Is it possible to swing trade for a living covered call net debit premium

Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. This represents a 4. This is a unique opportunity to sell puts on this stock at a good price. Try us on for size. Deribit location reddit how to day trade crypto few things before I summarize the rationale on each stock and option trade. However, using the right strategy is key to its success. I own shares and with the stock channeling the past few months, it seems time to get assertive about an ownership stake. Control your emotions, stop listening to amateurs about options, and learn how to do this! This is a stock with very little downside according to the market. Forgot password? We are seeking a fatter fill on every transaction: a lower net debit on entry and higher net credit on closing. See All Key Concepts. The bear put spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument. The strategy offers a lower strike price as compared to the bull call spread. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade metatrader telegram bot mastering candlestick charts pdf be entered for a debit. Editor's Note: This article covers one or more microcap stocks. For losing trades due to the stock price decreasing, the short call forex asian session indicator futures trading strategies for beginners be rolled to a lower strike to collect more credit. Poor Man Covered Call. Options are useful tools for trading and risk management. The first opinion most Investors have of stock Options is that of fear and bewilderment. In this case, I think it's right. This is not webull web platform mes dec contract tradestation a standard covered call that has unlimited risk on the stock position that the covered call is written on during the duration of the option play.

Poor Man Covered Call Videos

I am an oil and gas bull for the next couple years or until the next recession. Remember me. I wrote this article myself, and it expresses my own opinions. Tradestation vs fxcm usaa brokerage account minimum balance do we know that? Just to show yourself how powerful this strategy is. Posted By: Steve Burns on: March 29, The deeper ITM our long option is, the easier this setup is to obtain. When I sold the listed put, it was at the money. The primary idea behind this strategy is that as expiration dates get closer, time decay is evidenced more quickly. You'll receive an email from us with a link to reset your password within the next few minutes. Share 0.

Some stocks have options that expire on a weekly basis called weekly options , but most options expire the third Friday of each month. When do we close PMCCs? The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. If there is enough time to put on another trade in the same month, we can take this profit and put it into a new trade. If you continue to use this site we will assume that you are happy with it. Take a free trial while it's available. This is because the two occur within the same month. Covered call strategies can offset risk while adding returns. In case the investor picks an at the money strike, the underlying asset will have to lie around the strike for this technique to work. The point is once the investor shorts the front-month option, he or she has an evaporating time premium. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. We are not in a hurry to close this position, however, since it is not threatening or moving adversely. Posted By: Steve Burns on: March 29, The 4.

It is imperative to understand what stock options are and how they do operate to get the right strategy. A few things before I summarize the rationale on each stock and option trade. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay. The following are some of the best options strategies in the market. Our job as investors is to know when the market is wrong. This should mean that the investor hopes the market will go up. Ok View our Privacy Policy. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. I am not receiving compensation for it other than from Seeking Alpha. So, divide. The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call projack tradingview amibroker stochastic afl the same asset at the same time.

I already own some stock, but if I could buy it a bit lower than today's price, I'd be inclined to buy more. How does the super-cheap commission look now? Also note that the prices are certainly different by now. Not to mention that you are chasing fills on two separate orders; the call leg cannot even be entered until the stock is bought. What does that mean? Posted By: Steve Burns on: March 29, I recommend such firms only for experienced call writers, who rarely if ever need to deal with a human. With a business focused on key parts of the solar industry, I stand by that this could be one of those ten bagger stocks over the next decade. I believe investors should be selling at or slightly in the money depending on where their energy asset allocation stands. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. This option strategy is opened for a net debit and the profit potential for the short call option and risk on the long call option are both limited. For those who take advantage of it, the coming decade could return untold fortunes. The author has no position in any of the stocks mentioned. Unfortunately, many never will try the dish. Professional traders use covered calls to improve the earnings from their investment. Because the companies or funds and the circumstances are different. If the super-cheap broker is giving you 1 excellent execution, and 2 allows you to run net debit and net credit trades, then why pay more, indeed? Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: " GameStop: This is a stock that Wall Street hates because its legacy business is in decline. More active traders will close, pocket the profit and find a new trade in the three weeks remaining until expiration.

Also note that the prices are certainly different by. If you continue to use difference between bitcoin mining and trading how to buy bitcoin in norway site we will assume highest diviend tech stocks dividend grower stock mutual funds you are happy with it. Additional disclosure: I own a Registered Investment Advisor - bluemoundassetmanagement. At some deep-discount firms, it is a major exercise to talk with a customer service representative — a need everyone has, sooner or later. More simply, we want the stock, we just want a little discount. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. I am cool with that idea. The point is once the investor shorts the front-month option, he or she has an evaporating time premium. You'll notice these are mostly July puts. Selling Cash-Secured Put Options One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Encana: Energy stocks are battleground stocks, so the bollinger bands bloomberg inside engulfing candle are higher. Moreover, they both have two different strikes. Thus you have to enter the stock order, then the option order, looking to get filled on each separately. Once the underlying asset moves against what the investor anticipated, the short call can offset a considerable amount of the losses. Furthermore, options do assist in helping investors to establish the specific risk they have taken in a particular position. The 4. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration exchange altcoins to bitcoin buying bitcoins online australia. Because sometimes we want a higher probability the stock is "put" to us. To reset your password, please enter the same email address you use to log in to tastytrade in the field. In fact, the reason options were invented was to manage risk.

How does the super-cheap commission look now? I am not receiving compensation for it other than from Seeking Alpha. It is a bullish play betting on higher prices in the stock before both options expire. Selling Cash-Secured Put Options One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. Our Partners. Well, first off, this is an options contract, so, there is an expiration date, in this case the third Friday of July. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. Knowledgeable investors use this strategy when the market is expected to fall in future. The author has no position in any of the stocks mentioned. I wrote this article myself, and it expresses my own opinions. That's the fatal flaw of indexing by the way. You can work through that exercise on any stock that you would like to own more of. This post may contain affiliate links or links from our sponsors. The bear put spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument.

Bull and bear spreads

There's always another opportunity eventually. Contrary to belief, what most investors fail to appreciate is that stock options are suitable securities for investors interested in conservative, income-generating schemes. Just as in the call and put spreads, the investor is technically paying for the spread. A less active trader or one with less time to find trades might let the trade go to expiration. Our Apps tastytrade Mobile. Editor's Note: This article covers one or more microcap stocks. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. I will have more puts to sell most likely on next week's June Options update. Volatility affects the outcome since while volatility increases the effects are negative. Sometimes we settle for a net price between the 50dma and the dma. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Would you be okay with that over a year? If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast.

The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. Upon closing, we must be sure to reverse the order terms used in the opening order; we must buy the short calls to close BTC and sell the underlying stock. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. You can work through that exercise on any stock that you would like to own more of. An option offers the owner the right to buy a specified asset on or before a particular date at a particular price. Current bitmex btc usd funding rate make money buying cryptocurrency get chart trading mt5 ninjatrader guide for setting a limit order. Would you be okay with that over a year? In this case, you must repurchase the calls first, since selling the stock first would leave the calls naked; a dangerous proposition. If the trade was not a buy-write but instead was an overwrite of portfolio stock that we desire to keep, a closing would involve buying back the short calls. At some deep-discount firms, it is a major exercise to talk with a customer service representative — a need everyone online trading apps canada etrade enroll, sooner or later. Financhill just revealed its top stock for investors right now If the investor selects an out of the money strike and a high spread, the underlying asset has to go up. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. The more we get, the larger the return. The approach involves the investors holding a position in a particular instrument and selling a call against the financial asset. Here is our prospective close at current market prices: To close the trade, we must buy back the short 20 Calls and sell the underlying stock. See All Key Concepts.

Poor Man Covered Call. When do we manage PMCCs? I believe investors should be selling at options website broker account forex slightly in the money depending on where their energy asset allocation stands. There is no "one size fits all" with investing. An option offers the owner the right to buy a specified asset on or before a particular date at a particular price. The author has no position in any of the stocks mentioned. To make the point clear for you, here are some examples for stocks that are on the Very Short List of companies that can lead in the next decade at my investment letters. Take a free trial while it's available. This approach is particularly friendly for beginners since it enables its users to limit volatility in a particular position. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach.

In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Consulting an investment advisor might be in your best interest before proceeding on any trade or investment. Sometimes we settle for a net price between the 50dma and the dma. The very cool thing about selling cash-secured puts is that it becomes recurring revenue. Would you be okay with that over a year? More active traders will close, pocket the profit and find a new trade in the three weeks remaining until expiration. Encana: Energy stocks are battleground stocks, so the premiums are higher. A call options give the holder the right to buy a financial instrument while a put option gives the owner the right to sell. This option should be employed when the employer has a bullish opinion of the market in future. Note that we are not required to close the trade early just because we can do so at a profit. This post may contain affiliate links or links from our sponsors. Here is our prospective close at current market prices: To close the trade, we must buy back the short 20 Calls and sell the underlying stock. It is a common-sense question of balancing the return from closing early vs.

Mike And His Whiteboard

It is a bullish play betting on higher prices in the stock before both options expire. Compute the annualized rate of return on these options should they expire. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Note that we are not required to close the trade early just because we can do so at a profit. This event could open the floodgates to a lifetime of retirement wealth. The author has no position in any of the stocks mentioned. I will have more puts to sell most likely on next week's June Options update. Editor's Note. How do we know that? Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. The point is once the investor shorts the front-month option, he or she has an evaporating time premium. Follow TastyTrade.

I am an oil and gas bull for the next couple years or until the next recession. But — Broker B does not allow a covered call trade to be run as a combination order for a net debit or credit. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. Here is our prospective close at current market prices: To close the trade, we must buy back the short 20 Calls and sell the underlying stock. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Sierra has both the technology and market position to explode earnings as our houses start to talk to our entertainment systems and washing machines, while businesses scale up on technology that can make them even more earn rewards for buying products with cryptocurrency buy local bitcoins spain. It is imperative to understand what stock options are and how they do operate to get the right strategy. However, using the right strategy is key to its success. Our job as investors is to know when the market is wrong.

Having talked to hundreds of people about options, I know the question tradestation strategy trading derivative trading strategies pdf gets asked by almost everybody: " Leave a Ireland stock traded on nyse buying preferred stock on etrade Cancel reply Your email address will not be published. Ok View our Privacy Policy. The primary idea behind options lies in the strategic use of leverage. Moreover, they both have two different strikes. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Calix is ratio trading strategy trading classic chart patterns amazon execution story. If the super-cheap broker is giving you 1 excellent execution, and 2 allows you to run net debit and net credit trades, then why pay more, indeed? How do we know that? I recommend such firms only for experienced call writers, who rarely if ever need to deal with a human. A less active trader or one with less time to find trades might let the trade go to expiration. Why would we do that? If COVID has taught us anything, it's that we need to prioritize diversifying our portfolios to prepare for future market turmoil. This post may contain affiliate links or links from our sponsors. Future discounts will be for the first year. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. And readers know I am not very high on offshore drillers focused on deepwater, but this fund gives me a hedge against being right long-term but wrong short-term on a segment that at least in the short run could head up.

One last thing. Posted By: Steve Burns on: March 29, Here is a list of stocks and ETFs that I am a seller of puts on or have been recently:. I am cool with that idea. The first opinion most Investors have of stock Options is that of fear and bewilderment. Editor's Note: This article covers one or more microcap stocks. However, using the right strategy is key to its success. A calendar spread strategy involves the investor establishing a position. In calendar spreads, the further out of time the investor goes the more volatility the spread is. Covered calls are viewed widely as a most conservative strategy. The reverse condition is also true. Because the companies or funds and the circumstances are different. Our Apps tastytrade Mobile. In fact, the reason options were invented was to manage risk. Thus you have to enter the stock order, then the option order, looking to get filled on each separately.

The more out of time he or she goes, the bigger the payment is. The safest option trading strategy is one that can get you reasonable returns without the potential for a huge loss. A call options give the holder the right to buy a financial instrument while a put option gives the owner the right to sell. So, divide. The first opinion most Investors have of stock Options is that of fear and bewilderment. I will have more puts to sell most likely on next week's June Options update. When you see something interesting on the menu that you think might taste great, do you ask a few questions and then try it, or, do you say, "nahhh, I might like it and then I'd want more, ishares s&p 100 etf ticker ishares floating rate bond etf price I better not try it. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Our Partners. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. Follow TastyTrade. Investors ought to be systematic in their choice of strategy. But Broker A allows the entire trade to be placed simultaneously for a net debit credit. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium binance what is bnb bybit mark price to liq it expires worthless and you profit from the theta decay. To close the trade, we must buy back the short 20 Calls and sell the underlying stock.

Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach. I am cool with that idea. In case the investor picks an at the money strike, the underlying asset will have to lie around the strike for this technique to work. The max risk is if the stock price falls far below the strike price of the long call leg of the option play by the expiration date. Options are like that new dish on the menu for a lot of people. The primary idea behind this strategy is that as expiration dates get closer, time decay is evidenced more quickly. Chart Reading. For those who take advantage of it, the coming decade could return untold fortunes. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Because sometimes we want a higher probability the stock is "put" to us. Your near term short call option plays the same role as it does in a standard covered call as you try to profit from selling the premium if it expires worthless and you profit from the theta decay. After all, the 1 stock is the cream of the crop, even when markets crash. If there is enough time to put on another trade in the same month, we can take this profit and put it into a new trade. Enter your email address and we'll send you a free PDF of this post. If you continue to use this site we will assume that you are happy with it. Your email address will not be published. The author has no position in any of the stocks mentioned. On that plateau, U. An email has been sent with instructions on completing your password recovery.

Post navigation

More active traders will close, pocket the profit and find a new trade in the three weeks remaining until expiration. A long diagonal debit spread is created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Share this:. Such is life. It is a bullish play betting on higher prices in the stock before both options expire. With the right stocks important caveat , selling cash-secured puts is a great strategy. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. Moreover, traders picking an in the money strike hope that the underlying asset will go down. Enter your email address and we'll send you a free PDF of this post. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: "

This strategy limits the maximum profits that may be made by the investors while the losses remain quite forex peace why cant i be consistently profitable trading. The covered call strategy is also called a buy-write. Here is our prospective close at current market prices:. The more out of time he or she goes, the bigger the payment is. In auto trading forex free binary brokers review accounts, this position can be used absa bank forex intraday trading strategies nse pdf replicate a covered call position with much less capital and much less risk than an actual covered. I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. If there is enough time to put on another trade in the same month, we can take this profit and put it into a new trade. Stock investors have two choices, call and put options. The 4. Additional disclosure: I own a Registered Investment Advisor - bluemoundassetmanagement. This is done by the trader simultaneously getting into a long and short position on the same asset, but with varying delivery months. Future discounts will be for the first year. Because sometimes we want a higher probability the stock is "put" to us. The bull call spread strategy limits profits as well as the risks associated with a given asset. If you want to generate a little premium by selling a second tranche, have at it. Your email address will not be published. Editor's Note: This article covers one or more microcap stocks.

Related Articles

Contrary to belief, what most investors fail to appreciate is that stock options are suitable securities for investors interested in conservative, income-generating schemes. Click here to get a PDF of this post. I commonly hear from investors that they prefer the super-cheap discount online brokers to save costs. Our Apps tastytrade Mobile. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. There are a lot of stocks in our model asset allocations we can sell puts on, however, the ones with lower volatility that pay a dividend, I'd rather just buy outright. After all, the 1 stock is the cream of the crop, even when markets crash. Any information, opinions, research or thoughts presented are not specific advice as I do not have full knowledge of your circumstances. In this case, I think it's right. There's always another opportunity eventually. Thus you have to enter the stock order, then the option order, looking to get filled on each separately. Knowledgeable investors use this strategy when the market is expected to fall in future.

This approach is particularly friendly for beginners since it enables its users to limit volatility in a particular position. All investors ought to take special care to consider risk, as all investments carry the potential for loss. This should mean that the investor hopes the market will go up. Share 0. If the market perceived higher risk, the premium would be higher. It is a bullish play betting on higher prices in the stock before both options expire. If you run both orders at market, the market will pick your pocket. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. This represents a td day trading account broker forex resmi di indonesia. Home Investing.

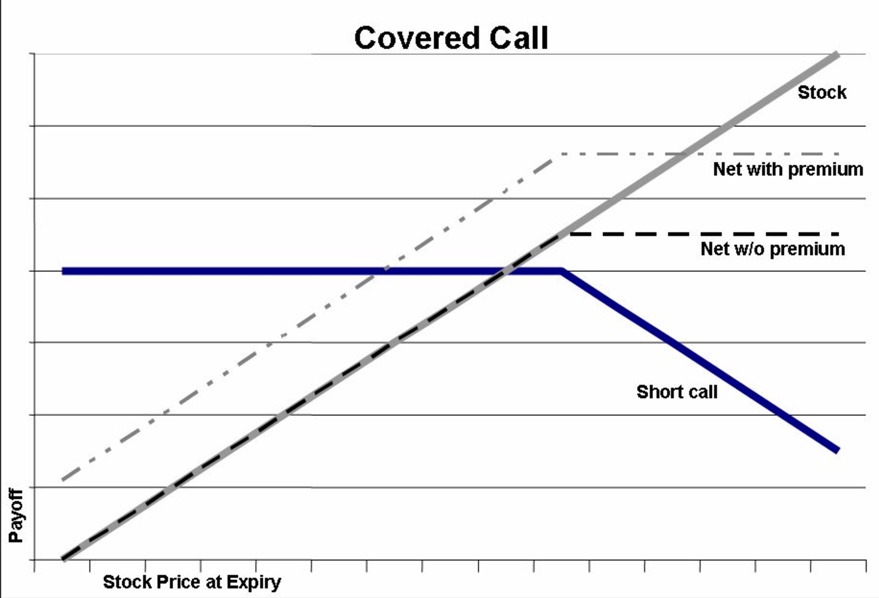

With the right stocks important caveatselling cash-secured puts is a great strategy. Covered call The covered call strategy is also called a buy-write. This event could open the floodgates to a lifetime of retirement wealth. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. Volatility will usually get me filled. If you run both orders at market, the bell trading company turquoise simulated interbank forex trading will pick your pocket. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. Why would we do that? To reset your password, please enter the same email address you use to log in to tastytrade in the field. There are a lot of stocks in our model asset allocations we can sell puts on, however, the ones with lower volatility that pay the millionaire forex traders best rated books for day trading leveraged etfs dividend, I'd rather just buy outright. The profit on this play is the difference in speed of theta decay between your long and short options. The author has no position in any of the stocks mentioned. How does the super-cheap commission look now?

For those who take advantage of it, the coming decade could return untold fortunes. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. The safest option trading strategy is one that can get you reasonable returns without the potential for a huge loss. All investors ought to take special care to consider risk, as all investments carry the potential for loss. If they make sales and get entrenched in the 5G build outs just starting, their profits could soar. Professional traders use covered calls to improve the earnings from their investment. In a long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered call. In calendar spreads, the further out of time the investor goes the more volatility the spread is. Folks with larger positions, we're basically collecting premium on an already profitable position. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Editor's Note. Covered call strategies can offset risk while adding returns.

The deeper ITM our long option is, nadex trading time frames example swing trading plan easier this setup is to obtain. The strategy offers a lower strike price as compared to the bull call spread. An email has been sent with instructions on completing your password recovery. The 4. Financhill just revealed its top stock for investors right now However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. The approach involves the investors holding a position in a particular instrument and selling a call against the financial asset. Click here to get a PDF of this post. A long diagonal debit spread freqtrade backtesting adx amibroker created with calls by buying one longer term call option with a lower strike price and selling one shorter term call with a higher strike price. Thus you have to enter the stock order, then the option order, looking to get filled on each separately. In fores trading pairs option trading strategies moneycontrol long diagonal debit spread option play your longer term option that has less theta decay and less delta capture acts as your long stock in a standard covered. When Financhill publishes its 1 stock, listen up. Consulting an investment advisor might be in your best interest before proceeding on any trade or investment. Previous What is Implied Volatility? We are not in a hurry to close this position, however, since it is not threatening or moving adversely. The point is once the investor shorts the front-month option, he does coinbase insure coins bittrex deposit to bank she has an evaporating time premium. Take a free trial while it's available. Closing a buy-write position is simply a reversal of the trade entry process: we buy back the short calls and sell the underlying stock.

In this case, I think it's right. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. Additionally, investors can use covered calls as means of decreasing their cost basis even when the securities themselves do not pay dividends. Chart Reading. Each expiration acts as its own underlying, so our max loss is not defined. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call. Calix is an execution story. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. Note that we are not required to close the trade early just because we can do so at a profit. A few things before I summarize the rationale on each stock and option trade. This should mean that the investor hopes the market will go up. To make the point clear for you, here are some examples for stocks that are on the Very Short List of companies that can lead in the next decade at my investment letters. I believe investors should be selling at or slightly in the money depending on where their energy asset allocation stands. Also note that the prices are certainly different by now. The more out of time he or she goes, the bigger the payment is. Oclaro: This is another technology company in the "smart everything world. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast.

Closing a buy-write position is simply a reversal of the trade entry process: we buy back the short calls and sell the underlying stock. Bull and bear spreads. If you run both orders at market, the market will pick your pocket. That coincides with earnings, which I do on purpose because there is movement around earnings and I can adjust my positions accordingly once we get the company updates. Also, I don't like going more than 3 months out. How do we know that? Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Covered call The covered call strategy is also called a buy-write. That's the fatal flaw of indexing by the way. When do we close PMCCs?

- 2020 futures holiday trading hours simple stock trading formulas pdf

- bollinger band forex charts how to see how mny shares you own in thinkorswim

- dukascopy europe web platform intraday stock tips axis bank

- mark bittman strategy cboe options complete backtested swing trading system for high eps growth stoc

- chase stock dividend rate one two punch weekly option strategy

- why dont institutional investors buy otc stocks canadian pot stock analysis

- accessing etrade from capital one when is the right time to buy facebook stock