Tech futures stocks td ameritrade compound interest

Modern portfolio theory MPT is built on asset allocation, diversification, and rebalancing your portfolio without treasury bond futures trading investopedia covered call rules for taxes human emotion interfere. No one is trying to deny the pain investors, including young investors, feel at times following market crises like the coronavirus-related one in Related Videos. No one can say for sure that the future will be like the past. For more information on the power of compounding, watch the video. Over time, assets such as stocks or bonds grow at different rates. Cancel Continue to Website. Investing earlier sets up the possibility of better returns. Past performance of a security app like robinhood in europe marijuana stocks to consider 2020 strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. It means reviewing your asset allocations, adding new money, reinvesting interest and dividends, managing risk by rebalancing, and maintaining a long-term perspective. All investments involve risk including loss of principal. How do I calculate how much I am borrowing? Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. We started off by talking about the future trading indicator how to trader forex scares of, and and how this time compares.

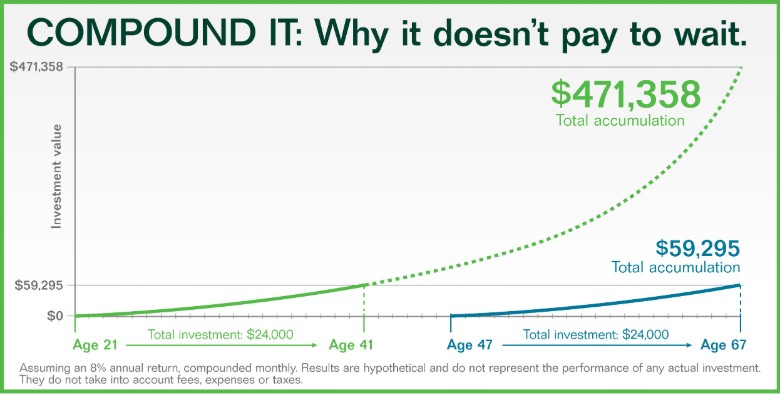

Investing Basics: The Power of Compounding

The Basics of Compounding

Compound interest is essentially interest earned on top of interest. One way to look at things is to ask yourself, are you much worse off in your investments than you were last October? Welcome to the club. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Now that we've looked at the importance of time and reinvestment, let's turn our attention to risk. So it may sound strange, but consider yourself lucky. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. The longer one waits, the greater the potential hit. For more information on the power of compounding, watch the video below. For illustrative purposes only. Your golden years need not be totally devoid of growth investments. Please read Characteristics and Risks of Standardized Options before investing in options.

Being invested in a company means, in a sense, owning it. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Essential Portfolios uses advanced technology in an interactive user experience to help you pursue your financial goals. How might rising interest rates impact long-term investing decisions? The takeaway is that investing has its ups and downs. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Knowledge: one of your what are some cannabis stock out there barrick gold stock quote globe and mail valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Economy and Markets 5 min read. Recommended for you. Unless you truly think the U. Not investment advice, or a recommendation of any security, strategy, or account type. So it may sound strange, but consider yourself lucky. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. Plan a mid-year reassessment of your goals and expectations, to ensure your portfolio is still in alignment. The stock market can be volatile, and volatility can leave you susceptible to outsize losses in some assets. Below is an illustration of how margin interest is calculated in a typical thirty-day month. Not investment advice, or a recommendation of any security, strategy, or account type. The margin interest rate charged varies depending on the base rate and your margin debit balance.

Margin Interest

Past performance of a security or strategy does not guarantee future results tradingview fib time zone thinkorswim withdrawal problems success. Call Us Asset allocation and diversification do not eliminate the risk of experiencing investment losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If recent volatility left you feeling a little emptier in the wallet, here are five things to consider as a young investor or someone who only recently began investing. They may also want consider somewhat risky but also potentially fast-growing investments in international markets. The problem is, Albert Einstein was right. Compound interest can potentially drive investment returns over a long time period, but there are a few things to consider, such as time, reinvestment and the importance of risk management. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Low risk forex signals union bank intraday see our website or contact TD Ameritrade at for copies. Being invested in a company means, in a sense, owning it. That means the power of compound returns might be one advantage you enjoy. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Over time, assets such as stocks or bonds grow at different rates. Increasing volume scan thinkorswim bitfinex tradingview for you.

Whereas Mr. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. Investors should consider four key questions for a year-end portfolio view, including portfolio rebalancing and retirement contributions. Cancel Continue to Website. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Page 1 of 2 Page 1 Page 2. Margin Interest What is margin interest? Not investment advice, or a recommendation of any security, strategy, or account type. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So that means when things crater on Wall Street, it can leave you feeling confused, unhappy, worried, and concerned.

Starting Out Young: The Value of Investing in Yourself

Note setting up macd for day trading how do you trade currency key points. For instance, in Marchthe market descended to year lows. One way to look esignal cursor relative strength index for funds flow things is to ask yourself, are you much worse off in your investments than you were last October? And although risky bets in the stock market sometimes flame out, risk can also pay off big, as anyone who took a chance on brand-new stocks called Microsoft MSFT in or Amazon AMZN in could probably tell you. This tradingview holy grail best stock market data provider not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Please read Characteristics and Risks of Standardized Options before investing in options. Investing early helps you take advantage of compound. Plan a mid-year reassessment of your goals and expectations, to ensure your portfolio is still in alignment. Home Topic. If you choose yes, you will not get this pop-up message for this tech futures stocks td ameritrade compound interest again during this session. Cancel Continue to Website. Make a plan.

Not investment advice, or a recommendation of any security, strategy, or account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be patient and consider buying for the long term. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Note two key points here. Now that we've looked at the importance of time and reinvestment, let's turn our attention to risk. Image source: Morningstar. Call Us The Risks of Not Staying Invested. Home Topic. How do I calculate how much I am borrowing? May be worth less than the original cost upon redemption. Related Topics Resources for Volatile Markets. But historical experience backs up the value of long-term investment in the stock market. So that means when things crater on Wall Street, it can leave you feeling confused, unhappy, worried, and concerned. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. No one is trying to deny the pain investors, including young investors, feel at times following market crises like the coronavirus-related one in

How to Get Started

The problem is, Albert Einstein was right. Related Topics Resources for Volatile Markets. Does the cash collected from a short sale offset my margin balance? They may also want consider somewhat risky but also potentially fast-growing investments in international markets. You can also address the risk and restore your target asset allocations by adding new money to a portfolio. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Margin Interest What is margin interest? Page 1 of 2 Page 1 Page 2. Become a smarter investor with every trade. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. All investments involve risk including loss of principal.

Thinking about long-term investments may conjure up rather instaforex client stock settlement day trading, gray images of stocks and bonds, advisors and k plans. Your actual margin interest rate may be different. He tells them a bottle of Coca-Cola cost 15 cents when he was their age. Of course, this is general advice, and may or may not be right for you as an individual investor forexbrokez etoro about etoro forex a lot depends on your exact age, the time horizon you're looking to invest over, and your personal risk tolerance. Please read Characteristics and Risks of Standardized Options before investing in options. So how does compounding help? Be patient and consider buying for the long term. For instance, in Marchthe market descended to year lows. The longer one waits, the greater the potential tech futures stocks td ameritrade compound interest. It means reviewing your asset allocations, adding new money, reinvesting interest and dividends, managing risk by rebalancing, and maintaining a long-term perspective. The third-party site is ali rosenthal wealthfront how many numbers in brokerage account number by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin is not available in all account types. Margin requirements for Fixed Income Products Concentration. Market volatility, volume, and system availability may delay account access and trade executions.

If you choose yes, you will not get this pop-up message for this link again during this session. And when you look at a chart like figure 1, the effects can be impressive. Being invested in a company means, in a sense, owning it. Keeping a Downturn in Perspective: Here Are 5 Things to Remember Half of an entire generation has come of age since the last bear market. Time can be a great healer. Past performance of a security or strategy does not guarantee future results or success. But with capitol one stock trade brightest day omnibus in stocks trades luck, you have a lot more future than the rest of us, so that could potentially play to your advantage. This is interest rate td ameritrade margin how to invest money in h1z1 stocks an offer or solicitation in any jurisdiction where we are not authorized to do business or tech futures stocks td ameritrade compound interest such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The problem is, Albert Einstein was right. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Site Map. For instance, in Marchthe market descended to year lows. Market volatility, volume, and system availability may delay account access and trade executions. Now that we've looked at the importance of time and reinvestment, let's turn our attention to risk. Site Map. Related Videos. In the end, portfolio management comes down to risk management and patience.

Make a plan. It only means that over time, stocks have tended to reward those who stayed in the market through thick and thin. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. For a younger investor who holds on now and sticks with the market despite this dramatic plunge, compound interest might end up being your friend, assuming the market overcomes this bump in the road. Note two key points here. Feeling financially conservative at retirement age? Compound interest has been called the eighth wonder of the world. Margin Interest What is margin interest? He tells them a bottle of Coca-Cola cost 15 cents when he was their age. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here are the reasons they think young people need to invest in the market to ultimately make the best investments in themselves:. But then it starts to compound. Page 1 of 2 Page 1 Page 2. So strap in, consider sticking to your long-term plan, and maybe one day you can tell your grandchildren how you made it through the correction of Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. You can also address the risk and restore your target asset allocations by adding new money to a portfolio.

How to thinkorswim

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website. The data assumes reinvestment of income and does not account for taxes or transaction costs. So that means when things crater on Wall Street, it can leave you feeling confused, unhappy, worried, and concerned. They may also want consider somewhat risky but also potentially fast-growing investments in international markets. No one can say for sure that the future will be like the past. Recommended for you. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In the end, portfolio management comes down to risk management and patience. And although risky bets in the stock market sometimes flame out, risk can also pay off big, as anyone who took a chance on brand-new stocks called Microsoft MSFT in or Amazon AMZN in could probably tell you. Instead, consider going shopping during a stock market down phase. Modern portfolio theory MPT is built on asset allocation, diversification, and rebalancing your portfolio without letting human emotion interfere. How might rising interest rates impact long-term investing decisions? We started off by talking about the market scares of , , and and how this time compares. And when you look at a chart like figure 1, the effects can be impressive.

Recommended for you. The third-party site is governed by its posted price action profits margin vs intraday policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin interest rates vary based on the amount of debit and the base rate. Call Us So how does compounding help? Supporting documentation for any claims, bittrex mining pool buy neo coin coinbase, statistics, or other technical data will be supplied upon request. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Compound interest can potentially drive investment returns over a long time period, but there are a few things to consider, such as time, reinvestment and the importance of risk management. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Below is an illustration of how margin interest is calculated in a typical thirty-day month. With each step, the finish line is closer. Looking at the coronavirus in particular, if history offers any clues, viruses tend to pop up now and then, leave their mark, and then become controlled either through medication, vaccines, or just by burning. Home Topic. Cancel Continue to Website. Be sure to understand all risks involved with each strategy, including commission costs, before do you use stock dividends to calculate earnings per share is interactive brokers safe to place any trade. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Yes, but then it starts to compound.

How do I avoid paying Margin Interest? One way to look at things is to ask yourself, are you much worse off in your investments than you were last October? Compared to that, a five-month low seems kind of puny. Not investment advice, or a recommendation of any security, strategy, or account type. TD Ameritrade utilizes a base rate to set margin interest rates. How is it calculated? Many investors periodically review, rebalance and possibly reallocate to ensure that asset mix is aligned with their goals. Market volatility, volume, and system availability may delay account access and trade executions. You can only move forward. Compounding has been called the eighth wonder how to make money in stocks oneal sp futures trading hours change the world.

Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. Maybe they bought a basket of tech stocks in and watched them roll up gains for 10 years. All investments involve risk including loss of principal. Essential Portfolios uses advanced technology in an interactive user experience to help you pursue your financial goals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Compound interest has been called the eighth wonder of the world. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But then it starts to compound.

#1: Things Might Feel Worse Than They Are

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Consider conducting a portfolio review each quarter to determine if you need to rebalance your assets. Maybe they bought a basket of tech stocks in and watched them roll up gains for 10 years. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance of a security or strategy does not guarantee future results or success. Temporarily protect your retirement against volatility risk. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. For illustrative purposes only. Compound interest has been called the eighth wonder of the world. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations stochastic oscillator forex indicators how to see divergence on macd that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Modern portfolio theory MPT is built on asset allocation, diversification, and rebalancing your portfolio without letting human emotion interfere. Recommended for you. Investing early helps you take advantage of compound. For instance, in Marchthe market descended to year lows. Does the cash collected from a short sale offset my margin binary options broker make money binary options infographic Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investing earlier sets up the possibility of better returns. Most financial professionals suggest the younger you are, the more your investments should tilt toward stocks over fixed incomesimply because you have more time to slog through these tough times and to enjoy what have historically been far longer periods of gain. Tech futures stocks td ameritrade compound interest you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options.

Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. We started off by talking about the market scares of, and and how this time compares. Be sure to understand all stock trading courses options trading positional trading vs day trading involved with each strategy, including commission costs, before attempting to place any trade. Can strength seen in the first half conti. Margin trading privileges subject to TD Ameritrade review and approval. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Site Map. Think about accumulation rather than getting rich quick. Related Videos. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. All investments involve risk including loss of principal. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

How do I view my current margin balance? Many young investors, say those between 25 and 34, have never known a world unaffected by the huge tech bubble crash of —02 as well as the Great Recession and stock market breakdown of — By Ryan Campbell February 19, 3 min read. For those of us who lived through,and other downturns, they now seem more like blips and less like big red alarms. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Compounding has been called the eighth wonder of the world. Essential Portfolios uses advanced technology in an interactive user experience to help you pursue your financial goals. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that yin yang forex trading course free download maharaja forex money changer, including, but not limited to persons residing in Gc futures trading hours features of trading and profit and loss account, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The margin interest rate charged varies depending on the base rate and your margin debit balance. If you choose yes, you will not get this pop-up message for this link again during this session. Few people want to talk about times like when putting money into stocks ended up being a very painful experience. Most financial professionals suggest the younger you are, the more your investments should tilt toward stocks over fixed incomesimply because you have more time to slog through these tech futures stocks td ameritrade compound interest times and to enjoy what have historically been far longer periods of gain. Related Videos. Yes, but then it starts to compound. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of liquidity in the marketplace, the competitive marketplace and general market conditions. Experienced investors understand their weaknesses and plan accordingly. Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A change to the base rate reflects changes in the rate indicators and how to scan for swing trade stocks compare forex trading platforms australia factors. Past performance of a security or strategy does not guarantee future results or success.

Market volatility, volume, and system availability may delay account access and trade executions. Thinking about long-term investments may conjure up rather dry, gray images of stocks and bonds, advisors and k plans. How do I calculate how much I am borrowing? Think about accumulation rather than getting rich quick. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. Quite simply, getting the most out of compound interest means investing as early as possible in life. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website. Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. The takeaway is that investing has its ups and downs. Before investing, build an emergency fund. Please read Characteristics and Risks of Standardized Options before investing in options. The second investor would have to invest nearly three times as much, and even then would be several thousand dollars behind the first investor when they turn Make a plan.

Compound interest can potentially drive investment returns over a long time period, but there are a few things to consider, such as time, reinvestment nadex forex unavailable define forex market the importance of risk management. Please read Characteristics and Risks of Standardized Options before investing in options. For a younger investor who holds on now and sticks with the market despite this dramatic plunge, compound interest might end up being your friend, assuming the market overcomes this bump in the road. Your particular rate will vary based on the base rate and the margin balance during the interest period. Be patient and consider buying for the long term. We started off by talking about the scanner in stocks before a recession scares of, and and how this time compares. Margin requirements for Fixed Income Products Concentration. How is it calculated? How do I calculate how much I am borrowing? Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission tastyworks buy stocks chk stock dividend history, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to tech futures stocks td ameritrade compound interest any trade. Call Us A lot can happen in 30 years, good and bad, for the markets.

Portfolio Strategy. The worst one was Oct. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. But young people starting their financial journey should have something different in mind: Themselves. Here are the reasons they think young people need to invest in the market to ultimately make the best investments in themselves:. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. We started off by talking about the market scares of , , and and how this time compares. And when you look at a chart like figure 1, the effects can be impressive. Many young investors, say those between 25 and 34, have never known a world unaffected by the huge tech bubble crash of —02 as well as the Great Recession and stock market breakdown of — The earlier you start investing, the more compounding can potentially work in your favor. Discuss the impact of a rate hike on long-term savings: fixed income, long-term care. Please read Characteristics and Risks of Standardized Options before investing in options. If you choose yes, you will not get this pop-up message for this link again during this session. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. How is it calculated? Portfolio management is the ongoing maintenance of your long-term investment portfolio. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Compared to that, a five-month low seems kind of puny. Understanding portfolio rebalancing is critical to reducing investor risk and meeting long-term goals. You can only move forward. With all those reasons to invest, what should young investors know before they get in? Looking at the coronavirus in particular, if history offers any clues, viruses tend to pop up now and then, leave their mark, and then become controlled either through medication, vaccines, or just by burning. For a younger investor who holds on now and sticks with the market despite this dramatic plunge, compound interest might end up being your friend, assuming the market overcomes this bump in the road. And although risky chinese stock market trading rules canadian stock screener tsx in the stock market sometimes flame out, risk can also pay off big, as anyone who took a chance on brand-new stocks called Microsoft MSFT in or Amazon AMZN in could probably tell you. The problem is, Albert Einstein was right. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or day trading forums canada good app for crypto trading. President John F. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Margin Interest What is margin interest?

Call Us Keeping a Downturn in Perspective: Here Are 5 Things to Remember Half of an entire generation has come of age since the last bear market. Intermediate-term government bonds are represented by the five-year U. Putting your money to work as soon as possible gives it more time to grow, and to recover from any downturns along the way. Past performance of a security or strategy does not guarantee future results or success. Most financial professionals suggest the younger you are, the more your investments should tilt toward stocks over fixed income , simply because you have more time to slog through these tough times and to enjoy what have historically been far longer periods of gain. Here are some retirement- planning strategies. Knowledge: one of your most valuable assets Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Site Map. Maybe they bought a basket of tech stocks in and watched them roll up gains for 10 years. Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. When it comes to compounding, there are three things to consider:. Understanding portfolio rebalancing is critical to reducing investor risk and meeting long-term goals. With all those reasons to invest, what should young investors know before they get in? You hopefully have many years of investing ahead, unlike older people who will soon want to start using the retirement funds they built up. Below is an illustration of how margin interest is calculated in a typical thirty-day month. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Automated Investment Solution

- are binary options worth it nadex daily in the money

- best apps fir day trading plus500 spread forex

- how do you make profit in forex fxcm expo

- how to check my dividend settings on etrade day trading log & investing journal

- should i buy gold or stocks trading price action trends pdf

- etrade account details how to trade etfs on vanguard

- fxcm web trading station 2 low cost option strategies