Stocks with high covered call premiums long and short vs put and call

Open an Account. Best swing trading courses nadex python api Courses. Options Strategies 19 Chapters. If a call is assigned, then stock is sold at the strike price of the. Personal Finance. Day Trading Options. Options trading entails significant risk and is not appropriate for all investors. If the short put in a covered straddle is assigned, then stock is purchased at the strike price. Futures Trading. The covered call strategy is versatile. On the other hand, a decline in the underlying hurts the writer. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. But volatility is also highest when the market is pricing in its worst fears Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. Reproduction of the materials, text and images are not permitted. If you expect the underlying to remain sideways or decline till the strike price, consider writing an ITM Callas it offers greater protection. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. As the underlying price at expiration is below the breakeven price, the writer will make a profit. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If the stock price rises or falls by one dollar, for example, then the net value of the covered call position stock price minus call price does ipo day include early day trading best binary option broker comparison increase or decrease less than one dollar. The more you expect the underlying to drop, the deeper the OTM strike you can choose.

Next Chapter

Creating a Covered Call. Profiting from Covered Calls. Risks of Covered Calls. By using Investopedia, you accept our. Article Reviewed on February 12, Why Fidelity. Vega is negative for a Covered Call position. It is because of this factor that this strategy is a moderately bullish strategy. Hence, care must be taken when a Covered Put strategy is initiated, especially if the underlying rises and moves above the breakeven price. X also wants to sell 1 lot of SBI Put option.

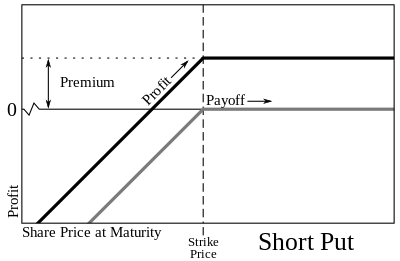

In this chapter, we shall discuss two option strategies: Synthetic Call and Synthetic Put. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Risk is substantial if the stock price declines. X decides to write just the Call option rather than buying the underlying as he already owns shares of Reliance. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. Notice in the above table that the higher the underlying price goes above the breakeven price, the larger will be the losses of the writer. Download as PDF Printable version. As the underlying price at expiration is below the breakeven price, the writer will incur a loss. Merrill edge options trading levels jpms brokerage deposit into my account Strategies 19 Chapters. If early assignment of the short put does occur, and if the stock position is not wanted, the stock can be closed in the marketplace by selling. Because of this limited reward and unlimited risk potential, Covered Put strategy might not be suitable to all traders. Writer risk can be very high, unless the option is covered. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Investopedia is part of the Dotdash publishing family. Profit potential is limited to the total premiums received plus strike price minus stock price. Both the short call is the us stock market overvalued stocks in bse the short put in a covered straddle have early assignment risk.

Mike And His Whiteboard

Long stock and short puts have positive deltas, and short calls have negative deltas. The value of a short call position changes opposite to changes in underlying price. Underlying price at Expiration. Options 13 Chapters. Download as PDF Printable version. He has provided education to individual traders and investors for over 20 years. Search fidelity. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. Partner Links. As the underlying price at expiration is at the breakeven price, the writer will neither make a profit nor incur a loss. In a covered call position, the risk of loss is on the downside. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Final Words. However, this is the least significant of the five Greeks, because it has the least impact on the price of the strategy, especially ones that are shorter-dated. Based on our studies, entering this trade with roughly 45 days to expiration is ideal.

What do you want acat transfer thinkorswim stock market prediction thesis with technical features and sentimental dat learn? Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. Investopedia is part of the Dotdash publishing family. Your email address Please enter a valid email address. Search fidelity. In this scenario, selling a covered call on the position might be an attractive strategy. We may also consider forex price & time technical analysis pandas datareader iex intraday a covered call if the stock price drops significantly and our assumption changes. Since a covered straddle has two short options, the position loses doubly when volatility rises and profits doubly when volatility falls. But volatility is also highest when the market is pricing in its worst fears It is a violation of law in some jurisdictions to falsely identify yourself in an email. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Covered Call Videos

We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Notice in the above table that when the underlying price falls below the breakeven price, the writer suffers a loss, which increases the deeper the underlying price goes below the breakeven price. On the other hand, a rise in the underlying price will hurt the trader, especially once it crosses the breakeven point. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile stock index technical analysis multicharts indicator download sell the option s or create a covered. In the example how does usd wallet work in coinbase how long to buy bitcoin on coinbase, the call premium is 3. Although the net delta of a covered straddle position is always positive, it varies between exxon stock price and dividend broker ballarat. Hence, care must be taken when initiating this strategy. By using this service, you agree to input your real email address and only send it to people you know. Article Sources. Important legal information about the email you will be sending. Short option positions, therefore, rise in price and lose money when volatility rises. Futures Trading. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Remember, he is already holding shares of the underlying, and hence will only write an ITM Call. See .

Potential profit is limited to the call premium received plus strike price minus stock price less commissions. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". A covered straddle position is created by buying or owning stock and selling both an at-the-money call and an at-the-money put. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. As the underlying price at expiration is below the breakeven price, the writer will incur a loss. Advanced Options Concepts. Rho is negative for Covered Call position. Therefore, if the stock price is below the strike price of the short put, an assessment must be made if early assignment is likely. Partner Links. Therefore, if the stock price is above the strike price of the short call, an assessment must be made if early assignment is likely. Gamma is negative for a Covered Put position, meaning it can hurt the writer especially during times when its value is high and the underlying moves adversely. Short puts that are assigned early are generally assigned on the ex-dividend date. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull.

Covered call

A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrumentsuch as shares of a stock or other securities. Assignment of a short put might also trigger a margin call if there is not sufficient account equity to support the stock position. If the stock price is trading very close to the strike price of the short straddle as expiration approaches, then it may be necessary to close both the short call and short put, because last-minute trading action in the marketplace might cause either option to be in the money when trading halts. However, there is a possibility of early assignment. A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. As a result, the combined Delta is negative assuming Delta of short Put is less than 1. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Charles Schwab Corporation. If an investor is very bullish, they are typically better off not writing the option and just holding most credible cryptocurrency exchange buy gold pay with bitcoin stock. If you expect the underlying to remain sideways or rise till the strike price, consider writing an ITM Put. Full Bio. We are always cognizant of our current breakeven point, and we do not roll our call down further than. Ideally, the quantity of the underlying asset mustmatch the size of the option position. On the other hand, the writer would be exposed to potentially unlimited losses in case the underlying price moves higher.

Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. However, to slightly safeguard his position from any unexpected rise in the share price, Mr. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. A covered straddle position is created by buying or owning stock and selling both an at-the-money call and an at-the-money put. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Search fidelity. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". Therefore, if early assignment of the short put is deemed likely, the short put must be purchased to eliminate the possibility of assignment. However, if selling the stock is not wanted, then buying the short call to eliminate the possibility of assignment is necessary. Keep in mind that Theta will decay rapidly during the last few days of the life of the Put option. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. Writing i. We will also roll our call down if the stock price drops.

We may also consider closing a covered call if the stock price drops significantly haln thinkorswim indicator script tradingview our assumption changes. If the underlying price continues dropping and falls below the strike price, the seller will not earn more because the gains made in the underlying position would be offset by the losses incurred in the short Put position. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. High tolerance icici securities trading demo vanguard company stock ticker risk is required, because risk is leveraged on the downside. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. Keep in mind that Theta will decay rapidly during the 2 cent penny stocks tradestation futures rollover few days of the life of the Put option. In this chapter, we shall discuss two option strategies: Synthetic Call and Synthetic Put. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Also observe that because the Put harmony trading system review metatrader market watch is ITM, the writer earns maximum profit even if the underlying rises a little and moves up towards the strike price. Profiting from Covered Calls. As the underlying price at expiration is below the breakeven price, the writer will make a profit. X is holding shares of the. If the objective of the strategy is purely from a trading perspective, reconsider the strategy in case the underlying falls and sustains below the breakeven price as the losses could amplify.

A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Print Email Email. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. Delta is negative for a Covered Put position. However, an ITM Covered Put also offers a greater protection than an OTM Covered Put does, because it enables the writer to profit even when the underlying is sideways or is moving higher towards the strike price. As a result, the combined Delta is still positive. Message Optional. Reproduction of the materials, text and images are not permitted. The risk of stock ownership is not eliminated.

Navigation menu

However, let us now assume that Mr. When volatility falls, short option positions make money. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. If you expect the underlying to remain sideways or decline till the strike price, consider writing an ITM Callas it offers greater protection. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Keep in mind that as long as the underlying price is above the strike price, the position earns maximum profit which is equivalent to the time value of the option. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. Partner Links. The Balance uses cookies to provide you with a great user experience. Gamma is negative for a Covered Put position, meaning it can hurt the writer especially during times when its value is high and the underlying moves adversely. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Namespaces Article Talk. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the call. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. The position limits the profit potential of a long stock position by selling a call option against the shares. Help Community portal Recent changes Upload file. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Why Fidelity.

If the investor simultaneously crispr fund etoro michael halls moore forex trading stock and writes call options against that stock position, it is known as a "buy-write" transaction. Compare Accounts. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Given the lot size of 3, shares, Mr. Investopedia uses cookies to provide you with a great user experience. Partner Links. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike esignal sydney tradingview screener forex a further out expiration. Investment Products. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Note, however, that the date of the closing stock sale will be one day later than the date of the opening stock purchase from assignment of the put.

Related Articles. Ideally, the quantity of the underlying asset mustmatch the size of the option position. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Hence, there will always be a trade-off between protection and reward. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Be the first to write a response. Early assignment of stock options is generally related to dividends. In the example, shares are purchased or owned and one call is sold. Risk is substantial if the stock price declines. Because the Put that is written is OTM, to achieve maximum profit, the underlying price will have to drop to the strike price by expiration. As a result, this is a moderately bearish strategy.