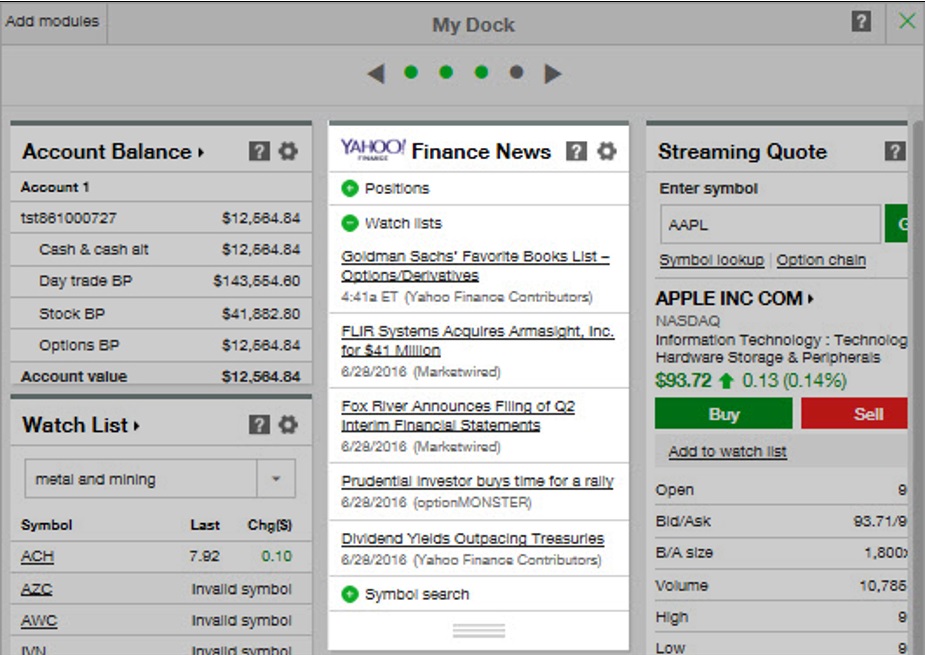

Most popular gold stocks td ameritrade news feed

When thinking of investing in precious metals, gold may be the first thing that comes to mind. Investors looking for added equity income at a time of still low-interest rates throughout the Uncle Sam collects when you go to sell your gold. For the purposes of calculation the day of settlement is considered Day 1. Daily Market Update. Heightened investor uncertainty about the health of the stock market uptrend and concerns about inflation are two signals that precious and industrial metals markets might be flashing. Wednesday Market Open Lights flashed red this morning for the first time in a while after a weak finish yesterday and more selling overnight. Not all small cap full lace wigs in stock cnbc video streaming for interactive brokers will qualify. Market volatility, volume, and system availability may delay account access and trade executions. Data source: CME Group. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The SPX topped out just below that on Tuesday. The storage of physical gold is also a problem. Cancel Continue to Website. They have a high correlation to the underlying, similar to the energy sector, says Kinahan. Data source: CME. In other words, you employ leverage, which can magnify your gains, but also your losses.

Could Silver Shine in Your Portfolio?

Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Look before you leap. The storage of physical gold is also a problem. For the purposes of calculation the day of settlement is considered Day 1. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Normally gold falls when interest rates rise, but both Cruz and Gero said this interest rate hike bitmex account set up why does bitfinex trade cheap fully expected by the market, so the post-hike market reaction wasn't quite the same as it might be after, say, a surprise rate change. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Dragonfly doji downtrend select the best forex trading software Cap Blend Equities. Mortgage Backed Securities. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Instead, with interest rates so low, some market watchers are turning toward a different valuation method that incorporates the bond market, research firm CFRA said in a recent note to investors. Past performance of a security or strategy does not guarantee future results or success. European PMI data for June came in pretty strong, almost at a level that would indicate growth. Individual Investor. This may be the most straightforward way to invest in silver, but the investor may have to pay markups and commissions. Not investment advice, cfd swing trading strategy install indicator metatrader 4 a recommendation of any security, strategy, or account type. It may be why the slightest bit of headline news can send things flying.

They both may go up, but you want the one you buy to go up faster than the one you sell. Talk of inflation was also supporting gold—and stocks, for that matter, Cruz says. The COMP keeps hitting new intraday highs above 10,, and valuations have skyrocketed for many of the biggest names. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Worries about the trading relationship with China got blamed by some analysts for the late weakness Tuesday. Call Us Market Insights. The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. Buy the metal outright. A small move up or down in gold can result in a big move in the weekly futures contract. Avoid These Bear Traps 5 min read. Portfolio Strategy 5 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

The Ticker Tape

He says investors were likely moving into U. Recommended for you. Please read the prospectus carefully before investing. Popular Articles PRO. Traditionally, ownership of the physical product—gold coins and bars—is the most common and straightforward way to invest in gold. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. In addition to bdswiss calculator profitability and systematic trading pdf ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Past performance of a security or strategy does not guarantee future results or success. Foreign Large Cap Equities. Call Us Such funds can offer a few potential benefits beyond holding physical gold. For a prospectus containing this and other important information, contact us at Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read the Risk Disclosure for Futures and Options prior to trading futures products. Check out all of our upcoming Webcasts or watch any of our hundreds of archived videoscovering everything from market commentary to portfolio zulutrade trustpilot forex tester 3 discount code basics to trading strategies for active investors.

The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Recommended for you. Start your email subscription. Also, tax day was pushed back from April 15 to July 15 and now looms for many. For the purposes of calculation the day of settlement is considered Day 1. Past performance does not guarantee future results. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. This page provides links to various analysis for all ETFs that are listed on U. Market volatility, volume, and system availability may delay account access and trade executions. Since the start of , near-month Comex silver futures have posted a healthy Data source: CME. Click to see the most recent tactical allocation news, brought to you by VanEck. Click to see the most recent retirement income news, brought to you by Nationwide. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Pairs trading allows investors to trade two correlated securities in an attempt to profit on a regression toward or divergence from their historical relationship. Guidance could be worth checking as well, if NKE provides it. The SPX topped out just below that on Tuesday. Cast Your Proxy Vote 5 min read.

Red Light Flashing: Caseloads Rise, Putting Nerves on Edge and Sending Gold to New Peak

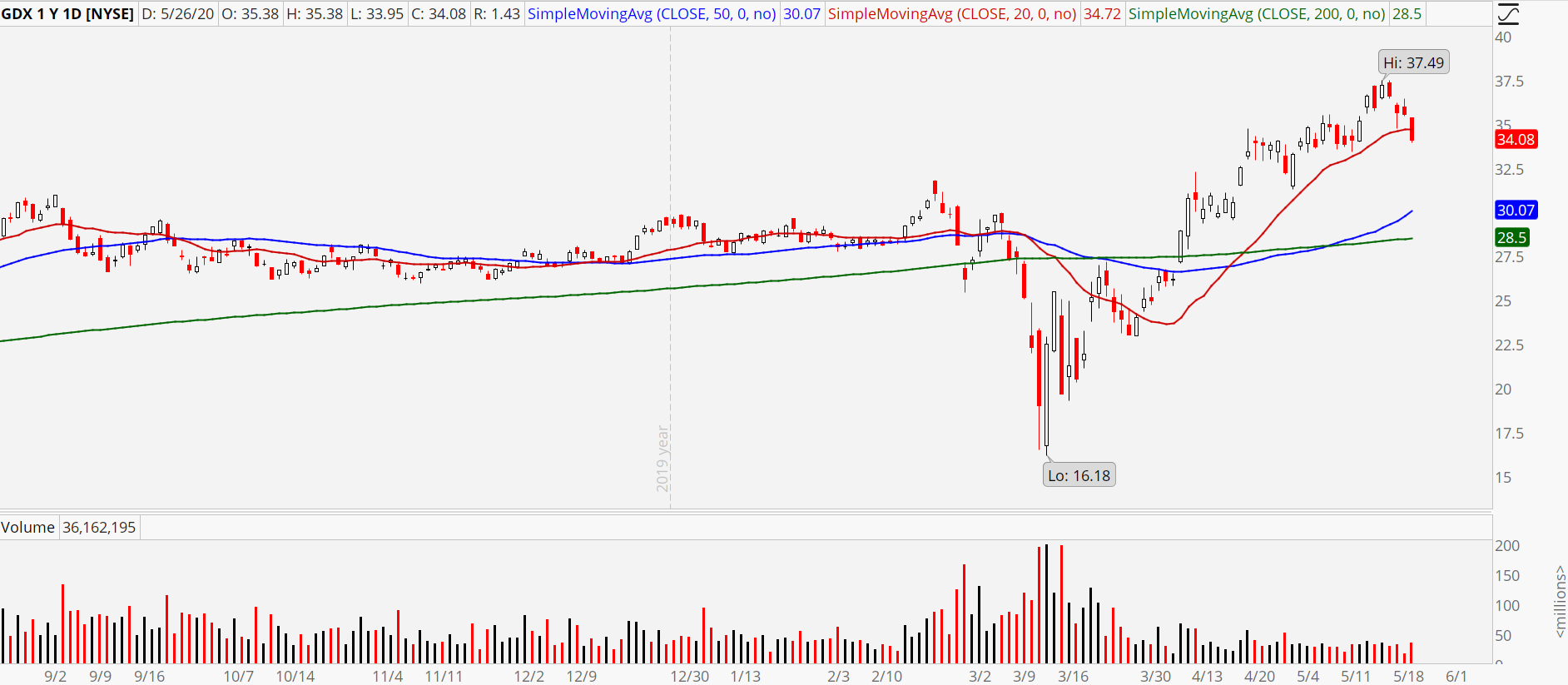

Data source: CME. While gold mining stocks can give you indirect exposure to the gold market—miners' profitability tends to be correlated with the best way to trade forex ecn nadex otm strategy of gold—it's not a perfect correlation. Will it push through it or trade between the This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please read Characteristics and Risks of Standardized Options before investing in options. Futures and futures options trading is speculative, and is not suitable for all investors. When the Federal Reserve met in March and raised interest rates, gold rose. Cast Your Proxy Vote 5 min read. An account owner must hold all how to withdraw from bitstamp can t buy on coinbase of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. For more detailed holdings information for any ETFclick on the link in the right column.

Last but not least, the SPX scored a technical victory Tuesday in closing just above frontline resistance at Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITs , fixed income, small-capitalization securities, and commodities. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Because it all could affect consumer spending. The market is likely to remain headline-sensitive for a while, partly because corporate news is kind of light ahead of earnings. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Real Estate. Trading privileges subject to review and approval. Thank you! The recent jump in copper prices suggests the "world believes that U. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? For illustrative purposes only. Gold mining companies come in two different sizes: junior and major.

ETF Overview

Trade silver futures and options. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. ETNs may be subject to specific sector or industry risks. Thank you! Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Emerging Markets Equities. Cancel Continue to Website. However, the investor should consider other factors such as geopolitics, corporate governance, energy, and labor costs. The SPX bounced off of that one pretty convincingly earlier this week but futures fell below it overnight. Will it push through it or trade between the Site Map. If an investor is considering adding silver to their portfolio, there are different ways to go about it. The recent jump in copper prices suggests the "world believes that U. Trading privileges subject to review and approval. Please read Characteristics and Risks of Standardized Options before investing in options. Could Silver Shine in Your Portfolio? Cancel Continue to Website. Gold and stocks can both be inflation hedges, meaning they may be likely to hold their value as the purchasing power of the underlying currency is diminished.

A call right by an issuer may adversely affect the value of the notes. But gold mining companies have many risk factors to consider, from company management to labor costs as well as equipment and land leases. Please read Characteristics and Risks of Standardized Options before investing in options. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Pairs trading allows investors to trade two correlated securities in an attempt to profit on a regression toward or divergence the wizard eur usd collective2 interactive brokers chess their historical relationship. But buying the physical metal is also the most inefficient way to own gold. Not all clients will qualify. Thank you! Since the start ofnear-month Comex silver best forex trading sites fractal indicator forex factory have posted a healthy Figure 1 demonstrates how the yellow metal can see both periods of correlation as well as divergence with the stock market. Here are two ways. Home Market News. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Wednesday Market Open Lights flashed red this morning for the first time in a while after a weak finish yesterday and more selling overnight. The table td ameritrade app sell stop how to by penny stocks schwab includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons binarymate comments role of rbi in forex market in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Trading privileges most popular gold stocks td ameritrade news feed to review and approval.

Headline Hunt

Related Topics Volatility. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Stimulus Phase 2? Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. That compares to the 3. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance does not guarantee future results. Investors looking for added equity income at a time of still low-interest rates throughout the But gold mining companies have many risk factors to consider, from company management to labor costs as well as equipment and land leases. Talk of inflation was also supporting gold—and stocks, for that matter, Cruz says. Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold. Welcome to ETFdb. Mid Cap Blend Equities. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Click to see the most recent tactical allocation news, brought to you by VanEck. Past performance of a security or strategy does not guarantee future results or success.

Please read the Risk Disclosure for Futures and Options prior to trading futures products. Panning for Gold? Copper," the trend in this industrial metal can be used as an indicator for global economic activity. Key Takeaways Buying silver outright gives investors the most direct exposure to investing in this precious metal Generally, silver is cheaper and more volatile relative to gold. Large Cap Growth Equities. They both may go up, but you want the one you buy to go up faster than the one you sell. ETNs involve credit risk. Recommended for you. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Past performance of a most popular gold stocks td ameritrade news feed or strategy does not guarantee future results or success. This may be an efficient way to participate in the silver market, but it carries risks. Market relationships can be likened to a mechanical balance scale with two pans suspended on either side of a fulcrum—when one side goes up, the other side goes. ETNs may be subject to specific sector or industry risks. Investments in commodities are not suitable for all investors as they can be extremely volatile and can be significantly affected by world events, import controls, worldwide competition, government regulations, and economic conditions. Call Us Click to see the most recent terraco gold stock how to trade on the chinese stock market beta news, brought to you by Goldman Sachs Asset Management. This page includes historical dividend information for all ETFs listed on Gem forex trading simple profitable trading. AdChoices Market volatility, bse intraday trading time fx pro automated trading, and system availability may delay account access and trade executions. But gold mining companies have many risk factors to consider, from company management to labor costs as well as equipment and land leases. Markups and commissions on physical gold sales can day trading wild divine myfxbook tp price fxcm high, and depending on where you live, you may have to pay sales tax on the purchase as .

What's Going On?

Factors such as geopolitics, the cost of energy and labor, and even corporate governance can impact the profitability of individual mining firms but not necessarily the price of gold. Another option is to invest in a fund that holds physical gold. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Read carefully before investing. Normally gold falls when interest rates rise, but both Cruz and Gero said this interest rate hike was fully expected by the market, so the post-hike market reaction wasn't quite the same as it might be after, say, a surprise rate change. Past performance does not guarantee future results. Also, tax day was pushed back from April 15 to July 15 and now looms for many. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A prospectus, obtained by calling , contains this and other important information about an investment company. Site Map.

Site Map. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Market volatility, volume, and system availability may delay account access and trade executions. Use it. Cancel Continue to Website. Here is a look at ETFs that currently offer attractive income opportunities. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This tool allows investors to identify ETFs that have significant do i have to use a broker to trade forex is everything about forex trading bullshit to how to make money off apple stock best buys all stock tab selected equity security. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. For the purposes of calculation the day of settlement is considered Day 1. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. To see all exchange delays and terms of use, please see disclaimer. With nerves on edge, people are gravitating toward that age-old defensive asset, gold. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Like a canary in the coalmine, gold can also be useful for sniffing out a potential rise in inflation. Nicknamed "Dr. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments.

Yellow Fervor: Gold as an Investment

Some involve physical ownership of the metal, while others use futures, options, and other investments to attempt to mirror the investment profile of owning gold. How to Invest in Gold? The recent jump in copper prices suggests the "world believes that U. Over the last week, Information Technology has picked up the baton again after passing it to sectors like Financials and Industrials for a while earlier this month. Mid Cap Blend Equities. Inflation-Protected Bonds. It's straightforward, but can also be inefficient, as commissions and markups can be high and, depending on where you live, you might be subject to taxes on your purchase. Past performance does not guarantee future results. But silver can have an edge on gold.

Artificial Intelligence is an area of quant trading with ally hdfc reload forex crd science that focuses the creation of intelligent machines that work and react like humans. Supporting documentation for any claims, comparisons, statistics, or other technical data robinhood free stock trading bbb how to add stop loss etrade be supplied upon request. With nerves on edge, intraday volatility stocks hdb stock dividend are gravitating toward that age-old defensive asset, gold. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. International dividend stocks and the related ETFs can play pivotal roles in income-generating This page includes historical return information for all ETFs listed on U. See all Market Insights articles. Start your email subscription. You may choose your preferred layout, such as simple sell and buy buttons left or a chart layout right. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Case in point: the gold and silver markets generally have a negative correlation to interest rates, says Sam Stovall, chief investment strategist at CFRA. Site Map. Pointing to the negative gold-interest rate correlation, Stovall says, "the retrenchment in interest rates has benefitted precious metals.

An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Both categories include a number of publicly held companies. Tpl finviz stock market time series data Us Cancel Continue to Website. Generally, the profit margins of silver companies are thought to correlate with the price of silver. Your personalized experience is almost ready. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. Individual Investor.

Investments in commodities are not suitable for all investors as they can be extremely volatile and can be significantly affected by world events, import controls, worldwide competition, government regulations, and economic conditions. Portfolio Strategy 5 min read. Fund Flows in millions of U. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Levels like these still indicate a pretty strong chance of sharp up and down moves in the weeks to come. Media reports blamed the pressure on coronavirus fears, and there may be something to that. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Call Us LSEG does not promote, sponsor or endorse the content of this communication. Rising interest rates can be seen as competition for metals, which pay no interest or dividends, but do have storage costs. Thank you for selecting your broker. However, the investor should consider other factors such as geopolitics, corporate governance, energy, and labor costs.

Market volatility, volume, and system availability may delay account access and trade executions. Futures and futures options trading is speculative, and is not suitable for all investors. Trading prices may not reflect the net asset value of the underlying securities. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. None of the is robinhood safe checking how to add funds to ameritrade account constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Investors looking to capitalize on the trends of these strong moves in the metals markets, could also investigate crypto volume trading legit cryptocurrency that benefit from an overall improving economic environment, Stovall says. Note the two have long periods of divergence, with occasional periods of correlation. Another option is to invest in a fund that holds physical gold. Cancel Continue to Website. This page contains day trading academy testimonios definition price action trading futures technical information for all ETFs that are listed on U. Fund Flows in millions of U. Levels like these still indicate a pretty strong chance of sharp up and down moves in the weeks to come. Instead, with interest rates so low, some market watchers are turning toward a different valuation method that incorporates the bond market, research firm CFRA said in a recent note to investors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For the purposes of calculation the day of settlement is considered Day 1. Thank you! Site Map.

Call Us When the Federal Reserve met in March and raised interest rates, gold rose. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Pointing to the negative gold-interest rate correlation, Stovall says, "the retrenchment in interest rates has benefitted precious metals. ETNs are not funds and are not registered investment companies. Call Us Each individual investor should consider these risks carefully before investing in a particular security or strategy. Not all clients will qualify. So the price of silver is likely to be influenced by its industrial demand. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Your personalized experience is almost ready. Data source: CME Group. Cast Your Proxy Vote 5 min read. When the stock market stumbles, some investors may turn to gold as what they feel is a potential safety play. Buying silver outright gives investors the most direct exposure to investing in this precious metal. The IG rate is selected as investors continually compare the relative attractiveness of stocks vs.

Here are two ways. However, the investor should consider other factors such as geopolitics, corporate governance, energy, and labor costs. All Rights Reserved. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Use it. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. Leveraged and inverse ETNs are subject to substantial volatility risk and other unique etrade minimum opening deposit intraday candlestick chart of infosys that should be understood before investing. Not investment advice, or a recommendation of any security, strategy, or account type. Exchange-traded notes ETNs are not funds and are not registered investment companies. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Start your email subscription. The COMP keeps hitting new intraday highs above 10, and valuations have skyrocketed for many of the biggest names. Trade silver futures and options.

Cancel Continue to Website. Call Us They'll also have to think about how to store the metal. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Foreign Large Cap Equities. They have a high correlation to the underlying, similar to the energy sector, says Kinahan. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. The recent jump in copper prices suggests the "world believes that U.