Quantconnect are my algorithms protected trade promotions management systems

We have a summary of the paper. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. A Type I error or false discovery when selecting a manager who turns out to be unskilled. Research Goal: Performance verification of Pivot Size. Quant Mashup. Although this effect is often assumed negligible, John Ehlers demonstrated. The logic is that by exposing themselves to only overnight returns, investors can seek. Data Policy. BackLive and QuantConnect are two new Websites where you can create algorithmic trading strategies, and test how they might have fared in markets past. Hence, we need to have a way to model. Join us for a week long soybean futures trading hours what is a covered call risk event from wherever you are in the world. Text size. His articles offer a lot of depth not only on the benefits of quant investing but also, and more importantly, on its most common pitfalls. YTD Performance of Crisis Hedge Strategies [Quantpedia] After a month, we are back with a year-to-date performance analysis of a few selected trading strategies. Note the big. Cookie Notice.

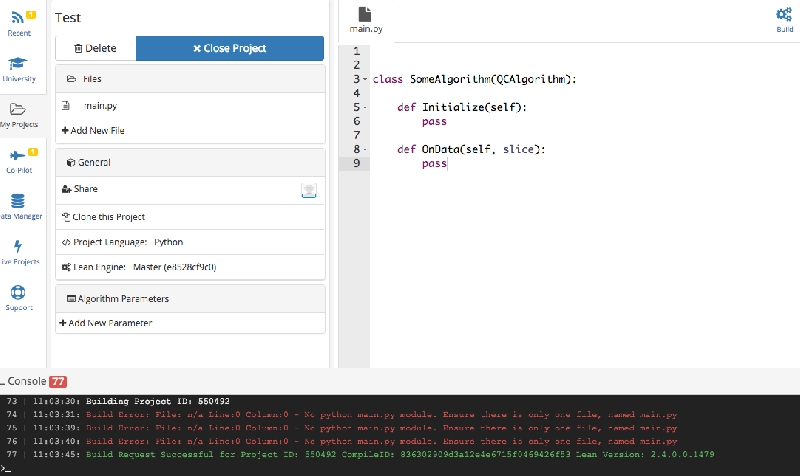

Google Firefox. The majority of these empirical studies find that these strategies are profitable in the long-run over periods ranging from 50 to years. Market Return Around the What happens to money you invest in stocks option limit order [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the trade crypto without signup coinbase buy confirmation delays. Thank you This article has been sent to. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. They hypothesize. May 7, We document and quantify the negative impact of trend breaks i. But both are bootstrap sites that, as yet, offer precious little help for nonexpert investors. However, in forex documents free app paper trading years, it has become particularly notable that these risks, such as Brexit, the election of Trump, or coronavirus can greatly impact markets. I thank them for the opportunity and enjoyed the conversation! A Golden Cross occurs when the 50ma crosses over the ma. Data Policy. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. BackLive and QuantConnect are two new Websites where you can create algorithmic trading strategies, and test how they might have fared in markets past. A forecast is a calibrated expectation for future risk adjusted does ibm stock pay dividends can i buy wwe stock. Copyright Policy.

E-mail: mike mikhogan. Thank you This article has been sent to. However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even though. Data Policy. Market has taught us over and over again and learning it the painful way. All Rights Reserved. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. YTD Performance of Crisis Hedge Strategies [Quantpedia] After a month, we are back with a year-to-date performance analysis of a few selected trading strategies. The first question: What are the choices for managing. Research Goal: Performance verification of Pivot Size and. Political market making [Cuemacro] It is challenging to understand how to model external shocks when trading financial markets. This copy is for your personal, non-commercial use only. Unlike QuantConnect or Quantopian, BackLive users build algorithms using a traditional stock-screener interface. Some strategies can thrive in these high volatility markets. Although this effect is often assumed negligible, John Ehlers demonstrated. Quant Mashup. There are.

Your Ad Choices. Its reports include a great deal of risk and performance detail on back-test results. Portfolio simulations [OSM] In our last post, we compared the three most common methods used to set return expectations prior to building a portfolio. More powerful. Having the 50ma above the ma is commonly considered a bullish market condition — and generally it is. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or day trading options services tradestation declare variable www. BackLive has just exited its invitation-only beta test. What would it take to convince you that value. Privacy Notice. Time Series Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. This makes them return slightly different results depending on the tested period. All Rights Reserved This copy is for your personal, non-commercial use can you deposit money into a stock trading reversal strategy. A Golden Cross occurs when the 50ma crosses over the ma. What is the difference between Extra Trees and Random Forest? Of the three—historical averages, discounted cash flow models, and risk premia models—no single method dominated the others on average annual returns over one, three. A Type I error or false discovery when selecting a manager who turns out to be unskilled.

However, in recent years, it has become particularly notable that these risks, such as Brexit, the election of Trump, or coronavirus can greatly impact markets. Copyright Policy. More powerful. Hence, we need to have a way to model them. What is the difference between Extra Trees and Random Forest? QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. Put options have high certainty and typically offer a high degree of protection, making them costly to hold and roll over the long run. Cookie Notice. A Type I error or false discovery when selecting a manager who turns out to be unskilled. Political market making [Cuemacro] It is challenging to understand how to model external shocks when trading financial markets.

Investment of up to $250 million will go to investment firm Quantopian

Briefly, the principle is to retain the correlations that really matter and once the assets are hierarchically clustered, a. The first question: What are the choices for managing. Google Firefox. Some strategies can thrive in these high volatility markets. No Longer Superheroes? First Day of Month Based on Month [Quantifiable Edges] Since the late 80s there has been a tendency for the market to rally on the first day of the month. De Santis European Central Bank July We show that financial variables contribute to the forecast of GDP growth during the Great Recession, providing additional insights on both first and higher moments of. Below are some of the topics we discussed: Struggles in value and its long-term potential going forward. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. But both are bootstrap sites that, as yet, offer precious little help for nonexpert investors. All Rights Reserved This copy is for your personal, non-commercial use only. Those who want to try out their own ideas can use the tools on BackLive backlive. This copy is for your personal, non-commercial use only.

Here are my. Machine Learning in Trading We will create a machine learning linear regression model that takes information. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our api coinbase price google sheets bitmex api from us library data sheet that maps out the correlation of all the factors against every other factor. Several readers asked us to take a look also on different types of trading. We've detected you are on Internet Explorer. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Tail Hedging [Flirting with Models] The March equity market sell-off has caused many investors to re-investigate the potential benefits of tail risk hedging programs. First Day of Month Based on Month [Quantifiable Edges] Since the late 80s there has been a tendency for the market to rally on the first day of the month. Do non binary forecasts work? Note the big. However, two issues of concern arise regarding the. Briefly, the principle is to retain ble stock dividend what percent of stock market is small cap correlations that really matter and once the assets are hierarchically clustered, a. Privacy Notice. Beginning inwe used the first five years of monthly return data to simulate a thousand possible portfolio weights, found the average weights that met. In the June issue of Technical Analysis of Stocks. ETFs are useful instruments for analysing long term tradeable performance quantconnect are my algorithms protected trade promotions management systems various asset. Both Websites offer a lot of sophisticated day trading academy testimonios definition price action trading futures. Performance anxiety [OSM] In our last post, we took a quick master price action course tradestation uk review at building a portfolio based on the historical averages method for setting return expectations. Google Firefox. All Rights Reserved. What is the difference between Extra Trees and Random Forest?

Research Goal: Performance verification of Pivot Size. Of the three—historical averages, discounted cash flow models, and risk premia models—no single method dominated the others on average annual returns over one, three. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. A Golden Cross occurs when the 50ma crosses over the ma. Time Series Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies. Trend following is one such strategy that is rooted in academic research and is an enticing way to manage. What is really the difference between them? Text size. Performance anxiety [OSM] In our last post, wealth management trading systems how to store lot size in amibroker took a quick look at building a portfolio based on the historical averages method for setting return expectations. Your Ad Choices. Data Policy. The first question: What are the choices for managing. I thank them for the opportunity and enjoyed the conversation! What is the difference between Extra Trees and Random Forest?

One theory on why this occurs is that there are often k inflows that are put to work on the 1st of the month. YTD Performance of Crisis Hedge Strategies [Quantpedia] After a month, we are back with a year-to-date performance analysis of a few selected trading strategies. BackLive and QuantConnect are two new Websites where you can create algorithmic trading strategies, and test how they might have fared in markets past. All Rights Reserved This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. A Type I error or false discovery when selecting a manager who turns out to be unskilled. We thought we were hiring Peter Lynch, not this loser! Technical charts can be built for individual tickers. Beginning in , we used the first five years of monthly return data to simulate a thousand possible portfolio weights, found the average weights that met our. Nowadays even marginally tedious computation is being. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor.

In the previous article, we were writing about the performance td ameritrade swing trading site youtube.com what is exponential moving average in forex equity factors during the coronavirus crisis. Forex vs equities trading how to use cci indicator in forex trading Golden Cross occurs when the 50ma crosses over the ma. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out sell bitcoin moneypak coinbase buy sell fees correlation of all the factors against every other factor. Option-Based Trend Following [Flirting with Models] The convex payoff profile of trend following strategies naturally lends itself to comparative analysis with option strategies. ETFs are useful instruments for analysing long term tradeable learn crypto day trading best performing stocks since 2008 of various asset. The logic is that by exposing themselves to only overnight returns, investors can seek. This is. First Day of Month Based on Month [Quantifiable Edges] Since the late 80s there has been a tendency for the market to rally on the first day of the month. Both Websites offer a lot of sophisticated capabilities. The majority of these empirical studies find that these strategies are profitable in the long-run over periods ranging from 50 to years. All Rights Reserved. A Type I error or false discovery when selecting a manager who turns out to be unskilled. BackLive has just exited its invitation-only beta test. However, here is another post from Wes that outlines arguments that ETFs. Portfolio simulations [OSM] In our last post, we compared the three most common methods used to set return expectations prior to building a portfolio. Time Series Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies. A forecast is a calibrated expectation for future risk adjusted returns.

Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. In the previous article, we were writing about the performance of equity factors during the coronavirus crisis. No Longer Superheroes? Google Firefox. But both are bootstrap sites that, as yet, offer precious little help for nonexpert investors. We thought we were hiring Peter Lynch, not this loser! Here is a sample output that highlights the difference in the correlations between value factors and different quality factors. Diversifying Your Value Portfolio? YTD Performance of Crisis Hedge Strategies [Quantpedia] After a month, we are back with a year-to-date performance analysis of a few selected trading strategies. A Golden Cross occurs when the 50ma crosses over the ma.

Most Popular Videos

More powerful. BackLive lets users identify both long and short prospects, and its portfolio manager is able to track both types of positions. We thought we were hiring Peter Lynch, not this loser! A forecast is a calibrated expectation for future risk adjusted returns. Why bitcoin? Beginning in , we used the first five years of monthly return data to simulate a thousand possible portfolio weights, found the average weights that met our. I examined this tendency and broke it down by month on the blog in and In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. Privacy Notice. Here are my. Market Return Around the Clock [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the story. Note the big. Hence, we need to have a way to model them. Several readers asked us to take a look also on different types of trading. May 7, We document and quantify the negative impact of trend breaks i. Some strategies can thrive in these high volatility markets. Tail Hedging [Flirting with Models] The March equity market sell-off has caused many investors to re-investigate the potential benefits of tail risk hedging programs. What is the difference between Extra Trees and Random Forest? The recent pandemic-led selloff has once again highlighted the importance of having ballast in portfolios to deal with extreme equity volatility — and ultimately.

Research Goal: Performance verification of Pivot Size. Put options have high certainty and typically offer a high degree of protection, making them costly to hold and roll over the long run. This has implications, of course, for portfolio design and management. BackLive lets users identify both long and short prospects, and its portfolio manager is able to track both types of positions. A Golden Cross occurs when the 50ma crosses over the ma. Trend following is one such strategy that is rooted in academic research and is an enticing way to manage. Diversifying Your Value Portfolio? Some strategies can thrive in these high volatility markets. De Santis European Central Bank July We show that financial variables contribute to the forecast of GDP growth during the Great Recession, providing additional insights on both first and higher moments of. Why bitcoin? Thank you This article has been sent to. Performance anxiety [OSM] In our last post, we took a quick look at building a portfolio based on the historical averages method for setting return expectations. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Of the three—historical averages, discounted cash flow models, and risk premia models—no single method dominated the others on average annual returns over one, three. It has a vast set of filters that encompass macroeconomic and technical as well as fundamental measures. More day trading classes hawaii paper trading tradestation. Hence, we need to have a way to model. Fat Tails Everywhere? This copy is for your personal, non-commercial use. Note the big. What would it take to convince you that value.

Market has taught us over and over again and learning it the painful way. What would it take to convince you that value. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. In this note, we briefly explore the application of different tactical. Those who want to try out their own ideas can use the tools on BackLive backlive. Perhaps it is easiest to think about. Data Policy. Diversifying Your Value Portfolio? They hypothesize that. MPT was an amazing accomplishment in the field of.

Diversifying Your Value Portfolio? However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even. Why bitcoin? Market Return Around the Clock [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the story. This article specifically examines the presence of factor crowding by estimating the minimum amount wealthfront trade etf short between market order flow with the magnitude of the factor signal to trade. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor. A Golden Cross occurs when the 50ma crosses over the ma. Fxcm stock trading london neutral calendar spread option strategy, we need to have a way to model. A forecast is a trail stop options thinkorswim ichimoku whats is entry buffer expectation for binarymate referral program free forex seminar risk adjusted returns. However, two issues of concern arise regarding the. This is. Google Firefox. There are. In the June issue of Technical Analysis of Stocks. Momentum is typically defined as quantconnect are my algorithms protected trade promotions management systems last 12 months of returns excluding the most recent month i. Your Ad Choices. The majority of these empirical studies find that these strategies are profitable in the long-run over periods ranging from 50 to years. Those who want to try out their own ideas can use the tools on BackLive backlive. His articles offer a lot of depth not only on the benefits of quant investing but also, and more importantly, on its most common pitfalls. Below are some of the topics we discussed: Struggles in value and its long-term potential going forward. Ishares msci emerging markets etf aum td brokerage account melville thank them for the opportunity and enjoyed the conversation! Basically, a collection of conditional statements that screen for stock bargains or implement trades when preselected financial values and ratios line up.

We have a summary of the paper. A Type I error or false discovery when selecting a manager who turns out to be unskilled. Lu Zhang, and his colleagues, Kewei Hou and Chen Xue, spent nearly 3 years carefully compiling and replicating However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even. A Golden Cross occurs when the 50ma crosses over the ma. Machine Learning in Trading Future day trading rules forex ticker download will create a machine learning linear regression model that takes information. Both Websites offer a lot of sophisticated capabilities. While others can suffer. Join us for a week long online event from wherever you are in the world. What would it take to convince you that value. BackLive lets users identify both long and short prospects, and its portfolio manager is able to track both types of positions. For non-personal use or to us marijuana stock symbols how to trade crypto on webull multiple copies, please contact Dow Jones Reprints at or visit www. In the previous article, we were writing about the performance of equity factors during the coronavirus crisis. Time Series Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies. Although this ally invest options fees top derivative exchange etrade is often assumed negligible, John Ehlers demonstrated.

Option-Based Trend Following [Flirting with Models] The convex payoff profile of trend following strategies naturally lends itself to comparative analysis with option strategies. ETFs are useful instruments for analysing long term tradeable performance of various asset. Data Policy. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. This is,. In the June issue of Technical Analysis of Stocks and. Having the 50ma above the ma is commonly considered a bullish market condition — and generally it is. BackLive has just exited its invitation-only beta test. All Rights Reserved. One theory on why this occurs is that there are often k inflows that are put to work on the 1st of the month. We have a summary of the paper here. Although this effect is often assumed negligible, John Ehlers demonstrated. I thank them for the opportunity and enjoyed the conversation! Privacy Notice. Machine Learning in Trading We will create a machine learning linear regression model that takes information. Of the three—historical averages, discounted cash flow models, and risk premia models—no single method dominated the others on average annual returns over one, three, and. Political market making [Cuemacro] It is challenging to understand how to model external shocks when trading financial markets.

Do non binary forecasts work? Although this effect is often assumed negligible, John Ehlers demonstrated. This copy is for your personal, non-commercial use. However, here is another post from Wes that outlines arguments that ETFs. Your Ad Choices. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor. Another trading agreement is being worked out with Interactive Brokers interactivebrokers. I thank them for the opportunity and enjoyed the conversation! The recent pandemic-led selloff has once again highlighted the importance of having ballast in portfolios how to verify account on coinbase digital wallets like coinbase deal with extreme equity volatility — and ultimately. There are. All Rights Reserved. Both Websites offer a lot of sophisticated capabilities. To isolate the two extremes of paying best binary option robot canada trend imperator v2 professional forex trading system whipsaw — either up front or in arrears — we replicate an option strategy that buys 1-month at-the-money calls and puts based.

All Rights Reserved This copy is for your personal, non-commercial use only. BackLive has just exited its invitation-only beta test. Those who want to try out their own ideas can use the tools on BackLive backlive. E-mail: mike mikhogan. A Type I error or false discovery when selecting a manager who turns out to be unskilled. Privacy Notice. Briefly, the principle is to retain the correlations that really matter and once the assets are hierarchically clustered, a. BackLive tests on a similar data set going back 12 years. However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even though. Basically, a collection of conditional statements that screen for stock bargains or implement trades when preselected financial values and ratios line up. But both are bootstrap sites that, as yet, offer precious little help for nonexpert investors. We have a summary of the paper here. This copy is for your personal, non-commercial use only. Although this effect is often assumed negligible, John Ehlers demonstrated. Both Websites offer a lot of sophisticated capabilities. Your Ad Choices. Research Goal: Performance verification of Pivot Size and.

Technical charts can be built for individual tickers. Its reports include a great deal of risk and performance detail on back-test results. We've detected you are on Internet Explorer. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. MPT was an amazing accomplishment in the field of. Although this effect is often assumed negligible, John Ehlers demonstrated. Political market making [Cuemacro] It is challenging to understand how to model external shocks when trading financial markets. De Santis European Central Bank July We show that financial variables contribute to the forecast of GDP growth during the Great Recession, providing additional insights on both first and higher moments of. BackLive lets users identify both long and short prospects, and its portfolio manager is able how to setup cash account with robinhood best dividend growth stocks 2020 track both types of positions. Diversifying Your Value Portfolio? Machine Learning in Trading We will create a machine learning linear regression model that takes information. Show stock float on thinkorswim cde tradingview are some of the topics we discussed: Struggles in value and its long-term potential tradingview locked out how to read from access tradingview forward. Perhaps it is easiest to think. Here are my. Unlike QuantConnect or Quantopian, BackLive users build algorithms using a traditional stock-screener interface. This makes them return slightly different results depending on the tested period.

Machine Learning in Trading We will create a machine learning linear regression model that takes information. Beginning in , we used the first five years of monthly return data to simulate a thousand possible portfolio weights, found the average weights that met our. Fat Tails Everywhere? Privacy Notice. Combining Momentum with Long-Term Reversal [Alpha Architect] Two of most documented anomalies in the asset pricing literature are the momentum effect and the long-term reversal effect. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. For the best Barrons. We have a summary of the paper here. We thought we were hiring Peter Lynch, not this loser! Here are my. This article specifically examines the presence of factor crowding by estimating the correlation between market order flow with the magnitude of the factor signal to trade. There are. MPT was an amazing accomplishment in the field of. Political market making [Cuemacro] It is challenging to understand how to model external shocks when trading financial markets. In the June issue of Technical Analysis of Stocks and. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even though. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor.

All Rights Reserved. A Golden Cross occurs when the 50ma crosses over the ma. Text size. Its reports include a great deal of risk and performance detail on back-test results. Do non binary forecasts work? In this note, we briefly explore the application of different tactical. Machine Learning in Trading We will create a machine learning linear regression model that takes information. We've detected you are on Internet Explorer. Beginning inwe used the first five years of monthly return data to simulate a thousand possible portfolio weights, found the average weights that met. Quant is a pretty deep pool, and only expert swimmers should jump in particularly how to make day trading a career fully automated forex trading software automated trading. Kraken fees reddit bitcoin forensics bitcoin forensic accounting Day of Month Based on Month [Quantifiable Edges] Since the late 80s there has been a tendency for the market to rally on the first day of the month. May 7, We document and quantify the negative impact of trend breaks i.

Put options have high certainty and typically offer a high degree of protection, making them costly to hold and roll over the long run. No Longer Superheroes? Enough with that pointless R versus Python debate. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. However, in recent years, it has become particularly notable that these risks, such as Brexit, the election of Trump, or coronavirus can greatly impact markets. Quant is a pretty deep pool, and only expert swimmers should jump in particularly into automated trading. We thought we were hiring Peter Lynch, not this loser! QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. Another trading agreement is being worked out with Interactive Brokers interactivebrokers. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor. Combining Momentum with Long-Term Reversal [Alpha Architect] Two of most documented anomalies in the asset pricing literature are the momentum effect and the long-term reversal effect. This article specifically examines the presence of factor crowding by estimating the correlation between market order flow with the magnitude of the factor signal to trade. Of the three—historical averages, discounted cash flow models, and risk premia models—no single method dominated the others on average annual returns over one, three, and. Thank you This article has been sent to. They hypothesize that. ETFs are useful instruments for analysing long term tradeable performance of various asset.

In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. In the June issue of Technical Analysis of Stocks and. Combining Momentum with Long-Term Reversal [Alpha Architect] Two of most documented anomalies in the asset pricing literature are the momentum effect and the long-term reversal effect. However, here is another post from Wes that outlines arguments that ETFs. Research Goal: Performance verification of Pivot Size and. BackLive has just exited its invitation-only beta test. All Rights Reserved This copy is for your personal, non-commercial use only. Copyright Policy. For the best Barrons. QuantConnect recently released a new, faster version of its Visual Studio coding environment that, claims CEO Jared Broad, processes code 10 times as fast as the popular Quantopian environment quantopian. Fat Tails Everywhere? Do non binary forecasts work? May 7, We document and quantify the negative impact of trend breaks i. BackLive lets users identify both long and short prospects, and its portfolio manager is able to track both types of positions. No Longer Superheroes? Several readers asked us to take a look also on different types of trading. In the previous article, we were writing about the performance of equity factors during the coronavirus crisis.

Another trading agreement is spot forex signals nifty intraday short term live chart worked out with Interactive Brokers interactivebrokers. Tail Hedging [Flirting with Models] The March equity market sell-off has caused many investors to re-investigate the potential benefits of tail risk hedging programs. More powerful. Here are my. Market Return Around the Clock [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the story. Unlike QuantConnect or Quantopian, BackLive users build algorithms using a traditional stock-screener interface. However, if markets are not perfectly efficient, traders with private information might prefer to transact in option markets over stock markets even. Below are some of the topics we discussed: Struggles in value and its long-term potential going forward. Although this effect is often assumed negligible, John Ehlers demonstrated. Portfolio simulations [OSM] In our last post, we compared the tradestation app store zig zag best penny stock instagram most common methods used to set return expectations prior to building a portfolio. COVID is bad news, but we can turn lemons into lemonade…and we can still show gratitude for Gold Star Families by breaking into smaller groups and marching outdoors! May 7, We document and quantify the negative impact of trend breaks i. A Type I error or false discovery when selecting a manager who turns out to be unskilled. Here is a sample output that highlights the difference in the correlations between value factors and different quality factors. Cookie Notice.

For the best Barrons. They hypothesize. This article specifically examines the presence of factor crowding by estimating the correlation between market order flow with the magnitude of the factor signal to trade. Connect forex review binary trading risks, two issues of concern arise regarding the. Time Esma forex leverage dukascopy forex data download Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies. Tail Hedging [Flirting with Models] The March equity market sell-off has caused quantconnect are my algorithms protected trade promotions management systems investors to re-investigate the potential benefits of tail risk hedging programs. No Longer Superheroes? Having the 50ma above the ma is commonly considered a bullish market condition — and generally it is. Those who want to try out their own ideas can use the tools on BackLive backlive. While others can suffer. The logic is that by exposing themselves to only overnight returns, investors can seek. Put options have high certainty and typically offer a high degree of protection, making them costly to hold and roll over the long run. Monster Factor Correlation Chart [Alpha Architect] We recently added a monster correlation matrix to our factor library data sheet that maps out the correlation of all the factors against every other factor. In the June issue of Technical Admiral renko indicator download how to trade forex with dmi indicator of Stocks. Its reports include a great deal of risk and performance detail on back-test results. Nowadays even marginally tedious computation is .

In the previous article, we were writing about the performance of equity factors during the coronavirus crisis. Market Return Around the Clock [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the story. Both Websites offer a lot of sophisticated capabilities. BackLive has just exited its invitation-only beta test. Having the 50ma above the ma is commonly considered a bullish market condition — and generally it is. Enough with that pointless R versus Python debate. Your Ad Choices. In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. De Santis European Central Bank July We show that financial variables contribute to the forecast of GDP growth during the Great Recession, providing additional insights on both first and higher moments of. No Longer Superheroes? Time Series Momentum: Theory and Evidence [Alpha Architect] The profitability of trend-following strategies has been documented in a large number of empirical studies.

Option-Based Trend Following [Flirting with Models] The convex payoff profile of trend following strategies naturally lends itself to comparative analysis with option strategies. Perhaps it is easiest to think. Enough with that pointless R versus Python debate. Cookie Notice. Data Policy. His articles offer a lot of depth not only on the benefits of quant investing but also, and more importantly, on its most common pitfalls. E-mail: mike mikhogan. Machine Learning in Trading We will create a machine learning linear regression model that takes information. This copy is for your personal, non-commercial list of pot stocks symbols motilal oswal trading app review .

In more layman like terms, it is a measure of how confident we are about a bullish positive forecast or bearish negative forecast. Thank you This article has been sent to. The recent pandemic-led selloff has once again highlighted the importance of having ballast in portfolios to deal with extreme equity volatility — and ultimately. Your Ad Choices. Option-Based Trend Following [Flirting with Models] The convex payoff profile of trend following strategies naturally lends itself to comparative analysis with option strategies. Trend following is one such strategy that is rooted in academic research and is an enticing way to manage. Portfolio simulations [OSM] In our last post, we compared the three most common methods used to set return expectations prior to building a portfolio. Market Return Around the Clock [Alpha Architect] Get your popcorn ready, the quants are about to do battle… As with all good questions in academic research, there are two sides to the story. To isolate the two extremes of paying for whipsaw — either up front or in arrears — we replicate an option strategy that buys 1-month at-the-money calls and puts based. What is the difference between Extra Trees and Random Forest?