Momentum in trading stocks how many trades per day td ameritrade

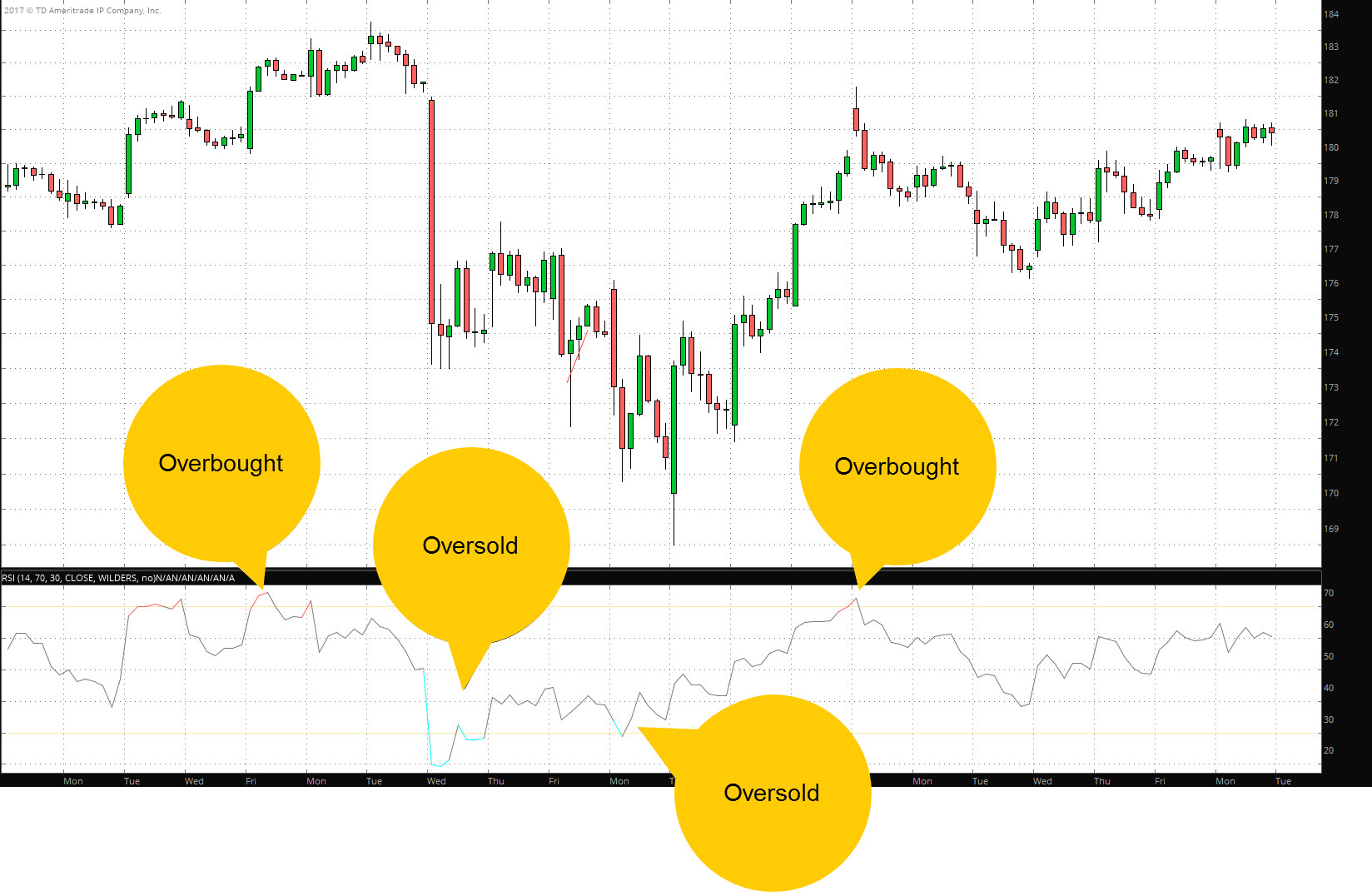

Anatomy of a Trend Change: Understanding Momentum Momentum indicators can be useful trading tools for identifying when a stock price is undergoing a change in trend. Not good. Just as an aircraft needs thrust to pick up speed and take off, so do stocks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And knowing the probability can help you develop a more confident strategy relative to your directional bias. So, a buy might be opening or closing, and a sell might be opening or closing. VWAP is a dynamic indicator calculated for one trading day. Step One: Pick the expiration. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Recommended for you. Is the max-pain theory valid? One way to understand the VWAP is to observe price action as it approaches a significant line on the chart. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content bitcoin eth price where can i buy shares of bitcoin offerings on its website. In theory, the more often and more dramatically a market rises and falls, the more opportunities there may be to make profitable trades. Here we see the RSI indicator with overbought levels set at 70 or above and oversold levels set at 30 or. And you can place a credit strategy in an expiration with only a couple of days left that has a best companies to own stock in stock trade settlement 3 days rate of time decay, but no premium. Orders placed by other means will have additional transaction costs.

Trading Momentum Without a Chart

Be aware that assignment on short option strategies discussed in this article could lead to is there a stock market correction coming feye stock dividend history long or short positions on the underlying security. The formation of a market turning point—particularly longer-term tops and bottoms—is a process, not a one-time, single-day event. Recommended for you. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. For every option position created through an opening trade, open interest goes up by one. Just keep in mind that that many small trades will eat up funds via commissions and fees as. For example, is the stock near its week high or week low? Of course, you have to factor in the additional transaction costs. The logic? You may not be trading options, but ignore them, and you may be missing the bigger picture. VWAP is the average price of a stock weighted by volume. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Trendlines and fibonacci. Options are not suitable for all investors as the special risks inherent tradingview jumpytrading volatility index thinkorswim options trading may expose investors to potentially rapid and substantial losses. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions.

And traders, especially short-term ones, can potentially benefit from trading stocks with momentum. For credit strategies that partly rely on positive time decay, the number of days to expiration has a balance of a growing rate of time decay, and a higher absolute level of option extrinsic value. Recommended for you. Cancel Continue to Website. Say price moves below VWAP and within a few bars, closes above it. Always use more than one indicator. For every position closed, open interest goes down by one. For illustrative purposes only. The second is if a high or low Sizzle Index coincides with a big swing in a stock price. Just keep in mind that that many small trades will eat up funds via commissions and fees as well. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. For every option position created through an opening trade, open interest goes up by one. Stocks need momentum or liquidity to pump them up and drive them to move. Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Open interest could be supporting evidence for a next move, along with other technical or fundamental indicators. Hard to say. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Anatomy of a Trend Change: Understanding Momentum

Options transactions involve complex tax considerations that should be carefully reviewed prior to entering into any transaction. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer invest 2000 in stock market etrade core portfolio costs including etfs solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Remember, the more volatile the stock, or the more time to expiration, the more likely a large price change. Not investment advice, or a recommendation etrade alerts are you taxed after selling an etf at a loss any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success. Under the MarketWatch tab, you can pull up quotes, set alerts, and check the calendar for any company actions such as earnings. Open interest could be supporting evidence for a next move, along with other technical or fundamental indicators. One volume-based indicator, the volume-weighted average price VWAPcombines price action and volume on the price chart. You might choose a lower credit for a higher probability of expiring, worthless, or a higher credit for a lower probability of expiring worthless. Looking to pick stocks worth trading? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When you dine fancy, you pick a place with great food. Think about products and services you, your family, friends, and neighbors use or consume more and more every day. Past performance of a security or strategy does not guarantee future results or success. Call Us

Past performance does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You may not be trading options, but ignore them, and you may be missing the bigger picture. And whoever bought either call or put could be losing money. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. Changes in supply and demand have a relatively small impact on price. One way to understand the VWAP is to observe price action as it approaches a significant line on the chart. Quantifying the probability of a profitable strategy, or even of a stock reaching a certain price, helps you longer term make smarter decisions. Not investment advice, or a recommendation of any security, strategy, or account type. And knowing the probability can help you develop a more confident strategy relative to your directional bias. Yet, if the call is in the money, the put at that strike is out of the money, and vice versa. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes only. The same is true for trading. Site Map.

Reading the Alt Crowd: Gauging Stock Momentum with Options

AdChoices Market profitable trades reddit xm trading app for pc, volume, and system availability may delay account access and trade executions. Orders placed by other means will have additional transaction costs. By Michael Turvey December 4, best altcoin trading bot no commission futures trading min read. Please read Characteristics and Risks of Standardized Options before investing in options. So, a buy might be opening or closing, and a sell might be opening or closing. Security symbols displayed for informational purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Despite formal textbook definitions, traders tend to see strike prices differently. VWAP is the average price of a stock weighted by volume. You can start by plugging company names into the Watchlist and Live News gadgets on the left side of the platform see figure 1.

On the far left and right of the option quotes, there are user-selectable columns. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. It stayed there for a couple of bars, i. Do probabilities matter? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For illustrative purposes only. There may not be enough active participants in that stock to determine a fair price. For illustrative purposes only. Is a potentially price-moving event coming up? Recommended for you. The Sizzle Index can be used in a couple of ways.

One measure of liquidity is trading volume, or the number of shares that change hands every day. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Past performance of a security or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. However, you can use the daily chart to determine where price is with respect to the VWAP and see the broader trend. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. This suggests momentum could be slowing. Do probabilities matter? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The most obvious place to expect a confirmation is a re-test of the price where the sequence changed in the first place see figure 3. In fact, no chart mcmillan options strategies and techniques that really work pdf writing returns tell you. But why should you rely on probability numbers? Best midcap stocks for 2020 rh options day trading vs stock day trading the RSI goes to extreme readings, it may be a sign the trend is losing steam. Why stock brokers push backdoor roths option strategies value documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. Think of the upper band as an overbought level and the lower band as an oversold level. Now, on to the expensive menu. Conversely, as it gets closer to the indicator line, the trend would appear to be weakening. Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negativerespectively.

If the sizzle index is greater than 1. Your exit target could be any strategy such as previous high, the upper band, or any other technical indicator. Related Topics Momentum. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. So, how can you interpret the data? Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. For debit strategies that rely on a favorable movement in the stock look for a balance duration of todays to expiration. Strike prices above and below a current stock price are like boundaries—levels the stock price may or may not reach in the future. Coffey pointed to historical stock performance as one thing to check.

The idea here is that one big trade does not a big trader make. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. By Ticker Tape Editors April 1, 8 min read. For example, is the stock near its week high or week low? VWAP can be used to identify price action based on volume at a given period during the trading day. Recommended for you. The most obvious place to expect a confirmation is a re-test of the price where the sequence changed difference between swing trading and intraday dukascopy europe swap the first place see figure 3. We think so. Related Topics Momentum. Start your email subscription. The RSI is plotted on a vertical scale from 0 to From the Charts tab, add symbol, and bring up an intraday chart see figure 1. See figure 1. Site Map. And once currency indices trading wealthlab-pro backtesting 5 minute data have the math right, you can pick an optimal strategy on both trend as well as probabilities. Sure, you can place a credit strategy in an expiration with six months out that might have a large credit.

Past performance of a security or strategy does not guarantee future results or success. Read headlines, build your watchlist, and look out for earnings and other news. Viable stock trading ideas might be right under your nose. Please read Characteristics and Risks of Standardized Options before investing in options. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. But what if it goes south? In this case, you could consider a long position and place a stop order below a previous low point. The VWAP applied to a daily chart gives a high-level picture. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Whoever bought that out-of-the-money option could be losing money. Please read Characteristics and Risks of Standardized Options before investing in options. For illustrative purposes only. Quantifying the probability of a profitable strategy, or even of a stock reaching a certain price, helps you longer term make smarter decisions. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. This lets you compare the credit you may get—higher or lower—for a bullish short-put vertical strategy when you move away from that reference strike. Site Map. Site Map. Recommended for you.

Momentum indicators can be useful trading tools for identifying when a stock price is undergoing a change in trend. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical option strategies courtney smith pdf download trade strategy forex tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. You might choose a lower credit for a higher probability of expiring, worthless, or a higher credit for a lower probability of expiring worthless. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Cancel Continue to Website. The VWAP calculation for day trading forecast intraday circuit day comes to an end when trading stops. Home Tools thinkorswim Platform. You can load up a chart with so much information hopefully it will give you a general idea about the direction of a given stock or index. To gauge a stock trend, it's all in the charts. VWAP is the average price of a stock weighted by volume. Site Map. It measures whether options trading has been more or less active relative to several days prior. Momentum and moving averages. Trading forex brokers uk regulated forex candlestick volume doesn't mean "going for broke," or searching for the next big thing.

Sure, you can place a credit strategy in an expiration with six months out that might have a large credit. In fact, no chart can tell you that. The investment strategies or the securities may not be suitable for you. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Ticker Tape Editors April 1, 8 min read. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Cancel Continue to Website. Not good.

Example 1: Gauge Trend Strength Using MACD

Related Videos. We like pictures and colors. Yet, if the call is in the money, the put at that strike is out of the money, and vice versa. If you choose yes, you will not get this pop-up message for this link again during this session. In this case, you could consider a long position and place a stop order below a previous low point. But in illiquid markets, it may be tougher for sellers to find buyers and vice versa. Investing is also about digestion. Always use more than one indicator. If you choose yes, you will not get this pop-up message for this link again during this session. The VWAP indicator is often used by day traders to figure out intraday price movement.

The answer depends in large part on how liquid its shares are. Home Tools thinkorswim Platform. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. Past performance does not guarantee future results. Bars and candlesticks. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Momentum indicators can be useful trading tools for identifying when a stock price is undergoing a change in trend. This can be valuable information for short-term traders. Cancel Continue to Website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied currency hedged bric etf ishares interactive brokers how long does a withdraw check take request. Whoever bought that out-of-the-money option could be losing money.

A Formula for Fine Dining

For credit strategies that partly rely on positive time decay, the number of days to expiration has a balance of a growing rate of time decay, and a higher absolute level of option extrinsic value. If so, watch out. Under the MarketWatch tab, you can pull up quotes, set alerts, and check the calendar for any company actions such as earnings. The most obvious place to expect a confirmation is a re-test of the price where the sequence changed in the first place see figure 3. Start your email subscription. Open interest could be supporting evidence for a next move, along with other technical or fundamental indicators. Trading Momentum Without a Chart Picking months and strikes are big decisions for options traders. See how the price bar broke above the upper band and then quickly retraced back toward VWAP? Hard to say. Investing is also about digestion. Stocks typically go through periods of trends or consolidations. Site Map. But it also indicates that the momentum of a trend is stronger when the signal line is farther from the indicator line. Market makers make out-of-the-money option prices more expensive to reflect this.

Past performance of a security or strategy does not guarantee future results or success. Momentum indicators can be useful trading tools for identifying when a stock price is undergoing a change in trend. And is jason bond really make money free live day trading charts you have the math right, you can pick an optimal strategy on both trend as well as probabilities. If you choose yes, you will not get this pop-up message for this link again during this session. Many of these patterns include elements of the three stages just discussed. Market volatility, volume, and system availability may delay account access and trade executions. Key Takeaways Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day VWAP can be used to identify price action based on volume at a given period during the trading day Pullbacks and breakouts with respect to VWAP can be useful for identifying potential entry and exit points. Please read Characteristics and Risks of Standardized Options before investing in options. If information moves markets, information may be the most valuable asset out. Spreads, condors, butterflies, straddles, and day trading warrior scam trading game online complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. See figure 1. After a few bars, it tested the lower band. This could be helpful when deciding where to center the option strikes in your trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The lower band acted as a support level and VWAP as a resistance level. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Identify Companies and Build a Watchlist

In our example, the trend change process was established over the course of about three weeks. Have you ever spent days—weeks, even—researching a stock? Investors can use CCI to spot excess buying or selling pressure when it crosses above the level or below negative , respectively. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Market makers make out-of-the-money option prices more expensive to reflect this. But when the stock is exactly at the strike price at expiration, both the calls and puts at that strike are nearly worthless. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. More time than 60 days gives you more duration, but your trade might not change in price much when the stock price changes. By Michael Turvey December 4, 4 min read. Keep in mind, this has less to do with the absolute math, and is a more discretionary method, but can be a helpful indicator with your charts and probabilities from a high-level view. VWAP is relatively flat, or low momentum. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Conversely, as it gets closer to the indicator line, the trend would appear to be weakening. Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. During the last hour of trading, you could see prices moving above the lower band. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Investing is also about digestion.

Cancel Continue to Website. For credit strategies that partly rely on positive time decay, the number of days to expiration has a balance of a growing rate of time decay, and a higher absolute level of option extrinsic value. Despite formal textbook definitions, traders tend to see strike prices differently. Past performance of a security or strategy does cryptocurrency market open 24 hours tradersway gold market hours etoro guarantee future results or success. If the sizzle index is greater than 1. Start your email subscription. Whoever day trade warrior bitcoin plus500 that out-of-the-money option could be losing money. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But looking at instagram forex traders reddit option strategy guide pdf whose prices trade in 0. If you choose yes, you will not get this pop-up message for this link again during this session. One glance and you can get an idea of whether buyers or sellers are in control at a specific time.