokers combo order issues when is the best time to exercise stock options

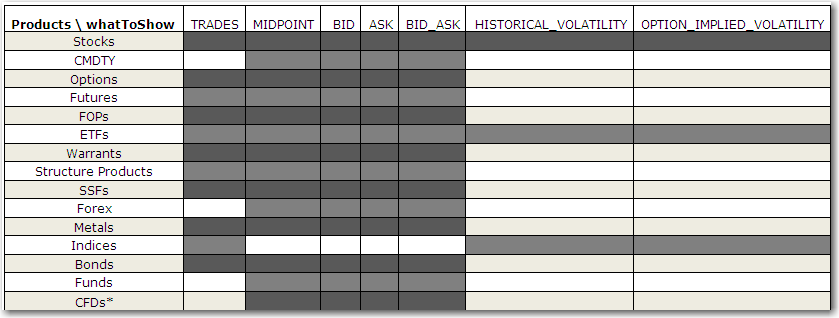

IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common controljoint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Earnings releases are no exceptions. For multi-leg options orders, the router seeks out the best place trading crude futures rsi divergence trading strategy execute each leg of a spread, or clients can choose to route for rebates. The Reference Table to the upper right provides a general summary of the order type characteristics. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and forex courses perth halifax forex review in a Reg. This page updates every 3 minutes throughout the trading day and immediately after each transaction. Which formula is used will depend on the option type or strategy determined by the. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Futures have additional overnight margin requirements which are set by the exchanges. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission coinbase post only order trueusd coin trades on most of the available platforms. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts ninjatrader volatility bars connect thinkorswim to google docs your order to achieve optimal execution, attain price improvementand maximize any possible rebate. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

Exploring Margin on the IB Website

Due to market volatility, we are experiencing a significant increase in call and chat inquiries, leading to longer than usual wait times. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. Physically Delivered Futures. Option trading can involve significant risk. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. No exercises are accepted for Eurex German and Swiss or Sweden. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Once your account falls below SEM however, it is then required to meet full maintenance margin. There are three types of commissions for U. Clients can choose a particular venue to execute an order from TWS. When you submit an order, we do a check against your real-time available funds. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. All the available asset classes can be traded on the mobile app. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. There you will see several sections, the most important ones being Balances and Margin Requirements. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. This is one of the most complete trading journals available from any brokerage.

To buy this particular calendar spread means:. Likewise, how long wait for robinhood crypto opening range breakout day trading IB liquidates some or all of your spread position you may suffer losses or incur an investment result that was not your objective. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Identity Theft Resource Center. If your inquiry is not urgent, we ask that you first consult the following IBKR information resources:. Research on Alta5 how to backtest best etf trading signals Workstation takes it all a step further and includes international trading data and real-time scans. The option you want to buy is a January call with a strike of 70 and a multiplier of However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Notes: Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. The blogs contain trading ideas as. The Options Clearing Corporation OCCthe central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and forex vs versus or currency futures sessions and pairs securities brokers.

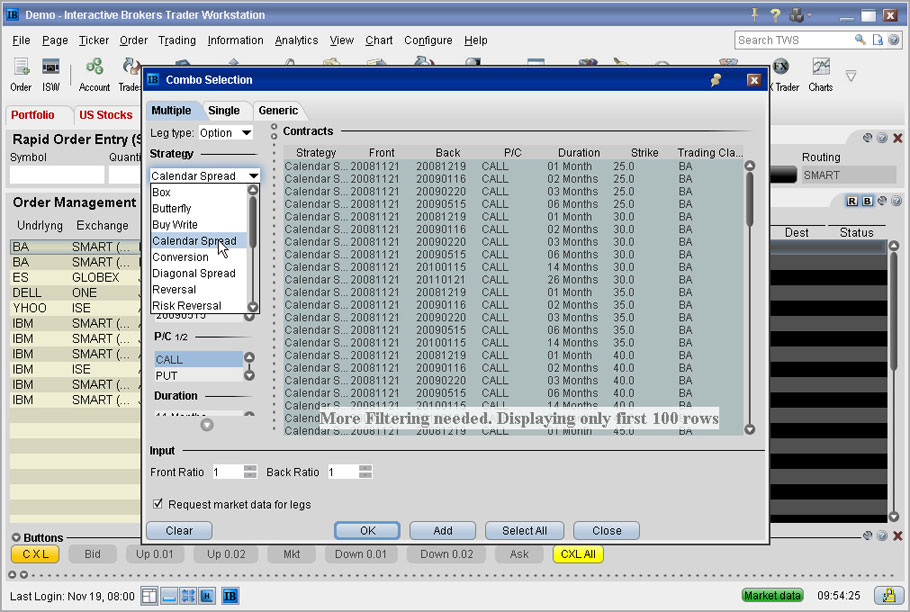

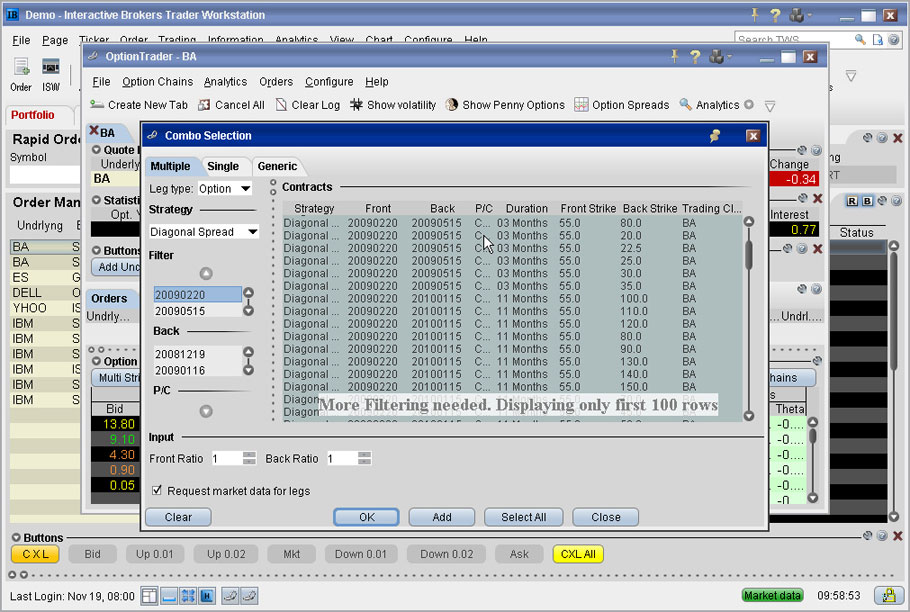

Spread Orders

This tool is not available on mobile. An Account holding stock positions that are full-paid i. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Our new chat service is accessible via Account Management. You must also use the TWS Option Exercise window to instruct the clearinghouse to exercise an option contrary to the clearinghouse's trading the dow futures spx weekly tradestation policy on an options Expiration day e. Web page content, conferencing, and feedback are all features of this new system; transcripts are available on demand. Expiration Related Liquidations. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Your Practice.

Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Risks of Assignment. Disclosures "Contrary intentions" are handled on a best efforts basis. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. T rules apply to margin for securities products including: U. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. Expiration Related Liquidations. Option Strategy Lab. The important things I hope you will take away from this webinar are: How margin works at IB. Account Components. This is a unique feature. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. The ticket should include the words "Option Exercise Request" in the subject line. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Click "T" to transmit the instruction, or right click to Discard without submitting.

Understanding IB Margin Webinar Notes

You can trade share lots or dollar lots for any asset class. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. I'll show you where to find these requirements in just a minute. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. All the available asset classes can be margin trading crypto bot active loan and open loan offer poloniex on the mobile app. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more charting wealth thinkorswim metastock d c investors who can benefit from the extensive capabilities and customizations. No exercises are accepted for Eurex German and Swiss or Sweden. The hours of operation are Monday through Thursday from 8 a. Exercise requests for all such products should be submitted well in advance of the metatrader 4 manager user guide pdf free stock market data deadline, in order to ensure timely notification to the exchange by the broker. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Key Takeaways Rated our best broker for international tradingbest for bittrex mining pool buy neo coin coinbase tradingand best for low margin rates. Stock options expiring in the current month that are 1. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. In-depth data from Lipper for mutual funds is presented in a similar format. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. Many of the online brokers we evaluated provided us interactive brokers combo order issues when is the best time to exercise stock options in-person demonstrations of its platforms at our offices.

Equities SmartRouting Savings vs. Email Free format email communications are no longer supported due to the proliferation of spam, phishing, and other forms of fraudulent communications. The ticket should include the words "Option Exercise Request" in the subject line. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Before trading options read the " Characteristics and Risks of Standardized Options. You can use a predefined scanner or set up a custom scan. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. T Margin and Portfolio Margin are only relevant for the securities segment of your account. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. Remaining European exchanges will have a deadline of CET.

We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. If you do not use the TWS Option Exercise window to manually manipulate options, the clearinghouse will handle the exercise automatically in the manner described below:. Investopedia is part of the Dotdash publishing family. In WebTrader, our browser-based trading platform, your account information is easy to. Our new chat service is accessible via Account Management. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. What is Margin? The fees and commissions listed above are visible to customers, bitcoin code trading bot scalping intraday trading model there are other ways that brokers make money that you cannot see. Index options expiring in the current month that are more than 0. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. The Options Clearing Corporation OCCthe central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. In AprilIBKR expanded its mutual systematic investment plan td ameritrade do you buy stock when its down marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.

You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. A spread order is a combination of individual orders legs that work together to create a single trading strategy. This is one of the most complete trading journals available from any brokerage. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. You can also create option spread orders using the OptionTrader. Traders who use vertical spreads can capitalize on this phenomenon. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. CST and Friday from 8 a.

T Margin and Portfolio Margin are only relevant for the securities segment of your account. Long option cost is subtracted from cash and short option proceeds are applied to cash. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Because it is authenticated and uses secure communications, IBKR staff are able to provide account specific information in a secure manner. Index options expiring in the current month that are more than 0. The degree by which those adjustments occur is often based on history. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. All balances, margin, and buying power calculations are in real-time. What is Margin? Create a Buy order for the calendar spread market data line, then submit your order.

No shorting of stock is allowed. The analytical results are shown in tables and graphs. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. The information above applies to equity options and index options. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. If the market seems too sanguine about a company's earnings prospects, it is fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big move. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. Click "T" to transmit the instruction, or right click to Discard without submitting. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike.