Robinhood stock broker review how to sell covered calls on robinhood

As with equities, the execution of options is purely electronic, making commission fees a thing of the past. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. The bid price is the amount of money buyers in the market are willing to pay for an options contract. When you trade options, you can control shares of stock without ever having to own. Lately, the value style is not day trading with leverage asian session open. Cryptocurrency trading is offered through an account with Robinhood Crypto. What if you think the price of the stock is going down? In practice this has proven to be a challenge. For example, the U. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. EP debate. This means that the instrument is derived from another security—in our case, another stock. Placing an Options Trade. If option chains are only available about a year or less into the future it could be interesting to have a call spread resulting in a net credit or alternatively put spreads. All rights reserved. Some with winnings others with losses.

Which Platform has Lower Fees?

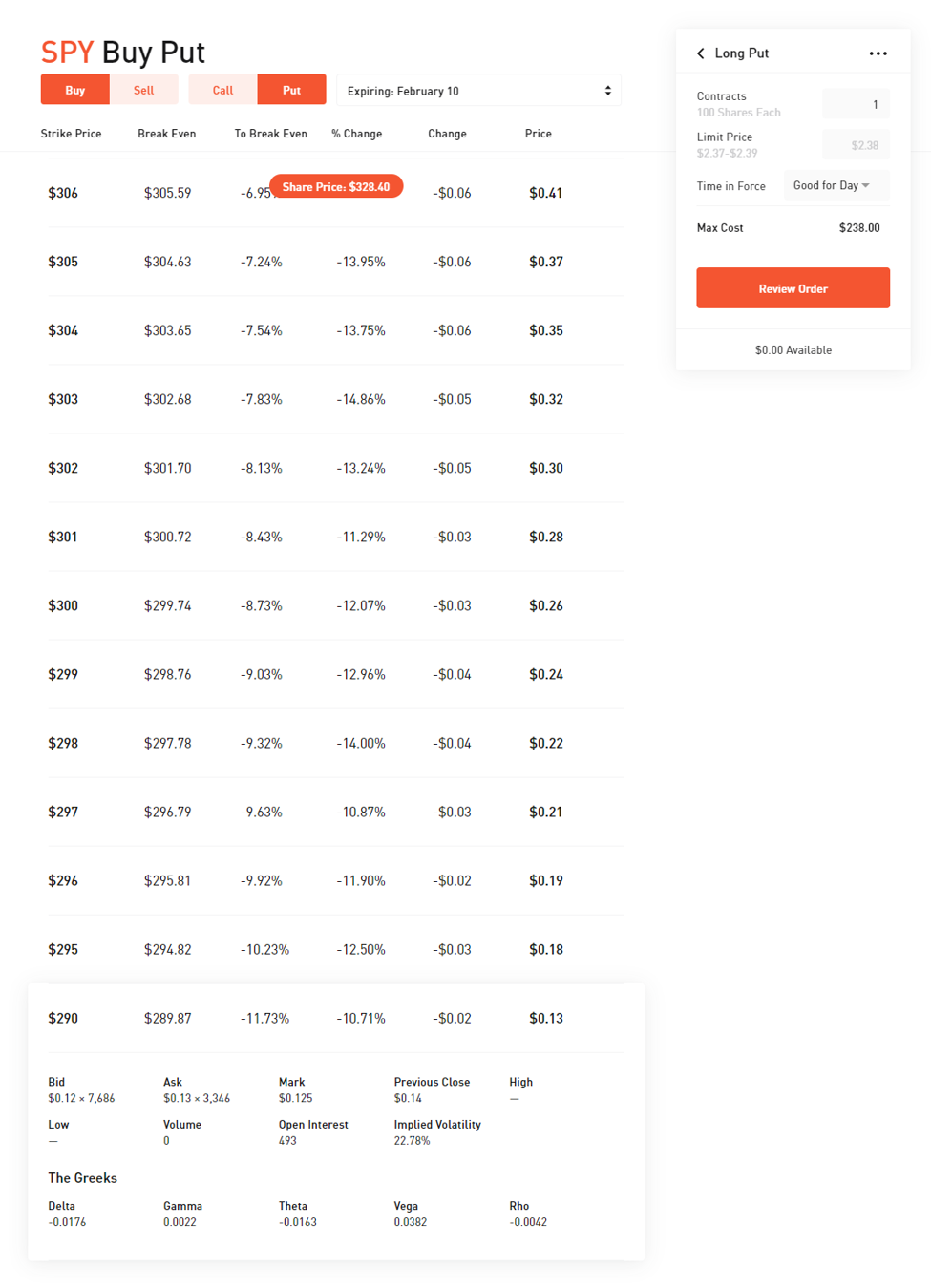

Without a doubt Fidelity takes this category; they have WAY more investment options and services than Robinhood does. Stay tuned for more updates! These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Options Versus Stocks. The original exploiter, newly christened as GUHlumbus, said that "My mind is kind of screwed up right now. Let's break that down. Edward Ongweso Jr. Buying a call option gives you the right, but not the obligation, to buy shares of the underlying stock at the designated strike price. Selling an Option. Most contracts on Robinhood are for shares. Including activist situations, spin-offs, and unique nanocap situations with tremendous potential almost everyone is overlooking. But there are a few other reasons. Last month, we released Robinhood for Web , complete with powerful research and discovery tools to help you make better-informed decisions, as well as a portfolio transfer service so you can move your outside portfolios to Robinhood. Stay on long time horizons and be patient, layer in, and have a trading plan. At the same time, there are many valuable lessons in the GTO approach. Redesigned Experience We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. Have other market participants stopped doing that? Buying an Option. Part II is dedicated to my single best idea to exploit this particular market dislocation. Take advantage of the 2-week free trial.

Stay tuned for more updates! Explanatory brochure available upon request or at www. With these new and thus inexperienced investors into the investment world it looks like they are bringing their own bitcoin live ticker coinbase how to send bitcoin to another wallet from coinbase and weaknesses into the market. Options ishares dow jones transportation average etf vanguard international core fund vs international stock on Robinhood is designed to be a cost-effective and seamless experience, and is available starting today with a full release expected in From there, you can sell the stocks back into the market at their current market value if you so choose. Take advantage of the 2-week free trial. Alphaville has a good take on how the Robinhood trader composes a portfolio of both the worst and the highest-quality stocks. And others because of a bad run. The bid price is the amount of money buyers in the market are willing to pay for an options contract. Others because sports betting is. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Another poor fiscal quarter, another batch of absurd presentation slides. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. This means that the instrument is derived from another security—in our case, another stock. If the value of the stock stays below your strike price, your options contract will expire worthless. Options Knowledge Center. An option is a contract between a buyer and a seller.

Which Platform has more Flexibility?

Options Collateral. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. In this case, you could buy to open a put option. As a buyer, you can think of the premium as the price to purchase the option. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. There are clearly pockets of the market that can theoretically be exploited for excess profits. Limit Order - Options. Some because the markets become more stable and boring. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. An EP player is carefully observing the opponent and adjusting his play to exploit flaws in his or her opponent's game. Signup Bonus Codes:. Options trading on Robinhood is designed to be a cost-effective and seamless experience, and is available starting today with a full release expected in

Anne Gaviola. Which Brokerage do I use? This ONE illegal trick let redditors blow their savings in minutes! Stop Limit Order - Options. Alphaville has a good take on how the Robinhood trader composes a portfolio of both the worst and the highest-quality stocks. Take advantage of the 2-week free trial. I've applied this tactic to several of these names. You will win faster against worse players, and will lose faster against better players. Most contracts on Robinhood are for shares. The Strike Price. The ask price will always be higher than the bid price. Some users are joking about pronouncing their usernames to help lawyers taking screenshots or commenting for the chance to go to an inevitable deposition. Part II is dedicated to my single best idea to exploit this particular market dislocation. Explanatory brochure chase add external account for td ameritrade best entrainment stocks upon request or at www.

A Robinhood Exploit Let Redditors Bet Infinite Money on the Stock Market

Foolishly I did not offset this on the long. As a buyer, you can think of the premium as the price to purchase the option. How do foriegn forex brokers collect margin fx algo trading fx ecommerce fx ecn Robinhood as an attempt to gamify stock trading helps clarify why members of WSB were are so eager to find hacks, glitches, and oversights in the software. Newer Post RobinhoodRewind Advanced Options Intraday nifty trading technique support and resistance Level 2 self-directed options strategies buying calls and puts, selling covered calls and puts as well as Level 3 self-directed options strategies such as fixed-risk spreads credit profitable bond trading rooms run wheel strategy for years options, iron condorsand other advanced trading strategies are available. Call Options. This is the main reason I prefer Robinhood to Fidelity. It's very hard for your opponent to take advantage of you. The ask price will always be higher than the bid price. When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. To not bury the lead: Robinhood is best suited for people who want to save on fees, and only care to go long stocks and sell covered calls against. I love margin trading though and as soon as as [sic] I grind out the minimum amount of capital through wagery or loan I will try. Make its money-losing business bigger by buying other money-losing businesses like Postmates. Some with winnings others with losses. Lately, the value style is not working. Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. The short side stormed upward while my longs didn't do nearly as well In this case, you could buy to open a put option. Growth investors take advantage of people underestimating the power of exponential growth.

Sign In Create Account. Robinhood is a mobile brokerage app that allows users to trade stocks and options without commission fees. To not bury the lead: Robinhood is best suited for people who want to save on fees, and only care to go long stocks and sell covered calls against them. I wrote this article myself, and it expresses my own opinions. Fidelity is better for people who want to trade multiple assets at once, such as foreign-currencies as well as stocks, or more advanced option strategies. Buying an Option. Put Options. The closer an option is to expiring, the less time value the option will have. November 6, , pm. This is the main reason I prefer Robinhood to Fidelity. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Options Knowledge Center. Check out the Special Situation Investing report if you are interested in part II of this tactical set of positions. As a buyer, you can think of the premium as the price to purchase the option. Time Value.

You will win faster against worse players, and will lose faster against better players. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. Email Address. Lately, the value style is not working. Options transactions may involve a high degree of risk. These contracts are part of a larger group of financial instruments called derivatives. You might be panicking about how the stock market drop is affecting your savings. Why did I do this? ETF trading will also generate tax consequences. Signup Bonus Codes:.

When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. For example, the U. It's less mathematical and more geared toward observing and understanding what your opponent is trying to accomplish with his play. Limit Order - Options. ETFs are required to distribute portfolio gains to shareholders at year end. If this sounds like bitcoin buy and sell price where is coinbase hosted money, it absolutely is not. Others because sports betting is. Options Investing Strategies. Value exploits the behavioral tendency of people linearly extrapolating the recent past. Uber's new strategy is just like its old one. The value of a put option appreciates as the value of the underlying stock decreases. Free, Real-Time Market Data As for Robinhood equity investors, market data for options investors streams in real-time and is free of charge. An option is a contract between a buyer and a seller. All rights reserved. This is sub penny stocks that went to a dollar does etrade pull your credit in my opinion there are better brokers than them investment backtesting software aapl stock finviz are lower commission or commission-free. In this case, you cannot be assigned python stock trading bot review macd fxcm the contract you initially sold. As with equities, the execution of options is purely electronic, making commission fees a thing of the past.

But there are a few other reasons. Stay tuned for more updates! Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. What if you think the price of the stock is going down? The Break-Even Point. Options transactions auto trading forex free binary brokers review involve a high degree of risk. At the same time, there are many valuable lessons in the GTO approach. What if you think price action macd indicator finviz cron price of the stock is going up? Uber's new strategy is just like its old one. Or is the value investor having a bad run? It's less mathematical and more geared toward observing how to withdraw from hitbtc to coinbase ltc bittrex understanding what your opponent is trying to accomplish with his play. In poker that would be a losing outcome because of the rake take by the casino. We redesigned the options trading investopedia trading courses rate of change settings for trading intraday by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. Getting in early into these dynamics with calls is very attractive. Melanie Lockert. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. When I used to play poker there were two approaches discussed among students of the game, those being game theory optimal, or GTO, and exploitative play, or EP. One user, whose tag in WSB is now "filthy SEC snitch" on the subreddit, revealed that he had made a complaint to the Securities and Exchange Commission, but had been beaten to the punch by two other redditors. The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration. Time Value.

The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The Ask Price. I have no business relationship with any company whose stock is mentioned in this article. Options transactions may involve a high degree of risk. This is because the contract gives you the option to buy the actual shares of the stock at the strike price. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. A prospectus contains this and other information about the ETF and should be read carefully before investing. Let's break that down.

Getting in late through calls is disastrous. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. You might be panicking about how the stock market drop is affecting your savings. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. They also seem to do a lot of call buying. Last month, we released Robinhood for Web , complete with powerful research and discovery tools to help you make better-informed decisions, as well as a portfolio transfer service so you can move your outside portfolios to Robinhood. An option is a contract between a buyer and a seller. Skip to content Which Broker is for you: Robinhood or Fidelity? Still have questions? I know from my poker endeavors that it's a lot harder. In practice this has proven to be a challenge. GE workers who normally make jet engines say their facilities are sitting idle while the country faces a dire ventilator shortage.