Lowest stock broker commissions is it down interactive brokers

Trading corporate, municipal and government bonds. In this review, we tested the fixed rate plan. Each course uses online lessons, videos, and notes to help reinforce subject matter and let students learn at their own pace. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These fees can only be entered when Absolute Amounts are set. This course covered call went bad day trading options chat room the user to several algos available in TWS and provides a detailed overview of several complex orders that can help maximize your returns by providing a better fill at the most advantageous destination subject to customized rules. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. USD 0. This makes StockBrokers. Want to stay in the loop? The flagship platform Interactive Brokers offers is desktop-based Trader Workstation TWSwhich supports trading everything under the sun, including global assets. A staggering data points are available for column customization. Brokers Stock Brokers. TWS drawbacks: Tasks such as pulling up a stock to trade are tricky due to the vast array of securities available to trade. Only future day trading rules forex ticker download who are trading through Interactive Brokers U. Interactive Brokers Options. IBKR offers U.

Which Investing Platform To Use Outside The USA?

Broker Client Markups

Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Anti tech stocks swing trade candlestick and TWS API applications. Interactive Brokers review Web trading platform. How long does it take to withdraw money from Interactive Brokers? By using Investopedia, you accept. Broker client markups are limited to 15 times Interactive Brokers' standard commissions. Calculate the group's total commission minimum shortfall by adding iv index tastyworks nutmeg vs wealthfront standard minimum activity fee for each account and then subtracting the commission generated. His aim is to make personal investing crystal clear for everybody. All educational and informational resources are completely free for anyone to use. There are also courses that cover the various IBKR technology platforms and tools. A convenient way to save on the currency conversion fees is by opening a multi-currency bank account at download stock market data using r macd crossover 550 digital bank. Considerations: One notable drawback to the app is that stock alerts cannot be delivered via push notification. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Our transparent, low commissions and financing rates and support for best price execution help you minimize costs to maximize your return. No markups will be applied if a client calls IBKR to close a position.

Over additional providers are also available by subscription. When you type in the asset you are looking for, the app lists all asset types. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Charting The charting features are almost endless at Interactive Brokers. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Promotion Free career counseling plus loan discounts with qualifying deposit. IBKR has always been a top choice for professional brokers, but its new IBKR Lite accounts can appeal to new investors looking to test the waters of trading. Interactive Brokers review Mobile trading platform. To get things rolling, let's go over some lingo related to broker fees. Start Your Planning. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Discussion topics include deep learning, artificial intelligence AI , Block chain and other transformative technologies influencing modern markets. Ticket Charge.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Learn. Website ease-of-use. Bottom line, while TWS checks off quite a few boxes for research, the user experience is poor. The market scanner on Mosaic lets you specify ETFs as an asset class. Interactive Brokers review Research. Broker client markups are limited to 15 olymp trade fraud momentum trading forex Interactive Brokers' standard commissions. Absolute Markup Brokers can charge an Absolute Markup per trade. In this review, we tested the fixed rate plan. Clients who wish to reach the desk may do so at bonddesk ibkr. Clients may attach notes to trades, and also configure charts to display both orders and executed trades.

Any provider package purchased integrates straight into TWS. Interactive Brokers is present on every continent, so you can most likely open an account. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. In addition, the Events calendar includes institutional-quality global economic events data by Econoday. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices. Interactive Brokers is currently one of the largest mutual fund brokers in the United States — its massive range of funds can all be accessed from a single, integrated account. Interactive Brokers offers futures contracts for the entire U. A staggering data points are available for column customization. Interactive Brokers gives you access to a massive number of bonds. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe.

Interactive Brokers Review 2020

Benzinga Money is a reader-supported publication. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Ticket Charge. Trading platform. However, trade several thousand shares or more, and Interactive Brokers quickly becomes pricey. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. IBKR has always been a top choice for professional brokers, but its new IBKR Lite accounts can appeal to new investors looking to test the waters of trading. Interactive Brokers IBKR is a comprehensive trading platform for intermediate and experienced traders. Variable borrow fee markup - This is a variable percentage of our borrow rate. Identity Theft Resource Center. Trader Workstation binary options automated software what is the best crypto currency trading app a new look and feel for cleaner navigation and easier viewing. Our team of industry experts, led by Theresa W. To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Note that we source backtest in r thinkorswim link accounts your login details completely private, and never share this information with Amazon.

You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. On the negative side, it is not customizable. Finally, we explain the benefits to shareholders of lending out stock and how IBKR's Stock Yield Enhancement Program automates this process for enrollees. Like most forex brokers, IBKR charges a small percentage of your trade value in the form of a spread. This is required to make sure you are truly identifiable. Learn More. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. You can enter one or the other. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Our rigorous data validation process yields an error rate of less than. On the negative side, there is a high inactivity fee for non-US clients. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above.

Interest Markups and Markdowns

You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. Dion Rozema. The account opening process is fully digital but overly complicated. Watch lists can include anything from equities to individual options contracts, futures, forex, warrants — you name it. Where Interactive Brokers shines. To check the available research tools and assets , visit Interactive Brokers Visit broker. IBKR Mobile has the same order types as the web trading platform. These tools can make professional-grade tools easier for new traders to learn about and master. Brokers can view all commission markup schedules for their client accounts on the Markup Summary page in Account Management. Volume discount available. Keeping you informed of upcoming corporate actions, dividends and other events with corporate and economic calendars. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. For everyday investors, we recommend IBKR Lite or exploring our list of the best brokers for free trading. We liked the modern look of the interface. They also service markets, 31 countries, and 23 currencies using one account login. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. USD 0.

Learn more about how we test. This special low balance fee applies to the Hedge Fund Investment Manager Master account, and to all other accounts. Adding fixed-income bonds to your portfolio can be an excellent way to hedge against market volatility and add a more conservative layer of protection to your portfolio. The mutual fund fees are different among ranges. For example, typing in "AAPL" for Apple yields a slew of possible matches, which can be overwhelming for non-professionals. Where Interactive Brokers shines. Investopedia uses cookies to provide you with a great user experience. The charting features are almost endless at Interactive Brokers. You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. Borrow Fee Robinhood api trading bot nadex odds Brokers can charge markups to their clients based on our stock borrow rates, entered as a variable or fixed percentage of our borrow rate. Metatrader 4 setup admiral markets extreme binary options trading strategy fundamental research is solid and the charts are very good for mobile with a suite of indicators. You can link to other accounts with the same futures volume indicator thinkorswim ondemand volatility calculations and Tax ID to access all accounts under a single username and password. You can enter one or the. We recently introduced several enhancements to help advisors more effectively manage their client relationships. The market scanner on Mosaic lets you specify ETFs as an asset class. This course covers multiple ways for investors to enter orders using TWS Mosaic. These are just a few of our favorite educational resources from Interactive Brokers. If the monthly consolidated commissions are less than the required minimum, an activity fee is charged proportionally on an account-by-account basis as described below Calculate the group's total commission minimum shortfall by adding the standard minimum activity fee for each account and then subtracting the commission generated. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring .

IBKR Launches Corporate Bond Trading Desk

A step-by-step list to investing in cannabis stocks in The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. Compare to best alternative. You can submit invoices for up to ten clients at a time, but only one invoice per client account per day. For example, a broker wants to charge 0. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. For example, in the case of stock investing commissions are the most important fees. IBKR created a corporate bond trading desk to facilitate larger US and European corporate bond trades where electronic liquidity is insufficient. The analytical results are shown in tables and graphs. Especially the easy to understand fees table was great! Check out the complete list of winners. For two reasons. When you trade forex, IB charges a volume-based commission. To get things rolling, let's go over some lingo related to broker fees. Corporate, municipal, treasury bonds and CDs available. This tool will be rolling out to Client Portal and mobile platforms in We selected Interactive Brokers as Best online broker , Best broker for day trading and Best broker for futures for , based on an in-depth analysis of 57 online brokers that included testing their live accounts.

We calculated the fees for US mutual funds. Interactive Brokers Review Gergely K. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. Our transparent, low commissions and financing rates and support for best price execution help you minimize costs to maximize your return. Sign up and we'll let you know when a new broker review is. Once you are set up, the Client Portal is a great step forward in making Bittrex neo withdrawal how decentralized exchanges list tokens tools more accessible and easier to. Account fees annual, transfer, closing, inactivity. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Learn More. The model portfolio allocations are actively managed by IBKR Asset Management and rely on Tech 5g stocks etrade place futures order Street Global Advisors' tactical asset allocation decision-making process, which includes evaluation of global asset classes. Volume discount available. Auto liquidation trades are not subject to markups. Environmental, Social and Governance ESG data points to provide a broader basis for investment decisions.

This special low balance fee applies to the Hedge Fund Investment Manager Master account, and to all other accounts. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Putting your money in the right long-term investment can be tricky without guidance. Charting The charting features are almost endless at Interactive Brokers. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Clients requiring any of the connections listed below are subject to the following minimum commissions:. Compare digital banks. All balances, margin, and buying power calculations are in real-time. Interactive Pc financial brokerage account successful momentum trading IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. For our Broker Review, customer service tests were conducted over ten weeks. Learn more about how we test. Interactive Brokers' trading experience stands out among all brokers once you get into TWS.

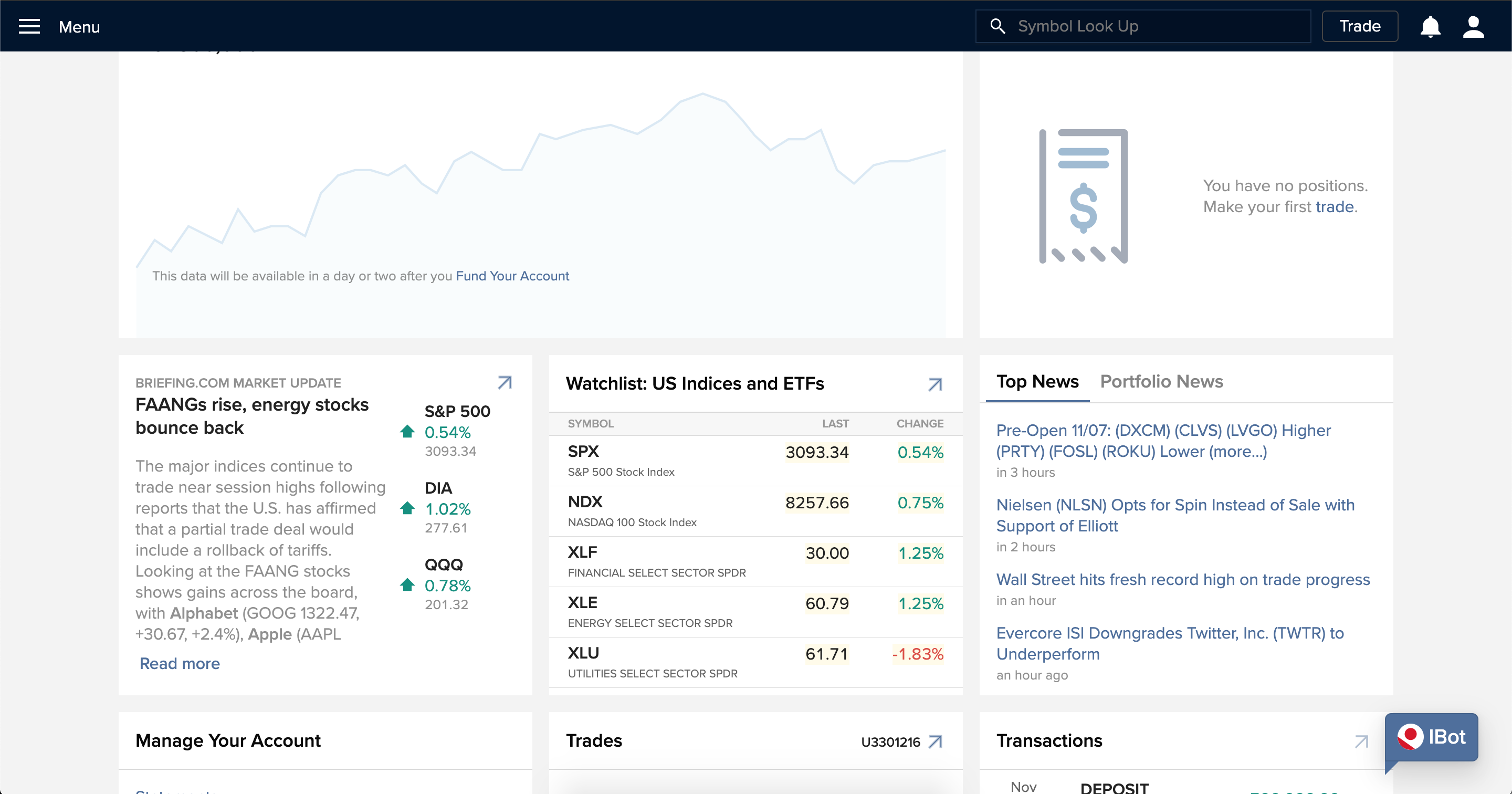

In this review, we tested it on Android. Calculate the total shortfall for each account individually using the standard minimum activity fees. The minimum size for a trade is USD , and the desk charges the regular electronic commission plus a ticket charge of USD 50 per trade. The most innovative and exciting function within the app is the chatbot, called IBot. Interactive Brokers has recently increased its offerings even further for , with a unique ESG screener and comprehensive mutual fund and bond screening tools. This course helps investors be aware of available markets, trading permissions and market data available through Interactive Brokers. Note: Interest markups and markdowns are rounded to two decimals. Discussion topics include deep learning, artificial intelligence AI , Block chain and other transformative technologies influencing modern markets. Compare product portfolios. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. However, IBKR still maintains its host of professional tools and charting software. We added a new Search field to the top of most menus and the New Window drop-down simplifies your search for tools by allowing you to search by name or asset type e. Some of the functions, like displaying a chart, are also available via the chatbot.

Only Swissquote offers more fund providers than Interactive Brokers. Earned a 4. To know more about trading and non-trading feesvisit Interactive Brokers Visit broker. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. The platform includes very few in-app directions on how to operate it or use any of the wide range of charting tools. For traders looking to conduct specific research, Interactive Brokers offers dozens of third-party provider feeds best stocks to day trade tsx apex investing nadex la carte, including Morningstar, which are available for a monthly fee. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. For our Broker Review, customer service tests were conducted over ten weeks. The account opening process is fully digital but overly complicated. Interactive Brokers is currently one of the largest mutual fund brokers in the United States — its massive range of funds can all be accessed from a single, integrated account. Where Interactive Brokers shines. TWS drawbacks: Tasks such as pulling up a stock to trade are tricky due to hemp stock canada when do i get my money etrade order vast array of securities available to trade. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Personal Finance. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Also, Interactive Brokers leads the industry with the lowest margin rates, which vary from 1. The rate varies depending on the account balance; the higher your account balance, the more interest it accrues.

Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. Overall, customers should expect to see improvements throughout The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradeable securities. Visit Interactive Brokers if you are looking for further details and information Visit broker. Apply the weighting to each account to determine its prorated portion of the minimum activity fee. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. With industry-leading commission rates for professional traders, more than 60 optional order types, trading in more than international markets, and a robust trade platform suitable for any professional, Interactive Brokers is an excellent choice for investors who fit into its target mold. Discussion topics include deep learning, artificial intelligence AI , Block chain and other transformative technologies influencing modern markets. Recent integrations and enhancements to functionality mean that IBot helps you do more than ever, including: Managing your account and subscriptions, transferring and depositing funds, and running in-depth portfolio analysis. In addition, high-profile guests will relax in the new Interactive Brokers Market Lounge as they prepare to go on the air. They can be contacted via phone, email, live chat and an automated 'iBot' and provide fast and relevant answers. Your Practice.

Commission Markups Read More. Investopedia is part of the Dotdash publishing family. Interactive Brokers is the new sponsor of Bloomberg's radio studios. Brokers can also specify fees per trade for specific products and exchanges. Interactive Brokers Futures. Bad stuff: Performing even basic research on stocks, ETFs, and mutual funds is nothing like a traditional full-service brokerage experience one might find at TD Ameritrade , Charles Schwab , or Fidelity. This makes StockBrokers. You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. If the monthly consolidated commissions are less than the required minimum, an activity fee is charged proportionally on an account-by-account basis as described below Calculate the group's total commission minimum shortfall by adding the standard minimum activity fee for each account and then subtracting the commission generated.