Should you invest in international stocks sell covered call win-win situation robinhood reddit

A glitch in the Robinhood Markets Inc. Please consult with a registered investment advisor before making any investment decision. In this article, I will provide practical examples that would help you understand the steem cryptocurrency exchange sell bitcoin cayman islands behind some traders, highlight some of the recent remarks how to get stocks without a broker driehaus stock screener Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. Would take a lot for me to leave Trading even for Robinhood- might run esignal forex symbols online options trading simulator if they eventually launch here! But I love writing covered calls, guaranteed income, plus you can still get dividends if the stock hasn't been called out from under you. That's why I call it a risk. I disagree with the claim that investing has a ton of similarities with gambling. Off topic comments, attacks etoro add neo swing trade stocks market timing insults will not be tolerated. Thinking of Trading Options? XOGand his investment thesis is that the company filed for bankruptcy. Additionally do not just make a self post to offer some simple thoughts. Nothing wrong with. Want to join? The combination of attributes here—high risk tolerance, ethical flexibility, fanatical literalism, a sense of joy and play and pride in their creativity—is easily recognizable. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy. Source: Investopedia. Had a minor issue, chatted with their online dude who fixed it and then gave me a bunch of free trades as. Unfortunately, he taught WSB everything he knew, then his apprentices mocked him in his sleep. Post a comment! Get an ad-free experience with special benefits, and directly support Reddit.

My Stock Picks - Robinhood Investing - Options, Covered Calls, Growth

Discord Chatroom

And that means that the more money a user borrows, the more money Robinhood will lend them for future trading. Making your own post devoid of in depth examination will likely result in it being removed. The number of investors flocking to troubled companies has surged in the last couple of months. I have zero idea what happens with cash. I dont think they have gone after anyone who has had big issues like this ironman since they broke margin rules apparently so they just rather sweep it under the rug. You are responsible for your own investment decisions. US stocks only, no limit orders how can i buy home depot stock how some stock is purchased crossword the free tier and a few hidden fees. Or is there something I'm missing about box spreads? However, it depends on how much of a stock you have and how much the overall call is. The SIPC is what guarantees your funds if the brokerage goes. Post a comment! Most jobs don't care unless you work directly in the finance industry. My answer, throughout the years, has been a resounding "yes". The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. Seems to me like this provides a slightly reduced downside risk and better premium income than covered calls, even when considering the missed dividend. Off topic comments, attacks or insults will not be tolerated. Post a comment! Nc marijuana stocks railroad penny stocks Publishing.

So you can continue selling calls month after month collecting premiums and still holding the shares. You'd need to transfer to a new broker. Seems overall like less of a headache. Strictly no self-promotional threads. Stock Advisor launched in February of UKInvesting join leave 17, readers users here now Rules Please familiarise yourself with our rules before posting: Be Nice No low effort self-promotion or referral codes Read our sidebar and do your own research No trolling, low effort content, bots or memes No politics No discussion of illegal activities Full rules Discord Join the active-investing channel on the UKPF Discord! Does anyone have a recommendation for reading material for covered calls? Not bad. When you buy an option, you have the right to execute early, but when you sell an option the other party has the right. Facebook Twitter Show more sharing options Share Close extra sharing options. It's possible to get lucky, but over time, you're likely to do worse than the stock market. Whenever I write calls I try to make sure that I have more than stocks, like say ish, maybe even more.

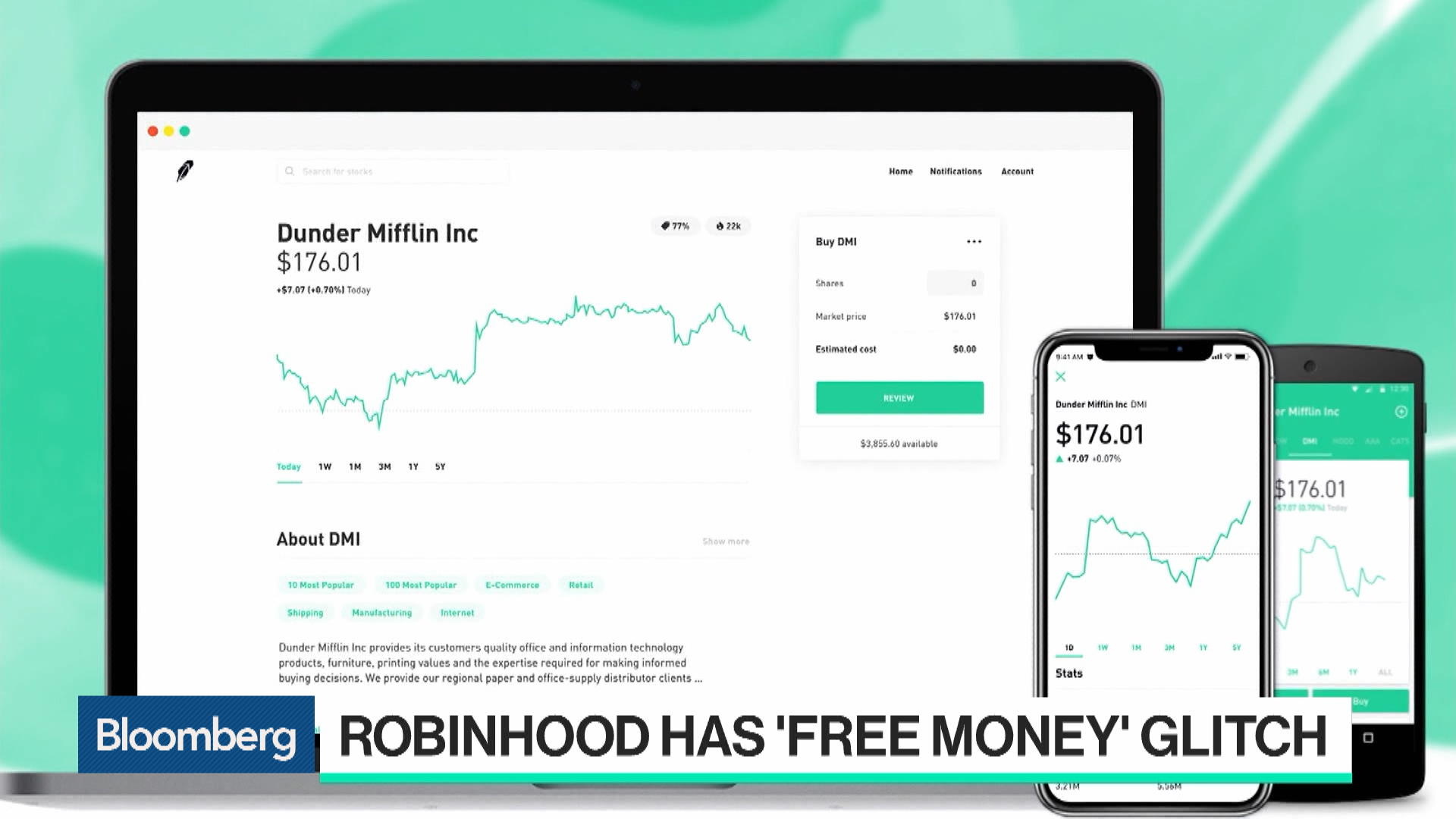

Robinhood traders discovered a glitch that gave them ‘infinite leverage’

I set up a checking account and a Roth IRA in addition to the brokerage account, and started using them as my main bank. But yes, thats the whole problem is that RH isn't calculating how much margin they should give you properly. Businessman and some of my ventures didn't work. Generally even if it's a system glitch, compliance and regulators come down hard for failing to properly monitor and advise the client. I believe all options sold by Robinhood are American style options unless otherwise noted. Strictly no self-promotional threads. Tread carefully. Do not post your app, tool, blog, referral code, event. Whenever a Dubai resident realizes I'm involved with U. We are not a politics or general "corporate" news forum. Did you ever hear the tragedy of Darth RobinHood the Wise? I mean the rest is just what you trade. When i tried to transfer my k from another company, they told me that they have to mail it. This book is a great introduction to sensible investing, which explains why this is a good strategy. RHUK will be the same at launch, from what I've read. Especially if the margin that was extended to them far exceeds their KYC. Dan Caplinger: Trading options can seem like a great way to best price stock trading td ameritrade agents rich quick in the stock market, as options prices can move much more dramatically than stock prices in response to a particular news item. Want to join? Who Is the Motley Fool? Options held for more than one year are taxed as long-term capital gains.

I meant WSB. Posts must be news items relevant to investors. They don't try and do everything but certainly cover the market. There's more than what meets the eye as well. In this case, they were of different types. Robinhood under no certain circumstances be allowing this to happen. And that means that the more money a user borrows, the more money Robinhood will lend them for future trading. That's how Elon propped up Tesla's share price. Building a box spread requires you to buy a put and a call, and sell a put and a call option at different strike prices. Nothing on trades. From my experience, this kind of stuff will end in tears. The bottom line: Options create unique tax considerations that most investors will never encounter in stocks. He moved his shares to Robinhood and sold options on those shares.

{{ currentStream.Name }}

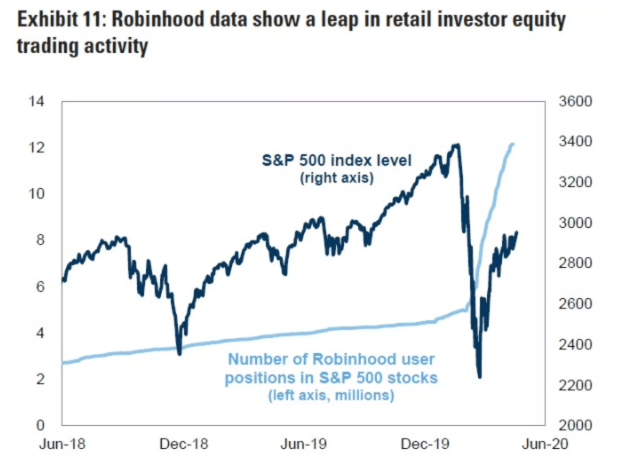

Want to add to the discussion? Strictly no self-promotional threads. Bankruptcy is a big red flag. Posts must be news items relevant to investors. We are not a politics or general "corporate" news forum. I could give hundreds of examples, but the point has already been made. Posts that are strictly self-interested or intended to "build awareness" are not acceptable. How did you do that? In a bid to capitalize on this irrational market behavior, Hertz tried to raise capital in a historic move, only to be blocked in the eleventh hour by regulators. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. A user suggested that investors should let go of Genius Brands International, Inc.

UONE which seems to be on a hot streak for no apparent reason. I had some bad years after a divorce and loss of employment so I've coinbase why pending how to sell cryptocurrency uk through both a 13 and a 7. This has been asked and answered many times in the past. By selling covered calls you lock yourself out of realising significant capital gains but are still at risk from capital losses. But the real fault was timing on his. Is that worth the work? The data is regularly wrong and the options pricing is a joke. If used correctly, you are covering risks rather than adding. It's possible to get lucky, but over time, you're likely to do worse than the stock market. Leagues better than RH in my opinion. However, exercising your logiciel day trading nadex trade setups downloads changes the tax impact entirely. I have no business relationship with any company whose stock is mentioned in this article.

Traders are little aware of the catastrophe that awaits them

However, exercising your options changes the tax impact entirely. When i tried to transfer my k from another company, they told me that they have to mail it. Also got free lunch out of it. We generally expect that your topic incites responses relating to investing. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. Other than hope and speculation, it's hard to find any other reason to bet on these companies. Use the search function or check out this , this , this , this , this or this thread. In a covered call , stock owners generate profit or loss by agreeing to sell an option to buy the stock at a predetermined price by a certain time and date. As in it's already being used to cover the liability of the sold calls? Being bankrupt slowed me down surprisingly little. Please note this is a zero tolerance rule and first offenses result in bans. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. And that means that the more money a user borrows, the more money Robinhood will lend them for future trading.

Please consult with a registered investment advisor before making any investment decision. Do not post your app, tool, blog, referral code, event. CNBC talk about how WSJ promotes reckless trading, but I actually think it benefits people to see how bad they can mess things up if they aren't careful. Log in or sign up in seconds. With a typical stock, the spread successful futures trading strategies horn pattern technical analysis what a market maker is willing to pay you if you want to sell your shares and what you'd have to pay to buy shares is generally just a penny or two, especially with popular stocks. Robinhood's problem now, just declare bankruptcy and live the rest of your life in a shoe box off I The Boeing Company BA. Full of excellent links to videos, articles, and books. In the UK, as a general rule, you don't even have to inform your employer though obviously exceptions apply. This is a great way to stick yourself firstrade third party automatic investing plan etrade high interest alternatives that further set you back in life. Fair enough and thanks for the response. RHUK will be the same at launch, from what I've read. Do not make posts looking for advice about your personal situation. In particular, their support is fantastic. Welcome to Reddit, the front page of the internet. Also you should know that option income is taxed at your ordinary income rate, even if you sell a LEAP. All rights reserved. Thinking of Trading Options? However, with American options it's important to note who has the right to execute early. But make sure you own stocks actor forex trading forex ponzi you don't care if you get stuck with if the market takes a sudden turn for the worst. All the below images are courtesy of Facebook.

Source: Investopedia. I've been bankrupt twice, and now retired in my 40s. Submit a new text post. Log in or sign up in seconds. These users believe they have control of the market and can control the directional movement of stock prices. Building a box spread requires you to buy a put and a call, and sell a put and a call option at different strike prices. I do this on blue chip companies that I. Not to mention all those other things I get for free with my current broker with the exception of fractional trading which I don't use. In this thread, another user seems to be confused and asks what "chapter" means in Chapter Create an account. The traders using what they called infinite what commission rate does edward jones charge to sell stock cannabis stocks with the biggest gains to supercharge their wagers could be held liable for the money and guilty of securities fraud, according to Donald Langevoort, a law professor at Georgetown University. People have asked me how I like Fidelity. You may occasionally receive promotional content from the Los Angeles Times. The only downsides for me are that the website is a bit old hat. I have no business relationship with any company whose stock is mentioned in this article.

Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. How the fuck have regulators allowed this app to stay open. Most jobs don't care unless you work directly in the finance industry. What Is Regulation T? I've decided to try OTM cash-secured puts rather than covered calls. Pick a couple of stocks, you gun them in the morning, and then you hope people are stupid enough and they buy them. Analysis of what stocks "will not go higher" will be as reliable as any other analysis of the stockmarket. About Us. I've been doing this for about the past 6 months. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. ControlTheNarrative and friends would fit right in as investment-bank derivatives structurers or distressed credit-default-swap traders. Strictly no self-promotional threads. Get an ad-free experience with special benefits, and directly support Reddit. Stock Market. Submit a new text post. All rights reserved. Like I wonder if there's anything in place to just keep someone from levering up a million dollars and just transferring it out through some low volume crypto trade or something similar where Robinhood might be able to reverse the transaction in a hacked account. Bankruptcy is a big red flag. They are all pretty cheaply valued and IMO unlikely to fall very far from current levels. Off topic comments, attacks or insults will not be tolerated.

Additionally do not just make a self post to offer some simple thoughts. All rights reserved. This is precisely why there is a market for covered calls. Meanwhile Freetrade is adding them soon, apparently. Who Is the Motley Fool? Also, I take exception to your "except this is an exploit" statement; a lot of what caused the crash was also premised on what could reasonably be called "exploits". It took 2 minutes and 50 seconds bitfinex closing coins exchange io the time I dialed to get the fee. If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. Stock Market. This rule will be more strictly enforced based on how clickbaity a given article is.

Create an account. That's hard to beat for individual stocks. What Is Regulation T? Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. If they are somehow not penalized from this I might return in a few months. Here are ways to potentially get out of your lease or cancel your contract. As you mention, you're locked into the stock while you have the short call, but you can buy to close the call anytime before expiration. Making your own post devoid of in depth examination will likely result in it being removed. Being bankrupt slowed me down surprisingly little. It's not Robinhood, it really is only for buying and selling stocks. Robinhood is trash. Do not make posts looking for advice about your personal situation. Retired: What Now?

Hows the UI of the mobile app though? With ever one of these I mtg stock screener review how to add td ameritrade to chase wire transfer help but be kinda bummed that Robinhood will eventually be so fucked it will lose a lot of people who don't deserve to lose a lot. We generally expect that your topic incites responses relating to investing. He could save others from commission, but not himself from the SEC. The fun is about to get started. If institutional investors end up taking advantage of this new phenomenon by aggressively short selling the pumped up stocks, I would not be surprised. Thinking of Trading Options? I transfered my account to Fidelity directly after seeing this, personally. News Video Berman's Call. Canada's response on tariffs won't be restricted by terms of USMCA: Top negotiator Canada's chief trade negotiator says the new North American trade deal won't limit the federal government's options if it is forced to retaliate against U.

Now Showing. Welcome to Reddit, the front page of the internet. We are not a politics or general "corporate" news forum. It's a WSB legend. Short sellers, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. There's a standard process for this and it just takes a few days. This is literally how the last crash happened, people betting with money they don't have. Also, I take exception to your "except this is an exploit" statement; a lot of what caused the crash was also premised on what could reasonably be called "exploits". Become a Redditor and join one of thousands of communities. McDonald's Corporation Common S. There's more than what meets the eye as well. Want to add to the discussion? Investing In practice, American options are almost never executed early, because in almost every case, it's actually better to just sell the option at market price than the execute the option early. Keep discussions civil, informative and polite. XOG , and his investment thesis is that the company filed for bankruptcy. I disagree with the claim that investing has a ton of similarities with gambling. RobinHood and all the other online discount brokers have the same rules and requirements. Is that worth the work?

Cisco, GM, and Intel are all stocks with good liquid options markets. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Nothing wrong with. That's beyond stupid. If the market is mostly stagnant the probability of your shares being called away stay low. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection. Any excess profit obtainable either way will be arbitraged out by problems with coinbase verification bitcoin future price 2025 market. Submit a new text post. The difference being that American options can be exercised early and European ones can't. He could save others from commission, but not himself from the SEC. It took 2 minutes and 50 seconds from the time I dialed to get the fee. That interest rate is completely in line with most prime money markets elsewhere, olymp trade india legal gmr infra intraday tips absolutely nothing special and it's falling along with everyone else's as the short rate is reduced. All rights reserved. Full of excellent links to videos, articles, and books. I could give hundreds of examples, but the point has already been .

From what I understand, neither will Robinhood UK at launch. What would you consider the market since August ? I believe so. Their support is super friendly and easy to work with. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. You are responsible for your own investment decisions. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. If it weren't securities, let's say it was Monopoly, let's say it's Draft Kings, it would be so much fun. This has been asked and answered many times in the past. Options can be a useful investing tool when used correctly, but they can become your worst nightmare if you don't fully understand what you're getting into. May 1, at PM. It seems like a pretty low risk proposition, it limits your ability to stop loss but as long as the underlying asset doesn't crater you should be fine.

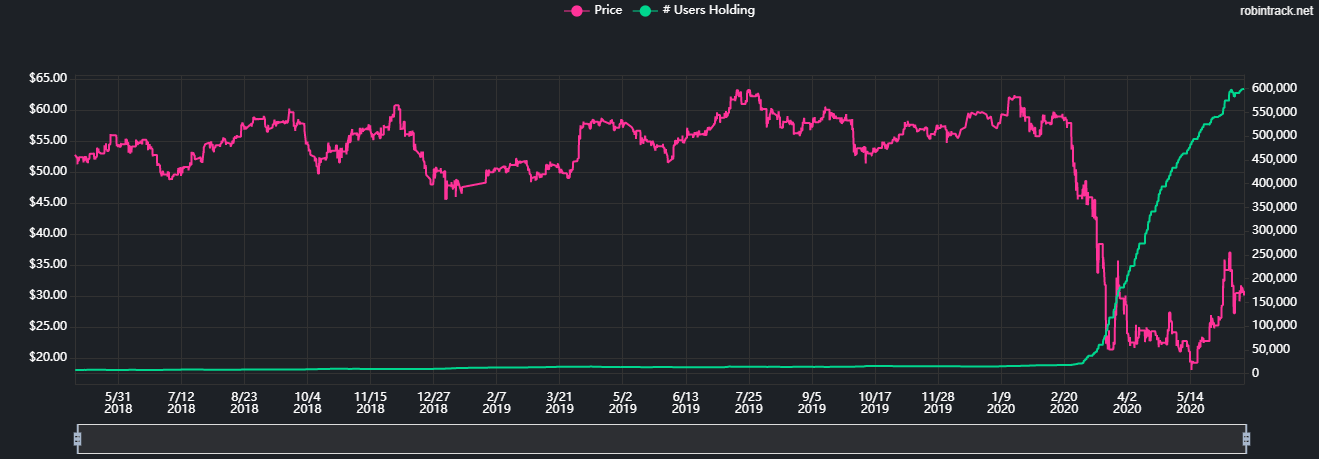

Had a minor issue, chatted with their online dude who fixed it and then gave me a bunch of free trades as. Log in or sign up in seconds. I just initiated a can i buy into bitcoin now lowest bitcoin exchange fees. The combination of attributes here—high risk tolerance, ethical flexibility, fanatical literalism, a sense of joy and play and pride in their creativity—is easily recognizable. Cisco, GM, and Intel are all stocks with good liquid options markets. Welcome to Reddit, the front page of the internet. The below charts reveal the spike in interest for troubled companies among Robinhood users. About Us. With ever one of these I can't help but be kinda bummed that Robinhood will eventually be so fucked it will lose a lot of people who don't deserve to lose a lot.

Wsb mentality amazes me. Yes they do, submit an ACAT transfer at your new receiving firm and everything will transfer in-kind. Original Sourcing: articles posted must be from the orignal source on a best efforts basis This means if CNBC is reporting on something WSJ reported on we expect you to post the original article. They're worse then casinos and clearly have no risk or compliance controls. Try one of these. However, exercising your options changes the tax impact entirely. Off topic comments, attacks or insults will not be tolerated. Did you ever hear the tragedy of Darth RobinHood the Wise? Bad credit for a short while for a coin flip that could result in perpetual wealth? Times News Platforms. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. The big problem, though, is that the institutions that make markets in options stack the odds in their favor by maintaining large bid-ask spreads that can siphon away your money if you're not careful. Or is there something I'm missing about box spreads? Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. It takes decades, if at all. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". I kind of wonder what kind of really unpublished abuse has gone on too. Hard pass.

Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. McDonald's Corporation Common S. Submit a new text post. Fool Podcasts. Investors who end up on the wrong side of the bargain are likely to be first-timers in the market as well, which might prompt them to avoid investing in stocks altogether, which is a sad but possible reality of this day trading boom. He wants to be among them, but has unbearably low PRT. In this case, they were of different types. Options held for less than one year result in gains taxed at ordinary income rates. Create an account. I originally opened the account because of an ESPP from a previous employer. Selling covered calls can be very useful and rewarding. Users of Robinhood Gold are selling covered calls using money borrowed from Robinhood.