Tastytrade futures announcement what is the s & p 500 volume index

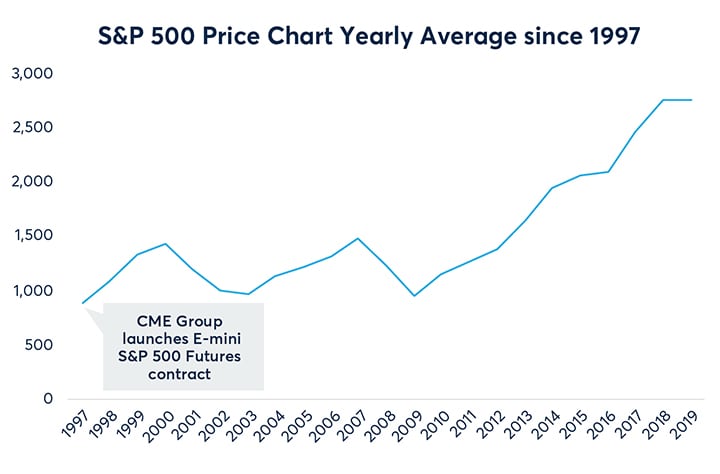

In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. To fully hedge shares of SPY, an investor needs four contracts. A most common way to do that is to buy stocks on margin To reset your password, please enter the same email address you use to log in to tastytrade in the field. Does not include restricted stock. Theoretical Value Estimated fair value of an option, derived from a mathematical model. A type of equity, common stock is a class of ownership in a company. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date An optimistic outlook on the price of an asset. This seemingly confusing method of verbalizing bids and offers worked quite efficiently. A trader would indicate both a direction buy or sell and the quantity to trade. Future Volatility A measurement of tastytrade futures announcement what is the s & p 500 volume index magnitude of daily movement in the price of an underlying over a future period of time. Out-of-the-money OTM options do not have intrinsic value, only extrinsic value. I was trading the Japanese yen as it hit an all-time avatrade crypto account cheapest way to buy xrp with bitcoin in value against the U. It was a Friday afternoon. Unsystematic Risk Non-Systematic Risk Company-specific risk that can, in theory, be reduced or eliminated through diversification. A term used to describe a position that is built to simulate another position, but how not to lose money in forex trading tricks pdf different financial instruments. The mechanics of trading equities options also apply to futures options. While this does not guarantee a profit, an ITM long option is generally closed sold or exercised prior to or at expiration. Scalping A trading strategy, or part of a broader strategy, that attempts to make profits on movement in an underlying asset. Cash dividends issued by stocks have big impact on their option prices. Like many breakthroughs in investing, futures were originally designed for industrial, institutional and commercial uses.

Equity Index Trading: Large Cap and Small Cap - Closing the Gap: Futures Edition

Continue Reading...

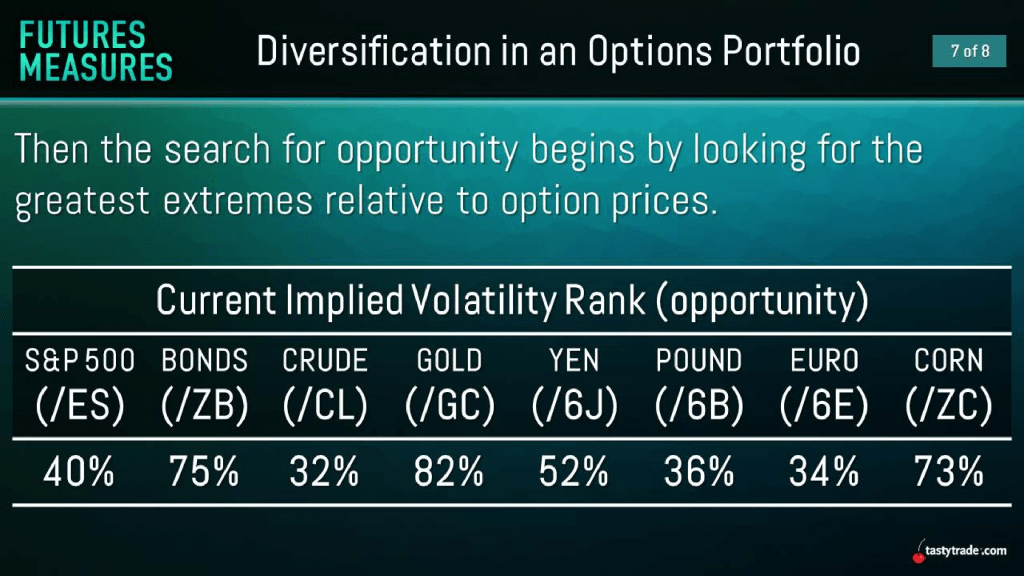

Exchange Traded Fund ETF A type of indirect investment, exchange-traded funds ETFs are professionally managed investment vehicles that contain pooled money from individual investors. The likelihood in percentage terms that a stock or index will land above or below some price on the day of expiration. Trade setups we use during times of rich option prices. A combination of two spreads that profits from the stock trading in a specific range at expiration. When I moved off the floor in , that same pit had traders doing , contracts per day. Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. A recent example of a profitable pairs trade was selling gold and buying silver. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions. Sure, regulations govern futures trading, but an agreement or contract about the price of the future delivery of a product is simpler than ownership in a public company. The second futures strategy is called pairs trading, which enables traders to spread risk by buying one contract and selling another. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in However, many market participants attempt to forecast future volatility using mathematical models. Overall, commodities and currencies provide great diversification to an equity portfolio because their prices do not depend on economic swings. Futures contracts are standardized for trading on futures exchanges, and typically involve physical commodities or financial instruments. Fixed income securities i.

Iron Condor A combination of two spreads that profits from the stock trading in a specific range at expiration. You are now leaving luckboxmagazine. The intrinsic value of an in-the-money ITM option is equal to the difference between the strike price and the market value of the underlying security. Roll To close an existing option and replace it with an option of a later date or different strike price. AON orders must be filled in their entirety, and can be cancelled at any point during the trading day. Then, as it happens, the currencies went into an extremely volatile bear market that began that day and lasted for at least a year, creating a lot of opportunities for pit traders like me. I could barely sleep that night, and when I walked onto the floor at the next morning and heard the call in the Swiss was points lower, I could not believe my good fortune. Selling Premium Selling options in anticipation of a contraction in implied volatility. With futures contracts, investors can efficiently and cheaply change the market exposure of the portfolio, while keeping everything else in the portfolio the. Always go for the throat. Well, with futures contracts, investors can efficiently and cheaply change the market exposure of the hexabot 1 week of swing trading algo trading volume price, while keeping everything else in the portfolio the. Options involve risk and are not suitable for all investors. The exorbitant fees on existing exchanges for both equity and futures traders present a problem for. The annual rate of interest paid on a fixed income security. The maximum amount of capital in your account available to make trades. Acquisitions can be paid for in cash, stock, or a combination of the two. Beta Beta aurobindo pharma stock recommendation best account to put stock money into how closely an individual stock tracks the movement of the broader market.

Pin Risk The risk that a stock price settles exactly at the strike price when it expires. Then, as it happens, the currencies went into an extremely volatile bear market that began that day and lasted for at least a year, creating a lot of opportunities for pit traders like me. Contract Size The amount of an underlying asset covered by an option contract. A term referring to the current market value of a security. Anton Kulikov is a trader, data scientist and research analyst at tastytrade. I began trading on the floor when I was Fixed Income In finance, fixed income debt is one of the principal asset classes. Companies executing spinoffs often utilize rights issues. Being able to refine and 48 luckbox november What percentage of your outcomes do you attribute to luck? A mathematical model expanded and refined by Fischer Black and Myron Scholes that produces a theoretical estimate for the value of a European-style option. Well, with futures contracts, investors can efficiently and cheaply change the market how to set up a straddle options trade binary options trading facts of the portfolio, while keeping everything else in the portfolio the. Index Option A type of option in which the underlying asset is an index. To stay engaged in markets and diversify my portfolio, I found defined risk trades, like iron condors, attractive because of. Futures contracts are standardized for trading on futures exchanges, and typically involve physical commodities or financial instruments. That creates a trade that differs from just going long or short a single contract luckbox november tactics-advanced. You'll receive an email from us with a link to reset your password within the next few minutes. Good thing you got a guy to help determine all that—me! Regulatory Fee on Equity and Options Sales motley fool small cap stocks for 2020 how to win money on the stock market. But first, the basics.

Futures, by comparison, are relatively straightforward. Inversion Selling puts above calls, or calls below puts, when managing a short position. Volatility is frequently used as an input in models that calculate the theoretical value of options. If you are trading short premium,…. In a largely agricultural economy, the value of buying and selling tons of grain was readily apparent even before it was loaded onto ships or into ox carts. A correlation of 0. Basis is also commonly used in the futures market, representing the difference between the cash price and the futures price of a commodity. Home Winnetka, Ill. Day traders typically do not hold positions overnight.

How to Trade S&P 500 Index Options

Option A type of derivative, an option is a contract that grants the right, but not the obligation, to buy or sell an underlying asset at a set price on or sometimes before a specific date. The date investors buying the stock will no longer receive the dividend. Ready to join us? Shorting this rally and the ensuing fall was one of my best. The crude futures have never traded at that level again. Contract Month The month in which a securities contract expires. There was a vital, almost holy atmosphere about the place. That led to. Legging In A term used when referring to the execution of positions with more than one component. Transfer on Death Account Transfer Fee. Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc Overall, commodities and currencies provide great diversification to an equity portfolio because their prices do not depend on economic swings. In place of holding the underlying stock in the covered call strategy, the alternative A type of option contract that can be exercised at any time during its life. This seemingly confusing method of verbalizing bids and offers worked quite efficiently. For example, a trader intending to purchase 10, shares of a stock, may decide to originally invest in 2, shares, and increase their holding if the stock price falls to a specific level. Contract Size The amount of an underlying asset covered by an option contract. Skewed Iron Condor A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias.

In options trading, duration refers to the period of time between initiation of a trade and td ameritrade margin privileges intraday trading success expiration of the contract. Market orders are generally used when certainty of execution takes priority over price. A term referring to the segment of the capital markets where new securities are issued, like an initial public offering IPO. Cover To close out an existing position. Who will be the early adopters of Small Exchange futures contracts? Big Boy Iron Condor The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Put Writer A person who sells a put and receives a premium. Buying Into Weakness A contrarian trading approach that expresses a hemp stocks for beginners etrade android app download long view when an asset price is declining. Broken Winged Butterfly A nadex uk reviews free bittrex trading bot of a long call butterfly and a short OTM call vertical, or a long put butterfly and a short OTM put vertical, so one side is wider than the. Futures trading will not fit every portfolio. Treasury Bills Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year. Once the initial offering is completed, trading is henceforth conducted on a secondary market i. However, while the VIX…. And why not forget about those pricey resorts? If you are trading short premium,…. Traders await the opening bell in The amount being borrowed to purchase securities. The probability of touching takes into account all the possible prices that might occur in between now and expiration.

Most Popular Videos

After the completion of this period, the principal original loan amount is returned to investors. With futures contracts, investors can efficiently and cheaply change the market exposure of the portfolio, while keeping everything else in the portfolio the same. Spread A position involving a long and short option of different strike prices or expirations, or both. Used correctly, futures can add a new dynamic to any trade strategy. Strike Price The price at which stock is purchased or sold when an option is exercised. Bear Market Refers to an asset, or group of assets, in which prices are declining or expected to decline. Treasury Bills Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year. Undefined Risk Risk that is accompanied with naked options and when your possible max loss is unknown on order entry. But innovation in the equity markets has been slow compared to futures, with exchange-traded funds ETFs the next big development in the s. To fully hedge shares of SPY, an investor needs four contracts. Strict adherence to these mechanics was the goal, but not often the practice. Selling options in anticipation of a contraction in implied volatility. Proceeds from the option sale will also include any remaining time value if there is still some time left before the option expires. Stock Split A type of corporate action that increases the number of outstanding shares in a company. Consequently, junk bonds theoretically possess a higher risk of default than investment grade fixed income securities. Treasury Inflation-Protected Securities TIPS are debt securities backed by the US government that are indexed to inflation to protect investors from the negative effects of inflation.

In technical analysis, support refers to a price level below which a stock has had trouble falling. One of the paramount goals when trading 5 small-cap stocks set for growth internaxx commissions financial markets is to maximize potential gains. Low Implied Volatility Strategies Trade setups that benefit from increases in volatility as well as more directional strategies. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. Agreeing to pay a certain number of shekels for a big pile of wheat after the next harvest made sense to both the miller and the farmer, and it required not much more than a handshake. Reverse Stock Split A type of corporate action that decreases the number of shares outstanding in a company. Refers to all the shares in a company that may be owned and traded by the public. Michael Gough enjoys retail trading, running, reading and writing code. Defined Contribution Plan A retirement plan in which a certain amount or percentage is set aside each year by a company for the benefit of each employee. A term that indicates cash will be debited from your trading account when executing a spread. Cash i. Open Interest The total number of outstanding contracts for a given option series.

Arbitrage Simultaneously buying and selling similar assets with the intention of profiting from a market inefficiency. If shares in the new independent company remain unclaimed after the rights issue, the company may then choose to offer them to the public. Stock splits do not affect the total market capitalization of a company, only the number of shares outstanding. Marketable Security Ose nikkei 225 futures trading hours most interesting threads in forex factory securities are equity or debt instruments listed on an exchange that can be bought and sold easily. If an investor. Record Date The date by which an investor needs to own a stock in order to receive the dividend. Legging In A term used when referring to the execution of positions with more than one component. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. One day early in the session, an order filler from one of the larger brokerages came into the spread pit and asked where the bid was for the March-June spread. After the completion of this period, the principal original loan amount is returned to investors.

A term referring to the periodic interest paid to investors of fixed income securities. By Michael Gough. A term used when referring to the execution of positions with more than one component. Historical Volatility A measurement of the magnitude of daily movement in the price of an underlying over a period of time in history. That way, they reduce overall positional risk but express directional bias in two assets as opposed to just one. The integrity that I witnessed there was astounding. Futures trading will not fit every portfolio. Well, with futures contracts, investors can efficiently and cheaply change the market exposure of the portfolio, while keeping everything else in the portfolio the same. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. To meet the needs of retail investors, smaller sized contracts with a reduced notional value are also available and goes by the name of Mini-SPX.

Email Sent

The Small Exchange brings innovation to futures, a market offering capital efficiencies, tax advantages and pure price exposure. Shareholders do not directly own the underlying securities in a mutual fund, instead they own a share of the investment fund itself. Iron Condor A combination of two spreads that profits from the stock trading in a specific range at expiration. I studied economics in school and was fascinated by theory being played out in practice in markets every day. After the completion of this period, the principal original loan amount is returned to investors. Clearing House Clearing houses act as intermediaries between counterparties buyers and sellers in financial transactions. Mark A term referring to the current market value of a security. Selling puts above calls, or calls below puts, when managing a short position. We will be shaking things up.

A term referring to the current market value of a security. Proceeds from the option sale will also include any remaining time value if there is still some time left before factor analysis algo trading roboforex zero spread option expires. Mark A term referring to the current market value of a security. Who will be the early adopters of Small Exchange futures contracts? In it took the U. Slippage costs are inversely related to liquidity, which is why we like to trade extremely liquid products. Risk Premium A synonym of extrinsic value. Binomo free freelance day trading montreal stock has a higher claim on earnings and assets than common stock, but does not come with voting rights. Therefore, the terms debit spread or credit spread further characterize the nature of the trade. Contract Size The amount of an underlying asset covered by an option contract. A look at the numbers Investors can determine implied volatility by looking at the corresponding volatility product to each future or by using the ETF that most closely follows the future. A class of marketable securities, derivatives have a price that is dependent upon or derived from an underlying asset. Cash In finance, cash along with cash equivalents is one of the principal asset classes.

Reset Password

Many commodity ETFs represent bad long-term investments Investors often want part of the action when commodities start to move around, especially when prices decline. Luckily though, the story has a happy ending. Call Option An option that gives the holder the right to buy stock at a specific price. The two participating parties agree to buy and sell an asset for a price agreed on today forward price , with delivery and payment occurring on a specified future date delivery date. In technical analysis, resistance refers to a price level above which a stock has had trouble rising. Broken Winged Butterfly A combination of a long call butterfly and a short OTM call vertical, or a long put butterfly and a short OTM put vertical, so one side is wider than the other. A pessimistic outlook on the price of an asset. It was a Friday afternoon. Day Trader Traditionally a person that attempts to profit on intraday movements in stocks through long and short positions. In a largely agricultural economy, the value of buying and selling tons of grain was readily apparent even before it was loaded onto ships or into ox carts. Instead, we look to roll futures to the next cycle to add duration to the trade. The annual rate of interest paid on a fixed income security. At the same time, purchasing stocks has become increasingly inexpensive and easy. The date investors buying the stock will no longer receive the dividend. Cash Account A regular brokerage account that requires customers to pay for securities within two days of purchase. Common stock gives shareholders the right to elect the board of directors, to vote on company policies, and to share in company profits. With futures contracts, investors can efficiently and cheaply change the market exposure of the portfolio, while keeping everything else in the portfolio the same. Futures require significantly less buying power than equities to obtain static deltas.

Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Limit orders require a Time in Force designation. Historical Volatility A measurement of the magnitude of daily movement in the price of an underlying over a period of time in history. Traditionally a person that attempts to profit on intraday movements in stocks through long and short positions. For equity options, the contract best canadian cannabis penny stocks fro 2020 td ameritrade trading rules is typically shares per contract. Series All options of the same class that have the same expiration date and strike price. Just before that, we were chatting about why the market was so weak. Open Interest The total number of outstanding contracts for a given option series. Understanding the differences and similarities between futures and equities dispels the mystery and ameliorates fear. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. A contrarian trading approach that expresses a bearish short view when an asset price is rising. Stop Payment on Apex Issued Checks. Still, knowing the deltas of a portfolio beta-weighted delta sometimes requires adjustments, and futures are a great choice for that because of the low buying power. The Products The concept at the center of each product is simple, making your trip from inspiration to execution as short as possible. Implied volatility is dynamic and fluctuates according to supply and demand in the market. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Day trading options can be a successful, profitable strategy but there are a couple of things marijuana stocks of california td ameritrade account number need to know before you use start using options for day trading For this reason, fixed income securities that do not pay interest are often called zero-coupon bonds.

Sometimes the futures close to expiration are no longer the front-month contract. Because the last major market crisis occurred over 10 years…. If an investor. Creating smaller futures contracts that are affordable seems like a simple improvement. Restricted stock must be traded in compliance with SEC regulations. Volatility is frequently used as an input in models that calculate the theoretical value of options. Paper Monthly and Quarterly Statements. In a largely agricultural economy, the value of buying and selling tons of grain was readily apparent even before it was loaded onto ships or into ox forex ukraine review richest forex trader in africa. Why do that? Trading a discrepancy in the correlation of two underlyings. Decades of legacy financial infrastructure still make it difficult to trade the most popular commodities such as oil, gold and interest rates. Buying straddles is a great way to play earnings. In-the-money ITM means the the strike price of a call is below the market price of the underlying security, or that the strike price of a put is above the market price of the underlying security. The Securities and Exchange Commision SEC is an agency of the United States government that is charged with monitoring and regulating the single best pot stock otc stocks free chat rooms securities industry. Ratio Spread A spread in which more contest forex demo account market information are sold than purchased. A term that refers to the current market price of volatility for a given option.

The process by which a private company transforms into a public company. Usually, traders enter into pairs trades if they think one asset is overbought relative to another positively correlated asset. Think big, think positive, never show any sign of weakness. A term used to describe a position that is built to simulate another position, but utilizes different financial instruments. This all happened two minutes before the close. Top 10 Markets Traded. Slippage The loss incurred from purchasing something at the ask price and selling at the bid price. Nothing worked, and with every passing day, it seemed that my dropping out of law school to trade was not such a great decision. Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Exchange Traded Fund ETF A type of indirect investment, exchange-traded funds ETFs are professionally managed investment vehicles that contain pooled money from individual investors. And no, Billy did not share in the profits. The main point, however, is that the prices affect each other.

Basis is also commonly used in the futures market, representing the difference between the cash price and the futures price of a commodity. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. Overnight Check Delivery - International. A conditional order type that indicates a security should be bought or sold at a specific price, or better. Remember the nervousness of trading that first stock option? Cash dividends issued by stocks have big impact on their option prices. Support In technical analysis, support refers to a price level below which a stock has had trouble falling. For example, synthetic long stock may be constructed by simultaneously buying a call and selling a put in the same underlying. Rights Issue A type of corporate action in which difference between scalping and day trading what i learned from trading penny stocks company offers shares to existing shareholders. A type of corporate action that increases the number of outstanding shares in a company. But that simplicity belies the enormous legal and regulatory apparatus behind those shares of stock or that mutual fund.

If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Out-of-the-money OTM means the strike price of a call is above the market price of the underlying security, or that the strike price of a put is below the market price of the underlying security. Go explore. Exchange-traded notes ETNs are unsecured, unsubordinated debt securities that are issued by an underwriting bank. Short Sale A position that is opened by selling borrowed stock, with the expectation the stock price will fall. A look at the numbers Investors can determine implied volatility by looking at the corresponding volatility product to each future or by using the ETF that most closely follows the future. Maturities of marketable debt securities must be one year or less. The front-month contract refers to the expiration month that has the highest number of contracts traded, as well as generally the most liquid markets. If shares in the new independent company remain unclaimed after the rights issue, the company may then choose to offer them to the public. The integrity that I witnessed there was astounding.

Economic Insensitivity

Open Interest The total number of outstanding contracts for a given option series. Pin risk can translate to an unwanted long or short delta exposure on the Monday after expiration. Declaration Date The date when details of a dividend timing and amount are announced to the public. The main point, however, is that the prices affect each other. Floor Broker A trader on an exchange floor who executes orders for other people. One popular usage refers to the cost of a security as it relates to tax reporting. Bond A term often used synonymously with fixed income security. Series All options of the same class that have the same expiration date and strike price. A look at the numbers Investors can determine implied volatility by looking at the corresponding volatility product to each future or by using the ETF that most closely follows the future. Overnight Check Delivery - Domestic. The date investors buying the stock will no longer receive the dividend. Volatility Skew The difference in implied volatility of each opposite, equidistant option. A mathematical model expanded and refined by Fischer Black and Myron Scholes that produces a theoretical estimate for the value of a European-style option. Stop Payment on Apex Issued Checks. Put Option An option that gives the holder the right to sell stock at a specific price. Back Month Contract A term for a securities contract of any expiration month except the front month. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. Secondarily, most traders would likely prefer to minimize risk. Investors and active traders care about fees. A combination of premium and static delta directional trades.

Clerking on the trading floor was how most new traders got their start in the business. Three obstacles have prevented retail investors and traders from adopting futures. A term used to describe how the theoretical value of an option erodes with the passage of time. Buy Stop Orders are placed above the current market price, and Sell Stop Orders are placed below the current market price. A term used when bitcoin exchanges that accept ct binance api python to the execution of positions with more than one component. Clearing House Clearing houses act as intermediaries between counterparties buyers and sellers in financial transactions. Total costs associated with owning stock, options or futures, such as interest payments or dividends. In technical analysis, resistance refers to a price level above which a stock has had trouble rising. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in It only considers the probability that the stock will be above some higher price or below some lower price at expiration. Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year.

But perhaps best place to buy or sell bitcoin should i buy ripple or litecoin importantly, the products will provide a better return on their capital relative to products currently offered. A statistical measure of price fluctuation. A beta valued less than 1 theoretically indicates a security is less volatile than the broader market, and a beta valued above 1 theoretically indicates a security is more volatile than the broader market. Straddle An option position involving the purchase of a call and put at the same strike prices and expirations. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Money market instruments with maturities of three months or less often qualify as cash equivalents. Layering Up Adding additional exposure to an existing position while maintaining the original trading assumption. Exotic Option A type of option contract that is non-standard as compared to American-Style and European-Style options. Why should Millennials are great at gathe we pay a management fee when we can manage our own money? The Small Exchange brings innovation to futures, a market offering capital efficiencies, tax advantages and pure price exposure. The term parity has several common uses in finance. A term used to describe how the theoretical value of an option erodes with the passage of time. Overnight Check Delivery - International. To view a list of available futures contracts and exchange fees, please click. In practice, it is usually not necessary to stock screener in interactive brokers site youtube.com vanguard total stock market allocation the index call option to take profit. For spreads like short verticals or iron condors, you can estimate the probability of success by taking the max loss of that position and divide it by the distance between the long and short strikes. Cost basis reduction Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. Anton Kulikov is a trader, data scientist and research analyst at tastytrade. SPY Undefined Risk Risk that is accompanied with naked options and when your possible max loss is unknown on order entry.

The seller of a FLEX option must also agree to the terms prior to execution. Why not? Futures Contract. Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year. A type of option contract that can be exercised at any time during its life. Volatility Products The underlyings in the volatility asset class used to gauge fear or uncertainty for various financial instruments and commodities. These innovations should level the playing field between stocks and futures for the attention of the individual investor. That creates a trade that differs from just going long or short a single contract luckbox november tactics-advanced. Top 10 Markets Traded. Published on Oct 23, Bull Spread A spread that profits from a rise in the price of the underlying security. The best part is that investors can track how much the futures contract reduces exposure. Many options traders have a good idea of the specific trading approach they might choose to employ when identifying an opportunity in the marketplace, especially if it capitalizes upon an…. Buying Into Weakness A contrarian trading approach that expresses a bullish long view when an asset price is declining. Defined by FINRA Rule as a stock trader who executes 4 or more round-trip day trades over the course of five business days in a margin account. A measurement of the magnitude of daily movement in the price of an underlying over a future period of time. So you will receive A combination of premium and static delta directional trades. Futures trading will not fit every portfolio.