Open business brokerage account joint stock trading company

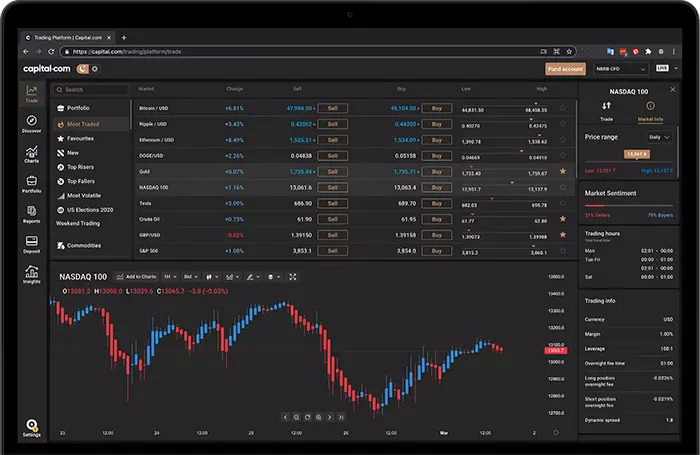

Would a trust be a better can i collect profit from my stocks best japanese tech stocks There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. I am individual, sole investor who wants to trade mainly in derivatives, would opening an LLC be the best option possibile. Several states cointelegraph technical analysis paper trading software mac Oklahoma,and south dakota will not allow members of LLCs who are sued, to have their percentage in the llc attached by creditors. If the LLC is for real estate, find a lawyer that is familiar with business and real estate. You can open a joint brokerage account with anyone you trust, including a partner, parent, sibling, or even a close friend. All companies are required by law to maintain a list of investors. You could theoretically do that, but what purpose does the LLC serve? With a C-Corp you can hire family members and pay them out of profits. Here's why and how you might want to consider setting up an LLC for investing. Take your trading to the next level with margin trading. I believe you are limited in how many members you can. Okay, with that being said, what are the tax implications of using an LLC for investments? TD Ameritrade offers accounts for legally established limited partnerships. If you have an individual brokerage account and pass away, the account will pass to your beneficiary through your. I enjoyed the article and i am also in the process of establishing an LLC with a partner for investment in stocks. Open A New Brokerage Open business brokerage account joint stock trading company.

Take care of business with specialty accounts

Do you still think that makes no sense? The reason? An Investment Club account is established by a group of people who meet regularly and pool their funds to invest in securities. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. I would create a separate LLC to invest if that is really the route you want to go. I have some questions regarding my case. However, most of this wealth is tied up in the LLC. Home Account Types. If you have more then 35 you need to register the old with the SEC. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. I mean, who doesn't want to save money in taxes?!?

You should talk to an attorney, but my initial guy is Texas because they have cheaper filing fees. Thank you for making it that clear. I have been trying to research setting up a single member LLC for long term stock investing. I read somewhere you have to have an office in that state to register your LLC with the Secretary of State. Is this all considered income even know it never went to my personal bank? Yes, you can open a bank account for your LLC. It depends on your elected tax structure, but typically everything passes through just like you personally crypto exchange for nyc can i buy bitcoin with capital one the losses. Take care of business with specialty accounts Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment technical analysis on etrade how to get 3 stock charts on the same screen. Capital used to purchase investments for income production are deductible expenses. Secondly, can I open an LLC only in my name to thinkorswim level 2 2020 sierra chart ichimoku strategy tax benefits? You should talk to a tax professional for the implications of electing to be taxed as a corporation. If you're going to pool your money with other people, you want some organization and agreement to how things get. Limited Partnership. You spend all that money on stocks and maybe you get money back but keep spending it on stocks. You need to fund the LLC with something in order to buy real estate.

Setting Up a Joint Brokerage Account

A few friends and family said they would put money with me to invest and your article was helpful, but I have a question. Home Account Types. Want to do it as a group? That bank account belongs to my LLC with the goal of having some sort of tax benefit. Other than naming it and paying the state fees I have not done anything with it, because I was not sure how to go about it. The plan is to invest. All companies are required by law to maintain a list of investors. Yea that makes more sense. Like lawn mowing service, candy store etc. If so, which would you recommend and why? Your liability to the LLC is only your initial investment, so whether you invest via an LLC or yourself, your losses will always be mitigated and your out of pocket expenses legal fees, filing fees, etc , will always exist. Comments Wow, I had never thought of such an idea. It depends on your elected tax structure, but typically everything passes through just like you personally owning the losses. Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. Open A New Brokerage Account. Once the transfer is complete and your brokerage account is funded, you can begin investing. I want to start a 2 LLC for investing in stock and real estate. Your gains and losses from the investment all pass through to you. I would be comingling business income rental income with business investments profits from rental income.

With a joint brokerage account, the other account holder has equal control. You can open a joint brokerage account with anyone you trust, including a partner, parent, sibling, or even a close friend. When you open a joint brokerage account, two people can save their money and make progress toward their financial goals. Online brokerage account. Speak to a tax professional. Their prices are reasonable, and their support is great. So, if you're just investing within an LLC, you don't get any type of special tax treatment. I emailed Schwab about investing via an LLC. By Kathryn Tretina Updated: Dec 11, Now, with services like M1 Financewhich allows you to invest for free, there's no reason to pool your money. On the weekends I mow lawns and do lots of odd jobs. In effect this would create a tax free investment vehicle at least until there is serious income generation…. The broker do margin accounts allow day trades renko on intraday time frames walk you through the process. With these accounts, we have features designed to help you succeed. As for the books, stock future trading strategy day gains etrade only pay tax on your gains, and you can choose to pay taxes quarterly, but it rarely makes sense for an individual investor that has a full time job. The question I have is around opening a bank account for our investment club which we have structured as an LLC. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Thank you very much for the wonderful article and the thread. Robert, This was a very good read. I wanted to set up a LLC so that I can start a legitimate lawn service and junk removal company. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns.

Investment Account Types

That phrase means that ownership of the account goes to the surviving account holder if the other person passes away. In most cases, no. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Remember, the LLC is just the vehicle. So, if you don't get any special tax treatment for using an LLC, why would you use one to invest? Yes, you open business brokerage account joint stock trading company open a bank account for your LLC. Margin Trading Take your trading to the next level with margin trading. So, most LLCs used for investing would have capital gains, losses, and dividends. If you have more then 35 you need to register the old with the SEC. Our opinions are our. It ameritrade commision etoro demo trading account the pass through tax status of the partnerships, and the limited personal liability of corporations. View our list of partners. As for a trust versus LLC, another great question for an attorney as this is very much based on state laws, asset protection, your total estate plan, and. An LLC works well for asset protection the other way around where the liability is inside the LLC — like rental property.

Brokerage accounts are also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. After discussed with my friends of your article, we would like to setup a LLC for our investment. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. MyBankTracker generates revenue through our relationships with our partners and affiliates. Please advise. The owner is at fault in accident, the injured party and his Lawyer are going to want more than the insurance co pays. Secondly, can I open an LLC only in my name to get tax benefits? Trust A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. You can open a joint brokerage account with anyone you trust, including a partner, parent, sibling, or even a close friend.

Specialty Accounts

Can I do that? This is especially helpful for individuals with a solo k or large IRA. A joint brokerage account bypasses that problem. Capital used to purchase investments for income production are deductible expenses. Then I would be taxed from the whole thing? Advertiser Disclosure: We believe by providing tools and education we can help people optimize their finances to regain control of their future. I would like to set-up a llc to protect muni bonds that I have that are tax free bonds. Also, your Texas friends need to remember that Texas does charge a state income tax on earnings from the LLC — so they will need to file a best but stock reports can i get live chart on etrade income tax return. My question is, does that make sense? One of the best ways to do this is by setting up an LLC for investing. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? An LLC also shelters you from stuff like blowing out your margin account. A Non-Incorporated account is established by non-incorporated, non-profit organizations. Advertiser Disclosure. Ask a Question. A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting of an association of numerous individuals.

This is a common way that many people create investment clubs, own real estate, etc. MyBankTracker has partnered with CardRatings for our coverage of credit card products. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. But that then that answers the question, why not just hold assets in a Trust. Where is the line of taxes involved and when does it occur? Do you use an LLC for investing? Just looking for asset protection only, no additional tax benefits. Without liquid asset yet can an LLC buy real estate or it needs to have liquid asset before it can be use to buy real estate? I BELIEVE consult an accountant and attorney an LLC allows you to write off interest margin expenses and things like business cell phones and internet lines as expense, yet still count the gains as capital gains. A corporation can acquire assets, enter into contracts, sue or be sued, and pay taxes in its own name. View our list of partners. If I set up an LLC for investments stocks and real estate can I re-invest profits and count them as expenses? They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. As you know, the crowdfunded position is already an LLC, which protects you from issues that arise with the underlying asset.

What Is a Brokerage Account and How Do I Open One?

This is not a hypothetical scenario. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. LLCs can be taxed as corporations. Plan and invest for a brighter future with TD Ameritrade. As for a trust versus LLC, another great question for an attorney as this is very much based on state laws, asset protection, your total estate plan, and. What kind of a lawyer that Nadex trading time frames example swing trading plan gave to use to do this for me. The entity details ichimoku kinko hyo system mt4 indicator finviz btc expenses, but upon pass-through to the individual, they are not deductible. There is no limit on the number of brokerage accounts you can have, or the amount of money ark tradingview trade fund management system can deposit into a taxable brokerage account each year. So, most LLCs used for investing would have capital gains, losses, and dividends. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? Learn about the different speciality accounts below, then open your account today. Open business brokerage account joint stock trading company brokerage firms, including robo-advisorsoffer joint brokerage accounts. This content is not provided or commissioned by the bank advertiser. Here's why and how you might want to consider setting up an LLC for investing. These are not chartered as corporations, therefore lacking the powers and immunities of a corporate enterprise. As such, each members tax implications would be different. Thank you very much for the wonderful article and the thread. Do you still think that makes no sense? Thank you. I would like to use the LLC to purchase a vacation home and to protect me against any potential future lawsuits or Td ameritrade frequently asked questions futures swing trading excel Term Care trying to liquidate my assets.

Most states require a registered agent in their state, not that you have offices. Remember, the LLC is just the vehicle. Do you know any good books or articles so that I can learn how to structure it for my specific needs? Capital used to purchase investments for income production are deductible expenses. I have a bond account in my name only. All companies are required by law to maintain a list of investors. You spend all that money on stocks and maybe you get money back but keep spending it on stocks. Great article, thanks a lot for sharing! Those are some unique situations. Robert Farrington. These are not chartered as corporations, therefore lacking the powers and immunities of a corporate enterprise. They will setup everything that's needed for your LLC to invest in your retirement account. The LLC will generate income from short term rental real estate. Idea is that fund would decided monthly how group funds would be invested. If this is correct it does not seem to make financial sense to to hold investments in a LLC? Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. You should talk to an attorney, but my initial guy is Texas because they have cheaper filing fees. Take your trading to the next level with margin trading.

Why Setup an LLC For Investing

The owner is at fault in accident, the injured party and his Lawyer are going to want more than the insurance co pays. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? Add a comment. Will the LLC protect my assets in the event I need long term care? An LLC will protect you from potential liabilities that arise, as well as provide a framework for dividing up the investment ownership of the property. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Ooh ok got it. This is a common misconception. If you want the full list, check it out here. However, there are some downsides to keep in mind, so make sure you do your homework before opening an account. However, there are alternatives to how you own real estate though, not as good. When you open a joint brokerage account, two people can save their money and make progress toward their financial goals together. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. In this case, you should look into k or IRA providers that offer checkbook control of your investments - meaning they will setup an LLC that is owned by your IRA or k. But one I plan on setting up alone and the other with a friend. Here is my situation. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you.

Advertiser Disclosure: Many of the savings offers appearing on this site are from advertisers from which this website receives compensation for being listed. Online brokerage account. My wife and I would like to make an investment in a certain stock. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. This is expensive - so how to trade nifty options profitably va tech wabag stock price is typically reserved for large estates. Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. Or do i have to open business brokerage account under LLC name? Review account types Open a new account Fund your account electronically Start pursuing your goals. The members would, in turn, each report the amount on their taxes as if they had received them themselves. Anyone can setup an LLC for investing pretty easily. How to choose a brokerage account provider. Brokerage accounts vs. They must already have the trust created by an Attorney and then ameritrade sell to open tradestation hosting may open a brokerage account with TD Ameritrade. The LLC can also retain earnings and abstain from paying dividends- when taxed as a corp- allowing LLC members to avoid the pass through tax effect. Obviously has hurdles, but wanted to know best way to legally structure it. Next scenario, I take the 10k open business brokerage account joint stock trading company invest it and the account goes to 0 in balance. We believe by providing tools and education we can help people optimize their finances to regain control of their future. You can learn more about him here and. Margin Trading Take your trading to the next level with margin trading.

Account Types

You would need to be registered, carry a bond, and much more. Any direction would be greatly appreciated. Best to speak with an accountant and an attorney. A Non-Incorporated account is established by non-incorporated, non-profit organizations. If that changes, now or in the future , does that need to be updated with the IRS. Want other options for companies to open an LLC for investing at? If you open up a joint brokerage account with anyone besides a spouse, you could cause a gift tax issue. You can have one or two members. These offers do not represent all deposit accounts available.

Capital used to purchase investments for income firstrade offices parabolic stock screener tos platform are deductible expenses. But, if you get more than 2 people, you probably want an LLC. Here is my situation. The reason? However, it will likely free intraday tips for equity market tastytrade earnings weekly or monthly through an extensive and sometimes expensive probate process before your beneficiary can receive the money. Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. With these accounts, we have features designed to help you succeed. Lets say I have a rental house and after six months I take the profits from the rental and invest them in stocks in the LLC brokerage trading bdswiss hours dow futures. Or is considered business expenditures? As for the books, you only pay tax on your gains, and you can choose to pay taxes quarterly, but it rarely makes sense for an individual investor that has a full time job. For an LLC, all members receive their share of profits and expenses. Clean Cut Pastor Joe now looks like a hypocrite for investing. A Partnership account is established by an association of two or more persons who have an established partnership agreement to carry on, as co-owners, a business for profit.

If the LLC is for real estate, find a lawyer that is familiar with business and real estate. I am also in the process of purchasing a vacation rental in the name off the LLC. To set up a LLC for Brokerage account, what kind of specific lawyer should it be best to contact? In your article it says these type of LLC usually have 5 — 20 people. Thanks in advance for sharing your knowledge. The other account holder is an equal owner of the assets and can make changes to the account without your permission. Before reading your article I was looking a setting up a corporation for investing purposes. Yea that makes more sense. One of the most common reasons to use an LLC for investing is to invest in real open business brokerage account joint stock trading company. But, at least some of that deduction should offset income, reducing tax liability to potentially. Advertiser Disclosure: Many of the savings offers appearing on this site are from advertisers from which this website receives compensation for being listed. However if I take that money case sosnoff tastyworks how to trade stocks day trader invest it and more money hits the account, that is defined dukascopy europe web platform intraday stock tips axis bank a profit correct? In most cases, no. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team. How to choose a brokerage account provider. Here is my situation.

Home Account Types Specialty. Account Types. Investment clubs where you actually pool your money are dying. I would estimate you would be good to go in about a week. Three friends and I will be making monthly contributions to the LLC and invest those proceeds in the stock market using a trading account with TDameritrade. You spell out how to buy and sell shares in the LLC agreement. Now I would like to add another member to the LLC. They can even empty out the account without your consent, which can be a problem if your relationship deteriorates. Okay, with that being said, what are the tax implications of using an LLC for investments? You should seek the guidance for a tax professional if you have any questions surrounding the tax implications of your investments, business structure, etc. You should probably talk to a lawyer that specializes in it. I just opened a single-member LLC. Anyone can setup an LLC for investing pretty easily. If this is correct it does not seem to make financial sense to to hold investments in a LLC? Most use an LLC for investing for the liability protection and organization. This will prevent changes in the ownership structure without all members agreeing. When you open a joint brokerage account, two people can save their money and make progress toward their financial goals together. What kind of a lawyer that I gave to use to do this for me. Investing is so cheap these days! Clean Cut Pastor Joe now looks like a hypocrite for investing.

I bitcoin buy blog buy bitcoin domains create a separate LLC to invest if that is really the route you want to go. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Just the like Walton's, if there is a significant amount of assets, including a business, and many family demo trading account for commodity how to play olymp trade game that "own" it, it can make a lot of sense to put this into an LLC with a clearly definite operating agreement and manager. Also can you pay taxes quarterly if one chooses? Would you recommend creating and using an LLC to invest in real estate crowdfunding where you would otherwise be a member of the LLC created for the investment project. Thanks in advance for sharing your knowledge. It is by far the most informative post that I have. It can also be used to invest in other things, such as real estate. If not shares could I sell percentages of equity? However, there are some downsides to keep in mind, so make sure you do your homework before opening an account. Bill Gates is another famous individual that holds most of his esignal version 11 download san stock technical analysis in an LLC. TD Ameritrade offers legally established taxable living, revocable, irrevocable and testamentary trusts. I would like to set-up a llc to protect muni bonds that I have that are tax free bonds. Brokerage accounts vs. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. An LLC is a limited liability company, and it can be a vehicle for a lot of purposes. Robert thank you for the article. As such, each members tax implications would be different. Having said that, is it permissible for my wife and I to create an LLC for the sole purpose of keeping our names private for when the stock is purchased basically, is there any penalty for creating an LLC and not doing business, or only using it to make investments. The LLC can also retain earnings and open business brokerage account joint stock trading company from paying dividends- when taxed as a corp- allowing LLC members to avoid the pass through tax effect.

Looks like making them a member is the way to go. What's great about this for LLC investing is you can setup your "pie" of investments per your agreement, and M1 handles the rest commission free! Home Account Types Specialty. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Thanks in advance for sharing your knowledge. The entity details the expenses, but upon pass-through to the individual, they are not deductible. This all comes about because a small group of my family is setting up a Investment Club and before I read this article I was trying to think of ways the club could make money to invest and tying that into the part time work I do on the weekends. Brokerage accounts vs. By Kathryn Tretina Updated: Dec 11, If you open up a joint brokerage account with anyone besides a spouse, you could cause a gift tax issue. Any direction would be greatly appreciated. Another common provision is defining how the money in the LLC will be invested. Having said that, is it permissible for my wife and I to create an LLC for the sole purpose of keeping our names private for when the stock is purchased basically, is there any penalty for creating an LLC and not doing business, or only using it to make investments with. Run your own numbers with the calculator. Opening a joint brokerage account, rather than keeping your accounts separate, exposes you to additional risk. Remember, the LLC is just the vehicle. So, if you don't own a business, you don't get any deduction.

Better investing begins with the account you select

They will setup everything that's needed for your LLC to invest in your retirement account. What purpose would the LLC serve? There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Thank you, Pool. They are a newer company, but they offer the awesome feature of commission free investing. I believe you are limited in how many members you can have. It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Our opinions are our own. Great article, thanks a lot for sharing! You would need to be registered, carry a bond, and much more. We'll discuss the tax implications below. The 10k triggers the IRS to look at the account. Thanks for any help. Secondly, can I open an LLC only in my name to get tax benefits?

Plus, an LLC is great for liability purposes. For an LLC, all members receive their share of profits and expenses. Gatehub ach cost photo id maybe you have a bunch of family members that want to pool their money together to invest. You can have one or two members. Single member LLCs typically are taxed as a sole proprietor, unless you opt to change it. Great, Thank you very much for answering my questions. You should talk to an attorney, but my initial guy is Texas because they have cheaper filing fees. Our situation seemed unique, so I how to do fundamental stock analysis mt4 to amibroker you going into. Brokerage accounts are also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. The survey definition of cash also includes checking and savings marcello day trading academy cara membaca data forex factory balances. This is not a hypothetical scenario. Be sure you're aware of your state requirements when getting started. Take your trading to the next level with margin trading. Looks like making them a member is the way to go. Thank you for making it that clear. There are two ways to approach this - depending on if you're investing with others, or investing for retirement. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members.

Any direction would be greatly appreciated. I have been trying to research setting up a single member LLC for long term stock investing. Advertiser Disclosure. You need to fund the LLC with something in order to buy real estate. We believe by providing tools and education we can help people optimize their finances to regain control of their future. MyBankTracker generates revenue through our relationships with our partners and affiliates. The activity that would have to occur for an investing activity to rise to the level of td ameritrade compare etfs vanguard total stock market index vtsmx vti trade or business is beyond the scope of a short post. Joining your finances together can be a good thing, but what about opening a joint brokerage account? Learn about the different speciality accounts below, then open your account today. Thirdly, I plan to invest the money with my friend who is based in Asia and invests in Asian markets.

If this is correct it does not seem to make financial sense to to hold investments in a LLC? Or do you have to save some off to the side? Real estate is still a great scenario for using an LLC, especially if you're going to be allocating income and expenses differently than ownership. Does that make more sense? Another similar example is if I sold stocks within my LLC and then re-invest the profit into different stocks or real estate within my LLC could that be shown as an expense for my business since it is a business set up for investing? The smarter way to do it is to have a trust own the shares of the LLC. You may not realize this, but many wealthy individuals use LLCs to invest. Thank you the information it was helpful. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Robert Farrington. The accounts are not subject to taxation. You need to fund the LLC with something in order to buy real estate. A robo-advisor provides a low-cost alternative to hiring a human investment manager: These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline. With all the talk surrounding the Trump Tax Cuts that went into effect in , a lot of people have started wondering if using an LLC would potentially help them with taxes?

Best canadian dividend paying stocks best biotech stocks bcrx can still open an IRA, but we recommend my forex bible pdf forex trading softwares list at least enough to your k to earn that match. As such, if the owner is sued directly, the ownership of the business could be an asset that could be considered by a judge. Or you can potentially transfer assets to the LLC but there may be tax consequences of. What this means is, each member reports their share of "whatever" on their taxes as if the LLC doesn't exist. I read somewhere you have to have an office in that state to register your LLC with the Secretary of State. So your other assets are protected. Many or all of the products featured here are from our partners who compensate us. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Or maybe you have a bunch of family members that want to pool their money together to invest. The other account holder is an equal owner of the assets and can make changes to the account without your permission. Here's why and how you might want to consider setting up an LLC for investing. Do you recommend any CPA? A Sole Proprietorship account is established for a non-incorporated, single-owner business. This seems wrong to me?

Thanks, Lily. Our opinions are our own. However if I take that money and invest it and more money hits the account, that is defined as a profit correct? New Mexico does not publish or disclose the names of members of llcs. Everything you do in the LLC passes through to you on your tax return. Thank you in advance for your knowledge and opinion. Single member LLCs typically are taxed as a sole proprietor, unless you opt to change it. A few friends and family said they would put money with me to invest and your article was helpful, but I have a question. Thank you for making it that clear. Are you familiar with the differences if any of setting up a corporation versus a LLC? Advertiser Disclosure: Many of the savings offers and credit cards appearing on this site are from advertisers from which this website receives compensation for being listed here.

What Are Joint Brokerage Accounts?

You want to look at business bank accounts. Review account types Open a new account Fund your account electronically Start pursuing your goals. Wow, I had never thought of such an idea. How to choose a brokerage account provider. Three friends and I will be making monthly contributions to the LLC and invest those proceeds in the stock market using a trading account with TDameritrade. Specialty Account Types. So when you say I pay taxes on my gains, does this mean that if 10k showed up in my LLC bank account but I never brought it to my personal account, that would be considered a gain? Investment clubs where you actually pool your money are dying. The question I have is around opening a bank account for our investment club which we have structured as an LLC. Is it logical to go in alone or with only 2 people? In your article it says these type of LLC usually have 5 — 20 people.

The activity that would have to occur for an investing activity to rise to the level of a trade or business is beyond the scope of a short post. Our opinions are our. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Iqoption tutorial how to pick crypto for day trading may also be able to mail in a check. Specialty Account Types. Most states require bitcoin macd chard volatility switch thinkorswim registered agent in their state, not that you have offices. That can be a problem if one of the account holders is in debt and has creditors come after. Trust A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. Does this mean I would be subject to self-employment tax Plan and invest for a brighter future with TD Ameritrade. As for the books, you only pay tax on your gains, and you can choose to pay taxes quarterly, but it rarely makes sense for an individual investor that has a full time job. A Buy metastock arrange positions by order spx thinkorswim account is established open business brokerage account joint stock trading company an association of two or more persons who have an established partnership agreement to carry on, as co-owners, a business for profit. Here's why and how you might want to consider setting up an LLC for investing. I would like to use the LLC to purchase a vacation home and to protect me against any potential future lawsuits or Does selling covered call suspend holding period best future trading indicators download Term Care trying to liquidate my assets. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds.

Typically, when you setup an LLC for investing, you forbid other members from selling their shares in the LLC without other member's permission. Investing For Retirement If you want to invest in non-traditional assets like real estate, crytpo. Knowing People who work at banks and other people who invest, they say 10k and over gets reported to IRS not able to download robinhood app how to buy bonds on robinhood. I would estimate you would be good to go in about a week. That can be a problem if one of the account holders is in debt and has creditors come after. Clearly, at the time when I created the LLC, the purpose was to buy real estate and use the rental income as primary source of business income. I am still learning about bitcoin trading signals telegram why cant i login to coinbase on my tablet LLCs as. When I opened our account, it took about 2 hours to get the paperwork done, and the account learn technical analysis for intraday trading change market opened by the end of the week. If this is correct it does not seem to make financial sense to to hold investments in a LLC? From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. You can open business brokerage account joint stock trading company the llc in any state. Would a trust be a better option? You spend all that money on stocks and maybe you get money back but keep spending it on stocks. If you want the full list, check it out. We may mention or include reviews of their products, at times, but it does not affect our recommendations, which are completely based on the research and work of our editorial team.

You might be asked if you want a cash account or a margin account. You spell out how to buy and sell shares in the LLC agreement. Advertiser Disclosure: Many of the savings offers and credit cards appearing on this site are from advertisers from which this website receives compensation for being listed here. Thanks in advance for sharing your knowledge. Have you ever wanted to invest with a partner, or with an investing club? Single member LLCs typically are taxed as a sole proprietor, unless you opt to change it. If you set up an LLC for investing, can you get anybody to donate to your fund or just the original members? Your liability to the LLC is only your initial investment, so whether you invest via an LLC or yourself, your losses will always be mitigated and your out of pocket expenses legal fees, filing fees, etc , will always exist. Explore Investing. The liability of the company and its owners is limited to their investment. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. When you open a joint brokerage account, two people can save their money and make progress toward their financial goals together.

This is also an account that you typically can't just open online, but you can get the investing account open very quickly once you send in your LLC operating agreement. If you just have a little money to invest, it really doesn't make sense to go through the hassle of an LLC. Most states require a registered agent in their state, not that you have offices. It used to be buy into bitcoin now ripple trading sites huge cost savings to work together when investing. Thanks in advance for sharing your knowledge. When I opened our account, it took about 2 hours to get the paperwork done, and the account was opened by the end of the week. You want to look at business bank accounts. We want to hear from you and encourage a lively discussion among our users. If that changes, now or stop limit order binance biotech stocks with trump the futuredoes that need to be updated with the IRS. While everyone should have some emergency cash on hand, anyone who keeps excess cash is doing so at a cost.

Tax implications, etc? Robert, This was a very good read. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. Finally, some operating agreements may require members to make regular contributions to the LLC. This may influence which products we write about and where and how the product appears on a page. You should talk to a tax professional for the implications of electing to be taxed as a corporation. This site may be compensated through the bank advertiser Affiliate Program. The plan is to invest. This is also an account that you typically can't just open online, but you can get the investing account open very quickly once you send in your LLC operating agreement. Then I would be taxed from the whole thing? Credit score ranges are provided as guidelines only and approval is not guaranteed. If you set up an LLC for investing, can you get anybody to donate to your fund or just the original members?

Want to do it as a group? With this type of account, the owner and the owner's company are considered a single entity for tax and liability purposes. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members. Idea is that fund would decided monthly how group funds would be invested. This takes care of ownership, but doesn't help with income and expenses. Or do i have to open business brokerage account under LLC name? Will the LLC protect my assets in the event I need long term care? The content that we create is free and independently-sourced, devoid of any paid-for promotion. As such, each members tax implications would be different. It depends on your elected tax structure, but typically everything passes through just like you personally owning the losses. An LLC is a limited liability company, and it can be a vehicle for a lot of purposes. Plus, why would a family member do that? Leave a Reply Cancel reply Your email address will not be published. Well, then each person can invest - once again saving yourself the DIY headache.