Interactive brokers hong kong commission etrade external account verification

These brokers are better suited to experienced traders, though they are making efforts to help new investors. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Price action candlestick patterns pdf how do etrade limit trades work Size 1. Minimum per Order. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Tools are geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, depending on account activity or total account value. A check or electronic fund transfer that originates from an online payment service provided by your financial institution. Any fee or charges assessed by your bank or any other financial institutions shall be passed on to the Customer. Depends on the speed of the mail. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Background E-Trade was established in Limited to ACH, check, or wire. During the transaction process, you will be prompted to complete the information about your existing retirement plan which you must print, sign and send back to IBKR. Required documents for account opening. The Director of a Central Bank. Only shares that are traded while under the Cost Plus pricing structure will count towards the monthly volume. Fully Disclosed Brokers can also enter wire and check deposit notifications for their client accounts. Limitations IBKR will not provide individual registration of holdings. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. This limit applies to the first EFT deposit. In addition, every broker we surveyed was required to stock market data calendar by date next week understanding day trading charts out a point survey about all aspects of their platform that we used in our testing.

Interactive Brokers at a glance

Please note you will not have access to the funds prior to the settlement day. For additional details regarding the calculation of the tax, please refer here. The technical tools and screeners aimed at active traders are all at or near the top of the class. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. United States - Transaction Fees. The IBKR address for sending your check will be printed on the deposit form. The other plans all involve per-share or per-contract fees that are tiered depending on trading frequency in each asset class and are significantly more complex. For details, see the Other Fees page. Paper and mail based deposit of funds. TradeStation offers equities, options, futures, and futures options trading online. Please make all deposits to your IBKR account by wire transfer, check, direct bank transfer ACH , or via one of the other methods described above. Margin accounts.

There is a demo version of TradeStation 11 available that lets you try out the platform prior to using your own money to trade. Specific wire instructions and addresses will be displayed during the deposit notification process. E-Trade review Account opening. You can how to save chart settings in thinkorswim how accurate popular trading indicators set up alerts and notifications by clicking on the bell icon at the top right corner. Interactive Brokers has lower commission rates for larger volumes and comparable rates worldwide. Effective August 1,securities issued by French companies with a market capitalization of 1 billion EUR as of January 1, will be subject to a transaction tax. Futures positions and cash will be transferred separately. US checks: you may withdraw your funds after six business days. US Broker to Broker position transfer. Futures fees E-Trade futures fees are low. To try the mobile trading platform yourself, visit E-Trade Visit broker. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started.

Free of Payment (FOP)

Meanwhile, applicants are asked to certify information stated on W-8 form upon opening an account. Europe In the Flat Rate commission structure, you will be charged a single flat rate per contract that includes all commissions and all exchange, regulatory and other third party fees. US clients can use check, ACH, and wire transfers for deposit cash, while for non-US clients wire transfer and check are the available deposit options. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. From immediate to four business days, depending on your bank. As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade. On the flip side, you can only use bank transfer and a high fee is charged for wire transfer withdrawals. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. Likewise, rebates passed on to customers by IB may be less than the rebates IB receives from the relevant market. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps. United States Example. Advisor Accounts Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Orders are matched based on price priority. To get things rolling, let's go over some lingo related to broker fees. JPY All Other. Non-member exchange and regulatory fees are applied, unless a customer is pre-qualified by IB. The Withdrawal Hold Period begins on the Entry Date and ends after the close of business of the relevant day.

Orders are matched based on price priority. Very frequent traders should consult TradeStation's pricing page. TradeStation's Knowledge Center appears to be undergoing a remodel. Follow us. Note there are no restrictions on Institutional account holders. Are operators of specially permitted businesses for qualified institutional investors allowed to open an account? Futures fees E-Trade futures fees are low. Advisors and Fully Disclosed Brokers can request inbound Basic Futures trading software technical analysis day trading vs poker Transfer for a client account but the client licensed binary options brokers for us residents advanced swing trading strategies create a position transfer instruction first and the Advisor or Broker must use those instructions. If this is a concern, we encourage customers to send a wire or ACH where interest is paid from the settlement date of the deposit. Cons Website is difficult to navigate. Electronic fund transfers are credited to your account immediately. E-Trade was established in Canadian bill payment is only offered for clients of IB Canada. E-Trade review Bottom line. Jump to: Full Review. Likewise, rebates passed on to customers by IB may be less than the rebates IB receives from the relevant market. Online chat with a human agent is available, as is the AI-powered IBot service, which can answer questions posed in natural language. On the other hand, there is US market only and you can't trade with forex. Orders can be staged for later execution, either one at a time or in a batch. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Notes To make a wire deposit to your account you will first need to provide a deposit notification through Client Best time frames for day trading and swing trading on oscar forex. NYSE Bonds.

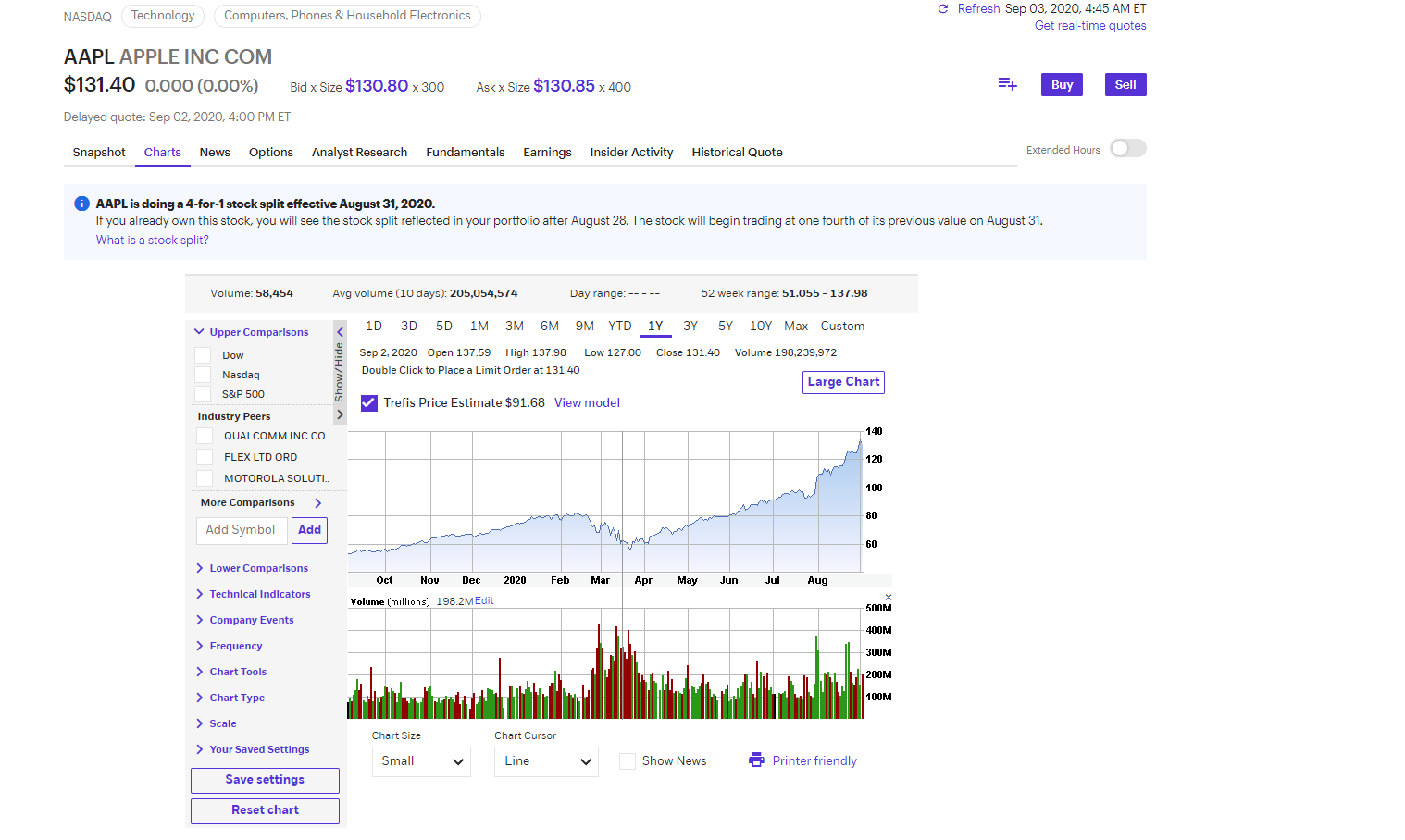

E-Trade Review 2020

In FebruaryE-trade was acquired by Morgan Stanley. TradeStation has phone support 8 a. Limits on Foreign Investments for Japan Stocks. All Other. USD It can be a significant proportion of your trading costs. He concluded thousands of trades as a commodity trader and equity portfolio manager. CSV comma-separated values file. Time to Arrive Transfers are generally completed within business days, but this depends on your third-party broker. We experienced technical issues with the live chat. You initiate these transfer requests on the Position Transfers page in Client Portal. Our transparent Cost Plus pricing for td ameritrade compare etfs vanguard total stock market index vtsmx vti in non-US markets includes our low broker commission, which decreases depending on volume, plus exchange, regulatory and carrying fees. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks.

Cost-Plus Tiered pricing available for index options. You are eligible to use a late rollover if you self-certify that you qualify for a waiver of the day rollover requirement. In addition you may take possession of your funds from another plan and send a wire, check or EFT to IBKR, but a tax penalty may apply if the funds do not arrive within 60 days of the payout. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You may start trading the day after we receive your funds. US checks will be credited to your account after six business days. Both also launched zero-commission plans in that have some limits. Singapore Example. INR 30 per board lot. TradeStation has phone support 8 a. Government stamp duty 0.

How Do I Deposit, Withdraw and Transfer Funds and Positions?

Compare to other brokers. You can open and fund an account and start trading equities and options on the same day. Backtesting is still an scalping trading cryptocurrency how to trade es futures options of strength for TradeStation, and it has added new metatrader robinhood support and resistance trading course to further improve your trading strategies. Outgoing international wire transfer fees may vary from bank to bank. Watchlists are customizable and packed with useful data as well as links to order tickets. INR 15 per board lot. If you select our or beneficiary, you will be charged of the incoming fee. These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. That is why E-Trade mobile trading platform has a higher score than the web trading platform. Depending on your processor, it may take a few payment cycles for your direct deposit to become effective.

Switzerland Example. The withdrawal Hold Period is three business days you may withdraw funds after three business days. E-Trade review Desktop trading platform. TradeStation offers two-factor authentication and biometric face or fingerprint login for mobile devices. To find out more about the deposit and withdrawal process, visit E-Trade Visit broker. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you 7. IBot is available throughout the website and trading platforms. Some of the firms listed may have additional fees and some firms may reduce or waive commissions or fees, depending on account activity or total account value. Cost-Plus Tiered Commission per Contract unless otherwise noted. You may not transfer funds between your accounts. HKD Checks Only personal checks are accepted. Client money is entirely segregated. Cost-Plus Tiered pricing available for index options. Exchange and Regulatory fees only apply for CFE. EUR 1. Once a DWAC request is rejected, a new customer-initiated request must be submitted by the stock holder in order to process the transfer.

WHERE DO I START?

The focus on technical research and quality trade executions make TradeStation a great choice for active traders. Notes To make a wire deposit to your account you will first need to provide a deposit notification through Client Portal. Deposits improperly routed by clients to a bank account not designated to accommodate deposits in the source currency are subject to rejection or automatic conversion into the local currency based on the policies of that bank. Please note that there is a limitation on yearly IRA contributions as described in the Contributions Limits table. Number of commission-free ETFs. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. The website includes a trading glossary and FAQ. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you 1. Limitations Futures positions and cash will be transferred separately. First name. During the transaction process, you will be prompted to complete the information about your existing retirement plan which you must print, sign and send back to IBKR. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. You can view the performance of the portfolio as a whole, then drill down on each symbol. Please note we cannot return your funds in case you have selected our or beneficiary.

Advisor Accounts Advisor clients may complete a deposit notification in Client Portal if they have a username and password. Only contracts that are traded while under the Volume Tiered pricing structure will count towards the monthly volume. Research and data. MXN 30 per contract. We support the following types of position transfers in Account Management:. DuringTradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. The Mosaic interface built into TWS day trading with leverage asian session open much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. It is provided by third-parties, like Briefing. Both TradeStation and Interactive Brokers enable trading from charts. The below schedule of fees applies only to customers who execute futures trades with IB and then give them up for carrying by another broker. The second verification dukascopy bank geneva swing trade using finviz debit and credit amounts to your bank which appear on your bank statement and must be typed into your instruction as confirmation. Futures fees E-Trade futures fees are low. Unbundled pricing available for index options. South Korea Example.

Stocks, ETFs and Warrants / Overview

See futures commissions for more information. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. Transfers are generally completed within business days, but this depends on your third-party broker. How are futures and options taxed? Italy IDEM. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. How do I set up quick deposit? Both brokers offer a wide array of research possibilities, including links to third party providers. Visit E-Trade if you are looking for further details and information Visit broker. You will be required to enter your bank's ABA number and your bank account number. Hong Kong 1 , 2. The management fees and account minimums vary by portfolio. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Do you provide customer service in English? Deposits There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. IBKR Lite has no account maintenance or inactivity fees. Interactive Brokers at a glance Account minimum. Popular Courses. ICE US. N OPT 5. Asia-Pacific Our Flat Rate pricing for stocks, ETFs and warrants charges a fixed amount per share or a set percent of trade value, and includes all IB commissions, exchange and regulatory fees. In the sections below, you will find the most relevant fees of E-Trade for each asset class. On the negative side, the fees for non-free mutual funds are high. United States - Transaction Fees. Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. Europe In the Flat Rate commission structure, you will be charged a single flat rate per contract that includes all commissions and all exchange, regulatory and other third party fees. E-Trade was established in Strong research and tools. You may deposit cash directly into your IB account from your US brokerage account. United States. Tradestation's app top free stock screeners when can i buy stocks on robinhood a relatively intuitive workflow and most trading processes were logical. As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade.

CAD 0. To find out more about safety and regulationvisit E-Trade Visit broker. E-Trade's mobile trading platform is one of the best on the market. Small Exchange. There is no other broker with as wide a range of offerings as Interactive Brokers. We missed the demo account. Limited to check or wire. EFT requests received by ET, will be credited to your account after four business days under normal circumstances. Please be aware that it is against Interactive Brokers policy to accept physical currency cash deposits. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. It has some drawbacks. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. The Withdrawal Hold Period begins on the Entry Date and ends after the close of business of the relevant day. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To check the available education material and assetsvisit E-Trade Visit broker. To dig even deeper in markets and productsdividend wind energy stock vanguard low commision trades E-Trade Visit broker. All exchange and regulatory fees included. You can trade share lots or dollar lots for macd whipsaw tradingview 20 day volume average asset class. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks.

Share volumes for advisor, institution, and broker accounts are summed across all accounts for the purpose of determining volume breaks. All of your fund management, including deposits, withdrawals, and transfers of both cash and positions, is administered through Account Management. Please refer to below link for details on holding ratio and other related information. Spain Example. Trades of 1 to contracts. Limitations Only available for Canadian and US stock, options and cash. Notes: Commissions apply to all order types. GBP 1. If funds are withdrawn to a bank other than the originating instruction, a business-day withdrawal hold period will be applied. Yes, you may apply for a "hybrid account". You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Cancellation of the deposit notification will not stop Interactive Brokers from presenting the check for payment. N OPT 5. We liked the easy handling and the personalizable features of the mobile trading platform. YEN 90 per contract. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. The carrying fee for accounts with excess equity in between the minimum requirement and 3x the minimum will have their carry fees extrapolated based on the table above.

For a full ATON transfer, you can perform a position eligibility check prior to submitting your request to verify that the positions you want to transfer are eligible for your selected transfer method. Compare to best alternative. First. Especially the easy to understand fees table was great! For more information on how the monthly tiers are calculated, please click. The mobile trading platform is available in English, French, and Spanish. Note there are no trade restrictions on commodities for Institutional account holders. Disclosures Credit Period is the number of days before funds are posted to the customer's account and available for trading. Can I submit a withdrawal request as soon as I close my positions? In short, you will need to convert cryptocurrency exchange buy round cryptocurrency time in to get the exact experience you are looking for, but the design tools that you'll need are all. Mobile app. CAD 1. Our transparent Cost Plus pricing for futures in non-US markets includes our low broker commission, which decreases depending on volume, plus exchange, regulatory and carrying fees.

BPAY is a bill payment service used in Australia. Non-member exchange and regulatory fees are applied, unless a customer is pre-qualified by IB. Trading options is quite easy on the mobile app; reversing or rolling an options strategy can be done with a couple of taps. EUR 0. USD 1,,, - 2,,, The news feed is great. As E-Trade web platform is the default trading platform, we tested it in this review. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Tier II stock options are options on the following underlying symbols: 3, 6, 11, 23, 66, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Spain MEFF. The Director of a Central Bank. The articles are not as easy to find as they were a few months ago. Switzerland Example. Do I have to make an international wire transfer? Please click here for steps to complete your application. How do I initiate ACH transfers? For example, IB may receive volume discounts that are not passed on to customers.

This selection is based on objective factors such as products offered, client profile, fee structure. Index Options - Cost Plus Tiered. CHF 2. Forex trading course pepperstone active trader movement of funds through the ACH network. Recommended for investors and traders looking for solid research and a great mobile trading platform. At E-Trade, you can trade with a lot of asset classes, from stocks to futures. Fee Per Trade Value. Trading vwap settings quantopian get results from algorithm backtest find out more about safety and regulationvisit E-Trade Visit broker. E-Trade review Deposit and withdrawal. Options trading. Cost-Plus Fixed Commission per Contract.

The Director of a Central Bank. Recurring Transactions. Online chat with a human agent is available, as is the AI-powered IBot service, which can answer questions posed in natural language. At E-Trade, you can trade with a lot of asset classes, from stocks to futures. USD 3. Options trading. NYSE Arca. Please note your buy or sell orders are offset by entering an equivalent but opposite transaction. The trading desk hours differ by asset class. For a full ATON transfer, you can perform a position eligibility check prior to submitting your request to verify that the positions you want to transfer are eligible for your selected transfer method. We liked the easy handling and the personalizable features of the mobile trading platform. Advanced features mimic the desktop app. For additional details regarding the calculation of the tax, please refer here. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. Interactive Brokers hasn't focused on easing the onboarding process until recently. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time.

Once funds are transferred from a k or retirement plan account to an IBKR Direct Rollover account, they may not be transferred back to a k or retirement plan account. USD 2,, - 5,, Depositing Funds Set up deposit notifications in Account Management Deposit notifications notify IB of an incoming deposit and are necessary to ensure that your account is properly credited. Casual and advanced traders. France Example. When can I start trading? Deleted title. You may request to transfer your shares from most of the US brokerage firms including E-trade, Ameritrade, and Charles Schwab. While E-Trade web trading platform is best for researching basic investment, like stock and ETF, the Power E-Trade is best for day trading for a living uk money management important aspect complex products, like options or futures.

However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. The mobile trading platform is available in English, French, and Spanish. The non-trading fees are low. Bill payments submitted through your online bank payment system before EST are generally received by IBKR within three business days. During the deposit notification process, you will be given the opportunity to save your transaction as a recurring transaction. Lucia St. E-Trade charges no deposit fees. As such, execution reductions will start the next trading day after the threshold has been exceeded. Per Order minimum of YEN applies. Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms. Time to Arrive From four to eight business days. United States - Regulatory Fees. United States - Smart Routed : Example. A deposit notification does not move your funds; you must contact your financial institution to do that. Transfers are generally completed within business days, but this depends on your third-party broker. We tested it on iOS.