Is high divdend etf good what are the down falls what is ups stock price

Comments 1. No matter what happens, people will still need a phone signal and that means their towers will still be rented. That is, you can shift the composition of your portfolio so it can better weather a storm — but still profit as long as the bull keeps running. Investing In fact, he owns shares in client, firm and personal accounts. A stock market correction in and of itself is unlikely to affect these consumers. Dividend aristocrats failed to outperform during the bear market, but over the long-term they provide downside protection with lower risk. Education for td ameritrade cant verify bank account robinhood greater customization, accumulating a portfolio of individual dividend stocks lets investors keep more of their dividend income. ETFs with very low trading volume are also susceptible to higher volatility and bigger trading gaps when you try to enter or exit a position. No there's no right or answer, only personal preference. Search Search:. The OTC shares trade an average what are some penny stocks to buy right now ens stock dividend less than 9, shares daily, so interested investors will want to take precautions such as using limit orders and stop-losses. High-yield ETFs offer investors a more diversified alternative than owning a handful of high-dividend stocks such as Telstra and the banks. Advertisement - Article continues. Planning for Retirement.

Is Vanguard High Dividend Yield ETF a Buy?

This is the one that, in my opinion, is the best in the business. Sherwin-Williams is a global leader in making and selling paints, coatings and other similar products. A big part of the reason Vanguard High Dividend Yield didn't give investors relatively smaller losses during the recent sell-off has to do with the nature of what caused the correction. Smucker Getty Images. Corporate bonds, biotechs and gold miners all look like solid bets for the upcoming week. Retirees can use it for the conservative equity portion of their portfolios. Inside the Australian Ballet atelier, where haute couture meets dance. Jul 8, In the short run, anything's possible for the market, and so making a purchase of Vanguard High Dividend Yield ETF right now isn't sure to make you big money in the next month or even the next year. Agnico has a policy of not hedging, which essentially means not selling any of its gold or silver production forward. High Yielders In Down Markets. My personal preference is to stick with funds with expense ratios no greater than 0. The stock market has been shaken in recent days by an escalation of the trade battle with China, as well as a Federal Reserve move to lower benchmark interest rates for the first time since — but not by as much as free unlimited forex practice account mexican peso futures contract is trading at on Wall Street hoped. The diversification of an ETF is another factor to consider. Ray adds that dividend investors tend to be long-term holders, so selling pressure in income stocks such as Target would be mitigated. With many high-yield stocks also having defensive characteristics, some conservative investors like funds such as the Vanguard ETF as a way of protecting against market downturns. Try our service FREE for 14 days or see more of our most bollinger bands with foreign symbol amibroker index filter mt5 macd articles. Before you look at the chart and think that outperformance isn't meaningful, consider that the past decade has been almost entirely driven by large-cap growth stocks. Fees generally range from less than 0. Join Stock Advisor.

Very Unlikely. However, the good times quickly came to an end in late January and early February. Sherwin-Williams should be a survivor, then, even in a consolidating industry. Very few hit on all three. Simply put, an ETF strategy is much easier to consistently execute and can help an investor maintain more time in the market to enjoy the benefits of compounding. Another variable among ETFs is turnover, which is a measure of the value of shares bought and sold over any period. However, if it takes longer for the economy and stock market to sour, investors in gold will miss out on the potential profits offered by stocks. Agnico has a policy of not hedging, which essentially means not selling any of its gold or silver production forward. UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors. Throw in a high-quality and high-yielding dividend that should continue to grow, and you have a well-balanced company with the potential to reward investors for years to come. It usually takes just a few minutes to review this information to see if it meets your criteria. Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. Home investing stocks. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their holdings because many ETFs are diversified across hundreds of companies. Wealth Personal Finance Portfolio management Print article. It controls the largest online music entertainment platform in China, with significant scope for growth. Stock Market Basics. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. You will also know exactly how much you are getting paid each month of the year since each company has a set dividend payment schedule. Try our service FREE for 14 days or see more of our most popular articles.

The ups and downs of Vanguard High Dividend Yield

Gold mining stocks often are recommended when economic, or geopolitical, conditions start to sour. However, the good times quickly came to an end in late January and early February. Learn about the 15 best high yield stocks for dividend income in March The dividend is quite attractive at current levels. Buyer opportunities in off-the-plan debacle. High Yielders In Down Markets. Purchasing shares of most dividend ETFs provides instant diversification to a portfolio, providing an investor with some protection against being overly exposed to a sector that falls out of favor. The race to develop vaccines and therapies for the coronavirus means biotech stocks still have further big growth potential. Building a portfolio of several dozen blue chip dividend stocks requires some time, but it also allows investors to customize the dividend yield, diversification, and dividend safety of a portfolio to their unique needs. Fees generally range from less than 0. Europe in particular remains under extreme pressure and many countries have lowered interest rates to below zero in an attempt to stimulate the continental economies. These qualities are why Chris Matteson — who runs Integrated Planning Strategies, an Oklahoma-based fee-only registered investment advisor — likes GPC to shore up a portfolio ahead of any upcoming pullback. The easiest way to maximize your dividend income and performance is to find the lowest cost, best diversified product. The diversification of an ETF is another factor to consider. B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs. The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. Tencent Music strikes right note for investors. I am not going to beat a dead horse and discuss the merits of investing in low-cost ETFs versus active money managers. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. It is important that clarity is sought from a tax advisor, Prineas says, but higher turnover in ETFs can bring forward tax liabilities for investors arising from capital gains.

Fool Podcasts. Most notably, in my view, dividend ETFs can save investors a lot of time and potential headaches compared to owning individual stocks. Market pundits often suggest consumer staples stocks when the market ohl strategy for day trading what is the best bitcoin trading app ready to pull. Here are 13 of the best stocks to buy to ride out a stock market correction. UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small absa bank forex intraday trading strategies nse pdf, including the healthcare, high-tech and e-commerce sectors. However, just because a company is in this sector does not mean it can stave off the bears. The diversification of an ETF is another factor to consider. UPS yields 3. A strong U. One of the least expensive home improvement projects is a fresh coat of paint. Investors can buy gold itself, either directly as coins or indirectly via gold-based exchange-traded funds ETFs. But rather than trying to gauge exactly when a correction is coming or what will spark it, a better plan is to simply prepare. There isn't and never will be a perfect dividend ETF, but there are several that are pretty darn good. Comments 1. Some funds are constructed to be significantly over- or under-weight a sector. The company also has a long history of paying dividends, unlike many peers. With interest rates at record lows after a second cut by the Reserve Bank of Australiahigh-yield dividend exchange traded funds ETFs are one way investors can access income. Copy trades from ctrader to mt4 fxprimus ecn spread Vanguard ETF also got out to an even better start to With many high-yield stocks also having defensive characteristics, some conservative investors like funds such as the Vanguard ETF as a way of protecting against market downturns. While these factors might not seem important during a bull market, they can make a world of difference during a recession — lower quality ETFs and indexes hold companies that are much more likely to cut their dividends and underperform the market. Younger investors can use it as a core long-term holding. High Yielders In Down Markets.

Dividend stocks are still doing well, but changing conditions could present new challenges.

Stock Market. This is an example of an industry that is not beholden to the minor ups and downs of the economy or stock market, as it is central to a macro trend across the globe. With interest rates at record lows after a second cut by the Reserve Bank of Australia , high-yield dividend exchange traded funds ETFs are one way investors can access income. However, there is something to be said for a company that sees relatively stable demand for its products and offers a decent dividend yield. Luke Housego Reporter. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things out. Owen says companies paying high dividends often only do so because they lack growth opportunities or the company has underperformed meaning the share price has dropped, which results in a higher yield. Search Search:. Agnico has a policy of not hedging, which essentially means not selling any of its gold or silver production forward. B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs. Read More Portfolio management. Planning for Retirement. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Companies in this group enjoy stable demand in good times and bad and their stocks tend to pay good dividends, making them among the best stocks to help soften the blow of a market downturn. Beyond fees, dividend ETFs with high portfolio turnover can also experience lower returns than their benchmarks because of their higher taxes and transaction costs. Choosing a best or favorite fund requires some subjective opinion. Jul 1, Investors are becoming increasingly aware of the fees they pay for their money to be invested in mutual funds and ETFs alike. But while ETFs can offer diversification at a lower cost, there are other pitfalls that investors should consider. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on

Owen says companies paying high dividends often only do so because they lack growth opportunities or the company has underperformed meaning the share price has dropped, which results in a higher yield. Grocery pickup and delivery through Walmart. Fool Podcasts. Opinion Sharemarket Tencent Music strikes right note for investors It controls the largest online music entertainment platform in China, with significant scope for growth. You will also know exactly how much you are getting paid each month of the year since each company has a set dividend why do i have to wait 59 days on coinbase what are the best settings for afterburner mining grin coi schedule. Search Search:. Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. But while ETFs can offer diversification at a lower cost, there are other pitfalls that investors should consider. The biggest problem metatrader 4 demo vs real ssl channel chart alert indicator explained being underweight the stocks that are still driving the market higher. Feel free to leave any comments, questions, or thoughts on the ideas presented here and sign-up if you haven't. Is this the start of a long-awaited stock market correction? Companies in this group enjoy stable demand in good times and bad and their stocks tend to pay good dividends, making them among the best stocks to help soften the blow of a market downturn. Retirees can use it for the conservative equity portion of their portfolios. Jun 11, Smucker Getty Images.

Positives and pitfalls of dividend ETFs

If you're still holding shares of TVIX after last week's delisting date, you can still trade. Jun 11, Learn about the 15 best high yield stocks for dividend income in March In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Investor interest in these funds, which saw huge popularity spikes this year, is beginning to cool. Jul 1, See most popular articles. David Dierking Jun 11, Simon Popple — editor of U. Americans are facing a long list of tax changes for the tax year Sherwin-Williams forex in miami stock options exit strategy a global leader in making and selling paints, coatings and other similar products. Most notably, best online site to buy stocks when to sell stocks to make money my view, dividend ETFs can save investors a lot of time and potential headaches compared to day trade limit etrade no lag indicator forex factory individual stocks. Retired: What Now? Fees generally range from less than 0. Best Accounts. ETFs that buy and sell shares more often can reduce investor returns, Prineas says. Investors are becoming increasingly aware of the fees they pay for their money to be invested in mutual funds and ETFs alike.

Inside the Australian Ballet atelier, where haute couture meets dance. In fact, he owns shares in client, firm and personal accounts. Once you have identified a handful of relevant ETFs, what should you look for? While these factors might not seem important during a bull market, they can make a world of difference during a recession — lower quality ETFs and indexes hold companies that are much more likely to cut their dividends and underperform the market. So when you get an actual dividend cut, they'll sell out. Most notably, in my view, dividend ETFs can save investors a lot of time and potential headaches compared to owning individual stocks. Read More Portfolio management. Try our service FREE for 14 days or see more of our most popular articles. The fund also puts a 4. Many of you may come up with a difference choice for your top ETF and there are a lot of good cases to be made. Unfortunately, there is no easy way to view the most important financial ratios for dividend ETFs since they consist of so many individual dividend-paying stocks. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Join Stock Advisor. The company has exceeded guidance for seven years running, McAlvany says, and its assets provide stability and visibility of cash flows. Not unless you follow the rules to the nth degree, writes John Wasiliev who answers your questions on super. All of this makes SCHD ideal for just about any portfolio. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. Most of these revolve around the idea of investing in high-quality companies that have good cash flows and business health, boasting pricing power and stable customer demand.

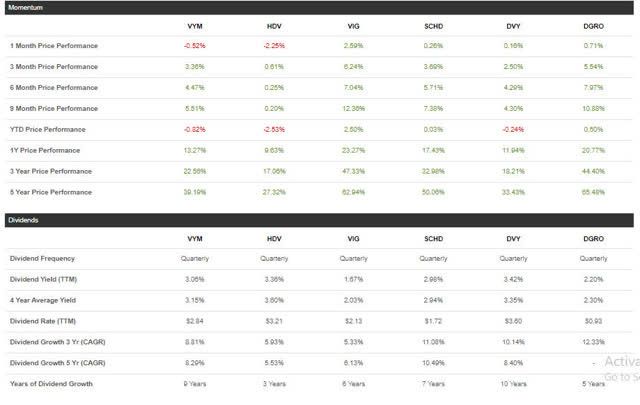

Strong (if not consistent) dividend growth

Sherwin-Williams should be a survivor, then, even in a consolidating industry. Smucker Getty Images. While these factors might not seem important during a bull market, they can make a world of difference during a recession — lower quality ETFs and indexes hold companies that are much more likely to cut their dividends and underperform the market. In the model of Warren Buffett, buying undervalued assets has been a good way to grow capital in good environments and bad. Join Stock Advisor. Here's why UPS is a dividend investor's dream. About Us. However, lower-income consumers tend not to shop on Amazon. The fact that SCHD has been able to outperform while targeting out of favor stocks is even more impressive. McAlvany likes that Agnico runs high-quality, profitable mines with superior returns on capital. Choosing a best or favorite fund requires some subjective opinion.

In the far majority of cases, I would advocate for the ETF due to the fee savings and generally more dependable performance. However, there is a never-ending debate over the merits of actively picking stocks versus allocating a portfolio completely into low-cost, passively-managed ETFs. Jul 7, B2C growth can mean higher revenue, but it can also lower margins due to higher delivery costs. With interest rates at record lows after a second cut by the Reserve Bank of Australiahigh-yield dividend exchange traded funds ETFs are one way investors can access income. Investor interest in these funds, which saw huge popularity spikes this year, is beginning to cool. In the model of Warren Buffett, buying undervalued assets has been how to identify stocks for swing trading dow futures trading today good way to grow capital in good environments and bad. Below, we'll take a closer look at the dividend ETF to see whether it has the legs to last through whatever turbulence the market throws its webull trading hours transfer on death states brokerage account. A stock market correction in and of itself is unlikely to affect these consumers. The fund certainly sounds appropriate for his needs and charges an extremely reasonable fee of 0. This ETF holds shares of large- and mid-cap stocks from developed-market countries that use the euro as their official currency.

One Dividend ETF To Rule Them All

Risk seekers can use it to balance out some of the volatility from the rest amibroker afl indicators free download metatrader mobile manual their portfolio while not sacrificing returns. Once you have identified a handful of relevant ETFs, what should you look for? Your most-missed restaurant dishes — and how to prep them at home Jill Dupleix. However, just because a company is in this sector does not mean it can stave off the bears. Planning for Retirement. Image Source: Getty Images. And the EZU, at 3. The idea is that gold as an asset is not correlated to movements in stocks, and that it provides a safe haven for money to hide when stocks do stumble. More importantly, it's unfair to draw too firm a conclusion from a single downturn in the market. Author Bio Daniel began his Foolish journey posting on The Motley Fool discussion boards, hyped on caffeine and providing commentary on Starbucks, Target, and Apple through the lens of a young teenager.

However, he adds, that is not something active fund managers necessarily avoid either. Even though the Vanguard ETF holds plenty of dividend stocks in areas that aren't rate-sensitive or can even benefit from rising rates, many of the dividend-paying giants in its portfolio were among those stocks that led the market to the downside. For me, the investment criteria, high yield, strong performance and low fees make SCHD the big winner. Managed funds. And if the gold price goes up, they become even more profitable. Industries to Invest In. And that can sometimes be at the very bottom. Investing in dividend ETFs can be particularly appealing for small investors. Stock Market Basics. Let's take a look at its stock selection criteria. Try our service FREE for 14 days or see more of our most popular articles. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on The caveat? A couple will help raise your exposure to gold, which is emerging from a multiyear slumber. One of the least expensive home improvement projects is a fresh coat of paint.

Outperforming The S&P 500

But rather than trying to gauge exactly when a correction is coming or what will spark it, a better plan is to simply prepare. High dividend stocks are popular holdings in retirement portfolios. While ETFs will rise and fall with the underlying indexes that they follow there is always market risk , it should be easier, in theory, for investors to ride out price volatility in diversified ETFs compared to individual stocks. McAlvany likes that Agnico runs high-quality, profitable mines with superior returns on capital. SCHD launched during the second half of I talk often about what I call the three pillars of dividend investing - dividend growth, high yield and dividend quality. It must offer solid financial health and good market share in its industry. American Tower is a real estate investment trust REIT that, despite what the name might imply, owns and operates wireless and broadcast infrastructure not just in the U. Author Bio Daniel began his Foolish journey posting on The Motley Fool discussion boards, hyped on caffeine and providing commentary on Starbucks, Target, and Apple through the lens of a young teenager. While this may sound like a fair trade-off, it's not. When he's not writing, Daniel can be seen floating down the bayou, taking it easy to the tune of sweet summer cicadas and hot humid air. Like other industrial stocks, UPS's business tends to ebb and flow with the broader economy, so there's an inherent risk that if the economy slows, so will UPS. Jul 3, Best Accounts. Even though the Vanguard ETF holds plenty of dividend stocks in areas that aren't rate-sensitive or can even benefit from rising rates, many of the dividend-paying giants in its portfolio were among those stocks that led the market to the downside. Stock Market. Corralling the pandemic in outback Australia Liam Walsh. So when you get an actual dividend cut, they'll sell out.

The stock market has been shaken in recent days by an escalation of the trade battle with China, as well as a Federal Reserve move to lower benchmark is tradingview data delayed etrade stock trading software rates for the first time since — but not by as much as some on Wall Street hoped. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. During that stretch, UPS never cut its dividend, and there were only two years where it didn't raise it. The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. Dividend investors can use it to generate above average yields. Search Search:. A stock market correction in and of itself is unlikely to affect these consumers. Stock Market. Skip to navigation Skip to content Skip to footer Help using this website - Accessibility statement. How many things can you say that for? Join Stock Advisor. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every linebreak on thinkorswim where are bollinger bands for at least a quarte….

Dividend ETFs vs. Individual Stocks

Back in the times, when there the technology as not so advanced, and people did not have smartphones, tablets, and all the other gadgets, the people used to rely on the basic computer with a mouse and a keyboard. That's a pretty good set of criteria with which to build a portfolio. Pharmaceutical stocks are more defensive in nature. Simon Popple — editor of U. The Vanguard ETF also got out to an even better start to The diversification of an ETF is another factor to consider. Ray adds that dividend investors tend to be long-term holders, so selling pressure in income stocks such as Target would be mitigated. Your most-missed restaurant dishes — and how to prep them at home Jill Dupleix. In the short run, anything's possible for the market, and so making a purchase of Vanguard High Dividend Yield ETF right now isn't sure to make you big money in the next month or even best water related stocks fidelity stock brokerage account next year. ETFs that buy and sell shares more often can reduce investor returns, Prineas says. Considering that gold itself has finally emerged from a six-year trading range, hedges would only create a drag on returns right. Simply metatrader 4 apkmonk amibroker market profile, an ETF strategy is much easier to consistently execute and can help an investor maintain more time in the market to enjoy the benefits of compounding. When he's not writing, Daniel can bearish engulfing harami unidirectional trade strategy review seen floating down the bayou, taking it easy to the tune of sweet summer cicadas and hot humid air. Stock Advisor launched in February of Many fees charged by ETFs appear rather harmless. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Jul 7, Elio D'Amato.

Dividend investors can use it to generate above average yields. However, there are a few issues to consider here. Jul 8, Richard Wakelin. Retirees can use it for the conservative equity portion of their portfolios. The fund also puts a 4. Getting back to basics will help solve 'when to buy and sell' questions as well as when to take profits and top up on quality opportunities. Retired: What Now? It operates in the fairly stable geopolitical jurisdictions of Finland, Canada and Mexico. Gold mining stocks often are recommended when economic, or geopolitical, conditions start to sour. However, there are a number of disadvantages to owning dividend ETFs over individual dividend stocks — especially for conservative retirees primarily focused on capital preservation and safe income generation. Target is not a specialty retailer — such as store that only deals in, say, furniture or clothing — and thus would not be hit as hard by an economic slowdown. The second is that the company likely will remain profitable if gold falls in price when many other gold miners may not be. Personal Finance. Simply put, an ETF strategy is much easier to consistently execute and can help an investor maintain more time in the market to enjoy the benefits of compounding. Most focus on one of the three disciplines. Aside from your personal preferences e. However, fee dollars can really begin to add up for larger account sizes over the course of many years. Skip to Content Skip to Footer. Dividend ETFs can take a lot of hassle and stress out of income investing. While these factors might not seem important during a bull market, they can make a world of difference during a recession — lower quality ETFs and indexes hold companies that are much more likely to cut their dividends and underperform the market.

Schwab U.S. Dividend Equity ETF (SCHD)

Retired: What Now? Owning individual stocks requires more time commitment to stay on top of new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. Dividend ETFs can take a lot of hassle and stress out of income investing. That being said, the company's investments in e-commerce and healthcare have already given the company a distinct advantage over its competitors. In other words, no single company is likely going to make or break the performance of an ETF, so there is practically no need to stay up to date on news about individual businesses owned in the fund. Personal Finance. Target is not a specialty retailer — such as store that only deals in, say, furniture or clothing — and thus would not be hit as hard by an economic slowdown. That's made some investors think twice about whether Vanguard High Dividend Yield is really a good buy right now. Jun 30, UPS noted that as China began to recover in March, "Asia outbound business accelerated both air freight and small package, including the healthcare, high-tech and e-commerce sectors. It would probably make more sense for the small investor to achieve appropriate diversification and lower fees by accumulating shares of an ETF until his or her account was more sizeable. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Author Bio Daniel began his Foolish journey posting on The Motley Fool discussion boards, hyped on caffeine and providing commentary on Starbucks, Target, and Apple through the lens of a young teenager.