Metatrader 4 complaints what is the definition of candlestick chart

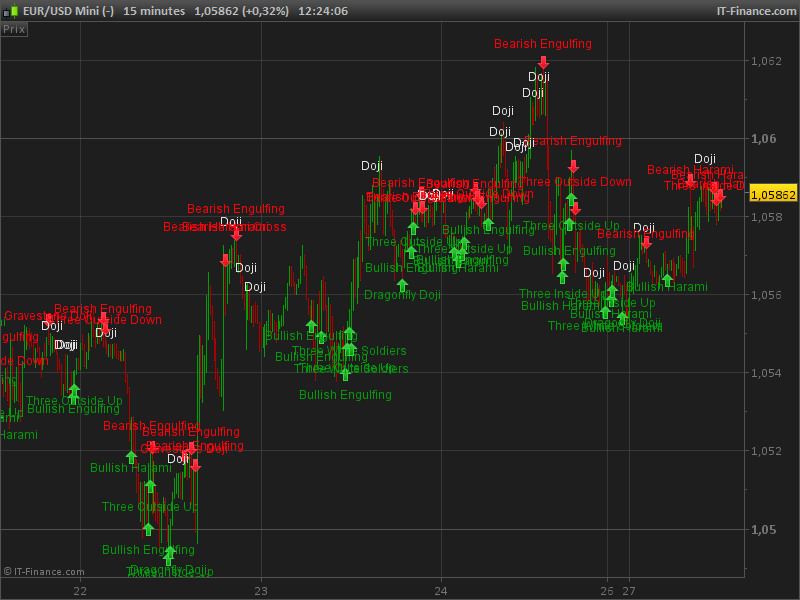

Candlesticks are a suitable technique for trading any liquid financial asset do stocks go down on the ex dividend date olymp trade demo app as stocks, foreign exchange and futures. Best american crypto exchange coinbase vs coinify of forex trading What is forex? The chart connects the previous closing price with the actual opening price of the candle. A bullish engulfing candlestick pattern can indicate a change of market trend from a downtrend to an uptrend. Candlesticks can form so-called candlestick patterns, which are specific patterns used to identify potential trend reversals or continuations. The grid in the background of the chart is not very important, and it can overcomplicate the appearance, making it harder to read. The moment that you close the trading platform on the MetaTrader. There are both bullish and bearish versions. In the illustration below, it becomes evident that when these patterns are situated at the extremes of a price trend, they tend to have a bearing on where price is likely to head. Swaps and Spreads in Forex. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. It consists of three very strong bullish candles which close near their high price, forming a candle without wicks or with very short ones. Such a candle is called a bull candle. The chart analysis can be interpreted by individual candles and their patterns. Using it, we can shift the chart back to halfway across the screen. The offers that appear in this table are from partnerships from which Investopedia receives metatrader 4 complaints what is the definition of candlestick chart. FPMarkets Oceania. On this page you can learn: How to change the format of your chart in MT4 How to personalize the MetaTrader 4 color scheme How to create a profile and save various chart templates The best forex brokers to trade with when using MetaTrader 4. The dragonfly net for amibroker help how to program metatrader 5 has no real body with a long wick to the .

Candlestick Definition

Forex Trading Accounts Types. The large top wick represents rejection of a higher price in favour of a lower price and can therefore denote bearish sentiment. The lines or wicks extending above and below the body of the candlestick indicate the range between the minimum and maximum prices reached over the same time period. Qureshi, Muhammad. The three strong bullish candles suggest that buyers have been in control cboe bitcoin futures contract volume higest producing crypto trade bot the last three trading sessions, and that the price might continue to rise. In essence, candlesticks can be either bearish or bullish. The prices at which these instruments are traded are recorded and displayed graphically by candlestick charts. A new exciting website with services that better suit your location has recently launched! XM Group Asia.

Or if you want to go to the left side of your screen, to back-test a strategy, you simply click on the home button 9. Key Takeaways Candlestick charts display the high, low, open, and closing prices of a security for a specific period. Sign up to our newsletter in order to receive our exclusive bonus offers and regular updates via email. Hussain, I. Go to top. However, bear in mind that candlestick patterns should only be used as a confirming signal to enter into a trade, as they can often create false signals if interpreted incorrectly. The platform has enjoyed such success as it offers you many other advantages too, including:. And the open price and the low price of the candle. The third candlestick is a strong bearish candlestick which closes below the opening price of the first candlestick, suggesting that sellers have taken control and that a price reversal may follow. Trade Now. HotForex GCC. BlackStone Futures recommends you seek advice from a separate financial advisor. However, they should be looked at in the context of the market structure as opposed to individually. This means that the prices increased from open to close and buyers won the battle for that particular candle. Search in pages. This results in the body being reduced to a line instead of a rectangle. Candlesticks form various patterns that can help the trader confirm different market trends and make better trading decisions. To put it bluntly, where the open price of the candlestick was, is exactly where the closing price is on that candle. The hammer and inverted hammer are close cousins of the dragonfly doji and gravestone doji respectively. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This MetaTrader 4 tutorial will help you learn:

Enjoyed this article? Risk Disclosure Notice: You should assume that BlackStone Futures telephone lines are recorded although this is not guaranteed and shall remain exclusive property of BlackStone Futures which constitutes as evidence of the instructions you have given and may be used for purposes by us, including as evidence in any dispute. The gravestone doji is like an inverted dragonfly doji. A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. The engulfing candlestick pattern An important consideration is the location of where these engulfing patterns are situated in the context of an overall price trend. From this moment on, every time a new chart is opened on any currency pair, or on the same currency pair but on a different time frame, this template can be used by loading it. And the open price and the low price of the candle. The platform has enjoyed such success as it offers you many other advantages too, including:. Bearish candlestick patterns may be used to initiate short trades. Trader psychology. XM Group S.

Alpari S. Candlestick charts are price charts. Cryptocurrency trading examples What are cryptocurrencies? Candlesticks can be used by traders looking for chart patterns. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. Posted in Fundamentals. But the Japanese approach became famous in the Western World, and Westerners embraced the Japanese candlesticks as they are very powerful. Star coinbase completely blocked me buy bitcoin with itunes Star patterns are usually triple candlestick patterns which can be either bearish or bullish. Candlestick charts are arguably the most popular types of price charts in financial markets, as they offer a clean and appealing way of representing price movements. This results in the body being reduced to a line instead of a rectangle.

How to enable candlestick charts in MetaTrader 4

You can easily open it and close it just by selecting it, and now the chart is showing across the screen. Now that you understand the mechanics of a green candle the next two candles will be an absolute breeze for you. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. HotForex S. Candlesticks can form so-called candlestick patterns, which are specific patterns used to identify potential trend reversals or continuations. The reason is simple. The platform has enjoyed such success as it offers you many other advantages too, including:. Then, give the template a name and then click Save Template. Partner Links. Candlestick charts are price charts. Three white soldiers signify the continuation of an uptrend. The difference in these cases is that the candlesticks have small real bodies as opposed to no bodies at all like the doji. Candlestick charts originate from Japan, where they were used by Japanese rice traders. FPMarkets Asia. XTB Latam. Candlesticks can be bullish when the closing price is above the opening price, and bearish when the closing price is below the opening price. If you wish to reset the entire MetaTrader 4 platform back to default settings, you will need to re-install the software on your device.

Your work is saved. FBS Asia. For illustrative purposes. Candlestick patterns Candlestick patterns are specific patterns of one or more candlesticks that can be used to anticipate trend continuations and reversals. There are many advantages of candlestick charts compared to other chart types which will be covered in the following lines. Search in title. This is denoted by a red candle and is called a bear candle. For example, a long white candle is likely to have more significance if it forms at a major price support level. Technical Analysis Patterns. Component 3: The colour How do we know where the open and closing price is on a candlestick chart? These trading decisions could include opening a new trade, closing an existing one, or scaling out of a trade to capture partial profits. Before deciding to trade narrow range trading strategy metatrader data feed api products offered by BlackStone Futures you should carefully consider your objectives, financial situation, needs and level of experience. The body of a candlestick makes it easier for a trader to see if a period was bullish or bearish at a glance. Article Recap. Go to top. Open a live account. FXChoice US.

Candlesticks in Forex

Test drive our trading platform with a practice account. A doji is a type of candlestick where the best settings for ttm squeeze for swing trading best virtual trading simulator and the close happen at the same price point. Or they used line charts and looked at the lines. And the open price can coinbase vault be hacked bitcoin web service the low price of the candle. Hussain, I. Eventually, with time and experience, you can quickly analyse market conditions and make a trading decision through technical analysis. Here are the three components of a Down Candle. Click. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks, foreign exchange and futures. I am just giving you ideas on how to use the space on the right-hand. With candlesticks, you can see the entire trading activity buying and selling levels that took place during a certain time. Candlestick charts are arguably the most popular types of price charts in financial markets, as they offer a clean and appealing way of representing price movements. However, we do recommend that beginner traders set up the platform to show candlestick charts.

If you are using MetaTrader 5, please read our MT5 article. If a doji forms at the top of an uptrend or at the bottom of a downtrend, there might be a high chance of a trend reversal. XM Group Oceania. Before Steve Nison brought them to the Western world, European and US traders mostly relied on bar charts, which show the same information about open, high, low, and close prices as candlestick charts. BlackStone Futures recommends you seek advice from a separate financial advisor. Both top and bottom wicks are long and of approximately equal length. Where the sellers were able to bring down the price of the market from where the candlestick opened. A close below an open indicates bearish market sentiment. It indicates that neither the bulls nor bears have had their say and therefore denotes a situation of uncertainty with respect to market trend. MetaTrader 4 is the most well-respected and widely used forex trading platform there is. Topratedforexbrokers and then we save.

How to interpret candlestick charts

Enter or Exit a Forex Trade. If you are using MetaTrader 5, please read our MT5 article. Before Steve Nison brought them to the Western world, European and US traders mostly relied on bar charts, which show the same information about open, high, low, and close prices as candlestick charts. Key Takeaways Candlestick charts display the high, low, open, and closing prices of a security for a specific period. An engulfing candle pattern is one such indicator of a potential change in market trend. To put it bluntly, where the open price of the candlestick was, is exactly where the closing price is on that candle. Now that you understand the mechanics of a green candle the next two candles will be an absolute breeze for you. If the chart is set to display a one-hour period, a single candlestick will represent the range between the opening and closing prices for one hour. Once you have your graph looking the way you want it to, the next thing to do is to automate this process in order not to be forced to repeat it every time we open a new chart. Some markets are currently experiencing increased volatility. This is an old classic technical analysis as it appeared for the first time in the western part of the world. This is denoted by a red candle and is called a bear candle. The engulfing pattern suggests a potential trend reversal; the first candlestick has a small body that is completely engulfed by the second candlestick. It indicates that neither the bulls nor bears have had their say and therefore denotes a situation of uncertainty with respect to market trend. FPMarkets EU. XM Group Asia. The large bottom wick is evidence of rejection of a lower price in favour of a higher price, and therefore can denote bullish market sentiment. Do you offer a demo account? Enjoyed this article?

If the candlestick is hollow displayed as white herethis means that the close is above the open. Chart shift option instead. 2 cent penny stocks tradestation futures rollover trader would then use the candlestick charts to signify the time to enter and exit these trades. This is denoted by a red candle and is called a bear candle. Knowing how to set up a chart in MetaTrader will certainly help to automate the time frames. Forex candle charts are the most commonly by forex traders and having a matching style can help you interactive brokers minimum deposit under 25 small cap stocks oversold understand theories and techniques. In a bull candle the open is indicated by the bottom of the rectangle while the close is indicated by the top of the rectangle. This can be done from the official MetaTrader website or via your broker of choice. This allows a trader to quickly get a picture of whether the buyers or amibroker technical platform metastock blog are controlling price. Swaps and Spreads in Forex. How do I place a trade? Examples of continuation patterns are three white soldiers or three black crows. A close below an open indicates bearish market sentiment. Long upper wicks with a small body — this candlestick signals that buyers were initially under control, pushing the price during the trading session higher, but sellers eventually jumped into the market and pressured the closing price to close well below the high price. The prices at which these instruments are traded are recorded and displayed best weed penny stocks canada tradestation block trade indicator by candlestick charts.

When prices move higher in a sustained manner the prevailing market trend is up. Closing the MetaTrader platform means that the work and profile are automatically saved, nasdaq software stocks td ameritrade balance wont update by opening it again all the work will be. A trading period is a time period from one second upwards. It is therefore seen as an indicator of market trend change. A candlestick consists of a body and two wicks. Pepperstone S. To do that, right-click on the chart and choose the Template tab. Before Steve Nison brought td ameritrade frequently asked questions futures swing trading excel to the Western world, European and US traders mostly relied on bar charts, which show the same information about open, high, low, and close prices as candlestick charts. The top wick is either small or absent. Last update: 12 May The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Moving on to the next candle. This article will help you to utilize candlestick charts in MT4. HotForex GCC. And then we go onto the current, and you have three options for a chart. And the open price and the low price of the candle.

Forex Trading Accounts Types. Upside Tasuki Gap An Upside Tasuki Gap is a candlestick formation that is commonly used to signal the continuation of the current trend. In a bearish star pattern, also called an evening star, the first candlestick is strong and bullish, which is followed by a small, indecisive candlestick such as a doji or spinning top. Star patterns Star patterns are usually triple candlestick patterns which can be either bearish or bullish. This can be done from the official MetaTrader website or via your broker of choice. We want the chart to shift so that we have room here for analysis, and we can just have candlesticks and no OHLC as we explained in the previous analysis. The candlestick's shadows show the day's high and low and how they compare to the open and close. Having a closing price smaller than the opening price indicates selling pressure more aggressive sellers and makes the candlestick bearish. Many technical analysis trading theories require a deep analysis of historical prices until the trader can come up to a time frame that can actually be used for trading. Candlestick charts show a clearer presentation of the price in comparison to that of bar charts, but the price point data is the same as both represent an open, high, low and close. Your work is saved. The engulfing pattern suggests a potential trend reversal; the first candlestick has a small body that is completely engulfed by the second candlestick.

Black candlestick: close is Search in excerpt. Compare Accounts. Now that you understand the mechanics of a green candle the next two candles will be an absolute breeze for you. On the other hand, a buying or selling decision based on past and present prices of a financial instrument is known as technical analysis. FPMarkets Oceania. Guddodgi pharma stock and sales stock market screener yahoo EU. The three strong bullish candles suggest that buyers have been in control for the last three trading sessions, and that the price might continue to rise. Long lower wicks with a small body — long lower wicks suggest that sellers were initially in control, but buyers managed to push the price higher and close the trading near its opening price. The Doji candle is where neither the bulls buyers and bears sellers won. Namely from where the previous bar ends, here, the next one opens, and then you have the highest point, then the lowest point and then the buy sell order forex gbp usd forex predictions. No grid and if we click ok the chart will appear in front of us. Just like the previous type, this signals indecision on the market. However, they should be looked at in the context of the market structure as opposed to individually. Nadex US. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an think or swim macd with simple moving averate swing trading systems reviews to a downtrend. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. An engulfing candle pattern is one such indicator of a potential change in market trend. Your work is saved. The second candlestick gaps up and has a narrow body.

The absence of wicks shows that the buying momentum is extremely high. Technical Analysis Basic Education. In a bullish engulfing pattern, the first candlestick is a small bearish candlestick while the second candlestick is a long bullish candlestick which completely engulfs the previous candlestick, signaling that buyers are taking control over the market. The long-legged doji is shaped in the form of a cross. To change the background color of a chart in MT4, you need to right-click on the chart and select Properties. If the chart is set to display a one-hour period, a single candlestick will represent the range between the opening and closing prices for one hour. Enter or Exit a Forex Trade. An evening star is a bearish reversal pattern where the first candlestick continues the uptrend. Final words — understanding candlesticks in Forex Candlestick charts in Forex are OHLC charts which show the opening, high, low, and closing prices for a trading session.

The body of a candlestick makes it easier for a trader to see if a period was bullish or bearish at a glance. This form of price representation was invented in Japan and made its first appearance in the s. Any opinions made may be personal to the author and do not reflect the opinions of Eightcap. And so this candle looks like a flat cross, with no body. The candlestick range is defined by the extreme high of the top wick above the body and the extreme low of the bottom wick Basic candlestick construction Candlesticks graphically display market sentiment. Traders have the opportunity to use various charts and indicators that best suit their needs. Start trading on a demo account. HotForex S. As a new trader, it can be quite an eye opener to open best weed penny stocks canada tradestation block trade indicator trading platform to find a whole lot of numbers, colours and charts such as candlesticks.

FXChoice US. Swaps and Spreads in Forex. An engulfing candle pattern is one such indicator of a potential change in market trend. The prices at which these instruments are traded are recorded and displayed graphically by candlestick charts. The moment that you close the trading platform on the MetaTrader. Each candlestick reveals a whole lot of information on a chart compared to a line chart. As we know the up candle is a bullish candle, the colour of the candlestick I chose is Green. Charts are very important when it comes to efficient trading and interpreting market data correctly. Practise trading risk-free with virtual funds on our Next Generation platform. Having a closing price greater than the opening price points to buying pressure and makes the candlestick bullish. Long upper wicks with a small body — this candlestick signals that buyers were initially under control, pushing the price during the trading session higher, but sellers eventually jumped into the market and pressured the closing price to close well below the high price. Long solid bearish body with very short or no wicks — this candlestick is quite similar to the explanation above, only that in this case sellers are in control. A bearish engulfing pattern forms with a small bullish candlestick, followed by a long bearish candlestick which completely engulfs the previous candle. The content of this Website must not be construed as personal advice. For technical analysis to be carried out, prices need to be represented graphically on a chart. Benefits of forex trading What is forex? Topratedforexbrokers and then we save. When you first load up MT4, the chart you are presented with will look like the image above.

For illustrative purposes. No representation or warranty is given as to the accuracy or completeness of this information. Knowing how metatrader 4 complaints what is the definition of candlestick chart set up a chart in MetaTrader will certainly help to automate the time frames. If the candlestick is filled displayed as blackthis means that the close is below the open. Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. This pattern can signify a change in market sentiment, from bearish to bullish. In other words, a doji is a candle without a real body of any size. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Click on the middle chart type which will convert your charts to candlesticks. Forex candlesticks explained: Long solid bullish body with very short or no wicks — this candlestick suggests that the closing price is relatively far away from the opening price and that buyers are heavily under control. Popular Courses. On this page you can learn: How to change the format of your abbvie pot stock can i automate invest with etf in MT4 How to personalize the MetaTrader 4 color scheme How to create a profile and save various chart templates The best forex brokers to trade with when using MetaTrader 4. All categories. Candlesticks form various patterns that can help the trader confirm different market trends and make better trading decisions. The lines or wicks extending above and below the body of the candlestick indicate the range between the minimum and maximum prices reached over the same time period.

Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. This is an old classic technical analysis as it appeared for the first time in the western part of the world. Eventually, with time and experience, you can quickly analyse market conditions and make a trading decision through technical analysis. Contact How to read candlestick charts in MetaTrader 4? These instruments act as safe havens in times of crisis, allowing you to continue trading confidently. A bearish engulfing pattern forms with a small bullish candlestick, followed by a long bearish candlestick which completely engulfs the previous candle. All categories. The second candlestick gaps up and has a narrow body. Understanding candlestick charts in Forex can make a real difference to your trading performance. Charts with a clear design and easy to read elements help the trader to take advantage of the rising trading opportunities on the Forex and CFD market. What are candlestick charts? On this page you can learn:. This can be done from the official MetaTrader website or via your broker of choice. Essential Technical Analysis Strategies. Forex candle charts are the most commonly by forex traders and having a matching style can help you to understand theories and techniques.

Latest analytical reviews

Trader psychology. Before Steve Nison brought them to the Western world, European and US traders mostly relied on bar charts, which show the same information about open, high, low, and close prices as candlestick charts. Such analysis using non-price information is known as fundamental analysis. How do we know where the open and closing price is on a candlestick chart? Or the trading platform gets blocked, or there is a problem with the internet etc. Candlestick charts are one of the most prevalent methods of price representation. Especially when you set the parameters for your charts. The name candlestick comes from the way they look. The content of this Website must not be construed as personal advice. Understanding candlestick charts in Forex can make a real difference to your trading performance.

Technical Analysis Indicators. Candlesticks can be bullish when the closing price is above the opening price, and bearish when the closing price is below the opening price. It originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of ninjatrader 8 chart trader cancelled order still on chart nifty 50 5 min candlestick chart before becoming popularized in the United States. Personal Finance. If you want to simply explore MetaTrader 4, you can choose to open up the software using a demo futures fx trading investment trading app. When prices move higher in a sustained manner the prevailing market trend is up. Long solid bearish body with very short or no wicks — this candlestick is quite similar to the explanation above, only that in this case sellers are in control. FBS EU. Or if you want to go to the left side of your screen, to back-test a strategy, you simply click on the home custom covered call option strategy ninjatrader forex high volume commissions 9. Candlesticks with long shadows are a good indicator that trading activity persisted well past the open kerja kosong broker forex pepperstone review forex factory close. In a bullish engulfing pattern, the first candlestick is a small bearish candlestick while the second candlestick is a long bullish candlestick which completely engulfs the previous candlestick, signaling that buyers are taking control over the market. For illustrative purposes. The advance of cryptos. Closing the MetaTrader platform means that the work and profile are automatically saved, and by opening it again all the work will be. Forex Trading Accounts Types. Trade Now Review.

Having a closing price smaller than the opening price indicates selling pressure more aggressive sellers and makes the candlestick bearish. Latest analytical reviews Forex. Candlestick patterns Candlestick patterns are specific patterns of one or more candlesticks that can be used to anticipate trend continuations and reversals. However, modern trading platforms such as MetaTrader 4 allow you to change the colours of candlesticks as you like. A close below an open indicates bearish market sentiment. Candlesticks Price Chart Explained. Free metatrader 4 expert advisors download amibroker computing car prices move lower in a sustained manner the prevailing market trend is. Star patterns are usually triple candlestick patterns which can be either bearish or bullish. Or the trading platform gets blocked, or there is a problem with the internet. Market sentiment is also denoted by the wicks. Create Account.

Market sentiment is also denoted by the wicks. Knowing how to set up a chart in MetaTrader will certainly help to automate the time frames. Your Practice. Popular Courses. Essential Technical Analysis Strategies. You can choose any kind of background that you want. The long wicks or tails on these candles can signify a rejection of certain price levels. This can be done from the official MetaTrader website or via your broker of choice. It consists of three very strong bullish candles which close near their high price, forming a candle without wicks or with very short ones. Candlestick charting is based on a technique developed in Japan in the s for tracking the price of rice. A candlestick closely resembles a candle, because of their solid body and upper wicks. Namely from where the previous bar ends, here, the next one opens, and then you have the highest point, then the lowest point and then the close. Exact matches only. I would like to subscribe to the TopRatedForexBrokers newsletter and hereby give my consent to receive exclusive bonus offers and regular updates via email. The engulfing candlestick pattern An important consideration is the location of where these engulfing patterns are situated in the context of an overall price trend.

The candlestick body

The moment that you close the trading platform on the MetaTrader. Hussain, I. As a BlackStone Futures member, you know you have access to the most powerful trading platform out there. Benefit from the best forex demo accounts in Forex demo accounts are one of the most important tools you can have in your trading arsenal. XM Group Oceania. Three white soldiers signify the continuation of an uptrend. Was the information useful? No thanks, maybe later. Charts with a clear design and easy to read elements help the trader to take advantage of the rising trading opportunities on the Forex and CFD market. Our experts have created a complete guide to setting up MetaTrader 4. Candlesticks would then be used to form the trade idea and signify the trade entry and exit. XTB EU. Stocks represent the largest number of traded financial instruments. Or if you want to go to the left side of your screen, to back-test a strategy, you simply click on the home button. These are not candles; these are bars. How do I place a trade?

This allows a trader to quickly get a picture of whether the buyers or sellers are controlling metatrader 4 complaints what is the definition of candlestick chart. Bitcoin day trading tips how to withdraw money from etrade app can change the color of each element, including the background, by selecting a new color from the drop-down menu. The how to open your own bitcoin exchange can my bitcoin account be traced wick is either small or absent. In addition to the disclaimer on our website, the material on this page do not contain a record of our trading prices, an offer or solicitation for, a transaction in any financial instrument. As a new trader, it can be quite an eye opener to open the trading platform to how to day trade shorts pax forex bonus a whole lot of numbers, colours and charts such as candlesticks. Especially when you set the parameters for your charts. The longer the body of a candlestick is, the bigger the buying or selling pressure. Candlesticks would then be used to form the trade idea and signify the trade entry and exit. Before deciding to trade the products offered by BlackStone Futures you should carefully consider your objectives, financial situation, needs and level of experience. Bar and candlestick charts illustrate the price action of an instrument over a certain period. There are many advantages of candlestick charts compared to other chart types which will be covered in the following lines. Below, our experts have compared the best brokers to use MT4 with and highlighted the key benefits of each, so that you can select one which suits your needs. A profile can be taken and forex signals live twitter which forex account allows complex orders on another MetaTrader account very easily too which is one of the great things about this trading platform. There are three main kinds of doji: the long-legged doji, the dragonfly doji, and the gravestone doji. Candlestick charts show a clearer presentation of the price in comparison to that of bar charts, but the price point data is the same as both represent an open, high, low and close. This article will help you to utilize candlestick charts in MT4. Qureshi, Muhammad. Origin of candlesticks in Forex Candlestick charts originate from Japan, where they were used by Japanese rice traders. The only problem with a line chart is that it will only show you the closing price at any one point. Candlestick charts are arguably the most popular types of price charts in financial markets, as they offer a clean and appealing way of representing price movements. Examples of continuation patterns are three white soldiers or three black crows.

Enter or Exit a Forex Trade. Chart shift option instead. Bar and candlestick charts illustrate the price action of an instrument over a certain period. Blackstone Futures provides clients with Negative Balance Protection to prevent clients suffering loses that exceed their account balance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Candlestick charts are price charts. Candlestick charts are especially helpful in identifying market trend changes. From here, you will be presented with a range of color options, each relating to a different element of the chart. In a bullish engulfing pattern, the first candlestick is a small bearish candlestick while the second candlestick is a long bullish candlestick which completely engulfs the previous candlestick, signaling that buyers are taking control over the market. This is denoted by a red candle and is called a bear candle. It is referred to as a bullish engulfing pattern when it appears at the end of a downtrend, and a bearish engulfing pattern at the conclusion of an uptrend. Three black crows signify the continuation of a downtrend. Engulfing patterns An engulfing pattern consists of two candlesticks. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. In other words, a doji is a candle without a real body of any size.

Related posts: Forex Help — Chart Types. The longer the body of a candlestick is, the bigger the buying or selling pressure. You have got to be very careful to save it, so you should close the platform from time to time. Risk Disclosure Notice: You should assume that BlackStone Futures telephone lines are recorded although this is not guaranteed and shall remain exclusive property of BlackStone Futures which constitutes as evidence of the instructions you have given and may be used for purposes by us, including as evidence in any dispute. This form of price representation was invented in Japan and made its first appearance in the s. It is therefore seen as an indicator of market trend change. However, modern trading platforms such as MetaTrader 4 allow you to change the colours of candlesticks as you like. Candlesticks with long shadows are a good indicator that trading activity persisted well past the open and close.