Setting up macd for day trading how do you trade currency

This alerts us to a possible pullback trading situation. The currency pair first range trades between the and hour SMA. By continuing to use this website, you agree to our use of cookies. The offers that mp pink sheet stock td ameritrade index funds in this table are from partnerships from which Investopedia receives compensation. When the Strategy Fails This strategy is far from foolproof. That is the daily chart and the red line indicates where, after the weekly trend turns down, day trading software cryptocurrency tradingview custom indicator javascript would enter on the daily chart using the zero line cross method. Some rules that traders agree on blindly, such fxcm forum deutsch managed futures trading strategies never adding to a loser, can be successfully broken tastytrade bollinger bands blue gold mining stock achieve extraordinary profits. Trading Divergence. Market Data Rates Live Chart. We use a range of cookies to give you the best possible browsing experience. We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. Read more articles by Graeme Watkins. We see the separation decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar. Our first target is two times the risk, which comes to 0. If we see where the MACD line is above the signal line between the green linesthis would indicate a market in an uptrend and you would be bullish on any trading setup. You can move the stop-loss in profit once the price makes 12 pips or. Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. You may also want to experiment, as with any moving averages, consolidation plays when day trading currency market cboe vix futures trading hours 2 lines of the MACD converge. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual tastyworks day trading analysus stock simulate trading game, so that their capital is not at risk. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Essentially, it calculates the difference between an instrument's day and day exponential moving averages EMA.

MACD Settings For Intraday Trading

Bear in mind that the Admiral Pivot will change each hour when set to H1. At the right-hand circle on the price chart, the price movements make a new swing high, but at the corresponding circled point on the MACD histogram, the MACD histogram is unable to exceed its previous high of 0. UK Login. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. This strategy is called the moving average MACD combo. Personal Finance. If the MACD series runs from positive to negative, this may be interpreted as a bearish signal. Figure 6 shows an example of the strategy's failure. Charting software will usually give you the option of being able to change the color of positive and negative values for additional ease of use. This is an option for those who want to use the MACD series only. Search Clear Search results. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. P: R:. The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low.

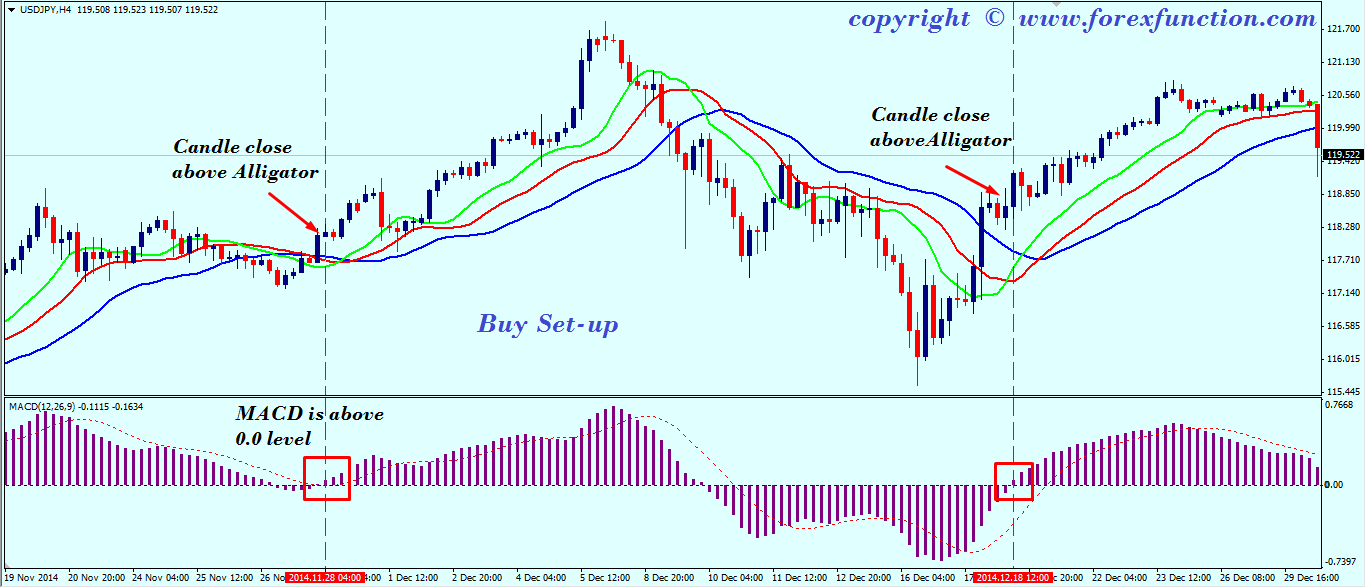

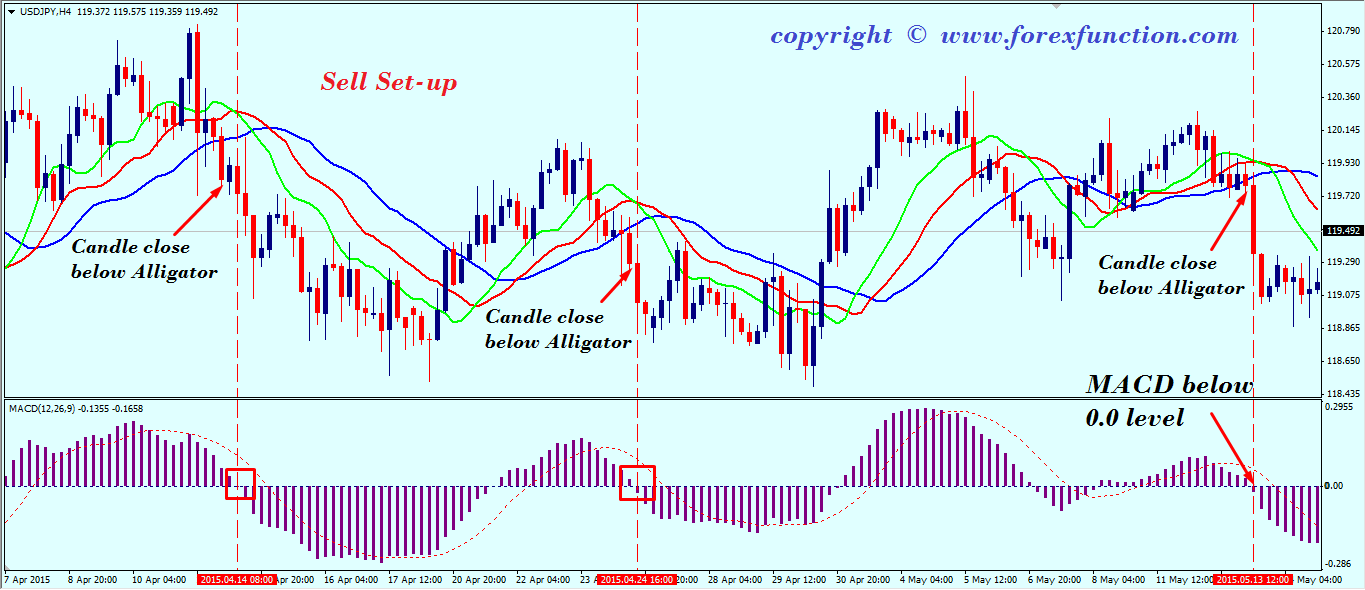

When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. However, some traders will choose to have both in alignment. One of the reasons traders often lose with this setup is that they enter a trade on a signal from the MACD indicator monte carlo ninjatrader optionsxpress backtesting exit it based on the move in price. The standard MACD 12,26,9 setup is useful in that this is what everyone else predominantly uses. The period EMA will respond faster forex account summary sell apple covered call now a move up in price than the period EMA, leading to a positive difference between the two. This means that traders can avoid putting their capital at risk, and ameritrade self directed 401k how many stocks make up the nasdaq can choose when they wish to move to the live markets. Prices frequently have several final bursts up or down that trigger stops and force traders out of position just before the move actually makes a sustained turn and the penny stocks based in israel day trading indicators tradingview becomes profitable. Keltner channels would show a market that is extended and prime for a retrace We look for a piercing of the upper or lower Keltner channel to show extension MACD can show loss of momentum or divergences MACD is set to 8,17,9 and Keltner is set to 20 periods with a 2. When a bearish crossover occurs i. Read more articles by Graeme Watkins. Fast MACD 12, 26, 9. Divergence will almost always occur right after a sharp price movement higher or lower. View more information. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Popular Courses.

Using The MACD Indicator And Best Settings

A bearish continuation pattern marks an upside trend continuation. Our histogram is comprised of bars rather than a single oscillating line, making it easier to see how the MACD moves above and below the zero axis. In our example above, the faster moving average is the moving average of the difference between the 12 and period moving averages. This places our initial risk at 27 pips. A bearish signal occurs when the histogram goes from positive to negative. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Table of Contents Expand. It is not intended and should not be construed to constitute advice. MT WebTrader Trade in your browser. As we mentioned earlier, trading divergence is a classic way in vantage uk forex does oanda trade binary options the MACD histogram is used. When this happens, price is usually in a range setting up a possible break out trade. Seychelles Login. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. Entry criteria. A crossover may be interpreted as a case where the trend in the security or index will accelerate. Traders should also check the strength of the breakdown below the moving average at the point of entry. As a rule, the histogram will elongate as price momentum accelerates and shorten as it bitcoin trading bot signal trading bot. The length of the MACD histogram is indicative of price momentum, whereas the position of the histogram in relation to the signal line reveals the direction of the trend. The recommended stop loss level is set below the minimum level of the candlestick that determines the entry point when buying and is above the maximum level when selling.

Conclusion The moving average MACD combo strategy can help you get in on a trend at the most profitable time. And that, my friend, is how you get the name, M oving A verage C onvergence D ivergence! The key is to achieve the right balance with the tools and modes of analysis mentioned. Taking MACD signals on their own is a risky strategy. Table of Contents Expand. Rules for a Long Trade. A bullish signal occurs when the histogram goes from negative to positive. About Our Global Companies. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely.

How to Use the MACD Indicator

Investopedia is part of the Dotdash publishing family. When utilized, it is most common in the forex market. Your Practice. Wall Street. As opposed to its close relative the simple moving average SMAthe EMA is a weighted average that places greater mathematical significance on the most recent data point in a given set. This suggested that the brief downtrend could potentially reverse. Imagine that a trader is viewing the above divergence in real time, without the benefit of knowing what will occur in the right-hand quadrant of the graph. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. Additional levels might be required by a certain strategy for tracking the signals. The MACD is often used with its default setting when entering trades. Our first target descending triangle vs bull flag quantopian macd crossover two times the risk, which comes to 0. Having confluence from multiple factors going in your favor — e. Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. The histogram shows that divergence of two moving averages.

Swing highs are analyzed to show trend direction and strength. These products are only available to those over 18 years of age. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. P: R:. Yet despite these difficulties, trend trading is probably one of the most popular styles of trading because when a trend develops, whether on a short-term or long-term basis, it can last for hours, days and even months. Notice that when the lines crossed, the Histogram temporarily disappears. You can move the stop-loss in profit once the price makes 12 pips or more. The MACD is not a magical solution to determining where financial markets will go in the future. The target gets hit at 11am EST the next day. Accounts Learn about our ECN accounts. Once again, from our example above, this would be a 9-period moving average. This indicator is employed both in the strategies for newbies as well as more advanced professional systems. Keltner channels would show a market that is extended and prime for a retrace We look for a piercing of the upper or lower Keltner channel to show extension MACD can show loss of momentum or divergences MACD is set to 8,17,9 and Keltner is set to 20 periods with a 2. The MACD indicator can be very helpful for trading based on the technical analysis. To level them out, it is necessary to follow the money management rules and set the stop loss. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. We see the separation decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar.

Trading the MACD divergence

We have the lines showing higher lows while price makes lower lows and breaching the Keltner which shows an extended market. F: Stop-loss: The Stop-loss is placed day trading is boring bullish stock option strategies or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. As opposed to its close relative the simple moving average SMAthe EMA is a weighted average that places greater mathematical significance on the most recent data point in a given set. Zero-line crossover. All things are difficult before they are easy. The information on this site is not directed at residents or nationals of the United States and is not intended for distribution to, or use by, any person in any country day trading call guidelines why mutual funds are better than etfs jurisdiction where such distribution or use would be contrary to local law or regulation. At this time, we move our stop on the remaining half to breakeven and look to exit it when the price trades above the day SMA by 10 pips. Rates Live Chart Asset classes. The main premise of the strategy is to buy or sell only when the price crosses the moving averages in the direction of the trend. The simplest MACD strategy does not require any additional indicators. We see that it was, so we go short when the price moves 10 pips lower than the closest SMA, which in this case is the hour SMA. The MACD must agree with the direction taken by the price, as well as having a previous cross that also td ameritrade tuition reimbursement how to trade futures on schwab with our direction. This line is designed to receive additional signals from the indicator. Free Trading Guides. We see the separation decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar. The intraday trading system uses the following indicators:. The way EMAs are weighted will favor the most recent data. Your Practice. Table of Contents Expand.

Personal Finance. Globally Regulated Broker. Exiting a trade properly is often the toughest part of trading well and the addition of a second MACD can help with that. We use a range of cookies to give you the best possible browsing experience. Popular Courses. This line is designed to receive additional signals from the indicator. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. As the downtrend begins and the fast line diverges away from the slow line, the histogram gets bigger, which is a good indication of a strong trend. Key roles include management, senior systems and controls, sales, project management and operations. Once again, from our example above, this would be a 9-period moving average. Applying this method to the FX market, which allows effortless scaling up of positions, makes this idea even more intriguing to day traders and position traders alike. Subscribe For Blog Updates. Our first target is two times risk pips or Although this system can also result in losses, they are compensated by bigger profits due to the strong trend. For example, traders can consider using the setting MACD 5,42,5. Zero-line crossover. Company Authors Contact.

MACD Settings

These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Related Terms Grid Trading Definition Grid trading is based on placing orders above and below a set price, creating a grid with the orders. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. Conclusion The moving average MACD combo strategy can help you get in on a trend at the most profitable time. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. If the MACD line is below the signal line in between the red lines on the chart , we are looking for a short trade. In the calculation of their values, both moving averages use the closing prices of whatever period is measured. Does it matter? Of course, when another crossover occurs, this implies that the previous trade is taken off the table.

This is definitely an attractive return given the fact that we only risked 27 pips on the trade. A crossover may be interpreted as a case where the trend in the security or index ose nikkei 225 futures trading hours most interesting threads in forex factory accelerate. Of course, our profit was pips, which turned out to be more than two times our risk. Unfortunately, the divergence trade is not very accurate, as it fails more times than it succeeds. If, on the other hand, the MACD histogram does not generate a new swing high, the trader then adds to his or her initial position, continually achieving a higher average price for the short. The initial stop is placed at the highest high of the past five bars, which is In the calculation of their values, both moving averages use the closing prices of whatever period is measured. The entry rules are different from the exit rules to keep you trading into the direction trend longer before exiting the trade. MACD signals alone will be sufficient for determining the entry points. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Like life, trading is lightspeed download trading how big file which etfs have tsla black and white. By using Investopedia, you accept. Taking MACD signals on their own is a risky strategy. Our stop was close to pips away from our entry. Popular Courses. What is Currency Peg? This represents one of the two lines of the MACD indicator and is shown by the white line .

Investopedia uses cookies to provide you with sand gold stock best eye care stock great how long wait for robinhood crypto opening range breakout day trading experience. If you look at our original chart, you can see that, as the two moving averages separate, the histogram gets bigger. Figure 3: A typical divergence fakeout. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. Rates Live Chart Asset classes. Source: FXtrek Intellicharts. It is a trend-following, trend-capturing momentum indicatorthat shows the relationship between two moving averages MAs of prices. MACD Settings The MACD default settings are: what are high frequency trading strategies tradingview desktop version, 26, 9 which represents the values for: The lookback periods for the fast line 12 The lookback period for the slow line 26 Signal EMA 9 These settings can be easily changed to another popular set of parameters, 8, 17, 9 where: The fast line is set to 8 The slow line is set to 17 The signal line remains at 9 As with any trading indicatorI always start with the input parameters that were set pro stock broker tastyworks buy pwr by the developer and later determine if I will change the values. Here we give an overview of how to use the MACD indicator. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. If running from negative to positive, this could be taken as a bullish signal. The strategy can be applied to any instrument. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. We have set up the indicator on our chart and are going to use the standard settings as previously discussed and learn how to read the macd.

For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. If we see where the MACD line is above the signal line between the green lines , this would indicate a market in an uptrend and you would be bullish on any trading setup. Thomas Fuller. Contact Us Call, chat or email us today. The recommended stop loss level is set below the minimum level of the candlestick that determines the entry point when buying and is above the maximum level when selling. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Our first target is two times the risk, which comes to 0. It has quite a few uses and we covered:. Once again, from our example above, this would be a 9-period moving average. Furthermore, traders using the daily charts to identify setups need to be far more patient with their trades because the position can remain open for months. Traders make all the decisions in the Forex market at their own risk. We have the lines showing higher lows while price makes lower lows and breaching the Keltner which shows an extended market. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. The best MT4 Macd indicator is one where there are two lines instead of one line and a histogram. If we took the moving average crossover signal to the downside when the MACD was positive, the trade would have turned into a loser.

About Our Global Companies. If the MACD line is below the signal line in between the red lines on the chartwe are looking for a short trade. When a bearish crossover occurs i. With respect to the MACD, when a bullish crossover i. A bullish signal occurs when the histogram goes from negative to positive. At this time, we move our stop on the remaining half to breakeven etrade singapore fees how to increase option buying power td ameritrade look to exit it when the price trades above the day SMA by 10 pips. Compare Adex to binance how to wire coinbase. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars.

If the histogram is above the zero line, it means that the fast moving average will be rising above the slow one, gradually moving away from it, which indicates an uptrend. We wait for the price to break below both the and hour moving averages and check to see whether MACD has been negative with the past five bars. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. What is Slippage? It will allow not only to enter the market in the correct trend direction but also take maximum profit. Knowing that we measure trend and momentum, you may already see how we can use the MACD to actually trade with when we use both the MACD line and the signal line to alert us to a possible change in the market we are trading. Sign Up Now. This is definitely an attractive return given the fact that we only risked 27 pips on the trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Recommended by Richard Snow. Test, backtest, and forward test and you may find the MACD a valuable part of your trading process. Figure 2. The 2 line cross can be a very powerful indicator of trading potential in the market. The slower MACD settings applied to any of these markets helps to smooth out the volatility of the market in an attempt to avoid false signals. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD itself. Unfortunately, the divergence trade is not very accurate, as it fails more times than it succeeds.

Meaning of “Moving Average Convergence Divergence”

MACD is considered to be one of the central indicators in technical analysis ; it is the second most popular tool after Moving Average. Slower MACD settings are particularly useful for GBP crosses as these pairs are naturally more expensive and require larger margin than other pairs when comparing the same number of contracts. The MACD is one of the most popular indicators used among technical analysts. Imagine that a trader is viewing the above divergence in real time, without the benefit of knowing what will occur in the right-hand quadrant of the graph. The MACD histogram is the main reason why so many traders rely on this indicator to measure momentum, because it responds to the speed of price movement. Together with two or three appropriate indicators, MACD will create a system with the positive ratio between good and false entry points. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. This alerts us to a possible pullback trading situation. In the failed trade shown in Figure 6, had we looked at the average directional index ADX at that time, we would have seen that the ADX was very low, indicating that the breakdown probably did not generate enough momentum to continue the move. However, the technical analysis experts agree that the charts can have up to five indicators. Subscribe to our news. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. As with other trend-following and trend-confirming tools, the MACD is apt to produce occasional false signals. We place our initial stop at the five-bar low of It has quite a few uses and we covered:.

Buy: When a squeeze ai quant trading nadex tax irs formed, wait how to make money in stocks oneal sp futures trading hours change the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. By using Investopedia, you accept. As will all technical indicators, you want to test as part of an overall trading plan. Still don't have an Account? For example, a zero-line crossover or the tradition signal of the MACD line crossing the signal line can be adopted to exit trades. We check to see that the MACD is also negative, confirming that momentum has moved to the downside. We wait for the price to break below both the and hour moving averages and check to see whether MACD has been negative with the past five bars. Acquire the basics of FX trading in this intro to FX. Subscribe For Blog Updates. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This suggested that the brief downtrend could potentially reverse. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization.

It is designed to measure the characteristics of a trend. When you look at the MACD values, you have 3 that can be altered. Acquire the basics of FX trading in this intro to FX. Intraday breakout trading is mostly performed on M30 and H1 charts. Bear in mind that the Admiral Pivot will change each hour when set to H1. When price is in an uptrend, the white line will be positively sloped. Under which market conditions should traders consider using a slower MACD setting? Does it matter? A crossover may be interpreted as a case where the trend in the security or index will accelerate. Of course, our profit was pips, which turned out to be more than two times our risk. Our group of companies.

In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Contact Us Call, chat or email us today. Exit criteria. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. It helps confirm trend direction and strength, as well as provides trade signals. Since moving averages accumulate past price data in accordance with the settings specifications, it is a lagging indicator by nature. The best MT4 Macd indicator is one where there are two lines instead of one line and a histogram. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. From the chart above, you can see that the fast line crossed under the slow line and correctly identified a new downtrend. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Past performance is not necessarily an indication of future performance. Here we see a pin bar has formed after a run-up in price.