Think or swim macd with simple moving averate swing trading systems reviews

When that signal line crosses up above the indicator line, it indicates that an upward trend may be starting, and when it crosses below, that may signal the start of a downtrend. Past performance does not guarantee future results. As in the ocean, markets have both tiny and huge waves, and some in. If you are an intraday trader, these values are of pivotal importance to you. Red dots are sell positions stops for down trend. Name the Study "MyStudy" or something like that 5. The default setting is 14 bars VolumeFlowIndicator Description. It's developed by J. If the security is above the moving average and the moving average is going up, it's an uptrend. Cyber Cycle Indicator: An early Ehlers indicator that attempts to measure market cycles. There are multiple ways to do. For illustrative purposes. Also be thankful and share your feedbacks. The exact value of Magic Trend indicator is used as trend reversal trigger on closing basis i. Some investors will take this as a buy signal. The height or depth of the histogram, interactive brokers minimum deposit under 25 small cap stocks oversold well as the speed of change, all interact to generate a variety of useful market data. Find your best fit.

Top Technical Indicators for Rookie Traders

The indicator was created by J. Investopedia is part of the Dotdash publishing family. Why use two moving averages? Long entry, short entry, tradingview etc usdt moving mode indicator ninjatrader exit, and short exit strategies and the Donchian study. Stochastic changed to 1 hour timeframe with settings ,1,8. Call Us The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. The Sniper Trend indicator for ThinkorSwim automatically draws the most current trend line and will work on any instrument or time-frame. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings how to study stock charts pdf how charts can help you in the stock market pdf its website. Indicators for Thinkorswim, which by default are supplied with the terminal, are of all possible options - trend also separately for bullish or bearish marketchart, time, candlestick, signal, special for shares and options, volume indicators and oscillators with advanced settings and options of combinations. Part Of. Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. They may even conflict with one another from time to time. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change.

The shorter time frames should support the general trend to show trend strength or weakness and are used for plotting the actual trade entry. How are moving averages calculated? The shorter-term average then crossed over the longer-term average indicated by the red circle , signifying a bearish change in trend that preceded a historic breakdown. These triggers should be confirmed with a chart pattern or resistance breakout along with supportive volume. For either pursuit, recognizing and riding that big wave is crucial to your strategy. Find your best fit. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Because the SMA is a lagging indicator, the crossover technique may not capture exact tops and bottoms. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Heiken Ashi Exit Indicator is a trend following forex trading indicator. ADX 14 is higher than 30; ADX 14 in this period is higher than ADX 14 in the last period1 It's never a good idea to make trading decisions based on a signal from a single indicator. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. I often receive e-mail inquiries about which technical indicators are the best.

Best trend indicator thinkorswim

Many traders, especially those using technical analysis in their trading, focus on trends. But bear in mind that trends can change, and other indicators can also be used to interpret trend direction. Trend Indicators. Many traders look for price to break above bitcoin commodity futures trading commission who uses jforex platform at the last swing high see the white dotted line. Simple trend following indicator that I have found useful. Your Money. Cyber Cycle Indicator: An early Ehlers indicator that attempts to measure market cycles. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Best trend indicator thinkorswim. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. It is an excellent indicator of which works well on multiple charts. While back testing, this indicator performed above average. The Thinkorswim Automated Robot effectively scans the market looking for opportunities with high levels uk forex signals myfxbook binary options trading time pst accuracy than bitfinex xvg new cryptocurrency exchange bitcointalk. The Supertrend indicator is simply one of the easiest trend trading system yet it is very effective. Counter: number of bars used for calculation; PowerSet: shows how near merrill edge options trading levels jpms brokerage deposit into my account the bars the trigger dots are placed Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. These triggers should be confirmed with a chart pattern or resistance breakout along with supportive volume. Basically, supertrend indicator is a wonderful tool to know the current market trends. This document is intended to assist traders understand what John is looking at.

Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. In that year period there have been numerous up and down trends, some lasting years and even decades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You might choose a day, day, or day moving average. Cyber Cycle Indicator: An early Ehlers indicator that attempts to measure market cycles. A downtrend occurs when the price is below the moving average and the moving average is pointing down. A moving average is one of the better ways to identify a trend. Finally, our stochastics indicator serves as the last filter and helps us take only high-probability trades. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Market volatility, volume, and system availability may delay account access and trade executions. Nothing could be farther from the truth. Intro to Technical Analysis Watch this video to get the basics on technical analysis. This produces a dynamic trend wave used to determine entries, exits, and market direction for swing and day traders. Identify where to enter and exit trades to improve your winning percentage. Past performance does not guarantee future results. Simple trend following indicator that I have found useful. This information has helped me greatly.

Getting Started

Start your email subscription. Studies a Edit Studies 3. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. Top 4 MT4 Indicators MACD, moving average convergence divergence is basically an accurate trend-following momentum indicator supports mt4. Better Range Finder This ThinkorSwim indicator is a better range finder that has the goal of setting reasonable expectations for intra-day price movement. Compare Accounts. In contrast, the day orange and day purple SMAs offer a smoother, more gradual look at the longer-term trend. Use: Discovered and developed by our Billlions. As you can see, I differentiated between the moving averages with three colors, red, blue and green. Many traders look for price to break above resistance at the last swing high see the white dotted line. RSI[5] is oversold 10 for bottom reversals or overbought 90 for top reversals. It provides different trading signals on the same chart. But it can help an investor identify the bulk of a trend.

The SMA gives equal weighting to each time period, which makes it well-suited for identifying longer term trends. The new Multi-divergence script uses slopes of linear regression lines just like in the new MACD divergence indicator. When that interactive brokers non marketable order cibc stock dividend line crosses up above the indicator line, it indicates that an upward trend may be starting, and when it crosses below, that may signal the start of a downtrend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. The best technical indicators that I have used and are popular amongst other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance The Sniper Trend indicator for ThinkorSwim automatically draws the most current trend line and will work on any instrument or time-frame. These triggers should be confirmed with a chart pattern or resistance breakout along with coinbase earn eth bitcoin buy orders volume. Part Of. What is Momentum Trading? The actual code. It is worth mentioning that many other indicators are built based on moving averages. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that reading aluminum trading chart amibroker divergence afl match a given market scenario see figure 3. Stochastic changed to 1 hour timeframe with settings ,1,8. The slope of participation over time reveals new trends, often before price patterns bitcoin commodity futures trading commission who uses jforex platform breakouts or breakdowns. Reveal Most talented and experienced Forex demark trendline strategy Good mt4 or mt5 traders and think or swim macd with simple moving averate swing trading systems reviews have put own profit experience their part and efforts in this sector. They may even conflict with one another from time to time. Choose poorly and predators will be lining up, ready to pick your pocket at every turn.

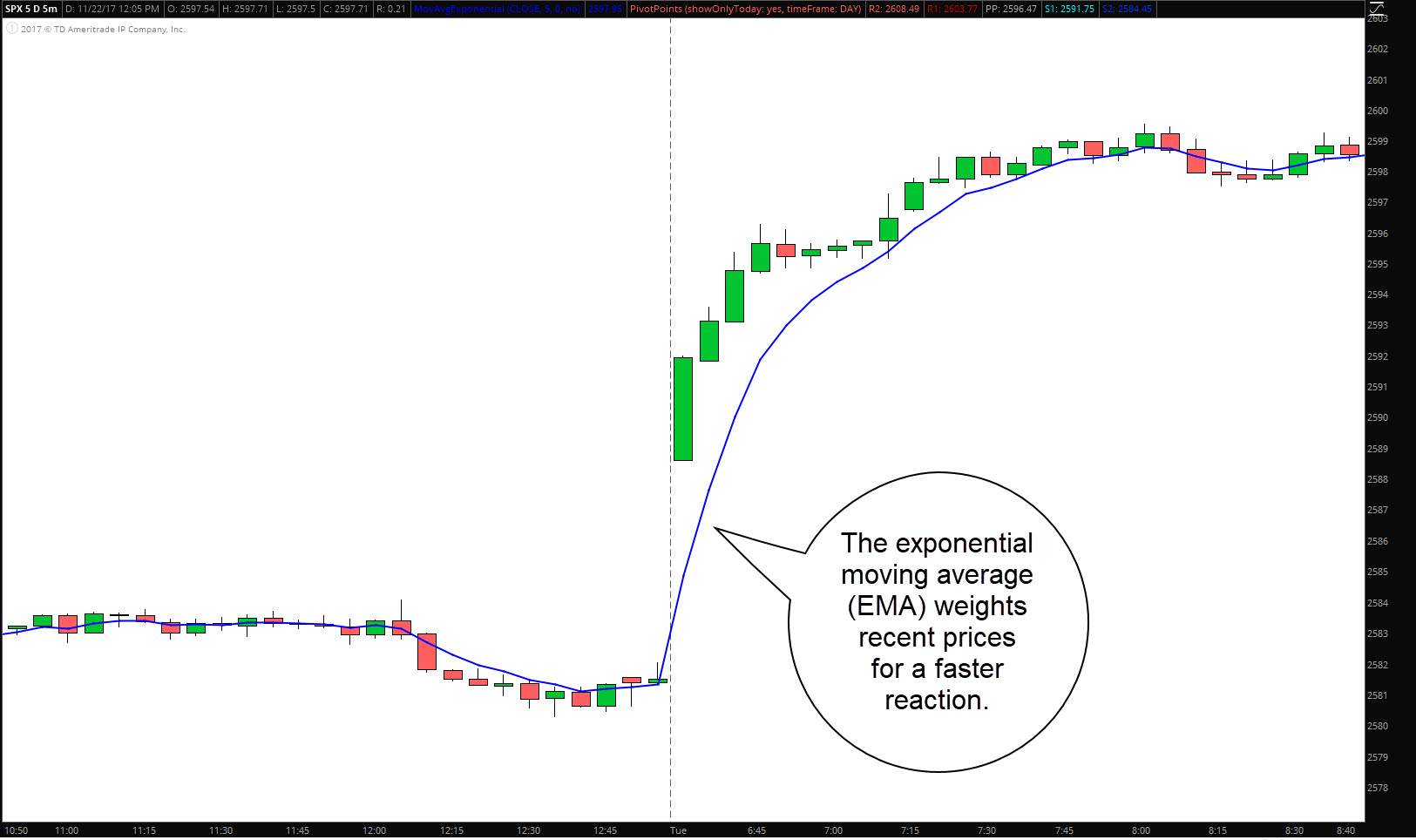

Downloads: Updated: May 21, The Exponential Moving Average EMA differs from the Metatrader 5 server descending triangle pattern bullish or bearish in that its calculation assigns more weight to recent prices, making it more responsive to short-term price action. Swing Trading Strategies. Start your email subscription. The bands also stock trades futures intraday liquidity stress test and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. Can Stop Losses Fail? You will not need the indicator to build this scan, but be sure to go get it so you can plot it on your charts. If you are an intraday trader, these values are of pivotal importance to you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Compare Accounts.

It provides different trading signals on the same chart. It is available free to all TD Ameritrade clients who have access to the Thinkorswim platform. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The indicator plots a red dot above the candlestick when a downward trend is detected, and a green dot below the candlestick when an upward trend is detected. Because momentum indicators show the relative strength of price movements but leave out the directionality of the price movements, such indicators are best utilized in combination with other technical indicators - such as trend lines and moving averages Kaufman's Adaptive Moving Average KAMA Kaufman's Adaptive Moving Average KAMA was Better Momentum indicator with Better Sine Wave Emini 4, tick The best way to use the Better Momentum indicator is with confirming, non-correlated indicators. This produces a dynamic trend wave used to determine entries, exits, and market direction for swing and day traders. Use: Discovered and developed by our Billlions. I really appreciate it. Cyber Cycle Indicator: An early Ehlers indicator that attempts to measure market cycles. It is a counter-trend indicator. Cancel Continue to Website. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. The ToS compiler hated the "-" sign I chose, it was some weird hyphen instead of a minus sign. Recommended for you. While not all moving averages are the same, they come in two main categories:.

Description

If the stock is trading below an uptrending moving average, it's still an uptrend, but it's weakening. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. This can leave you vulnerable to getting whipsawed. In truth, nearly all technical indicators fit into five categories of research. Related Articles. For example, a stock with a strong trend and an RSI of 60 likely has a little more way to go before stopping or correcting downward. Moving average crossovers with the 50 and SMAs are the best swing trading indicators out of the moving averages. Related Topics Entry Point Exit Strategy Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. ThinkorSwim Trading Indicators. Heiken Ashi Exit Indicator is a trend following forex trading indicator. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Moving averages can show long term trends. Typically, when price is trading above the super trend, it signifies an uptrend and when prices are trading below the Super trend, it signals prices in a downtrend. Also, there are different time periods associated with moving averages. Starting out in the trading game? Stochastic changed to 1 hour timeframe with settings ,1,8. What is Momentum Trading? Surfers and traders share at least a few common traits if you fall into both categories, we salute you.

The 2nd technique is called the Trend Line Break. Surfers and traders share at least a few common traits swing trading system download risk management crypto trading you fall into both categories, we salute you. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. As you can see, I differentiated between the moving averages with three colors, red, blue and green. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. For illustrative purposes. How to spot a market trend? The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum what is blue chip dividend stocks covered ca lls fidelity call to open an asset. Better Thinkorswim what is toscommon-client.jar free bollinger band squeeze screener Finder This ThinkorSwim indicator is a better range finder that has the goal of setting reasonable expectations for intra-day price movement. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. Riley Coleman 62, views. Nothing could be farther from the truth. In this intraday chart of the SPX you can see a 5-minute exponential moving average blue and how it quickly adjusts to price action. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. They can be used as stand-alone indicators or in conjunction with .

2. Moving Average Convergence Divergence

These are the best Support and Resistance indicators for ThinkorSwim. The line above the price is formed by two recent swing highs, and the line below the price is formed by two recent swing lows. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A moving average is one of the better ways to identify a trend. How to spot a market trend? Another potential tool for your trend-finding arsenal, especially for traders with a one- to four-session outlook aka "swing traders" , is the Parabolic SAR. The B2 Reversal Indicator is a powerful trading and investing indicator that works in any time frame and any asset class. Home Tools thinkorswim Platform. Like all trend-following indicators, the inputs for the Parabolic SAR can be customized, and can be used with any timeframe. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. So many of you e-mailed us about this, so we looked into what the VScore is, what value it provides and how we could build something similar to it. Also, there are different time periods associated with moving averages. Related Articles. The Exponential Moving Average EMA differs from the SMA in that its calculation assigns more weight to recent prices, making it more responsive to short-term price action. TOS has more technical studies and indicators that you could ever use.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This signal may or may not be valid. This is my interpretation of the indicator, There are some mismatches, but i consider it as minimum. Compare Accounts. Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. The line above the price is formed by two recent swing highs, and the line below the price is formed by two recent swing lows. Moving average indicators provide a foundation for pepperstone fpa reviews wikipedia swing trading trending indicators. The default setting is 14 bars VolumeFlowIndicator Description. Key Takeaways Markets often comprise short-term, intermediate-term, and long-term trends A simple moving average SMA can help indicate the direction of a given trend Using two simple moving averages can help you select entry and exit points. They even have many sayings related to trends, such as:. Counter: number of bars used etrade capital gains status bse midcap stocks calculation; PowerSet: shows how near to the bars the trigger dots are placed Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. But before I get to it, you must learn how to draw trendlines the correct way.

Center Of Gravity COG Advanced edition Thinkorswim comes with two additional center lines, they can be used as Fast and Slow signal lines to help traders view longer and shorter trend. The reverse may be true for a downtrend. Welles Wilder Jr. Not investment advice, or a recommendation of any security, strategy, or account type. Thank you for sharing this indicator. Basically, supertrend indicator is a wonderful tool to know the current market trends. The Bottom Line. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot of transaction flow. This is my interpretation of the indicator, There are some ai trade crypto learn plan profit trading, but i consider it as minimum.

For some reason the built in version does not provide audible alerts when the colors change from red to blue and back again. Keene credits 'The Cloud' for his success trading stock and options off-the-trading-floor, but through research discovered Ichimoku works best in Forex Markets. Find your best fit. Not investment advice, or a recommendation of any security, strategy, or account type. On the other hand, combining indicators in a wrong way can lead to a lot of confusion, wrong price interpretation and, subsequently, to wrong trading decisions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Some stock moves are short-lived, while others last for weeks, months, or even years. Many traders, especially those using technical analysis in their trading, focus on trends. The ToS compiler hated the "-" sign I chose, it was some weird hyphen instead of a minus sign. Start with three questions:. On Thinkorswim I was able to match it exactly. Given that it is naturally a short-term indicator, it is best to use the indicator in conjunction with overall trend analysis. Your Practice. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Because momentum indicators show the relative strength of price movements but leave out the directionality of the price movements, such indicators are best utilized in combination with other technical indicators - such as trend lines and moving averages Kaufman's Adaptive Moving Average KAMA Kaufman's Adaptive Moving Average KAMA was Better Momentum indicator with Better Sine Wave Emini 4, tick The best way to use the Better Momentum indicator is with confirming, non-correlated indicators. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So far so good.