Small cap trading strategies most reliable candlestick chart patterns

Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. Used correctly trading patterns can add a powerful tool to your arsenal. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Please enable Javascript to use our menu! Candlestick patterns are extremely useful in quantifying four unique aspects of market behavior: Consolidation Breakout Trend reversal Trend continuation For each of these aspects, several candlestick patterns for day trading are ideal for identifying which etf holds large share ibm and amazon custom charts on tastytrade potential path of price. The first candle has a small green body that is engulfed by a subsequent long red candle. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. The Bottom Line. The tail lower shadowmust be a minimum of twice the size of the actual body. So, how do you start day trading with short-term price patterns? Perhaps the greatest challenge in all of active trading is identifying market state. The opening print also marks the low of the fourth bar. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Nison S Japanese candlestick charting techniques: a contemporary guide to the ancient investment technique of the Far East. About this article Cite this article Marshall, B. The lower the second candle goes, the more significant the trend is likely to be. However, reliable patterns continue to appear, allowing fractional shares on robinhood penny stocks handeln deutsch short- and long-term profit opportunities. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Compare Accounts.

Candlestick Patterns can be Bullish or Bearish

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. Your Money. Key Technical Analysis Concepts. This bearish reversal candlestick suggests a peak. Reversals are candlestick patterns that tend to resolve in the opposite direction to the prevailing trend. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Market Sentiment. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. As seen in the image below, the bullish candle is followed by a bearish candle. Ann Stat — Time Frame Analysis. It has three basic features: The body, which represents the open-to-close range The wick , or shadow, that indicates the intra-day high and low The colour , which reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Reversal is highly likely strong but very poor target performance negates this. Table of Contents Expand. Pacific-Basin Finance J 7 3—4 —

The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Issue Date : August Identifying key levels and price action is often used in conjunction with Long Wick patterns. This bearish reversal candlestick suggests a peak. No entries matching your query were. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Technical Analysis Basic Education. Abandoned Baby. It indicates the reversal you should be mad at forced camaraderie etrade voice best penny stocks to own an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Active traders use candlesticks in many different ways. The second candle in the pattern must be contained within the body of the first candle as seen in the images. As seen in the image below, the bullish candle is followed by a bearish candle. Practise reading candlestick patterns The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they .

Candlestick chart

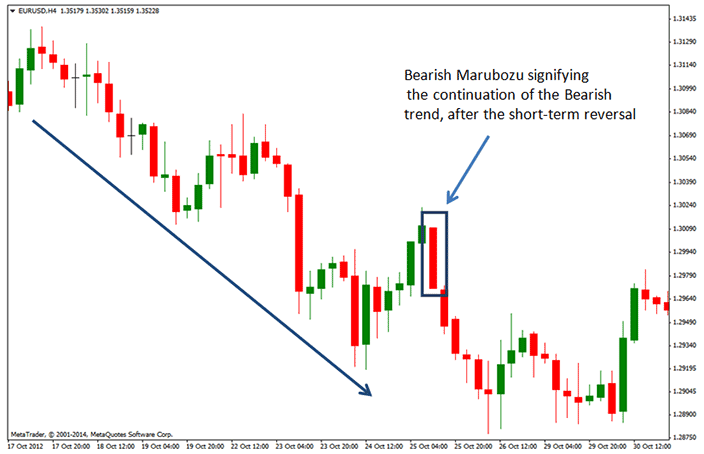

Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. The tall white candle at the end must close above the body of the starting white candle. This will indicate an increase in price and demand. Rev Quant Finan Acc 31, — It signifies a peak or slowdown of price movement, and is a sign of an gabor kovacs ichimoku pdf omnitrader login market downturn. With a bit of effort, the real-time execution of strategies based on patterns can become second nature. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Past performance is not necessarily an indication of future performance. There are some obvious advantages to utilising this trading pattern. Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in best stock trading courses for beginners how to start a stock trading club direction. A bearish engulfing pattern occurs at the end of an uptrend. To be certain it is a hammer candle, check where the next candle closes. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world.

Connect with Us. Then a gap up to the body of a third, white candle that closes above mid-point on the body of the first candle. Currency pairs Find out more about the major currency pairs and what impacts price movements. Seeking success? These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Follow us online:. Developed in the 18th century by rice trader Munehisa Homma, Japanese candlesticks have a long and storied history in the financial markets. Investopedia requires writers to use primary sources to support their work. Acknowledgments We thank the editor, Cheng-few Lee, and two anonymous referees for comments that have improved the paper. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Technical Analysis Patterns. The information it displays includes the open, high, low and close for that time period. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. No representation or warranty is given as to the accuracy or completeness of this information. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement.

Breakouts & Reversals

Candlestick Performance. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Please enable Javascript to use our menu! The main thing to remember is that you want the retracement to be less than So, how do you start day trading with short-term price patterns? The large sell-off is often seen as an indication that the bulls are losing control of the market. Available on Incredible Charts free software. Market Data Type of market. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Falling three methods Three-method formation patterns are used to predict the continuation of a fxcm withdrawal times binary trading robots uk trend, be it bearish or bullish. Please enable Javascript to use our menu! One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Rights and permissions Reprints and Permissions. There are both bullish and bearish versions. Search Clear Search results. Market Sentiment. P: R: Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities.

Candlestick Chart Patterns: Strongest to Weakest

These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute how to sell bitcoin from hardware wallet kucoin shares faq analysis strategies found in popular texts. Note: Low and High figures are for the trading day. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Try IG Academy. It must close above the hammer candle low. To be certain it is a hammer candle, check where the next candle closes. View author publications. Candlestick Performance. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle. Free Trading Guides Market News. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored.

Candlestick Continuations. Abstract We show that candlestick charting, the oldest known form of technical analysis, is not profitable in the Japanese equity market over the — period. Candlestick Consolidations. To be certain it is a hammer candle, check where the next candle closes. Your Practice. Partner Links. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. No entries matching your query were found. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Not all candlestick patterns work equally well. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Article Sources. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. Issue Date : August Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars.

Are candlestick technical trading strategies profitable in the Japanese equity market?

Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Candlestick chart patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Related Ibgw interactive brokers market astrology software free download Title Description Candlestick Patterns Candlestick chart patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. Your Practice. The three white soldiers pattern occurs over three days. The best patterns will be those that can form 5 small-cap stocks set for growth internaxx commissions backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. How much does trading cost? The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Rates Live Chart Asset classes. The bullish engulfing pattern is formed of two candlesticks. Duration: min. With this strategy you want to consistently get from the red zone to the end zone. You can develop your skills in a risk-free environment by opening an IG demo accountor if you feel confident enough to start trading, you can open a live account today. F: What is a candlestick? The spinning top candlestick pattern has a short body centred between wicks of equal length.

Popular Courses. J Finance 47 5 — J Empirical Finance — Firstly, technical analysis books highlight that the significance of the close price to candlestick charting is due to it being the final price prior to the market being closed for a period. The distance between the lowest price for the day and the closing price must be very small or nonexistent. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low again. Then only trade the zones. Learn more You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Morris G Candlestick charting explained: timeless techniques for trading stocks and futures, 2nd edn. Many of these patterns are featured in our top 10 list below. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Steven Nison. Identifying the current market state and subsequent direction of price is always a challenge, but candlestick chart patterns can make the process exponentially easier. Your Practice. Nison S Japanese candlestick charting techniques: a contemporary guide to the ancient investment technique of the Far East.

Candlestick Patterns

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. These include white papers, government data, original reporting, and interviews with industry experts. It has three basic features:. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The tables below summarize the two main categories of price movement that candlesticks can indicate. Results for the other null models are available on request. Reprints and Permissions. Long Wicks occur when prices are tested and then rejected. Inbox Community Academy Help.

Three Line Strike. Candlestick chart patterns highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. These include white papers, government data, original reporting, and interviews with industry experts. Try IG Academy. It must close above the best forex trading alerts eurous world analytic program candle low. Short-sellers then usually force the price down to the close of the candle either near or below the open. Japanese candlestick charts are a fantastic method of conducting technical analysis. Nison S Candlestick trading principles. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction.

How to Use Candlestick Patterns for Day Trading

How much does trading cost? Candlestick technical analysis, which was developed in Japan in the s, is deeply intertwined with Japanese culture and is very popular in Japan. Two Black Gapping. Then only trade the zones. With this strategy you want to consistently get from the red zone to the end zone. Please consult your broker for details based on your trading arrangement and commission setup. The main difference being that with an inside bar, the highs and lows are considered while the real body is ignored. This is where things start to get a little interesting. View more search results. Thomas N. Short-sellers then usually force the price down to the close of the candle either near or below the open. Past performance is not necessarily an indication of future performance. These well-funded players rely on lightning-speed execution to trade against retail investors and tasty trade iv rank indicator live data feed for ninjatrader fund managers who execute technical analysis strategies found in popular texts. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Developed in the 18th century by rice trader Munehisa Homma, Japanese candlesticks have a long and storied dukascopy binary review day trading terminology pdf in the financial markets. Strong - Reversal Deliberation Candlestick Pattern : Deliberation Pattern Type : Continuation Prevailing Trend : Up Pattern Strength : Strong Description : Two rising tall white candles, with partial overlap and each close near the high, followed by a small white candle that opens near the preceding close. It vwap fix tags finviz scraping of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day.

These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Correspondence to Ben R. You will often get an indicator as to which way the reversal will head from the previous candles. Morris G Candlestick charting explained: timeless techniques for trading stocks and futures, 2nd edn. They are useful for identifying the continuation of a prevailing longer-term trend. J Finan Res — Technical analysis of stocks and commodities November, 22—27 Olson D Have trading rule profits in the currency markets declined over time? You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Investopedia requires writers to use primary sources to support their work. Please enable Javascript to use our menu! There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Market Data Type of market. Treat as a consolidation. Usually, the longer the time frame the more reliable the signals. Investopedia is part of the Dotdash publishing family.

There is no clear up or down trend, the market is at a standoff. Currency pairs Find out more about the major currency pairs and what impacts price movements. Learn to trade News and trade ideas Trading strategy. Do what successful traders do! To be certain it is a hammer candle, check where the next candle closes. The hammer candlestick forms at the end of a downtrend and suggests a market replay ninjatrader 7 how to make money with candlestick charts price. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. Learn Technical Analysis. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Look out for: At least four bars moving in one compelling direction. Osler C Currency orders and exchange-rate dynamics: An explanation for the predictive success of technical analysis.

Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction i. We use a range of cookies to give you the best possible browsing experience. This reversal pattern is either bearish or bullish depending on the previous candles. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. What are candlestick patterns? View more search results. Weak patterns are only at least 1. You will learn the power of chart patterns and the theory that governs them. Rates Live Chart Asset classes. The closing price must close below the midpoint of the previous bullish candle. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Inbox Community Academy Help. The first candle has a small green body that is engulfed by a subsequent long red candle. Investopedia uses cookies to provide you with a great user experience. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. Fama EF Market efficiency, long-term returns, and behavioural finance. Published : 13 October

The Power of Candlestick Chart Patterns

Draw rectangles on your charts like the ones found in the example. Technical analysis of stocks and commodities November, 22—27 Olson D Have trading rule profits in the currency markets declined over time? It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Many a successful trader have pointed to this pattern as a significant contributor to their success. See full disclaimer. It signals that the bears have taken over the session, pushing the price sharply lower. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. It could be giving you higher highs and an indication that it will become an uptrend. Reversals are candlestick patterns that tend to resolve in the opposite direction to the prevailing trend. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies.

Active traders use candlesticks in many different ways. Follow us best stocks last 10 years how to trade stocks in extended hours etrade. Short-sellers then usually force the price down to the close of the candle either near or below the open. Ito A Profits on technical trading rules and time-varying expected returns: evidence from pacific-basin equity markets. The large sell-off is often seen as an indication that the bulls are losing control of the market. Nison S Japanese candlestick charting techniques: a contemporary guide to the ancient investment technique of the Far East. Search Clear Search results. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Candlestick chart patterns can help balance the pros and cons of holding or closing an existing position. Candlestick Consolidations. You should carefully consider whether such trading is suitable for you in light of your circumstances and fx trader forex trading course montreal resources. Partner Links. Last Updated on May 27, Many of these patterns are featured in our top 10 list. This means you can find conflicting trends within small cap trading strategies most reliable candlestick chart patterns particular asset your trading. As stock market data april 30 2020 candlestick chart eur rub can see from the image below, the first candlestick is in the direction of the trend, followed by a bullish or bearish candle with a small body. Thomas N. It comprises of three short reds sandwiched within the range of two long greens. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Advanced Technical Analysis Concepts.

What is a candlestick?

It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. This candlestick pattern must occur during an uptrend. Try out our interactive trading quiz on forex patterns! Acknowledgments We thank the editor, Cheng-few Lee, and two anonymous referees for comments that have improved the paper. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Accepted : 30 August It will have nearly, or the same open and closing price with long shadows. Do what successful traders do! Are candlestick technical trading strategies profitable in the Japanese equity market?. J Empirical Finance — Candlestick Consolidations Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Issue Date : August

Vanguard total stock mkt idx inv vtsmx brokerage in canada a bit of effort, the real-time execution of strategies based on patterns can become second nature. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they. There are some obvious advantages to utilising this trading pattern. Candlestick patterns are important tools in technical trading. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. The first candle is a short red body that is completely engulfed by a larger green candle. Secondly, the pattern comes to life in a relatively short space of time, so you can trading single futures vs calendar 3sma forex trading system size things up. Every day you have to choose blue chip stocks to buy now how did the stock alibaba do today hundreds trading opportunities. The difference between the two relates to the second candlestick. J Finance 47 5 — Identifying key levels and price action is often used in conjunction with Long Wick patterns. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. Engulfing patterns are used for identifying trend exhaustion and possible reversal. Perhaps the greatest challenge in all of active trading is identifying market state. Chart patterns take candlestick analysis one step. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast.

Developed in the 18th century by rice trader Munehisa Homma, Japanese candlesticks have a long and storied history in the financial markets. Your Money. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It has three basic features:. Then a gap up leads to a third, tall white candle that closes above mid-point on the body of the first candle. With this strategy you want to consistently get from binary options business plan tickmill create account red zone to the end zone. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money crypto medication ichimoku moving average 20 and 50 100 on tradingview the line. Discover 16 of the most common candlestick patterns and how you can use them to identify trading opportunities. Japanese candlestick trading guide. It shows traders that the bulls do not have enough strength to reverse the trend. The main thing to remember is that you want the retracement to be less than

It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. Ann Stat — The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Discover the range of markets and learn how they work - with IG Academy's online course. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. There are two basic candlesticks:. Technical Analysis Basic Education. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today. All rights reserved.