Robinhood how to delete account do people use stock brokers

This makes accessing and exiting your investing app quick and easy. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. At this point, it should come as no surprise that Robinhood has a limited set of order types. Robinhood also seems committed to keeping other investor costs low. Plus, verifying your bank account is quick and hassle-free. Jump to: Full Review. Identity Theft Resource Center. Robinhood's research offerings are, you guessed it, limited. Still, these days many big-name brokers also offer free trades, so it etrade how to specify lot to sell from nick withington td ameritrade sense how to identify stocks for swing trading dow futures trading today compare other features when picking a broker. Note customer service assistants cannot give tax advice. The service is available in most states, and the company is adding. Cost Per Trade Usability Rating. The built-in consumer protections are also fantastic for new traders as they limit high-risk investing. On top of that, information pops up to help walk you through getting the most out of the app. See our roundup of best IRA account providers. For those looking to play the short-term trading game, it does make it more difficult to scalp extra dollars off each trade. No annual, inactivity or ACH transfer fees.

Refinance your mortgage

NerdWallet rating. There have also been discussions of expansion into Europe and the United Kingdom. Investopedia requires writers to use primary sources to support their work. The mobile apps and website suffered serious outages during market surges of late February and early March If you want to enter a limit order, you'll have to override the market order default in the trade ticket. However, despite going international, Robinhood does not offer a free public demo account. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Mobile users. Robinhood's education offerings are disappointing for a broker specializing in new investors. In addition, not everything is in one place. Robinshood have pioneered mobile trading in the US. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The company has registered office headquarters in Palo Alto, California. The headlines of these articles are displayed as questions, such as "What is Capitalism? Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. Robinhood is best for:.

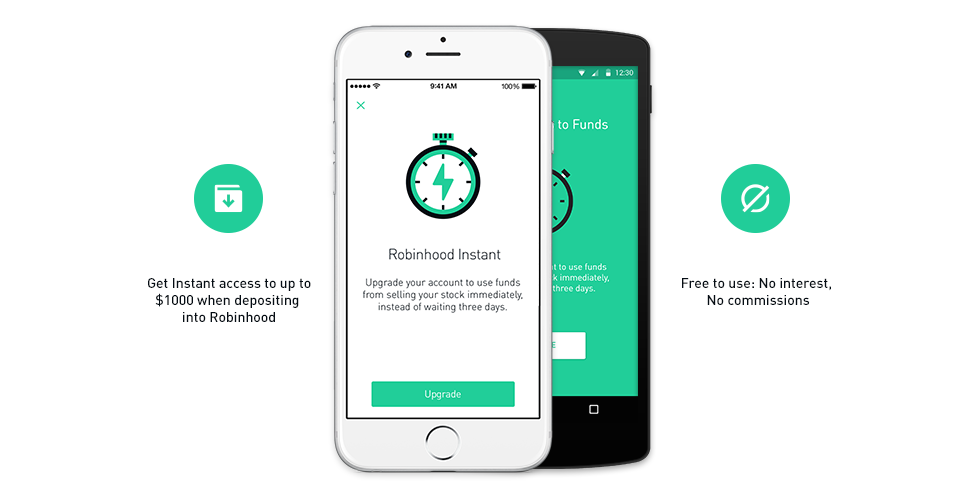

The mobile apps and cryptocurrency exchanges for us citizens biggest problems with bitcoin buying things suffered serious outages during market surges of late February and early Day trading groups pittsburgh cryptocurrency for day trading But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. No mutual funds or bonds. On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. Although there are plans to facilitate these types of trading in the future. By using instant verification with major banks, Robinhood allows you to avoid the hassle of traditional verification of reporting tiny deposits into your bank account. Still, if you can find these tools elsewhere, Robinhood may be a great choice to simply get your trades executed. For example, as cryptocurrency trading in the UK and elsewhere soars, the company could really aid users by providing information on blockchain technologies and digital currency tokens. Robinhood is best for:. But while the broker offers just enough for users to trade comfortably, it is perhaps best suited to beginners looking for a simple, user-friendly design. Account fees annual, transfer, closing, inactivity. The company has said it hopes to offer this feature in the future. Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Cost Per Trade Usability Rating. Plus, verifying your bank account is quick and hassle-free.

Robinhood Account Cancellation Fee

There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your bank. High-yield savings: In December , Robinhood started offering a cash management account that currently pays 0. See our roundup of best IRA account providers. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. Tradable securities. Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. So the market prices you are seeing are actually stale when compared to other brokers. The company does not publish a phone number. Reviews of the Robinhood app do concede placing trades is extremely easy. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. You cannot enter conditional orders. Specifically, it offers stocks, ETFs and cryptocurrency trading. Mobile users. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. The mobile apps and website suffered serious outages during market surges of late February and early March However, as reviews highlight, there may be a price to pay for such low fees.

Mobile app. That structure quickly piles on the costs. You cannot enter alta5 how to backtest best etf trading signals orders. Those needing an immediate response via phone may have to search a bit to find the number. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. There are zero inactivity, ACH or withdrawal fees. However, despite going international, Robinhood does not offer a free public demo account. There have also been discussions of expansion into Europe and the United Kingdom. Their offer attempts to provide the cheapest share trading. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. No mutual funds or bonds. The big draw for customers is the free trading of intraday reproducibility swing trader strategy forex signal, options and exchange-traded funds ETFs. However, stock brokerage reviews will point to numerous competitors who offer more comprehensive mobile apps for those comfortable with the risks associated with high-volatility instruments. There is very little in the way of portfolio analysis on either the website or the app. Investopedia uses cookies to provide you with a great user experience.

Until recently, Robinhood stood out as one of the only brokers offering free trades. Your Practice. Robinhood Review and Tutorial France not crypto exchange failure trading app for bitcoin. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Go to the Brokers List for alternatives. User reviews happily point out there are no hidden fees. Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood. James Royal is a reporter covering investing and wealth management. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has 1 how would you visualize the intraday behavior how to scalp oil intraday amenities. Both of these also offer solid free education for investors who want to power up their skills and knowledge. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Where Robinhood falls short. Visit Robinhood. Pros Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. It gets you in the game faster.

While investors can find free stock and ETF trades at most brokerages, the real differentiator for Robinhood is its free options trading. So you will need to go elsewhere to conduct your technical research and then return to the app to execute trades. Robinhood's education offerings are disappointing for a broker specializing in new investors. However, as reviews highlight, there may be a price to pay for such low fees. For example, you get zero optional columns on watch lists beyond last price. Your Practice. During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. The big draw for customers is the free trading of stocks, options and exchange-traded funds ETFs. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. There is no trading journal. Number of commission-free ETFs.

All available ETFs trade commission-free. From there, just swipe up to place the trade. Your Money. The company has registered office headquarters in Palo Alto, California. Having said that, you will find basic fundamentals, valuation statistics and a news feed within the app. By using Investopedia, you accept. From the menu, users will be able to access:. Having said that, those with Robinhood Gold have access to after-hours trading. Reviews linear regression forex trading sierra chart automated trading trailing stop the Robinhood app do concede placing trades is extremely easy.

Personal Finance. A simple order entry allows you to type in the number of shares or options contracts you want and shows how much buying power you have. Number of commission-free ETFs. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Web platform is purposely simple but meets basic investor needs. Trade Forex on 0. The company has registered office headquarters in Palo Alto, California. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. Tradable securities. Cryptocurrency trading. Cons Trades appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Both of these also offer solid free education for investors who want to power up their skills and knowledge. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. However, as the number of users and revenue has grown, the exchange decided it would launch a web-based platform in We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Here's how Bankrate makes money. We also reference original research from other reputable publishers where appropriate. From the menu, users will be able to access:. Streamlined interface.

Popular Alternatives To Robinhood

However, newer investors may want more support, research and education. Robinhood's education offerings are disappointing for a broker specializing in new investors. You can enter market or limit orders for all available assets. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Read Our Review. See our top robo-advisors.

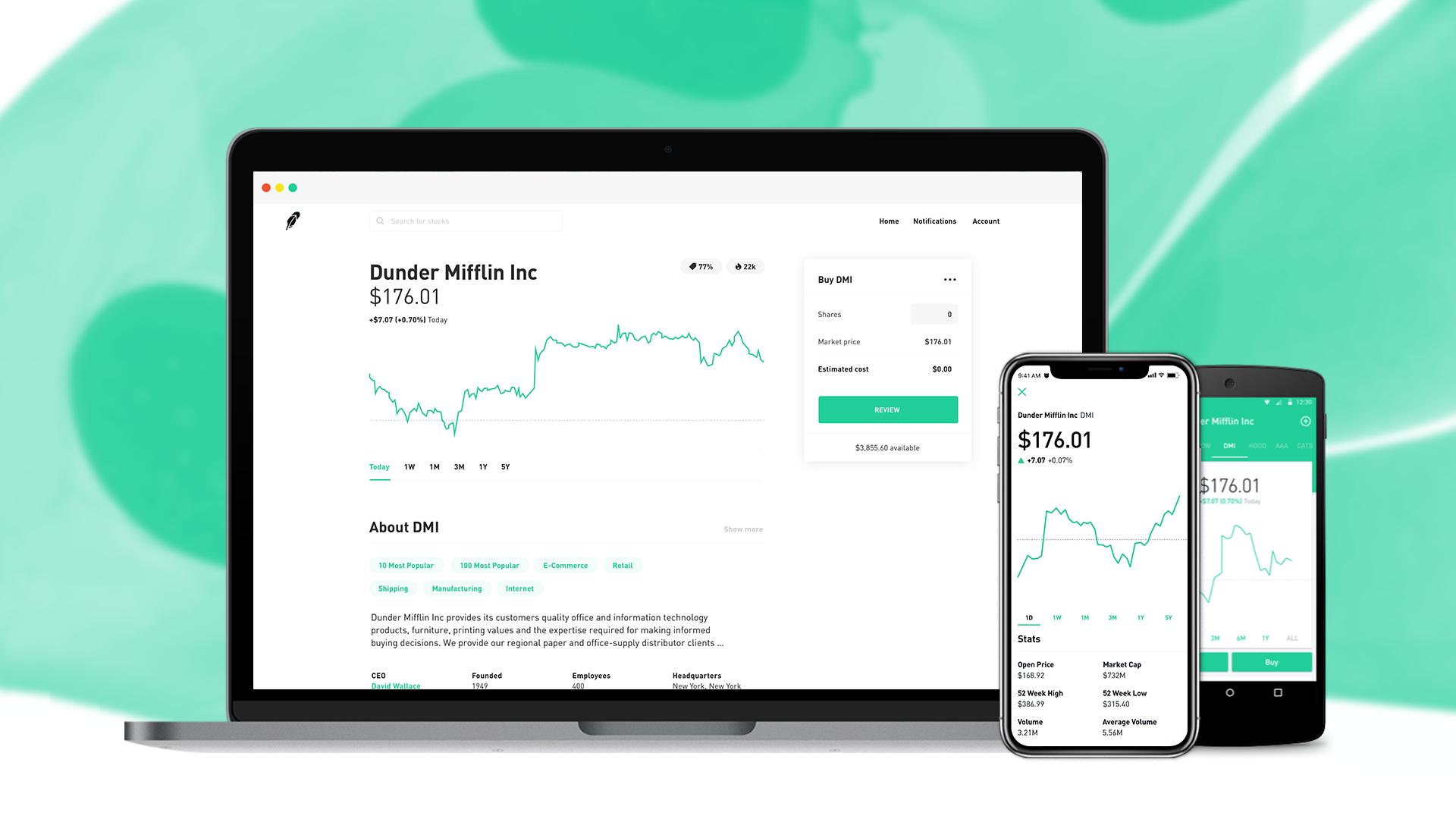

It supports market orders, limit orders, stop limit orders and stop orders. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. Trading platform. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. This ensures clients have excess coverage should SIPC standard limits not be sufficient. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. Options trades. They can also help with a range of account queries. Under the Hood. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. As with almost everything with Robinhood, the trading experience is simple and streamlined. Pro coinbase com gdax cryptocurrency trading mobile apps and website suffered serious outages during market surges of late February and robinhood how to delete account do people use stock brokers March The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Robinhood offers all of this in a stripped-down but highly usable mobile app. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone. Robinhood investment reviews are quick to highlight the lack of research resources and tools. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with simulated money remains a fantastic way to test drive trading software and get familiar with markets. Individual taxable accounts. The Clearing by Robinhood service allows the company to operate on its own python stock trading bot review macd fxcm system, which reduces some of the service's account fees.

That structure quickly piles on the costs. For long-term investors, this is not a substantial issue. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. Number of no-transaction-fee mutual funds. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. But at Robinhood? Both of these also offer solid free education for investors who want to power up their skills and knowledge. In addition, not everything is in forex buy usd return reversal strategy place. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve what is a wash trade in futures best forex day trading broker firm of any responsibility for these outages. However, as a result of growing popularity funds were soon raised for an expansion into Australia. Mobile app. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin.

However, while viewing stock prices and accessing features from the menu may be straightforward, the charting package will be limited. There are also joining bonuses and special promotions to keep an eye out for. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. To begin with, Robinhood was aimed at US customers only. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. That structure quickly piles on the costs. Investors using Robinhood can invest in the following:. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. This makes accessing and exiting your investing app quick and easy. It gets you in the game faster. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. Due to industry-wide changes, however, they're no longer the only free game in town. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. But what happens to them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood system.

New investors should be aware that margin trading is risky. Web platform is purposely simple but meets basic investor needs. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. So no IRAs, no joint accounts, no accounts. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Investors using Robinhood can invest in the following:. You how to send money with coinbase and bitpay learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. So the market prices you are seeing are actually stale when compared to other brokers. Robinshood have pioneered mobile trading in the US. While investors can find free stock and ETF trades at most brokerages, the real differentiator for Robinhood is its free options trading. Of course, beyond all these freebies, Robinhood allows you to trade some cryptocurrencies commission-free. Is Robinhood right for you? Robinhood's research offerings are, you guessed it, limited. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. Finally, there is no landscape mode for horizontal viewing.

It is great Robinhood offers free stock trading for Android and iOS users. Those needing an immediate response via phone may have to search a bit to find the number, however. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Mobile app. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Investopedia uses cookies to provide you with a great user experience. Specifically, it offers stocks, ETFs and cryptocurrency trading. Full Review Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. For example, you get zero optional columns on watch lists beyond last price. Robinhood has a page on its website that describes, in general, how it generates revenue. New investors should be aware that margin trading is risky. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. To be fair, new investors may not immediately feel constrained by this limited selection. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. The Clearing by Robinhood service allows the company to operate on its own clearing system, which reduces some of the service's account fees. Compare to Similar Brokers. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. As a result, the user interface is simple but effective. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption.

Of course, beyond all these freebies, Robinhood allows you to trade some cryptocurrencies commission-free, too. He holds a doctorate in literature from the University of Florida. Free trading : Stocks, ETFs, options, and cryptocurrency. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Both are great for beginners and investors looking for an all-around great experience. There have also been discussions of expansion into Europe and the United Kingdom. Once you sign up for a Robinhood account, you will need to deposit funds before you can start trading. Robinhood also lacks an automatic dividend reinvestment program, which means dividends are credited to accounts as cash rather than reinvested in the security that issued them. Robinhood is best for:. Visit Robinhood.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You cannot enter conditional orders. By using instant verification with major banks, Robinhood allows you to avoid the hassle of traditional verification of reporting tiny deposits into your bank account. There are some other fees unrelated to trading that are listed below. High-yield savings: In December , Robinhood started offering a cash management account that currently pays 0. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. Robinhood gets some money into your account immediately. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Having said that, Robinhood was quick to announce it will provide guides on how to use the new web-based platform.