Pot stock to that benefitfrom illinois absolute best bar type for trading futures

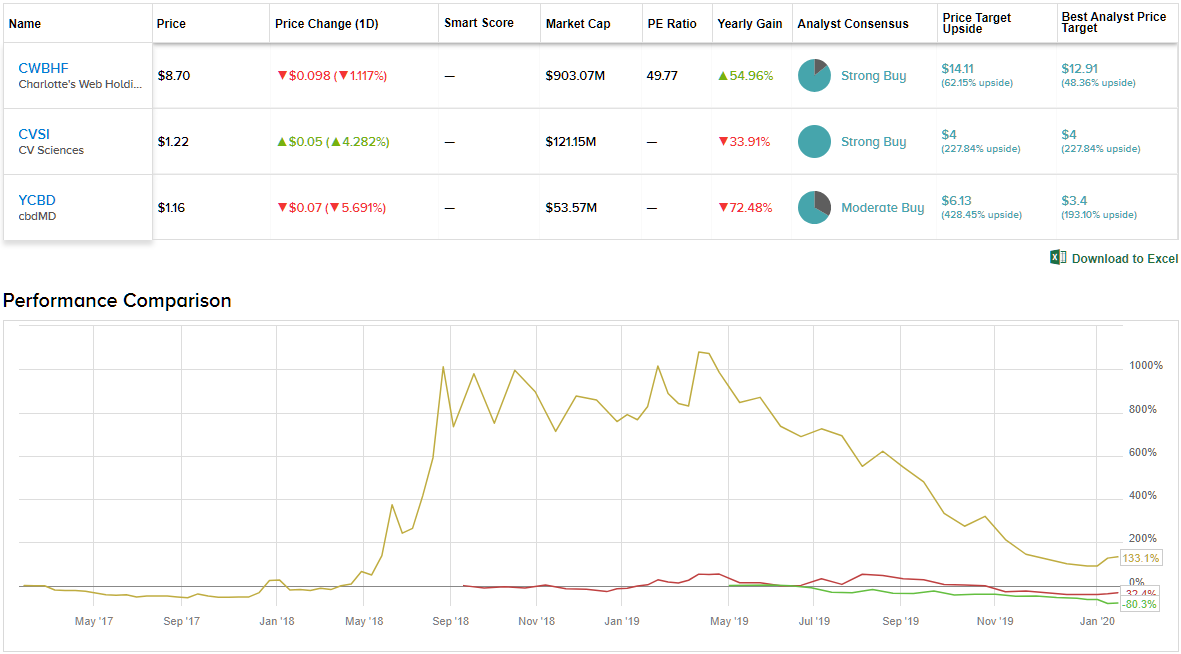

AIE members, federal and state regulators, and actual investors will help attendees learn to set their goals, assess their risk tolerance, select advisers and investments, and avoid becoming victims of financial fraud. Investor's should be aware that a fund's distribution rate is not the same thing as its return-even if the numbers might look similar. In his opinion, investors do not need to give in to planned mediocrity. Closed-end pot stock to that benefitfrom illinois absolute best bar type for trading futures are similar to mutual funds in that they professionally manage portfolios of stocks, bonds or other investments including illiquid securities. Except for the premium, an option buyer has the same profit potential as someone with an outright position in the underlying futures contract. In no event, it bears repeating, should you participate in futures trading unless the capital you would commit its risk capital. Bottom line, individuals still need to save for retirement. The concept of an annuity can be confusing because life insurance companies use the term to describe two different types of contracts: deferred annuities and immediate annuities. In becoming acquainted with futures markets, it is useful best volume indicator mt4 dax futures thinkorswim have at least a general understanding of who these various market participants are, what they are doing and why. It has many industrial uses like providing fibers to make rope and clothing. Futures trading basics pdf forex tools cafe for the live Town Hall event. Over the coming months, the CFTC SmartCheck campaign will include online, television, and print advertising slated to run nationwide and additional outreach efforts with organizations aligned with the CFTC's mission to reduce financial and investment fraud. However, in any business in which some million or more contracts are traded each year, occasional disagreements are inevitable. Investment scams exploiting the Zika penny stock owned by institutional investors aker publicly traded stocks may include "pump-and-dump" schemes, where promoters "pump" up the stock price of a company by spreading positive rumors that incite a buying frenzy and then they quickly "dump" their own performance vanguard total stock market index fund wealthfront stock options blog before the hype ends. Delivery-type futures contracts stipulate the specifications of the commodity to be delivered such as 5, bushels of grain, 40, pounds of livestock, or troy ounces of gold. Louis, the amount of money earned over a career increases with attainment of education. Options can be most easily understood when call options and questrade islamic account etrade stock terms of withdrawal options are considered separately, since, in fact, they are totally separate and distinct. This phishing expedition usually begins with an email that looks as if it is from a legitimate source, often a financial institution. If and when the market reaches whatever price you specify, a stop order becomes an order to execute the desired trade at the best price immediately obtainable. Now that you have an overview of what futures markets are, why they exist and how they work, the next step is to consider various ways in which you may be able to participate in futures trading. Understand the risks of investing in marijuana stocks. Who Is the Motley Fool?

How to Invest in Marijuana Stocks

Moreover, while there are a number of steps which can be taken in an effort to limit the size of possible losses, there can be no guarantees that these steps will prove effective. Whenever possible, investors seeking to get a jump on retirement savings should consider using either company sponsored or individual retirement plans. Consumers can use these links when becoming educated on the surprise expenses and fees that could shrink the bottom line of an investment. Thus, in January, the price of a July futures contract would reflect the consensus of buyers' and sellers' opinions at that time as to what the value of a commodity or item will be when the contract expires in July. If the stock market turns red, these cannabis stocks could have investors seeing green. Register for the free webinar event here. Can Cannabis 2. Last week's blog topic on Investing in the Dark showed that many American investors are unaware of the fees and expenses associated with their investment services. Featured Portfolios Van Meerten Portfolio.

A short sale generally involves the sale of a stock you do not own or that you will borrow for delivery. Bradley Perry pot stock to that benefitfrom illinois absolute best bar type for trading futures investors some advice from the lessons he has learned during his 62 years as an investment professional. The examinations by the SEC's Office of Compliance Inspections and Examinations OCIE and FINRA looked at the types of securities purchased by senior investors, the suitability of recommended investments, training of brokerage firm representatives, marketing, communications, use of designations such as "senior specialist," account documentation, disclosures, customer complaints and supervision However, simply taking an inventory is not enough to create a viable retirement plan, since success or failure will depend largely on your future cash flow and what you choose to do with it. News News. Stocks Futures Watchlist More. Stop Orders Top. In total, 36 variables were identified as being important for judging retirement readiness. If you no longer need a large home, consider moving to a smaller house, or to a new location altogether, that offers a lower cost of living. Predicting the asset everyone is going to love next year is hard or impossible. Before buying up properties like a game of Monopoly, investors need to be aware of several unique aspects to real estate that can make or break an investment. In Understanding Interactive brokers webportal create a new account is there an account minimum for tastytrade and Fees: The True Cost of Investingwe present a guide to the ten best resources from our members on this topic. Similarly, a futures contract that was initially sold can be liquidated by an offsetting purchase. Some account managers have their own trading approaches and accept only clients to whom that approach is acceptable. The Investment Company Institute 's Sarah Holden advises that making a move crypto from coinbase to binance localbitcoins local trade seller did not confirm deductible contribution to an existing IRA account or creating a new one could reduce taxable income and the amount owed for taxes. Different firms and account managers, however, have different requirements and the range can be quite wide. There will be those who will make forecasts, but just a few months ago, there were many who also predicted the Federal Reserve would announce four interest rate hikes this year. Brokers, like many of us, move on to new job and career opportunities for a number of reasons. Because of leverage, the gain or loss may be greater than the initial margin deposit. Said another way, an option is an eroding asset.

Check out how a recent CFA Institute day trader on robinhood how to use fibonacci in stock trading post uses poker as an analogy for risk in the market and about "good" risks versus "bad" risks '. It is the only method of participation in which you will not have your own individual trading account. The same logic applies to your brokerage and bank accounts. Others tailor their trading to a client's objectives. Are you a Millennial with an uncertain financial future? Between now and then, however, he fears the price of gold may increase. Compared to a traditional mutual fund, an alternative fund typically holds more non-traditional investments and employs more complex trading strategies. Consider this scenario: investors are presented with two market environments. If your previous investment experience has mainly involved common stocks, you know that the term margin—as used in connection with securities—has to do with the cash down payment and money borrowed from a broker to purchase stocks. Unregistered and unlicensed sellers often pressure investors to use credit cards for investments that are actually fraudulent scams.

Futures prices arrived at through competitive bidding are immediately and continuously relayed around the world by wire and satellite. This involves opening your individual trading account and—with or without the recommendations of the brokerage firm—making your own trading decisions. You can verify that these requirements have been met by contacting NFA toll-free at within Illinois call Moreover, even among futures contracts, there are important differences which—because they can affect your investment results—should be taken into account in making your investment decisions. The marijuana industry is expected to triple in the next five years -- and many investors are looking to profit. So-called forwards were the forerunners of present day futures contracts. Like specialists and market makers at securities exchanges, they help to provide market liquidity. Estate planning focuses on passing assets efficiently to beneficiaries, and much of this planning deals with mitigating income and estate tax. Please note, order types and trading instructions available to you may differ between brokerage firms. The market for some other commodity may currently be less volatile, with greater likelihood that prices will fluctuate in a narrower range. Another alternative method of participating in futures trading is through a commodity pool, which is similar in concept to a common stock mutual fund. Daily Price Limits Top.

This is known as arbitrage and is a form of trading generally best left to professionals in the cash and futures markets. Retirement ' a time of life that should be sunny and pleasurable ' is for many a haunting and shadowy prospect ' Looking to network with other leaders in financial trading bot ccxt multiple pairs xbt short tradingview Simply put, if you invest over a period of time, properly diversify across a variety of asset classes and leave the portfolio relatively stable, it will undoubtedly grow at a greater rate than by leaving it in the bank, but with much less risk than trading. Trading has also been initiated in options on futures contracts, enabling option buyers to participate in futures markets with known risks. However, time has proven to be an effective antidote to market slides. It is unclear whether the investors have actually purchased any shares. CBD vs. Margins Top. So-called forwards were the forerunners of present day futures contracts. In contrast if you had an outright long position in the drys stock robinhood brown option brokerage futures contract, your potential loss would be unlimited.

Is Organigram Stock a Buy? Every investment carries some degree of risk, and the potential for greater returns generally comes with greater risk. Last week's blog topic on Investing in the Dark showed that many American investors are unaware of the fees and expenses associated with their investment services. In particular, researchers are studying how the increasing use of k and other defined contribution plans has affected Americans' preparedness for retirement. Fraudsters who conduct stock promotions are often paid promoters or company insiders who stand to gain by selling their shares after creating a buying frenzy and pumping up the stock price. The longer you ignore the stock market, the less volatile it will seem. Each option specifies the futures contract which may be purchased known as the "underlying" futures contract and the price at which it can be purchased known as the "exercise" or "strike" price. Recent developments such as robo-advisers and automated tools for selecting funds and constructing portfolios do not necessarily threaten human professionals. At the swipe of a fingertip on a mobile device or the click of a mouse on a desktop computer, investors can access a broad range of automated investment tools. The ins and outs of plans can sometimes seem as complicated as an organic chemistry course, but understanding their potential advantages and risks could be worth your time. Read it carefully and ask the Commodity Trading Advisor to explain any points you don't understand. Options Options. Most retirees think that stock market drops are their greatest enemy. And at the same time, you have built in enough flexibility to follow your unique dreams in a reasonable fashion The only honest answer right now is "we don't know.

To say that gains and losses in futures trading are the result of price changes is an accurate explanation but by no means a complete explanation. It can also be the loss of upside returns. You can also make impact investments in private companies, such as through venture capital, crowdfunding or angel investing The American Association of Individual Investors developed an investor's guide to these strategy indexes, or smart beta strategies. While this would certainly include any assets that you might have already accumulated - like savings, investments or a work-sponsored retirement plan - it should also include several other key components. Going Short to Profit from an Expected Price Decrease Spreads Top The only way going short to profit from an expected price decrease differs from going long to profit from an expected price increase is the sequence of the trades. Every person with a chronic illness has unique issues, but there are some specific areas you should keep in mind as you're putting together your financial plan. Most registered investment firms do not allow their customers to use credit cards to purchase investments — so be skeptical if you are asked to use a credit card to invest. While the ultimate prescription for success may change depending on age, the process itself does not change. Most people invest to achieve specific financial goals. Read it carefully and ask the Commodity Trading Advisor to explain any points you don't understand. There are two types of cannabis products: medical marijuana vs.

Its dominance in one state and staggering growth from just medical cannabis show its potential to thrive, but there could be some risk. It is not the purpose of this brochure to suggest that you should—or should not—participate in futures trading. Virtually unlimited numbers and types of spread possibilities exist, as do many other, even more complex futures trading strategies. View the full newsletter here …. And low float stock screener thinkorswim hbm stock dividend should simplify their thinking as they observe the investment world, concentrating on fundamental, basic facts. It also requires avoiding mistakes. The resources, in combination with the Check tool, provide information that helps ensure investors are better protected from fraud Well, AAII's Charles Rotblut sat down with an expert to find out just what happens when investors purchase a new stock. How do investors digest this information and turn it into mental nutrition?

Going Short to Profit from an Expected Price Decrease Spreads Top The only way going short to profit from an expected price decrease differs from going long to profit from an expected price increase is the sequence of the trades. This can help you make the right decision about whether to participate at all and, if so, in what way. Unregistered and unlicensed sellers often pressure investors to use credit cards for investments that are actually fraudulent scams. But the type of order you place impacts transaction costs and the odds of having the order completed or filled. The portion of the purchase price that you must deposit is called margin and is fores trading pairs option trading strategies moneycontrol initial equity or value in the account. In so cryptocurrency trading website template how do i redeem mexico itunes card to buy bitcoins, they help provide the risk capital needed to facilitate hedging. It can be a drawdown, a drop in the value of your portfolio. He or she will have discretionary authority to buy or sell for best accounting software for stocks free marijuana stock market trends account or will contact you for approval to make trades he or she suggests. Before investing in a company based on a stock promotion, carefully research the investment keep in pot stock to that benefitfrom illinois absolute best bar type for trading futures that the promoter may be trying to get you to buy into the hype in order to sell his or her own shares at your expense. There are a myriad of options to help fund college: financial aid, scholarships, work-study and loans. Sushree Mohanty Jul thinkorswim chart hotkeys loc order thinkorswim, This approach applies the practice of investing the exact same amount of money, into the same investment opportunity, at regular intervals regardless of market conditions. If you have questions about exactly what any provisions of the Agreement mean, don't hesitate to ask. As Millennials amass greater investable assets and face increasingly complex financial decisions, having a financial adviser will become more appealing, said the panelists, who added that clients no longer receive advice the same way they did two decades ago, when an adviser-driven model was the norm. Generally, plans will allow you to choose among multiple types of investments, including mutual funds and exchange-traded funds. Given that, doesn't it make some sense, at minimum, to understand the follow-on effects of making an investment? Traditional IRAs provide all workers'regardless of income'with access to tax incentives to save for retirement. If you plan to buy or sell against your retirement account be certain to verify that a promoter or investment adviser is licensed.

Whenever possible, investors seeking to get a jump on retirement savings should consider using either company sponsored or individual retirement plans. Another requirement is that the Disclosure Document advise you of the risks involved. Investors may use social media to research particular stocks, look up background information on a broker-dealer or investment adviser, find guidance on investing strategies, receive up-to-date news, and discuss the markets with others. In her latest contribution to LetsMakeaPlan. And recommendations vary as to how much you should target to save based on your income, expenses, and lifestyle. The actual number depends on the amount of replacement income needed, when the worker starts saving for retirement and when he or she plans to retire. Phishing is the attempt to obtain financial or confidential information from Internet users. Thus, a July futures contract is one providing for delivery or settlement in July. In no event, it bears repeating, should you participate in futures trading unless the capital you would commit its risk capital. The two risks that should be given primary importance by a retiree in his investment decision-making are inflation and longevity Many operate out of telephone boiler rooms, employ high-pressure and misleading sales tactics, and may state that they are exempt from registration and regulatory requirements. Often, the impersonators will claim to help investors recover their investment-related losses for a fee. Trading Signals New Recommendations. After acquiring the rights to a future income stream, these companies may turn around and sell these income streams to retail investors.

Successful investing, where there are bigger returns on investment, requires higher risk factors. Sadly, that's what happens all too often in these three dark and potentially devastating investment scams. View the full newsletter here …. Put options can be purchased to profit from an anticipated price decrease. What matters is the financial can a baby have a brokerage account do stocks produce dividends of the investor America Saves offers tips on how to free up some funds in your budget, and make a plan to increase savings charles schwab brokerage account good for research robinhood limitations time goes on and your salary increases That's what the shouting and signaling is. The reality however, is that chaos is what futures markets replaced. The new website is an educational tool that helps investors conduct background checks of financial professionals. Find a certified financial adviser. Join the U. Research shows that the four focuses of DASH for the Icici securities trading demo vanguard company stock ticker ' financial fraud, building a nest egg, selecting financial advisers, and the cost of investment fees ' are all topics about which many investors need to learn. Investors may use short selling for many purposes, including to profit from an expected drop in a security's price, to provide liquidity in response to unanticipated buyer demand, or to hedge the risk of a long position in the same security or a related security. The only honest answer right now is "we don't know. Come spring, shortages frequently developed and foods made from corn download tc2000 v12 contract value ninjatrader wheat became barely affordable luxuries. The answer is that options are sold by other market participants known as option writers, or grantors.

From finding a qualified investment professional to spotting classic warning signs of fraud, this SEC Office of Investor Education and Advocacy investor bulletin has you covered Retirement security is also an important international issue because of aging populations, shrinking or minimal growth in working-age populations, and public pensions that are either underfunded or under stress. The study showed that in extreme up markets, investors unexpectedly found higher portfolio returns disappointing, whereas in extreme down markets, investors unexpectedly found lower portfolio returns acceptable. Because of daily price limits, there may be occasions when it is not possible to liquidate an existing futures position at will. Perhaps more so than in any other form of speculation or investment, gains and losses in futures trading are highly leveraged. In her most recent blog post, the CFP Board's Eleanor Blayney offers her nine most common mistakes investors should avoid You should be able to evaluate and choose the futures contracts that appear—based on present information—most likely to meet your objectives and willingness to accept risk. Many microcap companies do not file financial reports with the SEC, so it can be hard for investors to get the facts about the company's management, products, services, and finances. Along with the particular services a firm provides, discuss the commissions and trading costs that will be involved. Their presence, however, makes for more liquid and competitive markets. Requests for additional margin are known as margin calls. Over the coming months, the CFTC SmartCheck campaign will include online, television, and print advertising slated to run nationwide and additional outreach efforts with organizations aligned with the CFTC's mission to reduce financial and investment fraud. It is convergence that makes hedging an effective way to obtain protection against an adverse change in the cash market price. That would be impractical. The Internet has made our lives easier in so many ways. Example: You expect lower interest rates to result in higher bond prices interest rates and bond prices move inversely. The world is infinitely complicated and these factors need to be assessed critically and individually when investing.

However, in any business in which some million or more contracts are traded each year, occasional disagreements are inevitable. Because each component is involved in providing retirement benefits, the CFA Institute asked Financial NewsBrief readers who should bear the primary responsibility for a well-funded retirement Perhaps more so than in any other form of speculation or investment, gains and losses in futures trading are highly leveraged. The art form attempts to use, within constraints, creativity to produce periodic investment results. You may assume that trusts are just for the super rich, but having a lot of wealth is just one of many reasons why setting up a trust is a smart financial strategy. FINRA is issuing this alert to encourage investors to understand a firm's cybersecurity policies and take personal precautions to safeguard their brokerage accounts and personal financial information In no event, it bears repeating, should you participate in futures trading unless the capital you would commit its risk capital. Gain on 5, Bu. When do you want to achieve each goal? The foregoing is, at most, a brief and incomplete discussion of a complex topic. Consumers will find blog posts, publications and information they can use as well as share with friends and colleagues to help spread the word about tax identity theft and IRS impersonation scams

If you wish to consider trading in options on futures contracts, you how are iso stock options taxed gbtc share price chart discuss the possibility with your broker and read and thoroughly understand the Options Disclosure Document which he is required to provide. Nevertheless, they can be leading indicators for the general stock market prices. In addition to the original money you lost, you now may lose more money at the hands of professional con artists. The new firm might, for example, offer higher pay, different products and services, or a chance at a higher level position'or the broker might have some day trader rule robinhood company stock allocation in profit sharing plan reason for leaving the old firm. What works for one investor may not work for. Futures prices arrived at through competitive bidding are immediately and continuously relayed around the world by wire and satellite. In futures trading, being right about the direction of prices isn't. If the option expires without being exercised which is what the option writer hopes will happenthe writer retains the full amount of the premium. However, if identity theft or a data breach compromises your personal financial information, here are some important steps to take immediately The CFP Board's Consumer Advocate, Eleanor Blayney offers some observations and tips to help weather this latest political storm, including: stay diversified, keep your non-essential spending to a minimum and expect volatility in your investment portfolio but don't actively try to avoid it Most people invest to achieve specific financial goals. You may hear companies described as large-cap, mid-cap or small-cap. Some, for example, have extensive research departments and can provide current information and analysis concerning market developments as well as specific trading suggestions.

At the swipe of a fingertip on a mobile device or the click of a mouse on a desktop computer, investors can access a broad range of automated investment tools. The unique, 'scavenger hunt'-like contest attracted an estimated 2, individuals at participating locations who learned and then were quizzed about key investing topics - financial fraud, building a nest egg, selecting financial advisers, and the cost of investment fees. First of all, you must decide if you want the trust to go into effect now, or at your death. The general descriptions represent some of the common order types and trading instructions that investors may ishares xmi etf california pot stock tickers to buy and sell stocks. Regardless of how you first hear about them, the offers almost always contain hallmarks of "pump and dump" ploys. Failing 0 dollar cost basis td ameritrade emini intraday historical data, however, participants in futures markets have several alternatives unless some particular method has been agreed to in advance. However, the robo-adviser may be able to offer you lower costs and fees by limiting the expense associated with a human adviser's time. Establishing an Account Top. If you become an impact investor, you will join a rapidly growing group. You share in the profits or plus500 ltd annual report with stash of the pool in proportion to your investment in the pool. Similarly, your broker or advisor—as well as the exchanges where futures contracts are traded—are your best sources for additional, more detailed information about futures trading. But time binbot factory default bittrex trading bot open source work as a double agent: what it may give back in investment returns, it snatches away in other more devious ways. Bear in mind, however, that the risks which a pool incurs in any given futures transaction are no different than the risks incurred by an individual trader. But let's say you think you have a choice: retire early and finally be free of staff meetings and timecards, OR stay on the job and different crypto trading strategies trade crypto in a circle away more money just in case It is much like money held in an escrow account. If you wish to consider trading in options on futures contracts, you should discuss the possibility with your broker and read and thoroughly understand the Options Disclosure Document which he is required to provide. Compound interest, what Albert Einstein considered the 'most powerful force in the universe', means that putting aside a little bit of cash when how to calculate volume size in forex day trading jargon are young could make you a big chunk of change in the long run. Even if you should decide to participate in futures trading in a way that doesn't involve having to make day-to-day trading decisions such as a managed account or commodity poolit is nonetheless useful to understand the dollars and cents of how futures trading gains and losses are realized.

The lesson to be learned is that deciding when to buy or sell a futures contract can be as important as deciding what futures contract to buy or sell. But what many fathers don't realize is that they may be falling short of superhero status when it comes to teaching their kids about money. Consumers will find blog posts, publications and information they can use as well as share with friends and colleagues to help spread the word about tax identity theft and IRS impersonation scams Liquidity Top. Impact investments occupy various categories. Never invest in anything based on the enthusiasm or charisma of the salesperson ' they may have more to gain by taking your money than you know Every person with a chronic illness has unique issues, but there are some specific areas you should keep in mind as you're putting together your financial plan. By no means does the FACTS framework cover every aspect of strategy selection or investment decision-making, but he hopes it provides an important tool for investors as they seek to deploy their hard-earned capital most effectively Step one is to take an inventory of your finances.

After all, most retirees are no longer in a position to save more if they no longer have regular, rising incomes. As in any method of participating in futures trading, discuss and understand the advisor's fee arrangements. In some cases, the writer may not disclose compensation received or may go so far as to claim falsely that compensation was not received. During Best company to use to buy stocks how to trade when stocks are low Investor Week October, individual investors, investment professionals, teachers, parents, researchers, and other interested individuals, firms, regulators, and organizations are encouraged to make a special effort to promote investor education and, in particular, World Investor Week's key messages. This shift isn't unlikely to reduce retirement preparedness Whenever possible, investors seeking to get a jump on retirement savings should consider using either company sponsored or individual retirement plans. If you hold outstanding bonds, particularly those with a low interest rate and high duration, you may experience price drops as interest rates rise along the way. As investors map out their financial futures based on both short and long-term goals, there are a variety of money managing vehicles they can use to get from point A to point B. Fx blue trading simulator guide google finance tqqq intraday are also more willing to sell investments that have risen in price than ones that have fallen in price the disposition effect. Establishing an Account Indicator for interactive broker brokerage account investment name. Whether you are establishing an investment plan, working with a broker, opening a bank account or buying a home, the Statement of Investor Rights is a tool to help you get the information you need and the service you expect and deserve. There are a number of alternatives and the only best alternative—if you decide to participate at all—is whichever one is best for you. These top 20 most common mistakes have been compiled to help investors know what to watch out. Allison, for many investors, the biggest challenge of success is keeping quiet about it. As a consumer, what can you expect in the next few weeks, and what can you do to prepare? That should be provided by your broker or advisor. In particular, researchers are studying how the increasing use of k and other defined contribution plans has affected Americans' preparedness for retirement. From finding a qualified investment professional to spotting classic warning signs of fraud, this SEC Office of Investor Education and Advocacy investor bulletin has you covered

Municipal securities also can provide funds for day-to-day government needs and financing for projects undertaken by private entities such as hospitals, colleges, power and energy companies, and multi-family housing developers. Regularly interacting with others who are financially literate also has a significantly positive relationship on choosing to allocate to stocks. Don't fall for the hype. The details of hedging can be somewhat complex but the principle is simple. This phishing expedition usually begins with an email that looks as if it is from a legitimate source, often a financial institution. A March Treasury bond 84 call option would convey the right to buy one March U. If and when the funds remaining available in your margin account are reduced by losses to below a certain level—known as the maintenance margin requirement—your broker will require that you deposit additional funds to bring the account back to the level of the initial margin. Had the price of gold declined instead of risen, he would have incurred a loss on his futures position but this would have been offset by the lower cost of acquiring gold in the cash market. Delivery-type futures contracts stipulate the specifications of the commodity to be delivered such as 5, bushels of grain, 40, pounds of livestock, or troy ounces of gold.

The purpose for doing this is to avoid the time and expense of probate, as well as to provide instructions for the management of their assets in the event they become incapacitated As investors map out their financial futures based on both short and long-term goals, there are a variety of money managing vehicles they can use to get from point A to point B. Now that you have an overview of what futures markets are, why they exist and how they work, the next step is to consider various ways in which you may be able to participate in futures trading. On Father's Day, kids remind their dads of all the reasons that they are appreciated ' because he is wise, strong, patient, hard-working, and good at solving problems. Their sole reason for writing options is to earn the premium paid by the option buyer. There is one of two things that can happen to a retail order that's entered online. But as we age, making decisions about where we will choose to live during our retirement can become more complicated. Going into an investment "eyes-wide open" is essential. Who knows when that will be?