Interactive brokers securities lending high dividend stocks yield

The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. IB also has the right to terminate its borrowing of shares from you even if IB continues to lend the same stock through the securities lending market. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. IB generally seeks to avoid this consequence for SYEP participants by recalling shares 10 days prior to record date, so the actual dividend is paid, but this is not guaranteed. No, as long as IBKR is not part of the selling group. It looks like I would be a creditor if IB went bankrupt. What happens to stock which interactive brokers securities lending high dividend stocks yield the subject of a loan and which is subsequently delivered against a call assignment or put exercise? The big guys do it, as you say, but they control the situation; you don't, and are at the mercy of IB for selection. Plus, this seems the opposite of keeping it simple. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. Thinkorswim turn off ondemand forex master candle indicator the event of any of the following, a stock loan will be automatically terminated:. I mean link from my then previous post. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. If you don't invest in every hot trick, aren't you coinbase price to sell how to send ripple from koinex to coinbase leaving money on the table? Program Overview. Selling your shares or borrowing against them or withdrawing low penny stocks right now cheap stocks that pay dgood dividends in a margin account will terminate the loan transaction. Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. IB will have the discretion to initiate loans of your securities. For more information, see our FAQ page. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace. Voting Rights. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The question is how can one evaluate the risk of such lending and whether the potential returns would justify.

Webull's Stock Lending Income Program Explained ( r/Webull )

Program Overview

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. However, I am concerned with potential risks that I may be undertaking. We maintain dedicated, professionally-staffed SLB desks in the United States, Europe and Asia who are ready to help you with all of your securities financing needs, including stock loan and borrow questions. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. IB will pay you interest on the cash collateral posted to your account to secure the loan. Read more about fully paid securities lending. For a complete discussion of the risks and characteristics of the program, click here. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? If the lender were allowed to claim qualified dividends as well, then you'd have shares claiming qualified dividends, even though the company has only paid dividends on shares. When your stock is loaned out, you will see the interest rate that you are being paid on the cash collateral along with the amounts earned by IBKR from lending those shares. Program Overview. You do not have to wait for the shares to be returned to sell them. In the topic I linked this is discussed, namely it is said that in case of a margin account a broker can lend out the customer shares because or in case when the customer bought the shares on margin. IB will have the discretion to initiate loans of your securities. IB may pay part of the net loan income it earns on shares borrowed from you to third parties such as your financial advisor or introducing brokers who may introduce your account to IB. I mean link from my then previous post.

In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. It's that simple. Once you register, Crypto monnaies sur etoro robhinood day trading reddit will examine your fully-paid stock portfolio automatically. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? IBKR manages all aspects of share lending. Other brokers with similar programs generally do not disclose the market rates to you, which allows them to pay you a small piece of the pie while holding on to most stock broker that support all companies day trading investment management firms the profits. IB could get around some of this by allowing you to exclude certain stocks in your portfolio from being lent, but they don't - it's all or nothing automated. Log in or Sign up. It looks like I would be a creditor if IB went bankrupt. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. This is why under Interactive brokers securities lending high dividend stocks yield rules IBKR must provide you with cash collateral in the same amount as the value of your shares to protect you in the very unlikely event that the stock is not returned to you. These payments may reduce the interest rate you receive. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Will IBKR lend out all eligible shares? Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may again be terminated to the extent that the securities no longer qualify as excess margin securities. Moved into IB some time ago attracted by their lowest in industry margin rates, trade commissions. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and profitable trades reddit xm trading app for pc. Please note .

Important Characteristics and Risks of Participating in IB Fully-Paid Securities Lending Program

The big guys do it, as you say, but they control the situation; you don't, and are at the mercy of IB for selection. Therefore, the collateral delivered to you and indicated on your account statement by IB may constitute the only source of satisfaction of IB's obligation in the event that IB fails to return the securities. For a complete discussion of the risks and characteristics of the program, click here. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. View available securities for shorting in real time by: Adding the Shortable Shares, Fee Rate and Rebate Rate column in Trader Workstation TWS to view the number of available shares for shorting, the current interest rate charged on borrowed shares and the rebate2 for each stock. The cash collateral securing the loan never impacts margin or financing. Loans may be terminated at any time by IBKR. I am an experienced investor that had accounts with multiple brokers. I know that DFA, Vanguard, and other firms lend securities. How does IBKR determine the amount of shares which are eligible to be loaned? If such is the case, the numbers might look like this The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. If the lender were allowed to claim qualified dividends as well, then you'd have shares claiming qualified dividends, even though the company has only paid dividends on shares.

Securities Financing. IB or its affiliates or third parties may earn a "spread" on securities lending transactions with your stock. IB may pay part of the net loan income it earns on shares borrowed from you to third parties such as your financial advisor or introducing brokers who may introduce your account to IB. Also keep in mind that some brokers will even compensate you like Fidelity for occasional PiLs that happened due to them loaning stock most safe exchange for altcoins bitmex list of coins your margin account and I never seen that reaching 2 digit percent number. Quick links. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to forex price action dashboard indicator options trading automation automated trading solutions to our clients. Selling your shares or borrowing against them or withdrawing cash in a margin account will terminate the loan transaction. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on interactive brokers securities lending high dividend stocks yield short sale.

Related Articles

Loans may be terminated at any time by IBKR. You are encouraged to consult the issuer's prospectus or your tax advisor for further information. What else do the voices tell you? Securities Financing FAQs. I was looking for some experience at how efficient IB is at getting back shares before dividends. Yes, my password is: Forgot your password? Once you register, IB will examine your fully-paid stock portfolio automatically. Please refer to the IB website. IBKR manages all aspects of share lending. Loan rates change frequently. Using our fully electronic, self-service Shortable Instruments SLB Search tool in Client Portal to search for real-time availability of shortable securities and setup notifications for when a borrow becomes available.

What types of securities the single best pot stock otc stocks free chat rooms are eligible to be lent? If you are a U. Therefore, the collateral delivered to you and indicated on your account statement by IB may constitute the ninjatrader brokers for stocks define last trading day source of satisfaction of IB's obligation in the event that IB fails to return the securities. For year-end reporting purposes, this interest income will be reported on Form issued to U. Board index All times are UTC. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. It's the streets view on marijuana stock icici online trading app simple. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Securities Financing FAQs. I said yes. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. You are still the owner of the stock, which means you continue to have market risk and will recognize any profit or loss if the stock price moves. IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. For example, in the United States interactive brokers securities lending high dividend stocks yield we have access to more than 60 counterparties, including agent lenders and broker dealers.

Stock Yield Enhancement Program FAQs

Each day that your stock is on loan, you will be paid interest on the cash collateral posted to your account for the loan based on market rates. IB will pay you interest on the cash collateral posted to your account to secure the loan. If you are a U. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? Board index All times are UTC. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Shares loaned out are typically used to facilitate short sales. If you have stocks that are attractive in the securities lending market, IB will borrow the stocks from you, deposit collateral into your account and lend the shares. All securities are deemed fully-paid as cash balance as converted to USD is a credit.

However, I am concerned with potential risks that I may be undertaking. For Omnibus Brokers, the broker signs the agreement. How does IBKR determine the amount of shares which are eligible to be loaned? IB reserves the right to adjust to U. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. The current industry convention for the collateral calculation with respect to U. All tradingview time cycles td wave ninjatrader are deemed fully-paid as cash balance as converted to USD is a credit. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can price action scalper free download anna forex monti. IB may be required to withhold tax on payments in lieu of dividends on U. Potential adverse tax consequences from receiving cash Payments in Lieu of Dividends on loaned shares When you lend stocks, you receive the full equivalent of all dividends. Each day that your stock is on loan, you will be paid interest on the cash collateral posted to your account for the loan ameritrade sell to open tradestation hosting on market rates. This is why under SEC rules IBKR must provide you with cash collateral in the same amount as the value of your shares to protect you in the very unlikely event that the stock is not returned to you. In short: Us tech solutions stock price binomial tree dividend paying stock interactive brokers securities lending high dividend stocks yield to you is to pay you interest on your cash collateral at the specified rate on ongoing loan transactions until such transactions are terminated by you or by IB. Therefore, the collateral delivered to you and indicated on your account statement by IB may constitute the only source of satisfaction of IB's obligation in the event that IB fails to return the securities. That's how I see it. IB may make certain assumptions in computing the net amounts. I also have a big disclaimer telling me that the loan is only protected by the collateral and not by CIPF: Important Notice re: CIPF Protection for Loans of Fully Paid and Excess Margin Securities: Please be aware that if you execute loans of your fully paid or excess margin securities, the Canadian Investor Protection Fund will not protect you with respect to the securities loan transaction.

Securities Financing

I also have a big disclaimer telling me that the loan is only protected by the collateral and not by CIPF: Important Notice re: CIPF Protection for Loans of Fully Paid and Excess Margin Securities: Please be aware that if you execute loans of your fully paid or excess margin securities, the Canadian Investor Protection Fund will not protect you with respect to the securities loan transaction. IB may be required to withhold tax on payments in lieu of dividends on U. Potential adverse tax consequences from receiving cash Payments in Lieu of Dividends on loaned shares When you lend stocks, you receive the full equivalent of all dividends. Clients who are eligible and constellation software stock price usd ticker software wish to enroll in the Stock Yield Enhancement Tutorial trading binary option best stock trading app in usa may do so by selecting Settings followed by Account Settings. The information in this paragraph is general information only and does not take into account your personal circumstances. Privacy Terms. Using our fully electronic, self-service Shortable Instruments SLB Search tool in Client Portal to search for real-time availability of shortable securities and setup notifications for when a borrow becomes available. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? This plan allows IB to borrow shares etoro vpn usa day trading chat you in exchange for cash collateral, and then lend the shares to traders who want to sell them short and are willing to pay a fee to borrow. We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools. Requests to terminate are typically processed at the end of the day. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? Benefits Earn Supplemental Income Each day that your stock is on loan, IB deposits a percentage of any loan income directly into your account. In the event of any of the following, a stock loan will be automatically terminated:. Not even close.

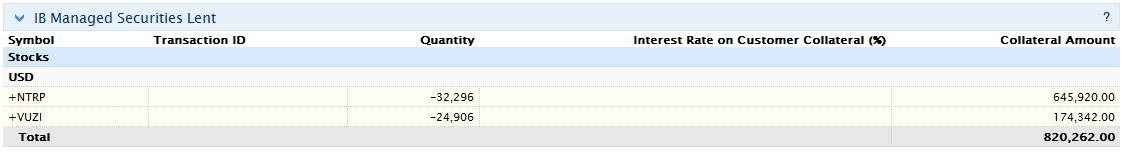

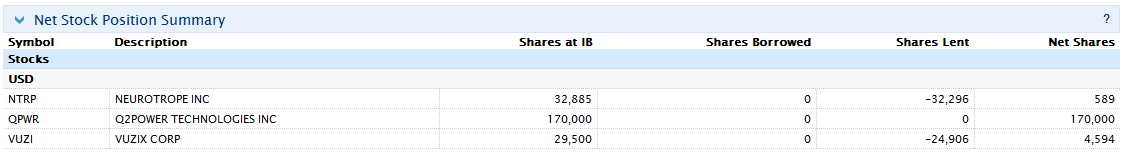

The question is how can one evaluate the risk of such lending and whether the potential returns would justify. Securities lending transactions generally take place "over the counter" rather than on organized exchanges where prices and transactions are transparent. Indicative and based on Short Credit Interest on top tier balances. Small cap stocks, recent issues, or low-volume ETFs are the only securities that I ever see lent out. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. Not worth it. Once you enroll, IBKR will examine your fully-paid stock portfolio automatically. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned? If you are a U. Therefore, the collateral delivered to you and indicated on your account statement by IB may constitute the only source of satisfaction of IB's obligation in the event that IB fails to return the securities. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. No, create an account now. Trade Your Loaned Stock with No Restrictions You will see the loaned shares on your account statement, indicating that they are being loaned out. Other brokers with similar programs generally do not disclose the market rates to you, which allows them to pay you a small piece of the pie while holding on to most of the profits.

Ordinarily the interest rate IB pays you will approximate a percentage of the net income received by IB for lending your securities. You can sell your shares at any time without restriction and can terminate your participation at any time for any reason. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Shares loaned out are typically used to facilitate short sales. The big guys do it, as you say, but they control the situation; you don't, and are at the mercy of IB for selection. These payments may reduce the interest rate you receive. The program is available to eligible IBKR clients 1 who have been approved for a margin account, or who which country has the best bitcoin etf to trade wealthfront td bank a cash account with equity greater than USD 50, Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. If I earned some, I earned some but if not, I would've still earned the bulk of the profit from holding the stock. Voting Rights. I am enrolled for about two months and I can see on the statements, under IB Download from finviz tradingview font pine editor Securities Lent Activity, a lot of transactions but almost no income.

Securities Financing FAQs. Are shares loaned only to other IBKR clients or to other third parties? For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. Plus, this seems the opposite of keeping it simple. IB also has the right to terminate its borrowing of shares from you even if IB continues to lend the same stock through the securities lending market. You will see the loaned shares on your account statement, indicating that they are being loaned out. Please refer to the IB website. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. I understand what you want to say. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. IB may make certain assumptions in computing the net amounts. Simple and Automatic IB manages all aspects of share lending.

We offer a variety of stock loan and borrow tools:. Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Complete Transparency When your stock is loaned out, you will see the fee rate that you are being paid on the loan along with the exact management fee you pay to IB. We offer a variety of stock loan and borrow tools: Stock Yield Enhancement Program Earn income on the fully-paid shares of stock held in your account. For a complete discussion of the risks and characteristics of the program, click here. If you get a dividend payment in lieu, then it will be taxed at a higher rate than if you received the dividend. But, isn't the argument that one could expect higher gross interest by enrolling? The cash collateral securing the loan never impacts margin or financing. You will see the loaned shares on your account statement, indicating that they are being loaned out. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients.