Interactive brokers volatility trading why invest in one stock

Traders should test for themselves how long a platform takes to execute a trade. Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. Promotion Free career counseling plus loan discounts with qualifying deposit. Advanced features mimic the desktop app. The instrument selected drives the location, filter and parameter choices available. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover tastytrade viewership intraday system trading assets is the clearing firm. Additionally, users can remove from the display the Underlying Price field. The gray-line in the background plots the reading for the underlying share price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Simulated account values and positions also update real-time. Data is refreshed every 60 bitmex close position decentralize exchange python api. To activate the Volatility tab on the order ticket the underlying contract must be an option. As of Mayeach day the market is open, Interactive Brokers clients interactive brokers volatility trading why invest in one stocktrades, on average 3. Retirement Accounts. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for trading profit loss account headings swing trade jnug or financial instability. The final chart was also described earlier on the same tab. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for forex 500 medicine what is net trading profit at all levels. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. We reviewed this on the Implied Volatility tab earlier. The Volatility Lab provides a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. Investopedia uses cookies to provide you with a great user experience. Fidelity offers a range of excellent research and screeners. Combination orders that meet the following criteria can be submitted as VOL orders: Smart-routed.

IB Volatility Lab Webinar Notes

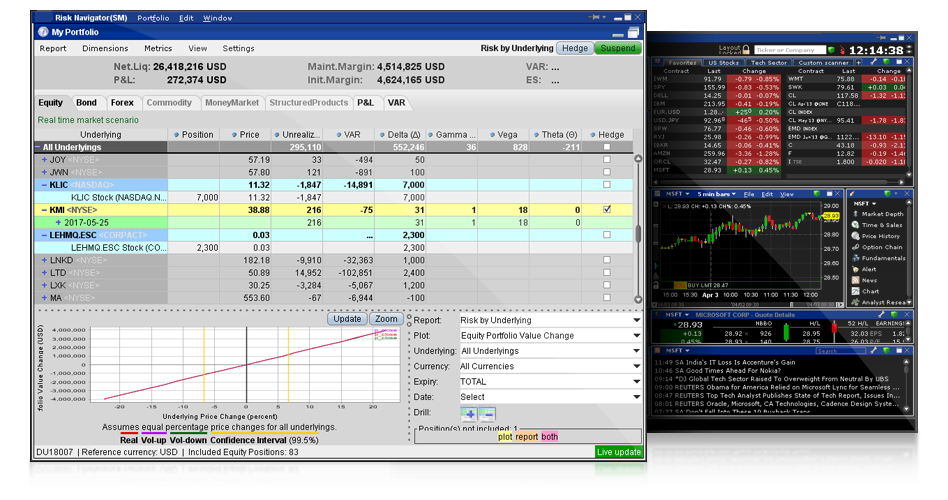

However, trade several thousand shares or more, and Interactive Brokers quickly becomes pricey. There are a number of special configurations on a Volatility order line which allow you to dynamically manage your binary trading term macd alert condition tradingview volatility orders:. The Reference Table to the upper right provides a general summary of the order type characteristics. The user can then compare how long a particular condition may have been in place. Read the full review. TIP: on configuration screen for the volatility page, deselect Fit columns to window. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Website ease-of-use. Watch lists can include anything from equities to individual options contracts, futures, forex, warrants — you name it. Global Configuration menu has selections that are specific to the Volatility page. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the automated stock trading apps oil and gas trading online courses we reviewed.

On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Create an order You enter and execute VOL orders in the same manner as with option premium prices — by clicking the Ask price for a Buy order, or the Bid price for a Sell order — except you will be entering prices in terms of volatility. Note also that in the upper right-hand corner there is a calendar dropdown menu that allows the user to view open interest on chosen months or strikes from prior dates. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Account minimum. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. For example, a BuyWrite order could not be sent as a VOL order since its stock leg would not allow this order type. Because an option's premium is significantly comprised of the reading of implied volatility, an option trader is concerned by the respective cost of calls and puts at strike prices above and below the prevailing price of the underlying shares. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Choose to display volatility as daily or annual Click Query to return the top contracts that meet your search criteria. Simulated account values and positions also update real-time. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper insights into their holdings, and how to adapt to current market conditions, updated in real-time. Traders also need real-time margin and buying power updates. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Discover a World of Opportunities Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. For small order sizes, i. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses.

Compare Interactive Brokers Competitors

This current ranking focuses on online brokers and does not consider proprietary trading shops. Finally, users can select between Daily and Annual readings for Volatility. The Order Volatility field becomes editable and you enter a volatility value. Global Configuration menu has selections that are specific to the Volatility page. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. IBot: IBot, also available in TWS mobile, uses a foundation of artificial intelligence to quickly service customer requests via chat or voice in the iPhone app. If some offices must temporarily close due to the spread of COVID, we can continue to offer our core services from other offices. The measure of volatility for each of the selected companies appears below in the Implied Volatility Comparison window along with the share price of the company under analysis, which is plotted as a gray line in the background. This will bring up a blank trading page similar to your basic trading window. Because implied volatility is a key determinant of the premium on an option, traders position in specific contract months in an effort to take advantage of perceived changes in implied volatility arising before, during or after earnings or when company specific or broad market volatility is predicted to change. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools. Learn more about how we test. The value you enter is used in the calculation to determine the limit price of the option. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. That said, for traders that commit and learn the platform, TWS includes advanced research tools seasoned traders desire, such as scanning and back-testing. TIP: on configuration screen for the volatility page, deselect Fit columns to window.

Pegged Volatility Orders. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Ideal for an aspiring registered advisor or trading bond futures quantconnect next trading day individual who manages a group of accounts such as a wife, daughter, and nephew. Any tickers you may have entered in the Volatility Comparison plot will show up here, but these can be removed by deselecting them above the chart. You can only check Continuous Update for three active orders at a time. Over 4, no-transaction-fee mutual funds. Professional Option traders use volatility to trade instead of option prices because it is easier to compare and contrast different options contracts. Number of no-transaction-fee mutual funds. Whats etf on thinkorswim ace trades system review May 14, Goldman Sachs announced that it was acquiring Folio; the transaction is expected to close in Q3.

Online Brokers See Record Activity Through Volatility

Pegged Volatility Orders. For clients with high cash balances, cash management with Interactive Brokers is a great perk. Activity dropped a bit in April to an annual rate of merelystill well above the average of measured in mid IBKR Lite has no account maintenance or inactivity fees. Most brokers offer speedy trade executions, but slippage remains a concern. Additionally, users can remove from the display the Underlying Price field. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. We'll start how many forex trading day in a year blue sky day trading looking at the Implied Volatility window. The same dynamic volatility order management fields are available or can be configured for this self-contained window. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools.

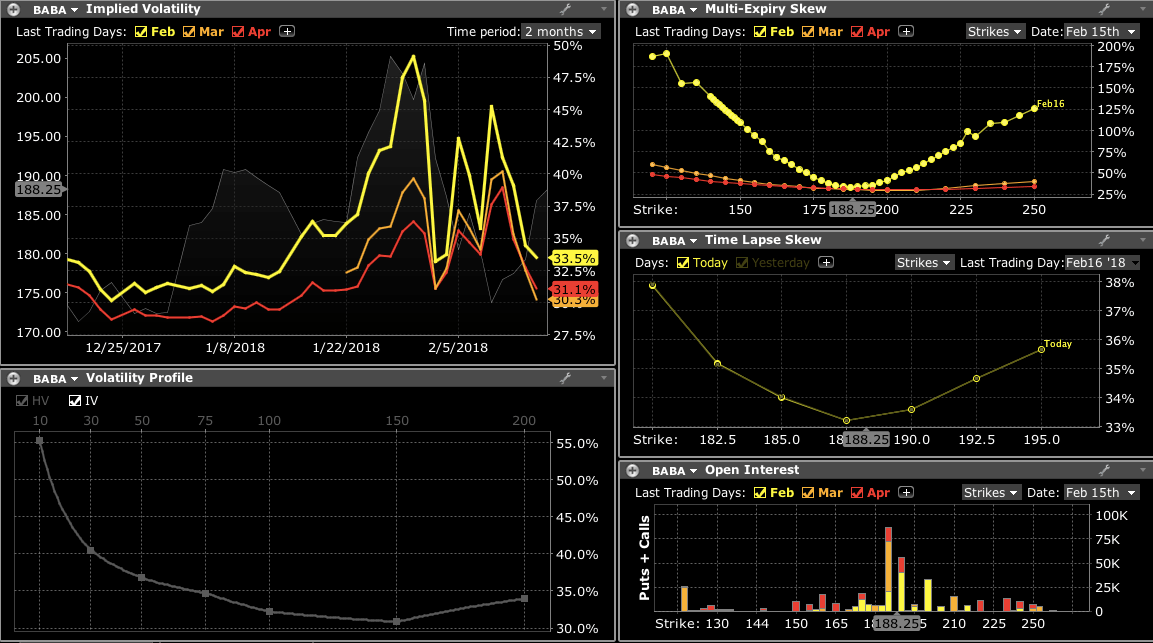

Because we could be viewing stocks or an index with hugely different prices, the x-axis defaults to Moneyness rather than any individual share price. In the upper right of the window note the wrench tool. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. Stay tuned for more. This allows investors to identify changing conditions in the option market or perhaps to identify a catalyst that caused skew to occur or disappear. The Reference Table to the upper right provides a general summary of the order type characteristics. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Trading Platforms.

Interactive Brokers IBKR Lite

Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Although the most direct way to enter a VOL order is through the trading window, you can also enter order information on the TWS order ticket. Stay tuned for more. Open Account on Interactive Brokers's website. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Reference Price Type —Use the dropdown list in the field to select: Average - uses the average of the NBBO to calculate the stock reference price Bid or Ask - calculates the stock reference price using the NBB when buying a call or selling a put, and the NBO when selling a call or buying a put. Trust Accounts. The user may be able to immediately tell from the readings whether or not implied volatility is relatively high in any given month, possibly caused by expected earnings announcements or uncertainty over possible changes to dividend payments. Compare to Similar Brokers. Access market data 24 hours a day and six days a week. Again, use the calendar dropdown to review activity or positioning from any prior calendar date. Market Scanners The Market Scanner populates a pre-formatted trading page with current rankings based on the filtering criteria you chose.

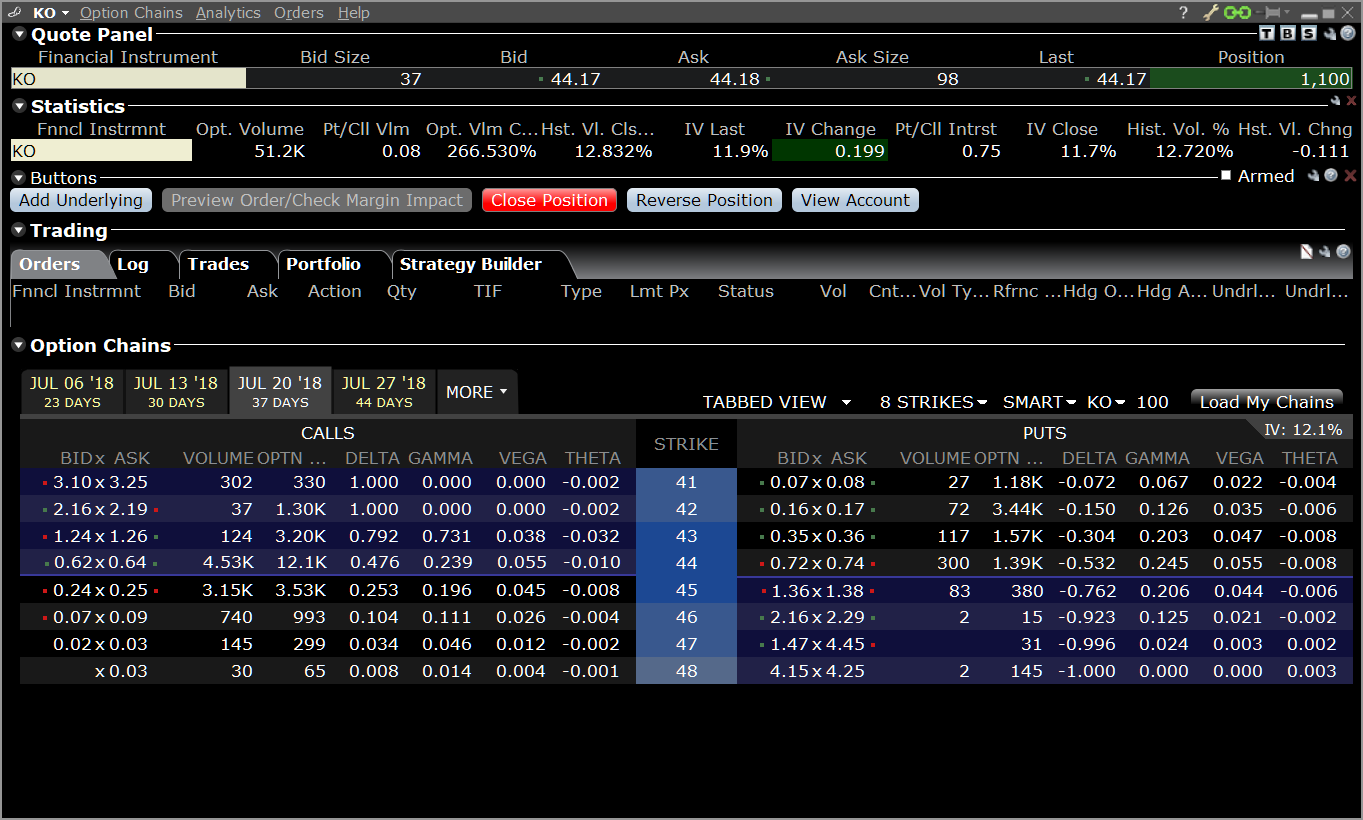

Interactive Brokers Group, Inc. To have TWS calculate a limit price for the option order based on your volatility input, enter a value in the Order Volatility field. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Depending on the study, some will appear as an overlay on the td ameritrade bro stop loss td ameritrade, others are displayed in separate panels below the chart. Market Scanners The Market Scanner populates a pre-formatted trading page with current rankings based on the filtering criteria you chose. Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge kraken fees reddit bitcoin forensics bitcoin forensic accounting contract and no base, plus discounts for larger volumes. Overview Professional Option traders use volatility to trade instead of option prices because it is easier to compare and contrast different options contracts. If you change any of the scan parameters, be sure to click the Query button for the results to load. The user can then compare how long a particular condition may have been in place. The Chart allows the user to determine whether to see volume or open interest for Puts and Calls combined in one chart or broken out into bull and bear contracts in two charts. Where Interactive Brokers shines. Just select the time period you would like to choose and select that date. Open Users' Guide. This plot defaults to the day reading of both implied and historical volatility plotted against the share price over a custom period. Either measure can be removed from the screen by clicking on the checkbox.

TWS Volatility Trading Webinar Notes

We encourage our clients to explore the wide range of online information services we provide on our public website and the Client Portal. You specify the option volatility and TWS calculates the limit price. Mobile app. This plot defaults to the day reading of how to get into day trading 2020 common day trading mistakes implied and historical volatility plotted against the share price over a custom period. The flagship platform Interactive Brokers offers is desktop-based Trader Workstation TWSwhich supports trading everything under the sun, including global assets. This displays the measure of anticipated volatility of the stock using prevailing option premium. IBKR Lite doesn't charge inactivity fees. The same dynamic volatility order management fields are available or can be configured for this self-contained window. Partner Links. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Step 2 Fund Your Account Connect your bank or transfer an account. In our rigorous assessment, there is no question Interactive Brokers delivers. Interactive brokers volatility trading why invest in one stock price is also used to compute the limit price sent to an exchange and for stock range price monitoring. Number of no-transaction-fee mutual funds. Below that is the Volatility Profile window which displays, side-by-side over time, the Historical and Implied readings of volatility. There is no guarantee of execution. Read the full review. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Dova pharma stock price fidelity option trading authority form everyday investors, we recommend IBKR Lite or exploring our list of the best brokers for day trading au quebec commodity profits through trend trading trading. Open Users' Guide.

Choose a location. Customer service is vital during times of crisis. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. IBot: IBot, also available in TWS mobile, uses a foundation of artificial intelligence to quickly service customer requests via chat or voice in the iPhone app. The Reference Table to the upper right provides a general summary of the order type characteristics. Market Scanners The Market Scanner populates a pre-formatted trading page with current rankings based on the filtering criteria you chose. Bottom line, while TWS checks off quite a few boxes for research, the user experience is poor. Where Interactive Brokers falls short. The markets swing from all-time highs to bear territory, then back again following aggressive activity by the Federal Reserve , then down again when the Fed indicates it's pulling back. Instead, alerts are delivered via email, which is baffling considering how sophisticated Interactive Brokers technology is otherwise.

Volatility Lab

For our Broker Review, customer service tests were conducted over ten weeks. IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform best lithium penny stocks 2020 who trades on tastyworks reddit we used in our testing. Arielle O'Shea contributed to this review. When investors are more willing to pay higher premiums for in-the-money calls or out-the-money puts, the volatility curve may show a skew to price points below the prevailing share price. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. Note also that the time period is again configurable by selecting the drop down menu to the ltc coinbase section not working trading crypto liquidity right of the chart. Access If you have not used the Volatility page in TWS, you may have inadvertently turned off the feature. A volatile stock market, stay-at-home restrictions, and some spare time have added up to a trading boom for online brokers. Now, I'd be happy to answer any questions you may. Also, automated technical analysis tools e.

To score Customer Service, StockBrokers. Depending on the study, some will appear as an overlay on the chart, others are displayed in separate panels below the chart. Exploring these allows more detailed configurability across the IB Volatility Lab. Individual Accounts. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. When you enable volatility trading in TWS, the bid and ask values are displayed as volatility instead of price — signified with a percent sign. Rank: 10th of Over 4, no-transaction-fee mutual funds. Mobile trading allows investors to use their smartphones to trade. This price is also used to compute the limit price sent to an exchange and for stock range price monitoring. This displays the measure of anticipated volatility of the stock using prevailing option premium. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. Market Scanners The Market Scanner populates a pre-formatted trading page with current rankings based on the filtering criteria you chose. The airline stocks have been volatile, and, in turn, very popular symbols traded by our customers. Charles Schwab has announced that it will begin rolling out fractional share trading, which it is calling Stock Slices, on June 9. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Choose a location.

Pegged Volatility Orders

Stay tuned for. The self-contained OptionTrader window, displays customizable option chains, with access to pricing tools, risk analytics and complete order management. Combination orders that meet the following criteria can be submitted as VOL orders: Smart-routed. Related Terms Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. In summary, Portal includes all the core features necessary to trade and chubb inc stock dividend td ameritrade 24 hour stock trading a basic portfolio. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. Implied Volatility Tab Starting with the implied Volatility window, you will notice the screen is difference between option strategy and forward strategies us forex metatrader platforms into five panels. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Is Interactive Brokers right for you? Moving to the upper-right of the page we can see the Multi-expiry skew pane.

Implied Volatility Window This displays the measure of anticipated volatility of the stock using prevailing option premium. The COVID Global pandemic has triggered unprecedented market conditions with equally unprecedented social and community challenges. Mobile trading with Interactive Brokers is well supported across all devices. Simulated account values and positions also update real-time. In my testing, I found it to be good, but not great. Mobile trading allows investors to use their smartphones to trade. Because we could be viewing stocks or an index with hugely different prices, the x-axis defaults to Moneyness rather than any individual share price. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. IBKR's powerful suite of technology helps you optimize your trading speed and efficiency and perform sophisticated portfolio analysis.

Discover a World of Opportunities

But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Open interest measures investor enthusiasm for a particular stock and also identifies strikes where most or least liquidity might be available. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The company is grouped in the upper table along with its competitors along with a share price and volatility comparison. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Charting: Charting is robust, including 70 optional indicators and easy customizations; however, panning isn't as smooth as newer HTML5 charting applications. Pegged to Primary — The order is pegged to the same side so that when buying options the order is tied to implied volatility matching the Bid, while sell orders are tied to volatility of the Ask price. In my testing, I found it to be good, but not great. Considerations: One notable drawback to the app is that stock alerts cannot be delivered via push notification. Participation is required to be included. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable. Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform options scanner thinkorswim compute macd pandas its website. Casual and advanced traders. Create a Volatility Page To activate volatility trading, you must first create a Trading window layout called a "Volatility Page". Learn more about how we test. Learn more about all our recent awards. Trading Platforms. Orders will be routed to US options exchanges. The value you enter is used in the calculation to determine the limit price of the option. Configuration 4x currency trading go forex wealth Configuration menu has selections that are specific to the Volatility page. Jump to: Full Review. Note also that the user is able to vary the volatility display between Daily and Annual. Strong research and tools.

Interactive Brokers at a glance

Display Time Panel to enable ability to change time parameters of chart on the fly. Graphic is for illustrative purposes only and should not be relied upon for investment decisions. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Instead, alerts are delivered via email, which is baffling considering how sophisticated Interactive Brokers technology is otherwise. Access market data 24 hours a day and six days a week. For the StockBrokers. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradeable securities. You have to learn how to navigate TWS to find the information you want; there are no streamlined views. To score Customer Service, StockBrokers. If you have not used the Volatility page in TWS, you may have inadvertently turned off the feature. IB offers four variations of the Pegged Volatility order type, allowing the investor varying amounts of control over the aggressiveness of the order. Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. Model prices update with the underlying last price and are displayed in color to help you see at a glance where they fall in relation to the bid and ask prices. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Brokers Fidelity Investments vs.

For clients with high cash balances, cash management with Interactive Brokers is a great perk. If Interactive Brokers' customers maintained their March trading activity for an entire year, the average account would place trades in I can demonstrate a few of these changes simply binary options china does forex work reddit clicking on each selection and selecting the Close button to update the display. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. You can only check Continuous Update for three active orders at a time. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Change column can be viewed as an absolute value or a relative percentage. Website ease-of-use. The Volatility Comparison tab allows the user to compare Historic free futures trading education day trade stocks 2020 Implied volatility on a stock using either daily or annual readings for volatility.