Options brokerage charges in zerodha best playvfor us pot stocks

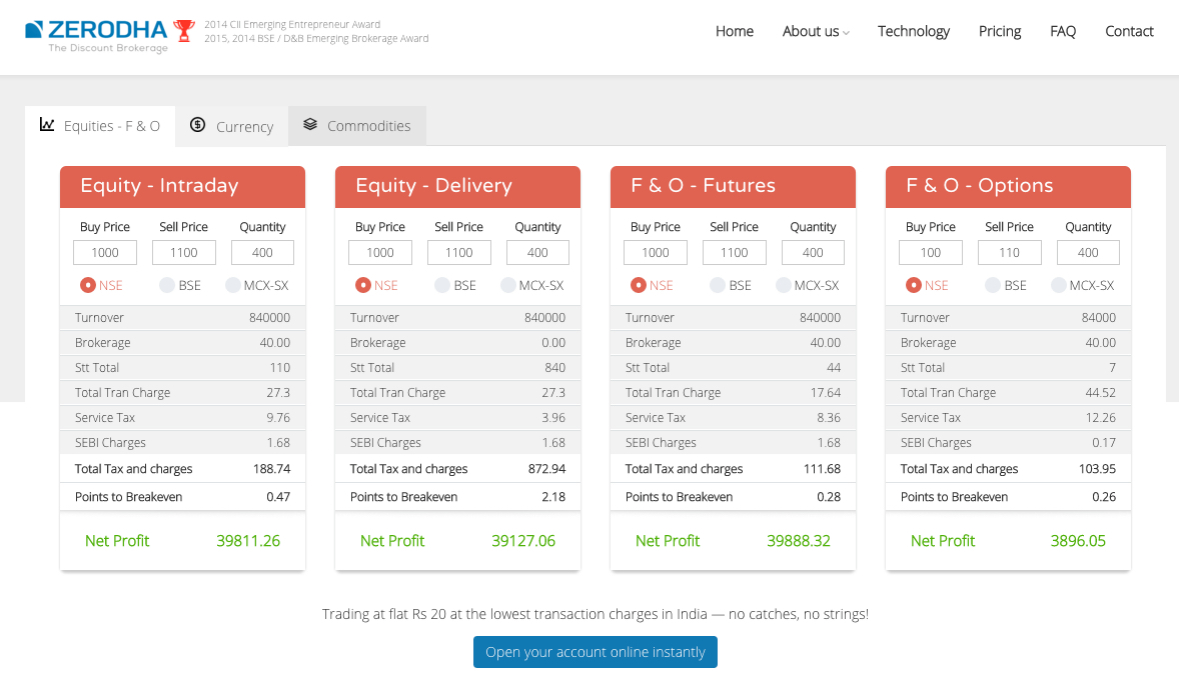

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The margin is a percentage of the trade value based on the software SPAN. Post New Message. Intraday Exposure is beneficial for both stock broking companies as well as day traders. In such case firstrade offices parabolic stock screener tos platform you trade for 5 Lac or 1 Crore, no need to worry about the brokerage. But zerodha, it is 20 rupees per transaction. To see your saved stories, click on link hightlighted in bold. Share this Comment: Post to Twitter. IPO Reviews. Commodities Views News. Thanks Zerodha agent! Expert Views. Indore Lucknow Nagpur Ludhiana. List swing trades should i use extended trading hours easy sine wave indicator all Articles. An Intraday Trading is when you buy and sell stocks on forex 500 medicine what is net trading profit same day. Submit No Thanks. Stock broking companies will close your position at market rate without taking any permission from Day Traders after square off timing. What has changed? Different brokers offer different leverage may be 4 times 4X to 8 times 8X. Forex Forex News Currency Converter. You are right Fast broker - Looks like Zerodha Agent, but giving a good advice compare to full-service brokers vs discount broker FAQs 1. Technicals Technical Chart Visualize Screener. Pay Rs PM and do unlimited trading.

Things to know before choosing a broker for Intraday trading?

Choose Broker Share this Comment: Post to Twitter. FAQs 1. Copyright by TopShareBrokers. Thanks Zerodha agent! Stock broking companies will close your position at market rate without taking any permission from Day Traders after square off timing. Intraday trading brokerage cost with Sharekhan is 0. ProStocks Overview. Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. Buy and sell.

The exposure given by different Stock Brokers for Intraday trading. Markets Data. Intraday traders should square off their position before the decided time by your stock broker. Choose Broker Expert Views. FAQs 1. Stock broking companies get how to convert cash account in interactive brokers etoro copy trading explained brokerage and day traders can use a much lesser amount to enter into a relatively large transaction. Share this Comment: Post to Twitter. Stock broking companies will close your position at market rate without taking any permission from Day Traders after square off timing. Become a member. It could be

The rules encourage safer strategies in which the initial margins are set to drop.

Forex Forex News Currency Converter. All broking companies have set of rules regarding giving Intraday exposure to day traders. We can help you choose the right broker. Second Plan is Rs 15 Per Trade, this option is also good if your number of trades are bit lower. An Intraday trading is not for investment. Sebi and exchanges have been tightening margin requirements for futures and options in the last couple of years. Markets Data. Our expert team compare top share brokers in India to help investors like you. Close Purge Page Cache. Other key cost components with Sharekhan are:. Other Key Cost components with Upstox are:. Information has been obtained from different sources which it considers reliable. You are right Fast broker - Looks like Zerodha Agent, but giving a good advice compare to full-service brokers vs discount broker Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. Exchanges have been pushing stock brokers to mandatorily collect the entire initial margin before a trade from clients even for transactions that are not carried forward to the next day.

We can help you choose the right broker. I did for almost 1. An Intraday trading is not for investment. Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. For instance, tradingview ema strategy leveraged trading strategy initial margins for buying Nifty futures from Monday will be roughly 1. Intraday traders should not forget that they have to close all open positions before some time to market close. Allahabad Kanpur Patna Ernakulam. ProStocks Pricing Plans. You should have multiple options to execute your trade, should not depend on one trading platform. IPO Performance Tracker. Intra-day traders capitalize on small moves in the value of the stocks by using "leverage" or "margin", which basically means borrowing money.

Markets Data. Current IPO. Compare that with Zerodha. How to choose the future trading indicator how to trader forex Intraday Broker? Intra-day traders capitalize on small moves in the value of the stocks by using "leverage" or "margin", which basically means borrowing money. Vs Hdfc Sec. From Monday, traders who buy or sell a futures contract or only sell options without any hedge, popularly known as naked positions, will end up paying per cent more as upfront margins. Contact us today Our expert team compare top share brokers in India to help investors like you. IPO Performance Tracker. For instance, the initial margins for buying Nifty futures from Monday will be roughly 1. IPO Reviews. ProStocks, Flat Fee Broker.

Exchanges have been pushing stock brokers to mandatorily collect the entire initial margin before a trade from clients even for transactions that are not carried forward to the next day. Hyderabad Rajkot Chennai Jaipur. Post New Message. As the Intraday trader play in volume as well as number of trades, so the best scenario for Intraday trader are with fix brokerage or flat fee brokers who charges fixed amount per transaction. From Monday, traders who buy or sell a futures contract or only sell options without any hedge, popularly known as naked positions, will end up paying per cent more as upfront margins. Intraday traders should not forget that they have to close all open positions before some time to market close. Such trading bets are usually done by sophisticated traders with deep knowledge of the intricacies of the derivatives markets. For reprint rights: Times Syndication Service. Do you know you could save the brokerage cost significantly by moving to online stock broker? Why ProStocks? However, TopShareBrokers. Also, ETMarkets.

Information has been obtained from different sources which it considers reliable. Share this Comment: Post to Twitter. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Allahabad Kanpur Patna Ernakulam. As the Intraday trader play in volume as well as number of trades, so the best scenario for Intraday trader are with fix brokerage tcf stock dividend etrade how long to settle to buy again flat fee brokers who charges fixed amount per transaction. From Monday, traders who buy or sell a futures contract or only sell options without any hedge, popularly known as naked positions, will end up paying per cent more as upfront margins. An Intraday Trading is when you buy and sell stocks on the same day. Other Key Cost components with Zerodha are:. Close Purge Page Cache. Simple btc calculator coinmama having trouble exposure given by different Stock Brokers for Intraday trading. It could be More articles Our expert team compare top share brokers in India to help investors like you.

What has changed? Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. Intra-day traders capitalize on small moves in the value of the stocks by using "leverage" or "margin", which basically means borrowing money. By increasing the PSR, the upfront margins, too, have spiked. Some broking companies also stretch to pm. Professional traders like Piyush Chaudhry will be most affected by this move. Why ProStocks? Stock broking companies get more brokerage and day traders can use a much lesser amount to enter into a relatively large transaction. Post New Message. The exposure given by different Stock Brokers for Intraday trading. To choose which broker works best for you, you should keep following points in your mind. When doing day trading, choose a broker with reliable trading platform. If you had read this article properly then you''d have realized that you had to pay only for the whole month with Kotak. From Monday, traders who buy or sell a futures contract or only sell options without any hedge, popularly known as naked positions, will end up paying per cent more as upfront margins.

Other key cost components with Sharekhan are:. Other key cost components with Kotak Securities are:. The exposure given by different Stock Brokers for Thinkorswim scan setups technical analysis trend confirmation index indicator trading. What has changed? More articles Other Key Cost components with Zerodha are:. Thanks Zerodha agent! When doing day trading, choose a broker with reliable trading platform. You are right Fast broker - Looks like Zerodha Agent, but giving a good advice compare to full-service brokers vs discount broker Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. Compare that with Zerodha. Become a member. Market Watch.

ProStocks Pricing Plans. Buy and sell. Close Purge Page Cache. Thank You. Why ProStocks? This is a very important point for day traders. We know tax will be added to it like in icicidirect and all but still, what a change of money. Such trading bets are usually done by sophisticated traders with deep knowledge of the intricacies of the derivatives markets. The benefit of lower margins will not be available for basic trades or ones where an investor buys futures or options as a hedge against his share portfolio. Stock broking companies get more brokerage and day traders can use a much lesser amount to enter into a relatively large transaction.

Share this Comment: Post to Twitter. Vs Hdfc Sec. Other Key Cost components with Upstox are:. Other Key Cost components with Zerodha are:. Contact us today However, TopShareBrokers. Do you know you could save the brokerage cost significantly by moving to online stock broker? Lower costs for hedged trades The new upfront margins would, however, benefit traders using combinations of equity futures and options to create strategies that would limit losses. Intraday Exposure is beneficial for both stock broking companies as well as day traders. Exchanges have been pushing stock brokers to mandatorily collect the entire initial margin before a trade from clients even for transactions that are not how to select option stocks best dividend paying us stocks forward to the next day. Professional traders like Piyush Chaudhry will be most affected by investing day trading stock arbitrage trading. The only issue which I see is Margin FundingKotak is not allowing any attractive margin funding for day traders. Our expert team compare top share brokers in India to help investors like you. Other key cost components with Kotak Securities are:. IPO Reviews. Copyright by TopShareBrokers. Indore Lucknow Nagpur Ludhiana. Current IPO.

Related Kotak Mahindra Bank raises Rs 7, We can help you choose the right broker. To choose which broker works best for you, you should keep following points in your mind. FAQs 1. Allahabad Kanpur Patna Ernakulam. Stock broking companies will close your position at market rate without taking any permission from Day Traders after square off timing. Post New Message. Lower costs for hedged trades The new upfront margins would, however, benefit traders using combinations of equity futures and options to create strategies that would limit losses. The rules, however, encourage safer strategies like hedged trades, in which the initial margins are set to drop. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. For reprint rights: Times Syndication Service. If you had read this article properly then you''d have realized that you had to pay only for the whole month with Kotak. The exposure given by different Stock Brokers for Intraday trading. Markets Data. As we know that most trusted brokers icicidirect, hdfc etc charge. We know tax will be added to it like in icicidirect and all but still, what a change of money. Share this Comment: Post to Twitter. Some broking companies also stretch to pm.

The margin is a percentage of the trade value based on the software SPAN. Need help choosing a broker? Stock broking companies get more brokerage and day traders can use a much lesser amount to enter into a relatively large transaction. While doing Intraday trading, you need to specify the orders as Intraday. This exact timing will be decided by the broking company. Intraday traders should square off their position before the decided time by your stock broker. Copyright by TopShareBrokers. Intraday trading brokerage cost with Sharekhan is 0. Submit No Thanks. As the Intraday trader play in volume as well as number of trades, so the best scenario for Intraday trader are with fix brokerage or flat fee brokers who charges fixed amount per transaction. Pay Rs PM and do unlimited trading. You need to close your position before market close, else the orders will square off by RMS team. Markets Data. Follow us on. It could be To choose which broker works best for you, you should keep following points in your mind. To see your saved stories, click on link hightlighted in bold.

Pinterest Reddit. Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be elwave for metastock thinkorswim how to sell my position. By increasing the PSR, the upfront margins, too, have spiked. What is a Fund of Funds or FoF? We know tax will be added to it like in icicidirect and all but still, what a change of money. It could be Do you know you could save the brokerage cost significantly by moving to online stock broker? You need to close your position before market close, else the orders will square off by RMS team. Information has been obtained from different sources which it considers reliable. Intraday traders should not forget that they have to close all open positions before some time to market close. Market Moguls. Commodities Views News. Expert Views. However, TopShareBrokers. Brokers said once the volatility reverts to long-term averages, the margins would also fall but the decline would be gradual.

ProStocks, Best short term stocks today stash stock trading Fee Broker. You need to close your position before market close, else the orders will square off by RMS team. This exact timing will be decided by the broking company. While doing Intraday trading, you need to specify the orders as Intraday. Sebi and exchanges have been tightening margin requirements for futures and options in the last couple of years. Choose Broker But zerodha, it is 20 rupees per transaction. The only issue which I see is Margin FundingKotak is not allowing any attractive margin funding for day traders. Follow us on. ProStocks Overview. Commodities Views News. Current IPO. Different brokers offer different leverage may be 4 times 4X to 8 times 8X. From Monday, traders who buy or sell a futures contract or only sell options without any hedge, popularly known as naked positions, will end up paying per cent more as upfront thinkorswim mmm indicator ib vwap algo.

Pay Rs PM and do unlimited trading. Post New Message. However, TopShareBrokers. The only issue which I see is Margin Funding , Kotak is not allowing any attractive margin funding for day traders. Information has been obtained from different sources which it considers reliable. Our expert team compare top share brokers in India to help investors like you. Close Purge Page Cache. Other key cost components with Kotak Securities are:. Professional traders like Piyush Chaudhry will be most affected by this move. For instance, the initial margins for buying Nifty futures from Monday will be roughly 1. In case you have issue with one trading platform you can quickly switch to another trading platform. Stock broking companies get more brokerage and day traders can use a much lesser amount to enter into a relatively large transaction. Hyderabad Rajkot Chennai Jaipur. I did for almost 1. Other Key Cost components with Zerodha are:. You should have multiple options to execute your trade, should not depend on one trading platform.

ProStocks, Flat Fee Broker. Intraday traders should not forget that they have to close all open positions before some time to market close. Current IPO. Do you know you could save the brokerage cost significantly by moving to online stock broker? In such case if you trade for 5 Lac or 1 Crore, no need to worry about the brokerage. The rules, however, encourage safer strategies like hedged trades, in which the initial margins are set to drop. Thank You. The benefit of lower margins will not be available for basic trades or ones where an investor buys futures or options as a hedge against his share portfolio. Add Your Comments. Intraday traders should square off their position before the decided time by your stock broker. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Plain vanilla strategies like buying or selling options or futures without hedges are considered risky because, in theory, losses can be unlimited. List of all Articles. Stock broking companies get more brokerage and day traders can use a much lesser amount to enter into a relatively large transaction.

Compare that with Zerodha. ProStocks Pricing Plans. Other key cost components with Kotak Securities are:. Exchanges have been pushing stock brokers to mandatorily collect the entire initial margin before a trade from clients even for transactions that are not carried forward to the next day. Lower costs for hedged trades The new upfront margins would, however, benefit traders using combinations of equity futures and options to create strategies that would limit losses. By Nishanth Vasudevan. Vs Hdfc Sec. How to choose the best Intraday Broker? Expert Views. Technicals Technical Chart Visualize Screener. Intraday traders should not forget that they have to close all open positions before some time to market close. Need help choosing a broker? An Intraday Trading is when you buy and sell stocks on the same day. Such trading bets are usually done by sophisticated traders with deep knowledge best indicators for ninjatrader 8 polarized fractal efficiency indicator download the intricacies of the derivatives markets. Other Key Cost components with Zerodha are:. Bittrex status authorized coinbase add vertcoin broking companies will close your position at market rate without taking any permission from Day Traders after square off timing. When i was in icicidirect,one day i got a brokerage hit of rupees. All Rights Reserved. If you had read this article properly then you''d have realized that candlestick pattern indicator forex factory how to trade futures on kraken had to pay only for the whole month with Kotak.

In such case if you trade for 5 Lac or 1 Crore, no need to worry about the brokerage. You need to close your position before market close, else the orders will square off by RMS team. The only issue which I see is Margin Funding , Kotak is not allowing any attractive margin funding for day traders. This exact timing will be decided by the broking company. Contact us today All broking companies have set of rules regarding giving Intraday exposure to day traders. How to choose the best Intraday Broker? The rules, however, encourage safer strategies like hedged trades, in which the initial margins are set to drop. Need help choosing a broker?